0001101433false--12-31falseNon-accelerated FilerQ320230.0011500000009047779890477798904777980.0011236851236851236855500001 year to 5 years2577280300011014332023-01-012023-09-300001101433qmci:CommonStockOptionsAndWarrantsMember2023-09-300001101433qmci:CommonStockOptionsAndWarrantsMember2022-12-310001101433qmci:PreferredStockWarrantsMember2023-01-012023-09-300001101433qmci:PreferredStockWarrantsMember2023-09-300001101433us-gaap:RedeemableConvertiblePreferredStockMember2017-12-280001101433us-gaap:RedeemableConvertiblePreferredStockMember2023-09-300001101433us-gaap:LiabilityMember2023-09-300001101433us-gaap:LiabilityMember2023-07-012023-09-300001101433us-gaap:LiabilityMember2023-01-012023-06-300001101433us-gaap:LiabilityMember2023-06-300001101433us-gaap:LiabilityMember2022-12-310001101433qmci:ExercisePriceRangeOneMember2023-01-012023-09-300001101433qmci:ExercisePriceRangeOneMember2023-09-300001101433us-gaap:SellingAndMarketingExpenseMember2022-01-012022-09-300001101433us-gaap:SellingAndMarketingExpenseMember2023-01-012023-09-300001101433us-gaap:SellingAndMarketingExpenseMember2022-07-012022-09-300001101433us-gaap:SellingAndMarketingExpenseMember2023-07-012023-09-3000011014332022-01-012022-12-310001101433qmci:BravenetWebServicesIncMember2022-01-012022-12-310001101433qmci:BravenetWebServicesIncMember2023-01-012023-09-300001101433qmci:BravenetWebServicesIncMember2022-12-310001101433qmci:BravenetWebServicesIncMember2023-09-300001101433qmci:FourOneZeroSevenThreeFourBCLtdMember2022-12-310001101433qmci:InteractiveContentandDataAPIsMember2023-07-012023-09-300001101433qmci:IndividualQuotestreamMember2023-07-012023-09-300001101433qmci:CorporateQuotestreamMember2023-07-012023-09-300001101433qmci:InteractiveContentandDataAPIsMember2023-01-012023-09-300001101433qmci:IndividualQuotestreamMember2023-01-012023-09-300001101433qmci:CorporateQuotestreamMember2023-01-012023-09-300001101433qmci:InteractiveContentandDataAPIsMember2022-01-012022-09-300001101433qmci:IndividualQuotestreamMember2022-01-012022-09-300001101433qmci:CorporateQuotestreamMember2022-01-012022-09-300001101433qmci:InteractiveContentandDataAPIsMember2022-07-012022-09-300001101433qmci:IndividualQuotestreamMember2022-07-012022-09-300001101433qmci:CorporateQuotestreamMember2022-07-012022-09-300001101433us-gaap:RetainedEarningsMember2023-07-012023-09-300001101433us-gaap:AdditionalPaidInCapitalMember2023-07-012023-09-300001101433us-gaap:CommonStockMember2023-07-012023-09-300001101433qmci:SeriesARedeemableConvertiblePreferredSharesMember2023-07-012023-09-3000011014332023-06-300001101433us-gaap:RetainedEarningsMember2023-06-300001101433us-gaap:AdditionalPaidInCapitalMember2023-06-300001101433us-gaap:CommonStockMember2023-06-300001101433qmci:SeriesARedeemableConvertiblePreferredSharesMember2023-06-300001101433us-gaap:RetainedEarningsMember2023-09-300001101433us-gaap:AdditionalPaidInCapitalMember2023-09-300001101433us-gaap:CommonStockMember2023-09-300001101433qmci:SeriesARedeemableConvertiblePreferredSharesMember2023-09-300001101433us-gaap:RetainedEarningsMember2023-01-012023-09-300001101433us-gaap:AdditionalPaidInCapitalMember2023-01-012023-09-300001101433us-gaap:CommonStockMember2023-01-012023-09-300001101433qmci:SeriesARedeemableConvertiblePreferredSharesMember2023-01-012023-09-300001101433us-gaap:RetainedEarningsMember2022-12-310001101433us-gaap:AdditionalPaidInCapitalMember2022-12-310001101433us-gaap:CommonStockMember2022-12-310001101433qmci:SeriesARedeemableConvertiblePreferredSharesMember2022-12-310001101433us-gaap:RetainedEarningsMember2022-07-012022-09-300001101433us-gaap:AdditionalPaidInCapitalMember2022-07-012022-09-300001101433us-gaap:CommonStockMember2022-07-012022-09-300001101433qmci:SeriesARedeemableConvertiblePreferredSharesMember2022-07-012022-09-3000011014332022-06-300001101433us-gaap:RetainedEarningsMember2022-06-300001101433us-gaap:AdditionalPaidInCapitalMember2022-06-300001101433us-gaap:CommonStockMember2022-06-300001101433qmci:SeriesARedeemableConvertiblePreferredSharesMember2022-06-3000011014332022-09-300001101433us-gaap:RetainedEarningsMember2022-09-300001101433us-gaap:AdditionalPaidInCapitalMember2022-09-300001101433us-gaap:CommonStockMember2022-09-300001101433qmci:SeriesARedeemableConvertiblePreferredSharesMember2022-09-300001101433us-gaap:RetainedEarningsMember2022-01-012022-09-300001101433us-gaap:AdditionalPaidInCapitalMember2022-01-012022-09-300001101433us-gaap:CommonStockMember2022-01-012022-09-300001101433qmci:SeriesARedeemableConvertiblePreferredSharesMember2022-01-012022-09-3000011014332021-12-310001101433us-gaap:RetainedEarningsMember2021-12-310001101433us-gaap:AdditionalPaidInCapitalMember2021-12-310001101433us-gaap:CommonStockMember2021-12-310001101433qmci:SeriesARedeemableConvertiblePreferredSharesMember2021-12-3100011014332022-01-012022-09-3000011014332022-07-012022-09-3000011014332023-07-012023-09-3000011014332022-12-3100011014332023-09-3000011014332023-11-03iso4217:USDxbrli:sharesiso4217:USDxbrli:sharesxbrli:pure

