false

0001499717

0001499717

2024-01-08

2024-01-08

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

January

8, 2024

Date

of Report (Date of earliest event reported)

STAFFING

360 SOLUTIONS, INC.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

001-37575 |

|

68-0680859 |

(State

or other jurisdiction of

incorporation) |

|

(Commission

File

Number) |

|

(I.R.S.

Employer

Identification

Number) |

757

3rd Avenue

27th

Floor

New

York, NY 10017

(Address

of principal executive offices)

(646)

507-5710

(Registrant’s

telephone number, including area code)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| |

☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

|

| |

☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

|

| |

☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

|

| |

☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

stock, par value $0.00001 per share |

|

STAF |

|

NASDAQ |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

4.01 Changes in Registrant’s Certifying Accountant.

(a)

Resignation of Independent Registered Public Accounting Firm

On

January 8, 2024, Baker Tilly US, LLP (“Baker Tilly”) resigned as the independent registered public accounting firm of Staffing

360 Solutions, Inc. (the “Company”), effective as of January 9, 2024. The Audit Committee (the “Audit Committee”)

of the board of directors of the Company (the “Board”) accepted Baker Tilly’s resignation on January 9, 2024.

The

report of Baker Tilly on the Company’s consolidated financial statements for the year ended December 31, 2022, did not contain

an adverse opinion or a disclaimer of opinion, and was not qualified or modified as to uncertainty, audit scope, or accounting principles,

except that Baker Tilly’s report dated May 19, 2023, contained an explanatory paragraph stating there was substantial doubt about

the Company’s ability to continue as a going concern. Baker Tilly was first appointed on August 26, 2022, as the Company’s

independent registered public accounting for the fiscal year ended December 31, 2022, and did not audit the Company’s financial

statements for the fiscal year ended January 1, 2022, or any prior period.

During

the two most recent fiscal years, ended December 30, 2023, and December 31, 2022, and the subsequent interim period through January 9,

2024, there were no disagreements (as defined in Item 304(a)(1)(iv) of Regulation S-K of the Securities Exchange Act of 1934, as amended

(“Regulation S-K”) and the related instructions to Item 304 of Regulation S-K) with Baker Tilly on any matter of accounting

principles or practices, financial statement disclosure, or auditing scope or procedure, which disagreements, if not resolved to the

satisfaction of Baker Tilly, would have caused Baker Tilly to make reference to the subject matter of the disagreements in connection

with its reports on the Company’s consolidated financial statements for such years. Also during this time, there were no “reportable

events,” as defined in Item 304(a)(1)(v) of Regulation S-K, except to note for the year ended December 31, 2022, and for each of

the quarters ended April 1, 2023, July 1, 2023, and September 30, 2023, that management identified a material weakness in the Company’s

(i) internal control over financial reporting related to the lack of sufficient number of competent finance personnel to appropriately

account for, review and disclose the completeness and accuracy of transactions entered into by the Company and (ii) design and operating

effectiveness over forecasts used in the Company’s goodwill impairment evaluation.

The

Company provided Baker Tilly with a copy of the above disclosures and requested that Baker Tilly furnish the Company with a letter addressed

to the Securities and Exchange Commission stating whether or not it agrees with the statements made above. A copy of Baker Tilly’s

letter dated January 12, 2024, is attached as Exhibit 16.1 to this Current Report on Form 8-K.

(b)

Appointment of New Independent Registered Public Accounting Firm

On

January 12, 2024,

the Audit Committee engaged RBSM LLP (“RBSM”) as the Company’s independent registered public accounting firm for the

fiscal year ending December 28, 2024, effective immediately. In connection with the engagement, RBSM will prepare the report on the Company’s

consolidated financial statements for the year ended December 30, 2023. During the fiscal years ended December 30, 2023, and January

1, 2022, and the subsequent interim period through January 12, 2024,

neither the Company nor anyone on its behalf has consulted with RBSM regarding (i) the application of accounting principles to any specified

transaction, either completed or proposed or the type of audit opinion that might be rendered on the Company’s consolidated financial

statements, and neither a written report nor oral advice was provided to the Company that RBSM concluded was an important factor considered

by the Company in reaching a decision as to any accounting, auditing, or financial reporting issue, or (ii) any matter that was either

the subject of a “disagreement,” as defined in Item 304(a)(1)(iv) of Regulation S-K, or a “reportable event,”

as defined in Item 304(a)(1)(v) of Regulation S-K.

Item

5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of

Certain Officers.

On

January 9, 2024, the Board appointed Ms. Melanie Grossman, Senior Vice President, Controller, as the principal accounting officer

of the Company, effective as of the same date.

Melanie

Grossman, age 57, joined the Company in November 2023. Ms. Grossman is a CPA with 35 years of accounting and finance experience within

the financial and medical device industries. Most recently, Ms. Grossman was the Director, Controller of Vaxxinity, Inc., a biotechnology

company, from May 2022 through November 2023. Previously, Ms. Grossman was the Controller at Byram Healthcare, an Owens & Minor subsidiary

from October 2016 through January 2022. Ms. Grossman graduated from the University of Buffalo in Buffalo, NY with a Bachelor of Science

degree in accounting and a minor in finance.

