Table of Contents

PROSPECTUS

Filed pursuant to Rule 424(b)(4)

Registration No. 333-274800

3,326,042 Common Units consisting of shares of Common Stock, Series

A Warrants and Series B Warrants and/or

39,531,100 Pre-Funded Units consisting of Pre-Funded Warrants, Series

A Warrants and Series B Warrants (and 39,531,100 shares of common stock underlying the Pre-Funded Warrants)

Up to 45,000,000 shares of common stock underlying the Series A

Warrants

Up to 15,000,000 shares of common stock underlying the Series B

Warrants

We are offering 3,326,042 Common Units at a

public offering price of $0.42 per Common Unit. Each Common Unit consists of one share of our common stock, 0.35 of a warrant to

purchase one share of our common stock at an exercise price of $0.55 per share (or 130% of the price of each Common Unit sold in the

offering) or pursuant to alternate cashless exercise option, which will expire on the five-year anniversary of the original issuance

date (the “Series A Warrants”) and 0.35 of a warrant to purchase one share of our common stock at an exercise price of

$0.84 per share (or 200% of the price of each Common Unit sold in the offering) which warrant will expire on the five-year

anniversary of the original issuance date (the “Series B Warrants” and together with the Series A Warrants, the

“Warrants”).

Under the alternate cashless exercise option of

the Series A Warrants, beginning on the date of the Warrant Stockholder Approval (described below), the holder of the Series A Warrant,

has the right to receive an aggregate number of shares equal to the product of (x) the aggregate number of shares of common stock that

would be issuable upon a cash exercise of the Series A Warrant and (y) 3.0. In addition, beginning on the date of the Warrant Stockholder

Approval, the Warrants will contain a reset of the exercise price to a price equal to the lesser of (i) the then exercise price and (ii)

lowest volume weighted average price for the five trading days immediately preceding and immediately following the date we effect a reverse

stock split in the future with a proportionate adjustment to the number of shares underlying the Warrants. Finally, beginning on the date

of the Warrant Stockholder Approval, with certain exceptions, the Series B Warrants will provide for an adjustment to the exercise price

and number of shares underlying the Series B Warrant upon our issuance of our common stock or common stock equivalents at a price per

share that is less than the exercise price of the Series B Warrant.

The alternate cashless exercise option

included in the Series A Warrants and the other adjustment provisions described in the above paragraph included in the Warrants will

be available only upon receipt of such stockholder approval as may be required by the applicable rules and regulations of the Nasdaq

Capital Market to permit the alternate cashless exercise of the Series A Warrants and the other adjustment provisions described in

the above paragraph included in the Warrants (the “Warrant Stockholder Approval”). In the event that we are unable to

obtain the Warrant Stockholder Approval, the Series A Warrants will not be exercisable using the alternate cashless exercise option

and the other adjustment provisions described in the above paragraph included in the Warrants will not be effective, and therefore

the Warrants may have substantially less value. See the Risk Factor on page 11 relating to the Warrants and Warrant Stockholder

Approval, and see the section entitled “Warrant Stockholder Approval” on page 20 for additional details regarding the

Warrant Stockholder Approval.

We are also offering to those purchasers, if any,

whose purchase of Common Units in this offering would otherwise result in such purchaser, together with its affiliates and certain related

parties, beneficially owning more than 4.99% (or, at the election of the purchaser, 9.99%) of our outstanding shares of common stock immediately

following the consummation of this offering, the opportunity to purchase, if any such purchaser so chooses, Pre-Funded Units, in lieu

of Common Units that would otherwise result in such purchaser’s beneficial ownership exceeding 4.99% (or, at the election of the

purchaser, 9.99%) of our outstanding shares of common stock. Each Pre-Funded Unit consists of one pre-funded warrant (“Pre-Funded

Warrant”) to purchase one share of our common stock, 0.35 of a Series A Warrant and 0.35 of a Series B Warrant. The purchase price

of each Pre-Funded Unit is $0.41999 (which is equal to the public offering price per Common Unit to be sold in this offering minus $0.00001).

The Pre-Funded Warrants are immediately exercisable and may be exercised at any time until all of the Pre-Funded Warrants are exercised

in full. For each Pre-Funded Unit we sell, the number of Common Units we are offering will be decreased on a one-for-one basis.

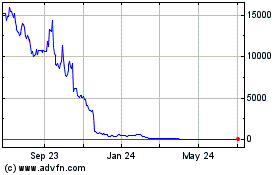

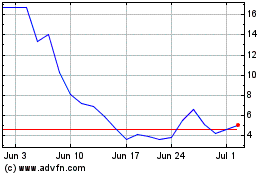

Our common stock is listed on The Nasdaq Capital

Market, or Nasdaq, under the symbol “VLCN.” On November 15, 2023, the closing price of our common stock on Nasdaq was $0.65

per share.

We are an “emerging growth company”

under the federal securities laws and are subject to reduced public company reporting requirements for this prospectus and future filings.

Investing in our securities involves a high

degree of risk. See “Risk Factors” beginning on page 8 of this prospectus supplement and the

risk factors incorporated by reference into this prospectus supplement and the accompanying prospectus.

| | |

| Per

Common Unit | |

|

|

Per Pre-Funded Unit |

| |

| Total | |

| Price to public | |

$ | 0.4200 | |

|

$ |

0.41999 |

| |

$ | 17,999,604 | |

| Underwriting discount(1) | |

$ | 0.0336 | |

|

$ |

0.0336 |

| |

$ | 1,439,968 | |

| Proceeds to us (before expenses) | |

$ | 0.3864 | |

|

$ |

0.3864 |

| |

$ | 16,559,636 | |

________________________

(1) See “Underwriting”

beginning on page 14 for additional information regarding the compensation payable to the underwriter.

The offering is being underwritten on a firm commitment

basis. We have granted the underwriter a 45-day option to purchase up to 6,428,571 additional shares of common stock and/or Pre-Funded

Warrants, representing 15% of the shares of common stock and Pre-Funded Warrants sold in the offering and/or up to 2,250,000 additional

Series A Warrants, representing 15% of the Series A Warrants sold in the offering, and/or up to 2,250,000 additional Series B Warrants,

representing 15% of the Series B Warrants sold in the offering, on the same terms and conditions set forth above solely to cover over-allotments.

The underwriter may exercise the over-allotment option with respect to shares of common stock only, Pre-Funded Warrants only, Series A

Warrants only, Series B Warrants only, or any combination thereof.

Neither the Securities and Exchange Commission

nor any state securities commission has approved or disapproved of these securities or determined if this prospectus supplement or the

accompanying prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The underwriter expects to deliver the securities

against payment through the facilities of the Depository Trust Company on or about November 17, 2023.

___________________________________

Sole Book-Running Manager

Aegis Capital Corp.

The date of this prospectus is November 16,

2023.

Table

of Contents

ABOUT THIS PROSPECTUS

We incorporate by reference

important information into this prospectus. You may obtain the information incorporated by reference without charge by following the instructions

under “Where You Can Find More Information.” You should carefully read this prospectus as well as additional information described

under “Incorporation of Certain Information by Reference,” before deciding to invest in our securities.