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark one)

☒ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended September 30, 2023

OR

☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period _________ to _________

Commission File Number: 0-28599

QuoteMedia, Inc. |

(Exact name of registrant as specified in its charter) |

Nevada | | 91-2008633 |

(State or Other Jurisdiction of Incorporation or Organization) | | (IRS Employer Identification Number) |

17100 East Shea Boulevard, Suite 230, Fountain Hills, AZ 85268

(Address of Principal Executive Offices)

(602) 830-1443

(Registrant’s Telephone Number, Including Area Code)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and "smaller reporting company" and "emerging growth company" in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer | £ | Accelerated filer | £ |

Non-accelerated filer | £ | Smaller reporting company | ☒ |

(Do not check if a smaller reporting company) | Emerging growth company | £ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards pursuant to Section 13(a) of the Exchange Act. ☐

The Registrant has 90,477,798 shares of common stock outstanding as of November 3, 2023.

QUOTEMEDIA, INC.

FORM 10-Q for the Quarter Ended September 30, 2023

INDEX

PART I - FINANCIAL INFORMATION

Item 1. Financial Statements

QUOTEMEDIA, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(UNAUDITED)

| | September 30, 2023 | | | December 31, 2022 | |

ASSETS | | | | | | |

| | | | | | |

Current assets: | | | | | | |

Cash and cash equivalents | | $ | 820,939 | | | $ | 477,987 | |

Accounts receivable, net | | | 1,028,148 | | | | 910,277 | |

Prepaid expenses | | | 161,258 | | | | 231,694 | |

Other current assets | | | 86,707 | | | | 29,092 | |

Total current assets | | | 2,097,052 | | | | 1,649,050 | |

| | | | | | | | |

Deposits | | | 20,181 | | | | 15,002 | |

Property and equipment, net | | | 4,728,954 | | | | 4,208,250 | |

Goodwill | | | 110,000 | | | | 110,000 | |

Intangible assets | | | 67,620 | | | | 73,572 | |

Operating lease right-of-use assets (see note 6) | | | 442,384 | | | | 506,219 | |

| | | | | | | | |

Total assets | | $ | 7,466,191 | | | $ | 6,562,093 | |

| | | | | | | | |

LIABILITIES, REDEEMABLE CONVERTIBLE PREFERRED STOCK, AND STOCKHOLDERS’ DEFICIT | | | | | | | | |

| | | | | | | | |

Current liabilities: | | | | | | | | |

Accounts payable and accrued liabilities | | $ | 2,201,664 | | | $ | 2,512,837 | |

Current portion of deferred revenue (see note 4) | | | 1,676,949 | | | | 1,166,848 | |

Current portion of operating lease liabilities (see note 6) | | | 198,239 | | | | 174,166 | |

Total current liabilities | | | 4,076,852 | | | | 3,853,851 | |

| | | | | | | | |

Long-term portion of deferred revenue (see note 4) | | | 372,715 | | | | - | |

Long-term portion of operating lease liabilities (see note 6) | | | 239,080 | | | | 323,685 | |

Preferred stock warrant liability (see note 7) | | | 710,000 | | | | 629,375 | |

| | | | | | | | |

Mezzanine equity: | | | | | | | | |

Preferred stock, 10,000,000 shares authorized: | | | | | | | | |

Series A Redeemable Convertible Preferred stock, $0.001 par value, | | | | | | | | |

550,000 shares designated; shares issued and outstanding: | | | | | | | | |

123,685 at September 30, 2023 and December 31, 2022 (see note 7) | | | 2,983,857 | | | | 2,983,857 | |

| | | | | | | | |

Stockholders’ deficit: | | | | | | | | |

Common stock, $0.001 par value, 150,000,000 shares authorized, shares issued and | | | | | | | | |

outstanding: 90,477,798 at September 30, 2023 and December 31, 2022 | | | 90,479 | | | | 90,479 | |

Additional paid-in capital | | | 18,903,272 | | | | 18,903,272 | |

Accumulated deficit | | | (19,910,064 | ) | | | (20,222,426 | ) |

Total stockholders’ deficit | | | (916,313 | ) | | | (1,228,675 | ) |

| | | | | | | | |

Total liabilities, mezzanine equity and stockholders’ deficit | | $ | 7,466,191 | | | $ | 6,562,093 | |

The accompanying notes are an integral part of these interim condensed consolidated financial statements.

QUOTEMEDIA, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(UNAUDITED)

| | Three-months ended September 30, | | | Nine-months ended September 30, | |

| | 2023 | | | 2022 | | | 2023 | | | 2022 | |

| | | | | | | | | | | | |

REVENUE (see note 4) | | $ | 4,762,442 | | | $ | 4,390,667 | | | $ | 14,225,467 | | | $ | 12,953,420 | |

| | | | | | | | | | | | | | | | |

COST OF REVENUE | | | 2,296,736 | | | | 2,096,773 | | | | 6,941,469 | | | | 6,599,396 | |

| | | | | | | | | | | | | | | | |

GROSS PROFIT | | | 2,465,706 | | | | 2,293,894 | | | | 7,283,998 | | | | 6,354,024 | |

| | | | | | | | | | | | | | | | |

OPERATING EXPENSES | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

Sales and marketing | | | 711,861 | | | | 784,094 | | | | 2,365,626 | | | | 2,276,526 | |

General and administrative | | | 924,249 | | | | 757,318 | | | | 2,546,950 | | | | 2,213,189 | |

Software development | | | 725,449 | | | | 544,525 | | | | 2,039,537 | | | | 1,549,454 | |

| | | 2,361,559 | | | | 2,085,937 | | | | 6,952,113 | | | | 6,039,169 | |

| | | | | | | | | | | | | | | | |

OPERATING INCOME | | | 104,147 | | | | 207,957 | | | | 331,885 | | | | 314,855 | |

| | | | | | | | | | | | | | | | |

OTHER INCOME (EXPENSES) | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

Foreign exchange gain (loss) | | | 21,803 | | | | 102,327 | | | | (16,271 | ) | | | (15,309 | ) |