There

is no family relationship between Ms. Grossman and any director or executive officer of the Company. There are no transactions between

Ms. Grossman and the Company that would be required to be reported under Item 404(a) of Regulation S-K.

In

connection with Ms. Grossman’s employment as Senior Vice President, Controller, of the Company, Ms. Grossman and the Company entered

into an employment agreement (the “Grossman Employment Agreement”), dated as of October 26, 2023, effective as of November

13, 2023. Pursuant to the Grossman Employment Agreement, Ms. Grossman is entitled to an annual base salary of $250,000, less applicable

payroll deductions and tax withholdings (the “Base Salary”), and is eligible to be considered for an annual bonus in an amount

up to thirty-five percent (35%) of her base salary, based upon the achievement of certain performance objectives set forth in the Grossman

Employment Agreement.

The

Grossman Employment Agreement will remain in effect for one year unless terminated earlier in accordance with its terms. Pursuant to

the Grossman Employment Agreement, either the Company or Ms. Grossman may terminate the Grossman Employment Agreement at any time upon

written notice, provided that Ms. Grossman will be required to provide the Company at least three months’ advance written notice

of her voluntary resignation. Upon termination of Ms. Grossman’s employment, the Company shall pay Ms. Grossman (i) any unpaid

salary accrued through the termination date, (ii) any accrued and unpaid vacation, paid time off or similar pay to which MS. Grossman

is entitled, and (iii) any unreimbursed expenses (collectively, the “Accrued Obligations”). In the event that Ms. Grossman

voluntarily resigns without Good Reason or the Company terminates Ms. Grossman for Cause (each as defined in the Grossman Employment

Agreement), the Company shall have no further liability or obligation to Ms. Grossman other than payment to Ms. Grossman of the Accrued

Obligations. If Ms. Grossman’s employment is terminated without Cause or by Ms. Grossman for Good Reason, Ms. Grossman shall receive

(i) the Accrued Obligations and (ii) severance pay equal to the Base Salary as of the date of termination for three months.

The

foregoing summary description of the Grossman Employment Agreement is qualified in its entirety by reference to the full text of the

Grossman Employment Agreement, a copy of which is attached hereto as Exhibit 10.1 and incorporated herein in its entirety by reference.

Item

8.01 Other Events.

On

January 10, 2024, the Company received a notice from the Nasdaq Office of General Counsel stating that as the Listing Qualifications

Staff of the Nasdaq Stock Market LLC has determined that the Company’s filing delinquencies for the periods ended July 1, 2023,

and September 30, 2023, have been cured, the scheduled hearing before the Hearings Panel on January 11, 2024, has been canceled and that

the matter is now closed.

Item

9.01 Financial Statements and Exhibits.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this report to be signed on its

behalf by the undersigned hereunto duly authorized.

| Date:

January 12, 2024 |

STAFFING

360 SOLUTIONS, INC. |

| |

|

|

| |

By: |

/s/

Brendan Flood |

| |

|

Brendan

Flood |

| |

|

Chairman

and Chief Executive Officer |

Exhibit 10.1

EMPLOYMENT

AGREEMENT

THIS

EMPLOYMENT AGREEMENT (this “Agreement”) is dated as of October 26, 2023 and is entered into by and

between Melanie Grossman (the “Executive”) and Staffing 360 Solutions, Inc. (the “Company”).

The Company and the Executive shall be referred to herein as the “Parties.”

RECITALS

WHEREAS,

the Company desires to employ the Executive as its SVP, Corporate Controller, and the Executive desires to be employed by the

Company as its SVP, Corporate Controller; and

WHEREAS,

the Company and the Executive desire to set forth in writing the terms and conditions of their agreement and understandings with respect

to the employment of the Executive as its SVP, Corporate Controller; and

WHEREAS,

the Company hereby employs the Executive, and the Executive hereby accepts employment with the Company for the period and upon the terms

and conditions contained in this Agreement.

NOW,

THEREFORE, in consideration of the mutual promises and agreements contained herein, and other good and valuable consideration, the

receipt and sufficiency of which are hereby acknowledged, and intending to be legally bound, the Parties hereby agree as follows:

ARTICLE

I.

SERVICES

TO BE PROVIDED BY EXECUTIVE

A. Position

and Responsibilities. The Executive shall be employed and serve as the SVP, Corporate Controller. The Executive shall

report directly to the Chief Financial Officer (the “CFO”), or as otherwise directed by the Chief Executive Officer

(the “CEO”). The Executive shall have such duties and responsibilities commensurate with the Executive’s title,

and as the CEO or the Board may require of the Executive from time to time. The Company may change the Executive’s title, and/or

reporting line, from time to time, in its sole discretion.

B. Performance.

During the Executive’s employment with the Company, the Executive shall devote on a full-time basis all of the Executive’s

time, energy, skill and reasonable best efforts to the performance of the Executive’s duties hereunder in a manner that will faithfully

and diligently further the business and interests of the Company, and shall exercise reasonable best efforts to perform the Executive’s

duties in a diligent, trustworthy, good faith and business-like manner, all for the purpose of advancing the business of the Company.

