false

--12-31

0001787518

0001787518

2023-12-22

2023-12-22

0001787518

NUKK:CommonStock0.0001ParValuePerShareMember

2023-12-22

2023-12-22

0001787518

NUKK:WarrantsEachWarrantExercisableForOneShareOfCommonStockFor11.50PerShareMember

2023-12-22

2023-12-22

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

United States

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

Current Report

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

December 22, 2023

Date of Report (Date of earliest event reported)

| NUKKLEUS INC. |

| (Exact Name of Registrant as Specified in its Charter) |

| Delaware |

|

001-39341 |

|

38-3912845 |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(I.R.S. Employer

Identification No.) |

| 525 Washington Blvd. Jersey City, New Jersey |

|

07310 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant’s telephone number, including

area code: 212-791-4663

Brilliant Acquisition Corporation

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act |

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which

registered |

| Common Stock, $0.0001 par value per share |

|

NUKK |

|

The Nasdaq Stock Market LLC |

| |

|

|

|

|

| Warrants, each warrant exercisable for one Share of Common Stock for $11.50 per share |

|

NUKKW |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities

Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☒

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act.

INTRODUCTORY NOTE

As previously announced,

on June 23, 2023, Brilliant Acquisition Corporation, a British Virgin Islands company (prior to the Merger “Brilliant”, and

following the Merger, a Delaware corporation “Nukkleus”), entered into an Amended and Restated Agreement and Plan of Merger

(as amended by the First Amendment to the Amended and Restated Agreement and

Plan of Merger on November 1, 2023, the “Merger Agreement”), by and among Brilliant BRIL Merger Sub, Inc., a Delaware

corporation and wholly-owned subsidiary of Brilliant (“Merger Sub”), and Nukkleus Inc., a Delaware corporation (“Old

Nukk”).

The Merger Agreement provides

that, among other things, at the closing (the “Closing”) of the transactions contemplated by the Merger Agreement,

Merger Sub merged with and into Old Nukk (the “Merger”), with Old Nukk surviving as a wholly-owned subsidiary of Brilliant.

In connection with the Merger, Brilliant changed its name to “Nukkleus Inc.” (“Nukkleus” or “Combined

Company”). The Merger and other transactions contemplated by the Merger Agreement are hereinafter referred to as the “Business

Combination.”

Brilliant held a special

meeting, at which its shareholders voted to approve the proposals outlined in the final prospectus and definitive proxy statement dated

November 13, 2023 (the “Joint Proxy Statement/Prospectus”) and filed with the Securities and Exchange Commission (“SEC”),

including, among other things, the adoption of the Merger Agreement. On December 22, 2023, as contemplated by the Merger Agreement and

described in the sections titled “Brilliant Proposal 1 - The Brilliant Business Combination Proposal” beginning on

page 104 of the Joint Proxy Statement/Prospectus, and “Nukkleus Proposal 1 - The Nukkleus Business Combination Proposal”

beginning on page 95 of the Joint Proxy Statement/Prospectus, Merger Sub merged with and into Old Nukk, and the separate corporate existence

of Merger Sub ceased, with Old Nukk being the surviving corporation and wholly owned subsidiary of Brilliant.

In connection with the Business

Combination, Brilliant (a) re-domiciled out of the British Virgin Islands and continued as a company incorporated in the State of Delaware,

prior to the Closing (the “Domestication”); (b) upon the Domestication adopted the Interim Charter (as described

in the joint proxy statement/prospectus) (c) filed an amended and restated certificate of incorporation (the “Amended Certificate

of Incorporation”) and (d) changed its name to “Nukkleus Inc.”

Terms used but not defined

herein, or for which definitions are not otherwise incorporated by reference herein, shall have the meaning given to such terms in the

Joint Proxy Statement/Prospectus and such definitions are incorporated herein by reference.

Business Combination Consideration

As a result of the Business

Combination, all of the outstanding shares of common stock, par value $0.0001 per share, of Old Nukk (“Old Nukk Common Stock”)

were cancelled in exchange for the right to receive a pro-rata portion of 10,500,000 shares of common stock of Brilliant (“Brilliant

Common Stock”). Each outstanding option to purchase shares of Old Nukk Common Stock (whether vested or unvested) was assumed by

Brilliant and automatically converted into an option to purchase shares of Brilliant Common Stock (each, an “Assumed Option”).

The holder of each Assumed Option has: (i) the right to acquire a number of shares of Brilliant Common Stock equal to (as rounded down

to the nearest whole number) the product of (A) the number of shares of Old Nukk Common Stock subject to such option prior to the effective

time of the Merger, multiplied by (B) the exchange ratio of 1:35 (the “Exchange Ratio”); (ii) have an exercise price equal

to (as rounded up to the nearest whole cent) the quotient of (A) the exercise price of the option, divided by (B) the Exchange Ratio;

and (iii) be subject to the same vesting schedule as the applicable option of Old Nukk.

In connection with the Domestication,

all of the issued and outstanding ordinary shares, no par value per share, of Brilliant (“Brilliant Ordinary Shares”), rights

to receive one-tenth of one ordinary share of Brilliant per right (“Brilliant Rights”) and warrants entitling the holder thereof

to purchase one Brilliant Ordinary Share at a price of $11.50 per Brilliant Ordinary Share (“Brilliant Warrants”) will remain

outstanding and become substantially identical securities of the SPAC as a Delaware corporation. The holders of Brilliant securities,

other than Brilliant’s sponsor or affiliates, received an additional issuance, as follows: (1) in the case of holders of Brilliant

Ordinary Shares, such number of newly issued shares of Brilliant Common Stock equal to a pro rata share of the Backstop Pool (as defined

below); and (2) in the case of holders of Brilliant Rights, such number of shares of Brilliant Common Stock equal to a pro rata share

of the Backstop Pool, in each case subject to rounding in accordance with the Merger Agreement (such ratio of the aggregate number of

shares of Brilliant Common Stock issuable to each Brilliant public shareholder, including such shareholder’s share in the Backstop

Pool, to the aggregate number of Brilliant Ordinary Shares and Brilliant Rights held by such Brilliant public shareholder, the “SPAC

Additional Share Ratio”). Outstanding Brilliant Warrants held by holders other than Brilliant’s sponsor or affiliates received

a number of Brilliant Warrants equal to one warrant exercisable to receive one share of Brilliant Common Stock plus an additional number

of warrants equal to the SPAC Additional Share Ratio, with each warrant exercisable to receive one share of Brilliant Common Stock per

warrant. The Backstop Pool is defined in the Merger Agreement as a pool of shares of Brilliant Common Stock equal to the lower of (1) 1,012,000

and (2) 40% of the aggregate number of Brilliant Ordinary Shares and Brilliant Rights, subject to rounding in accordance with the

Merger Agreement. In connection with the Business Combination, the Backstop Pool was equal to 40% of the aggregate number of Brilliant

Ordinary Shares and Brilliant Rights.

The foregoing description

of the Business Combination does not purport to be complete and is qualified in its entirety by the full text of the Merger Agreement,

which is attached hereto as Exhibits 2.1 and 2.2 and is incorporated herein by reference.

Closing

In connection with the Business

Combination, holders of 330,345 shares of Brilliant Ordinary Shares exercised their right to redeem their shares for cash at a redemption

price of approximately $11.57 per share, for an aggregate redemption amount of $3,822,431.16.

Immediately after giving

effect to the redemption of 256,994 shares of Brilliant Ordinary Shares in connection with the Business Combination, there were 1,557,702

shares of Brilliant Ordinary Shares (consisting of Brilliant public shares Brilliant founder shares, and Brilliant private shares) and

6,701,000 Brilliant Warrants outstanding.

After giving effect to the

redemption of Brilliant Common Stock in connection with the Business Combination, and the Business Combination, there are 13,899,713 shares

of Nukkleus Common Stock, and 6,701,000 Nukkleus Warrants outstanding. Upon the consummation of the Business Combination, Nukkleus Common

Stock and Nukkleus Warrants began trading on December 26, 2023 on the NASDAQ under the symbols “NUKK and “NUKKW” respectively.

The Brilliant Common Stock, Brilliant Units, Brilliant Rights and Brilliant Warrants ceased trading under the symbols BRLI, BRLIU, BRLIR

and BRLIW.