We have not, and the underwriter

has not, authorized anyone to provide any information or to make any representations other than those contained in this prospectus or

in any free writing prospectuses prepared by or on behalf of us or to which we have referred you. We take no responsibility for, and can

provide no assurance as to the reliability of, any other information that others may give you. This prospectus is an offer to sell only

the securities offered hereby, and only under circumstances and in jurisdictions where it is lawful to do so. The information contained

in this prospectus or in any applicable free writing prospectus is current only as of its date, regardless of its time of delivery or

any sale of our securities. Our business, financial condition, results of operations and prospects may have changed since that date.

For investors outside the

United States: We have not, and the underwriter has not, done anything that would permit this offering or possession or distribution

of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the

United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the

offering of the securities and the distribution of this prospectus outside the United States.

This prospectus and the information

incorporated by reference into this prospectus may contain references to trademarks belonging to other entities. Solely for convenience,

trademarks and trade names referred to in this prospectus and the information incorporated by reference into this prospectus, including

logos, artwork, and other visual displays, may appear without the ® or TM symbols. We do not intend our use or display of other companies’

trade names or trademarks to imply a relationship with, or endorsement or sponsorship of us by, any other company.

No dealer, salesperson or

other person is authorized to give any information or to represent anything not contained in this prospectus. You must not rely on any

unauthorized information or representations. This prospectus is an offer to sell only the securities offered hereby, but only under circumstances

and in jurisdictions where it is lawful to do so. The information contained in this prospectus is current only as of its date.

We further note that the representations,

warranties and covenants made by us in any agreement that is filed as an exhibit to the registration statement of which this prospectus

forms a part, or any document that is incorporated by reference in this prospectus were made solely for the benefit of the parties to

such agreement, including, in some cases, for the purpose of allocating risk among the parties to such agreements, and should not be deemed

to be a representation, warranty or covenant to you. Moreover, such representations, warranties or covenants were accurate only as of

the date when made. Accordingly, such representations, warranties and covenants should not be relied on as accurately representing the

current state of our affairs.

Market data and certain industry

data and forecasts used throughout this prospectus were obtained from internal company surveys, market research, consultant surveys, publicly

available information, reports of governmental agencies and industry publications and surveys. Industry surveys, publications, consultant

surveys and forecasts generally state that the information contained therein has been obtained from sources believed to be reliable, but

that the accuracy and completeness of such information is not guaranteed. We have not independently verified any of the data from third-party

sources, nor have we ascertained the underlying economic assumptions relied upon therein. Similarly, internal surveys, industry forecasts

and market research, which we believe to be reliable based on our management’s knowledge of the industry, have not been independently

verified. Forecasts are particularly likely to be inaccurate, especially over long periods of time. In addition, we do not necessarily

know what assumptions regarding general economic growth were used in preparing the forecasts we cite. Statements as to our market position

are based on the most currently available data. While we are not aware of any misstatements regarding the industry data presented in this

prospectus, our estimates involve risks and uncertainties and are subject to change based on various factors, including those discussed

under the heading “Risk Factors” included or incorporated by reference in this prospectus.

Cautionary

Note Regarding Forward-Looking Statements

This document contains forward-looking

statements. In addition, from time to time, we or our representatives may make forward-looking statements orally or in writing. We base

these forward-looking statements on our expectations and projections about future events, which we derive from the information currently

available to us. Such forward-looking statements relate to future events or our future performance, including: our financial performance

and projections; our growth in revenue and earnings; and our business prospects and opportunities. You can identify forward-looking

statements by those that are not historical in nature, particularly those that use terminology such as “may,” “should,”

“expects,” “anticipates,” “contemplates,” “estimates,” “believes,” “plans,”

“projected,” “predicts,” “potential,” “intends,” or “hopes” or the negative

of these or similar terms. In evaluating these forward-looking statements, you should consider various factors, including: our ability

to change the direction of the Company; our ability to keep pace with new technology and changing market needs; and the competitive

environment of our business. These and other factors may cause our actual results to differ materially from any forward-looking statement.

Forward-looking statements are only predictions. The forward-looking events discussed in this document and other statements made from

time to time by us or our representatives, may not occur, and actual events and results may differ materially and are subject to risks,

uncertainties and assumptions about us. We are not obligated to publicly update or revise any forward-looking statement, whether

as a result of uncertainties and assumptions, the forward-looking events discussed in this document and other statements made from time

to time by us or our representatives might not occur.

While we believe we have identified

material risks, these risks and uncertainties are not exhaustive. Other sections of this prospectus describe additional factors that could

adversely impact our business and financial performance. Moreover, we operate in a very competitive and rapidly changing environment.

New risks and uncertainties emerge from time to time, and it is not possible to predict all risks and uncertainties, nor can we assess

the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ

materially from those contained in any forward-looking statements.

Although we believe the expectations

reflected in the forward-looking statements are reasonable, we cannot guarantee future results, level of activity, performance or achievements.

Moreover, neither we nor any other person assumes responsibility for the accuracy or completeness of any of these forward-looking statements.

You should not rely upon forward-looking statements as predictions of future events. We are under no duty to update any of these forward-looking

statements after the date of this prospectus to conform our prior statements to actual results or revised expectations, and we do not

intend to do so.

Forward-looking statements include, but are not

limited to, statements about:

| · | our

ability to obtain the Warrant Stockholder Approval on a timely basis,

if at all; |

| · | our ability to generate revenues from sales, generate cash from operations,

or obtain additional funding to market our vehicles and develop new products; |

| · | our ability to successfully implement and effectively manage our outsourced

manufacturing, design and development model and achieve any anticipated benefits; |

| · | the ability of third-party manufacturers to produce our vehicles in accordance

with our design and quality specifications, with sufficient scale to satisfy customers and within a reasonable cost; |

| · | anticipated timing for the manufacture, design, production, shipping and

launch of our vehicles; |

| · | the inability of our suppliers to deliver the necessary components for our

vehicles at prices and volumes acceptable to our third-party manufacturers; |

| · | our ability to establish a network of dealers and international distributors

to sell and service our vehicles on the timeline we expect; |

| · | whether our vehicles will perform as expected; |

| · | our facing product warranty claims or product recalls; |

| · | our facing adverse determinations in significant product liability claims; |

| · | customer adoption of electric vehicles; |

| · | the development of alternative technology that adversely affects our business; |

| · | increased government regulation of our industry; |

| · | tariffs and currency exchange rates; and |

| · | the conflict with Russia and Ukraine and the potential adverse effect

it may have on the availability of materials used in the manufacturing of batteries for our vehicles. |

We caution you not to place

undue reliance on the forward-looking statements, which speak only as of the date of this prospectus in the case of forward-looking statements

contained in this prospectus.

Prospectus

Summary

This summary highlights

certain information about us, this offering and selected information contained elsewhere in or incorporated by reference into this prospectus.

This summary provides an overview of selected information and does not contain all of the information you should consider before deciding

whether to invest in our common stock. Therefore, you should read the entire prospectus (including the documents incorporated by reference

herein and therein), especially the “Risk Factors” section beginning on page 8 of this prospectus,

and any similar section contained in the documents incorporated by reference herein, and our consolidated financial statements and the

related notes incorporated by reference in this prospectus, before deciding to invest in our common stock. Unless otherwise indicated

or the context requires otherwise, the words “we,” “us,” “our,” the “Company,” or “our

Company,” and “Volcon” refer to Volcon, Inc., a Delaware corporation.

Our Company

We are an all-electric, off-road

powersports vehicle company developing electric two and four-wheel motorcycles and utility terrain vehicles, or UTVs, also known as side-by-sides,

along with a complete line of upgrades and accessories. In October 2020, we began building and testing prototypes for our future offerings

with two off-road motorcycles – the Grunt and the Runt. Our motorcycles feature unique frame designs protected by design patents.

