UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

6-K

REPORT

OF FOREIGN PRIVATE ISSUER

PURSUANT

TO RULE 13a-16 OR 15d-16 UNDER

THE

SECURITIES EXCHANGE ACT OF 1934

For

the month of November 2023

Commission

File Number: 001-38421

BIT

DIGITAL, INC.

(Translation

of registrant’s name into English)

33

Irving Place, New York, NY 10003

(Address

of principal executive offices)

Indicate

by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F

Form

20-F ☒ Form 40-F ☐

ADOPTION

OF CLAWBACK POLICY

Nasdaq

adopted a new listing standard related to recovery of erroneously awarded compensation (Nasdaq Listing Rule 5608, the “Executive

Compensation Clawback Rule”), which became effective on October 2, 2023, and pursuant to the Executive Compensation Clawback Rule,

all Nasdaq listed companies have until December 1, 2023, to adopt a clawback policy.

On

November 30, 2023, the Board of Directors (the “Board”) of Bit Digital Inc. (the “Company”) adopted a Clawback

Policy (the “Clawback Policy”), a copy of which is filed as Exhibit 4.1 to this Form 6-K. The Clawback Policy provides for

the recoupment of certain executive compensation in the event of an accounting restatement resulting from material noncompliance with

financial reporting requirements under the Federal securities laws. The Clawback Policy is designed to comply with Section 10D of the

Securities Exchange Act of 1934, and Nasdaq Listing Rule 5608.

The

Clawback Policy will be administered by the Board. It applies to the Company’s current and former executive officers and such other

senior executives and employees who may be deemed subject to the policy by the Board. The amount to be recovered will be the excess of

the Incentive Compensation (as defined) paid to the executive based on the erroneous data over the Incentive Compensation that would

have been paid had it been based on the restated results.

The

foregoing description of the Clawback Policy with Form of Acknowledgement is a summary only and is qualified in its entirety by reference

to the full text of the Clawback Policy, a copy of which is attached to this Report on Form 6-K as Exhibit 4.1 and is incorporated herein

by reference.

Exhibit

Index

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

| |

Bit Digital, Inc. |

| |

(Registrant) |

| |

|

| Date: November

30, 2023 |

By: |

/s/

Samir Tabar |

| |

Name: |

Samir Tabar |

| |

Title: |

Chief Executive Officer |

2

Exhibit 4.1

Bit Digital, Inc. (“the Company”)

CLAWBACK POLICY

Introduction

The Board of Directors of the Company (the “Board”)

believes that it is in the best interests of the Company and its shareholders to create and maintain a culture that emphasizes integrity

and accountability and that reinforces the Company’s pay-for-performance compensation philosophy. The Board has therefore adopted

this policy which provides for the recoupment of certain executive compensation in the event of an accounting restatement resulting from

material noncompliance with financial reporting requirements under the federal securities laws (the “Policy”). This

Policy is designed to comply with Section 10D of the Securities Exchange Act of 1934 (the “Exchange Act”) and Nasdaq

Listing Rule 5608 (the “Clawback Listing Standards”).

Administration

This Policy shall be administered by the Board

or, if so designated by the Board, the Compensation Committee, in which case references herein to the Board shall be deemed references

to the Compensation Committee. Any determinations made by the Board shall be final and binding on all affected individuals.

Covered Executives

This Policy applies to the Company’s current

and former executive officers, as determined by the Board in accordance with the definition in Section 10D of the Exchange Act and the

Clawback Listing Standards, and such other senior executives and employees who may from time to time be deemed subject to the Policy by

the Board (“Covered Executives”).

Recoupment; Accounting Restatement

In the event the Company is required to prepare

an accounting restatement of its financial statements due to the Company’s material noncompliance with any financial reporting requirement

under the securities laws, including any required accounting restatement to correct an error in previously issued financial statements

that is material to the previously issued financial statements or that would result in a material misstatement if the error were corrected

in the current period or left uncorrected in the current period, the Board will require reimbursement or forfeiture of any excess Incentive

Compensation (defined below) received by any Covered Executive during the three completed fiscal years immediately preceding the date

on which the Company is required to prepare an accounting restatement.

