0001818874FALSE00018188742024-01-292024-01-29

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

__________________________________

FORM 8-K

__________________________________

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): January 29, 2024

SoFi Technologies, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

Delaware (State or other jurisdiction of incorporation) | 001-39606 (Commission File Number) | 98-1547291 (I.R.S. Employer Identification No.) |

| | |

234 1st Street San Francisco, California | | 94105 |

| (Address of principal executive offices) | | (Zip Code) |

(855) 456-7634

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange

on which registered |

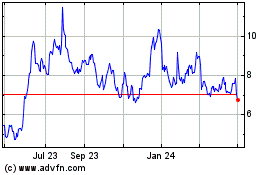

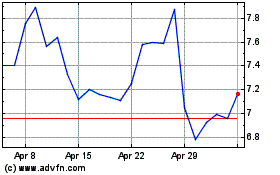

| Common stock, $0.0001 par value per share | | SOFI | | The Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On January 29, 2024, SoFi Technologies, Inc. issued a press release reporting its financial results for the three months and year ended December 31, 2023. A copy of the press release is attached as Exhibit 99.1 and is incorporated herein by reference.

This Exhibit 99.1 is deemed "filed" for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, and is incorporated by reference in all appropriate filings under the Securities Act of 1933, as amended, except for the quotes provided by Anthony Noto, CEO of SoFi Technologies, Inc., and the section entitled "Guidance and Outlook", which shall be "furnished", not "filed".

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

| | | | | | | | |

| Exhibit No. | | Description |

| | |

| | |

| 104 | | Cover Page Interactive Data File (embedded within the inline XBRL document) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| SoFi Technologies, Inc. |

| | |

Date: January 29, 2024 | By: | /s/ Christopher Lapointe |

| Name: | Christopher Lapointe |

| Title: | Chief Financial Officer |

SOFI TECHNOLOGIES, INC. REPORTS

FOURTH QUARTER AND FISCAL YEAR 2023 RESULTS

Accelerating Revenue Growth, Expanding Margins and GAAP Profitability

Fourth Quarter $615 Million GAAP Net Revenue Up 35% Year-over-Year; $594 Million Adjusted Net Revenue Up 34% Year-over-Year

Record Fourth Quarter Adjusted EBITDA of $181 Million Up 159% Year-over-Year, 30% Target Margin Reached

Fourth Quarter Positive GAAP Net Income of $48 Million, GAAP EPS of $0.02

Quarterly New Member Adds of Nearly 585,000; Total Members Up 44% Year-over-Year to Over 7.5 Million

Quarterly New Product Adds of Nearly 695,000; Total Products Up 41% Year-over-Year to Over 11.1 Million

Fourth Quarter Total Deposit Growth of $2.9 Billion to $18.6 Billion

Fourth Quarter Growth in Tangible Book Value of $204 Million, up $334 Million for Full Year 2023

Diversification Milestone with 40% of Fourth Quarter Adjusted Net Revenue from Tech Platform and Financial Services Segments

Management Announces 2024 Guidance & Longer Term Outlook

SAN FRANCISCO, Calif. – (BUSINESS WIRE) – January 29, 2024 – SoFi Technologies, Inc. (NASDAQ: SOFI), a member-centric, one-stop shop for digital financial services that helps members borrow, save, spend, invest and protect their money, reported financial results today for its fourth quarter and fiscal year ended December 31, 2023.

“We delivered another quarter of record financial results and generated our eleventh consecutive quarter of record adjusted net revenue of $594 million. We saw new member adds of nearly 585,000 and growth of 44% for total period end members of over 7.5 million, with new product adds of nearly 695,000 and growth of 41% to over 11 million total products at period end. Record revenue at the company level was driven by record revenue across all three of our business segments, with a record contribution of 40% of adjusted net revenue generated by our non-Lending segments (Technology Platform and Financial Services segments). On a consolidated level, we saw sequential and year-over-year expansion of our net interest margin to 6.02%. We also generated record adjusted EBITDA of $181 million, representing 159% year-over-year growth and a 74% incremental adjusted EBITDA margin, with all three segments profitable on a contribution basis. This equates to a 30% adjusted EBITDA margin, in line with our long-term target. We generated positive GAAP net income of $48 million in the quarter and EPS of $0.02. Finally, we generated $204 million in tangible book value growth in the quarter and $334 million for all of 2023,” said Anthony Noto, CEO of SoFi Technologies, Inc.

Consolidated Results Summary

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended December 31, | | % Change | | Year Ended December 31, | | % Change |

($ in thousands, except per share amounts) | | 2023 | | 2022 | | | 2023 | | 2022 | |

Consolidated – GAAP | | | | | | | | | | | | |

| Total net revenue | | $ | 615,404 | | | $ | 456,679 | | | 35 | % | | $ | 2,122,789 | | | $ | 1,573,535 | | | 35 | % |

Net income (loss) | | 47,913 | | | (40,006) | | | n/m | | (300,742) | | | (320,407) | | | (6) | % |

Net income (loss) attributable to common stockholders – basic(1) | | 37,724 | | | (50,195) | | | n/m | | (341,167) | | | (360,832) | | | (5) | % |

Net income (loss) attributable to common stockholders – diluted(1)(2) | | 24,615 | | | (50,195) | | | n/m | | (341,167) | | | (360,832) | | | (5) | % |

Earnings (loss) per share attributable to common stockholders – basic(1) | | 0.04 | | | (0.05) | | | n/m | | (0.36) | | | (0.40) | | | (10) | % |

Earnings (loss) per share attributable to common stockholders – diluted(1)(2) | | 0.02 | | | (0.05) | | | n/m | | (0.36) | | | (0.40) | | | (10) | % |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

Consolidated – Non-GAAP | | | | | | | | | | | | |

Adjusted net revenue(3) | | $ | 594,245 | | | $ | 443,418 | | | 34 | % | | $ | 2,073,940 | | | $ | 1,540,492 | | | 35 | % |

Adjusted EBITDA(3) | | 181,204 | | | 70,060 | | | 159 | % | | 431,737 | | | 143,346 | | | 201 | % |

Net income (loss), excluding impact of goodwill impairment(4) | | 47,913 | | | (40,006) | | | n/m | | (53,568) | | | (320,407) | | | (83) | % |

Net income (loss) attributable to common stockholders, excluding impact of goodwill impairment – basic(1)(4) | | 37,724 | | | (50,195) | | | n/m | | (93,993) | | | (360,832) | | | (74) | % |

Net income (loss) attributable to common stockholders, excluding impact of goodwill impairment – diluted(1)(2)(4) | | 24,615 | | | (50,195) | | | n/m | | (93,993) | | | (360,832) | | | (74) | % |

Earnings (loss) per share attributable to common stockholders, excluding impact of goodwill impairment – basic(1)(4) | | 0.04 | | | (0.05) | | | n/m | | (0.10) | | | (0.40) | | | (75) | % |

Earnings (loss) per share attributable to common stockholders, excluding impact of goodwill impairment – diluted(1)(2)(4) | | 0.02 | | | (0.05) | | | n/m | | (0.10) | | | (0.40) | | | (75) | % |

Tangible book value (as of period end)(5) | | 3,477,059 | | | 3,142,956 | | | 11 | % | | 3,477,059 | | | 3,142,956 | | | 11 | % |

___________________

(1)For additional information on the computation of basic and diluted earnings (loss) per share, see Table 8 in the “Financial Tables” herein.

(2)For the three months ended December 31, 2023, diluted earnings per share of $0.02 and diluted net income attributable to common stockholders of $24,615 exclude gain on extinguishment of debt and interest expense incurred, net of tax, associated with convertible note activity during the period.

(3)Adjusted net revenue and adjusted EBITDA are non-GAAP financial measures. For more information and reconciliations to the most comparable GAAP measures, see “Non-GAAP Financial Measures” and Table 2 to the “Financial Tables” herein.

(4)Earnings (loss) per share attributable to common stockholders, excluding impact of goodwill impairment is defined as net income (loss) attributable to common stockholders, adjusted to exclude goodwill impairment losses of $247.2 million for the year ended December 31, 2023, divided by the weighted average common stock outstanding. The goodwill impairment adjustment had no impact on weighted average common stock outstanding, or income tax impacts.

(5)Defined as permanent equity, adjusted to exclude goodwill and intangible assets.

Noto continued: “Continued growth of over 40% in both total members and products, along with improving operating efficiency, reflects the benefits of our broad product suite and unique Financial Services Productivity Loop (FSPL) strategy."

