0001762322

false

0001762322

2023-12-07

2023-12-07

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported)

December 7, 2023

SHIFT TECHNOLOGIES, INC.

(Exact name of registrant as specified in its charter)

| Delaware |

|

001-38839 |

|

82-5325852 |

(State or other jurisdiction of

incorporation or organization) |

|

(Commission File Number) |

|

(I.R.S. Employer

Identification No.) |

| 290 Division Street, Suite 400, San Francisco, CA |

|

94103 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code:

(855) 575-6739

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13a-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Class A common stock, par value $0.0001 per share |

|

N/A |

|

N/A |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act.

Item 8.01. Other Events.

As previously disclosed, Shift Technologies, Inc.

(the “Company”) and certain of its direct and indirect subsidiaries commenced bankruptcy cases by filing voluntary petitions

under Chapter 11 of the U.S. Bankruptcy Code in the U.S. Bankruptcy Court for the Northern District of California (the “Bankruptcy

Court”). As part of these cases, the Company filed the attached Statement of Financial Affairs and Schedules of Assets and Liabilities

with the Bankruptcy Court on November 22, 2023.

Cautionary Note Regarding the Company’s

Securities

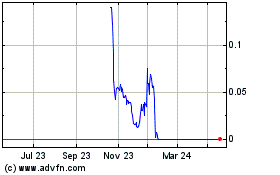

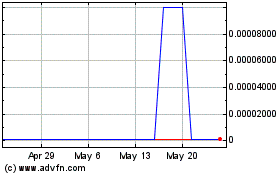

The Company cautions that trading in its securities,

including the Common Stock, during the pendency of the Chapter 11 Case is highly speculative and poses substantial risks. Trading prices

for the Company’s securities may bear little or no relationship to the actual recovery, if any, by holders of the Company’s

securities in the Chapter 11 Case. In particular, the Company expects that its stockholders could experience a significant or complete

loss on their investment, depending on the outcome of the Chapter 11 Case.

Forward-Looking Statements

Certain statements in

this Current Report on Form 8-K constitute “forward-looking statements” within the meaning of the U.S. Private Securities

Litigation Reform Act of 1995. Words contained in this Current Report on Form 8-K such as “believe,” “anticipate,”

“expect,” “estimate,” “plan,” “intend,” “should,” “would,” “could,”

“may,” “might,” “will” and variations of such words and similar future or conditional expressions,

are intended to identify forward-looking statements. These forward-looking statements include, but are not limited to, statements related

to the Company’s business operations, financial position, financial performance, liquidity, strategic alternatives, market outlook,

future capital needs, capital allocation plans, the impact and timing of any cost-savings measures; business strategies, the ability

to negotiate suitable restructuring or refinancing options and other such matters. These forward-looking statements are not guarantees

of future results and are subject to a number of risks and uncertainties, many of which are difficult to predict and beyond our control.

Important assumptions and other important factors that may cause actual results to differ materially from those in the forward-looking

statements include, but are not limited to: the Company’s ability to negotiate, finalize and enter into suitable restructuring or

refinancing options on satisfactory terms, if at all; the effects of the Company’s ongoing review of strategic alternatives, and

any other cost-savings measures, including increased legal and other professional costs necessary to execute the Company’s strategy;

general economic conditions, including inflation, recession, unemployment levels, consumer confidence and spending patterns, credit availability

and debt levels; the Company’s ability to attract, motivate and retain key executives and other employees; potential adverse reactions

or changes to business relationships resulting from the announcement of the Company’s restructuring plan and associated workforce

reduction; unexpected costs, charges or expenses resulting from the Company’s restructuring plan and associated workforce reduction

or other cost-saving measures; the Company’s ability to generate or maintain liquidity; legal and regulatory proceedings; and those

additional risks, uncertainties and factors described in more detail in the Company’s filings with the Securities and Exchange Commission

(“SEC”) from time to time, including under the caption “Risk Factors” in the Company’s Annual Report on

Form 10-K for the fiscal year ended December 31, 2022 (including any amendments thereto), and in the Company’s other filings with

the SEC (including any amendments thereto). The Company disclaims any obligation or undertaking to update, supplement or revise any forward-looking

statements contained in this Current Report on Form 8-K except as required by applicable law or regulation. Given these risks and uncertainties,

readers are cautioned not to place undue reliance on the forward-looking statements, which speak only as of the date hereof.

Item 9.01. Financial Statements and Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

SHIFT TECHNOLOGIES, INC. |

| |

|

| Dated: December 7, 2023 |

/s/ Jason Curtis |

| |

Name: |

Jason Curtis |

| |

Title: |

Chief Financial Officer |

2

Exhibit 99.1

STATEMENT OF FINANCIAL AFFAIRS FOR Shift Technologies, Inc. Case No: 23 - 30687 Chapter 11 Case No 23 - 30687 (Jointly Administered) In re Case: 23 - 30687 Doc# 183 Filed: 11/22/23 40 Entered: 11/22/23 14:58:21 Page 1 of Shift Technologies, Inc., et al., Debtors. ) ) ) ) ) ) UNITED STATES BANKRUPTCY COURT NORTHERN CALIFORNIA

Identify the Beginning and Ending Dates of the Debtor’s Fiscal Year, which may be a Calendar Year Sources of Revenue (Check all that apply) Gross Revenue (Before Deductions and Exclusions) 1. Gross Revenue from business None Shift Technologies, Inc. Case Number: 23 - 30687 Part 1: Income From to MM/DD/YYYY MM/DD/YYYY Operating a business Other Page 1 of 1 to Question 1 Case: 23 - 30687 Doc# 183 Filed: 11/22/23 40 Entered: 11/22/23 14:58:21 Page 2 of

Description of Sources of Revenue Gross Revenue (Before Deductions and Exclusions) 2. Non - business revenue Include revenue regardless of whether that revenue is taxable. Non - business income may include interest, dividends, money collected from lawsuits, and royalties. List each source and the gross revenue for each separately. Do not include revenue listed in line 1. None Shift Technologies, Inc. Case Number: 23 - 30687 Part 1: Income From to MM/DD/YYYY MM/DD/YYYY Page 1 of 1 to Question 2 Case: 23 - 30687 Doc# 183 Filed: 11/22/23 40 Entered: 11/22/23 14:58:21 Page 3 of

Shift Technologies, Inc. Case Number: 23 - 30687 3. Certain payments or transfers to creditors within 90 days before filing this case List payments or transfers - including expense reimbursements - to any creditor, other than regular employee compensation, within 90 days before filing this case unless the aggregate value of all property transferred to that creditor is less than $7,575 (this amount may be adjusted on 04/01/25 and every 3 years after that with respect to cases filed on or after the date of adjustment). None Reasons for Payment or Transfer Total Amount or Value Dates Creditor's Name and Address Part 2: List Certain Transfers Made Before Filing for Bankruptcy NONE . 3 1 Secured debt Unsecured loan repayment Suppliers or vendors Services Other TOTAL $0 $0 TOTAL Page 1 of 1 to Question 3 Case: 23 - 30687 Doc# 183 Filed: 11/22/23 40 Entered: 11/22/23 14:58:21 Page 3 of

4. Payments or other transfers of property made within 1 year before filing this case that benefited any insider List payments or transfers, including expense reimbursements, made within 1 year before filing this case on debts owed to an insider or guaranteed or cosigned by an insider unless the aggregate value of all property transferred to or for the benefit of the insider is less than $7,575 (this amount may be adjusted on 04/01/25 and every 3 years after that with respect to cases filed on or after the date of adjustment). Do not include any payments listed in line 3. Insiders include officers, directors, and anyone in control of a corporate debtor and their relatives; general partners of a partnership debtor and their relatives; affiliates of the debtor and insiders of such affiliates; and any managing agent of the debtor. 11 U.S.C. † 101(31). None Shift Technologies, Inc. Case Number: 23 - 30687 Insider's Name and Address and Relationship to Debtor Dates Amount Reason for Payment Part 2: List Certain Transfers Made Before Filing for Bankruptcy NONE . 4 1 TOTAL $0 $0 TOTAL Page 1 of 1 to Question 4 Case: 23 - 30687 Doc# 183 Filed: 11/22/23 40 Entered: 11/22/23 14:58:21 Page 3 of

5. Repossessions, foreclosures, and returns List all property of the debtor that was obtained by a creditor within 1 year before filing this case, including property repossessed by a creditor, sold at a foreclosure sale, transferred by a deed in lieu of foreclosure, or returned to the seller. Do not include property listed in line 6. None Shift Technologies, Inc. Case Number: 23 - 30687 Creditor's Name and Address Description of the Property Date Action was Taken Value of Property Part 2: List Certain Transfers Made Before Filing for Bankruptcy 5. 1 NONE $0 $0 TOTAL Page 1 of 1 to Question 5 Case: 23 - 30687 Doc# 183 Filed: 11/22/23 40 Entered: 11/22/23 14:58:21 Page 3 of

6. Setoffs List any creditor, including a bank or financial institution, that within 90 days before filing this case set off or otherwise took anything from an account of the debtor without permission or refused to make a payment at the debtor's direction from an account of the debtor because the debtor owed a debt . None Shift Technologies, Inc. Case Number: 23 - 30687 Creditor's Name and Address Description of Action Creditor Took Date Action Taken Account Amount Number Part 2: List Certain Transfers Made Before Filing for Bankruptcy 6. 1 NONE $0 $0 TOTAL Page 1 of 1 to Question 6 Case: 23 - 30687 Doc# 183 Filed: 11/22/23 40 Entered: 11/22/23 14:58:21 Page 3 of

