0001888654false00018886542024-01-292024-01-29

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): January 29, 2024 |

5E ADVANCED MATERIALS, INC.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

001-41279 |

87-3426517 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

9329 Mariposa Road, Suite 210 |

|

Hesperia, California |

|

92344 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: (442) 221-0225 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Stock |

|

FEAM |

|

The Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☒

Item 8.01 Other Events.

Exhibit 4.1 to this Current Report on Form 8-K sets forth a description of 5E Advanced Materials, Inc.’s securities registered under Section 12 of the Securities Exchange Act of 1934, as amended.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

5E Advanced Materials, Inc. |

|

|

|

|

Date: |

January 29, 2024 |

By: |

/s/ Paul Weibel |

|

|

|

Paul Weibel

Chief Financial Officer |

Exhibit 4.1

Description of Capital Stock

The following description of our capital stock is a summary. The complete text of our Amended and Restated Certificate of Incorporation and Bylaws are each included, respectively, as Exhibit 3.1 to our Form 8-K filed with the Securities and Exchange Commission (the “SEC”) on January 19, 2024 and as Exhibit 3.2 to our Registration Statement on Form 10-12B filed with the SEC on March 7, 2022 and are incorporated by reference herein. Our authorized share capital is 380,000,000 divided into 360,000,000 shares of Common Stock, par value of $0.01 per share, and 20,000,000 shares of preferred stock, par value of $0.01 per share (“Preferred Stock”). As of January 29, 2024, there are approximately 63,339,495 shares of our Common Stock issued and outstanding held by approximately 19 record holders. As of January 29, 2024, no shares of Preferred Stock are issued and outstanding. The actual number of stockholders is considerably greater than the number of stockholders of record and includes stockholders who are beneficial owners but whose CDIs or shares of Common Stock are held in street name by brokers and other nominees.

Common Stock

Except as otherwise required by law, as provided in our Amended and Restated Certificate of Incorporation or as provided in the resolution or resolutions, if any, adopted by our Board of Directors with respect to any series of the Preferred Stock, the holders of our Common Stock will exclusively possess all voting power. Each holder of shares of Common Stock will be entitled to one vote for each share held by such holder. Subject to the rights of holders of any series of outstanding Preferred Stock, holders of shares of our Common Stock will have equal rights of participation in the dividends and other distributions in cash, stock or property of the Company when, as and if declared thereon by our Board of Directors from time to time out of assets or funds legally available therefor and will have equal rights to receive the assets and funds of the Company available for distribution to stockholders in the event of any liquidation, dissolution or winding up of the affairs of the Company, whether voluntary or involuntary.

CDIs

CDIs confer the beneficial ownership of our Common Stock on each CDI holder, with the legal title to such securities held by an Australian depositary entity, CHESS Depositary Nominees Pty Ltd. (the “Depositary Nominee”). The Depositary Nominee will be the registered holder of those shares of our Common Stock held for the benefit of holders of CDIs. The Depositary Nominee does not charge a fee for providing this service. Ten CDIs will represent an interest in one share of our Common Stock. Holders of CDIs will not hold the legal title to the underlying shares of our Common Stock to which the CDIs relate, as the legal title will be held by the Depositary Nominee. Each holder of CDIs will, however, have a beneficial interest in the underlying shares in our Common Stock. Each holder of CDIs that elects to vote at a stockholders meeting will be entitled to one vote for every 10 CDIs held by such holder. In order to vote at a stockholder meeting, a CDI holder may:

•instruct the Depositary Nominee, as legal owner of the shares of Common Stock, to vote the Common Stock represented by their CDIs to vote the shares of our Common Stock represented by their CDIs in a particular manner. A voting instruction form will be sent to holders of CDIs and must be completed and returned to the share registry for the CDIs prior to a record date fixed for the relevant meeting, or the Voting Instruction Receipt Time, which is notified to CDI holders in the voting instructions included in a notice of meeting;

•inform us that they wish to appoint themselves or a third party as the Depositary Nominee’s proxy with respect to our shares of Common Stock underlying the holder’s CDIs for the purposes of attending and voting at the meeting. The instruction form must be completed and returned to the share registry for the CDI prior to the CDI Voting Instruction Receipt Time; or

•convert their CDIs into shares of our Common Stock and vote those shares at the meeting. The conversion must be undertaken prior to a record date fixed by the Board of Directors for determining

the entitlement of members to attend and vote at the meeting. If the holder later wishes to sell their investment on the ASX, it would first be necessary to convert those shares of Common Stock back to CDIs. Further details on the conversion process are set out below.

Voting instruction forms and details of these alternatives are included in each notice of meeting sent to CDI holders by the Company.

Conversion of CDIs to shares of Common Stock

CDI holders may at any time convert their CDIs to a holding of shares of Common Stock by instructing the share registry for the CDIs, either:

•Directly in the case of CDIs held on the issuer sponsored sub-register operated by the Company (holders of CDIs will be provided with a CDI issuance request form to return to the share registry for the CDIs); or

•Through their “sponsoring participant” (usually their broker) in the case of CDIs which are held on the CHESS sub-register (in this case, the sponsoring broker will arrange for completion of the relevant form and its return to the share registry for the CDIs).