Additional utility and design patents have been filed for other aspects of Volcon’s vehicles.

We initially began to sell

and distribute the Grunt and related accessories in the United States on a direct-to-consumer sales platform. We terminated our direct-to-consumer

sales platform in November 2021. Prior to the termination of our direct-to-consumer sales platform, U.S. consumers made deposits for 360

Grunts (net of cancellations) and five Runts, plus accessories and a delivery fee representing total deposits of $2.2 million. These orders

were cancelable by the consumer until the vehicle was delivered and after a 14-day acceptance period, therefore the deposits were recorded

as deferred revenue. As of June 30, 2022, we had completed shipping of all Grunts sold through our direct-to-consumer sales platform.

Due to delays in developing the Runt, we refunded the deposits made for all Runts.

Beginning in November

2021, we began negotiating dealership agreements with powersports dealers to display and sell our vehicles and accessories. Customers

can now, or will soon be able to, buy our vehicles and accessories directly from a local dealership. Some of these dealers will also

provide warranty and repair services to customers. As of September 30, 2023, we have 133 active dealers. Dealers can order any of our

available products provided they are current on their accounts receivable and are within their established credit limit. We are offering

dealers payment terms of up to 90 days to make larger purchases of our vehicles. We have entered into an accounts receivable factoring

arrangement to allow the Company the ability to generate cash for working capital. We have agreements with third-party financing companies

to provide financing to qualified customers of each dealer. There is no recourse to the Company or the dealer if the dealer’s customer

defaults on the financing agreement with the third-party.

As of September 30, 2023,

we have signed agreements with six importers in Latin America and one importer for the Caribbean Region, collectively referred to

herein as the LATAM importers, to sell our vehicles and accessories in their assigned countries/markets. In June 2022, we signed an exclusive

distribution agreement with Torrot Electric Europa S.A., referred to herein as Torrot, to distribute their electric motorcycles for youth

riders in Latin America. As discussed below, the agreement with Torrot was superseded by the December 2022 agreement to sell Volcon cobranded

Torrot youth motorcycles. We use our LATAM importers to sell Volcon cobranded Torrot youth motorcycles in Latin America.

In October 2022, we signed

an expanded agreement with Torrot to also be the exclusive distributor of Torrot and Volcon co-branded youth electric motorcycles in

the United States as well as Latin America. This agreement supersedes the original Torrot agreement and once all Torrot branded inventory

is sold, we will no longer distribute Torrot branded motorcycles. Finally, in December 2022, we signed an expanded agreement with Torrot

to be the exclusive distributor of Volcon co-branded youth electric motorcycles in Canada. In June 2023, we wrote down all remaining

Torrot branded inventory in the amount of $84,000. On September 27, 2023, we wrote down the Volcon cobranded Torrot youth motorcycles

by $1,622,262 to reduce their cost to the estimated net realizable value.

We expect to expand our global

sales of our vehicles and accessories beyond our current LATAM importer base. We expect to sign more LATAM importers in 2023 and in

October 2023 we signed an agreement with an importer who will sell our vehicles in New Zealand. In October 2023, the Company made a decision

to postpone expanding our dealer network in Canada for the foreseeable future and we have terminated the employment of our Canadian regional

sales managers. We expect export sales to be executed with individual importers in each country that buy vehicles by the container. Each

importer will sell vehicles and accessories to local dealers or directly to customers. Local dealers will provide warranty and repair

services for vehicles purchased in their country.

In July 2022, we expanded

our offerings with the introduction of the first of our Volcon UTV models, the Stag, which we initially anticipated would be available

for delivery to customers in the fourth quarter of 2023, followed by additional models of the Stag expected in 2024 and 2025. Due to

a delay in certain parts from third-party vendors, we expect delivery to customers to begin in November 2023. The Stag is being manufactured

by a third-party and incorporates electrification units, which include batteries, drive units and control modules provided by General

Motors. Beginning in June 2022, we have taken non-binding pre-production orders which are cancelable prior to delivery. We also expect

to introduce a higher performance, longer range UTV (to be named) but development of this vehicle has not yet begun and no timeline for

its development and release has been determined.

Through August 2022, we

assembled the Grunt in a leased production facility in Round Rock, Texas. In August 2022, we announced that we will outsource the manufacturing

of the Grunt to a third-party manufacturer, which has reduced costs and improved profitability on the Grunt. We also outsourced the manufacturing

of the 2023 Grunt EVO to the same third-party manufacturer. The 2023 Grunt EVO has replaced the Grunt and has a belt drive rather than

a chain drive as well as an updated rear suspension. We received prototypes of the Grunt EVO in the first quarter of 2023 and began selling

the Grunt EVO in the third quarter of 2023.

In September 2022, we reduced

our headcount in our product development and administration departments as we outsourced the design and development of certain components

of our vehicle development. We also hired our Chief Marketing Officer and hired additional sales and marketing employees and increase

marketing activities to further support our brand and products. In September 2023, we reduced our headcount in several departments to

reduce costs and we continue to evaluate other cost reduction opportunities.

We began taking pre-orders

for an E-Bike, the Brat, in September 2022 and shipments to customers began in the fourth quarter of 2022. The Brat is being manufactured

by a third-party. In January 2023, we began selling the Brat directly to consumers through our website. Consumers who order the Brat from

our website can have the Brat shipped to their specified destination.

In November 2022, we finalized

an agreement for a third-party to manufacture the Runt LT. We received prototypes of the Runt LT in the first quarter of 2023 and expect

to begin sales in the first quarter of 2024.

The estimated fulfillment

of all orders we have received assumes that our third-party manufacturers can successfully meet our order quantities and deadlines. If

they are unable to satisfy orders on a timely basis, our customers may cancel their orders.

Implications of Being an Emerging Growth Company

We qualify as an “emerging

growth company” as the term is used in The Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”), and therefore,

we may take advantage of certain exemptions from various public company reporting requirements, including:

| · | a requirement to only have two years of audited financial statements and only two years of related selected

financial data and management’s discussion and analysis; |

| | | |

| · | exemption from the auditor attestation requirement on the effectiveness of our internal controls over

financial reporting; |

| | | |

| · | reduced disclosure obligations regarding executive compensation; and |

| | | |

| · | exemptions from the requirements of holding a non-binding advisory stockholder vote on executive compensation

and any golden parachute payments. |

We may take advantage of

these provisions for up to five years or such earlier time that we are no longer an emerging growth company. We would cease to be an

emerging growth company if we have more than $1.235 billion in annual revenues, have more than $700.0 million in market value

of our capital stock held by non-affiliates or issue more than $1.0 billion of non-convertible debt over a three-year period. We may

choose to take advantage of some, but not all, of the available benefits of the JOBS Act. We have taken advantage of some of the reduced

reporting requirements in this prospectus. Accordingly, the information contained herein may be different than the information you receive

from other public companies in which you hold stock. In addition, the JOBS Act provides that an emerging growth company can delay adopting

new or revised accounting standards until such time as those standards apply to private companies. We have elected to avail ourselves

of this exemption from new or revised accounting standards and, therefore, we will not be subject to the same new or revised accounting

standards as other public companies that are not emerging growth companies.

