false000188865400018886542024-01-292024-01-29

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): January 29, 2024 |

5E ADVANCED MATERIALS, INC.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

001-41279 |

87-3426517 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

9329 Mariposa Road, Suite 210 |

|

Hesperia, California |

|

92344 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: (442) 221-0225 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Stock |

|

FEAM |

|

The Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☒

Item 1.01 Entry into a Material Definitive Agreement.

Second Closing of Private Placement

As previously disclosed, on January 18, 2024, 5E Advanced Materials, Inc. (the “Company”), Ascend Global Investment Fund SPC, for and on behalf of Strategic SP (“Ascend”) and 5ECAP, LLC (“5ECAP”) entered into an amended and restated subscription agreement (the “Amended and Restated 5ECAP Subscription Agreement”), by and among the Company, Ascend, and 5ECAP.

On January 29, 2024, pursuant to the Amended and Restated 5ECAP Subscription Agreement, the Company issued 8,317,074 shares of Common Stock to 5ECAP at a price of $1.025 per share, which shares include the placement fee paid to 5ECAP in shares of Common Stock (the “Second Closing”).

The foregoing summary is qualified in its entirety by reference to the full text of the Amended and Restated 5ECAP Subscription Agreement, which is incorporated by reference to Exhibit 10.1.

Item 3.02 Unregistered Sales of Equity Securities.

The disclosure contained in Item 1.01 of this Current Report on Form 8-K is incorporated herein by reference. The securities offered pursuant to the Second Closing were offered in a private placement exempt from registration pursuant to Section 4(a)(2) of the Securities Act of 1933, as amended (the “Securities Act”). This summary is qualified in its entirety by reference to the full text of the Amended and Restated 5ECAP Subscription Agreement, which is incorporated by reference to Exhibit 10.1.

Item 7.01 Regulation FD Disclosure.

On January 30, 2024, the Company issued a press release announcing the second closing of the previously announced private placement of the Company’s common stock (the “Press Release”). A copy of the Press Release is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

The information contained in this Item 7.01 and in Exhibit 99.1 attached hereto is furnished pursuant to the rules and regulations of the Securities and Exchange Commission and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such a filing.

Forward-Looking Statements

The information in this Form 8-K and the attached Press Release include “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, as amended. All statements other than statements of historical fact included in the Press Release and Form 8-K regarding our business strategy, plans, goal, and objectives are forward-looking statements. When used in the Press Release and this Form 8-K, the words “believe,” “project,” “expect,” “anticipate,” “estimate,” “intend,” “budget,” “target,” “aim,” “strategy,” “plan,” “guidance,” “outlook,” “intent,” “may,” “should,” “could,” “will,” “would,” “will be,” “will continue,” “will likely result,” and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain such identifying words. These forward-looking statements are based on the Company’s current expectations and assumptions about future events and are based on currently available information as to the outcome and timing of future events. We caution you that these forward-looking statements are subject to all of the risks and uncertainties, most of which are difficult to predict and many of which are beyond our control, incident to the extraction of the critical materials we intend to produce and advanced materials production and development. These risks include, but are not limited to: our limited operating history in the borates and lithium industries and no revenue from our proposed extraction operations at our properties; our need for substantial additional financing to execute our business plan and our ability to access capital and the financial markets; our status as an exploration stage company dependent on a single project with no known Regulation S-K 1300 mineral reserves and the inherent uncertainty in estimates of mineral resources; our lack of history in mineral production and the significant risks associated with achieving our business strategies, including our downstream processing ambitions; our incurrence of significant net operating losses to date and plans to incur continued losses for the foreseeable future; risks and uncertainties relating to the development of the Fort Cady project, including our ability to timely and successfully complete our Small Scale Boron Facility; our ability to obtain, maintain and renew required governmental permits for our development activities, including satisfying all mandated conditions to any such permits; the implementation of and expected benefits from certain reduced spending measures, and other risks and uncertainties set forth in our filings with the U.S. Securities and Exchange Commission from time to time. Should one or more of these risks or uncertainties occur, or should underlying assumptions prove incorrect, our actual results and plans could differ materially from those expressed in any forward-looking statements. These risks are not exhaustive and the information in this Form 8-K and the attached Press Release may be subject to additional risks. No representation or warranty (express or implied) is made as to, and no reliance should be place on, any information, including projections, estimates, targets, and opinions contained herein, and no liability whatsoever is accepted as to any errors, omissions, or misstatements contained herein. You are

cautioned not to place undue reliance on any forward-looking statements, which speak only as to the date of this Form 8-K and the attached Press Release, respectively.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

|

|

|

|

|

5E Advanced Materials, Inc. |

|

|

|

|

Date: |

January 30, 2024 |

By: |

/s/ Paul Weibel |

|

|

|

Paul Weibel

Chief Financial Officer |

Exhibit 99.1

5E ADVANCED MATERIALS CLOSES SECOND TRANCHE

OF EQUITY FINANCING

New capital will be deployed to continue our initial successful mining operations and complete the processing plant

HESPERIA, CA., January 30, 2024 (GLOBE NEWSWIRE) – 5E Advanced Materials, Inc. (Nasdaq: FEAM) (ASX: 5EA) (“5E” or the “Company”), a boron and lithium company with U.S. government Critical Infrastructure designation for its 5E Boron Americas Complex, today announced it has closed its previously announced second tranche of equity financing. The second closing included $7.75 million in new equity capital from 5ECAP, LLC. The Company previously closed $10 million on January 18th. The capital closed will be deployed to continue initial production of boric acid and lithium carbonate and to complete the final stages of the processing plant.