Incentive Compensation

For purposes of this Policy, Incentive Compensation

means any of the following; provided that, such compensation is granted, earned, or vested

based wholly, or in part, on the attainment of a financial reporting measure including, but not limited to:

| ● | Annual

bonuses and other short- and long-term cash incentives. |

| ● | Stock

appreciation rights. |

Financial

reporting measures include:

| ● | Total

shareholder return. |

| ● | Earnings

before interest, taxes, depreciation, and amortization (EBITDA). |

| ● | Liquidity

measures such as working capital or operating cash flow. |

| ● | Return

measures such as return on invested capital or return on assets. |

| ● | Earnings

measures such as earnings per share. |

Excess

Incentive Compensation: Amount Subject to Recovery

The

amount to be recovered will be the excess of the Incentive Compensation paid to the Covered Executive based on the erroneous data over

the Incentive Compensation that would have been paid to the Covered Executive had it been based on the restated results, as determined

by the Board, without regard to any taxes paid by the Covered Executive in respect of the Incentive Compensation paid based on the erroneous

data.

If the Board cannot determine the amount of excess

Incentive Compensation received by the Covered Executive directly from the information in the accounting restatement, then it will make

its determination based on a reasonable estimate of the effect of the accounting restatement.

Method of Recoupment

The Board will determine, in its sole discretion,

the method for recouping Incentive Compensation hereunder which may include, without limitation:

| (a) | requiring reimbursement of cash Incentive Compensation previously paid; |

| (b) | seeking recovery of any gain realized on the vesting, exercise, settlement, sale, transfer, or other disposition

of any equity-based awards; |

| (c) | offsetting the recouped amount from any compensation otherwise owed by the Company to the Covered Executive; |

| (d) | cancelling outstanding vested or unvested equity awards; and/or |

| (e) | taking any other remedial and recovery action permitted by law, as determined by the Board. |

No Indemnification

The Company shall not indemnify any Covered Executives

against the loss of any incorrectly awarded Incentive Compensation.

Interpretation

The Board is authorized to interpret and construe

this Policy and to make all determinations necessary, appropriate, or advisable for the administration of this Policy. It is intended

that this Policy be interpreted in a manner that is consistent with the requirements of Section 10D of the Exchange Act, any applicable

rules or standards adopted by the Securities and Exchange Commission, and the Clawback Listing Standards.

Effective Date

This Policy shall be effective as of November

30, 2023 (the “Effective Date”) and shall apply to Incentive Compensation that is accrued and/or received by Covered

Executives on or after the Effective Date, even if such Incentive Compensation was approved, awarded, or granted to Covered Executives

prior to the Effective Date.

Amendment; Termination

The Board may amend this Policy from time to time

in its discretion and shall amend this Policy as it deems necessary to reflect final regulations adopted by the Securities and Exchange

Commission under Section 10D of the Exchange Act and to comply with the Clawback Listing Standards and any other rules or standards adopted

by a national securities exchange on which the Company’s securities are listed. The Board may terminate this Policy at any time.

Other Recoupment Rights

Any right of recoupment under this Policy is in

addition to, and not in lieu of, any other remedies or rights of recoupment that may be available to the Company pursuant to the terms

of any similar policy in any employment agreement, equity award agreement, or similar agreement and any other legal remedies available

to the Company.

Relationship to Other Plans and Agreements

The Board intends that this Policy will be applied

to the fullest extent of the law. The Board may require that any employment agreement, equity award agreement, or similar agreement entered

into on or after the Effective Date shall, as a condition to the grant of any benefit thereunder, require a Covered Executive to agree

to abide by the terms of this Policy. In the event of any inconsistency between the terms of the Policy and the terms of any employment

agreement, equity award agreement, or similar agreement under which Incentive Compensation has been granted, awarded, earned or paid to

a Covered Executive, whether or not deferred, the terms of the Policy shall govern.