Risks Affecting Our Company

In evaluating an investment

in our securities, you should carefully read this prospectus and especially consider the factors incorporated by reference in the sections

titled “Risk Factors” commencing on page 8 of this prospectus and the Annual Report on Form 10-K

for the year ended December 31, 2022 incorporated by reference herein.

Company Information

Our principal executive offices

are located at 3121 Eagles Nest Street, Suite 120, Round Rock, TX 78665. Our phone number is (512) 400-4271 and our website address is

www.volcon.com. We make our periodic reports and other information filed with, or furnished to, the SEC available free of charge through

our website. The information on or accessible through our website is not part of and is not incorporated by reference into this prospectus.

THE OFFERING

| Common Units offered by us |

We are offering 3,326,042 Common Units, each Common Unit consisting of one share of common stock, 0.35 of a Series A Warrant to purchase one share of common stock and 0.35 of a Series B Warrant to purchase one share of common stock (3,824,948 Common Units if the underwriter exercises its over-allotment option in full). |

| |

|

| Pre-Funded Units offered by us |

We are also offering 39,531,100 Pre-Funded Units to those purchasers whose purchase of Common Units in this offering would otherwise result in such purchaser, together with its affiliates and certain related parties, beneficially owning more than 4.99% (or, at the election of the purchaser, 9.99%) of our outstanding shares of common stock immediately following the consummation of this offering, the opportunity to purchase, if any such purchaser so chooses, Pre-Funded Units, in lieu of Common Units that would otherwise result in such purchaser’s beneficial ownership exceeding 4.99% (or, at the election of the purchaser, 9.99%) of our outstanding shares of common stock. Each Pre-Funded Unit consists of one Pre-Funded Warrant to purchase one share of our common stock, 0.35 of a Series A Warrant and 0.35 of a Series B Warrant. The Pre-Funded Warrants are immediately exercisable and may be exercised at any time until all of the Pre-Funded Warrants are exercised in full. |

| |

|

| Over-allotment option |

The offering is being underwritten on a firm commitment basis. We have granted the underwriter a 45-day option to purchase up to 6,428,571 additional shares of common stock and/or Pre-Funded Warrants, representing 15% of the shares of common stock and Pre-Funded Warrants sold in the offering, and/or up to 2,250,000 additional Series A Warrants, representing 15% of the Series A Warrants sold in the offering, and/or up to 2,250,000 additional Series B Warrants, representing 15% of the Series B Warrants sold in the offering, on the same terms and conditions set forth above solely to cover over-allotments. The underwriter may exercise the over-allotment option with respect to shares of common stock only, Pre-Funded Warrants only, Series A Warrants only, Series B Warrants only, or any combination thereof. |

| |

|

| Common stock to be outstanding before this offering |

6,819,278 shares |

| |

|

| Common stock to be outstanding after this offering |

49,676,420 shares of common stock (or 56,104,991 shares of common stock if the underwriters exercise their option in full) (assuming the full exercise of all Pre-Funded Units issued in this offering and assuming no exercise of any Warrants issued in this offering). |

| |

|

| Use of Proceeds |

We expect to use the net proceeds from this offering for general corporate purposes. See “Use of Proceeds” on page 12. |

| |

|

| Risk Factors |

Investing in our securities involves a high degree of risk. See “Risk Factors” beginning on page 8 of this prospectus and the risk factors incorporated by reference into this prospectus. |

| |

|

|

Lock-up |

We have agreed not to offer, issue, sell, contract to sell, encumber, grant any option for the sale of or otherwise dispose of any of our securities for a period of 180 days after the date of this prospectus. Our directors, executive officers, and certain shareholders have agreed not to offer, issue, sell, contract to sell, encumber, grant any option for the sale of or otherwise dispose of any of our securities for a period of 120 days after the date of this prospectus. See “Underwriting” for more information. |

| |

|

| Nasdaq Capital Market Symbol |

Our common stock is listed on the Nasdaq Capital Market under the symbol “VLCN”. We do not intend to list the Pre-Funded Warrant, the Series A Warrants or the Series B Warrants on any securities exchange or nationally recognized trading system. Without a trading market, the liquidity of such securities will be extremely limited. |

The number of shares of our common stock expected

to be outstanding after this offering is based on 6,819,278 shares of common stock outstanding as of November 15, 2023, after given effect

for the 1 for 5 reverse stock split the Company completed on October 13, 2023, and excludes, as of that date, the following:

| |

· |

886,051 shares of common stock issuable upon the exercise of outstanding stock options, vested and unvested, with a weighted-average exercise price of $9.30 per share; |

| |

· |

1,661,531 shares of common stock issuable upon the exercise of outstanding warrants (excluding the warrants issued in our August 2022 and May 2023 offerings that are discussed below) with a weighted-average exercise price of $6.26 per share; |

| |

· |

23,454,126 shares of our common stock issuable upon the conversion of the convertible notes we issued in May 2023 based on a conversion price of $1.369); |

| |

· |

4,498,554 shares of common stock issuable upon the exercise of outstanding warrants issued in our August 2022 and May 2023 note offerings with a weighted-average exercise price of $1.26 per share; |

| |

· |

up to an aggregate of 494,838 shares of common stock

reserved for future issuance under our stock plan, as amended; and |

| |

· |

up to 45,000,000 shares of common stock underlying the Series A Warrants assuming the Series A Warrants are exercised utilizing the alternative cashless exercise option; and |

| |

· |

Up to 15,000,000 shares of common stock underlying the Series B Warrants. |

Except as otherwise indicated herein, all information

in this prospectus supplement assumes no exercise by the underwriter of its over-allotment option to purchase additional shares.

Risk

Factors

An investment in our securities involves risks.

We urge you to consider carefully the risks described below, and in the documents incorporated by reference in this prospectus, before

making an investment decision, including those risks identified under “Item IA. Risk Factors” in our Annual Report on Form

10-K for the year ended December 31, 2022, which is incorporated by reference in this prospectus and which may be amended, supplemented

or superseded from time to time by other reports that we subsequently file with the SEC. If any of these risks actually occurs, our business,

financial condition, results of operations or cash flow could be seriously harmed. This could cause the trading price of our common stock

to decline, resulting in a loss of all or part of your investment. Please also read carefully the section above entitled “Cautionary Note Regarding Forward-Looking Statements”.

Risks Related to this Offering

The common stock and Pre-Funded Warrants (which

are exercisable for common stock) sold in this offering will increase the number of our shares of common stock by over seven times from

approximately 6,819,278 shares to 49,676,420 shares. If all the Warrants sold in this offering are exercised (assuming the Series A Warrants

are exercised on an alternative cashless exercise basis), the number of our shares of common stock will increase by an additional 60,000,000

shares. The sales of these securities could depress the market price of our shares of common stock and/or increase the volatility of our

trading.

A substantial number of shares of common stock,

Pre-Funded Warrants and Warrants are being offered by this prospectus. Sales of a substantial number of our shares of common stock (and

other securities exercisable for common stock) in the public markets pursuant to the terms of this offering could depress the market

price of our shares of common stock and impair our ability to raise capital through the sale of additional equity securities. In addition

to causing the market price of our common stock to decline, such sales could also greatly increase the volatility associated with the

trading of our common stock. Furthermore, stockholders may initiate securities class action lawsuits if the market price of our common

stock drops significantly, which may cause us to incur substantial costs and could divert the time and attention of our management. We

cannot predict the number of these shares that might be sold nor the effect that future sales of our shares of our securities would have

on the market price of our shares of common stock.