7. Legal actions, administrative proceedings, court actions, executions, attachments, or governmental audits List the legal actions, proceedings, investigations, arbitrations, mediations, and audits by federal or state agencies in which the debtor was involved in any capacity - within 1 year before filing this case. None Shift Technologies, Inc. Case Number: 23 - 30687 Status of Case Court or Agency and Address Nature of Proceeding Caption of Suit and Case Number Part 3: Page 1 of 2 to Question 8 Case: 23 - 30687 Doc# 183 Filed: 11/22/23 40 Entered: 11/22/23 14:58:21 Page 8 of Legal Actions or Assignments SUPERIOR COURT OF THE STATE OF CALIFORNIA; COUNTY OF SAN FRANCISCO 575 POLK ST, SAN FRANCISCO, FIRST AMENDED COMPLAINT FOR DAMAGES AND EQUITABLE RELIEF 7.1 KEVIN ENGLE VS FAIR FINANCIAL CORP. 23STCV02615 CA 94102 SUPERIOR COURT OF THE NONPAYMENT OF WAGES 7.2 LEVONE HARRIS, ZACHARY BLACK, STATE OF CALIFORNIA,COUNTY JOSEPH DEWITT, TYLER DOWNEY, OF ALAMEDA RODOLFO FRIERA, CLINTON 2233 SHORE LINE DRIVE, HENDRICKS, AND NAVID IRAVANI V. ALAMEDA, CA 94501 SHIFT OPERATIONS, LLC, SHIFT TECHNOLOGIES, INC 22CV020736 SUPERIOR COURT OF THE COMPLAINT FOR DAMAGES 7.3 UNIFIED ACCOUTING & TAX LLP VS STATE OF CALIFORNIA; COUNTY SHIFT TECHNOLOGIES, INC. OF SAN FRANCISCO CGC - 23 - 607979 575 POLK ST, SAN FRANCISCO, CA 94102 CIVIL COURT OF LAW HARRIS, TX COMPLAINT FOR DAMAGES 7.4 POTTER EQUITIES VS SHIFT 201 CAROLINE, HOUSTON, TX TECHNOLOGIES, INC. 77002 NOT AVAILABLE COMPLAINT FOR DAMAGES 7.5 MINH VAN NGUYEN STATE OF CALIFORNIA COMPLAINT FOR DAMAGES 7.6 ERICA BECKER DEPARTMENT OF JUSTICE 4949 BROADWAY, SACRAMENTO, CA 95820 UNITED STATES DISTRICT COMPLAINT 7.7 STIFEL, NICOLAUS, & COMPANY, COURT SOUTHERN DISTRICT OF INC. VS SHIFT TECHNOLOGIES, INC. NEW YORK 1:21 - CV - 04135 - NRB 500 PEARL ST, NEW YORK, NY 10007 OREGON CIRCUIT COURT, NEGLIGENCE, NEGLIGENCE 7.8 ASIA LUERAS V. SHIFT COUNTY OF MULTNOMAH PER SE, TECHNOLOGIES, INC. A DELAWARE 1200 SW 1ST AVE, PORTLAND, NEGLIGENCE/VICARIOUS CORPORATION; AND YOLANDA OR 97204 LIABILITY NITASHA CANTORIA 22CV33710 STATE OF CALIFORNIA NONPAYMENT OF WAGES 7.9 FEDERICO HERNANDEZ V. SHIFT DEPARTMENT OF INDUSTRIAL TECHNOLOGIES, INC RELATIONS WC - CM - 879481 160 PROMENADE CIRCLE, SUITE 300, SACRAMENTO, CA 95834 STATE OF CALIFORNIA RETALIATION OR 7.10 SUMMER HARRISON V. SHIFT DEPARTMENT OF INDUSTRIAL DISCRIMINATION TECHNOLOGIES INC RELATIONS RCI - CM - 887237 160 PROMENADE CIRCLE, SUITE 300, SACRAMENTO, CA 95834

7. Legal actions, administrative proceedings, court actions, executions, attachments, or governmental audits List the legal actions, proceedings, investigations, arbitrations, mediations, and audits by federal or state agencies in which the debtor was involved in any capacity - within 1 year before filing this case. None Shift Technologies, Inc. Case Number: 23 - 30687 Status of Case Court or Agency and Address Nature of Proceeding Caption of Suit and Case Number Part 3: Legal Actions or Assignments 7.11 MARILYN JOHNSON V. SHIFT TECHNOLOGIES 21CV386311 PERSONAL INJURY CIVIL LITIGATION SUPERIOR COURT OF THE STATE OF CALIFORNIA, COUNTY OF SANTA CLARA 191 N FIRST STREET, SAN JOSE, CA 95113 7.12 OLASENI REID V. SHIFT TECHNOLOGIES REID WAS EMPLOYED BY SHIFT AS A LEAD DEVELOPMENT REPRESENTATIVE FROM AUGUST OF 2020 UNTIL BEING TERMINATED IN NOVEMBER OF 2020. THE DEMAND ALLEGES THAT REID WAS DISCRIMINATED AGAINST ON THE BASIS OF GENDER (SPECIFICALLY THE USE OF INCORRECT PRONOUNS) AND C/O LITTLER MENDELSON P.C., 101 2ND ST, SUITE 1000, SAN FRANCISCO, CA 94105 LITIGATION HOLD 7.13 MIGUEL CONTRERAS ADJ14628369 WORKER'S COMPENSATION STATE OF CALIFORNIA, DIVISION OF WORKERS' COMPENSATION 160 PROMENADE CIRCLE, SUITE 300, SACRAMENTO, CA 95834 Page 1 of 2 to Question 9 Case: 23 - 30687 Doc# 183 Filed: 11/22/23 40 Entered: 11/22/23 14:58:21 Page 9 of

8. Assignments and receivership List any property in the hands of an assignee for the benefit of creditors during the 120 days before filing this case and any property in the hands of a receiver, custodian, or other court - appointed officer within 1 year before filing this case. None Shift Technologies, Inc. Case Number: 23 - 30687 Value Description of Property Date Case Title and Number Court Name and Address Custodian's Name and Address Part 3: Legal Actions or Assignments 8.1 NONE Page 1 of 1 to Question 8 Filed: 11/22/23 Entered: 11/22/23 14:58:21 40 Case: 23 - 30687 Doc# 183 Page 10 of

Recipient’s Relationship to Debtor Recipient’s Name and Address Dates Given 9. List all gifts or charitable contributions the debtor gave to a recipient within 2 years before filing this case unless the aggregate value of the gifts to that recipient is less than $1,000 None Description of the Gifts or Contributions Value Shift Technologies, Inc. Case Number: 23 - 30687 Part 4: Certain Gifts and Charitable Contributions 9.1 NONE Page 1 of 1 to Question 9 Case: 23 - 30687 Doc# 183 Filed: 11/22/23 40 Entered: 11/22/23 14:58:21 Page 11 of

10. All losses from fire, theft, or other casualty within 1 year before filing this case. None Shift Technologies, Inc. Case Number: 23 - 30687 Property Value Date of Loss Amount of Payments Received How Loss Occurred Description of Property If you have received payments to cover the loss, for example, from insurance, govertnment compensation, or tort liability, list the total received. List unpaid claims on Official Form 106A/B (Schedule A/B: Assets - Real and Personal Property). Part 5: Certain Losses COLLISION 10/13/2022 10. 1 AUTOMOBILE - ALLIED CLAIM AD233858 - 001 $8,172 COLLISION 10/13/2022 10. 2 AUTOMOBILE - ALLIED CLAIM AD2212338 - 001 $7,827 $15,999 TOTAL Page 1 of 1 to Question 10 Case: 23 - 30687 Doc# 183 Filed: 11/22/23 40 Entered: 11/22/23 14:58:21 Page 12 of

Total Amount or Value Dates If not Money, Describe any Property Transferred Who Made the Payment, if not Debtor? Email / Website Who was Paid or Who Received the Transfer? Address 11. Payments related to bankruptcy List any payments of money or other transfers of property made by the debtor or person acting on behalf of the debtor within 1 year before the filing of this case to another person or entity, including attorneys, that the debtor consulted about debt consolidation or restructuring, seeking bankruptcy relief, or filing a bankruptcy case. None Shift Technologies, Inc. Case Number: 23 - 30687 Part 6: Certain Payments or Transfers 11. 1 NONE $0 Page 1 of 1 to Question 11 Filed: 11/22/23 Entered: 11/22/23 14:58:21 40 Case: 23 - 30687 Doc# 183 Page 13 of

Total Amount / Value Dates Transfers were Made Describe any Property Transferred Trustee Name of Trust or Device 12. Self - settled trusts of which the debtor is a beneficiary List any payments or transfers of property made by the debtor or a person acting on behalf of the debtor within 10 years before the filing of this case to a self - settled trust or similar device. Do not include transfers already listed on this statement. None Shift Technologies, Inc. Case Number: 23 - 30687 Part 6: Certain Payments or Transfers $0 12.1 NONE Page 1 of 1 to Question 12 Case: 23 - 30687 Doc# 183 Filed: 11/22/23 40 Entered: 11/22/23 14:58:21 Page 14 of