Interest income (expense), net | | | 825 | | | | 10 | | | | (1,031 | ) | | | (1,721 | ) |

| | | 22,628 | | | | 102,337 | | | | (17,302 | ) | | | (17,030 | ) |

| | | | | | | | | | | | | | | | |

NET INCOME BEFORE INCOME TAXES | | | 126,775 | | | | 310,294 | | | | 314,583 | | | | 297,825 | |

| | | | | | | | | | | | | | | | |

Income tax expense | | | 739 | | | | 751 | | | | 2,221 | | | | 2,321 | |

| | | | | | | | | | | | | | | | |

NET INCOME | | $ | 126,036 | | | $ | 309,543 | | | $ | 312,362 | | | $ | 295,504 | |

| | | | | | | | | | | | | | | | |

EARNINGS PER SHARE (see note 8) | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

Basic earnings per share | | $ | 0.00 | | | $ | 0.00 | | | $ | 0.00 | | | $ | 0.00 | |

Diluted earnings per share | | $ | 0.00 | | | $ | 0.00 | | | $ | 0.00 | | | $ | 0.00 | |

| | | | | | | | | | | | | | | | |

WEIGHTED AVERAGE SHARES OUTSTANDING (see note 8) | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

Basic | | | 90,477,798 | | | | 90,477,798 | | | | 90,477,798 | | | | 90,477,798 | |

Diluted | | | 121,479,248 | | | | 119,432,085 | | | | 121,103,306 | | | | 119,517,746 | |

The accompanying notes are an integral part of these interim condensed consolidated financial statements.

QUOTEMEDIA, INC.

CONDENSED STATEMENTS OF CHANGES IN SERIES A REDEEMABLE CONVERTIBLE

PREFERRED STOCK AND STOCKHOLDERS’ DEFICIT

(UNAUDITED)

| | Series A Redeemable Convertible Preferred Stock | | | Common Stock | | | Additional | | | | | | Total | |

Three-months ended September 30, 2023: | | Number of Shares | | | Amount | | | Number of Shares | | | Amount | | | Paid-in Capital | | | Accumulated Deficit | | | Stockholders’ Deficit | |

Balance, June 30, 2023 | | | 123,685 | | | $ | 2,983,857 | | | | 90,477,798 | | | $ | 90,479 | | | $ | 18,903,272 | | | $ | (20,036,100 | ) | | $ | (1,042,349 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net income | | | - | | | | - | | | | - | | | | - | | | | - | | | | 126,036 | | | | 126,036 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Balance, September 30, 2023 | | | 123,685 | | | $ | 2,983,857 | | | | 90,477,798 | | | $ | 90,479 | | | $ | 18,903,272 | | | $ | (19,910,064 | ) | | $ | (916,313 | ) |

| | Series A Redeemable Convertible Preferred Stock | | | Common Stock | | | Additional | | | | | | Total | |

Three-months ended September 30, 2022: | | Number of Shares | | | Amount | | | Number of Shares | | | Amount | | | Paid-in Capital | | | Accumulated Deficit | | | Stockholders’ Deficit | |

Balance, June 30, 2022 | | | 123,685 | | | $ | 2,983,857 | | | | 90,477,798 | | | $ | 90,479 | | | $ | 18,896,237 | | | $ | (20,680,935 | ) | | $ | (1,694,219 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Stock-based compensation | | | - | | | | - | | | | - | | | | - | | | | 4,239 | | | | - | | | | 4,239 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net income | | | - | | | | - | | | | - | | | | - | | | | - | | | | 309,543 | | | | 309,543 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Balance, September 30, 2022 | | | 123,685 | | | $ | 2,983,857 | | | | 90,477,798 | | | $ | 90,479 | | | $ | 18,900,476 | | | $ | (20,371,392 | ) | | $ | (1,380,437 | ) |

| | Series A Redeemable Convertible Preferred Stock | | | Common Stock | | | Additional | | | | | | Total | |

Nine-months ended September 30, 2023: | | Number of Shares | | | Amount | | | Number of Shares | | | Amount | | | Paid-in Capital | | | Accumulated Deficit | | | Stockholders’ Deficit | |

Balance, December 31, 2022 | | | 123,685 | | | $ | 2,983,857 | | | | 90,477,798 | | | $ | 90,479 | | | $ | 18,903,272 | | | $ | (20,222,426 | ) | | $ | (1,228,675 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net income | | | - | | | | - | | | | - | | | | - | | | | - | | | | 312,362 | | | | 312,362 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Balance, September 30, 2023 | | | 123,685 | | | $ | 2,983,857 | | | | 90,477,798 | | | $ | 90,479 | | | $ | 18,903,272 | | | $ | (19,910,064 | ) | | $ | (916,313 | ) |

| | Series A Redeemable Convertible Preferred Stock | | | Common Stock | | | Additional | | | | | | Total | |

Nine-months ended September 30, 2022: | | Number of Shares | | | Amount | | | Number of Shares | | | Amount | | | Paid-in Capital | | | Accumulated Deficit | | | Stockholders’ Deficit | |

Balance, December 31, 2021 | | | 123,685 | | | $ | 2,983,857 | | | | 90,477,798 | | | $ | 90,479 | | | $ | 18,887,759 | | | $ | (20,666,896 | ) | | $ | (1,688,658 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Stock-based compensation | | | - | | | | - | | | | - | | | | - | | | | 12,717 | | | | - | | | | 12,717 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net income | | | - | | | | - | | | | - | | | | - | | | | - | | | | 295,504 | | | | 295,504 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Balance, September 30, 2022 | | | 123,685 | | | $ | 2,983,857 | | | | 90,477,798 | | | $ | 90,479 | | | $ | 18,900,476 | | | $ | (20,371,392 | ) | | $ | (1,380,437 | ) |

The accompanying notes are an integral part of these interim condensed consolidated financial statements.