You will experience immediate and substantial

dilution in the book value per share of the common stock you purchase in the offering.

Because the public offering price per share of our common stock (attributing

no value to the Warrants) being offered is substantially higher than the net tangible book value per share of our outstanding common stock,

you will suffer immediate and substantial dilution in the net tangible book value of the common stock you purchase in this offering. Investors

purchasing shares of our common stock in this offering will incur immediate dilution of $0.51 per share, after giving effect to the

sale of an aggregate of shares of our common stock underlying the Common Warrants at the public offering price set forth on the cover

page of this prospectus supplement, after deducting the underwriting discount and estimated offering expenses payable by us. See “Dilution” on page 12 of this prospectus for

a more detailed discussion of the dilution you will incur if you purchase shares in this offering.

In addition, we may choose to raise additional

capital due to market conditions or strategic considerations even if we believe we have sufficient funds for our current or future operating

plans. To the extent that additional capital is raised through the sale of equity or convertible debt securities, the issuance of these

securities could result in further dilution to our stockholders or result in downward pressure on the price of our common stock.

Our management will have broad discretion over

the use of the net proceeds from this offering, you may not agree with how we use the proceeds, and the proceeds may not be invested successfully.

Our management will have broad discretion in

the application of the net proceeds from this offering, and our stockholders will not have the opportunity as part of their investment

decision to assess whether the net proceeds are being used appropriately. Because of the number and variability of factors that will

determine our use of the net proceeds from this offering, their ultimate use may vary substantially from their currently intended use.

The failure by our management to apply these funds effectively could harm our business. See “Use of Proceeds”

on page 12 of this prospectus for a description of our proposed use of proceeds from this offering.

We do not intend to pay dividends in the foreseeable

future.

We have never paid cash dividends on our common

stock and currently do not plan to pay any cash dividends in the foreseeable future.

The exercise prices of certain outstanding

warrants and the conversion prices of our outstanding convertible notes payable may require further adjustment.

If in the future, including in this offering,

we sell our common stock at a price below $1.369 per share, the conversion price of our outstanding Notes would adjust to such price,

and if we sell our common stock at a price below $1.369 per share, the exercise price of the Warrants to purchase 4,498,554 shares of

common stock we issued in our August 2022 and May 2023 note offerings would adjust to such price, in each case, subject to a floor price

of $0.22. The holders of the Notes and Warrants waived the right to adjust the conversion and exercise prices, respectively, for this

offering. There can be no assurance that the holders would agree to waive this right in future offerings, if any.

If we agree to complete additional warrant

inducements to the holders of warrants issued in in our August 2022 and May 2023 convertible note offerings (the “Investors”),

we may reduce the exercise price of warrants held by Investors and we may issue additional warrants to the Investors to replace some

or all of the warrants that were exercised.

On September 29, 2023, we entered into a

warrant inducement agreement with the Investors and reduced the exercise price of certain warrants from $2.50 to $1.75 in order

to induce them to exercise 307,001 warrants. We also issued 307,001 additional warrants to the Investors with an exercise price of

$2.50 on October 4, 2023.

On October 13, 2023, we entered into an inducement

offer letter agreement with the Investors and we reduced the exercise price of up to 973,000 warrants to the lesser of (i) $1.75 and

(ii) the exercise price in effect at the time of exercise of the Existing Warrants if further adjusted in accordance with the terms of

the May 2023 Warrants ($1.369 per share after adjustment for the lowest day’s VWAP for the five days following the reverse 1 for

5 stock split completed on October 13, 2023). The reduction of the exercise price of such Existing Warrants remained in effect until

October 27, 2023 (the “Inducement Period”). The Investors exercised 105,000 warrants at $1.369 on October 20, 2023, and there

were no more warrant exercises in the Inducement Period.

On October 29, 2023, in an effort to raise

cash, we entered into an inducement offer letter agreement (the “Inducement Reprice Letter”) with the Investors. Pursuant

to the Inducement Reprice Letter, in exchange for an aggregate cash payment of $346,500, we reduced the exercise price with respect to

warrants exercisable into an aggregate of 350,000 shares of common stock from $1.369 per share to $0.01 per share.

To the extent we complete similar warrant inducements

in the future, our stockholders may experience substantial dilution.

If we fail to satisfy all applicable continued

listing requirements of the Nasdaq Capital Market our common stock may be delisted from Nasdaq, which could have an adverse impact on

the liquidity and market price of our common stock.

Our common stock

is currently listed on the Nasdaq Capital Market. In order to maintain that listing, we must satisfy minimum financial and other continued

listing requirements and standards, including those regarding director independence and independent committee requirements, minimum stockholders’

equity, minimum bid price, and certain corporate governance requirements. There can be no assurances that we will be able to comply with

the applicable listing standards.

On July 5, 2023, we received a notice from

Nasdaq that we were not in compliance with Nasdaq’s Listing Rule 5550(b)(2), which requires that we maintain a market value of

listed securities (“MVLS”) of $35 million. MVLS is calculated by multiplying our shares outstanding by the closing price

of our common stock. On July 6, 2023, we received a notice from Nasdaq that we were not in compliance with Nasdaq’s Listing Rule

5550(a)(2), (the “Bid Price Rule”) as the minimum bid price of our common stock had been below $1.00 per share for 30 consecutive

business days. On October 30, 2023, the Company received a notice from Nasdaq that it has now regained compliance with Rule 5550(a)(2),

as the minimum bid price of its common stock was above $1.00 for 10 consecutive business days.

We have until January

2, 2024, to regain compliance with the MVLS requirement. To regain compliance with the MVLS requirement, our MVLS must close at $35 million

or more for a minimum of ten consecutive business days during this grace period. If we do not regain compliance within the allotted compliance

period, including any extensions that may be granted by Nasdaq, Nasdaq will provide notice that our shares of common stock will be subject

to delisting.

In the event that

our common stock is delisted from Nasdaq and is not eligible for quotation or listing on another market or exchange, trading of our common

stock could be conducted only in the over-the-counter market or on an electronic bulletin board established for unlisted securities such

as the Pink Sheets or the OTC Bulletin Board. In such an event, it could become more difficult to dispose of, or obtain accurate price

quotations for, our common stock, and there would likely also be a reduction in our coverage by securities analysts and the news media,

which could cause the price of our common stock to decline further. Also, it may be difficult for us to raise additional capital if we

are not listed on a major exchange.

We completed a reverse stock split on

October 13, 2023, in an effort to regain compliance with Nasdaq listing rules and we cannot predict the effect that such reverse stock

split will have on the market price for shares of our common stock.

Our board of directors approved a one-for-five

(1:5) reverse stock split of our common stock, which became effective on October 13, 2023, in order to regain compliance with the Bid

Price Rule. We cannot predict the effect that the reverse stock split will have on the market price for shares of our common stock, and

the history of similar reverse stock splits for companies in like circumstances has varied. Some investors may have a negative view of

a reverse stock split. Even if the reverse stock split has a positive effect on the market price for shares of our common stock, performance

of our business and financial results, general economic conditions and the market perception of our business, and other adverse factors

which may not be in our control could lead to a decrease in the price of our common stock following the reverse stock split.

Furthermore, even if the reverse stock split

does result in an increased market price per share of our common stock, the market price per share following the reverse stock split

may not increase in proportion to the reduction of the number of shares of our common stock outstanding before the implementation of

the reverse stock split. Accordingly, even with an increased market price per share, the total market capitalization of shares of our

common stock after a reverse stock split could be lower than the total market capitalization before the reverse stock split. Also, even

if there is an initial increase in the market price per share of our common stock after a reverse stock split, the market price may not

remain at that level.

