false

0001175151

0001175151

2023-12-13

2023-12-13

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported):

December 13, 2023

CYTOSORBENTS CORPORATION

(Exact name of registrant as specified in

its charter)

| Delaware |

|

001-36792 |

|

98-0373793 |

(State or other jurisdiction of

incorporation) |

|

(Commission File Number) |

|

(I.R.S. Employer Identification No.) |

|

305

College Road East

Princeton, New Jersey |

08540 |

| (Address of principal executive offices) |

(Zip Code) |

Registrant’s telephone number, including

area code: (732) 329-8885

Not Applicable

|

| (Former name or former address, if changed since last report.) |

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction

A.2. below):

| |

¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section

12(b) of the Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which

registered |

| common stock, $0.001 par value |

CTSO |

The Nasdaq Stock Market LLC (Nasdaq Capital Market) |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2

of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging Growth Company ¨

If an emerging growth company, indicate

by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act.

¨

On December 13, 2023, CytoSorbents

Corporation (the “Company”) issued a press release announcing the closing of its previously announced registered direct offering

of an aggregate of 7,733,090 shares of the Company’s common stock, par value $0.001 per share (the “Common Stock”) together

with warrants to purchase up to 2,706,561 shares of Common Stock. A copy of the press release is filed herewith as Exhibit 99.1 and incorporated

by reference into this Item 8.01.

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Dated: December 13, 2023 |

CYTOSORBENTS CORPORATION |

| |

|

|

| |

By: |

/s/ Dr. Phillip P. Chan |

| |

Name: |

Dr. Phillip P. Chan |

| |

Title: |

Chief Executive Officer |

Exhibit 5.1

December 13, 2023

CytoSorbents Corporation

305 College Road East

Princeton, NJ 08540

| RE: |

CytoSorbents Corporation, Registration Statement on Form S-3 (File No. 333-257910) |

Ladies and Gentlemen:

We have acted as counsel for CytoSorbents Corporation,

a Delaware corporation (the “Company”), in connection with the offering and sale by the Company of 7,733,090 shares (the “Shares”)

of its common stock, par value $0.001 per share (the “Common Stock”), and accompanying warrants (the “Warrants”)

to purchase up to 2,706,561 shares of Common Stock (the shares issuable upon exercise of the Warrants, the “Warrant Shares”)

pursuant to that certain Securities Purchase Agreement, dated December 11, 2023, between the Company and the several purchasers named

therein (the “Purchase Agreement”).

In connection with this opinion letter, we have examined the Company’s

registration statement on Form S-3, as amended (Reg. No. 333-257910) (the “Registration Statement”) filed by the Company with

the Securities and Exchange Commission (the “Commission”) under the Securities Act of 1933, as amended (the “Securities

Act”), which was declared effective on July 27, 2021, the Prospectus Supplement, dated December 11, 2023 (the “Prospectus

Supplement”) and the accompanying base prospectus (the “Base Prospectus”, and as supplemented by the Prospectus Supplement,

the “Prospectus”) and originals, or copies certified or otherwise identified to our satisfaction, of the Second Amended and

Restated Certificate of Incorporation, as amended, the Amended and Restated Bylaws of the Company, the Purchase Agreement, and such other

authorities, documents, records and other instruments as we have deemed appropriate for purposes of the opinions set forth herein.

We have assumed the genuineness of all signatures,

the legal capacity of all natural persons, the authenticity of the documents submitted to us as originals, the conformity with the originals

of all documents submitted to us as certified, facsimile or photostatic copies and the authenticity of the originals of all documents

submitted to us as copies.

Based upon the foregoing, we are of the opinion

that (i) the Shares, when issued and sold by the Company and delivered by the Company against receipt of the purchase price therefor,

in the manner contemplated by the Prospectus and the Purchase Agreement will be validly issued, fully paid and non-assessable; (ii) when

the Warrants are issued, sold and delivered in the manner and for the consideration stated in the Registration Statement and the Prospectus,

such Warrants will be valid and binding obligations of the Company, enforceable against the Company in accordance with their terms, subject

to bankruptcy, insolvency, fraudulent transfer, reorganization, moratorium and other laws of general applicability relating to or affecting

creditors’ rights and to general equity principles; and (iii) the Warrant Shares, when issued and delivered by the Company

upon exercise and payment of the exercise price of the Warrants, in accordance with the terms thereof, will be validly issued, fully paid

and non-assessable.

