false

--02-03

0000897429

0000897429

2024-01-05

2024-01-05

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

Current Report

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of report (Date of earliest event reported): January 5, 2024

Chico’s FAS, Inc.

(Exact Name of Registrant as Specified in its Charter)

| Florida |

001-16435 |

59-2389435 |

| (State or Other Jurisdiction of Incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

| 11215 Metro Parkway, Fort Myers FL |

33966 |

| (Address of Principal Executive Offices) |

(Zip code) |

(239) 277-6200

(Registrant’s Telephone Number, Including Area

Code)

(Former Name or Former Address, if Changed Since Last

Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously

satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, Par Value $0.01 Per Share |

|

CHS |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company

as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934

(§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the

registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act. ☐

Introductory Note

As previously disclosed, Chico’s FAS, Inc., a Florida corporation

(“Company”), entered into an Agreement and Plan of Merger (“Merger Agreement”), dated September 27, 2023, by and

among Daphne Parent LLC, a Delaware limited liability company (“Parent”), Daphne Merger Sub, Inc., a Florida corporation and

a wholly owned subsidiary of Parent (“Merger Sub” and, together with Parent, “Buyer Parties”), and the Company,

providing for the merger of Merger Sub with and into the Company, with the Company continuing as the surviving corporation (“Merger”).

On January 5, 2024, the Buyer Parties completed the acquisition of the Company.

Item 1.01. Entry into a Material Definitive Agreement.

Concurrently with the closing of the Merger, the Buyer Parties,

the Company, and certain material domestic subsidiaries of the Company were joined as guarantors to (i) the Term Loan Credit Agreement,

dated as of July 28, 2023 (as amended by Amendment No. 1 to the Term Loan Credit Agreement, dated as of December 8, 2023 (“Term

Loan Credit Agreement”)), by and among Knitwell Borrower LLC, a Delaware limited liability company (“Borrower”), Knitwell

Guarantor LLC, a Delaware limited liability company (“Holdings”), HPS Investment Partners, LLC (as administrative agent and

collateral agent), and the lenders party thereto, and (ii) the ABL Credit Agreement, dated as of July 28, 2023 (as amended by Amendment

No. 1 to the ABL Credit Agreement, dated as of December 12, 2023 (“ABL Credit Agreement”)), by and among Borrower, Holdings,

Bank of America, N.A. (as administrative agent and collateral agent), and the lenders party thereto. The Term Loan Credit Agreement and

the ABL Credit Agreement include representations and warranties, covenants, events of default, and other provisions that are customary

for facilities of their respective types.

Item 1.02. Termination of a Material Definitive Agreement.

The information set forth in the Introductory

Note of this Current Report on Form 8-K (“Current Report”) is incorporated by reference into this Item 1.02.

Concurrently with the closing of the Merger, the

Company repaid all loans and terminated all credit commitments outstanding under the Credit Agreement, dated as of August 2, 2018 (as

amended by Amendment No. 1 to the Credit Agreement, dated as of October 30, 2020 and Amendment No. 2 to the Credit Agreement, dated as

of February 2, 2022), by and among the Company, certain material domestic subsidiaries of the Company (as co-borrowers and guarantors),

Wells Fargo Bank, National Association (as agent, letter of credit issuer, and swing line lender), and each lender party thereto.

Item 2.01. Completion of Acquisition or Disposition of Assets.

Completion of the Merger

The information set forth in the Introductory

Note and in Items 3.03, 5.01, 5.02, 5.03, and 8.01 of this Current Report is incorporated by reference into this Item 2.01.

At the effective time of the Merger (“Effective

Time”), (i) each share of common stock, par value $0.01 per share, of the Company (“Chico’s Common Stock”) (other

than shares of Chico’s Common Stock that are (A) held by the Company and its Subsidiaries (as defined in the Merger Agreement);

(B) owned by the Buyer Parties; or (C) owned by any direct or indirect wholly owned Subsidiary of the Buyer Parties, in each case, as

of immediately prior to the Effective Time (“Owned Company Shares”); and (D) Chico’s Common Stock subject to Company

RSAs (as defined below)) outstanding immediately prior to the Effective Time was cancelled and extinguished and automatically converted

into the right to receive $7.60 per share in cash, without interest (“Per Share Price”), and (ii) each Owned Company Share

was cancelled and extinguished without any conversion thereof or consideration paid therefor.