The Executive shall at all times act in a manner consistent with the Executive’s position. Unless specifically permitted, during

the Executive’s employment, the Executive shall not engage in any other non-Company related business activities of any nature whatsoever,

whether or not competitive.

ARTICLE

II.

COMPENSATION

FOR SERVICES

As

compensation for all services the Executive will perform under this Agreement, the Company will pay the Executive, and the Executive

shall accept as full compensation, the following:

A. Base Salary. The

Company shall pay the Executive an annualized base salary of $250,000.00 ($4,807.70 annualized), less applicable payroll

deductions and tax withholdings (the “Base Salary”) for all services rendered by the Executive under this

Agreement. The Company shall pay the Base Salary in accordance with the normal payroll policies of the Company.

B. Performance

Bonus. The Executive shall be entitled to receive an annual bonus (“Performance Bonuses”) in an amount

and based upon the criteria set forth in Schedule A. Any Performance Bonus is payable within thirty (30) days of the Company’s

issuance of its audited financial statements on Form 10-K. All criteria shall be established reasonably and in good faith by the Board.

The evaluation of the applicable performance criteria and the awarding of bonuses, if any, shall be determined reasonably and in good

faith by the Board.

C. Expenses.

The Company agrees that, during the Executive’s employment, it will reimburse the Executive for out-of-pocket expenses reasonably

incurred in connection with the Executive’s performance of the Executive’s services hereunder, upon the presentation by the

Executive of an itemized accounting of such expenditures, with supporting receipts in compliance with the Company’s expense reimbursement

policies. Reimbursement shall be in compliance with the Company’s expense reimbursement policies.

D. Paid

Time Off. The Executive shall be eligible for 25 days paid time off in accordance with the Company’s policy, as

in effect from time to time. The Executive shall also be entitled to any paid holidays as designated by the Company.

E. Other

Benefits. The Employee is entitled to participate in any group health insurance plan, 401(k) plan, disability plan, group life

plan, and any other benefit or welfare program or policy that is made generally available, from time to time, to other employees of the

Company, on a basis consistent with such participation and subject to the terms of the plan documents, as such plans may be modified,

amended, terminated, or replaced from time to time.

ARTICLE

III.

TERM; TERMINATION

A. Term

of Employment. The Agreement’s stated term and employment relationship created hereunder will begin on November 13,

2023, and will remain in effect for one (1) year, unless earlier terminated in accordance with this Article III (the “Initial

Employment Term”). This Agreement shall continue in effect unless terminated by either party upon written notice provided

of not less than three (3) months or unless earlier terminated in accordance with this Article III.

B. Termination.

Either party may terminate the Executive’s employment at any time upon written notice provided that the Executive will be required

to provide the Company at least three (3) months’ advance written notice of the Executive’s voluntary resignation. Upon termination

of the Executive’s employment, the Company shall pay the Executive (i) any unpaid Base Salary accrued through the date of termination,

(ii) any accrued and unpaid vacation, paid time off or similar pay to which the Executive is entitled as a matter of law or Company policy,

and (iii) any unreimbursed expenses properly incurred prior to the date of termination (the “Accrued Obligations”).

(i) Expiration

of the Agreement; Termination for Cause, Voluntary Resignation, or as a Result of Death or Disability. In the event the Executive

voluntarily resigns without Good Reason (defined below), the Company may, in its sole discretion, shorten the notice period and determine

the date of termination without any obligation to pay the Executive any additional compensation other than the Accrued Obligations and

without triggering a termination of the Executive’s employment without Cause (as defined below). In the event the Company terminates

the Executive’s employment for Cause or the Executive voluntarily resigns without Good Reason, or as a result of the Executive’s

Disability (defined below) or death, the Company shall have no further liability or obligation to the Executive under this Agreement.

The Accrued Obligations shall be payable in a lump sum within the time period required by applicable law, and in no event later than

thirty (30) days following termination of employment. For purposes of this Agreement, “Cause” means termination

because of: (a) an act or acts of gross negligence, dishonesty, misrepresentation, fraud, moral turpitude, or willful malfeasance by

the Executive; (b) the Executive’s indictment or conviction of, or pleading nolo contendere or guilty to, a felony, or a crime

involving moral turpitude; (c) a material breach by the Executive of this Agreement or any other agreement to which the Executive and

the Company are parties; and (d) the Executive’s refusal to perform or intentional disregard of, or the poor or unsatisfactory

performance of, the Executive’s duties and responsibilities hereunder, after a 30 day opportunity to cure. For purposes of this

Agreement, “Disability” means termination as a result of Executive’s incapacity or inability, Executive’s

failure to have performed Executive’s duties and responsibilities as contemplated herein for ninety (90) consecutive business days,

or more within any one (1) year period (cumulative or consecutive), because Executive’s physical or mental health has become so

impaired as to make it impossible or impractical for Executive to perform the duties and responsibilities contemplated hereunder, with

or without reasonable accommodation.