Following the Business Combination, Old Nukk stockholders own approximately

78.3% of the Combined Company, Brilliant’s public stockholders own approximately 0.5% of the Combined Company, Brilliant’s

sponsor and Brilliant’s, officers, directors and advisors (collectively the “Initial Stockholders”) own

approximately 8.0% of the Combined Company.

Item 1.01. Entry into a Material Definitive

Agreement.

Lock-Up Agreement

In connection with the Closing,

the Sponsor, certain stockholders of Brilliant and certain former equity holders of Old Nukk (each, a “Lock-up Holder”)

entered into an agreement (the “Lock-Up Agreement”), pursuant to which and subject to certain customary exceptions,

during the period commencing on the date of the Closing and ending on the date that is two (2) years after the consummation of the Business

Combination such Lock-up Holder agreed not to (i) offer, sell, contract to sell, pledge or otherwise dispose of, directly or indirectly,

any of the Lock-up Shares (as defined in the Lock-Up Agreement, which shall include certain securities held by the Lock-Up Holders), (ii)

enter into a transaction that would have the same effect, or enter into any swap, hedge or other arrangement that transfers, in whole

or in part, any of the economic consequences of ownership of such Lock-up Shares, whether any of these transactions are to be settled

by delivery of any such Lock-up Shares, in cash or otherwise, (iii) publicly disclose the intention to make any offer, sale, pledge or

disposition, or (iv) enter into any transaction, swap, hedge or other arrangement, or engage in any short sales with respect to any security

of Brilliant.

The foregoing description

of the Lock-Up Agreement is subject to and qualified in its entirety by reference to the full text of the Form of Lock-Up Agreement, a

copy of which is included as Exhibit 10.3 hereto, and the terms of which are incorporated herein by reference.

Registration Rights Agreement

In connection with the Closing,

Nukkleus entered into a registration rights agreement (the “Registration Rights Agreement”), pursuant to which, Brilliant,

Nukkleus and the other parties thereto agreed to, among other things, file a resale shelf registration statement registering certain of

the securities held by the Holders (as defined in the Registration Rights Agreement, which includes certain stockholders of Brilliant

and certain equity holders of Old Nukk) no later than 45 business days after the Closing of the Business Combination. The Registration

Rights Agreement also provides certain registration rights, including customary demand registration rights and piggyback registration

rights to the Holders, subject to customary exceptions, terms and conditions. Nukkleus also agreed to pay certain fees and expenses relating

to registrations under the Registration Rights Agreement.

The foregoing description

of the Registration Rights Agreement is subject to and qualified in its entirety by reference to the full text of the Registration Rights

Agreement, a copy of which is included as Exhibit 10.2 hereto, and the terms of which are incorporated herein by reference.

Item 2.01 Completion of Acquisition or Disposition

of Assets.

The disclosure set forth

in the “Introductory Note” above is incorporated into this Item 2.01 by reference. On December 13, 2023, Brilliant

held a special meeting of shareholders (the “Brilliant Special Meeting”), at which the shareholders of Brilliant considered

and adopted, among other matters, a proposal to approve the Business Combination. On December 1, 2023, Old Nukk held a special meeting

of shareholders (the “Old Nukk Special Meeting”), at which the shareholders of Old Nukk considered and adopted, among

other matters, a proposal to approve the Business Combination.

The Business Combination

was completed on December 22, 2023.

FORM 10 INFORMATION

Item 2.01(f) of Form 8-K

provides that if the predecessor registrant was a “shell company” (as such term is defined in Rule 12b-2 under the Securities

Exchange Act of 1934, as amended (the “Exchange Act”)), as Brilliant was immediately before the Business Combination,

then the registrant must disclose the information that would be required if the registrant were filing a general form for registration

of securities on Form 10. As a result of the consummation of the Business Combination, and as discussed below in Item 5.06 of this Report,

Nukkleus has ceased to be a shell company. Accordingly, Nukkleus is providing the information below that would be included in a Form 10

if it were to file a Form 10. Please note that the information provided below relates to the Combined Company after the consummation of

the Business Combination, unless otherwise specifically indicated or the context otherwise requires.

Cautionary Note Regarding Forward-Looking

Statements

This Report contains statements

that are forward-looking and as such are not historical facts. This includes statements that express Nukkleus’ opinions, expectations,

beliefs, plans, objectives, assumptions or projections regarding future events or future results and therefore are, or may be deemed to

be, “forward-looking statements.” These forward-looking statements can generally be identified by the use of forward-looking

terminology, including the terms “believes,” “estimates,” “anticipates,” “expects,” “seeks,”

“projects,” “intends,” “plans,” “might,” “possible,” “potential,”

“predicts,” “may,” “could,” “will” or “should” or, in each case, their negative

or other variations or comparable terminology, but the absence of these words does not mean that a statement is not forward-looking. These

forward-looking statements include all matters that are not historical facts. They appear in a number of places throughout this Report

and include statements regarding Nukkleus’ intentions, beliefs or current expectations concerning, among other things, results of

operations, financial condition, liquidity, prospects, growth, strategies and the markets in which Nukkleus operates. Such forward-looking

statements are based on available current market material and management’s expectations, beliefs and forecasts concerning future

events impacting Nukkleus. Forward-looking statements in this Report and in any document incorporated by reference in this Report may

include, for example, statements about:

| ● | Nukkleus has a limited operating history in an evolving and

highly volatile industry, which makes it difficult to evaluate future prospects and may increase the risk that Nukkleus will not be successful. |

| ● | Nukkleus has experienced rapid growth recently through a

series of acquisitions, and if Nukkleus does not effectively manage its growth and the associated demands on operational, risk management,

sales and marketing, technology, compliance, and finance and accounting resources, Nukkleus’s business may be adversely impacted. |

| ● | Nukkleus’s growth may not be sustainable and depends

on Nukkleus’s ability to retain existing customers, attract new customers, expand product offerings, and increase processed volumes

and revenue from both new and existing customers. |

| ● | Nukkleus faces intense and increasing competition and, if

Nukkleus does not compete effectively, its competitive positioning and our operating results will be harmed. |

| ● | Nukkleus’s operating results from FXDD may fluctuate

due to market forces out of Nukkleus’s control that impact demand to conduct foreign exchange transfers. |

| ● | Cyberattacks and security breaches of Nukkleus’s systems,

or those impacting customers or third parties, could adversely impact Nukkleus’s brand and reputation and its business, operating

results and financial condition. |

| ● | Any significant disruption in Nukkleus’s technology

could adversely impact Nukkleus’s brand and reputation and its business, operating results, and financial condition. |

| ● | Certain large customers provide a significant share of Nukkleus’s

revenue and the termination of such agreements or reduction in business with such customers could harm our business. If Nukkleus were

to lose or was unable to renew these and other client contracts at favorable terms, or if an exchange, digital asset platform or banking

partners were to terminate affiliation with Nukkleus, Nukkleus’s results of operations and financial condition may be adversely

affected. |

| ● | Concerns about the environmental impacts of blockchain technology

could adversely impact usage and perceptions of Nukkleus’s technology and product offerings. |

| ● | There is no assurance that Nukkleus will maintain profitability

or that its revenue and business models will be successful. |

| ● | Nukkleus might require additional capital to support business

growth, and this capital might not be available or may require shareholder approval to obtain. |

| ● | The future development and growth of Nukkleus’s technology

and product offerings are subject to a variety of factors that are difficult to predict and evaluate and may be in the hands of third

parties to a substantial extent. If Nukkleus’s product offering does not grow as expected, its business, operating results, and

financial condition could be adversely affected. |

| ● | Due to unfamiliarity and some negative publicity associated

with blockchain technology, Nukkleus’s customer base may lose confidence in products and services that use blockchain technology. |

| ● | Nukkleus’s Platforms are an innovative product that

is difficult to analyze vis-à-vis existing financial services laws and regulations around the world. The product involves certain

risks, including reliance on third parties, which could limit or restrict Nukkleus’s ability to offer the product in certain jurisdictions. |

| ● | Nukkleus is subject to an extensive and highly-evolving regulatory

landscape, and any adverse changes to, or our failure to comply with, any laws and regulations could adversely affect Nukkleus’s

brand, reputation, business, operating results, and financial condition. |

| ● | Nukkleus’s intellectual property rights are valuable,

and any inability to protect them could adversely impact Nukkleus’s business, operating results, and financial condition. |

| ● | other factors detailed under

the section entitled “Risk Factors” beginning on page 37 of the Joint Proxy Statement/Prospectus, which are incorporated

herein by reference. |

The foregoing list of factors

is not exhaustive. You should carefully consider the foregoing factors and the other risks and uncertainties described in the “Risk

Factors” section of the other documents filed by Nukkleus from time to time with the SEC. The forward-looking statements contained

in this Report and in any document incorporated by reference are based on current expectations and beliefs concerning future developments

and their potential effects on Nukkleus. There can be no assurance that future developments affecting Nukkleus will be those that Nukkleus

has anticipated. Nukkleus undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information,

future events or otherwise, except as may be required under applicable securities laws.