13. Transfers not already listed on this statement List any transfers of money or other property - by sale, trade, or any other means - made by the debtor or a person acting on behalf of the debtor within 2 years before the filing of this case to another person, other than property transferred in the ordinary course of business or financial affairs. Include both outright transfers and transfers made as security. Do not include gifts or transfers previously listed on this statement. None Shift Technologies, Inc. Case Number: 23 - 30687 Total Amount or Value Date Transfer was Made Description of Property Name and Address of Transferee, Relationship to Debtor Part 6: Certain Payments or Transfers 13. 1 NONE $0 $0 TOTAL Page 1 of 1 to Question 13 Case: 23 - 30687 Doc# 183 Filed: 11/22/23 40 Entered: 11/22/23 14:58:21 Page 15 of

14. Previous addresses List all previous addresses used by the debtor within 3 years before filing this case and the dates the addresses were used. Does not apply Shift Technologies, Inc. Case Number: 23 - 30687 Dates of Occupancy Address Part 7: Previous Locations 14.1 2525 16TH STREET, SUITE 316, SAN FRANCISCO, CA 94103 From: 1/1/2020 To: 12/31/2020 14.2 290 DIVISION STREET, SUITE 400, SAN FRANCISCO, CA 94103 From: 1/1/2021 To: Page 1 of 1 to Question 14 Case: 23 - 30687 Doc# 183 Filed: 11/22/23 40 Entered: 11/22/23 14:58:21 Page 15 of

How are If Debtor Location Where Patient Nature of the Business Facility Name and Address Records Provides Meals Records are Maintained Operation, Including Kept? and Housing, (if Different from Facility Type of Services the Number of Address). If Electronic, Debtor Provides Patients in Identify any Service Debtor’s Care Provider. 15. Health Care bankruptcies Is the debtor primarily engaged in offering services and facilities for: - diagnosing or treating injury, deformity, or disease, or - providing any surgical, psychiatric, drug treatment, or obstetric care? No. Go to Part 9. Yes. Fill in the information below. Shift Technologies, Inc. Case Number: 23 - 30687 Part 8: Health Care Bankruptcies 15.1 NONE Electronic Paper Page 1 of 1 to Question 15 Case: 23 - 30687 Doc# 183 Filed: 11/22/23 40 Entered: 11/22/23 14:58:21 Page 15 of

Shift Technologies, Inc. Case Number: 23 - 30687 Part 9: Personally Identifiable Information 16. Does the debtor collect and retain personally identifiable information of customers? No. Yes. State the nature of the information collected and retained. Does the debtor have a privacy policy about that information? No Yes Page 1 of 1 to Question 16 Case: 23 - 30687 Doc# 183 Filed: 11/22/23 40 Entered: 11/22/23 14:58:21 Page 15 of

Shift Technologies, Inc. Case Number: 23 - 30687 Part 9: Personally Identifiable Information 17. Within 6 years before filing this case, have any employees of the debtor been participants in any ERISA, 401(k), 403(b), or other pension or profit - sharing plan made available by the debtor as an employee benefit? No. Go to Part 10. Yes. Does the debtor serve as plan administrator? No. Go to Part 10. Yes. Fill in below: Describe: Fidelity Management Trust Company 401(k) Plan Has the plan been terminated? No Yes Page 1 of 1 to Question 17 Case: 23 - 30687 Doc# 183 Filed: 11/22/23 40 Entered: 11/22/23 14:58:21 Page 15 of 82 - 5325852 EIN:

18. Closed financial accounts Within 1 year before filing this case, were any financial accounts or instruments held in the debtor's name, or for the debtor's benefit, closed, sold, moved, or transferred? Include checking, savings, money market, or other financial accounts; certificates of deposit; and shares in banks, credit unions, brokerage houses, cooperatives, associations, and other financial institutions. None Shift Technologies, Inc. Case Number: 23 - 30687 Last Balance Date of Closing Type of Account Last 4 Digits of Acct Number Financial Institution Name and Address Part 10: Certain Financial Accounts, Safe Deposit Boxes, and Storage Units DEPOSITORY 1/24/2023 6391 $0 18.1 SILICON VALLEY BANK 3003 TASMAN DR SANTA CLARA, CA 95054 Page 1 of 1 to Question 18 Case: 23 - 30687 Doc# 183 Filed: 11/22/23 40 Entered: 11/22/23 14:58:21 Page 15 of

Depository Institution Name and Address 19. Safe deposit boxes List any safe deposit box or other depository for securities, cash, or other valuables the debtor now has or did have within 1 year before filing this case. None Does Debtor still have it? Names of Anyone with Access to it and Address Description of the Contents Shift Technologies, Inc. Case Number: 23 - 30687 Part 10: Certain Financial Accounts, Safe Deposit Boxes, and Storage Units NONE No Yes 19. 1 Page 1 of 1 to Question 19 Case: 23 - 30687 Doc# 183 Filed: 11/22/23 40 Entered: 11/22/23 14:58:21 Page 15 of

Does Debtor still have it? Description of the Contents Address Names of Anyone with Access to it Facility Name and Address 20. Off - premises storage List any property kept in storage units or warehouses within 1 year before filing this case. Do not include facilities that are in a part of a building in which the debtor does business. None Shift Technologies, Inc. Case Number: 23 - 30687 Part 10: Certain Financial Accounts, Safe Deposit Boxes, and Storage Units 20. 1 IRON MOUNTAIN ONE FEDERAL STREET BOSTON, MA 02110 AYMAN MOUSSA, CEO; JASON CURTIS, CFO; SCOTT HODGDON, GENERAL COUNSEL 290 DIVISION ST SUITE 400 SAN FRANCISCO, CA 94103 BOOKS & RECORDS; MEDIA ARCHIVES; CORPORATE FILES No Yes Page 1 of 1 to Question 20 Case: 23 - 30687 Doc# 183 Filed: 11/22/23 40 Entered: 11/22/23 14:58:21 Page 15 of

Owner’s Name and Address 21. Property held for another List any property that the debtor holds or controls that another entity owns. Include any property borrowed from, being stored for, or held in trust. Do not list leased or rented property. None Value Location of the Property Description of the Property Shift Technologies, Inc. Case Number: 23 - 30687 Part 11: Page 1 of 1 to Question 21 Case: 23 - 30687 Doc# 183 Filed: 11/22/23 40 Entered: 11/22/23 14:58:21 Page 15 of Property the Debtor Holds or Controls That the Debtor Does Not Own 21.1 NONE

Shift Technologies, Inc. Case Number: 23 - 30687 Nature of Proceeding Court or Agency Name and Address Case Title and Case Number Status Part 12: Details About Environmental Information For the purpose of Part 12, the following definitions apply: Environmental law means any statute or governmental regulation that concerns pollution, contamination, or hazardous material, regardless of the medium affected (air, land, water, or any other medium). Site means any location, facility, or property, including disposal sites, that the debtor now owns, operates, or utilizes or that the debtor formerly owned, operated, or utilized. Hazardous material means anything than an environmental law defines as hazardous or toxic, or describes as a pollutant, contaminant, or a similary harmful substance. Report all notices, releases, and proceedings known, regardless of when they occurred. 22. Has the debtor been a party in any judicial or administrative proceeding under any environmental law? Include settlements and orders. No Yes. Provide details below. 22. 1 NONE Page 1 of 1 to Question 22 Case: 23 - 30687 Doc# 183 Filed: 11/22/23 40 Entered: 11/22/23 14:58:21 Page 15 of

Shift Technologies, Inc. Case Number: 23 - 30687 Date of Notice Environmental Law, if Known Governmental Unit Name and Address Site Name and Address Part 12: Details About Environmental Information For the purpose of Part 12, the followig definitions apply: Environmental law means any statute or governmental regulation that concerns pollution, contamination, or hazardous material, regardless of the medium affected (air, land, water, or any other medium). Site means any location, facility, or property, including disposal sites, that the debtor now owns, operates, or utilizes or that the debtor formerly owned, operated, or utilized. Hazardous material means anything than an environmental law defines as hazardous or toxic, or describes as a pollutant, contaminant, or a similary harmful substance. Report all notices, releases, and proceedings known, regardless of when they occurred. 23. Has any governmental unit otherwise notified the debtor that the debtor may be liable under or in violation of an environmental law? No Yes. Provide details below. 23. 1 NONE Page 1 of 1 to Question 23 Case: 23 - 30687 Doc# 183 Filed: 11/22/23 40 Entered: 11/22/23 14:58:21 Page 25 of

Date of Notice Environmental Law, if Known Governmental Unit Name and Address Site Name and Address Shift Technologies, Inc. Case Number: 23 - 30687 Part 12: Details About Environmental Information For the purpose of Part 12, the followig definitions apply: Environmental law means any statute or governmental regulation that concerns pollution, contamination, or hazardous material, regardless of the medium affected (air, land, water, or any other medium). Site means any location, facility, or property, including disposal sites, that the debtor now owns, operates, or utilizes or that the debtor formerly owned, operated, or utilized. Hazardous material means anything than an environmental law defines as hazardous or toxic, or describes as a pollutant, contaminant, or a similary harmful substance. Report all notices, releases, and proceedings known, regardless of when they occurred. 24. Has the debtor notified any governmental unit of any release of hazardous material? No Yes. Provide details below. 24.1 NONE Page 1 of 1 to Question 24 Case: 23 - 30687 Doc# 183 Filed: 11/22/23 40 Entered: 11/22/23 14:58:21 Page 26 of