(ii) Termination

Without Cause or for Good Reason. In the event the Executive’s employment is terminated by the Company without Cause or

by the Executive for Good Reason, the Executive shall receive the following, subject to the execution and timely return by the Executive

of a release of claims in the form to be delivered by the Company, which release shall, by its terms, be irrevocable no later than the

sixtieth (60th) day following the termination of employment: (a) the Accrued Obligations, payable in a lump sum within the

time period required by applicable law, and in no event later than thirty (30) days following termination of employment; and (b) severance

pay in an amount equal to the Executive’s Base Salary as of the date of termination for three (3) months payable in equal installments

in accordance with the normal payroll policies of the Company, with the first installment being paid on the Company’s first regular

pay date on or after the sixtieth (60th) day following the termination of employment, which initial payment shall include

all installment amounts that would have been paid during the first sixty (60) days following the termination of employment had installments

commenced immediately following the termination date. For purposes of this Agreement, “Good Reason” means termination

because of a material breach by the Company of this Agreement. In such event, the Executive shall give the Company written notice thereof

which shall specify in reasonable detail the circumstances constituting Good Reason, and there shall be no Good Reason with respect to

any such circumstances if cured by the Company within thirty (30) days after such notice.

C. Survival. The

Executive’s post-termination obligations in Article IV shall continue as provided in this Agreement.

ARTICLE

IV.

RESTRICTIVE COVENANTS

A.

Confidentiality.

(i) Confidential

Information. During the Executive’s employment with the Company, the Company shall grant the Executive otherwise prohibited

access to its trade secrets and confidential information which is not known to the Company’s competitors or within the Company’s

industry generally, which was developed by the Company over a long period of time and/or at its substantial expense, and which is of

great competitive value to the Company, and access to the Company’s customers and clients. For purposes of this Article IV,

the “Company” shall also include its parents, subsidiaries and affiliates. For purposes of this Agreement,

“Confidential Information” includes any trade secrets or confidential or proprietary information of the Company,

including, but not limited to, the following: methods of operation, products, inventions, services, processes, equipment, know-how, technology,

technical data, policies, strategies, designs, formulas, developmental or experimental work, improvements, discoveries, research, plans

for research or future products and services, corporate transactions, database schemas or tables, software, development tools or techniques,

training procedures, training techniques, training manuals, business information, marketing and sales methods, plans and strategies,

competitors, markets, market surveys, techniques, production processes, infrastructure, business plans, distribution and installation

plans, processes and strategies, methodologies, budgets, financial data and information, customer and client information, prices and

costs, fees, customer and client lists and profiles, employee, customer and client nonpublic personal information, supplier lists, business

records, product construction, product specifications, audit processes, pricing strategies, business strategies, marketing and promotional

practices, management methods and information, plans, reports, recommendations and conclusions, information regarding the skills and

compensation of employees and contractors of the Company, and other business information disclosed to the Executive by the Company, either

directly or indirectly, in writing, orally, or by drawings or observation. “Confidential Information” does

not include, and there shall be no obligation hereunder with respect to, information that (a) is generally available to the public on

the date of this Agreement or (b) becomes generally available to the public other than as a result of a disclosure not otherwise permissible

hereunder.

(ii) No

Unauthorized Use or Disclosure. The Executive acknowledges and agrees that Confidential Information is proprietary to and a trade

secret of the Company and, as such, is a special and unique asset of the Company, and that any disclosure or unauthorized use of any

Confidential Information by the Executive will cause irreparable harm and loss to the Company. The Executive understands and acknowledges

that each and every component of the Confidential Information (a) has been developed by the Company at significant effort and expense

and is sufficiently secret to derive economic value from not being generally known to other parties, and (b) constitutes a protectable

business interest of the Company. The Executive acknowledges and agrees that the Company owns the Confidential Information. The Executive

agrees not to dispute, contest, or deny any such ownership rights either during or after the Executive’s employment with the Company.

The Executive agrees to preserve and protect the confidentiality of all Confidential Information. The Executive agrees that the Executive

shall not during the period of the Executive’s employment with the Company and thereafter, directly or indirectly, disclose to

any unauthorized person or use for the Executive’s own account any Confidential Information without the Company’s consent.

Throughout the Executive’s employment with the Company thereafter: (a) the Executive shall hold all Confidential Information in

the strictest confidence, take all reasonable precautions to prevent its inadvertent disclosure to any unauthorized person, and follow

all Company policies protecting the Confidential Information; and (b) the Executive shall not, directly or indirectly, utilize, disclose

or make available to any other person or entity, any of the Confidential Information, other than in the proper performance of the Executive’s

duties.

(iii) Return

of Property and Information. Upon the termination of the Executive’s employment for any reason, the Executive shall immediately

return and deliver to the Company any and all Confidential Information, software, devices, cell phones, personal data assistants, credit

cards, data, reports, proposals, lists, correspondence, materials, equipment, computers, hard drives, papers, books, records, documents,

memoranda, manuals, e-mail, electronic or magnetic recordings or data, including all copies thereof, which belong to the Company or relate

to the Company’s business and which are in the Executive’s possession, custody or control, whether prepared by the Executive

or others. If at any time after termination of the Executive’s employment the Executive determines that the Executive has any Confidential

Information in the Executive’s possession or control, the Executive shall immediately return to the Company all such Confidential

Information in the Executive’s possession or control, including all copies and portions thereof.

B.