Noto concluded: “Total deposits grew by $2.9 billion, up 19% during the fourth quarter to $18.6 billion at year-end, and over 90% of SoFi Money deposits (inclusive of Checking and Savings and cash management accounts) are from direct deposit members. For new direct deposit accounts opened in the fourth quarter, the median FICO score was 744. More than half of newly funded SoFi Money accounts are setting up direct deposit by day 30, which has had a significant impact on debit spending, which exceeded $1.5 billion in quarterly debit transaction volume and was up nearly threefold year-over-year, representing more than $6 billion of annualized debit transaction volume. Importantly, and as anticipated, we also benefit from continued strong cross-buy trends from this attractive member base into Lending and other Financial Services products.

As a result of this growth in high quality deposits, we have benefited from a lower cost of funding for our loans. Our deposit funding also increases our flexibility to capture additional net interest margin (NIM) and optimize returns, a critical advantage in light of notable macroeconomic uncertainty. SoFi Bank, N.A. generated $128.6 million of GAAP net income at a 27% margin in the quarter, and an annualized return on tangible equity of 16.8%.”

Consolidated Results

Fourth quarter and full-year 2023 total GAAP net revenue of $615.4 million and $2.1 billion, respectively, each increased 35% relative to the prior-year period's $456.7 million and $1.6 billion. Fourth quarter and full-year 2023 adjusted net revenue of $594.2 million and $2.1 billion grew 34% and 35%, respectively, from the corresponding prior-year periods of $443.4 million and $1.5 billion. Fourth quarter record adjusted EBITDA of $181.2 million increased 159% from the same prior year period's $70.1 million, culminating in full-year positive adjusted EBITDA of $431.7 million, up 201% year-over-year.

SoFi reported a number of key financial achievements in the quarter, including positive GAAP net income of $47.9 million or $0.02 per share. This compares to a loss of $40.0 million in the fourth quarter of 2022. Full-year 2023 GAAP net loss, excluding the impact of impairment of goodwill assets, was $53.6 million, versus a loss of $320.4 million for full-year 2022.

Additionally, contribution profit in the Financial Services segment of $25.1 million increased nearly eightfold from the first quarter of positive contribution profit in the third quarter of 2023, while contribution margin grew 15 percentage points sequentially to 18%. The Financial Services segment also reached contribution profit break even for the full year 2023, relative to a loss of $199 million in 2022. This is a strong testament of our ability to scale new businesses from a significant investment phase to profitability via a continuous process of optimizing unit economics and efficiently acquiring members and achieving cross buy.

Net interest income of $389.6 million and $1.3 billion for the fourth quarter and full-year 2023, respectively, was up 87% and 116% from the corresponding prior-year periods and up 13% sequentially. Net interest margin of 6.02% was a record for the company, up from 5.99% last quarter and 5.94% in the prior-year quarter.

The average rate on interest-earning assets increased by 17 basis points sequentially and 122 basis points versus the prior-year period, while the average rate on interest-bearing liabilities increased just 9 basis points sequentially and 91 basis points year-over-year. The funding of loans continued to shift toward deposits. In the fourth quarter, the average rate on deposits was 218 basis points lower than that of warehouse facilities.

Technology Platform revenue of $96.9 million accelerated to 13% growth year-over-year, up from 6% year-over-year growth last quarter, with margins of 32% up 12 percentage points versus the prior year quarter.

Member and Product Growth

SoFi achieved strong year-over-year growth in both members and products in the fourth quarter and full-year 2023. New member additions of nearly 585,000 in the quarter brought total members to over 7.5 million by year end, up over 2.3 million, or 44%, from the prior year end.

Product additions of nearly 695,000 in the fourth quarter brought total products to over 11.1 million at year end, up 41% from 7.9 million at the prior year end.

| | | | | |

| Members | Products |

| In Thousands | In Thousands |

| | | | | |

| Products By Segment | Technology Platform Accounts (1)(2) |

| In Thousands | In Millions |

Note: For additional information on our company metrics, including the definitions of "Members", "Total Products" and "Technology Platform Total Accounts", see Table 6 in the “Financial Tables” herein.

(1)The company includes SoFi accounts on the Galileo platform-as-a-service in its total Technology Platform accounts metric to better align with the presentation of Technology Platform segment revenue.

(2)In 2023, Technology Platform total accounts reflects the previously disclosed migration by one of our clients of the majority of its processing volumes to a pure processor. These accounts remained open for administrative purposes through the end of 2022, and were included in our total accounts in such period.

In the Financial Services segment, total products increased by 45% year-over-year, to 9.5 million from 6.6 million at the prior year end. SoFi Money (inclusive of Checking and Savings and cash management accounts) grew 54% year-over-year to 3.4 million products, SoFi Relay grew 74% year-over-year to 3.3 million products and SoFi Invest grew 10% year-over-year to 2.4 million products.

Lending products increased 24% year-over-year to 1.7 million products, driven primarily by continued growth in personal loan products as well as a notable increase in student loan products.

Technology Platform enabled accounts increased by 11% year-over-year to 145 million.

Lending Segment Results

Lending segment GAAP and adjusted net revenues were $353.1 million and $346.5 million, respectively, for the fourth quarter of 2023, up 8% and 10%, respectively, and were $1.4 billion and $1.3 billion, respectively, for the full-year 2023, up 20% and 21%, respectively. Higher loan balances and net interest margin expansion drove strong growth in net interest income of $79.0 million, or 43%, and $429.3 million, or 81%, for the quarter and full-year 2023, respectively. Resulting net interest income of $262.6 million and $960.8 million significantly exceeded directly attributable segment expenses of $120.4 million and $513.1 million for the fourth quarter and full-year 2023, respectively.

Lending segment fourth quarter and full-year 2023 contribution profit of $226.1 million and $823.3 million increased 8% and 24%, respectively, from $208.8 million and $664.0 million in the corresponding prior-year periods. Contribution margin using Lending adjusted net revenue for the fourth quarter and full-year 2023 decreased to 65% from 66%, and increased to 62% from 60%, respectively, compared to the corresponding prior-year periods. These strong margins reflect SoFi’s ability to capitalize on continued strong demand for its lending products.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Lending – Segment Results of Operations |

| | Three Months Ended December 31, | | | | Year Ended December 31, | | |

($ in thousands) | | 2023 | | 2022 | | % Change | | 2023 | | 2022 | | % Change |

| Net interest income | | $ | 262,626 | | | $ | 183,607 | | | 43 | % | | $ | 960,773 | | | $ | 531,480 | | | 81 | % |

| Noninterest income | | 90,500 | | | 144,584 | | | (37) | % | | 409,848 | | | 608,511 | | | (33) | % |

| Total net revenue – Lending | | 353,126 | | | 328,191 | | | 8 | % | | 1,370,621 | | | 1,139,991 | | | 20 | % |

| Servicing rights – change in valuation inputs or assumptions | | (6,595) | | | (12,791) | | | (48) | % | | (34,700) | | | (39,651) | | | (12) | % |

| Residual interests classified as debt – change in valuation inputs or assumptions | | 10 | | | (470) | | | n/m | | 425 | | | 6,608 | | | (94) | % |

| Directly attributable expenses | | (120,431) | | | (106,131) | | | 13 | % | | (513,073) | | | (442,945) | | | 16 | % |

Contribution profit | | $ | 226,110 | | | $ | 208,799 | | | 8 | % | | $ | 823,273 | | | $ | 664,003 | | | 24 | % |

| | | | | | | | | | | | |

Adjusted net revenue – Lending(1) | | $ | 346,541 | | | $ | 314,930 | | | 10 | % | | $ | 1,336,346 | | | $ | 1,106,948 | | | 21 | % |

___________________

(1)Adjusted net revenue – Lending represents a non-GAAP financial measure. For more information and a reconciliation to the most comparable GAAP measure, see “Non-GAAP Financial Measures” and Table 2 to the “Financial Tables” herein.

| | | | | | | | | | | | | | | | | | | | | | | |

Lending – Loans At Fair Value | | | | | | | |

($ in thousands) | Personal Loans | | Student Loans | | Home Loans | | Total |

| December 31, 2023 | | | | | | | |

Unpaid principal | $ | 14,498,629 | | | $ | 6,445,586 | | | $ | 67,406 | | | $ | 21,011,621 | |

Accumulated interest | 114,541 | | | 34,357 | | | 92 | | | 148,990 | |

Cumulative fair value adjustments(1) | 717,403 | | | 245,541 | | | (1,300) | | | 961,644 | |

Total fair value of loans(2)(3) | $ | 15,330,573 | | | $ | 6,725,484 | | | $ | 66,198 | | | $ | 22,122,255 | |

| September 30, 2023 | | | | | | | |

Unpaid principal | $ | 14,177,004 | | | $ | 5,929,047 | | | $ | 110,320 | | | $ | 20,216,371 | |

Accumulated interest | 105,156 | | | 26,497 | | | 163 | | | 131,816 | |

Cumulative fair value adjustments(1) | 568,836 | | | 86,000 | | | (9,187) | | | 645,649 | |

Total fair value of loans(2)(3) | $ | 14,850,996 | | | $ | 6,041,544 | | | $ | 101,296 | | | $ | 20,993,836 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

___________________

(1) During the three months ended December 31, 2023, the cumulative fair value adjustments for personal loans were primarily impacted by a lower discount rate, which resulted in higher fair value marks, partially offset by lower origination volume and higher prepayment rate and default rate assumptions. The cumulative fair value adjustments for student loans were primarily impacted by a lower discount rate and increases in coupon rates, which resulted in higher fair value marks, partially offset by lower origination volume and higher default rate assumption.