Dates Business Existed Employer Identification Number Describe the Nature of the Business Business Name and Address 25. Other businesses in which the debtor has or has had an interest List any business for which the debtor was an owner, partner, member, or otherwise a person in control within 6 years before filing this case. Include this information even if already listed in the Schedules. None Shift Technologies, Inc. Case Number: 23 - 30687 Part 13: Page 1 of 2 to Question 25 Case: 23 - 30687 Doc# 183 Filed: 11/22/23 40 Entered: 11/22/23 14:58:21 Page 27 of Details About the Debtor's Business or Connections to Any Business Do not include SSN or ITIN - 5/17/2021 86 - 3833860 SUBSIDIARY OF CARLOTZ GROUP, INC. 25. 1 CARLOTZ CALIFORNIA, LLC 290 DIVISION ST SUITE 400 SAN FRANSISCO, CA 94103 - 3/14/2011 45 - 0701034 SUBSIDIARY OF CARLOTZ, INC. (DE) 25. 2 CARLOTZ GROUP, INC. (F/K/A CARLOTZ, INC.) 290 DIVISION ST SUITE 400 SAN FRANSISCO, CA 94103 - 4/18/2022 87 - 3561403 SUBSIDIARY OF CARLOTZ 25. 3 CARLOTZ LOGISTICS, LLC GROUP, INC. 290 DIVISION ST SUITE 400 SAN FRANSISCO, CA 94103 - 7/9/2021 87 - 1955480 SUBSIDIARY OF CARLOTZ GROUP, INC. 25. 4 CARLOTZ NEVADA, LLC 290 DIVISION ST SUITE 400 SAN FRANSISCO, CA 94103 - 1/26/2021 83 - 2456129 SUBSIDIARY OF SHIFT TECHNOLOGIES, INC. 25. 5 CARLOTZ, INC. (DE) 290 DIVISION ST SUITE 400 SAN FRANSISCO, CA 94103 - 5/21/2018 86 - 3833309 SUBSIDIARY OF CARLOTZ GROUP, INC. 25. 6 CARLOTZ, INC. (IL) 290 DIVISION ST SUITE 400 SAN FRANSISCO, CA 94103 - 3/15/2017 35 - 2589847 SUBSIDIARY OF SHIFT 25. 7 FAIR DEALER SERVICES, LLC MARKETPLACE, LLC 290 DIVISION ST SUITE 400 SAN FRANSISCO, CA 94103 - 1/31/2014 30 - 3809027 SUBSIDIARY OF CARLOTZ 25. 8 ORANGE GROVE FLEET SOLUTIONS, LLC GROUP, INC. 290 DIVISION ST SUITE 400 SAN FRANSISCO, CA 94103 - 6/15/2018 98 - 1436777 SUBSIDIARY OF ORANGE 25. 9 ORANGE PEEL PROTECTION REINSURANCE, LTD. PEEL, LLC 290 DIVISION ST SUITE 400 SAN FRANSISCO, CA 94103 - 7/1/2018 98 - 1224536 SUBSIDIARY OF ORANGE PEEL, LLC 25. 10 ORANGE PEEL REINSURANCE COMPANY, LTD. 290 DIVISION ST SUITE 400 SAN FRANSISCO, CA 94103

Dates Business Existed Employer Identification Number Describe the Nature of the Business Business Name and Address 25. Other businesses in which the debtor has or has had an interest List any business for which the debtor was an owner, partner, member, or otherwise a person in control within 6 years before filing this case. Include this information even if already listed in the Schedules. None Shift Technologies, Inc. Case Number: 23 - 30687 Part 13: Page 2 of 2 to Question 25 Case: 23 - 30687 Doc# 183 Filed: 11/22/23 40 Entered: 11/22/23 14:58:21 Page 28 of Details About the Debtor's Business or Connections to Any Business Do not include SSN or ITIN - 8/9/2012 30 - 0746776 SUBSIDIARY OF CARLOTZ GROUP, INC. 25. 11 ORANGE PEEL, LLC 290 DIVISION ST SUITE 400 SAN FRANSISCO, CA 94103 - 6/1/2015 47 - 4186332 SUBSIDIARY OF SHIFT PLATFORM, INC. 25. 12 SHIFT FINANCE, LLC 290 DIVISION ST SUITE 400 SAN FRANSISCO, CA 94103 - 11/4/2021 87 - 3561403 SUBSIDIARY OF SHIFT OPERATIONS LLC 25. 13 SHIFT INSURANCE SERVICES LLC 290 DIVISION ST SUITE 400 SAN FRANSISCO, CA 94103 - 5/10/2022 88 - 2801796 SUBSIDIARY OF SHIFT TECHNOLOGIES, INC. 25. 14 SHIFT MARKETPLACE HOLDINGS, LLC 290 DIVISION ST SUITE 400 SAN FRANSISCO, CA 94103 - 5/10/2022 88 - 2801587 SUBSIDIARY OF SHIFT 25. 15 SHIFT MARKETPLACE, LLC MARKETPLACE HOLDINGS, LLC 290 DIVISION ST SUITE 400 SAN FRANSISCO, CA 94103 - 3/14/2014 46 - 5189219 SUBSIDIARY OF SHIFT PLATFORM, INC. 25. 16 SHIFT OPERATIONS LLC 290 DIVISION ST SUITE 400 SAN FRANSISCO, CA 94103 - 10/13/2020 46 - 4260979 SUBSIDIARY OF SHIFT 25. 17 SHIFT PLATFORM, INC. TECHNOLOGIES, INC. 290 DIVISION ST SUITE 400 SAN FRANSISCO, CA 94103 - 9/15/2021 87 - 2682230 SUBSIDIARY OF SHIFT 25. 18 SHIFT TRANSPORTATION LLC OPERATIONS LLC 290 DIVISION ST SUITE 400 SAN FRANSISCO, CA 94103

26. Books, records, and financial statements 26a. List all accountants and bookkeepers who maintained the debtor’s books and records within 2 years before filing this case. None Name and Address Dates of Service Shift Technologies, Inc. Case Number: 23 - 30687 Part 13: Page 1 of 1 to Question 26a. Case: 23 - 30687 Doc# 183 Filed: 11/22/23 40 Entered: 11/22/23 14:58:21 Page 29 of Details About the Debtor's Business or Connections to Any Business To: 7/1/2016 From: AHMED BAPORIA 290 DIVISION STREET SUITE 400 SAN FRANCISCO, CA 94103 26a.1 To: 7/28/2017 From: GRETCHEN RIVERA 290 DIVISION STREET 26a.2 SUITE 400 SAN FRANCISCO, CA 94103 To: 6/1/2021 From: JASON CURTIS 290 DIVISION STREET 26a.3 SUITE 400 SAN FRANCISCO, CA 94103 8/11/2023 To: 5/23/2022 From: JOSH GAMBRELL 5889 SOUTH NATIONAL DRIVE 26a.4 PARKVILLE, MO 64152 9/15/2023 To: 1/4/2021 From: KYLE WHIDDEN 616 S MILLER AVE 26a.5 N SALT LAKE, UT 84054 9/27/2023 To: 3/15/2021 From: ODED SHEIN C/O MICHAEL J. FORTUNATO 26a.6 1200 LIBERTY DRIVE SUITE 220 WAYNE, PA 19087

26. Books, records, and financial statements 26b. List all firms or individuals who have audited, compiled, or reviewed debtor’s books of account and records or prepared a financial statement within 2 years before filing this case. None Name and Address Dates of Service Shift Technologies, Inc. Case Number: 23 - 30687 Part 13: Details About the Debtor's Business or Connections to Any Business 26b.1 DELOITTE TOUCHE TOHMATSU 30 ROCKEFELLER PLAZA 41ST FLOOR NEW YORK, NY 10112 Page 1 of 1 to Question 26b. Case: 23 - 30687 Doc# 183 Filed: 11/22/23 40 Entered: 11/22/23 14:58:21 Page 30 of From: 10/9/2021 To:

26. Books, records, and financial statements 26c. List all firms or individuals who were in possession of the debtor’s books of account and records when this case is filed. None Name and Address If any Books of Account and Records are Unavailable, Explain Why Shift Technologies, Inc. Case Number: 23 - 30687 Part 13: Details About the Debtor's Business or Connections to Any Business AHMED BAPORIA 290 DIVISION STREET SUITE 400 SAN FRANCISCO, CA 94103 26c.1 GRETCHEN RIVERA 290 DIVISION STREET SUITE 400 SAN FRANCISCO, CA 94103 26c.2 JASON CURTIS 290 DIVISION STREET SUITE 400 SAN FRANCISCO, CA 94103 Page 1 of 1 to Question 26c. Case: 23 - 30687 Doc# 183 Filed: 11/22/23 40 Entered: 11/22/23 14:58:21 Page 31 of 26c.3

26. Books, records, and financial statements 26d. List all financial institutions, creditors, and other parties, including mercantile and trade agencies, to whom the debtor issued a financial statement within 2 years before filing this case. None Name and Address Shift Technologies, Inc. Case Number: 23 - 30687 Part 13: Details About the Debtor's Business or Connections to Any Business 26d.1 SEE GLOBAL NOTE - Page 1 of 1 to Question 26d. Case: 23 - 30687 Doc# 183 Filed: 11/22/23 40 Entered: 11/22/23 14:58:21 Page 32 of