Pursuant to the Merger Agreement, at the Effective

Time, because of the Merger:

| |

• |

|

each award of restricted Chico’s Common Stock granted under the Chico’s FAS, Inc. Amended and Restated 2020 Omnibus Incentive Plan (“Company Equity Plan,” and each such award, “Company RSA”), whether vested or unvested, that was outstanding as of immediately prior to the Effective Time became fully vested, cancelled, and automatically converted into the right to receive an amount in cash equal to the product of (A) the aggregate number of shares of Chico’s Common Stock subject to such Company RSA, multiplied by (B) the Per Share Price, subject to any required withholding of taxes; |

| |

• |

|

each award of time-vesting restricted stock units granted under the Company Equity Plan (“Company RSU Award”), whether vested or unvested, that was outstanding as of immediately prior to the Effective Time became fully vested, cancelled, and automatically converted into the right to receive an amount in cash equal to the product of (A) the aggregate number of shares of Chico’s Common Stock subject to such Company RSU Award, multiplied by (B) the Per Share Price, subject to any required withholding of taxes; and |

| |

• |

|

each award of performance-vesting restricted stock units granted under the Company Equity Plan (“Company PSU Award”), whether vested or unvested, that was outstanding as of immediately prior to the Effective Time became fully time-vested, cancelled, and automatically converted into the right to receive an amount in cash equal to the product of (A) the aggregate number of shares of Chico’s Common Stock earned with respect to each Company PSU Award (determined based on (x) for each completed fiscal year during the performance period applicable to such Company PSU Award that ended at least one month prior to the Effective Time, actual performance as determined in accordance with the applicable award agreement, and (y) for each fiscal year during the performance period applicable to the Company PSU Award that did not end at least one month prior to the Effective Time, target performance for such fiscal year), multiplied by (B) the Per Share Price, subject to any required withholding of taxes. |

The description of the Merger

and the Merger Agreement contained in this Item 2.01 does not purport to be complete and is subject to, and qualified in its entirety

by reference to, the Merger Agreement, which was filed by the Company with the Securities and Exchange Commission (“SEC”)

on September 28, 2023 as Exhibit 2.1 to the Current Report on Form 8-K, and is filed as Exhibit 2.1 to this Current Report on Form 8-K

and is incorporated herein by reference.

Item 2.03. Creation of a Direct Financial Obligation or an Obligation

under an Off-Balance Sheet Arrangement of a Registrant.

The information set forth in Item 1.01 of

this Current Report is incorporated by reference into this Item 2.03.

Item 3.01. Notice of Delisting or Failure

to Satisfy a Continued Listing Rule or Standard; Transfer of Listing.

The information set forth in Item 2.01 of this Current Report is

incorporated by reference into this Item 3.01.

On January 5, 2024, the Company

notified the New York Stock Exchange (“NYSE”) that the Merger had been consummated and requested that the NYSE suspend trading

of Chico’s Common Stock on the NYSE prior to the opening of trading on January 5, 2024. The Company also requested that the NYSE

file with the SEC a notification of removal from listing and registration on Form 25 to effect the delisting of all shares of Chico’s

Common Stock from the NYSE, as well as the deregistration of such Chico’s Common Stock under Section 12(b) of the Securities Exchange

Act of 1934, as amended (“Exchange Act”). As a result, Chico’s Common Stock will no longer be listed on the NYSE.

In addition, the Company intends to file with the SEC a certification

on Form 15, requesting the termination of registration of the shares of Chico’s Common Stock under Section 12(g) of the Exchange

Act and the suspension of the Company’s reporting obligations under Sections 13 and 15(d) of the Exchange Act with respect to the

shares of Chico’s Common Stock.

Item 3.03. Material Modification to Rights of Security Holders.

The information set forth in the Introductory Note and in Items

2.01, 3.01, and 5.03 of this Current Report is incorporated by reference into this Item 3.03.

