false

0001267602

0001267602

2023-12-28

2023-12-28

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF

THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported):

December 28, 2023

ALIMERA SCIENCES, INC.

(Exact name of registrant as specified in its

charter)

| Delaware |

|

001-34703 |

|

20-0028718 |

(State

or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS

Employer

Identification No.) |

6310 Town Square, Suite 400

Alpharetta, Georgia 30005

(Address of principal executive offices, including

zip code)

Registrant’s telephone number, including

area code: (678) 990-5740

Not Applicable

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ |

Written communications

pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant

to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications

pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications

pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of

each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which

registered |

| Common stock, par value

$0.01 per share |

|

ALIM |

|

The

NASDAQ Stock Market LLC (Nasdaq Global Market) |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2

of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging

growth company ¨

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 5.02. |

Departure

of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers. |

Separation Agreement with Russell Skibsted

On December 28, 2023, Alimera Sciences, Inc.,

a Delaware corporation (the “Company”), determined that Russell Skibsted’s last day of employment as the Chief Financial

Officer of the Company was December 31, 2023. On January 3, 2024, the Company entered into a separation and release agreement

with Mr. Skibsted that provides for severance benefits in exchange for a release of claims

in favor of the Company, consistent with the terms of a termination without cause under Mr. Skibsted’s employment agreement

dated January 9, 2023 (the “Separation Agreement”). The Board of Directors

of the Company approved the terms of the Separation Agreement on December 28, 2023. Mr. Skibsted’s termination is not

due to any disagreement with the Company’s management team or the Company’s Board of Directors on any matter relating to

the operations, policies or practices of the Company or any issues regarding the Company’s accounting policies or practices.

The description of the Separation Agreement is

qualified by reference to the full text of the Separation Agreement, a copy of which is attached as Exhibit 10.1 to this Current

Report on Form 8-K, and is incorporated herein by reference.

Employment Agreement with Elliot Maltz

On January 2, 2024 (the “Effective

Date”), the Company entered into an Employment Agreement with Elliot Maltz (the “Employment Agreement”), pursuant to

which Mr. Maltz will serve as the Company’s Chief Financial Officer. A copy of the press release announcing Mr. Maltz’s

appointment, and the associated departure of Mr. Skibsted, is attached hereto as Exhibit 99.1 and incorporated herein by this

reference.

The Employment Agreement provides that Mr. Maltz

will be entitled to receive an annual base salary of $350,000. In addition, beginning on the Effective Date, Mr. Maltz is eligible

to participate in the Company’s Management Cash Incentive Program. His initial target annual bonus amount will be up to 40% of

his annual base salary and may not be reduced to an amount below 40% of his then-current base salary.

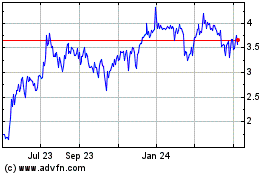

On the Effective Date, pursuant to the Employment

Agreement, Mr. Maltz was granted a one-time inducement nonstatutory stock option entitling him to purchase up to 75,000 shares of

Common Stock (the “Sign-On Option”) pursuant to the terms and conditions of a standalone stock option agreement outside of

the Company’s 2023 Equity Incentive Plan and attached hereto as Exhibit 10.3. The exercise price per share subject to the

Sign-On Option was $4.32, the closing price per share of the Common Stock on December 29, 2023 (the closing price on the business

day immediately preceding the grant date). This nonstatutory stock option was agreed to and granted as an inducement material to Mr. Maltz

entering into employment with the Company in accordance with Nasdaq Listing Rule 5635(c)(4).

Subject to the approval of the Compensation Committee,

Mr. Maltz will receive two additional inducement grants:

| · | A

grant of 75,000 restricted stock units (the “RSUs”). The RSUs are subject to

the following vesting schedule: 25% of the grant will become vested and exercisable on the

first anniversary of the Effective Date, and the remaining portion of the grant will become

vested and exercisable, as applicable, in equal monthly installments over the following thirty-six

(36) months, subject to Mr. Maltz’s continuous employment with the Company on

each such vesting date. |

| · | A

grant of 75,000 performance stock units (the “PSUs”), the vesting of which will

be conditioned on the satisfaction of certain performance metrics as further described in

the Employment Agreement. |

Pursuant to the Employment Agreement, Mr. Maltz

will also receive all other benefits generally available to the Company’s executive officers.

Mr. Maltz’s employment with us is

“at will.” The Employment Agreement provides certain severance benefits, including cash severance and vesting acceleration

upon the occurrence of certain defined events, as described below, in each case, subject to Mr. Maltz’s execution and non-revocation

of a release of claims.

| · | If

the Company terminates Mr. Maltz’s employment without “cause” or if

Mr. Maltz resigns for “good reason” (each as defined in the Employment Agreement),

then Mr. Maltz will be eligible to receive the following severance payments: (i) (A) if

termination occurs prior to Mr. Maltz’s completion of 6 months of continuous employment

with the Company, a cash severance payment equal to Mr. Maltz’s earned but unpaid

annual base salary, if any, (B) if termination occurs between 6 and 12 months’

completion of continuous employment with the Company, a cash severance payment equal to the

sum of Mr. Maltz’s (1) earned but unpaid annual base salary, if any, and

(2) 50% of Mr. Maltz’s then-current annual base salary, payable in 6 equal

monthly installments, (C) if termination occurs between 12 and 24 months’ completion

of continuous employment with the Company, a cash severance payment equal to the sum of Mr. Maltz’s

(1) earned but unpaid salary, if any, and (2) 75% of Mr. Maltz’s then-current

annual base salary payable in 9 equal monthly installments, and (D) if termination occurs

at any time after Mr. Maltz’s completion of 24 months of continuous employment

with the Company, a cash severance payment equal to the sum of Mr. Maltz’s (1) earned

but unpaid salary, if any, and (2) 100% of Mr. Maltz’s then-current annual

base salary, payable in 12 equal monthly installments; (ii) earned bonus for the fiscal

year of termination, payable no later than 2½ months after the close of the fiscal

year of termination; (iii) COBRA continuation coverage premium payments (or, if not

permitted under applicable law, reimbursements thereof) for the corresponding 6-, 9- or 12-month

periods following the termination, as applicable, or, if earlier, until Mr. Maltz is

eligible to be covered under another substantially equivalent medical insurance plan by a

subsequent employer; and (iv) 12 months of additional vesting for any time-based vesting

equity grants that are outstanding and unvested as of the termination date. |

| · | If

the Company terminates Mr. Maltz’s employment without cause or if Mr. Maltz

resigns for good reason, in each case, at any time within three months before and 12 months

after a change in control of the Company, then Mr. Maltz will be eligible to receive

the following severance payments and benefits: (i) a cash severance payment equal to

100% of the sum of Mr. Maltz’s (A) annual base salary and (B) target

annual bonus for the fiscal year of termination, payable in 12 equal monthly installments,

(ii) annual bonus for the fiscal year of termination, payable no later than 2½

months after the close of the fiscal year of termination, (iii) 18 months of COBRA continuation

coverage premium payments (or, if not permitted under applicable law, reimbursements thereof),

(iv) 100% vesting acceleration of any time-based vesting equity grants that are outstanding

and unvested as of the termination date, and (v) 100% vesting acceleration of any of

Mr. Maltz’s PSUs that are outstanding and unvested for the measurement year in

which the change in control occurs if the trajectory of the revenue for the year is on pace

to exceed the revenue target in the year of the change in control as of the date of the change

in control (as further described in the Employment Agreement). |

| · | If

Mr. Maltz’s employment is terminated due to a disability or in the event of his

death, Mr. Maltz (or his estate, as applicable) will be eligible to receive the following

payments and benefits: (i) base salary through the end of the month of termination or

death (as applicable), (ii) bonus for the fiscal year of termination, payable no later

than 2½ months after the close of the fiscal year of termination or death (as applicable),

