UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of November 2023

Commission File Number: 001-39461

NANO-X IMAGING LTD

Communications Center

Neve Ilan, Israel 9085000

(Address of principal executive office)

Indicate by check mark whether the registrant

files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☒ Form 40-F ☐

NANO-X IMAGING LTD (the “Company”)

announces that it will hold an Annual General Meeting of Shareholders on Wednesday, December 27, 2023 at 3:00 p.m. (Israel time) (8:00

a.m. EST) at the offices of the Company at The Communications Center, Neve Ilan, Israel. A copy of the Notice of Annual General Meeting

of Shareholders and Proxy Statement and the Proxy Card are attached hereto as Exhibit 99.1 and Exhibit 99.2, respectively, and are incorporated

herein by reference.

The information contained in this report is hereby

incorporated by reference into the Registration Statement on Form F-3, File No. 333-271688, and Form S-8, File No. 333-248322.

EXHIBIT INDEX

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto

duly authorized.

| |

NANO-X IMAGING LTD |

| |

|

| |

By: |

/s/ Ran Daniel |

| |

Name: |

Ran Daniel |

| |

Title: |

Chief Financial Officer |

Date: November 16, 2023

3

Exhibit 99.1

NANO-X IMAGING LTD

The Communications Center

Neve Ilan, Israel 9085000

NOTICE OF ANNUAL GENERAL MEETING OF SHAREHOLDERS

To Be Held on December 27, 2023

Dear Shareholders:

We cordially invite you to

attend the Annual Meeting of Shareholders of Nano-X Imaging Ltd (“we” or the “Company”) to be held

at the Company’s offices at The Communications Center, Neve Ilan, Israel on Wednesday, December 27, 2023 at 3:00 p.m. Israel time

(8:00 a.m. EST), and thereafter as it may be adjourned from time to time (the “Meeting”).

The Meeting is convened for

the following purposes:

| |

1. |

To (i) re-elect each of Ran Poliakine, Dan Suesskind and So Young Shin as Class III directors, to serve until the Company’s annual general meeting of shareholders in 2026, and until their respective successors are duly elected and qualified and (ii) elect Nehama Ronen as a Class I director for a one-year term to expire at the 2024 annual general meeting of shareholders, and until her successor is duly elected and qualified; |

| |

2. |

To approve the award of options to the non-executive directors who shall serve in such capacity immediately following the Meeting; and |

| |

3. |

To approve the re-appointment of Kesselman & Kesselman, Certified Public Accountants (Isr.), a member firm of PricewaterhouseCoopers International Limited, as the Company’s independent registered public accountants for the fiscal year ending December 31, 2023, and for such additional period until our next annual general meeting. |

In addition to considering

the foregoing proposals, the Company’s shareholders will have the opportunity to hear from representatives of the Company’s

management, who will be available at the Meeting to review and discuss with shareholders the consolidated financial statements of the

Company for the year ended December 31, 2022.

Shareholders of record at

the close of business on November 21, 2023 (the “Record Date”) are entitled to notice of and to vote at the Meeting

and any adjournments thereof. You are also entitled to notice of the Meeting and to vote at the Meeting if you held ordinary shares through

a bank, broker or other nominee that is one of our shareholders of record at the close of business on the Record Date, or which appeared

in the participant listing of a securities depository on that date.

If

you are a shareholder of record, you can vote either by mailing in your proxy, by Internet or on your smartphone or tablet or in person

by attending the Meeting. Only proxies that are received at the offices of the Company at The Communications Center, Neve Ilan, Israel,

Attention Marina Gofman Feler, Chief Legal Officer or by Broadridge Financial Solutions, Inc. (“Broadridge”)

at Vote Processing, c/o Broadridge, 51 Mercedes Way, Edgewood, NY 11717, on or

before December 25, 2023 at 3:00 p.m. Israel time (8:00 a.m. EST), will be deemed received in a timely fashion and the votes therein recorded.

If you attend the Meeting, you can revoke your proxy and vote your shares in person. If you hold

ordinary shares through a bank, broker or other nominee (i.e., in “street name”) which is one of our shareholders of record

at the close of business on the Record Date, or which appears in the participant listing

of a securities depository on that date, you must follow the instructions included in the voting instruction form you receive from your

bank, broker or nominee, and may also be able to submit voting instructions to your bank, broker or nominee by phone or via the Internet

or smartphone or tablet. If you hold your ordinary shares in “street name”

and you wish to vote in person at the Meeting, you must first obtain a “legal proxy” from your broker, bank, trustee or nominee

that holds your shares giving you the right to vote the shares at the Meeting.

Our Board of Directors

recommends that you vote FOR the election of each of the director nominees named above and each of the other proposals, which are described

in the Proxy Statement.

The presence, in person or

by proxy, of at least two shareholders holding at least twenty five percent (25%) of the voting rights, will constitute a quorum at the

Meeting. If such quorum is not present within half an hour from the time scheduled for the Meeting,

the Meeting will be adjourned to December 31, 2023, at the same time and place. At such adjourned meeting, the presence of at least one

or more shareholders in person or by proxy (regardless of the voting power represented by their ordinary shares) will constitute a quorum.