About 5E Advanced Materials, Inc.

5E Advanced Materials, Inc. (Nasdaq: FEAM) (ASX: 5EA) is focused on becoming a vertically integrated global leader and supplier of boron specialty and advanced materials, complemented by lithium co-product production. The Company’s mission is to become a supplier of these critical materials to industries addressing global decarbonization, food and domestic security. Boron and lithium products will target applications in the fields of electric transportation, clean energy infrastructure, such as solar and wind power, fertilizers, and domestic security. The business strategy and objectives are to develop capabilities ranging from upstream extraction and product sales of boric acid, lithium carbonate and potentially other co-products, to downstream boron advanced material processing and development. The business is based on our large domestic boron and lithium resource, which is located in Southern California and designated as Critical Infrastructure by the Department of Homeland Security’s Cybersecurity and Infrastructure Security Agency.

Forward-Looking Statements

This press release includes “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, as amended. All statements other than statements of historical fact included in this press release regarding our business strategy, plans, goal, and objectives are forward-looking statements. When used in this press release, the words “believe,” “project,” “expect,” “anticipate,” “estimate,” “intend,” “budget,” “target,” “aim,” “strategy,” “plan,” “guidance,” “outlook,” “intent,” “may,” “should,” “could,” “will,” “would,” “will be,” “will continue,” “will likely result,” and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain such identifying words. These forward-looking statements are based on the Company’s current expectations and assumptions about future events and are based on currently available information as to the outcome and timing of future events. We caution you that these forward-looking statements are subject to all of the risks and uncertainties, most of which are difficult to predict and many of which are beyond our control, incident to the extraction of the critical materials we intend to produce and advanced materials production and development. These risks include, but are not limited to: our limited operating history in the borates and lithium industries and no revenue from our proposed extraction operations at our properties; our need for substantial additional financing to execute our business plan and our ability to access capital and the financial markets; our status as an exploration stage company dependent on a single project with no known Regulation S-K 1300 mineral reserves and the inherent uncertainty in estimates of mineral resources; our lack of history in mineral production and the significant risks associated with achieving our business strategies, including our downstream processing ambitions; our incurrence of significant net operating losses to date and plans to incur continued losses for the foreseeable future; risks and uncertainties relating to the development of the Fort Cady project, including our ability to timely and successfully complete our Small Scale Boron Facility; our ability to obtain, maintain and renew required governmental permits for our development activities, including satisfying all mandated conditions to any such permits; the implementation of and expected benefits from certain reduced spending measures, and other risks and uncertainties set forth in our filings with the U.S. Securities and Exchange Commission from time to time. Should one or more of these risks or uncertainties occur, or should underlying assumptions prove incorrect, our actual results and plans could differ materially from those expressed in any forward-looking statements.

These risks are not exhaustive and the information in this press release may be subject to additional risks. No representation or warranty (express or implied) is made as to, and no reliance should be place on, any information, including projections, estimates, targets, and opinions contained herein, and no liability whatsoever is accepted as to any errors, omissions, or misstatements contained herein. You are cautioned not to place undue reliance on any forward-looking statements, which speak only as to the date of this press release.

For additional information regarding these various factors, you should carefully review the risk factors and other disclosures in the Company’s Form 10-K filed on August 30, 2023. Additional risks are also disclosed by 5E in its filings with the U.S. Securities and Exchange Commission throughout the year, including its Form 10-K, Form 10-Qs and Form 8-Ks, as well as in its filings under the Australian Securities Exchange. Any forward-looking statements are given only as of the date hereof. Except as required by law, 5E expressly disclaims any obligation to update or revise any such forward-looking statements. Additionally, 5E undertakes no obligation to comment on third party analyses or statements regarding 5E’s actual or expected financial or operating results or its securities.

For further information contact:

|

|

Davis Snyder or Joseph Caminiti Alpha IR Group FEAM@alpha-ir.com Ph: +1 (312) 445-2870 |

J.T. Starzecki Chief Marketing Officer jstarzecki@5eadvancedmaterials.com Ph: +1 (612) 719-5076 |

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

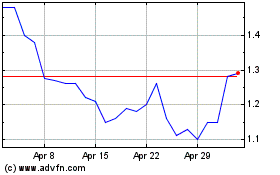

5E Advanced Materials (NASDAQ:FEAM)

Historical Stock Chart

From Apr 2024 to May 2024

5E Advanced Materials (NASDAQ:FEAM)

Historical Stock Chart

From May 2023 to May 2024