(iii) 12 months of COBRA continuation coverage premium payments (or, if not permitted

under applicable law, reimbursements thereof), and (iv) 100% vesting acceleration of

equity grants that are outstanding and unvested as of the termination date or date of death

(as applicable). |

The description of the Employment Agreement is

qualified by reference to the full text of the Employment Agreement, a copy of which is attached as Exhibit 10.2 to this Current

Report on Form 8-K, and is incorporated herein by reference.

| Item 9.01 |

Financial Statements and Exhibits. |

(d) Exhibits

Exhibit

No. |

|

Description |

| 10.1 |

|

Separation Agreement and General Release, dated January 2,

2024, by and between Alimera Sciences, Inc. and Russell Skibsted |

| 10.2 |

|

Employment Agreement, dated as of January 2, 2024,

by and between Alimera Sciences, Inc. and Elliot Maltz |

| 10.3 |

|

Inducement Stock Option Agreement, dated as of January 2,

2024, by and between Alimera Sciences, Inc. and Elliot Maltz (Non-Plan Inducement Award) |

| 99.1 |

|

Press Release, dated as of January 2, 2024 |

| 104 |

|

Cover Page Interactive Data File (embedded within

the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| |

ALIMERA SCIENCES, INC. |

| |

|

|

| Date: January 4, 2024 |

By: |

/s/ Richard S. Eiswirth, Jr. |

| |

Name: |

Richard S. Eiswirth, Jr. |

| |

Title: |

President and Chief Executive Officer |

EXHIBIT 10.1

SEPARATION AGREEMENT AND GENERAL RELEASE

This SEPARATION AGREEMENT

AND GENERAL RELEASE (“Agreement”) is entered into by and between Russell L. Skibsted (“Executive”), for himself

and his heirs, executors, administrators, successors, and assigns, and Alimera Sciences, Inc. (“Company”) (Executive

and Company each a “Party,” and together, the “Parties”).

In consideration of the promises

and mutual covenants in this Agreement, the Parties agree:

1. Termination;

Last Day of Employment. Executive’s last day of employment with Company will be December 31, 2023 (“Separation

Date”) as the result of a termination without Cause, as defined in Executive’s Employment Agreement with Company effective

as of January 9, 2023 (the “Employment Agreement”). Executive agrees that Executive has been paid all wages and accrued

benefits due through the Separation Date and further agrees that Company shall have no further obligation to Executive for wages, back

pay, severance pay, bonuses, incentive pay, accrued vacation, benefits, insurance, sick leave, other leave, or any other reason, except

as specifically set for in this Agreement. Any employee benefits to which Executive may be entitled will be governed by the terms of the

relevant plan and applicable law.

2. Consideration.

Consistent with Section 5(b) of the Employment Agreement, in consideration for Executive signing and not revoking this Agreement

and complying with its terms, Company agrees to provide Executive with the following:

(a) an amount equal to 100% of Executive’s

base salary in effect as of the Separation Date, less applicable withholdings and deductions, payable in twelve equal monthly installments,

Salary continuation payments shall commence within 60 days after the Separation Date and, once commenced, will include any unpaid amounts

accrued from the Separation Date.

(b) any continuation coverage premium

payments (for Executive and Executive’s dependents) for continued health insurance coverage under the Consolidated Omnibus Budget

Reconciliation Act (“COBRA”), for the one-year period following the Separation Date or, if earlier, until Executive is eligible

to be covered under another substantially equivalent medical insurance plan by a subsequent employer. Notwithstanding the foregoing, if

Company, in its sole discretion, determines that it cannot provide the foregoing subsidy of COBRA coverage without potentially violating

or causing Company to incur additional expense as a result of noncompliance with applicable law (including Section 2716 of the Public

Health Service Act), Company instead shall provide to Executive a taxable monthly payment in an amount equal to the monthly COBRA premium

that Executive would be required to pay to continue the group health coverage in effect on the Separation Date (which amount shall be

based on the premium for the first month of COBRA coverage), which payments (i) shall be made regardless of whether Executive elects

COBRA continuation coverage, (ii) shall commence on the later of (A) the first day of the month following the month in which

the Separation Date occurs and (B) the effective date of the Company’s determination of violation of applicable law, and (iii) shall

end on the earliest of (x) the effective date on which Executive becomes covered by a medical, dental or vision insurance plan of

a subsequent employer, and (y) the last day of the period one year after the Separation Date. Executive shall have no right to an

additional gross-up payment to account for the fact that such COBRA premium amounts are paid on an after-tax basis.

(c) no later than 75 days after the

end of the 2023 fiscal year, a single lump-sum amount equal to Executive’s Earned Bonus (as defined in the Employment Agreement)

for such fiscal year, less applicable withholdings and deductions.

To be eligible for the payments

and benefits described in subsections (a)-(c), Executive must have timely returned to Company a fully executed original of this Agreement

and not revoked the Agreement. The payments and benefits provided pursuant to this Section 2 shall not be taken into account as current

compensation under any retirement plan, benefit, program, or arrangement sponsored or maintained by Company. Any equity award previously

granted to Executive shall be governed by the terms of the equity incentive plan under which the grant was made. Executive understands,

acknowledges, and agrees that the consideration set forth in this Section 2 fully satisfies Company’s obligations to Executive

under the Employment Agreement or otherwise upon separation from employment. Executive further acknowledges that Executive is not entitled

to any additional payment or consideration not specifically referenced in this Agreement.

3. No

Consideration Absent Execution of this Agreement. Executive understands and agrees that Executive is not entitled to and would

not receive the monies and/or benefits specified in Section 2, above, except for Executive’s execution of this Agreement and

the fulfillment of the promises contained herein.

4. General

Release of Claims. Executive knowingly and voluntarily releases and forever discharges Company, its parent corporations, affiliates,

subsidiaries, divisions, predecessors, insurers, successors, and assigns, and its and their respective current and former employees,

attorneys, officers, directors, owners, and agents thereof, both individually and in their business capacities, and their employee benefit

plans and programs and any and all administrators and fiduciaries thereof (collectively referred to throughout the remainder of this

Agreement as “Releasees”), of and from any and all claims, known and unknown, asserted or unasserted, which Executive has

or may have against any or all of the Releasees as of the date of execution of this Agreement, including, but not limited to, any alleged

violation of the following:

| § | Title

VII of the Civil Rights Act of 1964; |

| § | Sections

1981 through 1988 of Title 42 of the United States Code; |

| § | The

Employee Retirement Income Security Act of 1974 (“ERISA”) (as modified below); |

| § | The

Immigration Reform and Control Act; |

| § | The

Americans with Disabilities Act of 1990; |

| § | The

Age Discrimination in Employment Act of 1967 (“ADEA”); |

| § | The

Workers Adjustment and Retraining Notification Act; |

| § | The

Fair Credit Reporting Act; |

| § | The

Family and Medical Leave Act; |

| § | The

Genetic Nondiscrimination Act of 2008; |

| § | The Georgia AIDS Confidentiality

Act, O.C.G.A. § 24-9-47; |

| § | The Georgia Equal Pay Act, O.C.G.A.