(2) Each component of the fair value of loans is impacted by charge-offs during the period. Our fair value assumption for annual default rate incorporates fair value markdowns on loans beginning when they are 10 days or more delinquent, with additional markdowns at 30, 60 and 90 days past due.

(3) As of December 31, 2023, student loans are classified as loans held for investment, and personal loans and home loans are classified as loans held for sale. As of September 30, 2023, all loans were classified as loans held for sale.

The following table summarizes the significant inputs to the fair value model for personal and student loans:

| | | | | | | | | | | | | | | | | | | | | | | |

| Personal Loans | | Student Loans |

| December 31,

2023 | | September 30,

2023 | | December 31,

2023 | | September 30,

2023 |

Weighted average coupon rate(1) | 13.8 | % | | 13.8 | % | | 5.6 | % | | 5.3 | % |

| Weighted average annual default rate | 4.8 | % | | 4.6 | % | | 0.6 | % | | 0.5 | % |

| Weighted average conditional prepayment rate | 23.2 | % | | 20.3 | % | | 10.5 | % | | 10.5 | % |

| Weighted average discount rate | 5.5 | % | | 6.6 | % | | 4.3 | % | | 4.8 | % |

Benchmark rate(2) | 4.1 | % | | 5.0 | % | | 3.6 | % | | 4.5 | % |

| | | | | | | |

___________________(1)Represents the average coupon rate on loans held on balance sheet, weighted by unpaid principal balance outstanding at the balance sheet date.

(2)As of December 31, 2023 and September 30, 2023, corresponds with two-year SOFR for personal loans, and four-year SOFR for student loans.

Fourth quarter Lending segment total origination volume increased 45% year-over-year, as a result of continued strong demand for personal loans and notable growth in both student loan and home loan originations.

Personal loan originations of $3.2 billion in the fourth quarter of 2023 were up 31% year-over-year, and declined 17% sequentially. Full year personal loan originations of $13.8 billion increased 41% from 2022. Fourth quarter student loan volume of nearly $790 million was up 95% year-over-year, and declined 14% sequentially. Fourth quarter home loan volume of $309 million was up 193% year-over-year, and declined 13% sequentially.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Lending – Originations and Average Balances |

| | Three Months Ended December 31, | | % Change | | Year Ended December 31, | | % Change |

| | 2023 | | 2022 | | | 2023 | | 2022 | |

Origination volume

($ in thousands, during period) | | | | | | | | | | | | |

| Personal loans | | $ | 3,222,759 | | | $ | 2,466,093 | | | 31 | % | | $ | 13,801,065 | | | $ | 9,773,705 | | | 41 | % |

| Student loans | | 789,970 | | | 405,789 | | | 95 | % | | 2,630,040 | | | 2,245,499 | | | 17 | % |

| Home loans | | 308,884 | | | 105,501 | | | 193 | % | | 997,492 | | | 966,177 | | | 3 | % |

| Total | | $ | 4,321,613 | | | $ | 2,977,383 | | | 45 | % | | $ | 17,428,597 | | | $ | 12,985,381 | | | 34 | % |

| | | | | | | | | | | | |

Average loan balance ($, as of period end)(1) | | | | | | | | | | | | |

| Personal loans | | $ | 24,223 | | | $ | 24,917 | | | (3) | % | | | | | | |

| Student loans | | 44,683 | | | 46,585 | | | (4) | % | | | | | | |

| Home loans | | 284,289 | | | 285,152 | | | — | % | | | | | | |

_________________

(1)Within each loan product category, average loan balance is defined as the total unpaid principal balance of the loans divided by the number of loans that have a balance greater than zero dollars as of the reporting date. Average loan balance includes loans on the balance sheet and transferred loans with which SoFi has a continuing involvement through its servicing agreements.

| | | | | | | | | | | | | | | | | | | | |

Lending – Products | | December 31, | | |

| | 2023 | | 2022 | | % Change |

| Personal loans | | 1,113,864 | | | 837,462 | | | 33 | % |

| Student loans | | 519,489 | | | 477,132 | | | 9 | % |

| Home loans | | 29,653 | | | 26,003 | | | 14 | % |

Total lending products | | 1,663,006 | | | 1,340,597 | | | 24 | % |

Technology Platform Segment Results

Technology Platform segment record net revenue of $96.9 million for the fourth quarter of 2023 and $352.3 million for the full year increased 13% and 12% from the comparable prior year periods and 8% sequentially. Contribution profit of $30.6 million for the fourth quarter of 2023 and $94.8 million for the full year increased 81% and 24% from the comparable prior year periods, for a margin of 32% and 27%, respectively.

In the fourth quarter, growth was driven by continued strong organic growth of existing partners, new product adoption and notable contributions from increasingly diversified clients which have launched within the last 6 months. As noted previously, we continue to make significant strides in our strategy of leveraging our unique product suite to pursue diversified growth and larger, more durable revenue opportunities.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Technology Platform – Segment Results of Operations |

| | Three Months Ended December 31, | | | | Year Ended December 31, | | |

($ in thousands) | | 2023 | | 2022 | | % Change | | 2023 | | 2022 | | % Change |

| Net interest income | | $ | 941 | | | $ | — | | | n/m | | $ | 1,514 | | | $ | — | | | n/m |

| Noninterest income | | 95,966 | | | 85,652 | | | 12 | % | | 350,826 | | | 315,133 | | | 11 | % |

| Total net revenue – Technology Platform | | 96,907 | | | 85,652 | | | 13 | % | | 352,340 | | | 315,133 | | | 12 | % |

| Directly attributable expenses | | (66,323) | | | (68,771) | | | (4) | % | | (257,554) | | | (238,620) | | | 8 | % |

Contribution profit | | $ | 30,584 | | | $ | 16,881 | | | 81 | % | | $ | 94,786 | | | $ | 76,513 | | | 24 | % |

Technology Platform total enabled client accounts increased 11% year-over-year, to 145.4 million at December 31, 2023 from 130.7 million at December 31, 2022.

There is a robust pipeline of ongoing discussions with potential partners with large existing customer bases across both the U.S. and Latin America spanning both the financial services and non-financial services segments.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Technology Platform | | December 31, | | | | | | | | | | | | |

| | 2023 | | 2022 | | % Change | | | | | | | | | | |

| Total accounts | | 145,425,391 | | | 130,704,351 | | | 11 | % | | | | | | | | | | |

Financial Services Segment Results

Financial Services segment record net revenue increased 115% in the fourth quarter of 2023 to $139.1 million from the prior year period's total of $64.8 million, and by 160% for the full year to $436.5 million in 2023, helped by 126% and 103% growth in segment interchange revenue and 139% and 262% growth in net interest income. Notably, the company exceeded $1.5 billion in point of sale debit transaction volume in the quarter, representing an annualized $6 billion run-rate. Strength in the segment results was driven by new all-time high revenue for SoFi Money, Credit Card and lending as a service, as well as continued contributions from SoFi Invest.

The Financial Services segment posted a positive contribution profit of $25.1 million for the fourth quarter and nearly broke even with a loss of $0.3 million for the full year of 2023, reflecting a $68.6 million and $199.2 million improvement over the comparable prior year periods of $43.6 million and $199.4 million losses. This came as a result of continued improvement in monetization for the segment, along with increasing operating leverage as we efficiently scale the business. Monetization progress is underscored by annualized revenue per product of $59 for the fourth quarter of 2023 and $46 for the full year, which grew 48% and 80% year-over-year and 10% sequentially. At the same time, operating leverage is evident, as the segment generated $74.3 million in incremental revenue, with only $5.7 million in incremental directly attributable expenses year-over-year, driving a 92.4% incremental contribution profit margin.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Financial Services – Segment Results of Operations |

| | Three Months Ended December 31, | | | | Year Ended December 31, | | |

($ in thousands) | | 2023 | | 2022 | | % Change | | 2023 | | 2022 | | % Change |

| Net interest income | | $ | 109,072 | | | $ | 45,609 | | | 139 | % | | $ | 334,847 | | | $ | 92,574 | | | 262 | % |

| Noninterest income | | 30,043 | | | 19,208 | | | 56 | % | | 101,668 | | | 75,102 | | | 35 | % |

| Total net revenue – Financial Services | | 139,115 | | | 64,817 | | | 115 | % | | 436,515 | | | 167,676 | | | 160 | % |

| Directly attributable expenses | | (114,055) | | | (108,405) | | | 5 | % | | (436,777) | | | (367,102) | | | 19 | % |

Contribution profit (loss) | | $ | 25,060 | | | $ | (43,588) | | | n/m | | $ | (262) | | | $ | (199,426) | | | (100) | % |

By continuously innovating with new and relevant offerings, features and rewards for members, SoFi grew total Financial Services products by over 2.9 million, or 45%, year-over-year, bringing the total to 9.5 million at year end. In the fourth quarter of 2023, SoFi Money products increased by nearly 311,000, and Relay products increased by over 378,000. SoFi Invest products decreased by 84,000, but when adjusted to exclude the accounts of our now closed digital assets business, products increased by over 113,000 in the quarter.