Basis Dollar Amount Date of Inventory Name and Address of the Person who has Possession of Inventory Records Shift Technologies, Inc. Case Number: 23 - 30687 27. Inventories Have any inventories of the debtor’s property been taken within 2 years before filing this case? No Yes. Give the details about the two most recent inventories. Name of the Person who Supervised the Taking of the Inventory 1. NONE Part 13: Details About the Debtor's Business or Connections to Any Business Page 1 of 1 to Question 27 Case: 23 - 30687 Doc# 183 Filed: 11/22/23 40 Entered: 11/22/23 14:58:21 Page 33 of

28. List the debtor's officers, directors, managing members, general partners, members in control, controlling shareholders, or other people in control of the debtor at the time of the filing of this case. Shift Technologies, Inc. Case Number: 23 - 30687 Name and Address Positition and Nature of any Interest Percent of Interest, if any Part 13: Page 1 of 1 to Question 28 Case: 23 - 30687 Doc# 183 Filed: 11/22/23 40 Entered: 11/22/23 14:58:21 Page 34 of Details About the Debtor's Business or Connections to Any Business DIRECTOR 28. 1 ADAM NASH 290 DIVISION ST 4TH FLOOR SAN FRANSISCO, CA 94103 OFFICER & DIRECTOR 28. 2 AYMAN MOUSSA 290 DIVISION ST 4TH FLOOR SAN FRANSISCO, CA 94103 OFFICER 28. 3 JASON CURTIS 290 DIVISION ST 4TH FLOOR SAN FRANSISCO, CA 94103 DIRECTOR 28. 4 JIM SKINNER 290 DIVISION ST 4TH FLOOR SAN FRANSISCO, CA 94103 DIRECTOR 28. 5 KIM SHEEHY 290 DIVISION ST 4TH FLOOR SAN FRANSISCO, CA 94103 9.14% MATERIAL EQUITY SHAREHOLDER 28. 6 LITHIA MOTORS INC. 150 NORTH BARTLETT MEDFORD, OR 97501 OFFICER 28. 7 SCOTT G. HODGDON 290 DIVISION ST 4TH FLOOR SAN FRANSISCO, CA 94103 OFFICER 28. 8 TINA NOVOA 290 DIVISION ST 4TH FLOOR SAN FRANSISCO, CA 94103 OFFICER 28. 9 TRACY M. NOTTE 290 DIVISION ST 4TH FLOOR SAN FRANSISCO, CA 94103 7.50% MATERIAL EQUITY SHAREHOLDER 28. 10 TRP CAPITAL ADVISORS, LLC 380 N OLD WOODWARD AVE SUITE 205 BIRMINGHAM, MI 48009 4.82% MATERIAL EQUITY SHAREHOLDER 28. 11 VENKATA MARUTHI JD 610 ZACK ST SUITE 110 TAMPA, FL 33602

29. Within 1 year before the filing of this case, did the debtor have officers, directors, managing members, general partners, members in control of the debtor, or shareholders in control of the debtor who no longer hold these positions? No Yes. Identify below. Shift Technologies, Inc. Case Number: 23 - 30687 Name and Address Position and Nature of Interest Period During Which Position Was Held Part 13: Details About the Debtor's Business or Connections to Any Business 8/7/2023 To: 10/13/2020 From: FORMER OFFICER & DIRECTOR 29. 1 GEORGE ARISON C/O GRINDR INC. 750 N SAN VINCENTE BLVD ST RE 1400 W HOLLYWOOD, CA 90069 12/9/2022 To: 10/13/2020 From: FORMER DIRECTOR 29. 2 JASON KRIKORIAN 441 WHISKEY HILL ROAD WOODSIDE, CA 94062 6/9/2023 To: 11/30/2022 From: FORMER OFFICER & DIRECTOR 29. 3 JEFF CLEMENTZ C/O ERIC HIDUKE 100 PINE STREET SUITE 1250 SAN FRANCISCO, CA 94111 10/6/2023 To: 9/7/2021 From: FORMER OFFICER 29. 4 KEITH VERTREES 8738 1/2 E FAIRVIEW AVE SAN GABIREL, CA 91775 FORMER DIRECTOR 29. 5 KELLYN SMITH KENNY 4511 CATHEDRAL AVENUE. SW WASHINGTON, DC 20016 From: 10/13/2020 8/7/2023 To: FORMER DIRECTOR 29. 6 LUIS SOLORZANO 700 HARBOR DR KEY BISCAYNE, FL 33149 From: 12/9/2022 9/22/2022 To: FORMER DIRECTOR 29. 7 MANISH PATEL SUITE 703 SAN FRANCISCO, CA 94158 From: 10/13/2020 To: 12/9/2022 9/27/2023 To: 3/15/2021 From: FORMER OFFICER ODED SHEIN 29. 8 C/O MICHAEL J. FORTUNATO 1200 LIBERTY RIDGE DRIVE SUITE 220 WAYNE, PA 19087 Page 1 of 1 to Question 29 Case: 23 - 30687 Doc# 183 Filed: 11/22/23 40 Entered: 11/22/23 14:58:21 Page 34 of

29. Within 1 year before the filing of this case, did the debtor have officers, directors, managing members, general partners, members in control of the debtor, or shareholders in control of the debtor who no longer hold these positions? No Yes. Identify below. Shift Technologies, Inc. Case Number: 23 - 30687 Name and Address Position and Nature of Interest Period During Which Position Was Held Part 13: Details About the Debtor's Business or Connections to Any Business FORMER OFFICER 29. 9 SEAN FOY C/O ERIC HIDUKE 100 PINE STREET SUITE 1250 SAN FRANCISCO, CA 94111 From: 11/19/2018 To: 7/1/2023 FORMER OFFICER & DIRECTOR 29. 10 TOBIAS RUSSELL 17 E MASON AVE ALEXANDRIA, VA 22301 From: 10/13/2020 8/29/2023 To: FORMER OFFICER 29. 11 TRACY LESSIN 112 8TH AVE SAN FRANCISCO, CA 94118 From: 7/17/2019 To: 3/17/2023 FORMER DIRECTOR 29. 12 VICTORIA MCINNIS 1055 GULF OF MEXICO DRIVE UNIT 305 LONGBOAT KEY, FL 34228 From: 10/13/2020 To: 8/22/2023 Page 36 of 2 to Question 29 Case: 23 - 30687 Doc# 183 Filed: 11/22/23 40 Entered: 11/22/23 14:58:21 Page 36 of

Shift Technologies, Inc. Case Number: 23 - 30687 Name and Address of Recipient and Relationship to Debtor Amount Reason for Providing the Value Part 13: Details About the Debtor's Business or Connections to Any Business 30. Payments, Distributions, or Withdrawals Credited or Given to Insiders Within 1 year before filing this case, did the debtor provide an insider with value in any form, including salary, other compensation, draws, bonuses, loans, credits on loans, stock redemptions, and options exercised? No Yes. Identify below. Dates 30.1 NONE TOTAL $0 $0 TOTAL Page 37 of 2 to Question 29 Case: 23 - 30687 Doc# 183 Filed: 11/22/23 40 Entered: 11/22/23 14:58:21 Page 37 of

31. Within 6 years before filing this case, has the debtor been a member of any consolidated group for tax purposes? No Yes. Identify below. Shift Technologies, Inc. Case Number: 23 - 30687 Employer Identification Number of the Parent Corporation Name of Parent Corporation Part 13: Page 38 of 2 to Question 29 Case: 23 - 30687 Doc# 183 Filed: 11/22/23 40 Entered: 11/22/23 14:58:21 Page 38 of Details About the Debtor's Business or Connections to Any Business 82 - 5325852 EIN: 31. 1 SHIFT TECHNOLOGIES, INC. 46 - 4230979 EIN: 31. 2 SHIFT PLATFORM, INC.

32. Within 6 years before filing this case, has the debtor as an employer been responsible for contributing to a pension fund? No Yes. Identify below. Shift Technologies, Inc. Case Number: 23 - 30687 Employer Identification Number of the Pension Fund Name of Pension Fund Part 13: Details About the Debtor's Business or Connections to Any Business 32. 1 NONE Page 39 of 2 to Question 29 Case: 23 - 30687 Doc# 183 Filed: 11/22/23 40 Entered: 11/22/23 14:58:21 Page 39 of EIN:

Shift Technologies, Inc. Signature: /s/ Jason Curtis Executed on: , Jason Curtis, Chief Financial Officer Name and Title Part 14: Signature and Declaration Warning - - Bankruptcy fraud is a serious crime . Making a false statement, concealing property, or obtaining money or property by fraud in connection with a bankruptcy case can result in fines up to $ 500 , 000 or imprisonment for up to 20 years, or both . 18 U . S . C . †† 152 , 1341 , 1519 , and 3571 . I have examined the information in this Statement of Financial Affairs and any attachments and have a resonable belief that the information is true and correct. I declare under penalty of perjury that the foregoing is true and correct. Case Number: 23 - 30687 Are additional pages to the Statement of Financial Affairs for Non - Individuals Filing for Bankruptcy (Official Form 207) attached? X No Yes Case: 23 - 30687 Doc# 183 Filed: 11/22/23 40 Entered: 11/22/23 14:58:21 Page 40 of 11/22/2023

IN

RE SHIFT TECHNOLOGIES, INC., ET AL.