§ 34-5-1 et seq.; |

| § | The Georgia Age Discrimination

in Employment Act, O.C.G.A. § 34-1-2; |

| § | The

Georgia Equal Employment for Persons with Disabilities Code, O.C.G.A. § 34-6A-1 et seq.; |

| § | The Georgia Wage Payment and Work

Hour Laws; |

| § | The

Massachusetts Wage Act; |

| § | The

Massachusetts Fair Employment Practices Act; |

| § | Any

other federal, state, or local law, rule, regulation, or ordinance; |

| § | Any

public policy, contract, tort, or common law; or |

| § | Any

basis for recovering costs, fees, or other expenses including attorneys’ fees incurred

in these matters. |

The

Parties intend that this Agreement shall discharge all claims against Releasees to the maximum extent permitted by law. However, Executive

is not waiving any rights Executive may have to (a) Executive’s own vested accrued employee benefits under Company’s

health, welfare, or retirement benefit plans as of the Separation Date; (b) benefits and/or the right to seek benefits under applicable

workers’ compensation and/or unemployment compensation statutes; (c) pursue claims which by law cannot be waived by signing

this Agreement; (d) enforce this Agreement; and/or (e) challenge the validity of this Agreement. Executive also is not waiving

any rights to vested stock options which he may elect to exercise within ninety (90) days of the Separation Date.

| § | Nothing

in this Agreement prohibits or prevents Executive from filing a charge with or participating,

testifying, or assisting in any investigation, hearing, or other proceeding before any federal,

state, or local government agency. However, to the maximum extent permitted by law, Executive

agrees that if such an administrative claim is made, Executive shall not be entitled to recover

any individual monetary relief or other individual remedies. Furthermore, nothing in this

Agreement in any way prohibits or in any way limits Executive from reporting possible violations

of federal law or regulation to, or otherwise communicating with, or participating in any

investigation brought by any governmental agency or entity, including, but not limited to

the Department of Justice, the SEC, Congress, and any agency Inspector General (collectively,

the “Government Agencies”), or from making disclosures that are protected under

the whistleblower provisions of federal law or regulation. This Agreement moreover does not

preclude Executive from receiving any award for information provided to any Government Agencies,

understanding that Executive otherwise is releasing Executive’s right to recovery for

claims arising out of Executive’s employment as provided hereunder. |

| § | If

any claim is not subject to release, to the extent permitted by law, Executive waives any

right or ability to be a class or collective action representative or to otherwise participate

in any putative or certified class, collective, or multi-party action or proceeding based

on such a claim in which Company or any other Releasee identified in this Agreement is a

party. |

5. Acknowledgments

and Affirmations. Executive affirms as follows:

| · | Executive has returned to Company all tangible and intangible Company property in Executive’s possession,

including without limitation all equipment, files and documents (physical and electronic), and confidential information in Executive’s

possession, custody, or control. Company shall be entitled to deduct from any amounts owed Executive the fair market value of any Company

property in Executive’s possession or provided to Executive by the Company that has not been returned to Company prior to the Separation

Date. Executive affirms having possession of all of Executive’s property that Executive had at Company’s premises and that

Company is not in possession of any of Executive’s property. |

| · | Executive has not filed or caused to be filed any claim against Releasees, is not presently a party to

any claim against Releasees, and is not aware of any claim against Releasees the Executive has not reported or disclosed to Releasees.

This Agreement is in no way intended to preclude Executive from otherwise reporting through appropriate Company channels any act or omission

in violation of state or federal law. |

| · | Executive has reported all hours worked as of the date he signs this Agreement and has been paid and/or

has received all compensation, wages, bonuses, commissions, and/or benefits which are due and payable as of the date Executive signs this

Agreement. |

| · | Executive has been granted any leave to which Executive was entitled under the Family and Medical Leave

Act or related state or local leave or disability accommodation laws and that Executive has no known workplace injuries or occupational

diseases. |

| · | Executive will not do or say anything that would have the effect in any way of diminishing or sullying

the goodwill and good reputation of Company or any of its directors, officers, employees, services, or products, including, but not be

limited to, refraining from making negative statements about Company’s methods of doing business, the effectiveness of its business

policies and practices, and the quality of any of its services, products, or personnel. |

| · | Executive has not been retaliated against for reporting any allegations of wrongdoing by Company or its

officers, including any allegations of corporate fraud. |

| · | Executive does not have applications for employment currently pending with Releasees, and Executive shall

not apply in the future for employment with Releasees because of, among other things, irreconcilable differences with Releasees. |

| · | All of Company’s decisions regarding Executive’s pay and benefits through the date of Executive’s

execution of this Agreement were not discriminatory based on age, disability, race, color, sex, religion, national origin, or any other

classification protected by law. |

6. Mutual

Non-Disparagement and Neutral Reference. Executive agrees to refrain from any disparagement, defamation, libel, or slander of

any of the Releasees, and agrees to refrain from any tortious interference with the contracts and relationships of any of the Releasees.

Company agrees to refrain from making any statements, whether oral or written, or taking any action that may diminish or sully Executive’s

reputation or otherwise cast Executive, his experience, expertise, or professional services in a negative light. Executive understands

that Company’s obligations under this section extend only to Company’s current executive officers and members of its Board

of Directors and only for so long as each officer or member is an employee or director of Company. Executive shall direct any inquiries

by potential future employers to the Company’s human resources department, which shall use best efforts to disclose only his dates

of employment and last position held.

7. Covenant

Not to Sue. Executive covenants not to file a lawsuit or otherwise pursue any of the claims released by this Agreement. This Covenant

Not to Sue includes, but is not limited to, claims arising under federal, state or local laws prohibiting employment discrimination, claims

arising under severance plans and contracts, tort claims and claims growing out of any legal restrictions on Company’s rights to

terminate its employees or to take any other employment action, whether statutory, contractual or arising under common law or case law,

provided that, Executive is not prohibited from filing an administrative charge of discrimination with the U.S. Equal Employment

Opportunity Commission (“EEOC”). Under no circumstances, however, may Employee seek or receive any monetary or injunctive

relief, directly or indirectly, from Company after the Separation Date of this Agreement for anything alleged to have occurred before

the Separation Date of this Agreement.

8. Trade

Secrets. Executive agrees that Executive shall hold in a fiduciary capacity in perpetuity for the sole benefit of Company and

its affiliates and shall not directly or indirectly use or disclose any Trade Secret that Executive may have acquired (whether or not

developed or compiled by Executive and whether or not Executive was authorized to have access to such information) during the term of

Executive’s employment with Company or any of its affiliates for so long as such information remains a Trade Secret. “Trade

Secret” as used herein means information, including technical or non-technical data, a formula, a pattern, a compilation, a program,

a device, a method, a technique, a drawing or a process that (1) derives economic value, actual or potential, from not being generally

known to, and not being generally readily ascertainable by proper means by, other persons who can obtain economic value from its disclosure

or use and (2) is the subject of reasonable efforts by Company or any of its affiliates to maintain its secrecy. This Section 8

is intended to provide rights to Company and its affiliates which are in addition to, not in lieu of, those rights Company and its affiliates

have under the common law or applicable statutes for the protection of trade secrets.

9. Confidential

Information. For the three-year period following the Separation Date, Executive shall hold in a fiduciary capacity for the sole

benefit of Company and its affiliates,

and shall not directly or indirectly use or disclose, any Confidential Information that Executive may have acquired (whether or not developed

or compiled by Executive and whether or not Executive was authorized to have access to such information) during the term of and in the

course of or as a result of Executive’s employment by Company or its affiliates unless and except to the extent that such disclosure

is required by any subpoena or other legal process (in which event Executive will give Company prompt notice of such subpoena or other

legal process in order to permit Company to seek appropriate protective orders). “Confidential Information” as used herein

means any secret, confidential or proprietary information possessed by Company or any of its affiliates, including Trade Secrets, customer

or supplier lists, details of client or consultant contracts, current and anticipated customer requirements, pricing policies, price lists,

market studies, business plans, operational methods, marketing plans or strategies, product flaws or development techniques, computer

software programs (including object code and source code), data and documentation data, base technologies, systems, structures and architectures,

inventions and ideas, past current and planned research and development, compilations, devices, methods, techniques, processes, financial

information and data, business acquisition plans and new personnel acquisition plans (not otherwise included as a Trade Secret) that has

not become generally available to the public, and the terms and conditions of this Agreement.