Morgan, Lewis & Bockius llp

502 Carnegie Center

Princeton, NJ 08540-6241  +1.609.919.6600

+1.609.919.6600

United States  +1.609.919.6701

+1.609.919.6701

The opinions expressed herein are limited solely to the Delaware General

Corporation Law without regard to choice of law, to the extent that the same may apply to or govern the transactions contemplated by the

Registration Statement. We express no opinion as to the effect of events occurring, circumstances arising, or changes of law becoming

effective or occurring, after the date hereof on the matters addressed in this opinion.

We hereby consent to the use of this opinion as Exhibit 5.1 to the

Registration Statement and to the reference to us under the caption “Legal Matters” in the Prospectus. In giving such consent,

we do not hereby admit that we are acting within the category of persons whose consent is required under Section 7 of the Securities Act

or the rules or regulations of the Commission thereunder.

Very truly yours,

/s/ Morgan, Lewis & Bockius LLP

Exhibit 99.1

CytoSorbents Announces Closing of $10.3 Million

Registered Direct Offering

Company insiders participated in the transaction

with $435,000 of investment

PRINCETON, N.J., December 13, 2023 — CytoSorbents

Corporation (NASDAQ: CTSO), a leader in the treatment of life-threatening conditions in the intensive care unit and cardiac surgery using

blood purification via its proprietary polymer adsorption technology, today announces the closing of its previously announced registered

direct offering for the sale by the Company directly to investors of an aggregate of 7,733,090 shares of registered common stock and warrants

to purchase up to 2,706,561 shares of common stock.

Dr. Phillip Chan, Chief Executive Officer of CytoSorbents

stated, “We are pleased to announce the closing of this equity financing, with participation and support from existing institutional

investors, new long-term fundamental investors, as well as all C-level executives and Board Directors, and other key leaders in the Company.

The fundraise represents a key piece of our overall financing strategy which combines equity with non-dilutive debt. Through the anticipated

addition of further debt capital and ongoing expense reductions, we expect to be well-capitalized to fund the operating needs of the Company

through at least the next 18 months. Meanwhile, we are very excited by the expected completion of initial data analysis from our pivotal

U.S. and Canadian STAR-T randomized, controlled trial before the end of this month.”

Net proceeds from the offering, after transaction

fees and expenses, are expected to be approximately $9.83 million, excluding any proceeds that may be received upon the exercise of the

warrants. Each warrant is immediately cash exercisable at an exercise price per share of $2.00 and will expire on the fifth anniversary

of the original issue date. Each share of common stock and accompanying warrant to purchase up to 0.35 shares of common stock, were sold

together for a combined purchase price of $1.33, for an aggregate gross purchase price of $10,285,009.70. The Company’s executive

officers, directors, and certain non-executive officer employees of the Company also participated in the financing with a combined investment

of $435,000.

The Company intends to use the net proceeds from

this offering for general corporate purposes, including to fund clinical and regulatory efforts to file for DrugSorb®-ATR marketing

approval in the United States and Canada, to fund clinical studies in the United States and Canada, to support growth initiatives for

CytoSorb®, to invest in clinical studies and the generation of new clinical data, and to fund ongoing R&D initiatives and further

develop products.

About CytoSorbents Corporation

(NASDAQ: CTSO)

CytoSorbents Corporation is

a leader in the treatment of life-threatening conditions in the intensive care unit and in cardiac surgery through blood purification.

Its lead product, CytoSorb®, is approved in

the European Union and distributed in 75 countries worldwide. It is an extracorporeal cytokine adsorber that reduces “cytokine storm”

or “cytokine release syndrome” in common critical illnesses that can lead to massive inflammation, organ failure and patient

death. In these diseases, the risk of death can be extremely high, and there are few, if any, effective treatments. CytoSorb is also used

during and after cardiothoracic surgery to remove antithrombotic drugs and inflammatory mediators that can lead to postoperative complications,

including severe bleeding and multiple organ failure. At the end of Q3 2023, more than 221,000 CytoSorb devices had been used cumulatively.

