false

0001566826

0001566826

2023-11-09

2023-11-09

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported):

November 15, 2023 (November 9, 2023)

LogicMark, Inc.

(Exact name of registrant as specified in its charter)

| Nevada |

|

001-36616 |

|

46-0678374 |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

2801 Diode Lane

Louisville, KY |

|

40299 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including

area code: (502) 442-7911

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General

Instruction A.2. below):

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on

which registered |

| Common Stock, par value $0.0001 per share |

|

LGMK |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial

Condition.

On November 9, 2023, LogicMark, Inc., a Nevada

corporation (the “Company”), issued a press release announcing its financial and operational results for the quarter ended

September 30, 2023, recent business highlights, and an investor webcast that occurred on November 9, 2023 to discuss the results and update

shareholders on general corporate developments. The press release and the transcript of the webcast are attached as Exhibits 99.1 and

99.2, respectively, to this Current Report on Form 8-K (this “Form 8-K”) and are incorporated herein by reference.

The information contained in this Form 8-K provided

under Items 2.02 and 7.01 and Exhibits 99.1 and 99.2 attached hereto are furnished to, but shall not be deemed filed with, the U.S. Securities

and Exchange Commission or incorporated by reference into the Company’s filings under the Securities Act of 1933, as amended, or

the Securities Exchange Act of 1934, as amended.

Item 7.01 Regulation FD Disclosure.

Reference is made to the disclosure in Item 2.02

of this Form 8-K, which disclosure is incorporated herein by reference.

Forward-Looking Statements

Exhibits 99.1 and 99.2 attached hereto contain,

and may implicate, forward-looking statements regarding the Company, and include cautionary statements identifying important factors that

could cause actual results to differ materially from those anticipated.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Date: November 15, 2023 |

LogicMark, Inc. |

| |

|

|

| |

By: |

/s/ Mark Archer |

| |

Name: |

Mark Archer |

| |

Title: |

Chief Financial Officer |

2

Exhibit 99.1

LogicMark, Inc. Reports Third Quarter Results Highlighted by Five

Percentage Point Increase in Gross Margin

November 9, 2023

Shipments of Freedom Alert Plus Underway

New PERS Device Expected to Launch in Fourth

Quarter

Expanded Board of Directors Adds Expertise

LOUISVILLE, Ky., Nov. 09, 2023 (GLOBE

NEWSWIRE) – LogicMark, Inc. (Nasdaq: LGMK), a provider of personal emergency response systems (PERS), health communications

devices, and technology for the growing care economy, announced financial results for the third quarter ended September 30, 2023,

and recent highlights.

Results and Recent Highlights:

| ● | Gross margin percentage improved

to 67% in the third quarter of 2023, a five percentage point increase compared to 62% for the prior year period. |

| ● | Revenues were $2.4 million,

compared with $2.8 million for the prior year period. |

| ● | Overall operating expenses were

12% lower at $3.4 million compared with $3.8 million in the prior year period. |

| | | |

| | ● | Cash and cash equivalents were $6.7 million, on September

30, 2023, compared with $7.0 million at year-end 2022. |

| | | |

| | ● | Two new board members were recently appointed to expand depth of experience. |

| ● | Freedom Alert Plus PERS shipments

are in progress, complemented by our unique Care Village software suite. |

| ● | Preparations are underway for

the launch of a new PERS device in the coming weeks. |

Ms. Chia-Lin Simmons, Chief Executive Officer of LogicMark,

commented, “In the third quarter, we made significant strides with our Care Village ecosystem as our catalog of innovative products,

services, and intellectual property expanded. With the successful launch of the new Freedom Alert Plus, our focus now turns to the release

of another new PERS product in the weeks ahead. This will mark our second product launch this year and we are delighted to report that

the initial feedback during testing has been very positive, particularly regarding its compact design, GPS location service, and fall

detection feature.”

