Form 424B5 - Prospectus [Rule 424(b)(5)]

December 14 2023 - 8:00AM

Edgar (US Regulatory)

Filed

Pursuant to Rule 424(b)(5)

Registration

No. 333-271110

PROSPECTUS

SUPPLEMENT

(To

Prospectus dated September 14, 2023)

RELIANCE

GLOBAL GROUP, INC.

897,594

Shares of Common Stock Underlying Prefunded Warrants

2,105,264

Shares of Common Stock Underlying Common Warrants

155,038

Shares of Common Stock for Resale by Selling Securityholder

This

Prospectus Supplement No. 1 (this “Prospectus Supplement No. 1”) relates to the sale of an aggregate of 3,157,896 shares

(the “shares”) of our common stock, $0.086 par value per share (the “common stock”) by one selling securityholder

identified in this prospectus (together with any of the holder’s transferees, pledgees, donees or successors, the “Selling

Securityholder”), consisting of up to 3,157,896 shares of common stock issuable upon the exercise of 897,594 warrants (the “Prefunded

Warrants”), and up to 2,105,264 shares of common stock are issuable upon the exercise of 2,105,264 warrants (the “Common

Warrants”) and 155,038 shares of common stock we issued to the Selling Securityholder (the “Issued Shares”). The Issued

Shares, Prefunded Warrants and Common Warrants were purchased by the selling securityholder in a private placement transaction exempt

from registration under Section 4(a)(2) of the Securities Act of 1933, as amended (the “Securities Act”), pursuant to a Securities

Purchase Agreement dated March 13, 2023 (the “Purchase Agreement”). Each Prefunded Warrant will entitle the holder to purchase

one share of common stock at an exercise price of $0.001 per share and each Common Warrant will entitle the holder to purchase one share

of common stock at an exercise price of $3.55 per share. We are registering the resale of the shares of common stock covered by this

prospectus as required by a Registration Rights Agreement we entered into with the selling securityholder pursuant to the terms of the

Purchase Agreement. For purposes of this prospectus, we have exercise price under the Prefunded Warrants of $0.001 per share and an assumed

exercise price under the Common Warrants of $3.55 per share of common stock, respectively.

As

used in this Prospectus Supplement No. 1, “Reliance Global,” “Company,” “we,” “us,” or

“our” refer to Reliance Global Group, Inc. and its subsidiaries, unless otherwise indicated. This Prospectus Supplement No.

1 should be read together with the Base Prospectus and this Prospectus Supplement No. 1 is qualified by reference to the Base Prospectus

(collectively, the “Prospectus”), except to the extent that the information in this Prospectus Supplement No. 1 updates and

supersedes the information contain in the Base Prospectus. This Prospectus Supplement No. 1 is not complete without and may not be delivered

or utilized except in conjunction with, the Base Prospectus, including any amendments thereto.

Our

common stock is listed on The Nasdaq Stock Market (“Nasdaq”) under the symbol “RELI.” On December 12, 2023, the

last reported sale price of our common stock as reported by Nasdaq was $0.6562.

As

previously reported by the Company, on or around March 13, 2023, the Company entered into a securities purchase agreement (the “March

2023 Purchase Agreement”) with accredited investors, pursuant to which the Company issued those certain Series F common stock purchase

warrants (the “Series F Warrants”) amongst other securities. On December 12, 2023, the Company entered into that certain

Inducement Offer to Exercise Series F Warrants to Subscribe for Common Stock with accredited investors (the “Series F Inducement

Agreement”), pursuant to which (i) the Company agreed to lower the exercise price of the Series F Warrants to $0.6562 per share

(which is equal to the Nasdaq minimum price) (the “Nasdaq Minimum Price”) and (ii) accredited investors agreed to exercise

the remaining Series F Warrants to purchase 2,105,264 shares of Common Stock into 2,105,264 shares of Common Stock (the “Exercise

