false

0001787518

0001787518

2024-01-17

2024-01-17

0001787518

NUKK:CommonStock0.0001ParValuePerShareMember

2024-01-17

2024-01-17

0001787518

NUKK:WarrantsEachWarrantExercisableForOneShareOfCommonStockFor11.50PerShareMember

2024-01-17

2024-01-17

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

United States

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

Current Report

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

January 17, 2024

Date of Report (Date of earliest event reported)

| NUKKLEUS INC. |

| (Exact Name of Registrant as Specified in its Charter) |

| Delaware |

|

001-39341 |

|

38-3912845 |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(I.R.S. Employer

Identification No.) |

| 525 Washington Blvd. Jersey City, New Jersey |

|

07310 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant’s telephone number, including

area code: 212-791-4663

Brilliant Acquisition Corporation

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act |

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name

of each exchange on which registered |

| Common Stock, $0.0001 par value per share |

|

NUKK |

|

The Nasdaq Stock Market LLC |

| |

|

|

|

|

| Warrants, each warrant exercisable for one Share of Common Stock for $11.50 per share |

|

NUKKW |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities

Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☒

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act.

Item 8.01. Changes in Registrant’s Certifying Accountant.

On January 17, 2024, Nukkleus Inc. (the “Company”)

issued a press release to announce the signing of a Memorandum of Understanding (MOU), that contemplates a substantial increase in Nukkleus’

holdings in Jacobi Asset Management.

A copy of the press release, dated January 17,

2024, is included as Exhibit 99.1 to this report.

Item 9.01. Exhibits

The exhibits filed or furnished with this report

are listed in the following Exhibit Index:

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

Nukkleus Inc.

(Registrant) |

| |

|

|

| Dated: January 17, 2024 |

By: |

/s/ Emil Assentato |

| |

Name: |

Emil Assentato |

| |

Title: |

Chief Executive Officer |

2

Exhibit 99.1

Nukkleus

Signs MOU to Substantially Increase Holdings in Jacobi Asset Management

MOU

Sets Stage for Nukkleus to Acquire Additional 16% in Jacobi, Europe’s First Approved Bitcoin Spot ETF, Elevating Total Holdings to Approx.

20%

NEW

YORK, January 17, 2024 – Nukkleus Inc. (NASDAQ: NUKK), a pioneering force in the fintech industry, today announced the signing

of a Memorandum of Understanding (MOU) as of January 16, 2024, that contemplates a substantial increase in Nukkleus’ holdings in

Jacobi Asset Management (“Jacobi”).

Jacobi,

distinguished as the sponsor of Europe’s only regulated and approved Bitcoin spot ETF traded on Euronext, represents a strategic alignment

with Nukkleus’ vision and commitment to pioneering in the fintech industry. This partnership extends Nukkleus’ reach into innovative

financial markets, complementing its diverse portfolio that includes breakthrough technologies in blockchain-powered payment solutions

and digital asset management.

The

MOU outlines a framework for Nukkleus to negotiate the acquisition of an additional 10% stake in Jacobi outright, as well as an option

to acquire One Hoxton Holding Ltd, which would hold an additional 6% of Jacobi. This potential acquisition, combined with Nukkleus’

existing holdings, would increase Nukkleus’ total stake in Jacobi to approximately 20%. Furthermore, as part of the MOU, Nukkleus

has been granted a right of first refusal in these negotiations.

The

MOU is effective for a period of 90 days and may be extended by mutual agreement in writing. Completion of the proposed acquisition will

be subject to successful completion of diligence and the negotiation and execution of definitive agreements.

“Increasing

our stake in Jacobi Asset Management is a strategic move that aligns with Nukkleus Inc.’s vision of pioneering in the fintech industry.

This investment underscores our commitment to leveraging innovative financial tools like blockchain and digital assets to transform and

democratize the global financial landscape. We are not just keeping pace with the future of finance; we are actively shaping it to be

more accessible, efficient, and inclusive,” said Emil Assentato, CEO and Chairman of Nukkleus.