Each

ordinary share is entitled to one vote upon each of the proposals to be presented at the Meeting. The affirmative vote of the holders

of a majority of the ordinary shares represented at the Meeting, in person or by proxy, and voting on the matter, is required to approve

each of the proposals.

The

last date for submitting a request to include a proposal in accordance with Section 66(b) of the Israeli Companies Law, 1999 (the “Companies

Law”), is November 23, 2023. To the extent any shareholder would like to state his/her/its position with respect to any

of the proposals described in this notice, pursuant to regulations under the Companies Law, such shareholder may do so by delivery of

a notice to the Company’s offices located at The Communications Center, Neve Ilan 9085000, Israel, not later than 3:00 p.m. Israel

time (8:00 a.m. EST) on December 17, 2023.

This Notice, together with

the Proxy Statement describing the various matters to be voted upon at the Meeting and the accompanying proxy card, will be mailed to

our shareholders of record. We will mail to our beneficial owners a Notice of Internet Availability of Proxy Materials (the “Notice”)

and will post our proxy materials on the website referenced in the Notice. Shareholders may also review the full version of the proposed

resolutions in the Proxy Statement as well as the accompanying proxy card, at www.proxyvote.com as described in the Notice or via the

website of the U.S. Securities and Exchange Commission at www.sec.gov as well at the Company’s offices upon

prior notice and during regular working hours (telephone number: +972-2-5360360) or

on the Company’s website www.nanox.vision until the date of the Meeting.

YOUR VOTE IS IMPORTANT. WHETHER OR NOT YOU

EXPECT TO ATTEND THE MEETING, PLEASE DATE AND SIGN THE PROXY CARD AND RETURN IT PROMPTLY IN THE ENCLOSED ENVELOPE FOR WHICH NO POSTAGE

IS REQUIRED IF MAILED IN THE UNITED STATES OR VOTE OVER THE INTERNET OR ON YOUR SMARTPHONE OR TABLET IN ACCORDANCE WITH THE INSTRUCTIONS

ON YOUR PROXY CARD. YOU CAN LATER REVOKE YOUR PROXY, ATTEND THE MEETING AND VOTE YOUR SHARES IN PERSON. ALL PROXY INSTRUMENTS AND POWERS

OF ATTORNEY MUST BE DELIVERED TO THE COMPANY OR BROADRIDGE NO LATER THAN 48 HOURS PRIOR TO THE MEETING. DETAILED PROXY VOTING INSTRUCTIONS

ARE PROVIDED BOTH IN THE PROXY STATEMENT AND ON THE ENCLOSED PROXY CARD.

| |

By Order of the Board of Directors, |

| |

|

| |

Ran Poliakine |

| |

Chairman of the Board of Directors |

| |

|

| November 16, 2023 |

|

NANO-X IMAGING LTD

The Communications Center

Neve Ilan, Israel 9085000

PROXY STATEMENT

ANNUAL GENERAL MEETING OF SHAREHOLDERS

To Be Held on December 27, 2023

This Proxy Statement is furnished

to the holders of ordinary shares, NIS 0.01 par value, of Nano-X Imaging Ltd (“we,” “us,” “our”

or the “Company”) in connection with the solicitation of proxies to be voted at the Annual General Meeting of Shareholders

of the Company (the “Meeting”), and at any adjournment thereof, pursuant to the accompanying Notice of Annual General

Meeting of Shareholders. The Meeting will be held on Wednesday, December 27, 2023 at 3:00 p.m. Israel time (8:00 a.m. EST) at the Company’s

offices at The Communications Center, Neve Ilan, Israel.

Purpose of the Annual General Meeting

At the Meeting, shareholders

of the Company will be asked to consider and vote upon the following: (1) (i) the re-election of each of Ran Poliakine, Dan Suesskind

and So Young Shun as Class III directors, to serve until the Company’s annual general meeting of shareholders in 2026, and until

their respective successors are duly elected and qualified; and (ii) the election of Nehama Ronen as a Class I director for a one-year

term to expire at the 2024 annual general meeting of shareholders, and until her successor is duly elected and qualified; (2) the approval

of the award of options to the non-executive directors who shall serve in such capacity immediately following the Meeting; and (3) the

approval of the re-appointment of Kesselman & Kesselman, Certified Public Accountants (Isr.), a member firm of PricewaterhouseCoopers

International Limited, as our independent registered public accountants for the fiscal year ending December 31, 2023 and for such additional

period until our next annual general meeting. In addition, at the Meeting, representatives of our management will be available to review

and discuss our financial statements for the year ended December 31, 2022.

We are not aware of any other

matters that will come before the Meeting. If any other matters properly come before the Meeting, the persons designated as proxies intend

to vote on such matters in accordance with their judgment and recommendation of the Board of Directors.

Recommendation of the Board of Directors

Our Board of Directors

recommends that you vote FOR the election of each of the director nominees named above and each of the other proposals, which are described

in the Proxy Statement.

Shareholders Entitled to Vote.

You are entitled to notice

of, and to vote in person or by proxy at the Meeting, if you are a holder of record of our ordinary shares as of the close of business

on November 21, 2023. You are also entitled to notice of the Meeting and to vote at the Meeting if you held ordinary shares through a

bank, broker or other nominee that is one of our shareholders of record at the close of business on November 21, 2023, or which appeared

in the participant listing of a securities depository on that date. See below “How You Can Vote.”