Shares”) by payment of the aggregate exercise price of approximately $1,381,474 (gross proceeds before expenses, including but

not limited to EF Hutton LLC, who acted as placement agent in connection therewith). The closing is expected to occur on or before December

15, 2023 (such closing date shall be referred to herein as the “Closing Date”). The Exercise Shares shall be issued in accordance

with the beneficial ownership limitations in the Series F Warrants and Series F Inducement Agreement. From December 12, 2023, until sixty

(60) days after the Closing Date, neither the Company nor any subsidiary of the Company shall (i) issue, enter into any agreement to

issue or announce the issuance or proposed issuance of any Common Stock or Common Stock equivalents (subject to customary carve outs

for certain exempt issuances) or (ii) file any registration statement or any amendment or supplement to any existing registration statement

(other than the Resale Registration Statement (as defined in this Form 8-K)) or any prospectus supplement to reflect the transactions

contemplated hereby). The Series F Inducement Agreement also contains customary representations, warranties, closing conditions, and

restrictive covenants.

Pursuant

to the Series F Inducement Agreement, the Company agreed to issue a new unregistered Series G common share purchase warrant (“Series

G Warrant”) pursuant to Section 4(a)(2) of the Securities Act of 1933, as amended (“Securities Act”), to purchase 4,210,528

shares of Common Stock at an initial exercise price equal to the Nasdaq Minimum Price. The Series G Warrant is not exercisable until

the Company obtains the approval of a sufficient amount of holders of the Company’s Common Stock to satisfy the shareholder approval

requirements for such action as provided in Nasdaq Rule 5635(e), to effectuate the issuance of all shares of Common Stock underlying

the Series G Warrant (the “Shareholder Approval”). The Company shall hold an annual or special meeting of shareholders on

or prior to the date that is ninety (90) days following the Closing Date for the purpose of obtaining Shareholder Approval. If the Company

does not obtain Shareholder Approval at the first meeting, the Company shall call a meeting every ninety (90) days thereafter to seek

Shareholder Approval until the earlier of the date on which Shareholder Approval is obtained or the Series G Warrants are no longer outstanding.

The Company is required to file a registration statement (the “Resale Registration Statement”) within 45 calendar days of

the Closing Date providing for the resale of the Common Stock underlying the Series G Warrant (the “Series G Warrant Shares”)

by the holders of the Series G Warrant. The Company shall use commercially reasonable efforts to cause the Resale Registration Statement

to become effective within 90 calendar days following the Closing Date and shall use commercially reasonable efforts to keep the Resale

Registration Statement effective at all times until the earlier of (i) no holder owns any Series G Warrant or Series G Warrant Shares

or (ii) the Series G Warrant Shares may be sold without volume or manner-of-sale restrictions pursuant to Rule 144 and without the requirement

for the Company to be in compliance with the current public information requirement under Rule 144. If the Company issues Common Stock

pursuant to an ATM at a cost basis per share less than the exercise price in effect under the Series G Warrant, then the exercise price

of the Series G Warrant will be adjusted to such lower price.

You

should review carefully the risks described in the section titled “Risk Factors” on page 5 of the prospectus

and the documents referred to therein before investing in our common stock.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed

upon the accuracy or adequacy of this prospectus supplement or the accompanying prospectus. Any representation to the contrary is a criminal

offense.

Supplement

dated December 14, 2023 to Prospectus dated September 14, 2023.

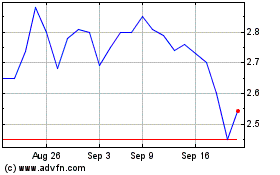

Reliance Global (NASDAQ:RELI)

Historical Stock Chart

From Mar 2024 to Apr 2024

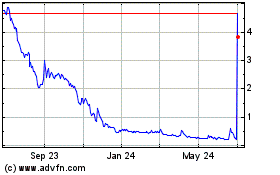

Reliance Global (NASDAQ:RELI)

Historical Stock Chart

From Apr 2023 to Apr 2024