Restrictive Covenants. In consideration for (i) the Company’s promise to provide Confidential Information to

the Executive, (ii) the substantial economic investment made by the Company in the Confidential Information and goodwill of the Company,

and/or the business opportunities disclosed or entrusted to the Executive, (iii) access to the Company’s customers and clients,

and (iv) the Company’s employment of the Executive pursuant to this Agreement and the compensation and other benefits provided by

the Company to the Executive, to protect the Company’s Confidential Information and business goodwill of the Company, the Executive

agrees to the following restrictive covenants:

(i) Non-Competition.

The Executive agrees that during the Restricted Period (defined below), other than in connection with the Executive’s duties under

this Agreement (including, without limitation, services to affiliates of the Company), the Executive shall not, and shall not use any

Confidential Information to, without the prior written consent of the Company, directly or indirectly, either individually or as a principal,

partner, stockholder, manager, agent, consultant, contractor, distributor, employee, lender, investor, or as a director or officer of

any corporation or association, or in any other manner or capacity whatsoever, become employed by, control, manage, carry on, join, lend

money for, operate, engage in, establish, perform services for, invest in, solicit investors for, consult for, do business with or otherwise

engage in any Competing Business. Notwithstanding the restrictions contained in this Article IV.B.(i), the Executive may own an

aggregate of not more than two percent (2%) of the outstanding stock of any class of any corporation engaged in a Competing Business,

if such stock is listed on a national securities exchange in the United States (or a comparable exchange in a foreign jurisdiction) or

regularly traded in the over-the-counter market by a member of a national securities exchange in the United States, without violating

the provisions of Article IV.B.(i).

For purposes of this Agreement:

(a)

“Restricted Period” means during the Executive’s employment with the Company and for a period of

three (3) months immediately following the date of Executive’s termination from employment for any reason.

(b)

“Competing Business” means any business, individual, partnership, firm, corporation or other entity that

is competing with any aspect of the Company’s business.

(ii) Non-Solicitation.

The Executive agrees that during the Restricted Period, other than in connection with Executive’s duties under this Agreement, the

Executive shall not, and shall not use any Confidential Information to, directly or indirectly, either as a principal, manager, agent,

employee, consultant, officer, director, stockholder, partner, investor or lender or in any other capacity, and whether personally or

through other persons:

(a)

Solicit business from, interfere with, induce, attempt to solicit business from, interfere with, induce or do business with any

actual or prospective customer, client, business partner or affiliate, supplier, vendor, licensor or licensee of the Company with whom

the Company did business prior to or during the Executive’s employment with the Company or entice or suggest to such individual

or entity to terminate the business relationship with the Company; or

(b)

Solicit, induce or attempt to solicit or induce, engage or hire, on behalf of the Executive or any other person or entity, any

person who is an employee or consultant of the Company or who was employed or engaged by the Company within the preceding twelve (12)

months or entice or suggest to such individual to terminate his or her employment or services with the Company.

(iii) Non-Disparagement.

During the Executive’s employment with the Company and any time thereafter, the Executive shall not make, publish, or otherwise

transmit any false, disparaging or defamatory statements, whether written or oral, regarding the Company and any of its employees, members,

agents, investors, procedures, investments, products, policies, or services.

C.

No Interference. Notwithstanding any other provision of this Agreement, (i) the Executive may disclose Confidential

Information when required to do so by a court of competent jurisdiction, by any governmental agency having authority over the Executive

or the business of the Company or by any administrative body or legislative body (including a committee thereof) with jurisdiction to

order the Executive to divulge, disclose or make accessible such information; and (ii) nothing in this Agreement is intended to interfere

with the Executive’s right to (1) report possible violations of state or federal law or regulation to any governmental or law enforcement

agency or entity; (2) make other disclosures that are protected under the whistleblower provisions of state or federal law or regulation;

(3) file a claim or charge with the Equal Employment Opportunity Commission (“EEOC”), any state human rights

commission, or any other governmental agency or entity; or (4) testify, assist, or participate in an investigation, hearing, or proceeding

conducted by the EEOC, any state human rights commission, any other governmental or law enforcement agency or entity, or any court. For

purposes of clarity, in making or initiating any such reports or disclosures or engaging in any of the conduct outlined in subsection

(ii) above, the Executive may disclose Confidential Information to the extent necessary to such governmental or law enforcement agency

or entity or such court, need not seek prior authorization from the Company, and is not required to notify the Company of any such reports,

disclosures or conduct.

D.

Defend Trade Secrets Act. The Executive is hereby notified in accordance with the Defend Trade Secrets Act of 2016

that the Executive will not be held criminally or civilly liable under any federal or state trade secret law for the disclosure of a trade

secret that is made in confidence to a federal, state, or local government official, either directly or indirectly, or to an attorney

solely for the purpose of reporting or investigating a suspected violation of law, or is made in a complaint or other document that is

filed under seal in a lawsuit or other proceeding. If the Executive files a lawsuit for retaliation against the Company for reporting

a suspected violation of law, the Executive may disclose the Company’s trade secrets to the Executive’s attorney and use the

trade secret information in the court proceeding if the Executive files any document containing the trade secret under seal, and does

not disclose the trade secret, except pursuant to court order.

E.