LEAD

CASE NO. 23-30687 (HLB)

GENERAL

NOTES AND STATEMENT OF

LIMITATIONS, METHODOLOGY, AND DISCLAIMERS

REGARDING DEBTORS’ SCHEDULES OF ASSETS AND

LIABILITIES AND STATEMENTS OF FINANCIAL AFFAIRS

On

October 9, 2023 (the “Petition Date”), Shift Technologies, Inc.; Shift Platform, Inc.; Shift Finance LLC; Shift Operations

LLC; Shift Transportation LLC; Shift Insurance Services LLC; Shift Marketplace Holdings, LLC; Shift Marketplace, LLC; Fair Dealer Services,

LLC; CarLotz, Inc., a Delaware Corporation; CarLotz Group, Inc.; CarLotz Nevada, LLC; CarLotz California, LLC; CarLotz, Inc., an Illinois

Corporation; CarLotz Logistics, LLC; Orange Peel, LLC; and Orange Grove Fleet Solutions, LLC, as debtors and debtors in possession (collectively,

the “Debtors”) in the above-captioned chapter 11 cases (the “Chapter 11 Cases”), each filed a voluntary

petition for relief under chapter 11 of title 11 of the United States Code (the “Bankruptcy Code”) with the United

States Bankruptcy Court for the Northern District of California (San Francisco Division) (the “Bankruptcy Court”).

The Debtors are authorized to operate their businesses and manage their properties as debtors in possession pursuant to sections 1107(a)

and 1108 of the Bankruptcy Code. The Debtors’ Chapter 11 Cases have been consolidated under case number 23-30687 (HLB) for procedural

purposes only and are being jointly administered pursuant to Rule 1015(b) of the Federal Rules of Bankruptcy Procedure (the “Bankruptcy

Rules”).

OVERVIEW

OF GENERAL NOTES

Each

of the Debtors has herewith filed separate Schedules of Assets and Liabilities (“Schedules”) and Statements of Financial

Affairs (“Statements”). These General Notes and Statement of Limitations, Methodology, and Disclaimers Regarding

Debtors’ Schedules and Statements (the “General Notes”) relate to each of the Debtors’ Schedules and

Statements and set forth the basis upon which the Schedules and Statements are presented. These General Notes pertain to, are incorporated

by reference in, and comprise an integral part of the Schedules and Statements and should be referred to and considered in connection

with any review of the Schedules and Statements. The General Notes are in addition to any specific notes contained in any Debtor’s

Schedules or Statements. The General Notes are presented for each individual Debtor, however, each provision contained in the General

Notes may not apply to all Debtors. Disclosure of information in one Schedule or Statement, exhibit, or continuation sheet, even if incorrectly

placed, shall be deemed to be disclosed in the correct Schedule or Statement, exhibit, or continuation sheet. Nothing contained in the

Schedules and Statements shall constitute a waiver of any rights or claims of the Debtors against any third party, or in or with respect

to any aspect of these Chapter 11 Cases.

The

Schedules, Statements, and General Notes should not be relied upon by any person for information relating to the current or future financial

conditions, events, or performance of any of the Debtors.

The

Schedules and Statements have been prepared, pursuant to section 521 of the Bankruptcy Code and Bankruptcy Rule 1007, by the

Debtors’ management with the assistance of their advisors and other professionals. The Schedules and Statements contain

unaudited information, which is subject to further review and potential adjustment. Reasonable efforts have been made to provide

accurate and complete information herein based upon information that was available at the time of preparation; however, subsequent

information or discovery thereof may result in material changes to the Schedules and Statements and inadvertent errors or omissions

may exist. Nothing contained in the Schedules and Statements shall constitute a waiver of any of the Debtors’ rights with

respect to the Chapter 11 Cases, including with respect to any issues involving substantive consolidation, recharacterization,

equitable subordination, and/or causes of action arising under the provisions of chapter 5 of the Bankruptcy Code and other relevant

non-bankruptcy laws to recover assets or avoid transfers.

The

Debtors and their agents, attorneys, and financial advisors expressly do not undertake any obligation to update, modify, revise, or re-categorize

the information provided herein, or to notify any third party for any direct, indirect, incidental, consequential, or special damages

(including, but not limited to, damages arising from the disallowance of a potential claim against the Debtors or damages to business

reputation, lost business, or lost profits), whether foreseeable or not and however caused, even if the Debtors or their agents, attorneys,

and financial advisors are advised of the possibility of such damages.

The

Debtors reserve all rights to amend, modify, or supplement the Schedules and Statements from time to time, in all respects, as may be

necessary or appropriate, including, but not limited to, the right to dispute or otherwise assert offsets or defenses to any claim reflected

on the Schedules and Statements as to amount, liability or classification, or to otherwise subsequently designate any claim as “disputed,”

“contingent” or “unliquidated.” Furthermore, nothing contained in the Schedules and Statements shall constitute

an admission of any claims or a waiver of any of the Debtors’ rights with respect to the Chapter 11 Cases, including with respect

to any issues involving causes of action arising under the provisions of chapter 5 of the Bankruptcy Code and other relevant non-bankruptcy

laws to recover assets or avoid transfers.

The

Schedules and Statements for each Debtor have been signed by Jason Curtis, Chief Financial Officer for each of the Debtors. In reviewing

and signing the Schedules and Statements, Mr. Curtis necessarily relied upon the efforts, statements, and representations of various

personnel employed by the Debtors and their advisors and other professionals. Mr. Curtis has not (and could not have) personally verified

the accuracy of each such statement and representation, including, without limitation, statements and representations concerning amounts

owed to creditors, classification of such amounts, and their addresses.

Shift

Technologies, Inc., et al.: Schedules and Statements General Notes

1. Net

Book Value of Assets. The Debtors do not have current market valuations for all of their assets as it would be prohibitively

expensive, unduly burdensome, and an inefficient use of estate assets and resources for the Debtors to obtain current market

valuations of all their assets. Accordingly, unless otherwise indicated herein, assets in the Schedules and Statements reflect net

book values as of the end of the day on October 9, 2023. Net book values may vary, sometimes materially, from market values. Certain

other assets may be listed as “unknown” amounts.

Additionally,

amounts ultimately realized may differ materially from net book value (or whatever value was ascribed). Certain depreciable assets with

a net book value of zero ($0) may also be included for completeness. The Debtors have not performed an analysis of impairment of fixed

assets, goodwill, or other intangibles. The Debtors do not intend to amend these Schedules and Statements to reflect actual values.

2. Basis

of Presentation. Information contained in the Schedules and Statements has been derived from the Debtors’ books and

records and historical financial statements. The Schedules and Statements do not purport to represent financial statements prepared

in accordance with United States Generally Accepted Accounting Principles (“GAAP”), nor are they intended to

fully reconcile with the financial statements of each Debtor.

3. Amendment. Reasonable

efforts have been made to prepare and file complete and accurate Schedules and Statements. Despite these efforts, inadvertent errors

or omissions may exist. The Debtors reserve all rights to, but are not required to, amend or supplement, or both, the Schedules and

Statements from time to time as is necessary and appropriate.

4. Recharacterization. The

Debtors have made reasonable efforts to correctly characterize, classify, categorize, and designate assets, liabilities, executory

contracts, unexpired leases, and other items reported in the Schedules and Statements. However, due to the complexity and size of

the Debtors’ business and operations, the Debtors may have improperly characterized, classified, categorized, or designated

certain items. The Debtors reserve all of their rights to recharacterize, reclassify, recategorize, or redesignate items reported in

the Schedules and Statements as necessary or appropriate as additional information becomes available, including, without limitation,

whether contracts or leases listed herein were deemed executory or unexpired as of the Petition Date and remain executory and

unexpired postpetition.

5. Confidentiality. There

may be instances in the Schedules and Statements where the Debtors have deemed it necessary and appropriate to redact or withhold

from the public record information such as names, addresses, or amounts. Typically, the Debtors have used this approach because of

an agreement between the Debtors and a third party, concerns of confidentiality, or concerns for the privacy of an

individual.

6. Cash

Management System. The Debtors use a consolidated cash management system through which the Debtors collect substantially all

receipts and pay liabilities and expenses. As a result, certain payments in the Schedules and Statements may have been made

prepetition by one entity on behalf of another entity through the operation of the consolidated cash management system. The

Debtors’ prepetition cash management system is described in the Motion of the Debtors for Interim and Final Orders (I)

Approving Continued Use of the Debtors’ Cash Management System, Bank Accounts, and Business Forms; (II) Authorizing the

Debtors to Open and Close Bank Accounts; and (III) Authorizing Banks to Honor Certain Prepetition Transfers (the “Cash

Management Motion”) dated October 9, 2023 [Docket No. 15].

7. Currency. Unless

otherwise indicated, all amounts are reflected in U.S. dollars.

8. Liabilities. The

Debtors have sought to allocate liabilities between the prepetition and postpetition periods based on information and research that

was conducted or available in connection with the preparation of the Schedules and Statements. As additional information becomes

available and further research is conducted, the allocation of liabilities between prepetition and postpetition periods may change.

The Debtors reserve all of their rights to amend, supplement, or otherwise modify the Schedules and Statements as they deem

necessary or appropriate.

The

liabilities listed on the Schedules and Statements do not reflect any analysis of claims under section 503(b)(9) of the Bankruptcy Code.

