Orgenesis Provides Business Update for the Third Quarter of 2023

November 13 2023 - 4:15PM

Orgenesis Inc. (NASDAQ: ORGS)

(“Orgenesis” or the “Company”), a global biotech company working to

unlock the full potential of cell and gene therapies (CGT), today

provided a business update for the third quarter ended September

30, 2023.

Vered Caplan, CEO of Orgenesis, said, “We

continue to advance the commercial launch of our POCare Platform

through Octomera, building out a decentralized network and

infrastructure to deliver these advanced therapeutic services that

are critically needed by the medical community. At the same time,

we are focused on growing our POCare Network of hospitals and

healthcare providers across the U.S., Europe, the Middle East and

other regions, where advanced cell and gene therapies can be

rapidly scaled up to meet growing demand across the industry. We

believe the Company is well positioned to support the clinical and

commercial advancement of these therapies for years to come.”

“Recently, we expanded our partnership with

California Davis (UC Davis) through California Institute of

Regenerative Medicine (CIRM) grant funding to streamline production

of CGT products across California. We believe that our platform

will benefit patients in the state by accelerating access to

CGT products in an affordable format at the point of care,

which, in turn, are expected to lower costs, expand capacity, and

enhance distribution. We remain on track to deploy our Octomera

Mobile Processing Units & Labs (OMPULs) for production at UC

Davis and other healthcare universities within the State of

California in the upcoming year. Moreover, Octomera entered into an

agreement with CGT Global to utilize its extensive network of U.S.

clinics to help accelerate research and clinical trials, aimed at

rapidly commercializing CGT products across the United States and

potentially bringing these life-saving therapies to larger numbers

of patients in need.”

Ms. Caplan continued, “In addition to our POCare

Services platform, we are advancing our therapeutic pipeline, which

now spans multiple clinical programs in the field of

immuno-oncology, anti-viral, metabolic/autoimmune diseases, and

tissue regeneration. Our cost-efficient strategy includes

leveraging government grants and funding from regional partners, as

well finding the optimal licensing and marketing partners for some

of the more advanced products in our pipeline. Importantly, we

believe we have built a highly scalable business model.”

The complete financial results for the third

quarter of 2023 are available on the Company’s website in the

Company’s Form 10-Q, which has been filed with the Securities and

Exchange Commission. It is important to note that the Company

deconsolidated Octomera on June 30, 2023, though the Company still

holds a 75% stake in the business. Accordingly, the results of

Octomera’s operations subsequent to June 30, 2023, are not

reflected in the Company’s consolidated financial statements.

Octomera itself recognized revenue of $2.7 million, reflecting a

temporary delay in cell processing and cell process development

contracts, which are expected to be completed in the fourth quarter

of 2023 and first quarter of 2024. The Company also notes that as a

result of the deconsolidation of Octomera, the assets and

liabilities of Octomera are not included on the Company’s balance

sheet and statements of comprehensive loss for the period ended

September 30, 2023.

About OrgenesisOrgenesis is a

global biotech company that has been committed to unlocking the

potential of decentralized cell and gene therapies (CGTs) since

2012. Orgenesis established the POCare Network in 2020 to bring

academia, hospitals, and Industry together to make these

innovations more affordable and accessible to patients. In 2022,

the POCare Services business unit responsible for developing and

managing the decentralized POCare Centers and proprietary OMPULs

was formed. Orgenesis will continue to focus on advancing to market

through various partnerships to provide a rapid, globally

harmonized pathway for these therapies to reach and treat large

numbers of patients at lowered costs through efficient, scalable,

and decentralized production. Additional information about the

Company is available at: www.orgenesis.com.