Business

Nukkleus’ business

is described in the Joint Proxy Statement/Prospectus in the section titled “Information aboutNukkleus” beginning on

page 160, which is incorporated herein by reference.

Risk Factors

The risks associated with

Nukkleus’ business are described in the Joint Proxy Statement/Prospectus in the section titled “Risk Factors”

beginning on page 37 and are incorporated herein by reference. A summary of the risks associated with Nukkleus’ business is also

included on pages 31-33 of the Joint Proxy Statement/Prospectus under the heading “Summary Risk Factors” and is incorporated

herein by reference.

Financial Information

The financial information

of Old Nukk as of and for the years ended September 30, 2022 and September 30, 2021, is described in the Joint Proxy Statement/Prospectus

in the sections titled “Selected Historical Financial Data of Nukkleus” and “Management’s Discussion

and Analysis of Financial Condition and Results of Operations of Nukkleus,” beginning on pages 34 and 167 thereof, respectively,

and are incorporated herein by reference.

The financial information

of Brilliant as of and for the years ended December 31, 2022 and December 31, 2021, is described in the Joint Proxy Statement/Prospectus

in the sections titled “Selected Historical Consolidated Financial Data of Brilliant” and “Management’s

Discussion and Analysis of Financial Condition and Results of Operations of Brilliant,” beginning on pages 35 and 184 thereof,

respectively, and are incorporated herein by reference.

The financial information

of Old Nukk as of and for the three and nine month periods ended June 30, 2023, is described in Old Nukk’s Quarterly Report on Form

10-Q for the quarterly period ended June 30, 2023, and filed with the SEC on August 14, 2023, and is incorporated herein by reference.

The financial information

of Brilliant as of and for the three and six month periods ended June 30, 2023, is described in Brilliant’s Quarterly Report on

Form 10-Q for the quarterly period ended June 30, 2023, and filed with the SEC on August 18, 2023, and is incorporated herein by reference.

The unaudited pro forma

condensed combined financial information of Old Nukk and Brilliant as of, and for the years ended, September 30, 2022, and September 30,

2021 and for the three and nine month periods ended June 30, 2023, is described in the Joint Proxy Statement/Prospectus in the section

titled “Unaudited Pro Forma Condensed Combined Financial Information,” beginning on page 189, and is incorporated herein

by reference.

Management’s Discussion and Analysis

of Financial Condition and Results of Operations

Reference is made to the

disclosures contained in the Joint Proxy Statement/Prospectus in the sections titled “Management’s Discussion and Analysis

of Financial Condition and Results of Operations of Nukkleus” and “Management’s Discussion and Analysis of Financial

Condition and Results of Operations of Brilliant,” beginning on pages 167 and 184, respectively, which are incorporated herein

by reference.

Reference is made to the

disclosures contained in Old Nukk’s Quarterly Report on Form 10-Q for the quarterly period ended June 30, 2023, and filed with the

SEC on August 14, 2023, in the section titled “Management’s Discussion and Analysis of Financial Condition and Results

of Operations” and is incorporated herein by reference.

Reference is made to the

disclosures contained in Brilliant’s Quarterly Report on Form 10-Q for the quarterly period ended June 30, 2023, and filed with

the SEC on August 18, 2023, in the section titled “Management’s Discussion and Analysis of Financial Condition and Results

of Operations” and is incorporated herein by reference.

Properties

Nukkleus’ facilities

are described in the Joint Proxy Statement/Prospectus in the section titled “Information about Nukkleus - Corporate Office,”

beginning on page 166, which is incorporated herein by reference.

Security Ownership of Certain Beneficial

Owners and Management

The following table sets

forth information known to Nukkleus regarding the beneficial ownership of Nukkleus Common Stock immediately following consummation of

the Business Combination by (i) each person who is the beneficial owner of more than 5% of the outstanding shares of Nukkleus Common Stock,

(ii) each of Nukkleus’ named executive officers and directors, and (iii) all of Nukkleus’ executive officers and directors

as a group.

Beneficial ownership is

determined according to the rules of the SEC, which generally provide that a person has beneficial ownership of a security if he, she

or it possesses sole or shared voting or investment power over that security, including options and warrants that are currently exercisable

or exercisable within 60 days. Except as described in the footnotes below and subject to applicable community property laws and similar

laws, Nukkleus believes that each person listed below has sole voting and investment power with respect to such shares.

The beneficial ownership

of Nukkleus Common Stock is based on 13,899,713 shares of Nukkleus Common Stock issued and outstanding immediately following consummation

of the Business Combination. References to “common stock” in the table below and its related footnotes are to the Nukkleus

Common Stock.

| | |

Assuming

Maximum

Redemptions | | |

| |

| Name and Address of Beneficial Owner(1) | |

Number of

Shares | | |

%

of Class | |

| Emil Assentato(5) | |

| 5,369,526 | | |

| 38.6 | % |

| Jamal Khurshid(2) | |

| 1,079,227 | | |

| 7.8 | % |

| Tony Porcheron(3) | |

| 25,017 | | |

| * | |

| Nicholas Gregory(3) | |

| 70,010 | | |

| * | |

| Brian Schwieger | |

| - | | |

| * | |

| Daniel Marcus | |

| - | | |

| * | |

| Brian Ferrier | |

| 5,000 | | |

| * | |

| All directors and executive officers post-Business Combination as a group (8 individuals) | |

| 6,548,780 | | |

| 47.1 | % |

| Nisun Investment Holding Limited(4) | |

| 1,635,164 | | |

| 11.8 | % |

| Dr. Peng Jiang(4) | |

| 1,635,164 | | |

| 11.8 | % |

| * |

Less than 1%. |

| (1) |

The business address of each of the individuals is c/o Nukkleus Inc., 525 Washington Blvd, Jersey City, New Jersey 07310. |

| (2) |

Mr. Khurshid’s beneficial ownership includes 836,953 shares of common held directly and 242,274 shares held through Aurora Holdings PCC Limited. |

| (3) |

Mr. Porcheron’s beneficial ownership includes 25,017 shares of common stock issuable upon exercise of options in the combined company. |

| (4) |

Dr. Peng Jiang, has voting and dispositive power over the shares held by Nisun Investment Holding Limited and therefore may be deemed to be the beneficial owner of the securities held by such entity. The business address of each of Nisun Investment Holding Limited is 99 Dan Ba Road, C-9 Putuo District, Shanghai, Peoples Republic of China 200062. |

| (5) |

Consists of (i) 3,892,792 shares of common stock held by Mr. Assentato directly, (ii) 757,678 shares held by FXDirectDealer, LLC, and (iii) 719,056 shares held by Global Elite Holdings Ltd. Mr. Assentato has voting and dispositive power over the shares held directly by FXDirectDealer, LLC and Global Elite Holdings Ltd. Mr. Assentato disclaims any beneficial ownership of the securities held by FXDirectDealer, LLC and Global Elite Holdings Ltd., except to the extent of his pecuniary interest therein. |

Directors and Executive Officers

Nukkleus’ directors

and executive officers upon the Closing are described in the Joint Proxy Statement/Prospectus in the section titled “Directors

and Executive Officers of the Combined Company After the Business Combination” beginning on page 208 thereof and that information

is incorporated herein by reference.

The following persons constitute

the executive officers and directors of the Combined Company following the Business Combination:

| Name |

|

Age |

|

Position |

| Emil Assentato |

|

73 |

|

Chairman and Chief Executive Officer |

| Jamal “Jamie” Khurshid |

|

47 |

|

Director and Chief Operating Officer |

| Nicholas Gregory |

|

48 |

|

Director |

| Brian Schwieger |

|

55 |

|

Director |

| Daniel Marcus |

|

49 |

|

Director |

| Brian Ferrier |

|

74 |

|

Director |

| Tony Porcheron |

|

54 |

|

Chief Financial Officer |

Biographical information

for these individuals is set forth in the Joint Proxy Statement/Prospectus in the section titled “Directors and Executive Officers

of the Combined Company after the Business Combination” beginning on page 208 thereof and is incorporated herein by reference.