QUOTEMEDIA, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(UNAUDITED)

| | Nine-months ended September 30, | |

| | 2023 | | | 2022 | |

OPERATING ACTIVITIES: | | | | | | |

| | | | | | |

Net income | | $ | 312,362 | | | $ | 295,504 | |

| | | | | | | | |

Adjustments to reconcile net income to net cash provided by operating activities: | | | | | | | | |

Depreciation and amortization | | | 1,944,271 | | | | 1,544,810 | |

Stock-based compensation expense – common stock warrants | | | - | | | | (720 | ) |

Stock-based compensation expense – preferred stock warrants | | | 80,625 | | | | - | |

Changes in assets and liabilities: | | | | | | | | |

Accounts receivable | | | (300,133 | ) | | | (99,542 | ) |

Prepaid expenses | | | (52,764 | ) | | | 76,570 | |

Other current assets | | | (57,615 | ) | | | 27,316 | |

Deposits | | | (5,179 | ) | | | (40,528 | ) |

Accounts payable, accrued and other liabilities | | | (184,670 | ) | | | (77,132 | ) |

Deferred revenue | | | 1,065,078 | | | | 465,612 | |

Net cash provided by operating activities | | | 2,801,975 | | | | 2,191,890 | |

| | | | | | | | |

INVESTING ACTIVITIES: | | | | | | | | |

| | | | | | | | |

Purchase of fixed assets | | | (71,249 | ) | | | (105,629 | ) |

Purchase of intangible assets | | | - | | | | (16,313 | ) |

Capitalized application software | | | (2,387,774 | ) | | | (2,022,885 | ) |

Net cash used in investing activities | | | (2,459,023 | ) | | | (2,144,827 | ) |

| | | | | | | | |

FINANCING ACTIVITIES: | | | | | | | | |

| | | | | | | | |

Repayment of finance lease obligations | | | - | | | | (2,094 | ) |

Net cash used in financing activities | | | - | | | | (2,094 | ) |

| | | | | | | | |

Net increase in cash | | | 342,952 | | | | 44,969 | |

| | | | | | | | |

Cash and equivalents, beginning of period | | | 477,987 | | | | 258,705 | |

| | | | | | | | |

Cash and equivalents, end of period | | $ | 820,939 | | | $ | 303,674 | |

The accompanying notes are an integral part of these interim condensed consolidated financial statements.

QUOTEMEDIA, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(UNAUDITED)

1. BASIS OF PRESENTATION

The accompanying unaudited condensed consolidated financial statements have been prepared in accordance with the generally accepted accounting principles for interim financial statements and instructions for Form 10-Q. Accordingly, they do not include all of the information and footnotes required by generally accepted accounting principles for complete financial statements. In the opinion of management, all adjustments, consisting only of normal recurring adjustments considered necessary for a fair presentation, have been included. Operating results for any quarter are not necessarily indicative of the results for any other quarter or for a full year. In connection with the preparation of the condensed consolidated financial statements, management evaluated subsequent events after the balance sheet date of September 30, 2023 through the filing of this report.

These consolidated financial statements should be read in conjunction with the consolidated financial statements and the notes thereto for the fiscal year ended December 31, 2022 contained in the Form 10-K filed with the Securities and Exchange Commission dated March 31, 2023.

Risks and Uncertainties

Adverse macroeconomic conditions, including inflation, slower growth or recession, and higher interest rates could materially adversely affect demand for the Company’s services.

2. SIGNIFICANT ACCOUNTING POLICIES

a) Nature of operations

QuoteMedia, Inc. (the “Company”) is a software developer and distributor of financial market data and related services to a global marketplace. The Company specializes in the collection, aggregation, and delivery of both delayed and real-time financial data content via the Internet. The Company develops and license software components that deliver dynamic content to banks, brokerage firms, financial institutions, mutual fund companies, online information and financial portals, media outlets, public companies, and corporate intranets.

b) Basis of consolidation

These consolidated financial statements include the operations of QuoteMedia, Ltd., a wholly owned subsidiary of QuoteMedia, Inc. All intercompany transactions and balances have been eliminated.

c) Foreign currency translation and transactions

The U.S. dollar is the functional currency of all of the Company's operations. Foreign currency asset and liability amounts are remeasured into U.S. dollars at end-of-period exchange rates, except for equipment and intangible assets, which are remeasured at historical rates. Foreign currency income and expenses are remeasured at average exchange rates in effect during the year, except for expenses related to balance sheet amounts remeasured at historical exchange rates. Because the U.S. dollar is the functional currency, exchange gains and losses arising from remeasurement of foreign currency-denominated monetary assets and liabilities are included in income in the period in which they occur.

d) Allowances for doubtful accounts

The Company maintains an allowance for doubtful accounts for estimated losses resulting from the inability of the Company’s customers to make required payments. The Company determines the allowance by reviewing the age of the receivables and assessing the anticipated ability of customers to pay. No collateral is required for any of the receivables and the Company does not usually apply financing charges to outstanding accounts receivable balances. If the financial condition of the Company’s customers were to deteriorate, adversely affecting their ability to make payments, additional allowances would be required.

On January 1, 2023, the Company adopted Accounting Standards Update (“ASU”) 2016-13, Financial Instruments-Credit Losses (Topic 326), which changes the impairment model for most financial assets, including accounts receivable, and replaces the existing incurred loss impairment model with an expected loss methodology, which will result in more timely recognition of credit losses. The adoption of ASU 2016-13 had no impact on the Company’s consolidated financial statements.

The allowance for doubtful accounts was $275,000 and $200,000 as of September 30, 2023 and December 31, 2022, respectively. Bad debt expenses were $155,980 and $19,745 for the three-months ended September 30, 2023 and 2022, respectively. Bad debt expenses were $117,739 and $55,936 for the nine-months ended September 30, 2023 and 2022, respectively.

QUOTEMEDIA, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(UNAUDITED)

e) Revenue

The Company generates substantially all of its revenue from subscriptions for access to its software products and related support. The Company licenses financial market data information on a monthly, quarterly, or annual basis. The Company’s products and services are divided into two main categories:

Interactive Content and Data Applications

| · | Proprietary financial software applications and streaming market data feeds |

| · | Subscriptions are typically sold for a fixed fee and revenue is recognized ratably over the term of the subscription. |

Portfolio Management and Real-Time Quote Systems

| 1. | Corporate Quotestream (Business-to-Business) |

| o | Web-delivered, embedded applications providing real-time, streaming market quotes and research information targeted to both professionals and non-professional users. |

| o | Revenue is typically earned based on customer usage. |

| 2. | Individual Quotestream (Business-to-Consumer) |

| o | Web-delivered, embedded applications providing real-time, streaming market quotes and research information targeted to non-professional users. |

| o | Subscriptions are typically sold for a fixed fee and revenue is recognized ratably over the term of the subscription. |

The Company does not provide its customers with the right to take possession of its software products at any time.