Notice Regarding Forward-Looking

Statements This press release contains forward-looking

statements which are made pursuant to the safe harbor provisions of

Section 27A of the Securities Act of 1933, as amended, and Section

21E of the Securities and Exchange Act of 1934, as amended. These

forward-looking statements involve substantial uncertainties and

risks and are based upon our current expectations, estimates and

projections and reflect our beliefs and assumptions based upon

information available to us at the date of this release. We caution

readers that forward-looking statements are predictions based on

our current expectations about future events. These forward-looking

statements are not guarantees of future performance and are subject

to risks, uncertainties and assumptions that are difficult to

predict. Our actual results, performance or achievements could

differ materially from those expressed or implied by the

forward-looking statements as a result of a number of factors,

including, but not limited to, our reliance on, and our ability to

grow, our point-of-care cell therapy platform and OMPUL business,

our ability to achieve and maintain overall profitability, our

ability to manage our research and development programs that are

based on novel technologies, our ability to control key elements

relating to the development and commercialization of therapeutic

product candidates with third parties, the timing of completion of

clinical trials and studies, the availability of additional data,

outcomes of clinical trials of our product candidates, the

potential uses and benefits of our product candidates, our ability

to manage potential disruptions as a result of the COVID-19

pandemic, the sufficiency of working capital to realize our

business plans and our ability to raise additional capital, the

development of our POCare strategy, our trans differentiation

technology as therapeutic treatment for diabetes, the technology

behind our in-licensed ATMPs not functioning as expected, our

ability to further our CGT development projects, either directly or

through our JV partner agreements, and to fulfill our obligations

under such agreements, our license agreements with other

institutions, our ability to retain key employees, our competitors

developing better or cheaper alternatives to our products, risks

relating to legal proceedings against us and the risks and

uncertainties discussed under the heading "RISK FACTORS" in Item 1A

of our Annual Report on Form 10-K for the fiscal year ended

December 31, 2022, and in our other filings with the Securities and

Exchange Commission. We undertake no obligation to revise or update

any forward-looking statement for any reason.

IR contact for Orgenesis:Crescendo

Communications, LLCTel: 212-671-1021Orgs@crescendo-ir.com

Communications contact for

OrgenesisIB CommunicationsNeil Hunter / Michelle BoxallTel

+44 (0)20 8943

4685neil@ibcomms.agency / michelle@ibcomms.agency

ORGENESIS INC.CONDENSED

CONSOLIDATED BALANCE SHEETS(U.S. Dollars, in

thousands)(Unaudited)

|

|

|

As of |

|

|

|

September 30,2023 |

|

|

|

December 31,2022 |

|

|

Assets |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| CURRENT

ASSETS: |

|

|

|

|

|

|

|

|

Cash and cash equivalents |

$ |

55 |

|

|

$ |

5,311 |

|

|

Restricted cash |

|

734 |

|

|

|

1,058 |

|

|

Accounts receivable, net |

|

71 |

|

|

|

36,183 |

|

|

Prepaid expenses and other receivables |

|

4,031 |

|

|

|

958 |

|

|

Receivables from related parties |

|

1,052 |

|

|

|

- |

|

|

Convertible loan to related party |

|

2,799 |

|

|

|

2,688 |

|

|

Inventory |

|

34 |

|

|

|

120 |

|

| Total current assets |

|

8,776 |

|

|

|

46,318 |

|

| |

|

|

|

|

|

|

|

| NON-CURRENT

ASSETS: |

|

|

|

|

|

|

|

|

Deposits |

$ |

40 |

|

|

$ |

331 |

|

|

Equity investees |

|

22,509 |

|

|

|

39 |

|

|

Loans to associates |

|

93 |

|

|

|

96 |

|

|

Property, plant and equipment, net |

|

1,503 |

|

|

|

22,834 |

|

|

Intangible assets, net |

|

7,528 |

|

|

|

9,694 |

|

|

Operating lease right-of-use assets |

|

431 |

|

|

|

2,304 |

|

|

Goodwill |

|

3,703 |

|

|

|

8,187 |

|

|

Deferred tax |

|

- |

|

|

|

103 |

|

|

Other assets |

|

716 |

|

|

|

1,022 |

|

| Total non-current assets |

|

36,523 |

|

|

|

44,610 |

|

| TOTAL

ASSETS |

$ |

45,299 |

|

|

$ |

90,928 |

|

ORGENESIS INC.CONDENSED

CONSOLIDATED BALANCE SHEETS(U.S. Dollars, in

thousands)(Unaudited)