“I’m pleased to see that our new

product launches are gaining traction, as we introduce a variety of industry-leading solutions with modern technology to meet on-the-go

and at-home customer needs. We pride ourselves on offering options for every budget, including premium Wi-Fi-connected devices with a

monthly subscription service, continuous monitoring, and automatic software updates through our Care Village application. We also offer

4G LTE as well as landline-based connectivity to support consumers whose budget better accommodates the one-time purchase of a PERS device

with no recurring costs. For those unable to purchase their PERS device upfront, interest-free installment plans are also available.”

“Given our plans to

enter several new verticals, we recently named two new board members, expanding the total number of directors to six. We look forward

to the Board’s collective expertise in many areas, including corporate governance, finance, operations, hardware, and software solutions.

I’m excited about our depth of talent and growing product offering as we enter the next phase of our evolution as a company,”

concluded Simmons.

Third Quarter 2023 Results

Revenue for the third quarter ended September 30, 2023, was $2.4 million

compared with $2.8 million in the same period last year. The decrease in year-over-year revenues was due to one-time replacement sales

in the same period last year of Freedom Alert 911 Plus 4G PERS units replacing older 3G units, as the national cellular network carriers

announced in 2022 that they would no longer support 3G networks.

Gross profit margin in the third quarter was 67%, or five percentage

points higher compared with 62% in the prior year period. The higher margin was due to improvements in the Company’s supply chain

management, including a shift from air freight to transpacific shipping from Asia-based contract manufacturers, as well as a competitive

bidding process to obtain optimal shipping rates to all domestic customers. Gross profit in the third quarter of this year was $1.6 million

compared to $1.7 million in the same period last year.

Total operating expenses in the third quarter of 2023 were $3.4 million,

decreasing 12% or $0.5 million, compared with the same period last year and down 13% quarter-over-quarter. The lower operating expenses

year-over-year were mainly due to a reduction in general and administrative expenses, slightly offset by higher selling and marketing

expenses.

Net loss attributable to common shareholders for the third quarter

was $1.5 million compared with a net loss of $2.2 million in the same period last year. On a fully diluted basis, the net loss per share

was $1.10, compared with a net loss of $4.53 per share in the prior period. The year-over-year earnings per common share comparison includes

a 1-for-20 reverse split of outstanding common stock that took place in the second quarter of 2023.

As of September 30, 2023, the cash and cash equivalents balance was

$6.7 million, compared with $7.0 million at the end of December 2022.

Investor Call and SEC Filings

Ms. Chia-Lin Simmons, CEO, and Mr. Mark Archer,

CFO, will host a live investor call and webcast on November 9, 2023, at 1:30 PM (PDT) / 4:30 PM (EDT) to review the Company’s results.

Investors wishing to participate in the conference

call must register to obtain their dial-in and pin number here https://register.vevent.com/register/BI5a557980b737415b9849bf393083a654.

To listen to the live webcast, please visit the LogicMark Investor

Relations website here, or use the following link: https://edge.media-server.com/mmc/p/tpcfsqtm.

The associated press release, SEC filings, and webcast replay will also be accessible on the investor relations website.

About LogicMark

LogicMark, Inc. (Nasdaq: LGMK) provides personal emergency

response systems (PERS), health communications devices and technologies to create a Connected Care Platform. The Company’s

devices give people the ability to receive care at home and the confidence to age in place. LogicMark revolutionized the PERS

industry by directly incorporating two-way voice communication technology into its medical alert pendant, providing life-saving

technology at a price point that everyday consumers can afford. The Company’s PERS technologies are sold through the United

States Veterans Health Administration, dealers, distributors, and direct-to-consumers. LogicMark has been awarded a contract by the

U.S. General Services Administration that enables the Company to distribute its products to federal, state, and local governments.

For more information visit our corporate website at logicmark.com and the investor website at investors.logicmark.com.