10. Non-solicitation

of Customers and Employees.

a. For

the twelve-month period following the Separation Date, Executive shall not, on Executive’s own behalf or on behalf of any person,

firm, partnership, association, corporation or business organization, entity or enterprise, solicit business for a Competing Business

(defined below) from customers or suppliers of Company or any of its affiliates with whom Executive had or made material business contact

with in the course of Executive’s employment by Company within the 24-month period immediately preceding the Separation Date.

b. For

the twelve-month period following the Separation Date, Executive shall not, either directly or indirectly, call on, solicit or attempt

to induce any other officer, employee or independent contractor of such business with whom Executive had contact, knowledge of, or association

in the course of Executive’s employment with Company or any of its affiliates, as the case may be, during the twelve-month period

immediately preceding the Separation Date, to terminate his or her employment with Company or any of its affiliates and shall not assist

any other person or entity in such a solicitation (regardless of whether any such officer, employee or independent contractor would commit

a breach of contract by terminating his or her employment). Notwithstanding the foregoing, nothing shall prohibit any person from independently

contacting Executive about employment or other engagement during the Restricted Period, provided that Executive does not solicit or initiate

the contact.

11. Non-competition

Obligation. Without the prior written consent of Company, Executive, for the twelve-month period following the Separation Date,

will not accept employment as a principal financial or accounting officer or chief financial officer or similar role within the geographical

area in which Company or any of its affiliates is actively engaged in developing, marketing and selling ophthalmic pharmaceuticals, for

himself or on behalf of any other person, partnership, corporation or other business entity that develops, sells, or markets ophthalmic

pharmaceuticals (“Competing Business”) for the purpose of competing with Company. Notwithstanding the preceding sentence,

Executive will not be prohibited from owning less than 5% percent of any publicly traded corporation, whether or not such corporation

is in a Competing Business.

12. Rights

and Remedies Upon Breach. Executive and Company acknowledge and agree that remedies at law for any breach of the covenants listed

in Sections 8, 9, 10, and 11, above (“Restrictive Covenants”), will be inadequate, and that in the event Executive breaches,

or threatens to breach, any of the Restrictive Covenants, Company shall have the right, without the necessity of proving actual damages

or posting any bond, to enjoin, preliminarily and permanently, Executive from violating or threatening to violate any of the Restrictive

Covenants and to have the Restrictive Covenants specifically enforced by any court of competent jurisdiction, it being agreed that any

breach or threatened breach of the Restrictive Covenants would cause irreparable injury to Company and that money damages would not provide

an adequate remedy to Company. The rights and remedies under this paragraph shall be in addition to, and not in lieu of, any other rights

or remedies available to Company at law or in equity.

13. Modification.

Executive acknowledges and agrees that the Restrictive Covenants are reasonable and valid in time and scope and all other respects and

that the Parties agree that their intention is that the Restrictive Covenants be enforced according to their express terms. If any portion

of the Restricted Covenants is found to be invalid or unenforceable because of its duration, geographic territory, scope of activities,

or information covered is considered to be unreasonable in scope, the invalid or unenforceable terms shall be redefined, or a new enforceable

term provided, such that the intent of the Parties shall be enforced to the fullest extent permitted.

14. Limited

Disclosure. Executive agrees not to disclose any information regarding the underlying facts leading up to or the existence or

substance of this Agreement except to Executive’s spouse, Executive’s tax advisor, an attorney with whom Executive chooses

to consult regarding the consideration of this Agreement and/or to any federal, state, or local government agency. In the event that Executive

receives any request from any third-party seeking to compel information regarding the underlying facts leading up to or the existence

or substance of this Agreement, Executive shall provide prompt written notice to Company, care of its General Counsel, and cooperate with

any request by Company to limit the disclosure of such information; provided, however, that nothing herein shall limit Executive’s

ability to communicate or cooperate with any investigation initiated by any Government Agencies.

15. Governing

Law and Interpretation. This Agreement shall be governed and conformed in accordance with the laws of the State of Georgia without

regard to its conflict of laws provision. In the event of a breach of any provision of this Agreement, either Party may institute an action

specifically to enforce any term or terms of this Agreement and/or seek any damages for breach. Should any provision of this Agreement

be declared illegal or unenforceable by any court of competent jurisdiction and cannot be modified to be enforceable, excluding the general

release language, such provision shall immediately become null and void, leaving the remainder of this Agreement in full force and effect.

16. Severability.

Should any portion of this Agreement be declared or be determined to be illegal, invalid, or unenforceable, the validity of the remaining

parts, terms or provisions shall not be affected thereby, and said illegal, invalid, or unenforceable part, term, or provision shall be

deemed not to be a part of this Agreement.

17. Section Headings.

The section headings used in this agreement are included solely for convenience and shall not affect, or be used in connection with, the

interpretation of this Agreement.

18. Successors

and Assigns; Binding Agreement. This Agreement shall inure to the benefit of and shall be binding upon the successor and assigns

of the Parties, including the surviving or resulting entity in the event Company transfers all or substantially all or its assets. Iin

the event of a merger, asset sale, or other business combination, the “surviving company” shall be entitled to invoke all

of Company’s rights hereunder and shall remain liable for ally payments and performance due Executive. If Executive shall die while

any amounts remain payable to Executive hereunder, all such amounts, unless otherwise provided herein, shall be promptly paid to such

person or persons legally appointed by Executive to receive such amounts, or no such person is appointed, to Executive’s estate.

19. No

Admission of Wrongdoing. The Parties agree that neither this Agreement nor the furnishing of the consideration for this Agreement

shall be deemed or construed at any time for any purpose as an admission by Releasees of wrongdoing or evidence of any liability or unlawful

conduct of any kind.

20. Amendment

and Waiver. This Agreement may not be modified, altered, or changed except in writing and signed by all Parties wherein specific

reference is made to this Agreement. No condition, term, or provision of this Agreement may be waived by any Party except in writing,

signed by the waiving Party and expressly setting forth such Party’s intention to waive a condition, term, or provision of this

Agreement.

21. Counterparts.

This Agreement may be executed in several counterparts, each of which shall be deemed to be an original but all of which together will

constitute one and the same instrument.

22. Entire

Agreement. This Agreement sets forth the entire agreement between the Parties hereto, and fully supersedes any prior agreements

or understandings between the Parties with respect to the matters contained herein. For avoidance of doubt, this Agreement does not supersede

Section 6(i) of the Employment Agreement. Executive acknowledges that Executive has not relied on any representations, promises,

or agreements of any kind made to Executive in connection with Executive’s decision to accept this Agreement, except for those set

forth in this Agreement.

EXECUTIVE

IS ADVISED AND AFFIRMS that HE has been afforded twenty-one (21) days from the date HE was presented this Agreement within which to consider

this Agreement and, if EXECUTIVE signed this Agreement before the end of the 21-day period, it was HIS voluntary decision to do so because

HE decided HE did not need any additional time to decide whether to sign the Agreement. EXECUTIVE ALSO IS HEREBY ADVISED

TO CONSULT WITH AN ATTORNEY BEFORE SIGNING THIS AGREEMENT.