In both cases, once the share registry for the CDIs has been notified, it will arrange the transfer of the relevant number of shares of Common Stock from the Depositary Nominee into the name of the CDI holder in book entry form or, if requested, deliver the relevant shares of Common Stock to their DTC participant in the United States Central Securities Depositary. The share registry for the CDIs will not charge a fee for the conversion (although a fee may be payable by market participants). Holding shares of Common Stock will, however, prevent a person from selling their shares of Common Stock on the ASX, as only CDIs can be traded on that market.

Conversion of shares of Common Stock to CDIs

Shares of Common Stock may be converted into CDIs and traded on the ASX. Holders of shares of Common Stock may at any time convert those shares to CDIs by contacting the Company’s transfer agent. The underlying shares of Common Stock will be transferred to the Depositary Nominee, and CDIs (and a holding statement for the corresponding CDIs) will be issued to the relevant security holder. No trading in the CDIs may take place on the ASX until this conversion.

The Company’s transfer agent will not charge a fee to a holder of shares of Common Stock seeking to convert their shares of Common Stock to CDIs, although a fee may be payable by market participants.

In either case, it is expected that each of the above processes will be completed within 24 hours, provided that the Company’s transfer agent is in receipt of a duly completed and valid request form. No guarantee can, however, be given about the time required for this conversion to take place.

Dividends and Other Shareholder Entitlements

Holders of CDIs are entitled to receive all the direct economic benefits and other entitlements in relation to the underlying shares of Common Stock that are held by the Depositary Nominee, including dividends and other entitlements that attach to the underlying shares of Common Stock.

It is possible that marginal differences may exist between the resulting entitlement of a holder of CDIs and the entitlements that would have accrued if a holder of CDIs held their holding directly as shares of Common Stock. As the ratio of CDIs to Common Stock is not one-to-one, and any entitlement will be

determined on the basis of shares of Common Stock rather than CDIs, a holder of CDIs may not always benefit to the same extent (e.g. from the rounding up of fractional entitlements). We will, however, be required by the ASX Settlement Rules to minimize any such differences where legally permissible. If a cash dividend or any other cash distribution is declared in a currency other than Australian dollars, we currently intend to convert that dividend or other cash distribution to which a holder of CDIs is entitled to Australian dollars and distribute it to the relevant holder of CDIs in accordance with their entitlement.

Due to the need to convert dividends from United States dollars to Australian dollars in the above mentioned circumstances, holders of CDIs may potentially be advantaged or disadvantaged by exchange rate fluctuations, depending on whether the Australian dollar weakens or strengthens against the United States dollar during the period between the resolution to pay a dividend and conversion into Australian dollars.

Takeovers

If a takeover bid is made in respect of any of our Common Stock of which the Depositary Nominee is the registered holder, the Depositary Nominee is prohibited from accepting the offer made under the takeover bid except to the extent that acceptance is authorized by the CDI holders in respect of the shares of Common Stock represented by their holding of CDIs.

The Depositary Nominee must accept a takeover offer in respect of shares of Common Stock represented by a holding of CDIs if the relevant holder of CDIs instructs it to do so and must notify the entity making the takeover bid of the acceptance.

Preferred Stock

Our Board of Directors is authorized to provide, out of the unissued shares of Preferred Stock, for one or more series of Preferred Stock and, with respect to each such series, to fix the number of shares constituting such series and the designation of such series, the voting powers, if any, of the shares of such series, and the preferences and relative, participating, optional or other special rights, if any, and any qualifications, limitations or restrictions thereof, of the shares of such series, as are stated in the resolution or resolutions providing for the issuance of such series adopted by the Board of Directors. The authority of the Board of Directors with respect to each series of Preferred Stock includes determination of the following:

•the designation of the series;

•the number of shares of the series;

•the dividend rate or rates on the shares of that series, whether dividends will be cumulative and, if so, from which date or dates, and the relative rights of priority, if any, of payment of dividends on shares of that series;

•whether the series will have voting rights in addition to the voting rights provided by law and, if so, the terms of such voting rights;

•whether the series will have conversion privileges and, if so, the terms and conditions of such conversion, including provision for adjustment of the conversion rate in such events as the Board of Directors determines;

•whether or not the shares of that series will be redeemable, in whole or in part, at the option of the Company or the holder thereof and, if made subject to such redemption, the terms and conditions of such redemption, including the date or dates upon or after which they will be redeemable, and the amount per share payable in case of redemptions, which amount may vary under different conditions and at different redemption rates;

•the terms and amount of any sinking fund provided for the purchase or redemption of the shares of such series;

•the rights of the shares of that series in the event of voluntary or involuntary liquidation, dissolution or winding up of the Company, and the relative rights of priority, if any, of payment of shares of that series;

•the restrictions, if any, on the issue or reissue of any additional Preferred Stock; and

•any other relative rights, preferences and limitations of that series.

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

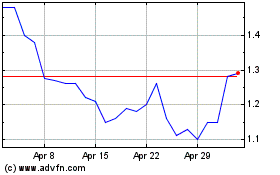

5E Advanced Materials (NASDAQ:FEAM)

Historical Stock Chart

From Apr 2024 to May 2024

5E Advanced Materials (NASDAQ:FEAM)

Historical Stock Chart

From May 2023 to May 2024