All directors were elected

to serve an initial term that expires at the Combined Company’s annual meeting of stockholders in 2024, or in each case until their

respective successors are duly elected and qualified, or until their earlier resignation, removal or death.

Committees of the Board of Directors

The standing committees

of Nukkleus’ Board of Directors consist of the Audit Committee, Compensation Committee, and Nominating and Corporate Governance

Committee. Each of the committees reports to the Board of Directors.

The Board of Directors appointed

to the Audit Committee following the Business Combination Brian Schwieger, Nicholas

Gregory and Daniel Marcus, each of whom are independent directors and are “financially literate” as defined under the

Nasdaq listing standards. Brian Schwieger serves as chairman of the

Audit Committee. The Combined Company’s Board of Directors determined that Brian

Schwieger qualifies as an “audit committee financial expert,” as defined under rules and regulations of the SEC.

The Audit Committee’s duties are specified in the Audit Committee Charter.

The Board of Directors appointed

to the Compensation Committee following the Business Combination Brian Schwieger

and Daniel Marcusl, each of whom is an independent director. Brian Schwieger

serves as chairman of the Compensation Committee. The functions of the Compensation Committee will be set forth in a Compensation Committee

Charter.

The Board of Directors appointed

to the Nominating and Corporate Governance Committee Brian Schwieger, Nicholas

Gregory and Daniel Marcus, each of whom is an independent director under NASDAQ’s listing standards. Brian

Schwieger serves as the chair of the Nominating and Corporate Governance Committee. The Nominating and Corporate Governance Committee

is responsible for overseeing the selection persons to be nominated to serve on the Board of Directors. The Nominating and Corporate

Governance Committee considers persons identified by its members, management, shareholders, investment bankers and others. The guidelines

for selecting nominees will be specified in the Nominating and Corporate Governance Committee Charter.

Executive Compensation

Executive Compensation

Information regarding the

compensation of Nukkleus’ directors and executive officers are described in the Joint Proxy Statement/Prospectus in the section

titled “Directors and Executive Officers of Nukkleus” beginning on page 201 thereof and that information is incorporated

herein by reference.

The board of directors of

the Combined Company expects to adopt a nonemployee director compensation program (the “Director Compensation Policy”).

The Director Compensation Policy will provide for an annual cash retainer for all non-employee directors, in addition to equity grants

determined by the compensation committee and reimbursement for reasonable expenses incurred in connection with attending board and committee

meetings.

Compensation Committee Interlocks and Insider

Participation

None of Nukkleus’

executive officers currently serves, and in the past year has not served, as a member of the compensation committee of any entity that

has one or more executive officers serving on Nukkleus’ Board.

Certain Relationships and Related Person

Transactions, and Director Independence

Certain Relationships and Related Person Transactions

Certain relationships and

related person transactions are described in the Joint Proxy Statement/Prospectus in the section titled “Certain Relationships

and Related Person Transactions” beginning on page 235 thereof and are incorporated herein by reference.

Director Independence

Under NASDAQ rules, independent

directors must comprise a majority of a listed company’s board of directors. In addition, the rules of NASDAQ require that, subject

to specified exceptions, each member of a listed company’s audit, compensation, and nominating and governance committees be independent.

Under the rules of NASDAQ, a director will only qualify as an “independent director” if, in the opinion of that company’s

board of directors, that person does not have a relationship that would interfere with the exercise of independent judgment in carrying

out the responsibilities of a director. The Board has determined that each of

Nicholas Gregory, Brian Schwieger, Dan Marcus and Brian Ferrier are independent directors under the Nasdaq listing rules and Rule 10A-3.

Legal Proceedings

Reference is made to the

disclosures regarding legal proceedings in the subsection of the Joint Proxy Statement/Prospectus titled “Information About Nukkleus

- Legal Proceedings” beginning on page 160, which is incorporated herein by reference.

Market Price of and Dividends on the Registrant’s

Common Equity and Related Stockholder Matters

Market Information and Dividends

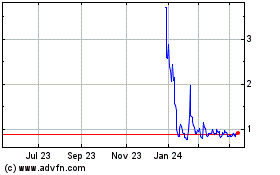

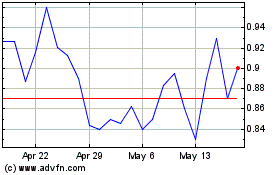

Upon the consummation of

the Business Combination, Nukkleus Common Stock and Nukkleus Warrants began trading on December 26, 2023 on the NASDAQ under the symbol

“NUKK” and “NUKKW” respectively, and the Brilliant Common Stock, Brilliant Units, Brilliant Rights, and Brilliant

Warrants ceased trading under the symbols BRLI, BRLIU and BRLIW. Old Nukk and Brilliant have never declared or paid any cash dividends

on its common stock, and Nukkleus does not presently plan to pay cash dividends on its common stock in the foreseeable future.

Holders of Record

Following the completion of the Business Combination,

Nukkleus has 13,899,713 shares of Nukkleus Common Stock outstanding that were held of record by approximately 130 holders.

Securities Authorized for Issuance Under the

Nukkleus 2023 Stock Plan

Reference is made to the

disclosure described in the Joint Proxy Statement/Prospectus in the section titled “Brilliant Proposal 5 - The Brilliant Incentive

Plan Proposal” beginning on page 139 thereof, which is incorporated herein by reference. The Nukkleus 2023 Stock Plan and the

material terms thereunder, were approved by the stockholders of Brilliant at the Special Meeting of Brilliant.

Recent Sales of Unregistered Securities

None.

Description of Registrant’s Securities

to be Registered

The Nukkleus Common Stock

and Warrants are described in the Joint Proxy Statement/Prospectus in the section titled “Description of the Brilliant’s

Securities” and “Comparison Of Stockholders’ Rights” beginning on pages 214 and 226, respectively,

thereof and that information is incorporated herein by reference.

Reference is made to the

disclosures set forth in Item 3.03 of this Report relating to Nukkleus’ Amended Certificate of Incorporation and bylaws and that

information is incorporated herein by reference.

Indemnification of Directors and Officers

The Nukkleus Charter provides

that Nukkleus shall indemnify its directors and officers to the fullest extent authorized or permitted by the DGCL as now or later amended,

and the right to indemnification shall continue after such person ceases to be a director or officer and shall inure to the benefit of

such person’s heirs, executors and personal and legal representatives. Nukkleus shall pay expenses in advance of the proceeding’s

final disposition upon receipt of a written undertaking to repay that amount if it is ultimately determined that such director is not

entitled to be indemnified.

Financial Statements and Supplementary Data

Reference is made to the

information set forth under Item 9.01 of this Report and is incorporated herein by reference.

Changes in Disagreements with Accountants

on Accounting and Financial Disclosure

Not applicable.

Financial Statements and Exhibits

Reference is made to the

information set forth under Item 9.01 of this Report and is incorporated herein by reference.

Item 3.03 Material Modification to Rights of

Security Holders

On the Closing Date, Brilliant filed its Certificate of Domestication

and its Certificate of Incorporation with the Secretary of State of the State of Delaware, in connection with the Domestication (the “Interim

Charter”).

On the Closing Date, following

the Domestication, Brilliant filed its the Amended Certificate of Incorporation with the Secretary of State of the State of Delaware,

changed its name to “Nukkleus Inc.” and adopted its bylaws (the “Bylaws”).

Copies of the Interim Charter,

the Amended Certificate of Incorporation and the Bylaws are included as Exhibits 3.1, 3.2 and 3.3, respectively, to this Report and are

incorporated herein by reference.

The material terms of each

of the Amended Certificate of Incorporation and the Bylaws and the general effect upon the rights of Brilliant’s shareholders are

included in the Joint Proxy Statement/Prospectus under the sections titled “Brilliant Proposal 3 - The Brilliant Charter Amendment

Proposal” and “Brilliant Proposal 4 - The Brilliant Advisory Proposal” beginning on pages 136 and 138, respectively,

which are incorporated herein by reference.