How You Can Vote

| |

● |

Voting in Person. If you are a shareholder of record, i.e., your shares are registered directly in your name with our transfer agent, Continental Stock Transfer & Trust Inc., you may attend and vote in person at the Meeting. If you are a beneficial owner of shares registered in the name of your broker, bank, trustee or nominee (i.e., your shares are held in “street name”), you are also invited to attend the Meeting; however, to vote in person at the Meeting as a beneficial owner, you must first obtain a “legal proxy” from your broker, bank, trustee or nominee that holds your shares giving you the right to vote the shares at the Meeting. If you vote by Internet or smartphone or tablet or by mailing your proxy, there is no need to vote again at the Meeting unless you wish to revoke and change your vote. |

| |

● |

Voting by mailing your proxy. If you are a shareholder of record, these proxy materials are being sent directly to you. You may submit your proxy by completing, signing, and mailing the enclosed proxy card that was mailed to you in the enclosed, postage-paid envelope. If your ordinary shares are held in “street name” and you have received printed copies of these proxy materials, please follow the voting instructions provided to you by your broker, trustee or nominee. Proxies must be received by Broadridge Financial Solutions, Inc. (at Vote Processing, c/o Broadridge, 51 Mercedes Way, Edgewood, NY 11717) or at our registered office in Israel no later than forty-eight (48) hours prior to the designated time for the Meeting. |

| |

● |

Voting by Internet or mobile. If you are a shareholder of record, you can submit a proxy over the Internet by logging on to the website listed on the enclosed proxy card, entering your control number located on the enclosed proxy card and submitting a proxy by following the on-screen prompts. You may also access Internet voting via your smartphone or tablet by scanning the QR image that appears on your proxy card. If you hold shares in “street name,” you may vote those shares by accessing the Internet website address specified in the Notice of Internet Availability of Proxy Materials or in the instructions provided by your broker, bank, trustee or nominee. Submitting an Internet or mobile proxy will not affect your right to vote at the Meeting should you decide to attend the Meeting. |

Change or Revocation of Proxy

If you are a shareholder of

record, you may change your vote at any time prior to the exercise of authority granted in the proxy by delivering to us a written notice

of revocation, by granting a new proxy bearing a later date or by voting again via the Internet or your smartphone or tablet, or by attending

the Meeting and voting in person. Attendance at the Meeting will not cause your previously granted proxy to be revoked unless you specifically

so request.

If your shares are held in

“street name,” you may change your vote by submitting new voting instructions to your broker, bank, trustee or nominee or,

if you have obtained a legal proxy from your broker, bank, trustee or nominee giving you the right to vote your shares, by attending the

Meeting and voting in person.

Solicitation of Proxies

All expenses of this solicitation

will be borne by the Company. In addition to the solicitation of proxies by mail, directors, officers and employees of the Company, without

receiving additional compensation therefor, may solicit proxies by telephone, facsimile, in person or by other means. Brokerage firms,

nominees, fiduciaries and other custodians have been requested to forward proxy solicitation materials to the beneficial owners of shares

of the Company held of record by such persons, and the Company will reimburse such brokerage firms, nominees, fiduciaries and other custodians

for reasonable out-of-pocket expenses incurred by them in connection therewith.

Quorum

The presence, in person or

by proxy, of at least two shareholders holding at least twenty five percent (25%) of the voting rights, will constitute a quorum at the

Meeting. If such quorum is not present within half an hour from the time scheduled for the Meeting, the Meeting will stand adjourned to

December 31, 2023, at the same time and place. At such adjourned meeting, the presence of at least one or more shareholders in person

or by proxy (regardless of the voting power represented by their ordinary shares) will constitute a quorum. This notice will serve as

notice of such reconvened meeting if no quorum is present at the original date and time and no further notice of the reconvened meeting

will be given to shareholders.

Abstentions and broker non-votes

will be counted towards the quorum. Broker non-votes occur when brokers that hold their customers’ shares in street name sign and

submit proxies for such shares and vote such shares on some matters but not on others. This occurs when brokers have not received any

instructions from their customers, in which case the brokers, as the holders of record, are permitted to vote on “routine”

matters, but not on non-routine matters.

Unsigned or unreturned proxies,

including those not returned by banks, brokers, or other record holders, will not be counted for quorum or voting purposes.

Vote Required for Approval of the Proposals

Each ordinary share entitles

the holder to one vote. The affirmative vote of the holders of a majority of the ordinary shares represented at the Meeting, in person

or by proxy, voting on the matter, is required to approve each of the proposals being presented at the Meeting.

In tabulating the voting results

for any particular proposal, shares that constitute broker non-votes and abstentions are not considered votes cast on that proposal, and

will have no effect on the vote. Unsigned or unreturned proxies, including those not returned by banks, brokers, or other record holders,

will not be counted for voting purposes. Therefore, it is important for a shareholder that holds ordinary shares through a bank or broker

to instruct its bank or broker how to vote its shares if the shareholder wants its shares to count towards the vote tally for a given

proposal.

Security Ownership of Certain Beneficial Owners and Management

The following table sets forth

information with respect to the beneficial ownership of our ordinary shares as of November 1, 2023 by: (i) each person or entity known

by us to own beneficially more than 5% of our outstanding ordinary shares, based on public filings or information provided to us; (ii)

each of our directors and executive officers; and (iii) all of our directors and executive officers as a group.