EXECUTIVE AGREES THAT THE

WAIVER AND RELEASE IN THIS AGREEMENT DOES NOT APPLY TO ANY RIGHTS OR CLAIMS THAT MAY ARISE UNDER THE ADEA AFTER THE EFFECTIVE DATE

OF THIS AGREEMENT. EXECUTIVE ACKNOWLEDGES THAT THE CONSIDERATION GIVEN FOR THIS WAIVER AND RELEASE IS IN ADDITION TO ANYTHING OF VALUE

TO WHICH EMPLOYEE WAS ALREADY ENTITLED. NOTHING IN THIS AGREEMENT PREVENTS OR PRECLUDES EXECUTIVE FROM CHALLENGING OR SEEKING A DETERMINATION

IN GOOD FAITH OF THE VALIDITY OF ADEA HEREIN, NOR DOES IT IMPOSE ANY CONDITION PRECEDENT, PENALTIES, OR COSTS FOR DOING SO, UNLESS SPECIFICALLY

AUTHORIZED BY FEDERAL LAW.

EXECUTIVE

MAY REVOKE ANY WAIVER OF CLAIMS EXECUTIVE HAS OR MAY HAVE UNDER THE ADEA FOR A PERIOD OF SEVEN (7) CALENDAR

DAYS FOLLOWING THE DAY EXECUTIVE SIGNS THIS AGREEMENT. ANY REVOCATION WITHIN THIS PERIOD MUST BE SUBMITTED, IN WRITING, TO MS. LAURA

CEGALA, HUMAN RESOURCES, ALIMERA SCIENCES, INC., AND STATE, “I HEREBY REVOKE MY RELEASE OF ANY CLAIMS UNDER THE ADEA AS PROVIDED

IN OUR AGREEMENT.” THE REVOCATION MUST BE PERSONALLY DELIVERED TO MS. CEGALA OR HER DESIGNEE OR MAILED TO MS. CEGALA AT ALIMERA

SCIENCES, INC., 6310 TOWN SQUARE, SUITE 400, ALPHARETTA, GEORGIA 30005, AND POSTMARKED

WITHIN SEVEN (7) CALENDAR DAYS AFTER EXCECUTIVE SIGNS THIS AGREEMENT.

EXECUTIVE AGREES THAT ANY

MODIFICATIONS, MATERIAL OR OTHERWISE, MADE TO THIS AGREEMENT DO NOT RESTART OR AFFECT IN ANY MANNER THE ORIGINAL UP TO TWENTY-ONE (21)

CALENDAR DAY CONSIDERATION PERIOD.

EXECUTIVE

FREELY AND KNOWINGLY, AND AFTER DUE CONSIDERATION, ENTERS INTO THIS AGREEMENT INTENDING TO WAIVE, SETTLE, AND RELEASE ALL CLAIMS EXECUTIVE

HAS OR MIGHT HAVE AGAINST RELEASEES.

The Parties knowingly and voluntarily

sign this Agreement as of the date(s) set forth below:

| | ALIMERA SCIENCES, INC. |

| | | |

| | | |

| By: |

/s/ Russell Skibsted | | By: |

/s/ Laura Cegala |

| |

Russell L. Skibsted | | |

Laura Cegala, Vice President, HR |

EXHIBIT 10.2

EMPLOYMENT AGREEMENT WITH

ALIMERA SCIENCES, INC.

This Employment Agreement

(this “Agreement”) is entered into between Alimera Sciences, Inc., a Delaware corporation (the “Company”),

and Elliot Maltz (“Executive”), as of January 2, 2024.

RECITALS:

WHEREAS, the Company

is engaged in the business of developing, marketing and selling ophthalmic pharmaceuticals in the United States and throughout the world;

and

WHEREAS, the Company

and Executive desire that Executive provide employment services to the Company upon the terms and conditions set forth below; and

WHEREAS, the Company

desires now to retain Executive as its Chief Financial Officer and Treasurer, effective as of January 2, 2024 (the “Effective

Date”), pursuant to the terms and conditions of this Agreement, and to implement a competitive compensation and benefit

package for Executive commensurate with his role, as provided herein.

NOW, THEREFORE, in

consideration of the promises and mutual covenants contained herein, the parties, intending to be legally bound, agree as follows:

AGREEMENT:

SECTION 1

EFFECTIVE DATE

Subject to the terms and

conditions set forth in this Agreement, the Company agrees to employ Executive as Chief Financial Officer, and Executive agrees to such

employment by the Company effective as of the Effective Date.

SECTION 2

DEFINITIONS

“2023 Plan”

means the Alimera Sciences, Inc. 2023 Equity Incentive Plan, as amended and/or restated from time to time.

“Board” means the Board of Directors

of the Company.

“Bonus”

means the bonus, determined based on the actual performance of the Company for the full fiscal year in which Executive’s employment

terminates, that Executive would have earned for the year in which his employment terminates had he remained employed for the entire

year, prorated based on the ratio of the number of days during such year that Executive was employed to 365. Subject to the conditions

set forth in Section 5(a), such Bonus will be determined and paid to Executive no later than 21/2 months

after the close of the fiscal year in which Executive’s employment terminates.

“Cause” means:

(1) Executive’s

gross negligence or willful misconduct with respect to the business and affairs of the Company, including violation of any material policy

or rule of the Company that is not cured within 30 days after written notice thereof is given to Executive by the Company;

(2) Executive’s

conviction of, or entering a guilty plea or plea of no contest with respect to a felony or to a crime involving moral turpitude, deceit,

dishonesty or fraud;

(3) Executive’s

material breach of the terms of this Agreement or any agreement between Executive and the Company or material violation of any of the

Company’s written employment policies;

(0) Executive’s

failure to fulfill Executive’s duties and responsibilities under this Agreement, or such other duties and responsibilities as may

be assigned or delegated to Executive, and such breach or failure, as the case may be, if capable of being cured, is not cured within

30 days after written notice thereof is given to Executive by the Company;

(4) Executive’s

engaging in any intentional act of dishonesty, deceit, fraud, moral turpitude, misconduct, breach of trust or acting intentionally against

the financial or business interests of the Company, or Executive’s use or possession of illegal drugs in the workplace; or

(5) Executive’s

failure to cooperate in good faith with a governmental or internal investigation of the Company or its directors, officers or employees,

if the Company has requested Executive’s cooperation.

For purposes of this definition

of Cause, no act, or failure to act, will be deemed “willful” or “intentional” if done or omitted to be done

by Executive in good faith with a reasonable belief that Executive’s act, or failure to act, was in the best interest of the Company.

“Change in Control”

means (i) the consummation of a merger or consolidation of the Company with or into another entity or any other corporate reorganization,

if persons who were not stockholders of the Company immediately prior to such merger, consolidation or other corporate reorganization,

own immediately after such merger, consolidation or other corporate reorganization 50% or more of the voting power of the outstanding

securities of each of (A) the continuing or surviving entity and (B) any direct or indirect parent corporation of such continuing

or surviving entity or (ii) the sale, transfer or other disposition of all or substantially all of the Company’s assets. A

transaction shall not constitute a Change in Control if its sole purpose is to change the state of the Company’s incorporation

or to create a holding company that will be owned in substantially the same proportions by the persons who held the Company’s securities

immediately before such transaction. Notwithstanding the foregoing, a Change in Control shall not be deemed to occur unless such transaction

also qualifies as a “change in control event” as described in Treas. Reg. § 1.409A-3(i)(5).

“Code”

means the United States Internal Revenue Code of 1986, as currently and hereafter amended.

“Compensation

Committee” means the compensation committee of the Board.

“Competing Business”

means any business which develops, sells or markets ophthalmic pharmaceuticals.

“Disability”

means a condition which renders Executive unable to engage in any substantial gainful activity by reason of any medically determinable

physical or mental impairment which can be expected to result in death, or which has lasted or is expected to last for a continuous period

of not less than six consecutive months with or without reasonable accommodation. Executive shall not be considered disabled unless Executive

furnishes proof in such form or manner, and at such times, as the Company may require.