If the market price of shares of our common

stock declines following the reverse stock split, the percentage decline as an absolute number and as a percentage of our overall market

capitalization may be greater than would occur in the absence of the reverse stock split due to decreased liquidity in the market for

our common stock. Accordingly, the total market capitalization of our common stock following the reverse stock split could be lower than

the total market capitalization before the reverse stock split.

The exercise prices of certain previously issued warrants, the Warrants

issued in this offering and the conversion prices of our outstanding convertible notes payable may require further adjustment if we complete

another reverse stock split.

The price of our common stock prior to this offering

was $0.65 as of November 15, 2023. As a result of this offering, we expect that the price of our common stock will remain below $1.00

and could remain below $1.00 for 30 days in which case we will not meet Nasdaq’s minimum bid requirement of $1.00. We would have

180 days for the stock price to increase above $1.00 for ten business days in order to regain compliance with the minimum bid price requirement.

In order to attempt to satisfy the bid price requirement, our board of directors may request shareholder approval for authorization and

effect a reverse split of our common stock.

The exercise prices of the warrants to purchase

4,148,554 shares of common stock we issued in our August 2022 and May 2023 note offerings, and the conversion prices of our outstanding

convertible notes, may be subject to downward adjustment if we complete a reverse stock split. Specifically, upon the completion of a

reverse stock split, if the lowest volume weighted average price of our common stock during the five consecutive trading days after the

completion of a reverse stock split is less than the exercise prices of the Warrants or the conversion prices of the convertible notes,

then such exercise prices and conversion prices shall be reduced to such price, in each case, subject to a floor price of $0.22.

Warrants issued in this offering will be subject

to downward adjustment if the lowest volume weighted average price of our common stock during the five consecutive trading days before

and after the completion of a reverse stock split is less than the excise prices of the warrants issued in this offering, then the exercise

prices shall be reduced to such price.

We will likely not receive any additional

funds upon the exercise of the Series A Warrants.

If we receive the Warrant Stockholder Approval,

the Series A Warrants may be exercised by way of an alternative cashless exercise, meaning that the holder may not pay a cash purchase

price upon exercise, but instead would receive upon such exercise the net number of shares of our common stock determined according to

the formula set forth in the applicable Series A Warrants. Accordingly, we will likely not receive any additional funds upon the exercise

of the Series A Warrants.

Certain beneficial provisions in the Warrants

will not be effective until we are able to receive stockholder approval of such provisions, and if we are unable to obtain such approval

the Warrant will have significantly less value.

Under Nasdaq listing rules, the alternative

cashless exercise option in the Series A Warrants and certain anti-dilution provisions in the Series B Warrants will not be effective

until, and unless, we obtain the approval of our stockholders. While we intend to promptly seek stockholder approval, there is no guarantee

that the Warrant Stockholder Approval will ever be obtained. If we are unable to obtain the Warrant Stockholder Approval, the foregoing

provisions will not become effective and the Warrants will have substantially less value. In addition, we will incur substantial cost,

and management will devote substantial time and attention, in attempting to obtain the Warrant Stockholder Approval.

Holders of Warrants purchased in this offering

will have no rights as stockholders until such holders exercise their Warrants and acquire our shares of common stock, except as set

forth in the Warrants.

Except as set forth in the Warrants, until

holders of Warrants acquire our shares of common stock upon exercise of the Warrants, holders of the Warrants have no rights with respect

to our shares of common stock underlying such Warrants, the holders will be entitled to exercise the rights of a stockholder of shares

of common stock only as to matters for which the record date occurs after the exercise date.

The Warrants are speculative in nature.

The Warrants offered hereby do not confer

any rights of share of common stock ownership on their holders, such as voting rights or the right to receive dividends, but rather merely

represent the right to acquire shares of common stock at a fixed price. Following this offering, the market value of the Warrants is

uncertain and there can be no assurance that the market value of the Warrants will equal or exceed their respective public offering prices.

There can be no assurance that the market price of the shares of common stock will ever equal or exceed the exercise price of the Warrants,

and consequently, whether it will ever be profitable for holders of Warrants to exercise the Warrants.

Use

of Proceeds

We estimate the net proceeds

from this offering will be approximately $16.1 million (or approximately $18.6 million if the underwriters exercise their over-allotment

option in full), after deducting underwriting discounts and commissions and estimated offering expenses payable by us, and excluding the

proceeds, if any, from the cash exercise of the Warrants sold in this offering.

We will only receive additional

proceeds from the exercise of the Warrants if the Warrants are exercised and the holders of such Warrants pay the exercise price in cash

upon such exercise and do not utilize the cashless exercise provision of the Warrants. Upon Warrant Stockholder Approval, the Series

A Warrants (but not the Series B Warrants) may be exercised by way of an alternative cashless exercise, meaning that the holder may not

pay a cash purchase price upon exercise, but instead would receive upon such exercise the net number of shares of our common stock determined

according to the formula set forth in the applicable Series A Warrants. Accordingly, we will likely not receive any additional funds

upon the exercise of the Series A Warrants.

DIVIDEND POLICY

We have never declared or paid any cash dividends

on our capital stock, and we do not currently intend to pay any cash dividends on our common stock for the foreseeable future. We expect

to retain future earnings, if any, to fund the development and growth of our business. Any future determination to pay dividends on our

common stock will be at the discretion of our board of directors and will depend upon, among other factors, our results of operations,

financial condition, capital requirements and any contractual restrictions.

DILUTION

If you invest in our securities

in this offering, your interest will be diluted immediately to the extent of the difference between the public offering price per share

of our common stock underlying the units and the as adjusted net tangible book value per share of our common stock immediately after

this offering.

Our net tangible book

value as of September 30, 2023 was approximately negative $20.9 million, or approximately $(3.27) per share. Net tangible book value

is determined by subtracting our total liabilities from our total tangible assets, and net tangible book value per share is determined

by dividing our net tangible book value by the number of shares of our common stock outstanding.

After giving effect to:

(i) the issuance of 307,001 shares of our common stock on October 4, 2023 for warrants exercised on September 29, 2023 at $1.75 per

share under a warrant inducement agreement; (ii) the issuance of 105,000 shares of our common stock for the exercise of 105,000

warrants on October 20, 2023 at $1.369 per share under a warrant inducement agreement; (iii) the issuance of 4,111 shares (net

amount after withholding of shares for income taxes) of our common stock on October 19, 2023 for vesting of restricted stock units

(vi) the issuance of 42,857,142 shares of our common stock underlying the Common Units and Pre-Funded Units to be sold in this

offering (assuming the full exercise of all Pre-Funded Warrants included in the Pre-Funded Units) at a public offering price of

$0.42 per share, attributing no value to the Warrants included in the Common or Pre-Funded Units, and after deducting the

underwriting discount and estimated offering expenses payable by us, our as adjusted net tangible book value as of September 30,

2023 would have been approximately negative $4.7 million, or approximately $(0.09) per share. This represents an immediate

increase in net tangible book value of approximately $3.18 per share to our existing stockholders and an immediate dilution of

approximately $0.51 per share to new investors participating in this offering. The following table illustrates this dilution on a

per share basis:

| Public offering price per unit |

|

|

|

|

$ |

0.42 |

|

| Net tangible book value per share as of September 30, 2023 |

|

$ |

(3.27) |

|

|

|

|

|

| Increase in net tangible book value per share attributable to this offering |

|

$ |

3.18 |

|

|

|

|

|

| As adjusted net tangible book value per share after giving effect to this offering |

|

|

|

|

|

$ |

(0.09) |

|

| Dilution per share to new investors participating in this offering |

|

|

|

|

|

$ |

0.51 |

|

If the underwriter exercises its option to purchase

an additional 6,428,571 Common and/or Pre-Funded Units in full, our as adjusted net tangible book value after giving effect to this offering,

would have been approximately $(0.04) per share, representing an increase in net tangible book value of approximately $3.23 per share

to existing stockholders and immediate dilution in net tangible book value of approximately $0.46 per share to new investors purchasing

shares in this offering.