Item 5.01 Changes in Control of the Registrant

The information set forth

above under “Introductory Note” and Item 2.01 of this Report is incorporated herein by reference.

Item 5.02 Departure of Directors or Certain

Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers

The information set forth

above in the sections titled “Directors and Executive Officers,” “Executive Compensation,” “Certain

Relationships and Related Person Transactions, and Director Independence” and “Indemnification of Directors and Officers”

in Item 2.01 to this Report is incorporated herein by reference.

Further, in connection with

the Business Combination, effective as of the Closing, Larry G. Swets, Jr. resigned from his position as Chairman of Brilliant, M. Wesley

Schrader resigned from his position as Chief Executive Officer of Brilliant, Mark Penway resigned from his position as Chief Financial

Officer of Brilliant and each of Larry G. Swets, Jr., M. Wesley Schrader, Hassan R. Baqar, Jeff Sutton and Ryan Turner resigned from their

positions as Directors of Brilliant.

Item 5.03 Amendments to Articles of Incorporation

or Bylaws

The material terms of each

of the Amended Certificate of Incorporation and the Bylaws and the general effect upon the rights of Brilliant’s shareholders are

included in the Joint Proxy Statement/Prospectus under the sections titled “Brilliant Proposal 3 - The Brilliant Charter Amendment

Proposal” and “Brilliant Proposal 4 - The Brilliant Advisory Charter Proposals”, beginning on pages 136 and

138, respectively, of the Joint Proxy Statement/Prospectus which are incorporated herein by reference.

Item 5.06 Change in Shell Company Status

As a result of the Business

Combination, Brilliant ceased to be a shell company. Reference is made to the disclosure in the Joint Proxy Statement/Prospectus in the

section entitled “Brilliant Proposal No. 1 - The Business Combination Proposal” beginning on page 104 thereof, which

is incorporated herein by reference.

Item 7.01 Regulation FD Disclosure.

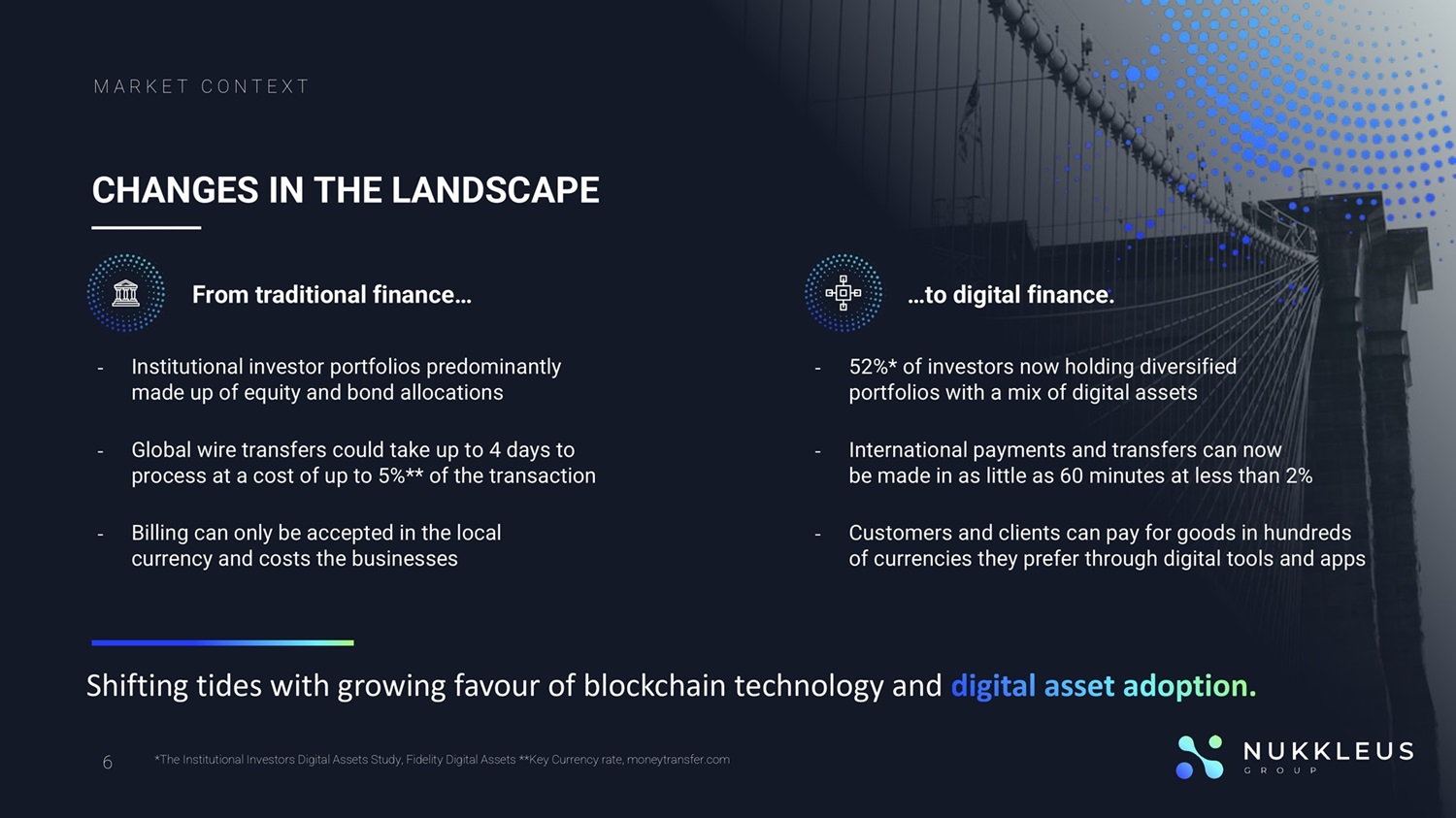

On December 22, 2023, Nukkleus

issued a press release announcing the Closing of the Business Combination. A copy of the press release is furnished hereto as Exhibit

99.1 and incorporated by reference herein. On December 29, 2023, Nukkleus issued a press release regarding its planned financial infrastructure

buildout, a copy of which is attached as Exhibit 99.2 as well as a Corporate Presentation, a copy of which is attached hereto as Exhibit

99.3.

The information in this Item 7.01 and Exhibits 99.1, 99.2 and 99.3

attached hereto is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Exchange Act, or otherwise

subject to the liabilities of that section, nor shall they be deemed incorporated by reference in any filing under the Securities Act

of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

(a) Financial statements of businesses acquired

The audited financial statements of Old Nukk as

of the years ending September 30, 2022, and September 30, 2021, are set forth in the Joint Proxy Statement/Prospectus beginning on page

F-4 and are incorporated herein by reference.

The unaudited financial statements of Old Nukk

as of June 30, 2023 and for the three and nine months ended June 30, 2023 are set forth in the Proxy Statement/Prospectus on page F-42,

and are incorporated herein by reference.

The unaudited financial statements of Old Nukk

as of and for the three and nine month periods ended June 30, 2023, is set forth in Old Nukk’s Quarterly Report on Form 10-Q for

the quarterly period ended June 30, 2023, and filed with the SEC on August 14, 2023, and is incorporated herein by reference.

(b) Pro forma financial information

The unaudited pro forma condensed combined financial

information of Old Nukk and Brilliant is filed as Exhibit 99.4 and is incorporated herein by reference.

