0000916540false00009165402024-01-252024-01-25

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

| | | | | | | | | | | |

Date of report (Date of earliest event reported) | January 25, 2024 |

| | | | | | | | | | | | | | |

DARLING INGREDIENTS INC. |

| (Exact Name of Registrant as Specified in Charter) |

| | | | | | | | |

| Delaware | 001-13323 | 36-2495346 |

(State or Other Jurisdiction

of Incorporation) | (Commission

File Number) | (IRS Employer

Identification No.) |

5601 N. MacArthur Blvd., Irving, Texas 75038

(Address of Principal Executive Offices) (Zip Code)

Registrant’s telephone number, including area code: (972) 717-0300

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common stock $0.01 par value per share | DAR | New York Stock Exchange | (“NYSE”) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On January 25, 2024, Darling Ingredients Inc. (the “Company”) issued a press release in which, among other things, the Company provided comments regarding its fourth quarter and fiscal year 2023 earnings. A copy of the press release is filed as Exhibit 99.1.

The information in this Item 2.02, including the exhibit attached hereto, shall not be deemed "filed" for purposes of Section 18 of the Securities Exchange Act of 1934, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, except as shall be expressly set forth by specific reference in such filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

| | | | | | | | |

| 99.1 | | | |

| 104 | | | Cover Page Interactive Data File (embedded within Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | DARLING INGREDIENTS INC. | |

| | | | |

| Date: January 25, 2024 | By: | /s/ John F. Sterling | |

| | | John F. Sterling | |

| | | Executive Vice President,

General Counsel | |

EXHIBIT 99.1

IMMEDIATE RELEASE

January 25, 2024

Darling Ingredients Inc. Statement on Fiscal Year 2023 Earnings

IRVING, Texas, – Darling Ingredients Inc. (NYSE: DAR) today released the following statement regarding fourth quarter and fiscal year 2023 earnings.

Fourth quarter and fiscal year 2023 earnings for Darling Ingredients’ 50/50 joint venture known as Diamond Green Diesel (DGD) were released earlier today by Darling’s joint venture partner.

Darling Ingredients will release its fourth quarter and fiscal year 2023 earnings on or around February 27, 2024, and expects to deliver its sixth consecutive year of record earnings for fiscal year 2023. The core ingredients business performed very well in the fourth quarter and is projected to show strong improvement quarter over quarter.

Heading into 2024, the company is making adjustments, which it believes will protect margins in the Feed segment as global finished good prices have declined, while the Food and Fuel segments are much more insulated from commodity volatility.

We remain optimistic about 2024 performance given the diversity of our integrated global platform, combined with expected contributions from recent acquisitions, successful integration efforts, improved performance at DGD and sustainable aviation fuel production on the horizon. The company will provide additional details regarding its 2024 outlook during its fiscal year 2023 earnings call.

About Darling Ingredients

Darling Ingredients Inc. (NYSE: DAR) is the largest publicly traded company turning edible by-products and food waste into sustainable products and a leading producer of renewable energy. Recognized as a sustainability leader, the company operates more than 260 facilities in over 15 countries and repurposes approximately 15% of the world's meat industry waste streams into value-added products, such as green energy, renewable diesel, collagen, fertilizer, animal proteins and meals, and pet food ingredients. To learn more, visit darlingii.com. Follow us on LinkedIn.

Cautionary Statements Regarding Forward-Looking Information:

This media release contains includes “forward-looking” statements that are subject to risks and uncertainties that could cause actual results to differ materially from those expressed or implied in the statements. Statements that are not statements of historical facts are forward-looking statements and are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Words such as “estimate,” “guidance,” “project,” “planned,” “contemplate,” “potential,” “possible,” “proposed,” “intend,” “believe,” “anticipate,” “expect,” “may,” “will,” “would,” “should,” “could,” and similar expressions are intended to identify forward-looking statements. All statements other than statements of historical facts included in this release are forward looking statements. Forward-looking statements are based on the Company's current expectations and assumptions regarding its business, the economy and other future conditions. The Company cautions readers that any such forward-looking statements it makes are not guarantees of future performance and that actual results may differ materially from anticipated results or expectations expressed in its forward-looking statements as a result of a variety of factors, including many that are beyond the Company's control. Important factors that could cause actual results to differ materially from the Company’s expectations include: existing and unknown future limitations on the ability of the Company's direct and indirect subsidiaries to make their cash flow available to the Company for payments on the Company's indebtedness or other purposes; global demands for bio-fuels and grain and oilseed commodities, which have exhibited volatility, and can impact the cost of feed for cattle, hogs and poultry, thus affecting available rendering feedstock and selling prices for the Company’s products; reductions in raw material volumes available to the Company due to weak margins in the meat production industry as a result of higher feed costs, reduced consumer demand or other factors, reduced volume from food service establishments, or otherwise; reduced demand for animal feed; reduced finished product prices, including a decline in fat and used cooking oil finished product prices; changes to worldwide government policies relating to renewable fuels and greenhouse gas (“GHG”) emissions that adversely affect programs like the U.S. government's renewable fuel standard, low carbon fuel standards (“LCFS”) and tax credits for biofuels both in the United States and abroad; possible product recall resulting from developments relating to the discovery of unauthorized adulterations to food or food additives; the occurrence of 2009 H1N1 flu (initially