Most notably, our SoFi Money offering has an APY of up to 4.60% as of January 29, 2024, no minimum balance requirement nor balance limits, FDIC insurance through a network of participating banks of up to $2 million, a host of free features and a unique rewards program. Total deposits grew 19% during the fourth quarter to $18.6 billion at year end, and over 90% of SoFi Money deposits (inclusive of Checking and Savings and cash management accounts) are from direct deposit members. More than half of newly funded SoFi Money accounts were setting up direct deposit by day 30 in the fourth quarter of 2023.

| | | | | | | | | | | | | | | | | | | | |

Financial Services – Products | | December 31, | | |

| | 2023 | | 2022 | | % Change |

Money(1) | | 3,374,310 | | | 2,195,402 | | | 54 | % |

| Invest | | 2,380,641 | | | 2,158,864 | | | 10 | % |

| Credit Card | | 245,385 | | | 171,425 | | | 43 | % |

Referred loans(2) | | 55,231 | | | 40,980 | | | 35 | % |

| Relay | | 3,336,868 | | | 1,921,986 | | | 74 | % |

| At Work | | 87,035 | | | 65,382 | | | 33 | % |

Total financial services products | | 9,479,470 | | | 6,554,039 | | | 45 | % |

___________________

(1)Includes SoFi Checking and Savings accounts held at SoFi Bank, and cash management accounts.

(2)Limited to loans wherein we provide third party fulfillment services.

Guidance and Outlook

Management expects to generate $550 to $560 million of adjusted net revenue in the first quarter of 2024, $110 to $120 million of adjusted EBITDA and GAAP net income of $10 to $20 million. This guide anticipates a 20% adjusted EBITDA margin.

For the full year 2024, management expects Tech Platform and Financial Services segments combined to grow at least 50% and lending revenue to be 92% to 95% of 2023 levels, and expenses under the EBITDA line to be flat when compared to 2023 results, excluding the reported goodwill impairment expense. This guidance anticipates an adjusted EBITDA margin of approximately 30% by year-end, which equates to a range of $580 to $590 million for the year. We anticipate that revenue from our Tech Platform and Financial Services segments, combined, will be approximately equal to revenue from our Lending segment for the year. That equates to full-year GAAP net income in the range of $95 to $105 million, or GAAP EPS of $0.07 to $0.08. We expect growth in tangible book value of $300 to $500 million for the year. In terms of Member growth, we expect at least 2.3 million new members during the full year 2024, which represents 30% growth.

Looking beyond 2024 management expects 20% to 25% compound revenue growth for the time periods of 2023 through 2026, assuming no meaningful changes in the macroeconomic environment and no significant new business

launches or acquisitions. This implies 50% compound growth for Financial Services revenue, mid-20% compound growth for Technology Platform revenue, and mid teens compound growth for Lending segment revenue. This is expected to drive between $0.55 and $0.80 in GAAP earnings per share in 2026.

Moreover, we see 20% to 25% EPS growth beyond 2026 reflecting both the continued growth of the core business growth plus the added benefit from new business lines launched in the 2024 to 2026 time period.

Management will further address full-year guidance on the quarterly earnings conference call. Management has not reconciled forward-looking non-GAAP measures to their most directly comparable GAAP measures of total net revenue, net income and gross margin. This is because the company cannot predict with reasonable certainty and without unreasonable efforts the ultimate outcome of certain GAAP components of such reconciliations due to market-related assumptions that are not within our control as well as certain legal or advisory costs, tax costs or other costs that may arise. For these reasons, management is unable to assess the probable significance of the unavailable information, which could materially impact the amount of the future directly comparable GAAP measures.

Earnings Webcast

SoFi’s executive management team will host a live audio webcast beginning at 8:00 a.m. Eastern Time (5:00 a.m. Pacific Time) today to discuss the quarter’s financial results and business highlights. All interested parties are invited to listen to the live webcast at https://investors.sofi.com. A replay of the webcast will be available on the SoFi Investor Relations website for 30 days. Investor information, including supplemental financial information, is available on SoFi’s Investor Relations website at https://investors.sofi.com.

Cautionary Statement Regarding Forward-Looking Statements

Certain of the statements above are forward-looking and as such are not historical facts. This includes, without limitation, statements regarding our expectations for the first quarter of 2024 adjusted net revenue, adjusted EBITDA, adjusted EBITDA margin and GAAP net income, our expectations regarding full year 2024 lending revenue, revenue and growth in our Technology Platform and Financial Services segments, expenses, adjusted EBITDA margin, GAAP net income, and tangible book value, quarterly and full year member growth, our expectations regarding compound revenue growth through 2026, growth in our segment revenue and EPS expectations beyond 2026, our expectations regarding our ability to continue to grow our business and launch new business lines and products, improve our financials and increase our member, product and total accounts count, our ability to achieve diversified growth and larger, more durable revenue, our ability to navigate the macroeconomic environment and the financial position, business strategy and plans and objectives of management for our future operations. These forward-looking statements are not guarantees of performance. Such statements can be identified by the fact that they do not relate strictly to historical or current facts. Words such as “achieve”, “continue”, “expect”, “growth”, “may”, “plan”, “strategy”, “will be”, “will continue”, and similar expressions may identify forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking. Factors that could cause actual results to differ materially from those contemplated by these forward-looking statements include: (i) the effect of and our ability to respond and adapt to changing market and economic conditions, including recessionary pressures, fluctuating inflation and interest rates, and volatility from global events; (ii) our ability to achieve profitability, operating efficiencies and continued growth across our three businesses in the future, as well as our ability to continue to achieve GAAP net income profitability and expected GAAP net income margins; (iii) the impact on our business of the regulatory environment and complexities with compliance related to such environment; (iv) our ability to realize the benefits of being a bank holding company and operating SoFi Bank, including continuing to grow high quality deposits and our rewards program for members; (v) our ability to continue to drive brand awareness and realize the benefits or our integrated multi-media marketing and advertising campaigns; (vi) our ability to vertically integrate our businesses and accelerate the pace of innovation of our financial products; (vii) our ability to manage our growth effectively and our expectations regarding the development and expansion of our business; (viii) our ability to access sources of capital on acceptable terms or at all, including debt financing and other sources of capital to finance operations and growth; (ix) the success of our continued investments in our Financial Services segment and in our business generally; (x) the success of our marketing efforts and our ability to expand our member base and increase our product adds; (xi) our ability to maintain our leadership position in certain categories of our business and to grow market share in existing markets or any new markets we may enter; (xii) our ability to develop new products, features and functionality that are competitive and meet market needs; (xiii) our ability to realize the benefits of our strategy, including what we refer to as our FSPL; (xiv) our ability to make accurate credit and pricing decisions or effectively forecast our loss rates; (xv) our ability to establish and maintain an effective system of internal controls over financial reporting; (xvi) our ability to maintain the security and reliability of our products; and (xvii) the outcome of any legal or governmental proceedings that may be instituted against us. The foregoing list of factors is not exhaustive. You should carefully consider the foregoing factors and the other risks and uncertainties set forth in the section titled “Risk Factors” in our last quarterly report on Form 10-Q, as filed with the Securities and Exchange Commission, and those that are included in any of our future filings with the Securities and Exchange Commission, including our annual report on Form 10-K, under the Exchange Act. These forward-looking statements are based on information available as of the date hereof and current expectations, forecasts and assumptions, and involve a number of judgments, risks and uncertainties. Accordingly, forward-looking statements should not be relied upon as representing our views as of any subsequent date, and we do not undertake any obligation to update forward-looking statements to reflect events

or circumstances after the date they were made, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws.

As a result of a number of known and unknown risks and uncertainties, our actual results or performance may be materially different from those expressed or implied by these forward-looking statements. You should not place undue reliance on these forward-looking statements.