Cautionary Statement Regarding Forward-Looking Statements

This press release contains forward-looking statements within the meaning

of the Private Securities Litigation Reform Act of 1995. Forward-looking statements reflect management’s current expectations, as

of the date of this press release, and involve certain risks and uncertainties. Forward- looking statements include statements herein

with respect to the successful execution of the Company’s business strategy. The Company’s actual results could differ materially

from those anticipated in these forward-looking statements because of various factors. Such risks and uncertainties include, among other

things, our ability to establish and maintain the proprietary nature of our technology through the patent process, as well as our ability

to possibly license from others patents and patent applications necessary to develop products; the availability of financing; the Company’s

ability to implement its long range business plan for various applications of its technology, including the anticipated product launches

of Aster, CPaaS and Freedom Alert Plus; the Company’s ability to enter into agreements with any necessary marketing and/or distribution

partners; the impact of competition, the obtaining and maintenance of any necessary regulatory clearances applicable to applications of

the Company’s technology; the Company’s ability to maintain its Nasdaq listing for its common stock; and management of growth

and other risks and uncertainties that may be detailed from time to time in the Company’s reports filed with the SEC.

Investor Relations Contact:

A. Pierre Dubois

FINN Partners, Inc.

investors@logicmark.com

Financial tables to follow:

LogicMark, Inc.

CONDENSED BALANCE SHEETS

(Unaudited)

| |

|

September 30,

2023 |

|

|

December 31,

2022 |

|

| Assets |

|

|

|

|

|

|

| Current Assets |

|

|

|

|

|

|

| Cash and cash equivalents |

|

$ |

6,682,997 |

|

|

$ |

6,977,114 |

|

| Restricted cash |

|

|

59,988 |

|

|

|

59,988 |

|

| Accounts receivable, net |

|

|

12,194 |

|

|

|

402,595 |

|

| Inventory |

|

|

1,135,786 |

|

|

|

1,745,211 |

|

| Prepaid expenses and other current assets |

|

|

680,872 |

|

|

|

349,097 |

|

| Total Current Assets |

|

|

8,571,837 |

|

|

|

9,534,005 |

|

| Property and equipment, net |

|

|

228,530 |

|

|

|

255,578 |

|

| Right-of-use assets, net |

|

|

128,718 |

|

|

|

182,363 |

|

| Product development costs, net of amortization of $15,029 as of September 30, 2023 and December 31, 2022 |

|

|

1,117,135 |

|

|

|

646,644 |

|

| Software development costs |

|

|

1,018,810 |

|

|

|

364,018 |

|

| Goodwill |

|

|

10,958,662 |

|

|

|

10,958,662 |

|

| Other intangible assets, net of amortization of $5,476,060 and $4,904,713, respectively |

|

|

3,128,507 |

|

|

|

3,699,854 |

|

| Total Assets |

|

$ |

25,152,199 |

|

|

$ |

25,641,124 |

|

| Liabilities, Series C Redeemable Preferred Stock and Stockholders’ Equity |

|

|

|

|

|

|

|

|

| Current Liabilities |

|

|

|

|

|

|

|

|

| Accounts payable |

|

$ |

715,838 |

|

|

$ |

673,052 |

|

| Accrued expenses |

|

|

1,211,005 |

|

|

|

1,740,490 |

|

| Total Current Liabilities |

|

|

1,926,843 |

|

|

|

2,413,542 |

|

| Other long-term liabilities |

|

|

390,259 |

|

|

|

440,263 |

|

| Total Liabilities |

|

|

2,317,102 |

|

|

|

2,853,805 |

|

| Commitments and Contingencies (Note 8) |

|

|

|

|

|

|

|

|

| Series C Redeemable Preferred Stock |

|

|

|

|

|

|

|

|

| Series C redeemable preferred stock, par value $0.0001 per share: 2,000 shares designated; 10 shares issued and outstanding as of September 30, 2023 and December 31, 2022 |

|

|

1,807,300 |

|

|

|

1,807,300 |

|

| Stockholders’ Equity |

|

|

|

|

|

|

|

|

| Preferred stock, par value $0.0001 per share: 10,000,000 shares authorized |

|

|

|

|

|

|

|

|

| Series F preferred stock, par value $0.0001 per share: 1,333,333 shares designated; 106,333 and 173,333 shares issued and

outstanding as of September 30, 2023 and December 31, 2022, respectively, aggregate liquidation preference of $319,000 as of September 30, 2023 and $520,000 as of December 31, 2022 |

|

|

319,000 |

|

|

|

520,000 |

|

| Common stock, par value $0.0001 per share: 100,000,000 shares authorized; 1,419,017 and 480,447 issued and outstanding as of