|

|

|

As of |

|

|

|

September 30,2023 |

|

|

December 31,2022 |

|

Liabilities and Equity |

|

|

|

|

|

|

|

|

|

|

|

|

|

CURRENT LIABILITIES: |

|

|

|

|

|

|

Accounts payable |

$ |

5,459 |

|

|

$ |

4,429 |

|

|

Accounts payable related parties |

|

132 |

|

|

|

- |

|

|

Accrued expenses and other payables |

|

1,895 |

|

|

|

2,578 |

|

|

Income tax payable |

|

307 |

|

|

|

289 |

|

|

Employees and related payables |

|

807 |

|

|

|

1,860 |

|

|

Other payables related parties |

|

999 |

|

|

|

- |

|

|

Advance payments on account of grant |

|

1,376 |

|

|

|

1,578 |

|

|

Short-term loans |

|

430 |

|

|

|

- |

|

|

Contract liabilities |

|

120 |

|

|

|

70 |

|

|

Current maturities of finance leases |

|

17 |

|

|

|

60 |

|

|

Current maturities of operating leases |

|

220 |

|

|

|

542 |

|

|

Short-term and current maturities of convertible loans |

|

2,540 |

|

|

|

4,504 |

|

| Total

current liabilities |

|

14,302 |

|

|

|

15,910 |

|

|

|

|

|

|

|

|

|

LONG-TERM LIABILITIES: |

|

|

|

|

|

|

Non-current operating leases |

$ |

140 |

|

|

$ |

1,728 |

|

|

Convertible loans |

|

18,394 |

|

|

|

13,343 |

|

|

Retirement benefits obligation |

|

- |

|

|

|

163 |

|

|

Long-term debt and finance leases |

|

8 |

|

|

|

95 |

|

|

Advance payments on account of grant |

|

- |

|

|

|

144 |

|

|

Other long-term liabilities |

|

58 |

|

|

|

271 |

|

| Total

long-term liabilities |

|

18,600 |

|

|

|

15,744 |

|

|

TOTAL LIABILITIES |

|

32,902 |

|

|

|

31,654 |

|

|

|

|

|

|

|

|

|

REDEEMABLE NON-CONTROLLING INTEREST |

$ |

- |

|

|

$ |

30,203 |

|

|

|

|

|

|

|

|

|

EQUITY:Common stock of $0.0001 par value:

Authorized at September 30, 2023 and December 31, 2022:

145,833,334 shares; Issued at September 30, 2023 and December

31, 2022: 30,753,374 and 25,832,322 shares, respectively;

Outstanding at September 30, 2023 and December 31, 2022:

30,466,807 and 25,545,755 shares, respectively |

|

3 |

|

|

|

3 |

|

|

Additional paid-in capital |

|

155,819 |

|

|

|

150,355 |

|

|

Accumulated other comprehensive income (loss) |

|

71 |

|

|

|

(270 |

) |

|

Treasury stock 286,567 shares as of September 30, 2023 and

December 31, 2022 |

|

(1,266 |

) |

|

|

(1,266 |

) |

|

Accumulated deficit |

|

(142,230 |

) |

|

|

(121,261 |

) |

|

Equity attributable to Orgenesis Inc. |

|

12,397 |

|

|

|

27,561 |

|

|

Non-controlling interest |

|

- |

|

|

|

1,510 |

|

| Total

equity |

|

12,397 |

|

|

|

29,071 |

|

|

TOTAL LIABILITIES REDEEMABLE NON-CONTROLLING INTEREST AND

EQUITY |

$ |

45,299 |

|

|

$ |

90,928 |

|

|

|

|

|

|

|

|

|

|

ORGENESIS INC.CONDENSED

CONSOLIDATED STATEMENTS OF LOSS AND COMPREHENSIVE

LOSS(U.S. Dollars, in thousands, except share and

per share amounts)(Unaudited)