Non-GAAP Financial Measures

This press release presents information about our adjusted net revenue and adjusted EBITDA, which are non-GAAP financial measures provided as supplements to the results provided in accordance with accounting principles generally accepted in the United States (GAAP). We use adjusted net revenue and adjusted EBITDA to evaluate our operating performance, formulate business plans, help better assess our overall liquidity position, and make strategic decisions, including those relating to operating expenses and the allocation of internal resources. Accordingly, we believe that adjusted net revenue and adjusted EBITDA provide useful information to investors and others in understanding and evaluating our operating results in the same manner as our management. These non-GAAP measures are presented for supplemental informational purposes only, have limitations as analytical tools, and should not be considered in isolation from, or as a substitute for, the analysis of other GAAP financial measures, such as total net revenue and net income (loss). Other companies may not use these non-GAAP measures or may use similar measures that are defined in a different manner. Therefore, SoFi's non-GAAP measures may not be directly comparable to similarly titled measures of other companies. Reconciliations of these non-GAAP measures to the most directly comparable GAAP financial measures are provided in Table 2 to the “Financial Tables” herein.

Forward-looking non-GAAP financial measures are presented without reconciliations of such forward-looking non-GAAP measures because the GAAP financial measures are not accessible on a forward-looking basis and reconciling information is not available without unreasonable effort due to the inherent difficulty in forecasting and quantifying certain amounts that are necessary for such reconciliations, including adjustments reflected in our reconciliation of historic non-GAAP financial measures, the amounts of which, based on historical experience, could be material.

About SoFi

SoFi (NASDAQ: SOFI) is a member-centric, one-stop shop for digital financial services on a mission to help people achieve financial independence to realize their ambitions. The company’s full suite of financial products and services helps its more than 7.5 million SoFi members borrow, save, spend, invest, and protect their money better by giving them fast access to the tools they need to get their money right, all in one app. SoFi also equips members with the resources they need to get ahead – like career advisors, Credentialed Financial Planners (CFP®), exclusive experiences and events, and a thriving community – on their path to financial independence.

SoFi innovates across three business segments: Lending, Financial Services – which includes SoFi Checking and Savings, SoFi Invest, SoFi Credit Card, SoFi Protect, and SoFi Insights – and Technology Platform, which offers the only end-to-end vertically integrated financial technology stack. SoFi Bank, N.A., an affiliate of SoFi, is a nationally chartered bank, regulated by the OCC and FDIC and SoFi is a bank holding company regulated by the Federal Reserve. The company is also the naming rights partner of SoFi Stadium, home of the Los Angeles Chargers and the Los Angeles Rams. For more information, visit https://www.sofi.com or download our iOS and Android apps.

Availability of Other Information About SoFi

Investors and others should note that we communicate with our investors and the public using our website (https://www.sofi.com), the investor relations website (https://investors.sofi.com), and on social media (Twitter and LinkedIn), including but not limited to investor presentations and investor fact sheets, Securities and Exchange Commission filings, press releases, public conference calls and webcasts. The information that SoFi posts on these channels and websites could be deemed to be material information. As a result, SoFi encourages investors, the media, and others interested in SoFi to review the information that is posted on these channels, including the investor relations website, on a regular basis. This list of channels may be updated from time to time on SoFi’s

investor relations website and may include additional social media channels. The contents of SoFi’s website or these channels, or any other website that may be accessed from its website or these channels, shall not be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended.

Contact

Investors:

SoFi Investor Relations

IR@sofi.com

Media:

SoFi Media Relations

PR@sofi.com

SOFI-F

FINANCIAL TABLES

(Unaudited)

1. Consolidated Statements of Operations

2. Reconciliation of GAAP to Non-GAAP Financial Measures

3. Consolidated Balance Sheets

4. Average Balances and Net Interest Earnings Analysis

5. Consolidated Cash Flow Data

6. Company Metrics

7. Segment Financials

8. Earnings (Loss) Per Share

Table 1

SoFi Technologies, Inc.

Consolidated Statements of Operations

(Unaudited)

(In Thousands, Except for Share and Per Share Data)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Year Ended December 31, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Interest income | | | | | | | |

| | | | | | | |

| | | | | | | |

| Loans and securitizations | $ | 598,959 | | | $ | 300,299 | | | $ | 1,944,128 | | | $ | 759,504 | |

| Other | 46,278 | | | 7,109 | | | 106,939 | | | 13,867 | |

| Total interest income | 645,237 | | | 307,408 | | | 2,051,067 | | | 773,371 | |

| Interest expense | | | | | | | |

| Securitizations and warehouses | 62,989 | | | 50,969 | | | 244,220 | | | 110,127 | |

| Deposits | 182,612 | | | 40,670 | | | 507,820 | | | 59,793 | |

| Corporate borrowings | 9,882 | | | 7,069 | | | 36,833 | | | 18,438 | |

| Other | 113 | | | 116 | | | 454 | | | 917 | |

| Total interest expense | 255,596 | | | 98,824 | | | 789,327 | | | 189,275 | |

| Net interest income | 389,641 | | | 208,584 | | | 1,261,740 | | | 584,096 | |

| Noninterest income | | | | | | | |

| | | | | | | |

| | | | | | | |

| Loan origination, sales, and securitizations | 82,929 | | | 131,347 | | | 371,812 | | | 565,372 | |

| Servicing | 7,525 | | | 13,544 | | | 37,328 | | | 43,547 | |

| Technology products and solutions | 87,026 | | | 81,339 | | | 323,972 | | | 304,901 | |

| Other | 48,283 | | | 21,865 | | | 127,937 | | | 75,619 | |

| Total noninterest income | 225,763 | | | 248,095 | | | 861,049 | | | 989,439 | |

| Total net revenue | 615,404 | | | 456,679 | | | 2,122,789 | | | 1,573,535 | |

| Noninterest expense | | | | | | | |

| Technology and product development | 141,817 | | | 113,281 | | | 511,419 | | | 405,257 | |

| Sales and marketing | 174,705 | | | 173,702 | | | 719,400 | | | 617,823 | |

| Cost of operations | 103,947 | | | 80,615 | | | 379,998 | | | 313,226 | |

| General and administrative | 131,685 | | | 113,085 | | | 511,011 | | | 501,618 | |

| Goodwill impairment | — | | | — | | | 247,174 | | | — | |

| Provision for credit losses | 12,092 | | | 14,945 | | | 54,945 | | | 54,332 | |

| Total noninterest expense | 564,246 | | | 495,628 | | | 2,423,947 | | | 1,892,256 | |

Income (loss) before income taxes | 51,158 | | | (38,949) | | | (301,158) | | | (318,721) | |

Income tax (expense) benefit | (3,245) | | | (1,057) | | | 416 | | | (1,686) | |

Net income (loss) | $ | 47,913 | | | $ | (40,006) | | | $ | (300,742) | | | $ | (320,407) | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

Earnings (loss) per share | | | | | | | |

Earnings (loss) per share – basic | $ | 0.04 | | | $ | (0.05) | | | $ | (0.36) | | | $ | (0.40) | |

Earnings (loss) per share – diluted | $ | 0.02 | | | $ | (0.05) | | | $ | (0.36) | | | $ | (0.40) | |

| Weighted average common stock outstanding – basic | 962,691,936 | | | 922,936,519 | | | 945,024,160 | | | 900,886,113 | |

| Weighted average common stock outstanding – diluted | 1,029,303,297 | | | 922,936,519 | | | 945,024,160 | | | 900,886,113 | |

Table 2

Non-GAAP Financial Measures

(Unaudited)

Reconciliation of Adjusted Net Revenue

Adjusted net revenue is defined as total net revenue, adjusted to exclude the fair value changes in servicing rights and residual interests classified as debt due to valuation inputs and assumptions changes, which relate only to our Lending segment, as well as gains and losses on extinguishment of debt. For our consolidated results and for the Lending segment, we reconcile adjusted net revenue to total net revenue, the most directly comparable GAAP measure, as presented for the periods indicated below:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended December 31, | | Year Ended December 31, |

($ in thousands) | | 2023 | | 2022 | | 2023 | | 2022 |

Total net revenue | | $ | 615,404 | | | $ | 456,679 | | | $ | 2,122,789 | | | $ | 1,573,535 | |

Servicing rights – change in valuation inputs or assumptions(1) | | (6,595) | | | (12,791) | | | (34,700) | | | (39,651) | |

Residual interests classified as debt – change in valuation inputs or assumptions(2) | | 10 | | | (470) | | | 425 | | | 6,608 | |

Gain on extinguishment of debt(3) | | (14,574) | | | — | | | (14,574) | | | — | |

Adjusted net revenue | | $ | 594,245 | | | $ | 443,418 | | | $ | 2,073,940 | | | $ | 1,540,492 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended December 31, | | Year Ended December 31, |

($ in thousands) | | 2023 | | 2022 | | 2023 | | 2022 |

Total net revenue – Lending | | $ | 353,126 | | | $ | 328,191 | | | $ | 1,370,621 | | | $ | 1,139,991 | |

Servicing rights – change in valuation inputs or assumptions(1) | | (6,595) | | | (12,791) | | | (34,700) | | | (39,651) | |

Residual interests classified as debt – change in valuation inputs or assumptions(2) | | 10 | | | (470) | | | 425 | | | 6,608 | |

| Adjusted net revenue – Lending | | $ | 346,541 | | | $ | 314,930 | | | $ | 1,336,346 | | | $ | 1,106,948 | |

___________________

(1)Reflects changes in fair value inputs and assumptions on servicing rights, including conditional prepayment, default rates and discount rates. These assumptions are highly sensitive to market interest rate changes and are not indicative of our performance or results of operations. Moreover, these non-cash charges are unrealized during the period and, therefore, have no impact on our cash flows from operations. As such, these positive and negative changes are adjusted out of total net revenue to provide management and financial users with better visibility into the net revenue available to finance our operations and our overall performance.