“Equity”

means (i) all Stock, including restricted stock; (ii) all options and other rights to purchase Stock; (iii) all restricted

stock units, performance units or phantom shares whose value is measured by the value of Stock; (iv) all stock appreciation rights

whose value is measured by increases in the value of Stock; and (v) any other award under an ISP.

“Good Reason” means:

| · | for

purposes of Section 4(e), that Executive resigns due to one of the following

conditions: (i) a material diminution of Executive’s authority, duties or responsibilities

with the Company; (ii) a geographic relocation of Executive’s primary business

location to a location that is more than 35 miles from the present location of Executive’s

primary business location; or (iii) any breach by the Company of this Agreement that

is material and, in the case of each clause above, that is not cured within 30 days after

written notice thereof to the Company from Executive. |

| · | for

purposes of Section 5, that Executive resigns after one of the following conditions

has come into existence without his consent: (i) a reduction in Executive’s base

salary from the amount set forth in Section 4(a) or target bonus opportunity

set forth in Section 4(b); (ii) a material adverse change in Executive’s

authority, responsibilities or duties with the Company; (iii) a requirement by the Company

that Executive relocate Executive’s primary business location to a location that is

more than 35 miles from the present location of Executive’s primary business location;

(iv) any breach by the Company of this Agreement that is material and that is not cured,

or is not capable of being cured, within 30 days after written notice thereof to the Company

and the Board from Executive as provided in the following sentence. A condition shall not

be considered “Good Reason” unless Executive gives the Company written notice

of such condition within 90 days after such condition first comes into existence, the Company

fails to remedy such condition within 30 days after receiving Executive’s written notice

(the “Cure Period”) as provided in the foregoing sentence, and

Executive terminates Executive’s employment within sixty (60) days after the end of

the Cure Period. For the avoidance of doubt, if the Company cures the Good Reason condition

during the Cure Period, Good Reason shall be deemed not to have occurred. |

“ISP”

means the 2023 Plan and any new equity incentive plan adopted by the Company, in each case as amended from time to time.

“Restricted Period”

means the 12-month period beginning on the date on which Executive’s employment with the Company is terminated pursuant to the

terms of this Agreement.

“Separation”

means a “separation from service,” as defined in the regulations under Section 409A of the Code.

“Stock” means shares of the Company’s

common stock.

SECTION 3

TITLE, POWERS AND RESPONSIBILITIES

(a) Title

. Executive shall serve as Chief Financial Officer of the Company.

(b) Powers

and Responsibilities .

(1) Executive,

in fulfilling Executive’s responsibilities, shall have such powers as are normally and customarily associated with a Chief Financial

Officer in a company of similar size and operating in a similar industry, including the power to hire and fire employees and executives

of the Company reporting to Executive and such other powers as are authorized by the Board.

(2) Executive,

as a condition to Executive’s employment under this Agreement, represents and warrants that Executive will assume and fulfill the

responsibilities described in Section 3(b)(1) without any risk of violating any non-compete or other restrictive covenant

or other agreement to which Executive is a party.

(c) Reporting

Relationship . Executive shall report to the Company’s Chief Executive Officer.

(d) Full-Time

Basis . Executive (1) shall undertake to perform all Executive’s responsibilities and exercise all Executive’s powers

in good faith and on a full-time basis, (2) shall not engage in any other employment, consulting or other business activity that

would create a conflict of interest with the Company, (3) shall not assist any person or entity in competing with the Company or

in preparing to compete with the Company, and (4) shall comply in all material respects with the Company’s policies and rules,

as they may be in effect from time to time.

(e) No

Conflicting Obligations . Executive represents and warrants to the Company that Executive is under no obligations or commitments,

whether contractual or otherwise, that are inconsistent with his obligations under this Agreement. Executive represents and warrants

that Executive will not use or disclose, in connection with Executive’s employment with the Company, any trade secrets or other

proprietary information or intellectual property in which Executive or any other person has any right, title or interest and that Executive’s

employment with the Company will not infringe or violate the rights of any other person.

SECTION 4

COMPENSATION, BENEFITS, ETC.

(a) Annual

Base Salary . Executive’s base salary shall be $350,000 per year, which amount may be reviewed and adjusted from time to time

at the discretion of the Board or the Compensation Committee. Executive’s annual base salary shall be payable in accordance with

the Company’s standard payroll practices and policies for executives and shall be subject to such withholdings as are required

by law or as are otherwise permissible under such practices or policies.

(b) Annual

Bonus . Beginning on January 2, 2024, for each fiscal year, the Company shall pay an annual bonus to Executive no later than

21/2 months after the close of such fiscal year, subject to the terms and conditions of the Company’s Management

Cash Incentive Program (or any predecessor or successor cash incentive plan thereto), which may be reviewed from time to time at the

discretion of the Board or the Compensation Committee. To earn an annual bonus for any particular fiscal year of employment, Executive

must remain employed by the Company through the date the bonus is paid except as specifically set forth in Section 5. Executive’s

initial target annual bonus amount shall be up to 40% of Executive’s annual base salary, as determined by the Board or the Compensation

Committee. The determinations of the Board or the Compensation Committee with respect to such bonus shall be final and binding; provided,

however, that Executive’s target annual bonus amount shall not be reduced to an amount below 40% of Executive’s

then-current base salary.

(c) Employee

Benefit Plans . Executive shall be eligible to participate in the employee benefit plans, programs and policies maintained by the

Company on terms no less favorable to Executive than the participation terms applicable to similarly situated executives of the Company,

subject to the terms and conditions of such plans, programs and policies as in effect from time to time.

(d) Equity

Awards . Subject to the approval of the Compensation Committee, the Company will grant to Executive the following stock option, time-based

restricted stock units, and performance-based restricted stock units, each as an inducement material to Executive’s entering into

this Agreement, within the meaning of NASDAQ Marketplace Rule 5635(c)(4) and the related guidance under NASDAQ IM 5635-1, and

not pursuant to the 2023 Plan:

(1) Stock

Option . Executive shall receive an option to purchase 75,000 shares of Stock (the “Option”). The exercise

price of the Option shall be equal to the fair market value per share of Stock as of the date of grant of the Option. The Option will

be subject to the terms and conditions set forth in the corresponding inducement stock option agreement (the “Stock Option

Agreement”). As more fully described in the Stock Option Agreement, Executive will vest in 25% of the Option shares after

twelve (12) months of continuous service with the Company, and the balance will vest in equal monthly installments over the next thirty-six

(36) months of continuous service with the Company.

(2) Restricted

Stock Units . Executive shall receive an award of 75,000 restricted stock units representing a notional account equal to a corresponding

number of shares of Stock (the “RSUs”). Such RSUs will be subject to the terms and conditions set forth

the corresponding inducement restricted stock unit agreement (the “RSU Agreement”). As more fully described

in the RSU Agreement, the RSUs will vest with respect to 25% of the RSUs after twelve (12) months of continuous service with the Company,

and the balance will vest in equal annual installments over the next thirty-six (36) months of continuous service with the Company.