Item 5.01. Changes in Control of Registrant.

The information set forth in the Introductory Note and in Items

1.01, 2.01, 3.03, and 5.02 of this Current Report is incorporated by reference into this Item 5.01.

As a result of the consummation of the Merger, a change in control of the

Company occurred, and the Company became a wholly owned subsidiary of Parent. Parent is an affiliate of Sycamore Partners Management,

L.P. The aggregate consideration of the Merger was approximately $1 billion, which was funded by equity financing and borrowings under

the Term Loan Credit Agreement and the ABL Credit Agreement.

Item 5.02. Departure of Directors or Certain Officers; Election of Directors;

Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

The information set forth in the Introductory Note and in Item 2.01

of this Current Report is incorporated by reference into this Item 5.02.

In connection with the Merger,

and effective as of the Effective Time, the Company elected to terminate the employer match and the earnings’ portion of the Chico’s

FAS, Inc. Deferred Compensation Plan (“Deferred Compensation Plan”). The Deferred Compensation Plan had previously been frozen,

effective as of December 31, 2021, and at such time, the Company terminated and distributed the elective deferrals’ portion of the

Deferred Compensation Plan. In connection with the termination of the employer match and the earnings’ portion of the Deferred Compensation

Plan at the Effective Time, participating employees, including certain named executive officers, will receive a distribution of their

remaining balance, as follows:

| |

Named Executive Officer |

Distribution Amount |

|

| |

David M. Oliver |

$6,324.15 |

|

| |

Kristin M. Gwinner |

$8,650.13 |

|

Effective as of the consummation of the Merger, all of the members of the

Board of Directors of the Company, immediately prior to consummation of the Merger, resigned as directors of the Company, and Stefan Kaluzny

and Dary Kopelioff were appointed as directors of the Company.

Item 5.03. Amendments to Articles of Incorporation or Bylaws;

Changes in Fiscal Year.

The information set forth in the Introductory

Note and in Item 2.01 of this Current Report is incorporated by reference into this Item 5.03.

Pursuant to the Merger Agreement, at the Effective

Time, the Restated Articles of Incorporation of the Company, as in effect immediately prior to the Effective Time, were amended and restated

in their entirety to be in the form of the Second Amended and Restated Articles of Incorporation, as set forth in an exhibit to the Merger

Agreement. In addition, at the Effective Time, subject to the provisions of the Merger Agreement, Merger Sub’s Bylaws, as in effect

immediately prior to the Effective Time, became the bylaws of the Company.

Item 8.01. Other Events.

On January 5, 2024, the Company issued a press release announcing

the closing of the Merger. The press release is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

Item 9.01. Exhibits.

(d) Exhibits:

| No. |

|

Description |

| |

|

| 2.1 |

|

Agreement and Plan of Merger, dated as of September 27, 2023, by and among Daphne Parent LLC, Daphne Merger Sub, Inc., and Chico’s FAS, Inc. (incorporated by reference to Exhibit 2.1 to the Current Report on Form 8-K, as filed with the Securities and Exchange Commission on September 28, 2023) |

| |

|

| 99.1 |

|

Press Release, dated January 5, 2024, issued by Chico’s FAS, Inc. |

| |

|

| 104 |

|

Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| |

CHICO’S FAS, INC. |

|

| |

|

|

|

Date: January 5, 2024 |

By: |

/s/ Molly

Langenstein |

|

| |

|

Name: |

Molly

Langenstein |

|

| |

|

Title: |

Chief

Executive Officer, President and Director |

|

EXHIBIT 99.1

Sycamore Partners Completes Acquisition of Chico’s

FAS, Inc.

Fort Myers, FL – January 5, 2024 –

Chico’s FAS, Inc. (“Company” or “Chico’s FAS”) today announced the completion of its acquisition by

Sycamore Partners, a private equity firm specializing in retail, consumer, and distribution-related

investments, for $7.60 per share, in an all-cash transaction valued at approximately $1 billion.