Accordingly, the Debtors reserve all rights to dispute or challenge the validity of any asserted claims under section 503(b)(9) of the

Bankruptcy Code or the characterization of the structure of any such transaction or any document or instrument related to any creditor’s

claim. On or about November 13, 2023, the Bankruptcy Court entered the Order Establishing Procedures for the Assertion, Resolution,

and Satisfaction of Claims Asserted Pursuant to 11 U.S.C. § 503(b)(9), which, among other relief, authorized the payment of

certain claims under section 503(b)(9) of the Bankruptcy Code. Claims satisfied pursuant to this order have not been listed in Schedule

E/F.

9. Property

and Equipment. Unless otherwise indicated, owned property and equipment are presented at net book value.

10. Executory

Contracts and Unexpired Leases. The listing of a contract or lease in the Schedules shall not be deemed an admission that such

contract is an executory contract or unexpired lease, or that it is necessarily a binding, valid, and enforceable agreement. The

Debtors hereby expressly reserve the right to assert that any contract or lease listed on the Debtors’ Schedules does not

constitute an executory contract or unexpired lease within the meaning of section 365 of the Bankruptcy Code.

11. Leases. The

Debtors may lease real property, furniture, fixtures, and equipment from certain third-party lessors. Such leases are presented in

the Schedules and Statements, subject to the reservation of rights set forth herein. The Debtors have not included in the Schedules

and Statements the future obligations of any leases. Nothing herein or in the Schedules or Statements shall be construed as a

concession, admission or evidence as to the determination of the legal status of any leases (including whether any lease is a true

lease or a financing agreement) identified in the Schedules or Statements, including whether such leases: (i) constitute an

executory contract within the meaning of section 365 of the Bankruptcy Code or other applicable law; or (ii) have not expired or

been terminated or otherwise are not current in full force and effect, and the Debtors reserve all of their rights.

12. Causes

of Action. Despite their reasonable efforts to identify all known assets, the Debtors may not have listed all of their causes of

action or potential causes of action against third parties as assets in their Schedules and Statements, including, without

limitation, avoidance actions arising under chapter 5 of the Bankruptcy Code and actions under other relevant non-bankruptcy laws to

recover assets. The Debtors reserve all of their rights with respect to any claims, causes of action or avoidance actions they may

have, and neither these General Notes nor the Schedules and Statements shall be deemed a waiver of any such claims, causes of

action, or avoidance actions or in any way prejudice or impair the assertion of such claims.

13. Taxes. Claims

listed on the Debtors’ Schedule E/F include claims owing to various taxing authorities to which the Debtors may potentially be

liable. However, certain of such claims may be subject to ongoing audits and the Debtors are otherwise unable to determine with

certainty the amount of many, if not all, of the claims listed on Schedule E/F. Therefore, the Debtors have listed estimated claim

amounts, where possible, or alternatively listed such claims as unknown in amount and marked the claims as unliquidated, pending

final resolution of ongoing audits or other outstanding issues. The Debtors reserve their rights to dispute or challenge whether

such claims are entitled to priority.

14. Unknown

Amounts. Claim amounts that could not readily be quantified by the Debtors are scheduled as “unknown.” These may

include claims for prepetition services for which the Debtors have not yet received invoices. The description of an amount as

“unknown” is not intended to reflect upon the materiality of the amount.

15. Payment

of Prepetition Claims Pursuant to First Day Orders. On or about October 11 and 12, 2023, the Bankruptcy Court entered interim

orders (the “Interim Orders”) authorizing, but not directing, the Debtors to, among other things, pay certain

prepetition claims relating to (a) employee wages, salaries, and other compensation and benefits; (b) insurance premiums; (c) taxes;

and (d) the continued use of the Debtors’ Cash Management System. Final orders granting such relief were entered on or about

November 9, 2023 (the “Final Orders,” and, collectively with the Interim Orders, the “First Day

Orders”). Where the Schedules list creditors and set forth the amounts attributable to such claims, such scheduled amounts

reflect balances owed as of the Petition Date. To the extent any adjustments are necessary to reflect any payments made on account

of such claims following the commencement of these Chapter 11 Cases pursuant to the authority granted to the Debtors by the

Bankruptcy Court under the First Day Orders, such adjustments have been included in the Schedules unless otherwise noted on the

applicable Schedule. The Debtors reserve the right to update the Schedules to reflect payments made pursuant to the First Day

Orders.

16. Employee

Claims. The Bankruptcy Court entered a First Day Order granting the authority, but not the obligation, to the Debtors to pay

certain prepetition employee wages, salaries, benefits and other obligations in the ordinary course. Employee claims for prepetition

amounts that were paid, or were authorized to be paid pursuant to such orders of the Bankruptcy Court, may not be included in the

Schedules and Statements.

17. Other

Claims Paid Pursuant to Court Orders. Pursuant to certain orders of the Bankruptcy Court entered in the Debtors’ Chapter

11 Cases, the Debtors were authorized (but not directed) to pay, among other things, certain prepetition claims. Accordingly, these

liabilities may have been or may be satisfied in accordance with those orders, and therefore may not be listed in the Schedules and

Statements.

18. Insiders. The

Debtors have included all payments and awards made to executive officers and the members of the board of directors during the twelve

months preceding the Petition Date.

Included

in the value reflected are cash payments to or for the benefit of the insider (inclusive of payroll, bonus and other employee benefits

paid in cash). Persons have been included in the Statements for informational purposes only, and the listing of an individual as an insider

is not intended to be and should not be construed as a legal characterization of that person as an insider and does not act as an admission

of any fact, claim, right or defense, and all such rights, claims and defenses are reserved. Further, the Debtors do not take any position

concerning (a) the person’s influence over the control of the Debtors, (b) the person’s management responsibilities and functions,

(c) the person’s decision-making or corporate authority, or (d) whether the person could successfully argue that he or she is not

an insider under applicable law, including federal securities law, or any theories of liability or for any other purpose. Information

for insiders of CarLotz, Inc., a Delaware corporation, and its direct and indirect subsidiaries (the “CarLotz Debtors”)

prior to their December 2022 merger with the other Debtors (the “CarLotz Merger”) may not be included.

19. Excluded

Assets and Liabilities. The Debtors may have excluded from the Schedules certain of the following items, which may be included

in their GAAP financial statements: intercompany receivables and payables, investments in subsidiaries, certain accrued liabilities,

including, without limitation, accrued salaries, employee benefit accruals, and certain other accruals, capitalized interest, debt

acquisition costs, restricted cash, goodwill, financial instruments, certain prepaid and other current assets considered to have no

market value, certain contingent assets such as insurance recoveries, and deferred revenues and gains. Other non-material assets and

liabilities may also have been excluded. The Debtors have reflected intercompany balances as of the end of the day on October 9,

2023, on Schedules A/B and E/F for the relevant debtor.

20. Intercompany

Claims. Claims between the Debtors, as reflected in the applicable entities’ balance sheet accounts, are not reported. The

Debtors take no position in these Schedules and Statements as to whether such accounts would be allowed as claims, interests, or not

allowed at all.

21. Litigation. Certain

litigation actions reflected as claims against one Debtor may relate to any of the other Debtors. The Debtors have made commercially

reasonable efforts to record these actions in the Schedules and Statements of the Debtor that is party to the action. In addition,

the Debtors may have excluded details relating to federal and state agency discrimination charges, labor arbitration and grievance

claims, and government investigations and civil penalty actions. Discrimination charges have been excluded to protect the privacy

interests of the charging parties and because the majority of such claims generally will not result in actual litigation. Labor

arbitration and grievance claims are omitted to protect the privacy interests of the grieving party. Government investigations and

civil penalty actions were excluded due to confidentiality and privacy concerns or because the majority of such claims are for de

minimis amounts, have been promptly remediated or will not ultimately give rise to a civil penalty.

22. Claim

Description. Any failure to designate a claim in the Schedules and Statements as “contingent,”

“unliquidated,” or “disputed” does not constitute an admission that such claim or amount is not

“contingent,” “unliquidated,” or “disputed.” The Debtors reserve all of their rights to dispute,

or to assert offsets or defenses to, any claim reflected on these Schedules and Statements on any grounds, including, without

limitation, amount, liability, priority, status, or classification, or to otherwise subsequently designate any claim as

“contingent,” “unliquidated,” or “disputed.”

Moreover,

although the Debtors may have scheduled claims of various creditors as secured claims for informational purposes, no current valuation

of the Debtors’ assets in which such creditors may have a lien has been undertaken. Moreover, the Debtors reserve all of their

rights to, but are not required to, amend, supplement, or otherwise modify their Schedules and Statements as necessary and appropriate,

including modifying claims descriptions and designations.

23. Debt

Representatives. Claims relating to the repayment of principal, interest and other fees and expenses under agreements governing

any syndicated credit facility where the identities of the lenders or other parties in interest are not known with certainty are

scheduled listing the administrative agent under the applicable credit facility.

24. Unliquidated

Claim Amounts. Claim amounts that could not be readily quantified by the Debtors are scheduled as “unliquidated.” To

the extent the Debtors are able to ascertain or estimate all or a portion of the claim amounts, they may have listed the known or

estimated claim amount and marked the claims as unliquidated, pending final resolution of outstanding issues necessary to determine

the total claim amount with certainty.

25. Liabilities. The

Debtors have sought to allocate liabilities between prepetition and postpetition periods based on the information and research that

was conducted in connection with the preparation of the Schedules and Statements. As additional information becomes available and

further research is conducted, the allocation of liabilities between prepetition and postpetition periods may change. The Debtors

reserve their right to, but are not required to, amend the Schedules and Statements as they deem appropriate to reflect

this.