(3) Performance

Stock Units . Executive shall receive an award of 75,000 performance stock units representing a notional account equal to a corresponding

number of shares of Stock (the “PSUs”). Such PSUs will be subject to the terms and conditions set forth in

the corresponding inducement performance stock unit agreement (the “PSU Agreement”). As will be more fully

described in the PSU Agreement, the vesting of the PSUs will be conditioned on the satisfaction of either of the following performance

metrics, in each case subject to Executive’s continuous service with the Company:

(A) Revenue

Target. The PSUs will vest in three tranches, subject to the achievement of the following milestones, as determined by the Compensation

Committee following the completion of the Company’s audited financial statements for the applicable measurement year. Each tranche

will vest if the (i) Company’s audited revenue for the applicable measurement year equals or exceed that annual revenue target

set forth below for the applicable year and (ii) the corporate Adjusted EBITDA (as defined in the PSU Agreement) exceeds

20% of revenue in such year (the “Revenue Target”):

Measurement Year (Number of

Shares Subject to

PSUs) | |

Annual Revenue Target | |

| 2024 (25,000) | |

$ | 115,000,000 | |

| 2025 (25,000) | |

$ | 135,000,000 | |

| 2026 (25,000) | |

$ | 155,000,000 | |

If the Revenue Target is not satisfied

for a measurement year, no PSUs will vest for that measurement year unless the PSUs for such year have previously vested as a result

of satisfaction of the Stock Price Target milestones (discussed below) during or prior to such measurement year. For the avoidance of

doubt, if the Revenue Target milestone is not met in one of the measurement years set forth above, the shares subject to the PSUs for

such measurement year shall not be eligible to vest in a later year as a result of subsequent Revenue Target milestones being met.

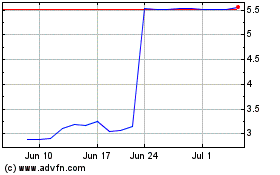

(B) Stock

Price Target. Notwithstanding the Revenue Target, the PSUs will vest in three tranches of shares, subject to the achievement

of the following milestones. For any measurement year, the applicable shares subject to the PSUs will vest if the per share closing price

of the Stock equals or exceeds the price in the table below for any 20 trading days within any 30-trading day period during the applicable

measurement year (adjustments to be made for stock splits, stock dividends, reorganizations, and recapitalizations) (the “Stock

Price Target”):

Measurement Year (Number of

Shares Subject to

PSUs) | |

Closing Price of Share of Stock | |

| 2024 (25,000) | |

$ | 5.10 | |

| 2025 (25,000) | |

$ | 6.80 | |

| 2026 (25,000) | |

$ | 8.50 | |

If neither the Revenue Target nor the

Stock Price Target are satisfied for a measurement year, no PSU shares will vest for that measurement year; however, if the Stock Price

Target for a future year is achieved in a prior year then the number of vested PSUs shall be accelerated to include the number of PSUs

that would have vested in such future year (e.g., if in 2024 the Stock Price Target equals or exceeds $8.50 for the applicable period,

then all 75,000 PSUs shall vest in 2024, and if in 2024 the Stock Price Target does not equal or exceed $5.10, but in 2025 the Stock

Price Target equals or exceeds $8.50 for the applicable period, then 50,000 of the PSUs shall vest).

The determinations

of the Board or the Compensation Committee with respect to the achievement of a Revenue Target or Stock Price Target shall be final and

binding. The Board and the Compensation Committee have discretion to modify the Revenue Targets or performance results to reflect significant

transactions (such as acquisitions, divestitures, or newly formed joint ventures) or other unusual items if such events occur following

the Effective Date, provided however that any such modifications

made with respect to the Revenue Targets or performance results related to the PSUs granted to Executive pursuant to this Section 4(d)(3) shall

be consistent with modifications made to equity awards made to other similarly situated Company executives on equivalent terms.

(4) Other

Awards . Executive may receive additional Equity awards at the discretion of the Board, subject to the terms and conditions set forth

in the applicable ISP and any corresponding notice, agreement or certificate under the ISP.

(e) Acceleration

of Vesting of Equity . The following terms shall apply to all of Executive’s Equity awards in Section 4(d), subject

to Executive’s execution and non-revocation of the Release provided for in Section 5(a):

(1) The

vested percentage of Executive’s Equity awards subject to time-based vesting (“Time-Based

Awards”) shall be determined by adding 12 months to the actual period of service that Executive has completed with

the Company if Executive’s employment with the Company is terminated by the Company without Cause or Executive resigns for Good

Reason. (i.e., Executive’s vesting shall be accelerated by an additional 12 months).

(2) Executive

shall vest in 100% of Executive’s remaining unvested Time-Based Awards if (i) a Change in Control occurs and (ii) within

3 months prior to a Change in Control, on a Change in Control, or within 12 months after the Change in Control, Executive’s employment

with the Company is terminated by the Company (or its successor) without Cause or Executive resigns for Good Reason.

(3) Executive

shall vest in 100% of Executive’s unvested PSUs for the measurement year in which a Change in Control occurs (i) if the pro-rated

annual revenue and Adjusted EBITDA as of the date of the Change in Control, annualized, would exceed the Revenue Target for the year

in which the Change in Control occurs (i.e., the trajectory of the revenue for the year is on pace to exceed the Revenue Target in the

year of the Change in Control as of the date of the Change in Control), as determined by the Compensation Committee and (ii) if

(A) a Change in Control occurs and (B) within 3 months prior to a Change in Control, on a Change in Control, or within 12 months

after the Change in Control, Executive’s employment with the Company is terminated by the Company (or its successor) without Cause

or Executive resigns for Good Reason. For the avoidance of doubt, (x) PSUs that did not vest in a prior year because the applicable

Revenue Target milestone was not satisfied or the Stock Price Target milestone was not satisfied shall not be subject to any acceleration

of vesting and (y) PSUs that have not vested because the applicable measurement year has not yet begun as of the Change in Control

shall not be subject to any acceleration of vesting under the Revenue Target milestone; provided, however, that, if the per-share closing

price of the Stock equals or exceeds the Stock Price Target, disregarding the trading day requirement, for a future year upon the Change

in Control, then the number of vested PSUs shall be accelerated to include the number of PSUs that would have vested in such future year.

(4) Executive

shall vest in 100% of the remaining unvested Equity awards in the event of Disability where a Separation occurs or in the event of death.

(f) Rights

to Time Off Work . Executive shall be eligible for paid time off in accordance with the Company paid time-off policies, as in effect

from time to time.

(g) Expense

Reimbursements . Executive shall have the right to expense reimbursements in accordance with the Company’s standard policy

on expense reimbursements, as in effect from time to time. Any reimbursement shall (a) be for expenses reasonably and necessarily

incurred in the performance of Executive’s duties, (b) be paid promptly but not later than the last day of the calendar year

following the year in which the expense was incurred, (c) not be affected by any other expenses that are eligible for reimbursement

in any calendar year, and (d) not be subject to liquidation or exchange for another benefit.

(h) Indemnification

. The Company shall, to the maximum extent permitted by applicable law and the Company’s governing documents, indemnify Executive

and hold Executive harmless from and against any claim, loss or cause of action arising from or out of Executive’s performance

as an officer, director, manager or employee of the Company or in any other capacity in which Executive serves at the request of the

Board. If any claim is asserted hereunder against Executive, the Company shall pay Executive’s legal expenses (or cause such expenses

to be paid) on a quarterly basis, provided that Executive shall reimburse the Company, in a timely manner, for such amounts if Executive

shall be found by a final, non-appealable order of a court of competent jurisdiction not to be entitled to indemnification. The indemnification

obligations of the Company in this paragraph shall survive any termination of this Agreement and shall be supplemental to any other rights

to indemnification from the Company to which Executive may be entitled.

(i) Directors

and Officers Liability Insurance . The Company shall maintain directors’ and officers’ liability insurance coverage covering

Executive in amounts customary for similarly situated companies in the pharmaceutical industry and with insurers reasonably acceptable

to Executive. All policies for such coverage shall provide for insurance on an “occurrence” basis, or if on a “claims-made”

basis, with sufficient coverage for claims made after the date on which Executive’s employment with the Company terminates.