(2)Reflects changes in fair value inputs and assumptions on residual interests classified as debt, including conditional prepayment, default rates and discount rates. When third parties finance our consolidated securitization VIEs by purchasing residual interests, we receive proceeds at the time of the closing of the securitization and, thereafter, pass along contractual cash flows to the residual interest owner. These residual debt obligations are measured at fair value on a recurring basis, but they have no impact on our initial financing proceeds, our future obligations to the residual interest owner (because future residual interest claims are limited to contractual securitization collateral cash flows), or the general operations of our business. As such, these positive and negative non-cash changes in fair value attributable to assumption changes are adjusted out of total net revenue to provide management and financial users with better visibility into the net revenue available to finance our operations.

(3)Reflects gain on extinguishment of debt. Gains and losses are recognized during the period of extinguishment for the difference between the net carrying amount of debt extinguished and the fair value of equity securities issued. These non-cash charges are not indicative of our core operating performance, and as such are adjusted out of total net revenue to provide management and financial users with better visibility into the net revenue available to finance our operations and our overall performance.

Reconciliation of Adjusted EBITDA

Adjusted EBITDA is defined as net income (loss), adjusted to exclude, as applicable: (i) corporate borrowing-based interest expense (our adjusted EBITDA measure is not adjusted for warehouse or securitization-based interest expense, nor deposit interest expense and finance lease liability interest expense, as these are not direct operating expenses), (ii) income tax expense (benefit), (iii) depreciation and amortization, (iv) share-based expense (inclusive of equity-based payments to non-employees), (v) impairment expense (inclusive of goodwill impairment and property, equipment and software abandonments), (vi) transaction-related expenses, (vii) foreign currency impacts related to operations in highly inflationary countries, (viii) fair value changes in warrant liabilities, (ix) fair value changes in each of servicing rights and residual interests classified as debt due to valuation assumptions, and (x) other charges, as appropriate, that are not expected to recur and are not indicative of our core operating performance. We reconcile adjusted EBITDA to net loss, the most directly comparable GAAP measure, for the periods indicated below: | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended December 31, | | Year Ended December 31, |

($ in thousands) | | 2023 | | 2022 | | 2023 | | 2022 |

Net income (loss) | | $ | 47,913 | | | $ | (40,006) | | | $ | (300,742) | | | $ | (320,407) | |

| Non-GAAP adjustments: | | | | | | | | |

Interest expense – corporate borrowings(1) | | 9,882 | | | 7,069 | | | 36,833 | | | 18,438 | |

Income tax expense (benefit)(2) | | 3,245 | | | 1,057 | | | (416) | | | 1,686 | |

Depreciation and amortization(3) | | 53,449 | | | 42,353 | | | 201,416 | | | 151,360 | |

| Share-based expense | | 69,107 | | | 70,976 | | | 271,216 | | | 305,994 | |

Restructuring charges(4) | | 7,796 | | | — | | | 12,749 | | | — | |

Impairment expense(5) | | — | | | — | | | 248,417 | | | — | |

Foreign currency impact of highly inflationary subsidiaries(6) | | 10,971 | | | — | | | 10,971 | | | — | |

Transaction-related expense(7) | | — | | | 1,872 | | | 142 | | | 19,318 | |

Servicing rights – change in valuation inputs or assumptions(8) | | (6,595) | | | (12,791) | | | (34,700) | | | (39,651) | |

Residual interests classified as debt – change in valuation inputs or assumptions(9) | | 10 | | | (470) | | | 425 | | | 6,608 | |

Gain on extinguishment of debt(10) | | (14,574) | | | — | | | (14,574) | | | — | |

| Total adjustments | | 133,291 | | | 110,066 | | | 732,479 | | | 463,753 | |

| Adjusted EBITDA | | $ | 181,204 | | | $ | 70,060 | | | $ | 431,737 | | | $ | 143,346 | |

___________________

(1)Our adjusted EBITDA measure adjusts for corporate borrowing-based interest expense, as these expenses are a function of our capital structure. Corporate borrowing-based interest expense includes interest on our revolving credit facility and the amortization of debt discount and debt issuance costs on our convertible notes. Revolving credit facility interest expense in the 2023 periods increased due to higher interest rates relative to the prior year periods on identical outstanding debt.

(2)Income taxes were primarily attributable to tax expense associated with the profitability of SoFi Bank in state jurisdictions where separate filings are required. For the full year 2023 period, this expense was more than offset by income tax benefits from foreign losses in jurisdictions with net deferred tax liabilities related to Technisys.

(3)Depreciation and amortization expense for the 2023 periods increased compared to the 2022 periods primarily in connection with acquisitions and growth in our internally-developed software balance.

(4)Restructuring charges in 2023 primarily included employee-related wages, benefits and severance associated with a small reduction in headcount in our Technology Platform segment in the first quarter of 2023 and expenses in the fourth quarter of 2023 related to a reduction in headcount across the Company, which do not reflect expected future operating expenses and are not indicative of our core operating performance.

(5)Impairment expense for the full year 2023 period includes $247,174 related to goodwill impairment, and $1,243 related to a sublease arrangement, which are not indicative of our core operating performance.

(6)Foreign currency charges reflect the impacts of highly inflationary accounting for our operations in Argentina, which are related to our Technology Platform segment and commenced in the first quarter of 2022 with the Technisys Merger. For the year ended December 31, 2023, all amounts were reflected in the fourth quarter, as inter-quarter amounts were determined to be immaterial. Amounts in 2022 were determined to be immaterial.

(7)Transaction-related expenses in the 2023 and 2022 periods primarily included financial advisory and professional services costs associated with our acquisitions of Wyndham and Technisys, respectively.

(8)Reflects changes in fair value inputs and assumptions, including market servicing costs, conditional prepayment, default rates and discount rates. This non-cash change is unrealized during the period and, therefore, has no impact on our cash flows from operations. As such, these positive and negative changes in fair value attributable to assumption changes are adjusted out of net loss to provide management and financial users with better visibility into the earnings available to finance our operations.

(9)Reflects changes in fair value inputs and assumptions, including conditional prepayment, default rates and discount rates. When third parties finance our consolidated VIEs through purchasing residual interests, we receive proceeds at the time of the securitization close and, thereafter, pass along contractual cash flows to the residual interest owner. These obligations are measured at fair value on a recurring basis, which has no impact on our initial financing proceeds, our future obligations to the residual interest owner (because future residual interest claims are limited to contractual securitization collateral cash flows), or the general operations of our business. As such, these positive and negative non-cash changes in fair value attributable to assumption changes are adjusted out of net loss to provide management and financial users with better visibility into the earnings available to finance our operations.

(10)Reflects gain on extinguishment of debt. Gains and losses are recognized during the period of extinguishment for the difference between the net carrying amount of debt extinguished and the fair value of equity securities issued. These non-cash charges are not indicative of our core operating performance, and as such are adjusted out of total net revenue to provide management and financial users with better visibility into the net revenue available to finance our operations and our overall performance.

Table 3

SoFi Technologies, Inc.