Martin

Bednall, CEO of Jacobi Asset Management commented: “We are excited by the prospect of deepening our relationship with Nukkleus through

this MOU, supporting the growth of Jacobi. This step symbolizes our mutual commitment to innovation in the fintech sector. The potential

increase in Nukkleus’ stake in Jacobi marks a significant milestone towards collaborative development and the advancement of regulated

financial solutions in the market.”

About

Nukkleus Inc.:

Nukkleus

Inc. (NASDAQ: NUKK) is a dynamic fintech aggregator dedicated to revolutionizing the financial services industry. Through strategic acquisitions

and technology development, Nukkleus is creating a comprehensive ecosystem that addresses the evolving needs of modern finance. As ‘A

Gateway to the Future of Finance’, Nukkleus is committed to driving growth, fostering innovation, and setting new standards for efficiency,

security, and inclusivity in the financial world. For more information about Nukkleus please visit: https://www.nukk.com/.

Financial

Products and Services Disclaimer:

Investment

in digital assets involves risks, including the lack of regulation and customer protections typical in other financial markets, and is

subject to a changing regulatory environment. These assets may lack legal tender status and are not covered by deposit protection insurance.

Past performance is not indicative of future results. Local laws and regulations may restrict your ability to transact with us, and some

services may not be available in your jurisdiction (e.g., Jacobi Asset Management’s fund in the United States, Digital RFQ’s licensing).

For detailed information on Nukkleus’ offerings and regulatory compliance, visit our EDGAR profile: https://www.sec.gov/edgar/browse/?CIK=1592782.

Cautionary

Note Regarding Forward-Looking Statements:

This

press release contains forward-looking statements as defined under U.S. securities laws. These statements, identified by words such as

“will,” “believe,” “anticipate,” “contemplate,” “expect,” “estimate,” “intend,”

“plan,” or their negatives or variations of these words, or similar expressions, are not guarantees of future performance and

are subject to risks, uncertainties, and assumptions. Actual results may differ materially due to various factors, including our ability

to benefit from the business combination, market competition, regulatory changes, and the risks inherent in our industry and operations.

Forward-looking statements in this release are based on information available as of the release date and are subject to change. Except

as required by law, we do not undertake to update these statements.

For

further information please contact:

Nukkleus

Investor Relations

IR@nukk.com

v3.23.4

Cover

|

Jan. 17, 2024 |

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Jan. 17, 2024

|

| Entity File Number |

001-39341

|

| Entity Registrant Name |

NUKKLEUS INC.

|

| Entity Central Index Key |

0001787518

|

| Entity Tax Identification Number |

38-3912845

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

525 Washington Blvd.

|

| Entity Address, City or Town |

Jersey City

|

| Entity Address, State or Province |

NJ

|

| Entity Address, Postal Zip Code |

07310

|

| City Area Code |

212

|

| Local Phone Number |

791-4663

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

false

|

| Entity Information, Former Legal or Registered Name |

Brilliant Acquisition Corporation

|

| Common Stock, $0.0001 par value per share |

|

| Title of 12(b) Security |

Common Stock, $0.0001 par value per share

|

| Trading Symbol |

NUKK

|

| Security Exchange Name |

NASDAQ

|

| Warrants, each warrant exercisable for one Share of Common Stock for $11.50 per share |

|

| Title of 12(b) Security |

Warrants, each warrant exercisable for one Share of Common Stock for $11.50 per share

|

| Trading Symbol |

NUKKW

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=NUKK_CommonStock0.0001ParValuePerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=NUKK_WarrantsEachWarrantExercisableForOneShareOfCommonStockFor11.50PerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

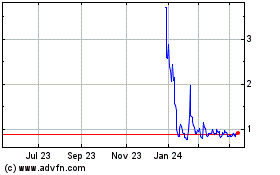

Nukkleus (NASDAQ:NUKK)

Historical Stock Chart

From Mar 2024 to Apr 2024

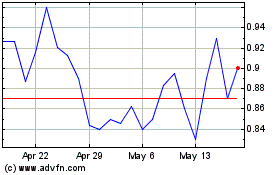

Nukkleus (NASDAQ:NUKK)

Historical Stock Chart

From Apr 2023 to Apr 2024