The beneficial ownership of

our ordinary shares is determined in accordance with the rules of the U.S. Securities and Exchange Commission (“SEC”).

Under these rules, a person is deemed to be a beneficial owner of a security if that person has or shares voting power, which includes

the power to vote or to direct the voting of the security, or investment power, which includes the power to dispose of or to direct the

disposition of the security. In determining beneficial ownership percentages, we deem ordinary shares that a shareholder has the right

to acquire, including the ordinary shares issuable pursuant to options or warrants that are currently exercisable or exercisable within

60 days of November 1, 2023 and ordinary shares underlying restricted stock units (“RSUs”) that are vested or vest

within 60 days of November 1, 2023, if any, to be outstanding and to be beneficially owned by the person with such right to acquire additional

ordinary shares for the purposes of computing the percentage ownership of that person, but we do not treat them as outstanding for the

purpose of computing the percentage ownership of any other person. The percentage of ordinary shares beneficially owned prior to or after

the offering is based on 57,732,425 ordinary shares outstanding as of November 1, 2023.

| | |

Shares Beneficially Owned | |

| Name of Beneficial Owner | |

Number | | |

Percentage | |

| 5% or greater shareholders | |

| | |

| |

| SK square Co., Ltd. and SK Square Americas, Inc. (formerly known as SK Telecom TMT Investment Corp.)(1) | |

| 4,869,909 | | |

| 7.51 | % |

| Ran Poliakine (2) | |

| 3,358,009 | | |

| 5.43 | % |

| Executive Officers | |

| | | |

| | |

| Erez Meltzer (3) | |

| 191,901 | | |

| * | |

| James Dara (4) | |

| 91,979 | | |

| * | |

| Ran Daniel (5) | |

| 27,395 | | |

| * | |

| Ofir Koren (6) | |

| 86,822 | | |

| * | |

| Gali Yahav (7) | |

| 12,895 | | |

| * | |

| Guy Yoskovitz (8) | |

| 55,449 | | |

| * | |

| Tamar Aharon Cohen (9) | |

| 39,707 | | |

| * | |

| Marina Gofman Feler (10) | |

| 3,125 | | |

| - | |

| Orit Wimpfheimer (11) | |

| 17,592 | | |

| * | |

| Directors | |

| | | |

| | |

| Ran Poliakine (2) | |

| 3,358,009 | | |

| 5.43 | % |

| Erez Meltzer (3) | |

| 191,901 | | |

| * | |

| Noga Kainan (12) | |

| 26,044 | | |

| * | |

| So Young Shin (13) | |

| 24,349 | | |

| * | |

| Dan Suesskind (12) | |

| 26,044 | | |

| * | |

| Erez Alroy | |

| - | | |

| - | |

| All directors and executive officers as a group (14 persons) | |

| 3,979,021 | | |

| 6.74 | % |

| * | Amount

represents less than 1% of outstanding ordinary shares. |

| (1) | Based

solely on the Schedule 13G filed by SK square Co., Ltd.

and SK Square Americas, Inc. with the SEC on February 14, 2023, consisting of (i) 2,607,466 ordinary shares and (ii) a warrant to purchase

2,262,443 ordinary shares held by SK Square Americas, Inc., a wholly owned subsidiary of SK square. Co., Ltd. |

| (2) | Represents

(i) 2,626,927 ordinary shares and (ii) options to purchase 731,082 ordinary shares currently exercisable or exercisable within 60 days

of November 1, 2023. |

| (3) | Represents

(i) 7,917 ordinary shares and (ii) options to purchase 183,984 ordinary shares currently

exercisable or exercisable within 60 days of November 1,

2023. |

| (4) | Represents

options to purchase 91,979 ordinary shares currently

exercisable or exercisable within 60 days of November 1,

2023. |

| (5) | Represents

options to purchase 27,395 ordinary shares currently

exercisable or exercisable within 60 days of November 1,

2023. |

| (6) | Represents

(i) options to purchase 76,822 ordinary shares currently

exercisable or exercisable within 60 days of November 1,

2023 and (ii) 10,000 vested RSUs. |

| (7) | Represents

options to purchase 12,895 ordinary shares currently

exercisable or exercisable within 60 days of November 1,

2023. |

| (8) | Represents

(i) 13,575 ordinary shares, (ii) options

to purchase 36,874 ordinary shares currently exercisable or exercisable within 60 days of

November 1, 2023 and (iii) 5,000 vested RSUs. |

| (9) |

Represents options to purchase 39,707 ordinary shares currently exercisable or exercisable within 60 days of November 1, 2023. |

| |

|

| (10) |

Represents options to purchase 3,125 ordinary shares currently exercisable or exercisable within 60 days of November 1, 2023. |

| (11) | Represents

(i) options to purchase 14,103 ordinary shares currently

exercisable or exercisable within 60 days of November 1,

2023 and (ii) 3,489 vested RSUs. |

| (12) | Represents

options to purchase 26,044 ordinary shares currently exercisable or exercisable within 60 days of November 1, 2023. |

| (13) | Represents

options to purchase 24,349 ordinary shares currently

exercisable or exercisable within 60 days of November 1,

2023. |

Executive Officer Compensation

For information regarding

the compensation incurred by us in relation to our five most highly compensated office holders (within the meaning of the Israeli Companies

Law, 1999 (the “Companies Law”)) for the year ended December 31, 2022, see “Item 6B. Directors, Senior Management

and Employees — Compensation of Directors and Executive Officers” of our annual report on Form 20-F for the year ended December

31, 2022, filed with the SEC on May 1, 2023.