(d) Exhibits:

| |

|

|

Incorporated

by Reference |

| Exhibit |

|

Description |

|

Schedule/

Form |

|

File Number |

|

Exhibits |

|

Filing Date |

| 2.1# |

|

Amended and Restated Agreement and Plan of Merger dated as of June 23, 2023, by and among Nukkleus and Brilliant. |

|

Form 8-K |

|

001-39341 |

|

2.1 |

|

June 26, 2023 |

| 2.2# |

|

First Amendment to Amended and Restated Agreement and Plan of Merger dated as of November 1, 2023, by and among Nukkleus and Brilliant. |

|

Form 8-K |

|

001-39341 |

|

2.2 |

|

November 2, 2023 |

| 3.1 |

|

Certificate of Incorporation of Brilliant |

|

|

|

|

|

|

|

|

| 3.2 |

|

Certificate of Amendment to the Certificate of Incorporation |

|

|

|

|

|

|

|

|

| 3.3 |

|

Bylaws of Nukkleus Inc. |

|

|

|

|

|

|

|

|

| 10.1* |

|

Nukkleus 2023 Incentive Award Plan. |

|

|

|

|

|

|

|

|

| 10.2 |

|

Form of Registration Rights Agreement by and among Nukkleus, Brilliant and certain stockholders. |

|

Form 8-K |

|

001-39341 |

|

10.3 |

|

June 26, 2023 |

| 10.3 |

|

Form of Lock-Up Agreement by and among Nukkleus, Brilliant and certain stockholders. |

|

Form 8-K |

|

001-39341 |

|

10.2 |

|

June 26, 2023 |

| 99.1 |

|

Press Release dated December 22, 2023 |

|

|

|

|

|

|

|

|

| 99.2 |

|

Press Release dated December 29, 2023 |

|

|

|

|

|

|

|

|

| 99.3 |

|

Investor Presentation dated December 2023 |

|

|

|

|

|

|

|

|

| 99.4 |

|

Unaudited pro forma condensed combined financial information of Brilliant and Old Nukk as of June 30, 2023 and for the nine months ended June, 2023 and for the year ended September 30, 2022 |

|

|

|

|

|

|

|

|

| 104 |

|

Cover Page Interactive Data File - the cover page XBRL tags are embedded within the Inline XBRL document. |

|

|

|

|

|

|

|

|

| * | Indicates management contract or compensatory plan or arrangement. |

| # | Certain of the exhibits and schedules to this exhibit have been omitted in accordance with Regulation

S-K Item 601. The Registrant agrees to furnish a copy of all omitted exhibits and schedules to the SEC upon its request. |

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

Nukkleus Inc.

(Registrant) |

| |

|

|

| Dated: December 29, 2023 |

By: |

/s/ Emil Assentato |

| |

Name: |

Emil Assentato |

| |

Title: |

Chief Executive Officer |

13

Exhibit 3.1

CERTIFICATE

OF CORPORATE DOMESTICATION

OF BRILLIANT ACQUISITION CORPORATION

Pursuant

to Section 388

of

the General Corporation Law of the State of Delaware

Brilliant

Acquisition Corporation, presently a British Virgin Islands business company, organized and existing under the laws of the British Virgin

Islands (the “Company”), DOES HEREBY CERTIFY:

1. The Company was first incorporated on June 26, 2020 under the laws of the British Virgin Islands.

2.

The name of the Company immediately prior to the filing of this Certificate of Corporate Domestication with the Secretary of State

of the State of Delaware was Brilliant Acquisition Corporation

3.

The name of the Company as set forth in the Certificate of Incorporation being filed with the Secretary of State of the State of

Delaware in accordance with Section 388(b) of the General Corporation Law of the State of Delaware is “Brilliant Acquisition

Corporation”.

4.

The jurisdiction that constituted the seat, siege social, or principal place of business or central administration of the Company

immediately prior to the filing of this Certificate of Corporate Domestication was the British Virgin Islands.

5.

The domestication has been approved in the manner provided for by the document, instrument, agreement or other writing, as the case

may be, governing the internal affairs of the Company and the conduct of its business or by applicable non-Delaware law, as

appropriate.

IN

WITNESS WHEREOF, the Company has caused this Certificate to be executed by its duly authorized officer on this 22nd day of December,

2023.

| |

BRILLIANT ACQUISITION CORPORATION, |

| |

a British Virgin Islands business company |

| |

|

| |

By: |

/s/ Peng Jiang |

| |

|

Name: |

Peng Jiang |

| |

|

Title: |

Chief Executive Officer |

[SIGNATURE

PAGE TO CERTIFICATE OF CORPORATE DOMESTICATION

OF BRILLIANT ACQUISITION CORPORATION]

CERTIFICATE

OF INCORPORATION

OF

BRILLIANT ACQUISITION CORPORATION

FIRST:

The name of the corporation is “Brilliant Acquisition Corporation” (hereinafter called the “Corporation”).

SECOND:

The registered office of the Corporation is to be located at 1521 Concord Pike Suite 201, in the City of Wilmington, in the County of

New Castle, Delaware 19803. The name of its Registered Agent at such address is Corporate Creations Network Inc.

THIRD:

The purpose of the Corporation is to engage in any lawful act or activity for which corporations may be organized under the General Corporation

Law of Delaware (“GCL”).

FOURTH:

The name and mailing address of the incorporator is: Peng Jiang, c/o Brilliant Acquisition Corporation, 99 Dan Ba Road, C-9,Putuo District,

Shanghai, Peoples Republic of China.

FIFTH:

The total number of shares which the Corporation shall have authority to issue is one hundred one million (101,000,000) shares, consisting

of (a) 100,000,000 shares of common stock, $0.0001 par value (the “Common Stock”), and one million (1,000,000) shares of

preferred stock, $0.0001 par value (the “Preferred Stock”). The holders of the Common Stock shall exclusively possess all

voting power and each share of Common Stock shall have one vote.

SIXTH:

This Article Sixth shall apply during the period commencing upon the filing of this Certificate of Incorporation and terminating upon

the consummation of any Business Combination (as defined below). A “Business Combination” shall mean any merger, capital

stock exchange, asset acquisition, stock purchase, recapitalization, reorganization or other similar business combination involving the

Corporation and one or more businesses or entities (“Target Business”), or entering into contractual arrangements that give

the Corporation control over such a Target Business, and, if the Corporation is then listed on a national securities exchange, the Target

Business has a fair market value equal to at least 80% of the balance in the Trust Fund (as defined below), less any deferred underwriting

commissions and taxes payable on interest earned, at the time of signing a definitive agreement in connection with the initial Business

Combination. “IPO Shares” shall mean the shares sold pursuant to the registration statement on Form S-1 (“Registration

Statement”) filed with the Securities and Exchange Commission (“Commission”) in connection with the Corporation’s

initial public offering (“IPO”).

A.

Prior to the consummation of a Business Combination, the Corporation shall either (i) submit any Business Combination to its holders

of Common Stock for approval (“Proxy Solicitation”) pursuant to the proxy rules promulgated under the Securities

Exchange Act of 1934, as amended (“Exchange Act”), or (ii) provide its holders of IPO Shares with the opportunity to

sell their shares to the Corporation by means of a tender offer (“Tender Offer”).

B.

If the Corporation engages in a Proxy Solicitation with respect to a Business Combination, the Corporation will consummate the

Business Combination only if a majority of the then outstanding shares of Common Stock present and entitled to vote at the meeting

to approve the Business Combination are voted for the approval of such Business Combination.

C.

In the event that a Business Combination is consummated by the Corporation or the Corporation holds a vote of its stockholders to

amend its Certificate of Incorporation prior to the consummation of a Business Combination, any holder of IPO Shares who (i)

followed the procedures contained in the proxy materials to perfect the holder’s right to convert the holder’s IPO

Shares into cash, if any, or (ii) tendered the holder’s IPO Shares as specified in the tender offer materials therefore, shall

be entitled to receive the Conversion Price (as defined below) in exchange for the holder’s IPO Shares. The Corporation shall,

promptly after consummation of the Business Combination or the filing of the amendment to the Certificate of Incorporation with the

Secretary of State of the State of Delaware, convert such shares into cash at a per share price equal to the quotient determined by

dividing (i) the amount then held in the Trust Fund (as defined below) plus interest earned, less any interest released to pay

income taxes owed on such funds but not yet paid, calculated as of two business days prior to the consummation of the Business

Combination or the filing of the amendment, as applicable, by (ii) the total number of IPO Shares then outstanding (such price being

referred to as the “Conversion Price”). “Trust Fund” shall mean the trust account established by the

Corporation at the consummation of its IPO and into which the amount specified in the Registration Statement is deposited.

Notwithstanding the foregoing, a holder of IPO Shares, together with any affiliate of his or any other person with whom he is acting

in concert or as a “group” (within the meaning of Section 13(d)(3) of the Exchange Act) (“Group”) with, will

be restricted from demanding conversion in connection with a proposed Business Combination with respect to 20.0% or more of the IPO

Shares. Accordingly, all IPO Shares beneficially owned by such holder or any other person with whom such holder is acting in concert

or as a Group with in excess of 20.0% or more of the IPO Shares will remain outstanding following consummation of such Business

Combination in the name of the stockholder and not be converted.

D.