September 30, 2023 and December 31, 2022, respectively |

|

|

142 |

|

|

|

48 |

|

| Additional paid-in capital |

|

|

111,864,732 |

|

|

|

106,070,253 |

|

| Accumulated deficit |

|

|

(91,156,077 |

) |

|

|

(85,610,282 |

) |

| Total Stockholders’ Equity |

|

|

21,027,797 |

|

|

|

20,980,019 |

|

| Total Liabilities, Series C Redeemable Preferred Stock and Stockholders’ Equity |

|

$ |

25,152,199 |

|

|

$ |

25,641,124 |

|

LogicMark, Inc.

CONDENSED STATEMENTS OF OPERATIONS

(Unaudited)

| | |

For the Three Months Ended

September 30, | | |

For the Nine Months Ended

September 30, | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| Revenues | |

$ | 2,367,227 | | |

$ | 2,751,570 | | |

$ | 7,503,940 | | |

$ | 9,769,951 | |

| Costs of goods sold | |

| 769,956 | | |

| 1,047,204 | | |

| 2,444,401 | | |

| 3,860,176 | |

| Gross Profit | |

| 1,597,271 | | |

| 1,704,366 | | |

| 5,059,539 | | |

| 5,909,775 | |

| Operating Expenses | |

| | | |

| | | |

| | | |

| | |

| Direct operating cost | |

| 266,746 | | |

| 345,972 | | |

| 841,974 | | |

| 1,156,959 | |

| Advertising costs | |

| 57,195 | | |

| 68,170 | | |

| 190,588 | | |

| 68,170 | |

| Selling and marketing | |

| 636,643 | | |

| 264,528 | | |

| 1,620,109 | | |

| 728,746 | |

| Research and development | |

| 242,697 | | |

| 374,842 | | |

| 806,851 | | |

| 841,917 | |

| General and administrative | |

| 1,901,516 | | |

| 2,575,105 | | |

| 6,759,135 | | |

| 7,025,674 | |

| Other expense | |

| 54,296 | | |

| 3,222 | | |

| 133,261 | | |

| 35,306 | |

| Depreciation and amortization | |

| 217,767 | | |

| 210,632 | | |

| 649,468 | | |

| 599,686 | |

| Total Operating Expenses | |

| 3,376,860 | | |

| 3,842,471 | | |

| 11,001,386 | | |

| 10,456,458 | |

| Operating Loss | |

| (1,779,589 | ) | |

| (2,138,105 | ) | |

| (5,941,847 | ) | |

| (4,546,683 | ) |

| Other Income | |

| | | |

| | | |

| | | |

| | |

| Interest income | |

| 88,975 | | |

| 44,587 | | |

| 149,914 | | |

| 57,747 | |

| Other income | |

| 246,138 | | |

| - | | |

| 246,138 | | |

| - | |

| Total Other Income | |

| 335,113 | | |

| 44,587 | | |

| 396,052 | | |

| 57,747 | |

| Loss before Income Taxes | |

| (1,444,476 | ) | |

| (2,093,518 | ) | |

| (5,545,795 | ) | |

| (4,488,936 | ) |

| Income tax expense | |

| - | | |

| - | | |

| - | | |

| - | |

| Net Loss | |

| (1,444,476 | ) | |

| (2,093,518 | ) | |

| (5,545,795 | ) | |

| (4,488,936 | ) |

| Preferred stock dividends | |

| (75,000 | ) | |

| (81,790 | ) | |

| (225,000 | ) | |

| (257,934 | ) |

| Net Loss Attributable to Common Stockholders | |

$ | (1,519,476 | ) | |

$ | (2,175,308 | ) | |

$ | (5,770,795 | ) | |

$ | (4,746,870 | ) |

| Net Loss Attributable to Common Stockholders Per Share - Basic and Diluted | |

$ | (1.10 | ) | |

$ | (4.53 | ) | |

$ | (4.73 | ) | |

$ | (9.93 | ) |

Weighted Average Number of Common Shares Outstanding -

Basic and Diluted | |

| 1,380,373 | | |

| 480,447 | | |

| 1,219,749 | | |

| 478,118 | |

Source: LogicMark, Inc.

Exhibit 99.2

| REFINITIV STREETEVENTS | www.refinitiv.com | Contact Us ©2023 Refinitiv. All rights reserved. Republication or redistribution of Refinitiv content, including by framing or similar means, is prohibited without the prior written consent of Refinitiv. ‘Refinitiv’ and the Refinitiv logo are registered trademarks of Refinitiv and its affiliated companies. |  1 1 |