CytoSorb was originally launched in the European Union under CE mark as the first cytokine adsorber. Additional CE mark extensions were

granted for bilirubin and myoglobin removal in clinical conditions such as liver disease and trauma, respectively, and for ticagrelor and rivaroxaban removal

in cardiothoracic surgery procedures. CytoSorb has also received FDA Emergency Use Authorization in

the United States for use in adult critically ill COVID-19 patients with impending or confirmed respiratory failure. The DrugSorb™-ATR

antithrombotic removal system, based on the same polymer technology as CytoSorb, also received two FDA

Breakthrough Device Designations, one for the removal of ticagrelor and

another for the removal of the direct oral anticoagulants (DOAC) apixaban and rivaroxaban in

a cardiopulmonary bypass circuit during urgent cardiothoracic procedures. The Company has completed the FDA-approved, randomized, controlled

STAR-T (Safe and Timely Antithrombotic Removal-Ticagrelor) study of 140 patients at approximately 30 centers in U.S. and Canada to evaluate

whether intraoperative use of DrugSorb-ATR can reduce the perioperative risk of bleeding in patients receiving ticagrelor and undergoing

cardiothoracic surgery. This pivotal study is intended to support U.S. FDA and Health Canada marketing approval for DrugSorb-ATR in this

application.

CytoSorbents’

purification technologies are based on biocompatible, highly porous polymer beads that can actively remove toxic substances from blood

and other bodily fluids by pore capture and surface adsorption. Its technologies have received non-dilutive grant, contract, and other

funding of approximately $50 million from DARPA, the U.S. Department of Health and Human Services (HHS), the National Institutes

of Health (NIH), National Heart, Lung, and Blood Institute (NHLBI), the U.S. Army, the U.S. Air Force, U.S. Special Operations Command

(SOCOM), Air Force Material Command (USAF/AFMC), and others. The Company has numerous marketed products and products under development

based upon this unique blood purification technology protected by many issued U.S. and international patents and registered trademarks,

and multiple patent applications pending, including ECOS-300CY®, CytoSorb-XL™, HemoDefend-RBC™, HemoDefend-BGA™,

VetResQ®, K+ontrol™, DrugSorb™, ContrastSorb, and others. For more information, please

visit the Company’s websites at www.cytosorbents.com and www.cytosorb.com or

follow us on Facebook and X (fka Twitter).

Forward-Looking Statements

This press release includes forward-looking statements

intended to qualify for the safe harbor from liability established by the Private Securities Litigation Reform Act of 1995. These forward-looking

statements include, but are not limited to, statements about our plans, objectives, future targets and outlooks for our business, statements

about potential exposures resulting from our cash positions, representations and contentions, and are not historical facts and typically

are identified by use of terms such as “may,” “should,” “could,” “expect,” “plan,”

“anticipate,” “believe,” “estimate,” “predict,” “potential,” “continue”

and similar words, although some forward-looking statements are expressed differently. You should be aware that the forward-looking statements

in this press release represent management’s current judgment and expectations, but our actual results, events and performance could

differ materially from those in the forward-looking statements. Factors which could cause or contribute to such differences include, but

are not limited to, the risks discussed in our Annual Report on Form 10-K, filed with the SEC on March 9, 2023, as updated by the risks

reported in our Quarterly Reports on Form 10-Q, and in the press releases and other communications to shareholders issued by us from time

to time which attempt to advise interested parties of the risks and factors which may affect our business. We caution you not to place

undue reliance upon any such forward-looking statements. We undertake no obligation to publicly update or revise any forward-looking statements,

whether as a result of new information, future events, or otherwise, other than as required under the Federal securities laws.

Please Click to Follow Us on Facebook and X (fka Twitter)

U.S. Company Contact:

Kathleen Bloch, CFO

305 College Road East

Princeton, NJ 08540

+1 (732) 398-5429

kbloch@cytosorbents.com

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

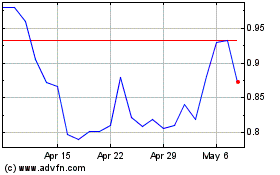

CytoSorbents (NASDAQ:CTSO)

Historical Stock Chart

From Mar 2024 to Apr 2024

CytoSorbents (NASDAQ:CTSO)

Historical Stock Chart

From Apr 2023 to Apr 2024