known as “Swine Flu”), highly pathogenic strains of avian influenza (collectively known as “Bird Flu”), severe acute respiratory syndrome (“SARS”), bovine spongiform encephalopathy (or “BSE”), porcine epidemic diarrhea (“PED”) or other diseases associated with animal origin in the United States or elsewhere, such as the outbreak of African Swine Fever in China and elsewhere; the occurrence of pandemics, epidemics or disease outbreaks, such as the COVID-19 outbreak; unanticipated costs and/or reductions in raw material volumes related to the Company’s compliance with the existing or unforeseen new U.S. or foreign (including, without limitation, China) regulations (including new or modified animal feed, Bird Flu, SARS, PED, BSE or ASF or similar or unanticipated regulations) affecting the industries in which the Company operates or its value added products; risks associated with the DGD Joint Venture, including possible unanticipated operating disruptions, a decline in margins on the products produced by the DGD Joint Venture and issues relating to the announced SAF upgrade project; risks and uncertainties relating to international sales and operations, including imposition of tariffs, quotas, trade barriers and other trade protections imposed by foreign countries; tax changes, such as the introduction of a global minimum tax; difficulties or a significant disruption in the Company's information systems or failure to implement new systems and software successfully; risks relating to possible third party claims of intellectual property infringement; increased contributions to the Company’s pension and benefit plans, including multiemployer and employer-sponsored defined benefit pension plans as required by legislation, regulation or other applicable U.S. or foreign law or resulting from a U.S. mass withdrawal event; bad debt write-offs; loss of or failure to obtain necessary permits and registrations; continued or escalated conflict in the Middle East, North Korea, Ukraine or elsewhere, including the Russia-Ukraine war and the Israeli-Palestinian conflict; uncertainty regarding the exit of the U.K. from the European Union; and/or unfavorable export or import markets. These factors, coupled with volatile prices for natural gas and diesel fuel, inflation rates, climate conditions, currency exchange fluctuations, general performance of the U.S. and global economies, disturbances in world financial, credit, commodities and stock markets, such as the recent turmoil in the world banking markets, and any decline in consumer confidence and discretionary spending, including the inability of consumers and companies to obtain credit due to lack of liquidity in the financial markets, among others, could cause actual results to vary materially from the forward-looking statements included in this report or negatively impact the Company's results of operations. Among other things, future profitability may be affected by the Company’s ability to grow its business, which faces competition from companies that may have substantially greater resources than the Company. The Company’s announced share repurchase program may be suspended or discontinued at any time and purchases of shares under the program are subject to market conditions and other factors, which are likely to change from time to time. For more detailed discussion of these factors and other risks and uncertainties regarding the Company, its business and the industries in which it operates, see the Company’s filings with the SEC, including the Risk Factors discussion in Item 1A of Part I of the Company's Annual Report on Form 10-K for the fiscal year ended December 31, 2022. The Company cautions readers that all forward-looking statements speak only as of the date made, and the Company undertakes no obligation to update any forward-looking statements, whether as a result of changes in circumstances, new events or otherwise.

# # #

Darling Ingredients Contacts

Investors: Suann Guthrie

Senior VP, Investor Relations, Sustainability & Communications

(469) 214-8202; suann.guthrie@darlingii.com

Media: Jillian Fleming

Director, Global Communications

(972) 541-7115; jillian.fleming@darlingii.com

v3.23.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

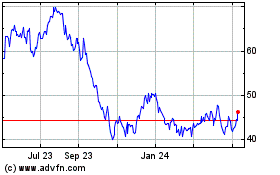

Darling Ingredients (NYSE:DAR)

Historical Stock Chart

From Apr 2024 to May 2024

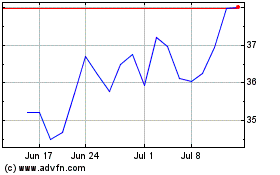

Darling Ingredients (NYSE:DAR)

Historical Stock Chart

From May 2023 to May 2024