Board Diversity Matrix

The table below provides certain

information with respect to the diversity of our Board of Directors as of the date hereof.

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Country of Principal Executive Offices |

|

Israel |

|

|

|

|

|

|

|

|

|

|

| Foreign Private Issuer: |

|

Yes |

|

|

|

|

|

|

|

|

|

|

| Disclosure Prohibited Under Home Country Law |

|

No |

|

|

|

|

|

|

|

|

|

|

| Total Number of Directors |

|

6 |

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Female |

|

|

Male |

|

|

Non-Binary |

|

|

Did Not

Disclose

Gender |

|

| Part I: Gender Identity |

|

|

|

|

|

|

|

|

|

|

|

|

| Directors |

|

|

2 |

|

|

|

4 |

|

|

|

- |

|

|

|

- |

|

| Part II: Demographic Background |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Underrepresented Individual in Home Country Jurisdiction |

|

1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| LGBTQ+ |

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Did Not Disclose Demographic Background |

|

1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

PROPOSAL 1

RE-ELECTION OF CLASS III DIRECTORS

(Item 1 on the Proxy Card)

Background

The Company’s Articles

of Association provide that the number of directors shall be not less than 5 and not more than 10. There are currently six members on

the Company’s Board of Directors. The Company’s Board of Directors is classified into three classes of directors with staggered

three-year terms as follows:

| Name |

|

Age |

|

Position |

| Class I Directors Serving until 2024 Annual General Meeting |

| |

| Erez Meltzer |

|

66 |

|

Chief Executive Officer and Director |

| |

| Class II Directors Serving until 2025 Annual General Meeting |

| |

| Erez Alroy (1) |

|

61 |

|

Independent Director |

| Noga Kainan (1) |

|

69 |

|

Independent Director |

| |

| Class III Directors Serving until 2023 Annual General Meeting |

| |

| Ran Poliakine |

|

56 |

|

Chairman of the Board of Directors |

| Dan Suesskind (1) |

|

79 |

|

Independent Director |

| So Young Shin |

|

45 |

|

Independent Director |

| (1) | Member

of our audit committee and compensation committee |

At each annual general meeting

of our shareholders, the election or re-election of directors following the expiration of the term of office of the directors of that

class will be for a term of office that expires on the date of the third annual general meeting following such election or re-election.

At the Meeting, the term of

the Class III directors, namely, Ran Poliakine, the Chairman of our Board of Directors, Dan Suesskind and So Young Shin, will expire and

successor Class III directors shall be elected at the Meeting. We rely on the exemption available to foreign private issuers under the

Nasdaq Listing Rules and follow Israeli law and practice with regard to the process of nominating directors, in accordance with which

our Board of Directors (or a committee thereof) is authorized to recommend to our shareholders director nominees for election. Accordingly,

our Board of Directors has nominated each of Ran Poliakine, Dan Suesskind and So Young Shin for re-election to our Board of Directors

as Class III directors for an additional three-year term to expire at the 2026 annual general meeting of our shareholders, and until their

respective successors have been duly elected and qualified or until their respective office is vacated in accordance with our Articles

of Association and the Companies Law.

In addition, our Board of

Directors has nominated Nehama Ronen for election to our Board of Directors as a Class I director for a one-year term to expire at the

2024 annual general meeting of our shareholders, and until her successor has been duly elected and qualified or until her office is vacated

in accordance with our Articles of Association and the Companies Law.

Each of Dan Suesskind, So

Young Shin and Nehama Ronen, who are standing for election at the Meeting, and our directors Noga Kainan and Erez Alroy, qualifies as

an independent director under the Nasdaq Listing Rules. Subject to shareholder approval of the above director nominees, our Board of Directors

will consist of seven members, five of whom satisfy the independence requirements of the Nasdaq Listing Rules.

In accordance with the Companies

Law, each of the director nominees has certified to us that he or she meets all the requirements of the Companies Law for election as

a director of a public company and that he or she possesses the necessary qualifications and is able to dedicate sufficient time to fulfill

his or her duties as a director of our company, taking into consideration our company’s size and special needs.

We are unaware of any reason

why any of the nominees, if re-elected, should be unable to serve as a director. All nominees listed below have advised the Board of Directors

of the Company that they intend to serve as director if re-elected.

Nominees for Director

The following information

concerning the director nominees is based on the records of the Company and information furnished to it by the nominees:

Ran

Poliakine, our founder, has served as a member of our board of directors since our inception and has served as the Chairman of

the Board of Directors since the closing of our initial public offering. Mr. Poliakine served as our Chief Executive Officer from

September 2019 until January 2022, and served as Chief Executive Officer of Nanox Imaging PLC (“Nanox

Gibraltar”), a Gibraltar public company, from August 2018 until November 2019. Prior to that, Mr. Poliakine served

as Chief Strategy Officer of Nanox Gibraltar from June 2015 to August 2018. Mr. Poliakine is a serial entrepreneur and has founded

numerous companies over the past two decades, including SixAI Ltd. (“SixAI”) and two of its controlled subsidiaries

634 Ai Ltd. (“634 Ai”) and Musashi Ai Ltd., Powermat Technologies Ltd., Wellsense, Inc., and Illumigyn Ltd. (“Illumigyn”).