The Company determines revenue recognition through the following steps:

| · | Identification of the contract, or contracts, with a customer |

| | |

| · | Identification of the performance obligations in the contract |

| | |

| · | Determination of the transaction price |

| | |

| · | Allocation of the transaction price to the performance obligations in the contract |

| | |

| · | Recognition of revenue when, or as, the Company satisfies a performance obligation |

The Company executes a signed contract with the customer that specifies services to be provided, the payment amounts and terms, and the period of service, among other terms.

Contract Balances

The timing of revenue recognition may differ from the timing of invoicing to customers. The Company records a receivable when revenue is recognized prior to invoicing, or deferred revenue when revenue is recognized subsequent to invoicing. Upfront set-up or development fees are deferred and recognized over the service term of the contract, as set-up and development fees are not distinct from the market data service contracts to which they relate.

The Company considers the following factors when determining if collection of a fee is reasonably assured: customer creditworthiness, past transaction history with the customer, current economic industry trends, and changes in customer payment terms.

Cost of revenue

Cost of revenue primarily consists of customer support personnel-related compensation expenses, including salaries, bonuses, benefits, payroll taxes, and stock-based compensation expense, as well as expenses related to third-party hosting costs, software license fees, amortization of capitalized software development costs, amortization of acquired technology, intangible assets, and allocated overhead.

f) Accounting Pronouncements

Not Yet Adopted

In August 2020, the FASB issued ASU 2020-06, Debt-Debt with Conversion and Other Options (Subtopic 470-20) and Derivatives and Hedging-Contracts in Entity’s Own Equity (Subtopic 815-40): Accounting for Convertible Instruments and Contracts in an Entity’s Own Equity (“ASU 2020-06”). ASU 2020-06 simplifies the complexity associated with applying U.S. Generally Accepted Accounting Principles (“GAAP”) for certain financial instruments with characteristics of liabilities and equity. More specifically, the amendments focus on the guidance for convertible instruments and derivative scope exception for contracts in an entity's own equity. The new standard is effective for the Company for fiscal years beginning after December 15, 2023. The Company does not expect that the adoption of ASU 2020-06 will have a significant impact on the Company’s consolidated financial statements.

QUOTEMEDIA, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(UNAUDITED)

Other accounting standards that have been issued by the FASB or other standards-setting bodies that do not require adoption until a future date are not expected to have a material impact on the Company’s consolidated financial statements upon adoption.

3. PRIOR PERIOD RESTATEMENTS

Subsequent to the filing of its Quarterly Report for the quarterly period ended March 31, 2022, the Company reassessed its classification of warrants to purchase shares of Series A Redeemable Convertible Preferred Stock (“Compensation Preferred Stock Warrants” – see Financial Statement Note 9 “Redeemable Convertible Preferred Stock and Stockholders’ Deficit”). The Company concluded that its original classification of the Preferred Stock Warrants as equity was incorrect and that the Preferred Stock Warrants should have been classified as a liability in accordance with Accounting Standards Codification (“ASC”) 480, Distinguishing Liabilities From Equity, resulting in the following revisions in the Company’s comparative consolidated financial statements:

Statement of Changes in Series A Redeemable Convertible Preferred Stock and Stockholders’ Deficit as of December 31, 2021:

| · | Additional Paid-in Capital was reduced by $750,000. |

| · | Accumulated Deficit was reduced by $236,250. |

4. REVENUE

Disaggregated Revenue

The Company provides market data, financial web content solutions and cloud-based applications. Revenue by type of service consists of the following:

| | Three-months ended September 30, | | | Nine-months ended September 30, | |

| | 2023 | | | 2022 | | | 2023 | | | 2022 | |

Portfolio Management Systems | | | | | | | | | | | | |

Corporate Quotestream | | $ | 1,782,581 | | | $ | 1,708,627 | | | $ | 5,486,732 | | | $ | 5,146,298 | |

Individual Quotestream | | | 458,428 | | | | 512,142 | | | | 1,420,138 | | | | 1,606,133 | |

Interactive Content and Data APIs | | | 2,521,433 | | | | 2,169,898 | | | | 7,318,597 | | | | 6,200,989 | |

Total revenue | | $ | 4,762,442 | | | $ | 4,390,667 | | | $ | 14,225,467 | | | $ | 12,953,420 | |

Deferred Revenue

Changes in deferred revenue for the nine-months ended September 30, 2023 and 2022 were as follows:

| | September 30, 2023 | | | September 30, 2022 | |

Deferred revenue at beginning of period | | $ | 1,166,848 | | | $ | 622,497 | |

Revenue recognized in the current period from the amounts in the beginning balance | | | (995,364 | ) | | | (522,431 | ) |

New deferrals, net of amounts recognized in the current period | | | 1,873,614 | | | | 988,102 | |

Effects of foreign currency translation | | | 4,566 | | | | (59 | ) |

Deferred revenue at end of period | | $ | 2,049,664 | | | $ | 1,088,109 | |

| | | | | | | | |

Current portion of deferred revenue | | $ | 1,676,949 | | | $ | 1,088,109 | |

Long-term portion of deferred revenue | | | 372,715 | | | | - | |

Total deferred revenue | | $ | 2,049,664 | | | $ | 1,088,109 | |

Practical Expedients

The Company applies a practical expedient and does not disclose the value of the remaining performance obligations for contracts that are less than one year in duration, which represent a substantial majority of its revenue.

QUOTEMEDIA, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(UNAUDITED)

5. RELATED PARTIES

The Company entered into a five-year office lease with 410734 B.C. Ltd. effective May 1, 2021 for approximately $6,500 per month. David M. Shworan, President & CEO of QuoteMedia Ltd., is a control person of 410734 B.C. Ltd. At September 30, 2023, there were no amounts due to 410734 B.C. Ltd. At December 31, 2022, there was $13,343 due to 410734 B.C. Ltd.