CORPORATE PARTICIPANTS

Pierre Dubois FINN Partners, Inc - IR

Chia-Lin Simmons LogicMark, Inc - CEO

Mark Archer LogicMark, Inc - CFO

CONFERENCE CALL PARTICIPANTS

Marla Marin Zacks Investment Research, Inc - IR

PRESENTATION

Operator

Day and welcome to the LogicMark third quarter 2023 financial results

and corporate update conference call. (Operator instructions)

I would now like to hand the conference over to your speaker today,

Pierre Dubois, Investor Relations. Please go ahead.

Pierre Dubois FINN Partners, Inc - IR

Thank you, Abigail, and good afternoon, everyone. We appreciate you

participating in today’s conference call. Joining me from LogicMark are Chia-Lin Simmons, Chief Executive Officer, and Mark Archer, Chief

Financial Officer.

During this call, management will be making forward-looking statements,

including statements that address LogicMark’s expectations for future performance or operational results and anticipated product launches.

Forward-looking statements involve risks and other factors that may cause actual results to differ materially from those statements. For

more information about these risks, please refer to the risk factors described in LogicMark’s most recently filed annual report on Form

10-K and subsequent reports filed with the SEC as well as LogicMark’s press release that accompanies this call particularly the cautionary

statements in it.

The content of this call contains time-sensitive information that is

accurate only as of today, November 9, 2023. Except as required by law, LogicMark disclaims any obligation to publicly update or revise

any information to reflect events or circumstances that occur after this call.

With that said, I’ll hand over the call to Chia-Lin.

Chia-Lin Simmons LogicMark, Inc - CEO

Thank you, Pierre, and good afternoon, everyone. I’m excited to speak

with you today on the heels of our first new product launch. Since our team came together and the first for the Company in many years.

When our team began this journey, the opportunity to build a company that continues to meet the needs of our valued veterans and aging

population was front and centre, but also the potential to develop an expanded suite of products to improve safety for an even broader

population was very compelling and it still is.

Our vision is to expand beyond just hardware to a broader ecosystem

that better prepares us to capture opportunities in the growing care economy. We’re doing just that with our new Care Village Ecosystem

, a proprietary software stack that includes an iOS and Android app, on-device proprietary middleware, a Proprietary AI enabled cloud

infrastructure as well as subscription services, all of which will allow us to add additional revenue streams and obtain margin uplift.

Our research and development teams worked extremely hard to release

the new Freedom Alert Plus, the first product to be offered under our New Care Platform as a Service or CPaaS platform. Freedom Alert

Plus is an advanced device offering features such as our new patented fall detection algorithms and GPS location.