Mr. Poliakine is the chief executive officer and chairman of the board of directors of SixAI, the chairman of the board of directors

and a senior advisor to Illumigyn, and a member of the board of directors of Powermat Technologies Ltd.

Dan

Suesskind has served as a member of our board of directors since February 2021. Mr. Suesskind served as the Chief Financial

Officer of Teva Pharmaceutical Industries Ltd. (“Teva”) from 1977 to 2008 and as a director of Teva for several periods

of time until 2018. Mr. Suesskind is currently a director of Nextar Chempharma Solutions Ltd., Sanotize Research and Development Corp.,

Imed Infinity Medical Limited partnership (TASE) and The Jerusalem Foundation. Mr. Suesskind previously served as a director of the following

companies: Israel Corporation Ltd., Redhill Biopharma Ltd., Syneron Medical Ltd., Migdal Ltd., Ness Technologies Inc., the First International

Bank of Israel, First International Selective Investment – Portfolio Management Company Ltd., LanOptics Ltd., ESC Medical Systems

and the Hadassah Medical Center in Jerusalem. Mr. Suesskind’s public activities include membership in the Investment Committee of

the Israeli Academy of Sciences and Humanities, Ben Gurion University and the Jerusalem Foundation. Mr. Suesskind is a member of the Board

of Trustees of the Hebrew University of Jerusalem and the Board of Trustees of Ben Gurion University. Mr. Suesskind has a bachelor’s

degree in economics and political science from the Hebrew University of Jerusalem and an M.B.A. degree from the University of Massachusetts.

So

Young Shin has served as a member of our board of directors since May 2022. Ms. Shin has served as Chief Executive Officer

of SK Hynix America Investment Corp. and SK Square Americas, Inc., U.S. investment entities of the SK group, based in New York, since

November 2021 and prior to that, served as Chief Executive Officer of SK Telecom TMT Investment Corp. from January 2020, a U.S. investment

entity of SK Telecom, based in New York. Prior to that, Ms. Shin served in the SK Telecom group as Managing Director, Head of SK Telecom

EU office (May 2017-January 2020) and Team Leader, Smart Learning TF (January 2010- May 2017). Ms. Shin has a BA degree in Computer Science

from Ewha Womans University, an M.A. degree in Economics from Seoul National University and an M.B.A. degree from Oxford Saïd Business

School, Oxford University.

Nehama

Ronen served as the Director General of the Israeli Ministry of Environmental Protection (during the years 1996-1999) and

as a member of the Israeli Knesset (during the years 2001-2003). Since 2004, Ms. Ronen has served as the Chairperson of Maman Cargo Terminals

& Handling Ltd., Israel’s largest and leading logistic company. From 2005-2019, Ms. Ronen served as Executive Chairperson of

ELA Recycling Corporations. Ms. Ronen has served on the board of directors of Tamar Petroleum Ltd. (established to sell the Tamar Gas

Reservoir) since 2017, of Dan Public Transportation since 2020 and of Trendlines Group (which invests in innovations in agrifood technologies

and MedTech) since 2022. Previously, Ms. Ronen served as a director on the board of directors of Bank Hapoalim (during the years 2010-2015)

and SHL Telemedicine (during the years 2007-2016). Ms. Ronen also previously served as a member of the board of directors of Oil Refineries

Ltd., where she also served as the chairperson of its environmental committee and a member of its audit and corporate governance committees

(during the years 2008-2011). Ms. Ronen’s civic activities include participating in a number of advisory boards of major Israeli

academic institutions. Ms. Ronen holds a B.A. degree in Education and History from Tel Aviv University and Beit Berl Collage and an M.A.

degree in Public Management from Haifa University.

If

elected at the Meeting, each of the director nominees (other than Mr. Ran Poliakine, the non-executive Chairman of our Board of Directors)

shall be entitled to the same cash compensation currently paid to our non-executive directors of $36,000 per annum plus an additional

annual fee for service on a board committee of $7,500 per each committee (or $15,000 for the chairperson of a committee), paid monthly.

If they are elected as directors at the Meeting, the approval of the election of such director nominees will be deemed to be an approval

of the foregoing cash compensation. In addition, at the Meeting, shareholders are being asked to approve the grant of options to each

of the non-executive director nominees (i.e., other than Mr. Ran Poliakine), subject to their respective election as a director at the

Meeting (see Proposal 2). Mr. Ran Poliakine, who served as our Chief Executive Officer until December 31, 2021, and as Executive Chairman

of our Board of Directors until September 30, 2022, began to serve as a non-executive Chairman of our Board of Directors effective as

of October 1, 2022. In lieu of cash compensation for his services as non-executive Chairman of the Board of Directors, Mr. Poliakine was

granted options to purchase 85,000 ordinary shares, at an exercise price of $17.63 per share, pursuant to the approval of our shareholders

at the annual general meeting held on December 28, 2022. The options vest in 16 equal installments over a period of four years, such that

6.25% of the options vest on each of the three-month anniversaries of the effective vesting commencement date of October 1, 2022, subject

to Mr. Poliakine’s continuing service as Chairman of the Board of Directors on each applicable vesting date, and will be exercisable

for a period of 24 months following termination of service. The vesting of any outstanding options shall fully accelerate upon an M&A

Transaction, as defined in our 2019 Equity Incentive Plan (the “2019 Plan”). In addition, if elected at the Meeting,

the director nominees will benefit from our directors’ and officers’ liability insurance policy, as in effect from time to

time, and indemnification and exemption letter agreements.