26. Guarantees

and Other Second Liability Claims. The Debtors have used commercially reasonable efforts to locate and identify guarantees and

other secondary liability claims (collectively, the “Guarantees”) in their executory contracts, unexpired leases,

secured financings, debt instruments, and other such agreements. Where Guarantees have been identified, they have been included in

the relevant Schedules D, E/F, G and H for the affected Debtor or Debtors. Guarantees have generally been included in Schedules of

the guarantor Debtor as “contingent” unless otherwise specified. While the Debtors have used commercially reasonable

efforts to locate and identify Guarantees, it is possible that Guarantees embedded in the Debtors’ executory contracts,

unexpired leases, secured financings, debt instruments, and other such agreements may have been inadvertently omitted. The Debtors

reserve all of their rights to, but are not required to, amend, supplement, or modify the Schedules if additional Guarantees are

identified.

27. Intellectual

Property Rights. Exclusion of certain intellectual property shall not be construed to be an admission that those intellectual

property rights have been sold, abandoned, or terminated, or otherwise have expired by their terms, or have been assigned or

otherwise transferred pursuant to a sale, acquisition, or other transaction. Conversely, inclusion of certain intellectual property

shall not be construed to be an admission that those intellectual property rights have not been abandoned, have not been terminated,

or otherwise have not expired by their terms, or have not been assigned or otherwise transferred pursuant to a sale, acquisition, or

other transaction. Accordingly, the Debtors reserve all of their rights as to the legal status of all intellectual property

rights.

28. Post-petition

Agreements. The Debtors have entered into and may continue to enter into certain post-petition agreements with creditors and

other counterparties such as landlords and critical vendors with respect to the amounts of pre-petition claims or cure amounts. The

amounts listed in the Schedules and Statements represent amounts owed as of the Petition Date and are not intended to be a waiver or

repudiation of any such post-petition agreement. The Debtors reserve all of their rights to, but are not required to, amend,

supplement, or otherwise modify their Schedules and Statements as necessary and appropriate to reflect such post-petition

agreements, including modifying claims descriptions and designations.

29. Totals. All

totals that are included in the Schedules and Statements represent totals of all the known amounts included in the Schedules and

Statements and exclude items identified as “unknown” or “unliquidated.” If there are unknown or unliquidated

amounts, the actual totals may be materially different from the listed totals.

Specific

Disclosures with Respect to the Debtors’ Schedules

30. Schedule

A/B – Assets: Real and Personal Property. All values are as of October 9, 2023, except for fixed assets disclosed in Parts

7, 8, and 9, which are reported as net book values as of September 30, 2023. Finished goods and Tesla consignment inventory are

reported as Manheim Market Report value. Bank account balances are as of the end of the day on October 9, 2023. Details with respect

to the Debtors’ cash management system and bank accounts are provided in the Cash Management Motion. The net book values of

leases do not include leasehold improvements on the subject properties that are scheduled separately.

Net

operating losses are listed on the Schedules as they are recorded in the Debtors’ books and records.

Real

property leased listed in Schedule A/B is further described in Schedule G.

31. Schedule

D: Creditors Holding Secured Claims. Except as otherwise agreed pursuant to a stipulation or agreed order or general order

entered by the Bankruptcy Court, the Debtors reserve their rights to dispute or challenge the validity, perfection or immunity from

avoidance of any lien purported to be granted or perfected in any specific asset to a secured creditor listed on Schedule D of any

Debtor. Certain claims may be listed on Schedule D as “unliquidated” because the value of the collateral securing such

claims is unknown. Moreover, although the Debtors may have scheduled claims of various creditors as secured claims, the Debtors

reserve all rights to dispute or challenge the secured nature of any such creditor’s claim or the characterization of the

structure of any such transaction or any document or instrument (including without limitation, any intercompany agreement) related

to such creditor’s claim. In certain instances, a Debtor may be a co-obligor, co-mortgagor or guarantor with respect to

scheduled claims of other Debtors, and no claim set forth on Schedule D of any Debtor is intended to acknowledge claims of creditors

that are otherwise satisfied or discharged by other entities. The descriptions provided in Schedule D are intended only to be a

summary. Reference to the applicable loan agreements and related documents is necessary for a complete description of the collateral

and the nature, extent and priority of any liens. Nothing in the General Notes or the Schedules and Statements shall be deemed a

modification or interpretation of the terms of such agreements.

32. Schedule

E/F: Creditors Who Have Unsecured Claims. Listing a claim on Part 1 of Schedule E/F as priority does not constitute an admission

by the Debtors of the claimant’s legal rights or a waiver of the Debtors’ right to recharacterize or reclassify the

claim or contract. The Bankruptcy Court entered a number of first day orders granting authority to pay certain prepetition priority

claims. Accordingly, only claims against Debtors for prepetition amounts as of the Petition Date that have not been paid have been

included in Part 1 of Schedule E/F. The Debtors reserve their rights to object to any listed claims on the ground that, among other

things, they have already been satisfied.

Part

2 of Schedule E/F does not include certain deferred charges, deferred liabilities or general reserves. Such amounts are general estimates

of liabilities and do not represent specific claims as of the Petition Date; however, they are reflected on the Debtors’ books

and records as required in accordance with GAAP. The claims listed in Part 2 of Schedule E/F arose or were incurred on various dates.

In certain instances, the date on which a claim arose is an open issue of fact. While commercially reasonable efforts have been made,

determining the date upon which each claim in Part 2 of Schedule E/F was incurred or arose would be, in certain cases, unduly burdensome

and cost prohibitive and, therefore, the Debtors have not listed a date for each claim listed on Part 2 of Schedule E/F. Part 2 of Schedule

E/F may contain information regarding potential, pending and closed litigation involving the Debtors. In certain instances, the Debtor

that is the subject of the litigation is unclear or undetermined. However, to the extent that litigation involving a particular Debtor

has been identified, such information is contained in the Schedule for that Debtor. The inclusion of any litigation in these Schedules

and Statements does not constitute an admission by any Debtor of liability, the validity of any action, the availability of insurance

coverage, or the amount or treatment of any claims, defenses, counterclaims, or cross-claims or the amount or treatment of any potential

claim resulting from any current or future litigation. In addition, certain litigation or claims covered by insurance policies maintained

by the Debtors may be excluded from Part 2 of Schedule E/F. The claims of individual creditors are generally listed at the amounts recorded

on the Debtors’ books and records and may not reflect credits or allowances due from the creditor. The Debtors reserve all of their

rights concerning credits or allowances. The Bankruptcy Court entered First Day Orders granting authority to the Debtors to pay certain

prepetition obligations in the ordinary course of business. Accordingly, only claims against the Debtors for prepetition amounts that

have not been paid as of the Petition Date have been included in Part 2 of Schedule E/F. The Debtors reserve their rights to object to

any listed claims on the ground that, among other things, they have already been satisfied. Additionally, Part 2 of Schedule E/F does

not include potential rejection damage claims, if any, of the counterparties to executory contracts and unexpired leases that may be

rejected.

Amounts

listed as obligations under real property leases on Schedule E/F are net of any common area maintenance credits.

33. Schedule

G: Executory Contracts and Unexpired Leases. While commercially reasonable efforts have been made to ensure the accuracy of

Schedule G, inadvertent errors, omissions or over-inclusions may have occurred. The Debtors hereby reserve all of their rights to

dispute the validity, status, or enforceability of any contracts, agreements or leases set forth in Schedule G and to amend or

supplement such Schedule as necessary. The contracts, agreements and leases listed on Schedule G may not have taken effect or be

binding on any party and may have expired or been modified, amended, or supplemented from time to time by various amendments,

restatements, waivers, estoppel certificates, letter and other documents, instruments and agreements which may not be listed

therein. Certain of the real property leases and contracts listed on Schedule G may contain renewal options, guarantees of payments,

options to purchase, rights of first refusal, rights to lease additional space and other miscellaneous rights. Such rights, powers,

duties and obligations are not set forth on Schedule G. Nothing herein shall be construed as a concession or evidence that any of

the contracts, agreements or leases identified on Schedule G: (i) constitute an executory contract within the meaning of section 365

of the Bankruptcy Code or other applicable law; or (ii) have not expired or been terminated or otherwise are not current in full

force and effect. The Debtors reserve all of their rights, claims and causes of action with respect to the contracts and agreements

listed on the Schedule, including the right to dispute or challenge the characterization or the structure of any transaction,

document, or instrument. Certain of these contracts or leases may have been modified, amended or supplemented by various documents,

instruments or agreements that may not be listed, but are nonetheless incorporated by this reference. Certain executory agreements

may not have been memorialized in writing and could be subject to dispute. Schedule G generally does not include stand-alone

equipment purchase orders. Certain of the contracts, agreements and leases listed on Schedule G may have been entered into by more

than one of the Debtors. Such contracts, agreements and leases are listed on Schedule G of each such Debtor.

34. Schedule

H: Co-Debtors. In the ordinary course of their businesses, the Debtors are involved in pending or threatened litigation and

claims arising out of the conduct of their businesses. These matters may involve multiple plaintiffs and defendants, some or all of

whom may assert cross- claims and counter-claims against other parties. Because such claims are listed elsewhere in the Schedules

and Statements, they have not been set forth individually on Schedule H. Schedule H also reflects guarantees by various Debtors. The