In the event that the Corporation does not consummate a Business Combination by December 23, 2023, the Corporation shall (i) cease

all operations except for the purposes of winding up, (ii) as promptly as reasonably possible but not more than ten business days

thereafter redeem 100% of the IPO Shares for cash for a redemption price per share as described below (which redemption will

completely extinguish such holders’ rights as stockholders, including the right to receive further liquidation distributions,

if any), subject to applicable law, and (iii) as promptly as reasonably possible following such redemption, subject to approval of

the Corporation’s then stockholders and subject to the requirements of the GCL, including the adoption of a resolution by the

Board of Directors pursuant to Section 275(a) of the GCL finding the dissolution of the Corporation advisable and the provision of

such notices as are required by said Section 275(a) of the GCL, dissolve and liquidate the balance of the Corporation’s net

assets to its remaining stockholders, as part of the Corporation’s plan of dissolution and liquidation, subject (in the case

of (ii) and (iii) above) to the Corporation’s obligations under the GCL to provide for claims of creditors and other

requirements of applicable law. In such event, the per share redemption price shall be equal to a pro rata share of the Trust

Account plus any pro rata interest earned on the funds held in the Trust Account and not previously released to the Corporation to

pay its taxes (less up to $100,000 of interest to pay dissolution expenses), divided by the total number of IPO Shares then

outstanding.

E.

A holder of IPO Shares shall only be entitled to receive distributions from the Trust Fund in the event (i) such holder demands

conversion of such holder’s shares or sells such holder’s shares in a tender offer in accordance with paragraph C above,

or (ii) that the Corporation has not consummated a Business Combination by the Termination Date as described in paragraph E above.

In no other circumstances shall a holder of IPO Shares have any right or interest of any kind in or to the Trust Fund.

F.

Other than the IPO Shares, prior to a Business Combination, the Board of Directors may not issue any securities which participate in

or are otherwise entitled in any manner to any of the proceeds in the Trust Fund or which vote as a class with the Common Stock on a

Business Combination.

G.

Unless and until the Corporation has consummated its initial Business Combination as permitted under this Article Sixth, the

Corporation may not consummate any other business combination transaction, whether by merger, capital stock exchange, asset

acquisition, stock purchase, reorganization or other similar business combination, transaction or otherwise. The Corporation shall

not consummate a Business Combination with an entity that is affiliated with any of the Corporation’s officers, directors or

sponsors unless the Corporation has obtained an opinion from an independent investment banking firm or another independent entity

that commonly renders valuation opinions that such a Business Combination is fair to the Corporation from a financial point of view

and a majority of the Corporation’s disinterested independent directors approve such Business Combination.

H.

If any amendment is made to this Article Sixth that would (A) modify the substance or timing of the Corporation’s obligation

to provide for the conversion of the IPO Shares in connection with an initial Business Combination or to redeem 100% of the IPO

Shares if the Corporation has not consummated an initial Business Combination by December 23, 2023 or (B) with respect to any other

provision in this Article Sixth, the holders of IPO Shares shall be provided with the opportunity to redeem their IPO Shares upon

the approval of any such amendment, at the per- share price specified in paragraph C above.

SEVENTH:

The following provisions are inserted for the management of the business and for the conduct of the affairs of the Corporation, and for

further definition, limitation and regulation of the powers of the Corporation and of its directors and stockholders:

A.

Election of directors need not be by ballot unless the bylaws of the Corporation so provide.

B.

The Board of Directors shall have the power, without the assent or vote of the stockholders, to make, alter, amend, change, add to

or repeal the bylaws of the Corporation as provided in the bylaws of the Corporation.

C.

The directors in their discretion may submit any contract or act for approval or ratification at any annual meeting of the

stockholders or at any meeting of the stockholders called for the purpose of considering any such act or contract, and any contract

or act that shall be approved or be ratified by the vote of the holders of a majority of the stock of the Corporation which is

represented in person or by proxy at such meeting and entitled to vote thereat (provided that a lawful quorum of stockholders be

there represented in person or by proxy) shall be as valid and binding upon the Corporation and upon all the stockholders as though

it had been approved or ratified by every stockholder of the Corporation, whether or not the contract or act would otherwise be open

to legal attack because of directors’ interests, or for any other reason.

D.

In addition to the powers and authorities hereinbefore or by statute expressly conferred upon them, the directors are hereby

empowered to exercise all such powers and do all such acts and things as may be exercised or done by the Corporation; subject,

nevertheless, to the provisions of the statutes of Delaware, of this Certificate of Incorporation, and to any bylaws from time to

time made by the stockholders; provided, however, that no bylaw so made shall invalidate any prior act of the directors which would

have been valid if such bylaw had not been made.

EIGHTH:

A.

A director or officer of the Corporation shall not be personally liable to the Corporation or its stockholders for monetary damages

for breach of fiduciary duty as a director, except for liability (i) for any breach of the director’s or officer’s duty

of loyalty to the Corporation or its stockholders, (ii) for acts or omissions not in good faith or which involve intentional

misconduct or a knowing violation of law, (iii) under Section 174 of the GCL, or (iv) for any transaction from which the director or

officer derived an improper personal benefit. If the GCL is amended to authorize corporate action further eliminating or limiting

the personal liability of directors or officers, then the liability of a director or officer of the Corporation shall be eliminated

or limited to the fullest extent permitted by the GCL, as so amended. Any repeal or modification of this paragraph A by the

stockholders of the Corporation shall not adversely affect any right or protection of a director or officer of the Corporation with

respect to events occurring prior to the time of such repeal or modification.

B.

The Corporation, to the full extent permitted by Section 145 of the GCL, as amended from time to time, shall indemnify all persons

whom it may indemnify pursuant thereto. Expenses (including attorneys’ fees) incurred by an officer or director in defending

any civil, criminal, administrative, or investigative action, suit or proceeding for which such officer or director may be entitled

to indemnification hereunder shall be paid by the Corporation in advance of the final disposition of such action, suit or proceeding

upon receipt of an undertaking by or on behalf of such director or officer to repay such amount if it shall ultimately be determined

that he is not entitled to be indemnified by the Corporation as authorized hereby.

C.

Notwithstanding the foregoing provisions of this Article Eighth, no indemnification nor advancement of expenses will extend to any

claims made by the Corporation’s officers and directors to cover any loss that such individuals may sustain as a result of

such individuals’ agreement to pay debts and obligations to target businesses or vendors or other entities that are owed money

by the Corporation for services rendered or contracted for or products sold to the Corporation, as described in the Registration

Statement.

NINTH:

A.

Unless the Corporation consents in writing to the selection of an alternative forum, the Court of Chancery of the State of Delaware

shall be the sole and exclusive forum for any stockholder (including a beneficial owner) to bring (i) any derivative action or

proceeding brought on behalf of the Corporation, (ii) any action asserting a claim of breach of a fiduciary duty owed by any

director, officer or other employee of the Corporation to the Corporation or the Corporation’s stockholders, (iii) any action

asserting a claim against the Corporation, its directors, officers or employees arising pursuant to any provision of the GCL or this

Certificate of Incorporation or the Bylaws, or (iv) any action asserting a claim against the Corporation, its directors, officers or

employees governed by the internal affairs doctrine, except for, as to each of (i) through (iv) above, (a) any claim as to which the

Court of Chancery determines that there is an indispensable party not subject to the jurisdiction of the Court of Chancery (and the

indispensable party does not consent to the personal jurisdiction of the Court of Chancery within ten days following such

determination), which is vested in the exclusive jurisdiction of a court or forum other than the Court of Chancery, or for which the

Court of Chancery does not have subject matter jurisdiction, and (b) any action or claim arising under the Exchange Act or

Securities Act of 1933, as amended.

B.

If any action the subject matter of which is within the scope of Paragraph A of this Article Ninth immediately above is filed in a

court other than a court located within the State of Delaware (a “Foreign Action”) in the name of any stockholder, such

stockholder shall be deemed to have consented to (i) the personal jurisdiction of the state and federal courts located within the

State of Delaware in connection with any action brought in any such court to enforce Paragraph A of this Article Ninth immediately

above (an “FSC Enforcement Action”) and (ii) having service of process made upon such stockholder in any such FSC

Enforcement Action by service upon such stockholder’s counsel in the Foreign Action as agent for such stockholder.

C.