Proposal

The shareholders are being

asked to (i) re-elect each of Ran Poliakine, Dan Suesskind and So Young Shin as Class III directors for a term to expire at the 2026 annual

general meeting of our shareholders, and until his/her respective successor has been duly elected and qualified, or until his/her office

is vacated in accordance with our Articles of Association or the Companies Law; and (ii) elect Nehama Ronen as a Class I director for

a one-year term to expire at the 2024 annual general meeting of shareholders, and until her successor is duly elected and qualified, or

until her office is vacated in accordance with our Articles of Association or the Companies Law. Each director nominee shall be voted

on separately.

Approval Required

See “Vote Required for

Approval of the Proposals” above.

Board Recommendation

Our Board of Directors

recommends a vote “FOR” the re-election of each of Ran Poliakine, Dan Suesskind and So Young Shin as a Class III director

for a term to expire at the 2026 annual general meeting of shareholders and the election of Nehama Ronen as a Class I director for a one-year

term to expire at the 2024 annual general meeting of shareholders.

PROPOSAL 2

APPROVAL OF GRANT OF OPTIONS TO CERTAIN NON-EXECUTIVE

DIRECTORS

(Item 2 on the Proxy Card)

Background

Under the Companies Law, the

terms of compensation of directors, including equity-based compensation, generally requires the approval of the compensation committee,

board of directors and shareholders, in that order.

Our Compensation Committee

and Board of Directors determined to approve, subject to shareholder approval, the award to (i) each of our current non-executive directors,

i.e., Erez Alroy, Noga Kainan, Dan Suesskind and So Young Shin, of options to purchase 10,000 ordinary shares at an exercise price of

$11.52 per share (which is equal to the average share price of our ordinary shares on the Nasdaq Global Market during the 30 calendar

days prior to approval of the grant by our Board of Directors); and (ii) Nehama Ronen, who is standing for election as a director of the

Company for the first time at the Meeting, of options to purchase 50,000 ordinary shares at an exercise price of $17.63 per share, which

is the standard exercise price for the first option award to a director. The Black-Scholes-Merton value of the option awards to our current

non-executives and to Nehama Ronen as of November 1, 2023 was approximately $6,565 and $37,637, respectively, per vesting annum (based

on the fair value of the grant on the assumed date of November 1, 2023, calculated annually, on a linear basis), which is in compliance

with our Compensation Policy for Officers and Directors (the “Compensation Policy”). Since the Black-Scholes-Merton

model is merely a financial model that determines the accounting value of the grant, it does not guarantee any actual economic gain to

the directors. The directors will only realize an economic gain from such option grant if our share price increases and exceeds the exercise

price, irrespective of the Black-Scholes-Merton value of the option granted. Subject to shareholder approval of the option awards, the

options shall vest over a period of four years, such that (i) with respect to the option awards to each of our current non-executive directors

other than Nehama Ronen, the options shall vest in 16 equal installments, of 6.25% each, on each of the three-month anniversaries commencing

as of the date of the approval of the grant by our Board of Directors; and (ii) with respect to the option award to Nehama Ronen, 25%

of the options shall vest on the first anniversary of the date of grant and thereafter, the options shall vest quarterly in equal installments,

in each case, subject to the respective director’s continued service on each applicable vesting date. The vesting of any outstanding

options shall fully accelerate upon an M&A Transaction, as defined in the 2019 Plan. The options shall be granted in accordance with

Section 102 of the Israeli Income Tax Ordinance (New Version), 1961, as amended, and the regulations

promulgated thereunder, under the capital gains track though a trustee. The options shall be awarded under, and shall be subject

to, the terms and conditions of the 2019 Plan and the award agreement to be entered into with each of the directors. The award of the

proposed options to the directors is consistent with our Compensation Policy. With respect to Dan Suesskind, So Young Shin and Nehama

Ronen, the option award is subject to their respective election as a director at the Meeting under Proposal 1 (such that if he/she is

not elected at the Meeting, he/she shall not be entitled to the options).

Proposal

It is proposed that the following

resolution be adopted at the Meeting:

“RESOLVED, to approve the award

of options to the Company’s non-executive directors who shall serve in such capacity immediately following the Meeting, in such

amounts and with such terms and conditions (including exercise price and vesting terms), as set forth in Proposal 2 of the Proxy Statement

for the Meeting.”

Vote

Required

See “Vote Required for

Approval of the Proposals” above.

Board

Recommendation

Our Board of Directors

recommends a vote “FOR” the foregoing resolution.