“Joining the Sycamore portfolio of leading retail

brands marks an important milestone for Chico’s FAS and continues our journey as a customer-led, product-obsessed, digital-first,

and operationally excellent company,” said Chico's FAS Chief Executive Officer and President Molly Langenstein. “Sycamore

and Chico’s FAS both share a commitment to providing solutions, building communities, and creating memorable experiences to bring

women confidence and joy. We look forward to working together to reach even greater levels of success.”

“Completing this transaction represents the beginning

of an exciting new chapter for the company’s three iconic brands -- Chico’s, White House Black Market and Soma,” said

Stefan Kaluzny, Managing Director of Sycamore Partners. “We look forward to supporting the company’s more than 14,000 talented

associates as they continue to deliver best-in-class product assortments to their loyal customer base and help these brands reach their

fullest potential.”

With the completion of the transaction, Chico’s

FAS shares of common stock have ceased trading and are no longer listed on the New York Stock Exchange.

Solomon Partners, L.P. acted as financial advisor to

Chico’s FAS, and Paul, Weiss, Rifkind, Wharton & Garrison LLP acted as legal advisor.

UBS Investment Bank acted as financial advisor to Sycamore

Partners and Kirkland & Ellis LLP acted as legal advisor.

ABOUT CHICO'S FAS, INC.

Chico’s FAS is a Florida-based fashion company

founded in 1983 on Sanibel Island, FL. The Company reinvented the fashion retail experience by creating fashion communities anchored by

service, which put the customer at the center of everything we do. As one of the leading fashion retailers in North America, Chico’s

FAS is a company of three unique brands – Chico’s®, White House Black Market®, and Soma® – each operating

in their own white space, founded by women, led by women, providing solutions that millions of women say give them confidence and joy.

Our Company has a passion for fashion, and each day,

we provide clothing, shoes and accessories, intimate apparel, and expert styling in our brick-and-mortar boutiques, digital online boutiques,

and through StyleConnect®, the Company’s customized, branded, digital styling tool that enables customers to conveniently shop

wherever, whenever, and however they prefer.

As of October 28, 2023, the Company operated 1,256 stores

in the U.S. and sold merchandise through 58 international franchise locations in Mexico and through two domestic franchise locations in

airports. The Company’s merchandise is also available at www.chicos.com, www.chicosofftherack.com, www.whbm.com, and www.soma.com.

To learn more about Chico’s FAS, please visit

our corporate website at www.chicosfas.com. The information on our corporate website is not, and shall not be deemed to be, a part of

this press release or incorporated into our federal securities law filings.

ABOUT SYCAMORE PARTNERS

Sycamore Partners is a private equity firm based in

New York. The firm specializes in retail, consumer, and distribution-related investments and partners with management teams to seek to

improve the operating profitability and strategic value of their business. With approximately $10 billion in aggregate committed capital

raised since its inception in 2011, Sycamore Partners’ investors include leading endowments, financial institutions, family offices,

pension plans, and sovereign wealth funds. For more information on Sycamore Partners, visit www.sycamorepartners.com.

Chico’s FAS Contact:

Julie MacMedan

Chico’s FAS, Inc.

(239) 346-4384

julie.macmedan@chicos.com

Sycamore Partners Contact:

Michael Freitag or Lyle Weston

Joele Frank, Wilkinson Brimmer Katcher

212-355-4449

media@sycamorepartners.com

Chico’s FAS, Inc. • 11215 Metro

Parkway • Fort Myers, Florida 33966 • (239) 277-6200

v3.23.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionEnd date of current fiscal year in the format --MM-DD.

| Name: |

dei_CurrentFiscalYearEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gMonthDayItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

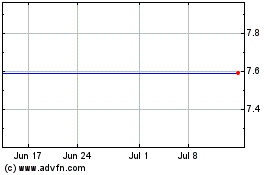

Chicos FAS (NYSE:CHS)

Historical Stock Chart

From Mar 2024 to Apr 2024

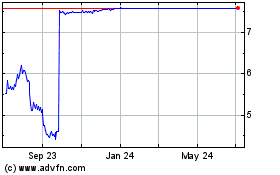

Chicos FAS (NYSE:CHS)

Historical Stock Chart

From Apr 2023 to Apr 2024