If any provision or provisions of this Article Ninth shall be held to be invalid, illegal or unenforceable as applied to any person

or entity or circumstance for any reason whatsoever, then, to the fullest extent permitted by law, the validity, legality and

enforceability of such provisions in any other circumstance and of the remaining provisions of this Article Ninth (including,

without limitation, each portion of any sentence of this Article Ninth containing any such provision held to be invalid, illegal or

unenforceable that is not itself held to be invalid, illegal or unenforceable) and the application of such provision to other

persons or entities and circumstances shall not in any way be affected or impaired thereby. Any person or entity purchasing or

otherwise acquiring any interest in shares of capital stock of the Corporation shall be deemed to have notice of and consented to

the provisions of this Article Ninth.

TENTH:

To the extent allowed by law, the doctrine of corporate opportunity, or any other analogous doctrine, shall not apply with respect

to the Corporation or any of its officers or directors, or any of their respective affiliates, in circumstances where the

application of any such doctrine would conflict with any fiduciary duties or contractual obligations they may have as of the date of

this Certificate of Incorporation or in the future, and the Corporation renounces any expectancy that any of the directors or

officers of the Corporation will offer any such corporate opportunity of which he or she may become aware to the Corporation,

except, the doctrine of corporate opportunity shall apply with respect to any of the directors or officers of the Corporation with

respect to a corporate opportunity that was offered to such person solely in his or her capacity as a director or officer of the

Corporation and (i) such opportunity is one the Corporation is legally and contractually permitted to undertake and would otherwise

be reasonable for the Corporation to pursue and (ii) the director or officer is permitted to refer that opportunity to the

Corporation without violating any legal obligation.

ELEVENTH:

Whenever a compromise or arrangement is proposed between this Corporation and its creditors or any class of them and/or between this

Corporation and its stockholders or any class of them, any court of equitable jurisdiction within the State of Delaware may, on the

application in a summary way of this Corporation or of any creditor or stockholder thereof or on the application of any receiver or

receivers appointed for this Corporation under Section 291 of the GCL or on the application of trustees in dissolution or of any

receiver or receivers appointed for this Corporation under Section 279 of the GCL order a meeting of the creditors or class of

creditors, and/or of the stockholders or class of stockholders of this Corporation, as the case may be, to be summoned in such

manner as the said court directs. If a majority in number representing three fourths in value of the creditors or class of

creditors, and/or of the stockholders or class of stockholders of this Corporation, as the case may be, agree to any compromise or

arrangement and to any reorganization of this Corporation as a consequence of such compromise or arrangement, the said compromise or

arrangement and the said reorganization shall, if sanctioned by the court to which the said application has been made, be binding on

all the creditors or class of creditors, and/or on all the stockholders or class of stockholders, of this Corporation, as the case

may be, and also on this Corporation.

IN

WITNESS WHEREOF, the Corporation has caused this Certificate of Incorporation to be duly executed and acknowledged in its name and

on its behalf by an authorized officer as of the 22nd day of December, 2023.

| BRILLIANT ACQUISITION CORPORATION |

|

| |

|

| By: |

/s/ Peng Jiang |

|

| Name: |

Peng Jiang |

|

| Title: |

Incorporator |

|

Exhibit 3.2

AMENDED AND RESTATED

CERTIFICATE OF INCORPORATION

OF

BRILLIANT ACQUISITION CORPORATION

December 22, 2023

Brilliant

Acquisition Corporation, a corporation organized and existing under the laws of the State of Delaware (the “Corporation”),

DOES HEREBY CERTIFY AS FOLLOWS:

1.

The name of the Corporation is Brilliant Acquisition Corporation. The original certificate of incorporation was filed with the Secretary

of State of the State of Delaware on December 22, 2023 (the “Current Certificate”).

2.

This Amended and Restated Certificate of Incorporation (the “Amended and Restated Certificate”), which both

restates and amends the provisions of the Current Certificate, was duly adopted in accordance with Sections 141(f), 228, 242 and

245 of the General Corporation Law of the State of Delaware, as amended from time to time (the “DGCL”).

3.

This Amended and Restated Certificate shall become effective on the date of filing with the Secretary of State of Delaware.

4.

Certain capitalized terms used in this Amended and Restated Certificate are defined where appropriate herein.

5.

The text of the Current Certificate is hereby restated and amended in its entirety to read as follows:

ARTICLE I

NAME

The

name of the corporation is Nukkleus Inc. (the “Corporation”).

ARTICLE II

PURPOSE

The

purpose of the Corporation is to engage in any lawful act or activity for which corporations may be organized under the DGCL. In addition

to the powers and privileges conferred upon the Corporation by law and those incidental thereto, the Corporation shall possess and may

exercise all the powers and privileges that are necessary or convenient to the conduct, promotion or attainment of the business or purposes

of the Corporation, including, but not limited to, effecting a merger, capital stock exchange, asset acquisition, stock purchase, reorganization

or similar business combination involving the Corporation and one or more businesses (a “Business Combination”).

ARTICLE III

REGISTERED AGENT

The

address of the Corporation’s registered office in the State of Delaware is 16192 Coastal Highway, Lewes, Delaware 19958-9776, County

of Sussex, and the name of the Corporation’s registered agent at such address is Harvard Business Services Inc.

ARTICLE IV

CAPITALIZATION

Section 4.1 Authorized

Capital Stock. The total number of authorized shares which the Corporation is authorized to issue is 40,000,000 shares of Common Stock

having a par value of $0.0001 per share (the “Common Stock”) and 15,000,000 shares of preferred stock having

a par value of $0.0001 per share (the “Preferred Stock”).

Section 4.2 Preferred

Stock. Subject to Article IX of this Amended and Restated Certificate, the Board of Directors of the Corporation

(the “Board”) is hereby expressly authorized to provide out of the unissued shares of the Preferred Stock for

one or more series of Preferred Stock and to establish from time to time the number of shares to be included in each such series and to

fix the voting rights, if any, designations, powers, preferences and relative, participating, optional, special and other rights, if any,

of each such series and any qualifications, limitations and restrictions thereof, as shall be stated in the resolution or resolutions

adopted by the Board providing for the issuance of such series and included in a certificate of designation (a “Preferred

Stock Designation”) filed pursuant to the DGCL, and the Board is hereby expressly vested with the authority to the full

extent provided by law, now or hereafter, to adopt any such resolution or resolutions.

Section 4.3 Common

Stock.

(a) Voting.

(i)

Except as otherwise required by law or this Amended and Restated Certificate (including any Preferred Stock Designation), the holders

of the Common Stock shall exclusively possess all voting power with respect to the Corporation.

(ii)

Except as otherwise required by law or this Amended and Restated Certificate (including any Preferred Stock Designation), the holders

of shares of Common Stock shall be entitled to one vote for each such share on each matter properly submitted to the stockholders on which

the holders of the Common Stock are entitled to vote. The holders of shares of Common Stock shall not have cumulative voting rights.

(iii)

Except as otherwise required by law or this Amended and Restated Certificate (including any Preferred Stock Designation), at any annual

or special meeting of the stockholders of the Corporation, holders of the Common Stock shall have the exclusive right to vote for the

election of directors and on all other matters properly submitted to a vote of the stockholders. Notwithstanding the foregoing, except

as otherwise required by law or this Amended and Restated Certificate (including any Preferred Stock Designation), holders of shares of

any series of Common Stock shall not be entitled to vote on any amendment to this Amended and Restated Certificate (including any amendment

to any Preferred Stock Designation) that relates solely to the terms of one or more outstanding series of Preferred Stock or other series

of Common Stock if the holders of such affected series of Preferred Stock or Common Stock, as applicable, are entitled exclusively, either

separately or together with the holders of one or more other such series, to vote thereon pursuant to this Amended and Restated Certificate

(including any Preferred Stock Designation) or the DGCL.

(b)

Dividends. Subject to applicable law, the rights, if any, of the holders of any outstanding series of the Preferred Stock and the

provisions of Article IX hereof, the holders of shares of Common Stock shall be entitled to receive such dividends and

other distributions (payable in cash, property or capital stock of the Corporation) when, as and if declared thereon by the Board from

time to time out of any assets or funds of the Corporation legally available therefor and shall share equally on a per share basis in

such dividends and distributions.

(c) Liquidation,

Dissolution or Winding Up of the Corporation. Subject to applicable law, the rights, if any, of the holders of any outstanding

series of the Preferred Stock and the provisions of Article IX hereof, in the event of any voluntary or involuntary liquidation,