It also provides 2-way communications with a caregiver and 24/7 monitor

emergency services with our partner, U.S. Monitoring, a prestigious 5 diamond monitoring centre. Our new Care Village app can be downloaded

for free at the Apple App Store or Google Play Store, which connects the Freedom Alert Plus, allowing caregivers to always connect to

their loved ones PERS device, providing a caregiver access to monitor file status, device battery and more.

| REFINITIV STREETEVENTS | www.refinitiv.com | Contact Us ©2023 Refinitiv. All rights reserved. Republication or redistribution of Refinitiv content, including by framing or similar means, is prohibited without the prior written consent of Refinitiv. ‘Refinitiv’ and the Refinitiv logo are registered trademarks of Refinitiv and its affiliated companies. |  2 2 |

And of course, we have accessories to accompany the device, including

both a lanyard to wear around your neck and a clip that can be attached for belts, purse or backpacks. Freedom Alert Plus is one of several

in an expanded line of solutions that we are developing to meet the specific needs of our customers. LogicMark has 3 other products to

choose from currently, whether or not that be Wi-Fi, 4G or landline connected devices at various price points.

The Freedom Alert and LogicMark Guardian Alert 911 are at our home

solutions. And for those on the go, we have our Guardian Alert 911+. Our devices have recently been recognized by Forbes as among top-rated

medical alert systems with no monthly fee. We believe that those with limited means should have access to a PERS device that fits within

their budgets. So, we continue to offer these products with no monthly subscription fees. Further, for those who need help with the purchase

of their device, we have a new partnership with Afterpay, which offers a no interest payment plan.

So what’s next ? Our ability to use artificial intelligence, sensors

and machine learning is revolutionizing the direction of our product road map. Along the way, our team is finding new innovative solutions

using this technology and at the same time, expanding our IP portfolio. At the moment, we are preparing to launch a new device, our second

PERS device launch this year. We are delighted to report that the initial feedback during testing has been very positive, particularly

regarding its weight, compact design, GPS location service and fault detection feature. This new product is a smaller form factor which

some customers prefer, not dissimilar to phones which come in various sizes to meet consumer preferences.

Our efforts not only focus on new devices, but we continue to look

for ways to improve operating efficiencies and find sustainable solutions. For example, we are working towards environmentally friendly

packing solutions, including biodegradable boxes and bags, and reducing packaging waste. And as we’ve mentioned, transitioning from shipping

versus airfreight after COVID-19 is also helping us reduce shipping costs and sustain our margins.

LogicMark’s planned expansion includes entry into other areas such

as health monitoring and offering expanded features to complement what we’re doing with our PERS devices, not only solutions that are

reactive, but those that are predictive or preventative, such as medicine reminders.

Given our plans to enter several new verticals and the progress we

are making, we are excited to have recently welcomed two new Board members : Carine Schneider and Tom Wilkinson, expanding the total number

of Directors to six.

We look forward to the Board’s collective expertise in many areas,

including corporate governance, finance, operations, hardware and software solutions. I’m very excited about our talented team and growing

product lineup as we advance to the next stage of the Company’s developments.

At this time, I’ll hand over the call to Mark to provide a brief review

of the financials.

Mark Archer LogicMark, Inc - CFO

Thank you, Chia-Lin. Our third quarter results included a gross margin

of 67% on revenues of $2.4 million. This compares to a gross margin of 62% on revenues of $2.8 million for the same quarter last year.

The year-over-year decline in sales during this third quarter was due to the onetime sale of replacement units last year which boosted

prior year quarter results. The national cellular network carriers, as they upgraded to 5G discontinued their support for 3G.

So our customers with older 3G Guardian Alert 911+ units needed to

replace those units with our current model that supports 4G services. This replacement process was completed in September of last year,

so we anticipate an end to the reduction in year-over-year sales starting with this current December quarter.