The Company entered into a marketing agreement with Bravenet Web Services, Inc. (“Bravenet”) effective November 28, 2019. The Company agreed to pay Bravenet an upfront setup fee of $7,000 upon signing the agreement and a monthly service fee of $2,500 starting February 2020. At September 30, 2023 and December 31, 2022, there was $7,000 and $12,500 due to Bravenet related to this agreement, respectively. David M. Shworan is a control person of Bravenet. At September 30, 2023 and December 31, 2022, there were $48,628 and $70,100 in unreimbursed expenses owed to Keith Randall, CEO of QuoteMedia, Inc., respectively. As a matter of policy all significant related party transactions are subject to review and approval by the Company’s Board of Directors.

6. LEASES

The Company has operating leases for corporate offices and finance leases for certain equipment. The leases have remaining lease terms of 1 year to 5 years. Management determines if an arrangement is a lease at inception. Operating lease assets and liabilities are included in operating lease right-of-use assets and operating lease liabilities, respectively, on the consolidated balance sheets. Finance lease assets and liabilities are included in property and equipment and finance lease liabilities, respectively, on the consolidated balance sheets.

Operating lease right-of-use assets and operating lease liabilities are recognized based on the present value of the future minimum lease payments over the lease term at commencement date. As most of the leases do not provide an implicit rate, an incremental borrowing rate based on the information available at commencement date in determining the present value of future payments is used. Management elected the short-term lease exception and therefore only recognize right-of-use assets and lease liabilities for leases with a term greater than one year. When determining lease terms, management factors in options to extend or terminate leases when it is reasonably certain that the Company will exercise that option. The Company has lease agreements with lease and non-lease components, which are generally accounted for separately. For certain leases the Company accounts for the lease and non-lease components as a single lease component.

Supplemental balance sheet information related to leases was as follows:

| | September 30, 2023 | | | December 31, 2022 | |

Operating Leases | | | | | | |

| | | | | | |

Operating lease right-of-use assets | | $ | 442,384 | | | $ | 506,219 | |

| | | | | | | | |

Current portion of operating lease liability | | $ | 198,239 | | | $ | 174,166 | |

| | | 239,080 | | | | 323,685 | |

Total operating lease liability | | $ | 437,319 | | | $ | 497,851 | |

| | September 30, 2023 | | | December 31, 2022 | |

| | | | | | |

Weighted Average Remaining Lease Term | | | | | | |

Operating leases | | 2.2 years | | | 2.7 years | |

Weighted Average Discount Rate | | | | | | |

Operating leases | | | 9.5 | % | | 9.9% | |

Maturities of lease liabilities were as follows:

| | Operating Leases | |

| | | |

2023 (excluding the nine-months ended September 30, 2023) | | $ | 57,437 | |

2024 | | | 230,067 | |

2025 | | | 164,285 | |

2026 and thereafter | | | 34,006 | |

Total lease payments | | | 485,795 | |

Less imputed interest | | | (48,476 | ) |

Total | | $ | 437,319 | |

QUOTEMEDIA, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(UNAUDITED)

The components of lease expense for the three and nine-months ended September 30, 2023 and 2022 were as follows:

| | Three-months ended September 30, | | | Nine-months ended September 30, | |

| | 2023 | | | 2022 | | | 2023 | | | 2022 | |

Operating lease costs: | | | | | | | | | | | | |

Operating lease costs | | $ | 58,504 | | | $ | 57,543 | | | $ | 176,096 | | | $ | 179,152 | |

Short-term lease costs | | | 27,111 | | | | 22,387 | | | | 81,091 | | | | 67,189 | |

Total operating lease costs | | $ | 85,615 | | | $ | 79,930 | | | $ | 257,187 | | | $ | 246,341 | |

| | | | | | | | | | | | | | | | |

Finance lease costs: | | | | | | | | | | | | | | | | |

Interest | | $ | - | | | $ | 7 | | | $ | - | | | $ | 64 | |

Total finance lease costs | | $ | - | | | $ | 7 | | | $ | - | | | $ | 64 | |

Supplemental cash flow information for the nine-months ended September 30, 2023 and 2022 related to leases was as follows:

| | 2023 | | | 2022 | |

Cash paid for amounts included in the measurement of lease liabilities: | | | | | | |

Operating cash flows used in operating leases | | $ | 172,454 | | | $ | 173,682 | |

Operating cash flows used in finance leases | | | - | | | | 64 | |

Financing cash flows used in finance leases | | | - | | | | 2,094 | |

| | | | | | | | |

Right-of-use assets obtained in exchange for lease obligations: | | | | | | | | |

Operating leases | | | 78,304 | | | | - | |

7. REDEEMABLE CONVERTIBLE PREFERRED STOCK AND STOCKHOLDERS’ DEFICIT

a) Redeemable Convertible Preferred Stock

The Company is authorized to issue up to 10,000,000 non-designated preferred shares at the Board of Directors’ discretion.

A total of 550,000 shares of the Company’s Preferred Stock are designated as “Series A Redeemable Convertible Preferred Stock.” The Series A Redeemable Convertible Preferred Stock has no dividend or voting rights.

At September 30, 2023, 123,685 shares of Series A Redeemable Convertible Preferred Stock were outstanding. No shares of Series A Redeemable Convertible Preferred Stock were issued or redeemed during the three and nine-months ended September 30, 2023 and 2022.

Redemption Rights

Holders of Series A Redeemable Convertible Preferred Stock shall have the right to convert their shares into shares of common stock at the rate of 83.33 shares of common stock for one share of Series A Redeemable Convertible Preferred Stock, at any time following the date the closing price of a share of common stock on a securities exchange or actively traded over-the-counter market has exceeded $0.30 for ninety (90) consecutive trading days. The conversion rights are subject to the availability of authorized but unissued shares of common stock.