The above discussion and table are based on 6,403,166 shares of

our common stock outstanding as of September 30, 2023, and excludes as of that date the following (all share and per share amounts are

after giving effect for the 1 for 5 reverse stock split completed on October 13, 2023):

| |

· |

1,000,016 shares of common stock issuable upon the exercise of outstanding stock options, vested and unvested, with a weighted-average exercise price of $10.06 per share; |

| |

· |

307,001 shares of our common stock issued for exercise of warrants at an exercise price of $1.75 per share |

| |

· |

5,000 shares of common stock issuable for vesting of restricted stock units (4,111 shares issued after withholding of shares for income taxes); |

| |

· |

1,261,531 shares of common stock issuable upon the exercise of outstanding warrants (excluding the warrants issued in our August 2022 and May 2023 offerings that are discussed below) with a weighted-average exercise price of $13.488 per share; |

| |

· |

23,454,126 shares of our common stock issuable upon the conversion of the convertible notes we issued in May 2023 based on a conversion price of $1.369 per share; |

| |

· |

4,498,554 shares of common stock issuable upon the exercise of outstanding warrants issued in our August 2022 and May 2023 note offerings at a weighted average exercise price of $1.26 per share; |

| |

· |

up to an aggregate of 251,351 shares of common stock reserved for future issuance under our stock plan, as amended; |

| |

· |

400,000 shares of common stock issuable upon exercise of outstanding warrants issued to the manufacturer of the Stag UTV and Grunt EVO motorcycle at an exercise price of $2.10 per share; |

| |

· |

105,000 shares of common stock issued in connection with a warrant inducement agreement where 105,000 warrants were exercised on October 20, 2023 at an exercise price of $1.369 per share and 105,000 replacement warrants were granted with an exercise price of $1.369 per share; |

| |

· |

up to 45,000,000 shares of common stock underlying the Series A Warrants assuming the Series A Warrants are exercise utilizing the alternative cashless exercise option; and |

| |

· |

up to 15,000,000 shares of common stock underlying the Series B Warrants. |

The above illustration of dilution per share to

investors participating in this offering assumes no exercise of outstanding options or warrants to purchase our common stock, and no conversion

of convertible notes. The exercise of outstanding options or warrants or the conversion of convertible notes having an exercise or conversion

price less than the offering price would increase dilution to investors participating in this offering. In addition, we may choose to

raise additional capital depending on market conditions, our capital requirements and strategic considerations, even if we believe we

have sufficient funds for our current or future operating plans. To the extent that additional capital is raised through our sale of equity

or convertible debt securities, the issuance of these securities could result in further dilution to our stockholders.

UNDERWRITING

We will enter into an underwriting

agreement with Aegis Capital Corp. (“Aegis”) in connection with this offering. Aegis is acting as the sole book-running manager.

The underwriting agreement provides for the purchase of a specific number of units. The underwriter has agreed to purchase the number

of units set forth opposite its name below:

| Underwriter |

|

Number

of

Units |

|

| Aegis Capital Corp. |

|

|

42,857,142 |

|

The underwriter has agreed

to purchase all of the units offered by this prospectus (other than those covered by the over-allotment option described below),

if any are purchased under the underwriting agreement.

The underwriter is offering

the units subject to various conditions and may reject all or part of any order. The representative of the underwriter has advised us

that the underwriter proposes to offer the units directly to the public at the public offering price per unit that appears on the cover

page of this prospectus. In addition, the representative may offer some of the units to other securities dealers at such price less a

concession of $0.0189 per unit. After the units are released for sale to the public, the representative may change the offering

price and other selling terms at various times.

We have granted the underwriter

an over-allotment option to purchase up to 6,428,571 additional shares of common stock and/or Pre-Funded Warrants, representing 15% of

the shares of common stock and Pre-Funded Warrants sold in the offering, and/or up to 2,250,000 additional Series A Warrants, representing

15% of the Series A Warrants sold in the offering, and/or up to 2,250,000 additional Series B Warrants, representing 15% of the Series

B Warrants sold in the offering, on the same terms and conditions set forth above solely to cover over-allotments. The underwriter may

exercise the over-allotment option with respect to shares of common stock only, Pre-Funded Warrants only, Series A Warrants only, Series

B Warrants only, or any combination thereof.

If the underwriter exercises

all or part of this option, they will purchase shares, warrants or units covered by the option at the public offering price that appears

on the cover page of this prospectus, less the underwriting discount. The underwriter has agreed that, to the extent the over-allotment

option is exercised, they will purchase the additional shares, warrants or units reflected in the foregoing table.

The following table provides

information regarding the amount of the discount to be paid to the underwriter by us, before expenses (these amounts are shown assuming

both no exercise and full exercise of the underwriter’s over-allotment option in the offering):

| |

|

Per

Unit (1) |

|

|

Total Without

Exercise of

Underwriter’s

Option |

|

|

Total With

Full Exercise

of

Underwriter’s

Option |

|

| Public offering price |

|

$ |

0.41999 |

|

|

$ |

17,999,604 |

|

|

$ |

20,699,545 |

|

| Underwriting discount (8.0%) |

|

$ |

0.033599 |

|

|

$ |

(1,439,968 |

) |

|

$ |

(1,655,964 |

) |

| Non-accountable expense allowance (1.0%)(2) |

|

$ |

0.00420 |

|

|

$ |

(179,996 |

) |

|

$ |

(206,995 |

) |

| Proceeds to us (before expenses) |

|

$ |

0.38219 |

|

|

$ |

16,379,640 |

|

|

$ |

18,836,586 |

|

| (1) |

The per unit price represents the weighted average price of the Common Units and Pre-Funded Units sold in the offering |

| (2) |

We have agreed to pay a non-accountable expense allowance to Aegis equal to 1.0% of the gross proceeds received in this offering. We

have also agreed to reimburse Aegis for certain out-of-pocket expenses, including, but not limited to, up to $100,000 for reasonable

legal fees and disbursements for the underwriter’s counsel. |

From time to time, Aegis

or its affiliates have in the past or may in the future engage in investment banking and/or other services with us and our affiliates

for which it has received or may in the future receive customary fees and expenses. In September 2023, Aegis served as the underwriter

in connection with a public offering (the “Offering”) of an aggregate of 1,400,000 shares (the “Shares”) of our

common stock, par value $0.00001 per share, pursuant to an underwriting agreement between Aegis and us (the “September Underwriting

Agreement”) containing standard terms, including standstill provisions. The Offering closed on September 18, 2023, and we received

net proceeds of approximately $547,000 after deducting underwriting discounts and commissions and estimated expenses payable by us associated

with the Offering.