Back to our continued improvement in gross margin, we focused on three

areas to drive that improvement. First, we’ve been able to shift from air freight back to transpacific shipping from our Asia-based contract

manufacturers. During the peak of COVID, shipping costs and port delays increased, which necessitated us to move to expensive airfreight

in order to ensure that we could meet customer demand on a timely basis.

| REFINITIV STREETEVENTS | www.refinitiv.com | Contact Us ©2023 Refinitiv. All rights reserved. Republication or redistribution of Refinitiv content, including by framing or similar means, is prohibited without the prior written consent of Refinitiv. ‘Refinitiv’ and the Refinitiv logo are registered trademarks of Refinitiv and its affiliated companies. |  3 3 |

Second, we switched to procuring inventory more opportunistically

versus our traditional previous just-in-time approach. Now we purchase some of our components when prices are most favourable rather

than when we need the part.

And third, our domestic shipping costs to customers have improved.

Previously, we were using one shipping vendor exclusively. Now we’ve implemented software that selects whether the United States Postal

Service, UPS or FedEx is the lowest cost option on each particular order.

Turning to total operating expenses, the third quarter came in at $3.4

million, decreasing 12% or $0.5 million compared with the same quarter last year and down 13% from this year’s June quarter. The lower

operating expense year over year was due mainly to a reduction in general and administrative expenses, slightly offset by higher selling

and marketing expenses to support our new product launches.

Net loss attributable to common shareholders for the third quarter

was $1.5 million versus a net loss of $2.2 million in the same quarter last year. On a fully diluted basis, the net loss per share was

$1.10 compared with a net loss of $4.53 a share in the prior year quarter.

Third, our EPS values, have been adjusted for our one for 20 reverse

stock split completed this last April. In terms of liquidity as of the end of September, the cash balance was $6.7 million compared to

$7 million at the end of December 2022. We had no debt on our books.

So as we move into the last quarter of the year, we remain focused

on launching new products increasing year over year revenues, continuing to improve margins, and reaching breakeven profitability. And

with that, I’d like to hand it back to Abigail, who will open the call up for questions to queue.

QUESTIONS AND ANSWERS

Operator

Thank you. At this time, we’ll conduct a question-and-answer session.

One moment for our first question. Marla Marin with Zacks.

Marla Marin Zacks Investment Research, Inc - IR

Hi, thank you. Can you talk a little bit about the launch of the Freedom

Alert Plus Product ? First of all, were there any surprises that, you know, you saw like following your product introduction? And also,

do you think that you can use this experience with introducing this new product as a template for other potential product launches going

forward? Thank you.

Chia-Lin Simmons LogicMark, Inc - CEO

Hello Marla. I’m happy to answer that question. So, we did not see

a huge unanticipated -- surprise when it came to the launch of this particular product. We had gone through a fairly rigorous QA testing

of the product, the back-end services, and a 24/7 monitor service. As you -- as I might have spoken about during this particular call,

when we talked about the launch of the FA Plus, it’s really not just the launch of that particular hardware itself, but with the launch

basically of our Care Village Technology platform.

So we have launched the app. We launched the proprietary suite of middleware

technology, the AI-enabled cloud-based services and then sort of the recurring subscription services in the form of the 24/7 monitor service,

the fall detection sort of technology and so forth and so we did not see any surprises there.

However, I will say that this in-home solution we have -- because it’s

the first time sort of rolling out a 24/7 monitor service and a subscription fall detection service, we have launched this on a consumer

platform side and so as we are going out and reaching out to our B2B and B2G partners, we are introducing some of the technology to them

and demonstrating this to them as we are going along.

| REFINITIV STREETEVENTS | www.refinitiv.com | Contact Us ©2023 Refinitiv. All rights reserved. Republication or redistribution of Refinitiv content, including by framing or similar means, is prohibited without the prior written consent of Refinitiv. ‘Refinitiv’ and the Refinitiv logo are registered trademarks of Refinitiv and its affiliated companies. |  4 4 |

And so in the future, we may be simultaneously launching our technology

platforms across all of the channels in pair, at the same time. But at least with this particular first launch because we’re launching

all of these different facets of concurrently at the same time, we did launch consumer first and then I’m rolling out to B2B and B2G.

And so even this week, we actually have -- we’re attending our Veterans Administration Show in Orlando, where the government sector is

being introduced to our new technology this week.

Marla Marin Zacks Investment Research, Inc - IR

Thank you.