(j) At-Will

Employment. Executive’s employment with the Company shall be “at will,” meaning that either Executive or the Company

shall be entitled to terminate Executive’s employment at any time and for any or no reason, with or without Cause or Good Reason

subject to Sections 4(e) and 5 of this Agreement. Any contrary representations that may have been made to Executive shall

be superseded by this Agreement. This Agreement shall constitute the full and complete agreement between Executive and the Company on

the “at will” nature of Executive’s employment, which may only be changed in an express written agreement signed by

Executive and a duly authorized officer of the Company (other than Executive).

SECTION 5TERMINATION

OF EMPLOYMENT

(a) General.

If the Board terminates Executive’s employment without Cause or Executive resigns for Good Reason, then Executive will be entitled

to the benefits described in Section 4(e) and this Section 5. However, Executive will not be entitled to

any of the benefits described in Section 4(e) or this Section 5 (with the exception of salary amounts that

are earned but unpaid as of the date of termination) unless Executive (or, with respect to Section 5(f), the executor of

Executive’s estate) has (i) returned all Company property in Executive’s possession and (ii) executed a separation

agreement and general release of all claims that Executive may have against the Company or persons affiliated with the Company in a form

prescribed by the Company (the “Release”), with applicable carve-outs for rights to indemnification, enforcement

of the Release and to vested Equity awards. Executive must execute and return the Release on or before the date specified by the Company

in the Release (the “Release Deadline”). The Release Deadline will in no event be later than fifty (50) days

after Executive’s Separation. If Executive fails to return the executed Release on or before the Release Deadline, or if Executive

revokes the Release within seven (7) days after return of the executed Release, then Executive will not be entitled to the benefits

described in Section 4(e) or this Section 5.

(b) Termination

by Board without Cause or Resignation for Good Reason Not in Connection with Change in Control. If the Board terminates Executive’s

employment without Cause or Executive resigns for Good Reason either more than three months prior to a Change in Control or more than

12 months after a Change in Control, the Company shall make the following payments to Executive (subject in each case to applicable deductions

and such withholdings for taxes as required by law):

(i) If

Executive’s Separation occurs prior to Executive’s completion of six month of continuous employment with the Company, Executive

will receive his earned but unpaid base salary, if any, up to the date Executive’s employment terminates, and no further payments;

(ii) If

Executive’s Separation occurs after the first continuous six months of Executive’s employment with the Company but prior

to completion of twelve months of continuous employment with the Company, Executive will receive his earned but unpaid base salary if

any, up to the date Executive’s employment terminates, plus 50% of Executive’s then-current annual base salary, which latter

amount shall be payable in six equal monthly installments;

(iii) If

Executive’s Separation occurs after the first continuous twelve months of Executive’s employment with the Company but prior

to completion of twenty-four months of employment with the Company, Executive will receive his earned but unpaid base salary, if any,

up to the date Executive’s employment terminates, plus 75% of Executive’s then-current annual base salary, which latter amount

shall be payable in nine equal monthly installments in accordance with the Company’s regular payroll practices; and

(iv) If

Executive’s Separation occurs at any time after completion of twenty-four months of continuous employment with the Company, Executive

will receive his earned but unpaid base salary, if any, up to the date Executive’s employment terminates, plus 100% of Executive’s

then-current annual base salary, which latter amount shall be payable in twelve equal monthly installments in accordance with the Company’s

regular payroll practices.

In addition, Executive shall be paid, no later

than 21/2 months following the close of the fiscal year of termination, Executive’s Bonus for the fiscal

year in which the Separation occurs. The salary continuation payments shall commence within 60 days after Executive’s Separation

and, once they commence, shall include any unpaid amounts accrued from the date of Separation. However, if such 60-day period spans two

calendar years, then the payments will in any event begin in the second calendar year. In addition, subject to Section 5(g) below,

if Executive is participating in the Company’s group health insurance plans on the effective date of termination and timely elects

and remains eligible for continued coverage under the Consolidated Omnibus Budget Reconciliation Act (“COBRA”),

the Company shall make any continuation coverage premium payments (for Executive and Executive’s dependents) for continued health

insurance coverage under COBRA for the corresponding six-, nine-, or twelve-month period, as applicable under clauses (ii), (iii), and

(iv), above, following the Separation or, if earlier, until Executive is eligible to be covered under another substantially equivalent

medical insurance plan by a subsequent employer.

(c) Termination

by Board without Cause or Resignation for Good Reason in Connection with Change in Control. If the Board terminates Executive’s

employment without Cause or Executive resigns for Good Reason and a Separation occurs either within the period that begins three months

prior to a Change in Control and ends within 12 months after a Change in Control, the Company shall pay Executive his earned but unpaid

base salary plus the sum of (i) 100% of Executive’s then-current annual base salary plus (ii) 100% of Executive’s

target annual bonus for the then-current year (subject to such withholdings as required by law), payable in twelve equal monthly installments

in accordance with the Company’s regular payroll practices (the “Severance Payments”). In addition, Executive

shall be paid, no later than 21/2 months following the close of the fiscal year of termination, Executive’s

Bonus for the fiscal year in which the Separation occurs. The Severance Payments shall commence within 60 days after Executive’s

Separation. However, if such 60-day period spans two calendar years, then the payments will in any event begin in the second calendar

year. In addition, subject to Section 5(g) below, the Company shall make any continuation coverage premium payments

(for Executive and Executive’s dependents) for continued health insurance coverage under the COBRA for the 12-month period following

the Separation or, if earlier, until Executive is eligible to be covered under another substantially equivalent medical insurance plan

by a subsequent employer.

(d) Termination

by the Board for Cause or by Executive without Good Reason . If the Board terminates Executive’s employment for Cause or Executive

resigns without Good Reason, the Company’s only obligation to Executive under this Agreement shall be to pay Executive his earned

but unpaid base salary, if any, up to the date Executive’s employment terminates, and Executive shall have no right to any Bonus

or any unpaid bonus payment whatsoever. The Company shall only be obligated to reimburse any unreimbursed business expenses and to make

such payments and provide such benefits under any employee benefit plan, program or policy in which Executive was a participant as are

explicitly required to be paid to Executive by the terms of any such benefit plan, program or policy following the date on which Executive’s

employment terminates.

(e) Termination

for Disability . The Board shall have the right to terminate Executive’s employment on or after the date Executive has a Disability,

and such a termination shall not be treated as a termination without Cause under this Agreement. If Executive’s employment is terminated

on account of a Disability and a Separation occurs, the Company shall:

(1) pay

Executive Executive’s base salary through the end of the month in which a Separation occurs as soon as practicable after the Separation,

(2) pay

Executive Executive’s Bonus for the fiscal year in which such Separation occurs; provided that the Bonus shall in no event be paid

later than 21/2 months after the close of such fiscal year,

(3) pay

or cause the payment of benefits to which Executive is entitled under the terms of the disability plan(s) of the Company covering

Executive at the time of such Disability,

(4) make

such payments and provide such benefits as otherwise called for under the terms of the ISP and each other employee benefit plan, program

and policy in which Executive was a participant; provided that no payments made under Section 5(e) (l), Section 5(e)(2) or

Section 5(e)(3) shall be taken into account in computing any payments or benefits described in this Section 5(e)(4),

and

(5) make

any COBRA continuation coverage premium payments (for Executive and for Executive’s dependents), for the 12-month period following

the termination of Executive’s employment or, if earlier, until Executive is eligible to be covered under another substantially

equivalent medical insurance plan by a subsequent employer, subject to Section 5(g) below.

(f) Death.

If Executive’s employment terminates because of his death, the Company shall:

(1) pay

to Executive’s estate Executive’s base salary through the end of the month of his death as soon as practicable after his

death,

(2) pay

to Executive’s estate Executive’s Bonus, when actually determined, for the year in which Executive’s death occurs,

(3) make

such payments and provide such benefits as otherwise called for under the terms of the ISP and each other employee benefit plan, program