Tolling. If the Executive violates any of the restrictions contained in this Article IV, the Restricted Period

shall be suspended and shall not run in favor of the Executive from the time of the commencement of any violation until the time when

the Executive cures the violation to the satisfaction of the Company.

F.

Remedies. The Executive acknowledges that the restrictions contained in Article IV of this Agreement, in view

of the nature of the Company’s business and the Executive’s position with the Company, are reasonable and necessary to protect

the Company’s legitimate business interests and that any violation of Article IV of this Agreement would result in irreparable

injury to the Company. In the event of a breach by the Executive of Article IV of this Agreement, then the Company shall be entitled

to a temporary restraining order and injunctive relief restraining the Executive from the commission of any breach. Such remedies shall

not be deemed the exclusive remedies for a breach or threatened breach of this Article IV but shall be in addition to all remedies

available at law or in equity, including the recovery of damages from the Executive, the Executive’s agents, any future employer

of the Executive, and any person that conspires or aids and abets the Executive in a breach or threatened breach of this Agreement.

G.

Reasonableness. The Executive hereby represents to the Company that the Executive has read and understands, and agrees

to be bound by, the terms of this Article IV. The Executive acknowledges that the scope and duration of the covenants contained

in this Article IV are fair and reasonable in light of (i) the nature and wide geographic scope of the operations of the Company’s

business; (ii) the Executive’s level of control over and contact with the Company’s business; and (iii) the amount of compensation,

trade secrets and Confidential Information that the Executive is receiving in connection with the Executive’s employment by the

Company.

H.

Reformation. If any of the aforesaid restrictions are found by a court of competent jurisdiction to be unreasonable,

or overly broad as to geographic area or time, or otherwise unenforceable, the Parties intend for the restrictions herein set forth to

be modified by the court making such determination so as to be reasonable and enforceable and, as so modified, to be fully enforced. By

agreeing to this contractual modification prospectively at this time, the Company and the Executive intend to make this provision enforceable

under the law or laws of all applicable jurisdictions so that the entire agreement not to compete and this Agreement as prospectively

modified shall remain in full force and effect and shall not be rendered void or illegal.

I.

No Previous Restrictive Agreements. The Executive represents that, except as disclosed to the Company, the Executive

is not bound by the terms of any agreement with any previous employer or other party to refrain from using or disclosing any trade secret

or confidential or proprietary information in the course of the Executive’s employment with the Company or to refrain from competing,

directly or indirectly, with the business of such previous employer or any other party. The Executive further represents that the Executive’s

performance of all the terms of this Agreement and the Executive’s work duties for the Company do not and will not breach any agreement

to keep in confidence proprietary information, knowledge or data acquired by the Executive in confidence or in trust prior to the Executive’s

employment with the Company. The Executive shall not disclose to the Company or induce the Company to use any confidential or proprietary

information or material belonging to any previous employer or others.

ARTICLE

V.

MISCELLANEOUS PROVISIONS

A.

Governing Law. The Parties agree that the Agreement shall be governed by and construed under the internal laws of

the State of New York. In the event of any dispute regarding this Agreement, the parties hereby irrevocably agree to submit to the exclusive

jurisdiction of the federal and state courts situated in New York, New York, and Employee agrees that the Executive shall not challenge

personal or subject matter jurisdiction in such courts. The Parties also hereby waive any right to trial by jury in connection with any

litigation or disputes under or in connection with this Agreement.

B.

Headings. The paragraph headings contained in this Agreement are for convenience only and shall in no way or manner

be construed as a part of this Agreement.

C.

Severability. In the event that any court of competent jurisdiction holds any provision in this Agreement to be invalid,

illegal, or unenforceable in any respect, the remaining provisions shall not be affected or invalidated and shall remain in full force

and effect.

D.

Reformation. In the event any court of competent jurisdiction holds any restriction in this Agreement to be unreasonable

and/or unenforceable as written, the court may reform this Agreement to make it enforceable, and this Agreement shall remain in full force

and effect as reformed by the court.

E.

Entire Agreement. This Agreement constitutes the entire agreement between the Parties, and fully supersedes any and

all prior agreements, understanding or representations between the Parties pertaining to or concerning the subject matter of this Agreement,

including, without limitation, the Executive’s employment with the Company. No oral statements or prior written material not specifically

incorporated in this Agreement shall be of any force and effect, and no changes in or additions to this Agreement shall be recognized,

unless incorporated in this Agreement by written amendment, such amendment to become effective on the date stipulated in it. Any amendment

to this Agreement must be signed by all parties to this Agreement. The Executive acknowledges and represents that in executing this Agreement,

the Executive did not rely, and has not relied, on any communications, promises, statements, inducements, or representation(s), oral or

written, by the Company, except as expressly contained in this Agreement. The Parties represent that they relied on their own judgment

in entering into this Agreement.

F.

Waiver. No waiver of any breach of this Agreement shall be construed to be a waiver as to succeeding breaches. The

failure of either party to insist in any one or more instances upon performance of any terms or conditions of this Agreement shall not

be construed as a waiver of future performance of any such term, covenant or condition but the obligations of either party with respect

thereto shall continue in full force and effect. The breach by one party to this Agreement shall not preclude equitable relief or the

obligations in Article IV.