Consolidated Balance Sheets

(Unaudited)

(In Thousands, Except for Share Data)

| | | | | | | | | | | |

| December 31,

2023 | | December 31, 2022 |

| Assets | | | |

| Cash and cash equivalents | $ | 3,085,020 | | | $ | 1,421,907 | |

| Restricted cash and restricted cash equivalents | 530,558 | | | 424,395 | |

Investment securities (includes available-for-sale securities of $595,187 and $195,438 at fair value with associated amortized cost of $596,757 and $203,418, as of December 31, 2023 and December 31, 2022, respectively) | 701,935 | | | 396,769 | |

| Loans held for sale, at fair value | 15,396,771 | | | 13,557,074 | |

| Loans held for investment, at fair value | 6,725,484 | | | — | |

Loans held for investment (less allowance for credit losses on loans at amortized cost of $54,695 and $40,788, as of December 31, 2023 and December 31, 2022, respectively) | 836,159 | | | 307,957 | |

| Servicing rights | 180,469 | | | 149,854 | |

| Property, equipment and software | 216,908 | | | 170,104 | |

| Goodwill | 1,393,505 | | | 1,622,991 | |

| Intangible assets | 364,048 | | | 442,155 | |

| Operating lease right-of-use assets | 89,635 | | | 97,135 | |

Other assets (less allowance for credit losses of $1,837 and $2,785, as of December 31, 2023 and December 31, 2022, respectively) | 554,366 | | | 417,334 | |

| Total assets | $ | 30,074,858 | | | $ | 19,007,675 | |

| Liabilities, temporary equity and permanent equity | | | |

| Liabilities: | | | |

| Deposits: | | | |

| Interest-bearing deposits | $ | 18,568,993 | | | $ | 7,265,792 | |

| Noninterest-bearing deposits | 51,670 | | | 76,504 | |

| Total deposits | 18,620,663 | | | 7,342,296 | |

| Accounts payable, accruals and other liabilities | 549,748 | | | 516,215 | |

| Operating lease liabilities | 108,649 | | | 117,758 | |

| Debt | 5,233,416 | | | 5,485,882 | |

| Residual interests classified as debt | 7,396 | | | 17,048 | |

| Total liabilities | 24,519,872 | | | 13,479,199 | |

| Commitments, guarantees, concentrations and contingencies | | | |

| Temporary equity: | | | |

Redeemable preferred stock, $0.00 par value: 100,000,000 and 100,000,000 shares authorized; 3,234,000 and 3,234,000 shares issued and outstanding as of December 31, 2023 and December 31, 2022, respectively | 320,374 | | | 320,374 | |

| Permanent equity: | | | |

Common stock, $0.00 par value: 3,100,000,000 and 3,100,000,000 shares authorized; 975,861,793 and 933,896,120 shares issued and outstanding as of December 31, 2023 and December 31, 2022, respectively | 97 | | | 93 | |

| Additional paid-in capital | 7,039,987 | | | 6,719,826 | |

| Accumulated other comprehensive loss | (1,209) | | | (8,296) | |

| Accumulated deficit | (1,804,263) | | | (1,503,521) | |

| Total permanent equity | 5,234,612 | | | 5,208,102 | |

| Total liabilities, temporary equity and permanent equity | $ | 30,074,858 | | | $ | 19,007,675 | |

Table 4

SoFi Technologies, Inc.

Average Balances and Net Interest Earnings Analysis

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended December 31, 2023 | | Three Months Ended December 31, 2022 |

| ($ in thousands) | | Average Balances | | Interest Income/Expense | | Average Yield/Rate | | Average Balances | | Interest Income/Expense | | Average Yield/Rate |

| Assets | | | | | | | | | | | | |

| Interest-earning assets: | | | | | | | | | | | | |

| Interest-bearing deposits with banks | | $ | 2,675,248 | | | $ | 34,217 | | | 5.07 | % | | $ | 1,286,970 | | | $ | 6,911 | | | 2.15 | % |

| Investment securities | | 697,032 | | | 13,837 | | | 7.88 | | | 417,150 | | | 3,435 | | | 3.29 | |

| Loans | | 22,326,117 | | | 597,183 | | | 10.61 | | | 12,399,647 | | | 297,824 | | | 9.61 | |

| | | | | | | | | | | | |

| Total interest-earning assets | | 25,698,397 | | | 645,237 | | | 9.96 | | | 14,103,767 | | | 308,170 | | | 8.74 | |

| Total noninterest-earning assets | | 2,879,773 | | | | | | | 3,084,282 | | | | | |

| Total assets | | $ | 28,578,170 | | | | | | | $ | 17,188,049 | | | | | |

| Liabilities, Temporary Equity and Permanent Equity | | | | | | | | | | | | |

| Interest-bearing liabilities: | | | | | | | | | | | | |

| Demand deposits | | $ | 2,553,537 | | | $ | 13,062 | | | 2.03 | % | | $ | 2,103,395 | | | $ | 11,118 | | | 2.11 | % |

| Savings deposits | | 11,664,436 | | | 133,795 | | | 4.55 | | | 3,135,963 | | | 22,915 | | | 2.92 | |

| Time deposits | | 2,719,390 | | | 35,755 | | | 5.22 | | | 672,690 | | | 6,637 | | | 3.95 | |

| Total interest-bearing deposits | | 16,937,363 | | | 182,612 | | | 4.28 | | | 5,912,048 | | | 40,670 | | | 2.75 | |

| Warehouse facilities | | 3,285,127 | | | 53,473 | | | 6.46 | | | 2,645,291 | | | 39,558 | | | 5.98 | |

| Securitization debt | | 543,152 | | | 6,283 | | | 4.59 | | | 659,962 | | | 7,278 | | | 4.41 | |

| Other debt | | 1,626,551 | | | 13,228 | | | 3.23 | | | 1,648,150 | | | 10,948 | | | 2.66 | |

| Total debt | | 5,454,830 | | | 72,984 | | | 5.31 | | | 4,953,403 | | | 57,784 | | | 4.67 | |

| Residual interests classified as debt | | 9,192 | | | — | | | — | | | 36,638 | | | 254 | | | 2.77 | |

| Total interest-bearing liabilities | | 22,401,385 | | | 255,596 | | | 4.53 | | | 10,902,089 | | | 98,708 | | | 3.62 | |

| Total noninterest-bearing liabilities | | 761,532 | | | | | | | 733,524 | | | | | |

| Total liabilities | | 23,162,917 | | | | | | | 11,635,613 | | | | | |

| Total temporary equity | | 320,374 | | | | | | | 320,374 | | | | | |

| Total permanent equity | | 5,094,879 | | | | | | | 5,232,062 | | | | | |

| Total liabilities, temporary equity and permanent equity | | $ | 28,578,170 | | | | | | | $ | 17,188,049 | | | | | |

| | | | | | | | | | | | |

| Net interest income | | | | $ | 389,641 | | | | | | | $ | 209,462 | | | |

| Net interest margin | | | | | | 6.02 | % | | | | | | 5.94 | % |

SoFi Technologies, Inc.

Average Balances and Net Interest Earnings Analysis (Continued)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Year Ended December 31, 2023 | | Year Ended December 31, 2022 |

| ($ in thousands) | | Average Balances | | Interest Income/Expense | | Average Yield/Rate | | Average Balances | | Interest Income/Expense | | Average Yield/Rate |

| Assets | | | | | | | | | | | | |

| Interest-earning assets: | | | | | | | | | | | | |

| Interest-bearing deposits with banks | | $ | 2,172,013 | | | $ | 91,312 | | | 4.20 | % | | $ | 1,122,364 | | | $ | 10,841 | | | 0.97 | % |

| Investment securities | | 541,590 | | | 25,096 | | | 4.63 | | | 494,005 | | | 12,542 | | | 2.54 | |

| Loans | | 18,733,812 | | | 1,934,659 | | | 10.33 | | | 9,200,023 | | | 749,071 | | | 8.14 | |

| Total interest-earning assets | | 21,447,415 | | | 2,051,067 | | | 9.56 | | | 10,816,392 | | | 772,454 | | | 7.14 | |

| Total noninterest-earning assets | | 3,055,580 | | | | | | | 2,812,054 | | | | | |

| Total assets | | $ | 24,502,995 | | | | | | | $ | 13,628,446 | | | | | |

| Liabilities, Temporary Equity and Permanent Equity | | | | | | | | | | | | |

| Interest-bearing liabilities: | | | | | | | | | | | | |

| Demand deposits | | $ | 2,214,794 | | | $ | 51,673 | | | 2.33 | % | | $ | 1,336,006 | | | $ | 21,814 | | | 1.63 | % |

| Savings deposits | | 8,481,895 | | | 359,444 | | | 4.24 | | | 1,403,750 | | | 31,045 | | | 2.21 | |

| Time deposits | | 1,958,002 | | | 96,703 | | | 4.94 | | | 281,633 | | | 6,934 | | | 2.46 | |

| Total interest-bearing deposits | | 12,654,691 | | | 507,820 | | | 4.01 | | | 3,021,389 | | | 59,793 | | | 1.98 | |

| Warehouse facilities | | 3,142,096 | | | 192,987 | | | 6.14 | | | 2,378,935 | | | 71,717 | | | 3.01 | |