On September 29, 2023, we

entered into a warrant inducement agreement with the Investors. In connection with this agreement, we lowered the exercise price of 307,001

warrants to purchase our common stock to $1.75 per share and the Investor exercised these warrants and paid us $537,250. In addition,

we issued 307,001 warrants (“New Warrants”) to purchase our common stock with an exercise price of $2.50 per share. The New

Warrants can be exercised for unregistered shares of our common stock and expire on August 24, 2027. On October 3, 2023, we entered into

a waiver agreement with Aegis (the “Waiver”) pursuant to which Aegis agreed to waive the standstill provisions of the September

Underwriting Agreement in connection with the issuance of the New Warrants to GLV Ventures. The Waiver is limited solely to the proposed

issuance of the New Warrants to GLV Ventures. Aegis is not a party to the warrant inducement agreement, and will not receive any compensation

in connection with the warrant inducement agreement, the issuance of the New Warrants or the Waiver.

Lock-Up Agreements

Our directors and executive

officers have agreed that, for a period of one hundred twenty (120) days from the closing date of the offering, subject to certain limited

exceptions, they will not directly or indirectly, without the prior written consent of Aegis, (a) offer, sell, or otherwise transfer or

dispose of, directly or indirectly, any shares of capital stock of the Company or any securities convertible into or exercisable or exchangeable

for shares of capital stock of the Company; or (b) file or caused to be filed any registration statement with the Commission relating

to the offering of any shares of capital stock of the Company or any securities convertible into or exercisable or exchangeable for shares

of capital stock of the Company.

Our directors and executive

officers have agreed not to offer, sell, dispose of or hedge any shares of our common stock, subject to specified limited exceptions,

for a period of one hundred twenty (120) days after the date of this offering.

Aegis, in its sole discretion,

may release the common stock and other securities subject to the lock-up agreements described above in whole or in part at any time. When

determining whether or not to release common stock and other securities from lock-up agreements, Aegis will consider, among other factors,

the holder’s reasons for requesting the release, the number of shares of common stock and other securities for which the release

is being requested and market conditions at the time.

Company Standstill

Without the prior written

consent of Aegis, the Company has agreed, for a period of one hundred eighty (180) days from the closing date of the offering, that it

will not (a) offer, sell, or otherwise transfer or dispose of, directly or indirectly, any shares of capital stock of the Company or any

securities convertible into or exercisable or exchangeable for shares of capital stock of the Company; or (b) file or caused to be filed

any registration statement with the Commission relating to the offering of any shares of capital stock of the Company or any securities

convertible into or exercisable or exchangeable for shares of capital stock of the Company except for (i) the adoption of an equity incentive

plan, or the amendment of an existing equity incentive plan, and the grant of awards or equity pursuant to any equity incentive plan,

and the filing of a registration statement on Form S-8; provided, however, that any sales by parties to the lockups shall be subject to

the lock-up agreements and (ii) this issuance of shares in connection with an acquisition or a strategic relationship which may include

the sale of equity securities, including, without limitation, an issuance of shares in connection with an agreement with a vehicle manufacturer;

provided, that none of such shares shall be saleable in the public market until the expiration of the applicable period described above.

Right of First Refusal

If, for the period ending

36 months from the closing of the offering, we or any of our subsidiaries decides to raise funds by means of a public offering or a private

placement or any other capital raising financing of equity, equity-linked or debt securities, Aegis (or any affiliate designated

by Aegis) shall have the right to act as sole book-running manager, sole underwriter or sole placement agent for such financing.

If Aegis or one of its affiliates decides to accept any such engagement, the agreement governing such engagement will contain, among

other things, provisions for customary fees for transactions of similar size and nature, but in no event will the fee structure be less

than those outlined in the underwriting agreement between the Company and Aegis entered into for this offering, and the provisions of

such underwriting agreement, including indemnification, which are appropriate to such transaction. Notwithstanding the foregoing, the

decision to accept the Company’s engagement shall be made by Aegis or one of its affiliates, by a written notice to the Company,

within ten (10) days of the receipt of the Company’s notification of its financing needs, which notice shall include a detailed

term sheet.. The foregoing right of first refusal shall not apply to (i) any transaction where the book-running manager, underwriter

or placement agent for such financing is a tier one investment bank in the United States or (ii) any non-public financings or transactions

not involving an investment bank, financial advisor, placement agent, finder or other party receiving payment in connection with the

offering, including, without limitation, rights offerings to existing shareholders or similar transactions.

Tail Financing

Aegis shall be entitled

to compensation with respect to any public or private offering or other financing or capital raising transaction of any kind to the extent

that such financing or capital is provided to us by funds whom Aegis had contacted during the engagement period or introduced to us during

the engagement period, if such tail financing is consummated at any time within the 18 month period following the closing of the

offering or the expiration or termination of the letter of engagement between Aegis and us dated September 29, 2023, as may be amended

from time to time.

Indemnification

We have agreed to indemnify

the underwriter against certain liabilities, including liabilities under the Securities Act of 1933.

Rules of the Securities and

Exchange Commission may limit the ability of the underwriter to bid for or purchase shares before the distribution of the shares is completed.

However, the underwriter may engage in the following activities in accordance with the rules:

· Stabilizing

transactions — The representative may make bids or purchases for the purpose of pegging, fixing or maintaining the price of the

shares, so long as stabilizing bids do not exceed a specified maximum.

· Over-allotments

and syndicate covering transactions — The underwriter may sell more shares of our common stock in connection with this offering

than the number of shares that they have committed to purchase. This over-allotment creates a short position for the underwriter.

This short sales position may involve either “covered” short sales or “naked” short sales. Covered short sales

are short sales made in an amount not greater than the underwriter’s over-allotment option to purchase additional shares in this

offering described above. The underwriter may close out any covered short position either by exercising their over-allotment option or

by purchasing shares in the open market. To determine how they will close the covered short position, the underwriter will consider,

among other things, the price of shares available for purchase in the open market, as compared to the price at which they may purchase

shares through the over-allotment option. Naked short sales are short sales in excess of the over-allotment option. The underwriter must

close out any naked short position by purchasing shares in the open market. A naked short position is more likely to be created if the

underwriter is concerned that, in the open market after pricing, there may be downward pressure on the price of the shares that could

adversely affect investors who purchase shares in this offering.

· Penalty

bids — If the representative purchases shares in the open market in a stabilizing transaction or syndicate covering transaction,

it may reclaim a selling concession from the underwriter and selling group members who sold those shares as part of this offering.

· Passive

market making — Market makers in the shares who is the underwriter may make bids for or purchases of shares, subject to limitations,

until the time, if ever, at which a stabilizing bid is made.

Similar to other purchase

transactions, the underwriter’s purchases to cover the syndicate short sales or to stabilize the market price of our common stock

may have the effect of raising or maintaining the market price of our common stock or preventing or mitigating a decline in the market

price of our common stock. As a result, the price of the shares of our common stock may be higher than the price that might otherwise

exist in the open market. The imposition of a penalty bid might also have an effect on the price of the shares if it discourages resales

of the shares.

Neither we nor the underwriter

make any representation or prediction as to the effect that the transactions described above may have on the price of the shares. These

transactions may occur on the Nasdaq Capital Market or otherwise. If such transactions are commenced, they may be discontinued without

notice at any time.

Electronic Delivery of Preliminary