G.

Modification. The provisions of this Agreement may be amended, modified or waived only with the prior written consent

of the Company and the Executive, and no course of conduct or failure or delay in enforcing the provisions of this Agreement shall be

construed as a waiver of such provisions or affect the validity, binding effect or enforceability of this Agreement or any provision hereof.

H.

Assignment. This Agreement shall be binding upon and inure to the benefit of the Parties hereto and their respective

heirs, successors and permitted assigns. The Executive may not assign this Agreement to a third party. The Company may assign its rights,

together with its obligations hereunder, to any affiliate and/or subsidiary of the Company or any successor thereto or any purchaser of

substantially all of the assets of the Company.

I.

Code Section 409A.

(i) To the extent

(A) any payments to which the Executive becomes entitled under this Agreement, or any agreement or plan referenced herein, in connection

with the Executive’s termination of employment with the Company constitute deferred compensation subject to Section 409A of the

Internal Revenue Code of 1986, as amended (the “Code”); (B) the Executive is deemed at the time of his separation

from service to be a “specified employee” under Section 409A of the Code; and (C) at the time of the Executive’s separation

from service the Company is publicly traded (as defined in Section 409A of Code), then such payments (other than any payments permitted

by Section 409A of the Code to be paid within six (6) months of the Executive’s separation from service) shall not be made until

the earlier of (1) the first day of the seventh month following the Executive’s separation from service or (2) the date of the Executive’s

death following such separation from service. Upon the expiration of the applicable deferral period, any payments which would have otherwise

been made during that period (whether in a single sum or in installments) in the absence of this Article V, Section I shall be

paid to the Executive or the Executive’s beneficiary in one lump sum, plus interest thereon at the Delayed Payment Interest Rate

(as defined below) computed from the date on which each such delayed payment otherwise would have been made to the Executive until the

date of payment. For purposes of the foregoing, the “Delayed Payment Interest Rate” shall mean the national

average annual rate of interest payable on jumbo six-month bank certificates of deposit, as quoted in the business section of the most

recently published Sunday edition of The New York Times preceding the Executive’s separation from service.

(ii) To the extent

any benefits provided under Article III, Section B(ii) above are otherwise taxable to the Executive, such benefits shall, for purposes

of Section 409A of the Code, be provided as separate in-kind payments of those benefits, and the provision of in-kind benefits during

one calendar year shall not affect the in-kind benefits to be provided in any other calendar year.

(iii) In the case

of any amounts payable to the Executive under this Agreement, or under any plan of the Company, that may be treated as payable in the

form of “a series of installment payments,” as defined in Treas. Reg. §1.409A-2(b)(2)(iii), the Executive’s right

to receive such payments shall be treated as a right to receive a series of separate payments for purposes of Treas. Reg. §1.409A-2(b)(2)(iii).

(iv) It is intended

that this Agreement comply with or be exempt from the provisions of Section 409A of the Code and the Treasury Regulations and guidance

of general applicability issued thereunder, and in furtherance of this intent, this Agreement shall be interpreted, operated, and administered

in a manner consistent with such intent.

SCHEDULE

A – BONUS ARRANGEMENT

| 1.

|

The

Company agrees to pay you an annual bonus (the “Bonus”) of up to thirty-five percent (35%) of the Base Salary. |

| |

|

| 2.

|

For

the Financial Year 2023 this bonus will be pro-rated from the effective date of this agreement. |

| |

|

| 3.

|

Performance

is measured by way of growth in Adjusted EBITDA of the Group year on year, based on the Base Number approved by the Board of Directors

of the Parent annually, generally before the end of January but usually no later than the end of February. |

| |

|

| 4.

|

The

amount of the Bonus in any particular Financial Year (if any payable) shall be determined by the Board of the Parent, based on comparison

between the Base Number and the AEBITDA of the Group and calculated as follows: |

| Achievement

of less than 90% of base year |

|

Zero

bonus payable |

| Achievement

between 90% and 100% of base year |

|

50%

of bonus payable on pro-rated basis |

| Achievement

between 100% and 120% of base year |

|

50%

of bonus payable on pro-rated basis |

| 5.

|

The

decision of the Board as to the Base Numbers, the AEBITDA figures and the level of your Bonus, if any, shall be final and binding. |

| |

|

| 6.

|

The

Bonus (if any) shall be paid in cash within thirty (30) days following the Parent’s filing of its Annual Report on Form 10-K

with the Securities and Exchange Commission containing the Parent’s and Company’s consolidated audited financial statements

(“Form 10- K Filing”) (the “Payment Date”). |

| |

|

| 7.

|

If,

as at the Payment Date, you are no longer employed by the Company or either you or the Company has given notice to terminate the

employment, you shall have no rights to a Bonus or pro-rated Bonus, except where such termination of employment: |

| |

7.1

|

is

by reason of death; |

| |

|

|

| |

7.2

|

is

without Cause or for Good Reason; or |

| |

|

|

| |

7.3

|

is

by reason of Disability. |

In

such circumstances, you shall be entitled to a pro-rated Bonus in respect of the period of service in the Financial Year in which the

employment terminates, calculated at the end of that year and payable on the Payment Date.