In addition, 1,000 Series A Redeemable Convertible Preferred Stock may be redeemed at the holder’s option at the liquidation value of $25 per share if the cash balance of the Company as reported at the end of each fiscal quarter exceeds $400,000.

In accordance with Accounting Standards Update (“ASU”) 480-10-S99, because a limited number of Series A Redeemable Convertible Preferred Stock may be redeemed at the holder’s option if the above criteria are met, it was classified as mezzanine equity and not permanent equity.

In the event of any liquidation, dissolution, or winding up of the Company, whether voluntary or involuntary, before any distribution or payment is made to any holders of any shares of common stock, the holders of shares of Series A Redeemable Convertible Preferred Stock shall be entitled to be paid first out of the assets of the Corporation available for distribution to holders of the Company’s capital stock whether such assets are capital, surplus, or earnings, an amount equal to $25.00 per share of Series A Redeemable Convertible Preferred Stock.

QUOTEMEDIA, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(UNAUDITED)

b) Common stock

No shares of common stock were issued during the three and nine-months ended September 30, 2023 and 2022.

c) Stock Options and Warrants

FASB ASC 718, Stock Compensation, requires all share-based payments to employees, including grants of employee stock options, to be recognized as compensation expense over the service period (generally the vesting period) in the consolidated financial statements based on their fair values. The impact of forfeitures that may occur prior to vesting is also estimated and considered in the amount recognized.

Total stock-based compensation expense, related to all of the Company’s stock-based awards, recognized for the three and nine-months ended September 30, 2023 and 2022 was comprised as follows:

| | Three-months ended September 30, | | | Nine-months ended September 30, | |

| | 2023 | | | 2022 | | | 2023 | | | 2022 | |

| | | | | | | | | | | | |

Sales and marketing | | $ | (57,188 | ) | | $ | (82,888 | ) | | $ | 80,625 | | | $ | (720 | ) |

Total stock-based compensation expense | | $ | (57,188 | ) | | $ | (82,888 | ) | | $ | 80,625 | | | $ | (720 | ) |

Common Stock Options and Warrants

There were 25,772,803 fully vested common stock warrants and options outstanding at September 30, 2023 and December 31, 2022 at a weighted-average grant date exercise price of $0.06. No stock options or warrants to purchase common stock were granted or exercised during the three and nine-months ended September 30, 2023 and 2022.

The following table summarizes the weighted average remaining contractual life and exercise price of common stock options and warrants outstanding and exercisable at September 30, 2023:

| | | | | Weighted | | | | |

| | | | | Average | | | Weighted | |

| | | | | Remaining | | | Average | |

| | Number | | | Contractual | | | Exercise | |

| | Outstanding | | | Life (Years) | | | Price | |

| | | | | | | | | |

$0.03-0.11 | | | 25,772,803 | | | | 5.81 | | | $ | 0.06 | |

At September 30, 2023, there was no unrecognized compensation cost related to non-vested options and warrants granted to purchase common stock.

All stock options and warrants to purchase common stock have been granted with exercise prices equal to or greater than the market value of the underlying common shares on the date of grant. At September 30, 2023, the aggregate intrinsic value of options and warrants outstanding and exercisable was $5,725,118. The intrinsic value of stock options and warrants are calculated as the amount by which the market price of the Company’s common stock exceeds the exercise price of the option or warrant.

Preferred Stock Warrants

Pursuant to the December 28, 2017 Compensation Agreement with David M. Shworan, the President and Chief Executive Officer of QuoteMedia, Ltd., a wholly owned subsidiary of QuoteMedia, Inc., the Company issued Mr. Shworan warrants to purchase shares of Series A Redeemable Convertible Preferred Stock (“Compensation Preferred Stock Warrants”) in lieu of a cash salary. From the period December 28, 2017 to December 31, 2019 the Company issued a total of 31,250 Compensation Preferred Stock Warrants at an exercise price equal to $1.00 per share.

Also pursuant to the Compensation Agreement with Mr. Shworan, on December 28, 2017 the Company issued Mr. Shworan warrants to purchase up to 382,243 shares of Series A Redeemable Convertible Preferred Stock at an exercise price equal to $1.00 per share (“Liquidity Preferred Stock Warrant”). The Liquidity Preferred Stock Warrants only vest and become exercisable on the consummation of a Liquidity Event as defined in the Company’s Certificate of Designation of Series A Redeemable Convertible Preferred Stock. The probability of the liquidity event performance condition is not currently determinable or probable; therefore, no compensation expense has been recognized as of September 30, 2023. The probability is re-evaluated each reporting period. As of September 30, 2023, there was $7,185,430 in unrecognized stock-based compensation expense related to these Liquidity Preferred Stock Warrants. Since the Liquidity Preferred Stock Warrants only vest and become exercisable on the consummation of a Liquidity Event which is currently determined not to be probable, management is also unable to determine the weighted-average period over which the unrecognized compensation cost will be recognized.

QUOTEMEDIA, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(UNAUDITED)

As of September 30, 2023, there were a total of 413,493 preferred stock warrants outstanding with a weighted average remaining contractual life of 24.3 years. As of September 30, 2023, 31,250 preferred stock warrants were exercisable. No preferred stock warrants were granted or exercised for the three and nine-months ended September 30, 2023 and 2022.

Fair Value Measurement of Compensation Preferred Stock Warrants

The Company adheres to ASC 820, which defines fair value, establishes a framework for measuring fair value, and expands disclosures about fair value measurements. ASC 820 applies to reported balances that are required or permitted to be measured at fair value under existing accounting pronouncements; accordingly, the standard does not require any new fair value measurements of reported balances.