| |

Three Months Ended |

|

Nine Months Ended |

|

|

|

September 30,2023 |

|

|

|

September 30,2022 |

|

|

|

September 30,2023 |

|

|

|

September 30, 2022 |

|

| Revenues |

$ |

110 |

|

|

$ |

7,841 |

|

|

$ |

14,129 |

|

|

$ |

21,117 |

|

| Revenues from related

party |

|

- |

|

|

|

147 |

|

|

|

- |

|

|

|

1,284 |

|

| Total revenues |

|

110 |

|

|

|

7,988 |

|

|

|

14,129 |

|

|

|

22,401 |

|

| Cost of revenues |

|

139 |

|

|

|

983 |

|

|

|

6,093 |

|

|

|

2,760 |

|

| Gross profit (loss) |

|

(29 |

) |

|

|

7,005 |

|

|

|

8,036 |

|

|

|

19,641 |

|

| Cost of development services

and research and development expenses |

|

808 |

|

|

|

3,683 |

|

|

|

7,616 |

|

|

|

18,172 |

|

| Amortization of intangible

assets |

|

153 |

|

|

|

225 |

|

|

|

568 |

|

|

|

686 |

|

| Selling, general and

administrative expenses |

|

1,245 |

|

|

|

3,104 |

|

|

|

8,621 |

|

|

|

8,758 |

|

| Operating loss |

|

2,235 |

|

|

|

7 |

|

|

|

8,769 |

|

|

|

7,975 |

|

| Other loss (income), net |

|

(2 |

) |

|

|

2 |

|

|

|

(4 |

) |

|

|

(6 |

) |

| Loss from extinguishment in

connection with convertible loan |

|

- |

|

|

|

- |

|

|

|

283 |

|

|

|

- |

|

| Financial expenses, net |

|

508 |

|

|

|

1,100 |

|

|

|

1,807 |

|

|

|

1,702 |

|

| Profit from deconsolidation of

Octomera (see note 3) |

|

- |

|

|

|

- |

|

|

|

(411 |

) |

|

|

- |

|

| Share in net loss of

associated companies |

|

9,518 |

|

|

|

274 |

|

|

|

9,517 |

|

|

|

1,189 |

|

| Loss before income taxes |

|

12,259 |

|

|

|

1,383 |

|

|

|

19,961 |

|

|

|

10,860 |

|

| Tax expenses |

|

394 |

|

|

|

25 |

|

|

|

614 |

|

|

|

37 |

|

| Net loss |

|

12,653 |

|

|

|

1,408 |

|

|

|

20,575 |

|

|

|

10,897 |

|

| Net income (loss) attributable

to non-controlling interests (including redeemable) |

|

- |

|

|

|

(52 |

) |

|

|

394 |

|

|

|

(105 |

) |

| Net loss attributable to

Orgenesis Inc. |

$ |

12,653 |

|

|

$ |

1,356 |

|

|

$ |

20,969 |

|

|

$ |

10,792 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Loss per

share: |

|

|

|

|

|

|

|

|

|

|

|

| Basic and diluted |

$ |

0.43 |

|

|

$ |

0.05 |

|

|

$ |

0.75 |

|

|

$ |

0.43 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Weighted average

number of shares used in computation of Basic and Diluted loss per

share: |

|

|

|

|

|

|

|

|

|

|

|

| Basic and diluted |

|

29,162,459 |

|

|

|

25,403,907 |

|

|

|

27,933,067 |

|

|

|

24,944,814 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Comprehensive

loss: |

|

|

|

|

|

|

|

|

|

|

|

| Net loss |

$ |

12,653 |

|

|

$ |

1,408 |

|

|

$ |

20,575 |

|

|

$ |

10,897 |

|

| Other comprehensive loss

(income) - translation adjustments |

|

(9 |

) |

|

|

556 |

|

|

|

43 |

|

|

|

1,033 |

|

| Release of translation

adjustment due to deconsolidation of Octomera |

|

- |

|

|

|

- |

|

|

|

(384 |

) |

|

|

- |

|

| Comprehensive loss |

|

12,644 |

|

|

|

1,964 |

|

|

|

20,234 |

|

|

|

11,930 |

|

| Comprehensive income (loss)

attributed to non-controlling interests |

|

- |

|

|

|

(52 |

) |

|

|

394 |

|

|

|

(105 |

) |

| Comprehensive loss attributed

to Orgenesis Inc. |

$ |

12,644 |

|

|

$ |

1,912 |

|

|

$ |

20,628 |

|

|

$ |

11,825 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

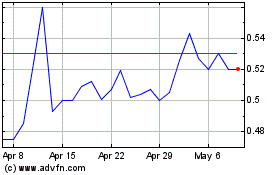

Orgenesis (NASDAQ:ORGS)

Historical Stock Chart

From Mar 2024 to Apr 2024

Orgenesis (NASDAQ:ORGS)

Historical Stock Chart

From Apr 2023 to Apr 2024