| 8.

|

This

Bonus schedule shall be administered under the direction of the Board who may at any time by resolution amend its terms in any respect. |

| |

|

| 9.

|

The

Company will deduct applicable taxes and other withholdings from any Bonus payable to you. Any Bonus payable to you will not be taken

into account for the purpose of calculating pension contributions. |

| |

|

| 10.

|

In

this Schedule, the following term is as defined below: |

| |

10.1

|

“Adjusted

EBITDA” / “AEBITDA” means earnings (or loss) from continuing operations before interest expense, income taxes,

depreciation and amortization, and amortization of non-cash stock-based compensation, non-recurring acquisition and restructuring

expenses and goodwill impairment charges; |

| |

|

|

| |

10.2

|

“Base

Number” means the final adjusted AEBITDA number for the previous Financial Year; |

| |

|

|

| |

10.3

|

“Financial

Year” means the Company’s financial year ending on or around 31 December each year; |

| |

|

|

| |

10.4

|

“Group”

in this schedule only has the meaning given to it in clause 3 of this Schedule 1; |

| |

|

|

| |

10.5

|

“Parent”

means Staffing 360 Solutions, Inc; and |

| |

|

|

| |

10.6

|

“Salary”

means your Base Salary as at the beginning of the Financial Year or the start of the employment, if later. |

SCHEDULE

B

Schedule

of Other Benefits

| Medical |

|

Choice

between three (3) Aetna medical plan options, consistent with other senior corporate executives on the tier chosen (employee, employee

+ spouse, employee + children or Family) |

| |

|

|

| Dental |

|

Aetna

Dental consistent with other senior corporate executives. |

| |

|

|

| Vision |

|

Aetna

Vision consistent with other senior corporate executives. |

| |

|

|

| Short-term

Disability |

|

Sun

Life consistent with other senior corporate executives. |

| |

|

|

| Long-term

Disability |

|

Sun

Life consistent with other senior corporate executives. |

| |

|

|

| Voluntary

Life Insurance |

|

Sun

Life consistent with other senior corporate executives. |

| |

|

|

| Accident

Insurance |

|

Sun

Life consistent with other senior corporate executives. |

| |

|

|

| Critical

Illness Insurance |

|

Sun

Life consistent with other senior corporate executives. |

Questions

or requests for additional details regarding Benefits Plan Offerings should be submitted via email to benefits_us@staffing360solutions.com.

IN

WITNESS WHEREOF, the Company and the Executive have caused this Agreement to be executed on the date first set forth above, to be effective

as of that date.

| EXECUTIVE: |

|

| |

|

| /s/

Melanie Grossman |

|

| Melanie

Grossman |

|

| 10/27/2023 |

|

| COMPANY: |

|

| |

|

| Staffing

360 Solutions, Inc. |

|

| |

|

| /s/

Alicia Barker |

|

| Alicia

Barker |

|

| 10/27/2023 |

|

Exhibit

16.1

Baker

Tilly US, LLP

1500

RXR Plaza, West Tower

Uniondale,

NY 11556

United

States of America

T:

+1 (516) 747 2000

F:

+1 (516) 747 6707

bakertilly.com

January

12, 2024

Securities

and Exchange Commission

100 F Street, NE

Washington,

DC 20549

Dear

Ladies and Gentlemen:

We

are the former independent registered public accounting firm for Staffing 360 Solutions Inc. (the “Company”). We have read

the Company’s disclosure set forth in Item 4.01 “Changes in Registrant’s Certifying Accountant” of the Company’s

Current Report on Form 8-K dated January 8, 2024 (the “Current Report”) and are in agreement with the disclosure in the Current

Report, insofar as it pertains to our firm.

Sincerely,

/s/

Baker Tilly US, LLP

Baker

Tilly US, LLP, trading as Baker Tilly, is a member of the global network of Baker Tilly International Ltd., the members of which are

separate and independent legal entities. © 2020 Baker Tilly US, LLP

Rev.

Aug. 2023

v3.23.4

Cover

|

Jan. 08, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Jan. 08, 2024

|

| Entity File Number |

001-37575

|

| Entity Registrant Name |

STAFFING

360 SOLUTIONS, INC.

|

| Entity Central Index Key |

0001499717

|

| Entity Tax Identification Number |

68-0680859

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

757

3rd Avenue

|

| Entity Address, Address Line Two |

27th

Floor

|

| Entity Address, City or Town |

New

York

|

| Entity Address, State or Province |

NY

|

| Entity Address, Postal Zip Code |

10017

|

| City Area Code |

(646)

|

| Local Phone Number |

507-5710

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common

stock, par value $0.00001 per share

|

| Trading Symbol |

STAF

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

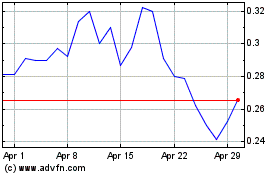

Staffing 360 Solutions (NASDAQ:STAF)

Historical Stock Chart

From Mar 2024 to Apr 2024

Staffing 360 Solutions (NASDAQ:STAF)

Historical Stock Chart

From Apr 2023 to Apr 2024