Operator

Thank you. I’m showing no further questions at this time. I would like

to turn the call back to Chia-Lin Simmons for closing remarks.

Chia-Lin Simmons LogicMark, Inc - CEO

Thank you. In conclusion, I would like to thank all our employees,

customers, and investors for their continued support. We look forward to reporting on the fourth quarter and full year results early next

year. In the meantime, our dedicated teams will continue to work passionately to progress our vision, which is to provide solutions for

every segment of the population to help improve the quality of their lives. This includes our valued veterans, our elderly aging in place

and those who seek enhanced safety and health.

As we head into the Veterans Day holiday, we reflect on their service

and sacrifice as well as the sacrifice of our veterans families in honor to our country. Today, we announced the donation to the Bob Woodruff

foundation in support of their mission which aligns with ours. To ensure that our nation’s veterans and service members and their families,

which stood for us has stable and successful futures.

We have worked with the Veterans Administration for over a decade to

facilitate our veteran’s independence, and we look forward to continuing our great relationship with them. As we enter the holiday season,

our entire team at LogicMark wishes all of you the very best. Thank you so much.

Operator

Thank you for your participation in today’s conference. This does conclude

the program. You may now disconnect.

DISCLAIMER

Refinitiv reserves the right to make changes to documents, content,

or other information on this web site without obligation to notify any person of such changes

In the conference calls upon which Event Briefs are based, companies

may make projections or other forward-looking statements regarding a variety of items. Such forward-looking statements are based upon

current expectations and involve risks and uncertainties. Actual results may differ materially from those stated in any forward-looking

statement based on a number of important factors and risks, which are more specifically identified in the companies’ most recent SEC filings.

Although the companies may indicate and believe that the assumptions underlying the forward-looking statements are reasonable, any of

the assumptions could prove inaccurate or incorrect and, therefore, there can be no assurance that the results contemplated in the forward-looking

statements will be realized.

THE INFORMATION CONTAINED IN EVENT BRIEFS REFLECTS REFINITIV’S SUBJECTIVE

CONDENSED PARAPHRASE OF THE APPLICABLE COMPANY’S CONFERENCE CALL AND THERE MAY BE MATERIAL ERRORS, OMISSIONS, OR INACCURACIES IN THE REPORTING

OF THE SUBSTANCE OF THE CONFERENCE CALLS. IN NO WAY DOES REFINITIV OR THE APPLICABLE COMPANY ASSUME ANY RESPONSIBILITY FOR ANY INVESTMENT

OR OTHER DECISIONS MADE BASED UPON THE INFORMATION PROVIDED ON THIS WEB SITE OR IN ANY EVENT BRIEF. USERS ARE ADVISED TO REVIEW THE APPLICABLE

COMPANY’S CONFERENCE CALL ITSELF AND THE APPLICABLE COMPANY’S SEC FILINGS BEFORE MAKING ANY INVESTMENT OR OTHER DECISIONS.

©2023 Refinitiv. All Rights Reserved.

| REFINITIV STREETEVENTS | www.refinitiv.com | Contact Us ©2023 Refinitiv. All rights reserved. Republication or redistribution of Refinitiv content, including by framing or similar means, is prohibited without the prior written consent of Refinitiv. ‘Refinitiv’ and the Refinitiv logo are registered trademarks of Refinitiv and its affiliated companies. |  5 5 |

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

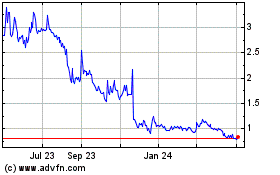

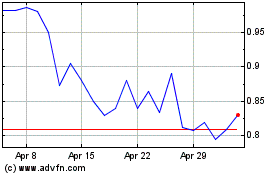

LogicMark (NASDAQ:LGMK)

Historical Stock Chart

From Mar 2024 to Apr 2024

LogicMark (NASDAQ:LGMK)

Historical Stock Chart

From Apr 2023 to Apr 2024