Acknowledgment

The Covered Executive shall sign an acknowledgment

form in the form attached hereto as Exhibit A in which they acknowledge that they have read and understand the terms of the Policy and

are bound by the Policy.

Impracticability

The Board shall recover any excess Incentive Compensation

in accordance with this Policy unless such recovery would be impracticable, as determined by the Board in accordance with Rule 10D-1 of

the Exchange Act and the listing standards of the national securities exchange on which the Company’s securities are listed.

Successors

This Policy shall be binding and enforceable against

all Covered Executives and their beneficiaries, heirs, executors, administrators or other legal representatives.

EXHIBIT A

FORM OF

EXECUTIVE OFFICER ACKNOWLEDGEMENT & AGREEMENT

PERTAINING TO Bit

Digital, Inc.

CLAWBACK POLICY

This Acknowledgement & Agreement (the “Acknowledgement”)

is delivered by the undersigned executive officer (“Executive”), as of the date set forth below, to Bit Digital, Inc.

(the “Company”).

The Company’s Board of Directors (the “Board”)

adopted the Bit Digital, Inc. Clawback Policy, attached as Exhibit A hereto (as amended, restated, supplemented or otherwise

modified from time to time by the Board, the “Clawback Policy”). The Clawback Policy provides for the recovery of certain

incentive-based compensation from executive officers in the event that the Company is required to prepare an accounting restatement due

to the material noncompliance of the Company with any financial reporting requirement under the securities laws, including any required

accounting restatement to correct an error in previously issued financial statements that is material to the previously issued financial

statements, or that would result in a material misstatement if the error were corrected in the current period or left uncorrected in the

current period.

In consideration of the continued benefits to

be received from the Company and Executive’s right to participate in, and as a condition to the receipt of, incentive-based compensation

(as defined in the Clawback Policy), Executive hereby acknowledges and agrees to the following:

| 1. | Executive has read and understands the Clawback Policy and has had an opportunity to ask questions to

the Company regarding the Clawback Policy. |

| 2. | Executive agrees to be bound by and to abide by the terms of the Clawback Policy and intends for the Clawback

Policy to be applied to the fullest extent of the law. |

| 3. | The Clawback Policy shall apply to any and all incentive-based compensation that is received (as defined

in the Clawback Policy) by Executive on or after November 30, 2023. |

| 4. | Executive agrees and understands that the recovery of compensation under the Clawback Policy shall not

be an event giving rise to a right to resign for “good reason” or “constructive termination” (or similar term)

under any plan, agreement, or other arrangement with the Company. |

| 5. | In the event of any inconsistency between the provisions of the Clawback Policy and this Acknowledgement

or any applicable incentive-based compensation arrangements, equity agreement, indemnification agreement or similar agreement or arrangement

setting forth the terms and conditions of any incentive-based compensation, the terms of the Clawback Policy shall govern. |

No modifications, waivers or amendments of the

terms of this Acknowledgement shall be effective unless signed in writing by Executive and the Company. The provisions of this Acknowledgement

shall inure to the benefit of the Company, and shall be binding upon, the successors, administrators, heirs, legal representatives and

assigns of Executive.

By signing below, Executive agrees to the application

of the Clawback Policy and the other terms of this Acknowledgement.

_________________________

Name:

Date: ____________________

[Signature Page to Executive Officer Acknowledgement

& Agreement

Pertaining to the Bit Digital, Inc.

Clawback Policy]

Bit Digital (NASDAQ:BTBT)

Historical Stock Chart

From Mar 2024 to Apr 2024

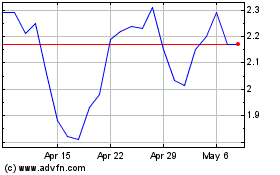

Bit Digital (NASDAQ:BTBT)

Historical Stock Chart

From Apr 2023 to Apr 2024