PROPOSAL 3

APPROVAL OF THE RE-APPOINTMENT OF KESSELMAN

& KESSELMAN (PWC ISRAEL) AS THE COMPANY’S INDEPENDENT ACCOUNTANTS

(Item 3 on the Proxy Card)

Background

At the Meeting, shareholders

will be asked to ratify and approve the re-appointment of Kesselman & Kesselman, Certified Public Accountants (Isr.), a member firm

of PricewaterhouseCoopers International Limited, as our independent registered public accountants for the fiscal year ending December

31, 2023 and for such additional period until our next annual general meeting, pursuant to the recommendation of our Audit Committee and

Board of Directors.

In accordance with the rules

of the SEC, Israeli law and our Articles of Association, our Audit Committee pre-approves and recommends to the Board, and our Board of

Directors approves the compensation of Kesselman & Kesselman for audit and other services, in accordance with the volume and nature

of their services. The following table sets forth the aggregate fees by categories specified below in connection with certain professional

services rendered by its independent auditors Kesselman & Kesselman in each of the last two fiscal years.

| | |

Year Ended

December 31, | |

| | |

2021 | | |

2022 | |

| Audit Fees(1) | |

$ | 608,000 | | |

$ | 577,000 | |

| Audit-Related Fees(2) | |

| — | | |

| — | |

| Tax Fees(3) | |

| 19,000 | | |

| 37,000 | |

| All Other Fees(4) | |

| — | | |

| 11,000 | |

| Total | |

$ | 627,000 | | |

$ | 625,000 | |

| (1) | “Audit

Fees” represents the aggregate fees billed or accrued for the interim reviews and audit of our annual financial statements. This

category also includes services that generally the independent accountant provides, such as consents and assistance with and review of

documents filed with the SEC as well as fees related to audits in connection with our secondary public offering in February 2021. |

| (2) | “Audit-Related

Fees” represents the aggregate fees billed or accrued for assurance and related services that are reasonably related to the performance

of the audit or review of our financial statements and not reported under “Audit Fees.” |

| (3) | “Tax

Fees” represents the aggregate fees billed or accrued for professional tax services rendered by our independent registered public

accounting firm for tax compliance and tax advice on actual or contemplated transactions. |

| (4) | “All

Other Fees” represents the aggregate fees billed or accrued for services rendered by our independent registered public accounting

firm other than services reported under “Audit Fees,” “Audit-Related Fees” and “Tax Fees.” |

Proposal

It is proposed that the following

resolution be adopted at the Meeting:

“RESOLVED, to re-appoint Kesselman

& Kesselman, a member firm of PricewaterhouseCoopers International Limited, as the Company’s independent registered public accounting

firm for the year ending December 31, 2023 and for such additional period until the next annual general meeting of shareholders.”

Vote

Required

See “Vote Required for

Approval of the Proposals” above.

Board

Recommendation

Our Board of Directors

recommends a vote “FOR” the foregoing resolution.

REVIEW AND DISCUSSION OF AUDITED CONSOLIDATED

FINANCIAL STATEMENTS

At the Meeting, our audited

consolidated financial statements for the fiscal year ended December 31, 2022 will be presented. The Company’s audited consolidated

financial statements for the fiscal year ended December 31, 2022, which form part of our annual report on Form 20-F, were filed with the

SEC on May 1, 2023, and appear on its website: www.sec.gov, as well as on the Company’s website: www.nanox.vision. None of the audited

financial statements, the Form 20-F nor the contents of our website form part of the proxy solicitation material. This item does not involve

a vote of the shareholders.

We are subject to the information

reporting requirements of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), as applicable to foreign

private issuers. We fulfill these requirements by filing reports with the SEC. Our SEC filings are available to the public on the SEC’s

website at www.sec.gov. As a foreign private issuer, we are exempt from the rules under the Exchange Act related to the furnishing and

content of proxy statements. The circulation of this Proxy Statement should not be taken as an admission that we are subject to those

proxy rules.

OTHER BUSINESS

The Meeting is called for

the purposes set forth in the Notice accompanying this Proxy Statement. As of the date of the Notice, the Board of Directors knows of

no business which will be presented for consideration at the Meeting other than the foregoing matters. If

any other matters do properly come before the Meeting, including the authority to adjourn the Meeting pursuant to Article 39 of the Company’s

Articles of Association, it is intended that the persons named as proxies will vote, pursuant to their discretionary authority, according

to their best judgment and recommendation of the Board of Directors.

| |

By Order of the Board of Directors, |

| |

|

| |

Ran Poliakine |

| |

Chairman of the Board of Directors |

| |

|

| November 16, 2023 |

|

13

Exhibit 99.2

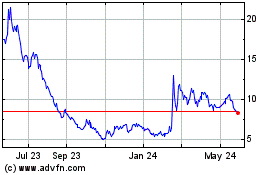

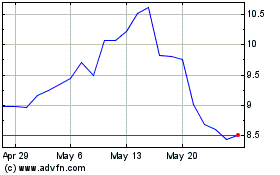

Nano X Imaging (NASDAQ:NNOX)

Historical Stock Chart

From Mar 2024 to Apr 2024

Nano X Imaging (NASDAQ:NNOX)

Historical Stock Chart

From Apr 2023 to Apr 2024