| Securitization debt | | 751,869 | | | 36,853 | | | 4.90 | | | 593,824 | | | 22,507 | | | 3.79 | |

| Other debt | | 1,638,748 | | | 51,526 | | | 3.14 | | | 1,575,027 | | | 30,618 | | | 1.94 | |

| Total debt | | 5,532,713 | | | 281,366 | | | 5.09 | | | 4,547,786 | | | 124,842 | | | 2.75 | |

| Residual interests classified as debt | | 12,301 | | | 141 | | | 1.15 | | | 57,510 | | | 3,723 | | | 6.47 | |

| Total interest-bearing liabilities | | 18,199,705 | | | 789,327 | | | 4.34 | | | 7,626,685 | | | 188,358 | | | 2.47 | |

| Total noninterest-bearing liabilities | | 757,070 | | | | | | | 657,314 | | | | | |

| Total liabilities | | 18,956,775 | | | | | | | 8,283,999 | | | | | |

| Total temporary equity | | 320,374 | | | | | | | 320,374 | | | | | |

| Total permanent equity | | 5,225,846 | | | | | | | 5,024,073 | | | | | |

| Total liabilities, temporary equity and permanent equity | | $ | 24,502,995 | | | | | | | $ | 13,628,446 | | | | | |

| | | | | | | | | | | | |

| Net interest income | | | | $ | 1,261,740 | | | | | | | $ | 584,096 | | | |

| Net interest margin | | | | | | 5.88 | % | | | | | | 5.40 | % |

Table 5

SoFi Technologies, Inc.

Consolidated Cash Flow Data

(Unaudited)

(In Thousands)

| | | | | | | | | | | |

| Year Ended December 31, |

| 2023 | | 2022 |

| Net cash used in operating activities | $ | (7,227,139) | | | $ | (7,255,858) | |

| Net cash used in investing activities | (1,889,864) | | | (106,333) | |

| Net cash provided by financing activities | 10,885,602 | | | 8,439,485 | |

| Effect of exchange rates on cash and cash equivalents | 677 | | | 571 | |

| Net increase in cash, cash equivalents, restricted cash and restricted cash equivalents | $ | 1,769,276 | | | $ | 1,077,865 | |

| Cash, cash equivalents, restricted cash and restricted cash equivalents at beginning of period | 1,846,302 | | | 768,437 | |

| Cash, cash equivalents, restricted cash and restricted cash equivalents at end of period | $ | 3,615,578 | | | $ | 1,846,302 | |

Table 6

Company Metrics

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| December 31,

2023 | | September 30,

2023 | | June 30,

2023 | | March 31,

2023 | | December 31,

2022 | | September 30,

2022 | | June 30,

2022 | | March 31,

2022 | | December 31,

2021 | | | | | | | | | | | | | | |

| Members | 7,541,860 | | | 6,957,187 | | | 6,240,091 | | | 5,655,711 | | | 5,222,533 | | | 4,742,673 | | | 4,318,705 | | | 3,868,334 | | | 3,460,298 | | | | | | | | | | | | | | | |

| Total Products | 11,142,476 | | | 10,447,806 | | | 9,401,025 | | | 8,554,363 | | | 7,894,636 | | | 7,199,298 | | | 6,564,174 | | | 5,862,137 | | | 5,173,197 | | | | | | | | | | | | | | | |

| Total Products — Lending segment | 1,663,006 | | | 1,593,906 | | | 1,503,892 | | | 1,416,122 | | | 1,340,597 | | | 1,280,493 | | | 1,202,027 | | | 1,138,566 | | | 1,078,952 | | | | | | | | | | | | | | | |

| Total Products — Financial Services segment | 9,479,470 | | | 8,853,900 | | | 7,897,133 | | | 7,138,241 | | | 6,554,039 | | | 5,918,805 | | | 5,362,147 | | | 4,723,571 | | | 4,094,245 | | | | | | | | | | | | | | | |

Total Accounts — Technology Platform segment(1) | 145,425,391 | | | 136,739,131 | | | 129,356,203 | | | 126,326,916 | | | 130,704,351 | | | 124,332,810 | | | 116,570,038 | | | 109,687,014 | | | 99,660,657 | | | | | | | | | | | | | | | |

___________________

(1)Beginning in the fourth quarter of 2021, the company included SoFi accounts on the Galileo platform-as-a-service in its total Technology Platform accounts metric to better align with the presentation of Technology Platform segment revenue. Quarterly amounts for the earlier quarters in 2021 were determined to be immaterial, and as such were not recast.

Members

We refer to our customers as “members”. We define a member as someone who has a lending relationship with us through origination and/or ongoing servicing, opened a financial services account, linked an external account to our platform or signed up for our credit score monitoring service. Our members have continuous access to our CFPs, our career advice services, our member events, our content, educational material, news, and our tools and calculators, which are provided at no cost to the member. We view members as an indication not only of the size and a measurement of growth of our business, but also as a measure of the significant value of the data we have collected over time.

Once someone becomes a member, they are always considered a member unless they violate our terms of service. We adjust our total number of members in the event a member is removed in accordance with our terms of service. This could occur for a variety of reasons—including fraud or pursuant to certain legal processes—and, as our terms of service evolve together with our business practices, product offerings and applicable regulations, our grounds for removing members from our total member count could change. The determination that a member should be removed in accordance with our terms of service is subject to an evaluation process, following the completion, and based on the results, of which, relevant members and their associated products are removed from our total member count in the period in which such evaluation process concludes. However, depending on the length of the evaluation process, that removal may not take place in the same period in which the member was added to our member count or the same period in which the circumstances leading to their removal occurred. For this reason, our total member count may not yet reflect adjustments that may be made once ongoing evaluation processes, if any, conclude.

Total Products

Total products refers to the aggregate number of lending and financial services products that our members have selected on our platform since our inception through the reporting date, whether or not the members are still registered for such products. Total products is a primary indicator of the size and reach of our Lending and Financial Services segments. Management relies on total products metrics to understand the effectiveness of our member acquisition efforts and to gauge the propensity for members to use more than one product.

In our Lending segment, total products refers to the number of personal loans, student loans and home loans that have been originated through our platform through the reporting date, whether or not such loans have been paid off. If a member has multiple loan products of the same loan product type, such as two personal loans, that is counted as a single product. However, if a member has multiple loan products across loan product types, such as one personal loan and one home loan, that is counted as two products.

In our Financial Services segment, total products refers to the number of SoFi Money accounts (inclusive of checking and savings accounts held at SoFi Bank and cash management accounts), SoFi Invest accounts, SoFi Credit Card accounts (including accounts with a zero dollar balance at the reporting date), referred loans (which are originated by a third-party partner to which we provide pre-qualified borrower referrals), SoFi At Work accounts and SoFi Relay accounts (with either credit score monitoring enabled or external linked accounts) that have been opened through our platform through the reporting date. Checking and savings accounts are considered one account within our total products metric. Our SoFi Invest service is composed of three products: active investing accounts, robo-advisory accounts and digital assets accounts. Our members can select any one or combination of the types of SoFi Invest products. We began to wind-down our crypto-related activities in November 2023, whereby members could

no longer create new digital assets accounts and we began closing existing digital assets accounts. This process is expected to be completed in the first quarter of 2024. If a member has multiple SoFi Invest products of the same account type, such as two active investing accounts, that is counted as a single product. However, if a member has multiple SoFi Invest products across account types, such as one active investing account and one robo-advisory account, those separate account types are considered separate products. In the event a member is removed in accordance with our terms of service, as discussed under “Members” above, the member’s associated products are also removed.

Technology Platform Total Accounts

In our Technology Platform segment, total accounts refers to the number of open accounts at Galileo as of the reporting date. Beginning in the fourth quarter of 2021, we included intercompany accounts on the Galileo platform-as-a-service in our total accounts metric to better align with the Technology Platform segment revenue, which includes intercompany revenue. We recast the accounts in the fourth quarter of 2021, but did not recast the accounts for the earlier quarters in 2021, as the impact was determined to be immaterial. Total accounts is a primary indicator of the accounts dependent upon our technology platform to use virtual card products, virtual wallets, make peer-to-peer and bank-to-bank transfers, receive early paychecks, separate savings from spending balances, make debit transactions and rely upon real-time authorizations, all of which result in revenues for the Technology Platform segment. We do not measure total accounts for the Technisys products and solutions, as the revenue model is not primarily dependent upon being a fully integrated, stand-ready service.

Table 7

Segment Financials

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Quarter Ended | | | | | | | | | | |

($ in thousands) | | December 31, 2023 | | September 30, 2023 | | June 30,

2023 | | March 31,

2023 | | December 31,

2022 | | September 30,

2022 | | June 30,

2022 | | March 31,

2022 | | December 31,

2021 | | | | | | | | | | | | | | |