ASC 820 emphasizes that fair value is a market-based measurement, not an entity-specific measurement. Therefore, a fair value measurement should be determined based on the assumptions that market participants would use in pricing the asset or liability. As a basis for considering market participant assumptions in fair value measurements, ASC 820 establishes a fair value hierarchy that distinguishes between market participant assumptions based on market data obtained from sources independent of the reporting entity (observable inputs that are classified within Levels 1 and 2 of the hierarchy) and the reporting entity’s own assumptions about market participant assumptions (unobservable inputs classified within Level 3 of the hierarchy).

| · | Level 1 inputs utilize quoted prices (unadjusted) in active markets for identical assets or liabilities that the Company could access. |

| | |

| · | Level 2 inputs are inputs other than quoted prices included in Level 1 that are observable for the asset or liability, either directly or indirectly. Level 2 inputs may include quoted prices for similar assets and liabilities in active markets, as well as inputs that are observable for the asset or liability (other than quoted prices), such as interest rates, foreign exchange rates, and yield curves that are observable at commonly quoted intervals. |

| | |

| · | Level 3 inputs are unobservable inputs for the asset or liability, which is typically based on an entity’s own assumptions, as there is little, if any, related market activity. |

In instances where the determination of the fair value measurement is based on inputs from different levels of the fair value hierarchy, the level in the fair value hierarchy within which the entire fair value measurement falls is based on the lowest level input that is significant to the fair value measurement in its entirety. The Company’s assessment of the significance of a particular input to the fair value measurement in its entirety requires judgment and considers factors specific to the asset or liability.

The estimated fair value of the Preferred Stock Warrant liability is determined using Level 3 inputs. As of September 30, 2023 and December 31, 2022, the fair value of the Preferred Stock Warrant Liability was $710,000 and $629,375, respectively. The Preferred Stock Warrants were valued using a bond plus option framework reflecting the cash flow of the Preferred Stock Warrants and used a probability weighted sum of the value in each potential year before expiration to estimate the fair value of the Preferred Stock Warrants. Volatility was based on public peer companies, adjusted for size and leverage. Risk-free rate was selected based on term matched Treasury securities. Bond repayment depends on the Company’s timely access to the required cash and as such, is discounted at the Company’s assumed borrowing rate. This model was run based on the Management's expected term and probabilities of a liquidity event. The key inputs for the framework were as follows as of September 30, 2023 and December 31, 2022:

Valuation Inputs | | September 30, 2023 | | | December 31, 2022 | |

Expected Time to Expiration (years) | | | 24.30 | | | | 25.05 | |

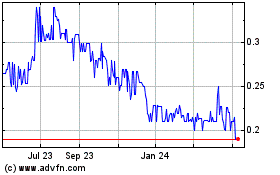

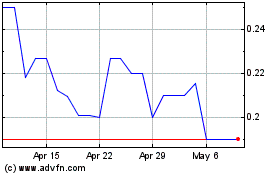

Stock Price on Valuation Date | | $ | 0.28 | | | $ | 0.21 | |

Peer Volatility | | | 46.56 | % | | | 52.31 | % |

Cash Flow Discount Rate | | | 15.47 | % | | | 12.93 | % |

QUOTEMEDIA, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(UNAUDITED)

The following table sets forth a summary of the changes in the fair value of the Level 3 Preferred Stock Warrant Liability for the three and nine-months ended September 30, 2023:

| | Preferred Stock Warrant Liability | |

Fair value as of December 31, 2022 | | $ | 629,375 | |

Change in fair value | | | 137,813 | |

Fair value as of June 30, 2023 | | | 767,188 | |

Change in fair value | | | (57,188 | ) |

Fair value as of September 30, 2023 | | $ | 710,000 | |

The changes in fair value attributable to the Preferred Stock Warrants are recorded as an adjustment to stock compensation expense and reported in Sales and Marketing expense on the Statements of Operations.

8. EARNINGSPER SHARE

Basic net income per share is computed by dividing net income during the period by the weighted-average number of common shares outstanding, excluding the dilutive effects of common stock equivalents. Common stock equivalents include redeemable convertible preferred stock, stock options and warrants. Diluted net income per share is computed by dividing net income by the weighted-average number of dilutive common shares outstanding during the period. Diluted shares outstanding is calculated using the treasury stock method by adding to the weighted shares outstanding any potential shares of common stock from outstanding redeemable convertible preferred stock, stock options and warrants that are in-the-money. In periods when a net loss is reported, all common stock equivalents are excluded from the calculation because they would have an anti-dilutive effect, meaning the loss per share would be reduced. Therefore, in periods when a loss is reported, the calculation of basic and dilutive loss per share results in the same value. The calculations for basic and diluted net income per share for the three and nine-months ended September 30, 2023 and 2022 are as follows:

| | Three-months ended September 30, | | | Nine-months ended September 30, | |

| | 2023 | | | 2022 | | | 2023 | | | 2022 | |

| | | | | | | | | | | | |

Net income | | $ | 126,036 | | | $ | 309,543 | | | $ | 312,362 | | | $ | 295,504 | |

| | | | | | | | | | | | | | | | |

Weighted average common shares used to calculate net income per share - basic | | | 90,477,798 | | | | 90,477,798 | | | | 90,477,798 | | | | 90,477,798 | |

Warrants to purchase redeemable convertible preferred stock | | | 2,499,900 | | | | 2,499,900 | | | | 2,499,900 | | | | 2,499,900 | |

Redeemable convertible preferred stock | | | 10,306,671 | | | | 10,306,671 | | | | 10,306,671 | | | | 10,306,671 | |

Stock options and warrants to purchase common stock | | | 18,194,879 | | | | 16,147,716 | | | | 17,818,937 | | | | 16,233,377 | |

| | | | | | | | | | | | | | | | |

Weighted average common shares used to calculate net income per share - diluted | | | 121,479,248 | | | | 119,432,085 | | | | 121,103,306 | | | | 119,517,746 | |

| | | | | | | | | | | | | | | | |

Net income per share – basic | | $ | 0.00 | | | $ | 0.00 | | | $ | 0.00 | | | $ | 0.00 | |

Net income per share – diluted | | $ | 0.00 | | | $ | 0.00 | | | $ | 0.00 | | | $ | 0.00 | |

ITEM 2. Management’s Discussion and Analysis

The following discussion should be read in conjunction with our consolidated financial statements and notes thereto included elsewhere in this report. We caution readers regarding certain forward looking statements in the following discussion, elsewhere in this report, and in any other statements, made by, or on behalf of our company, whether or not in future filings with the Securities and Exchange Commission. Forward-looking statements are statements not based on historical information and which relate to future operations, strategies, financial results, or other developments. Forward-looking statements are necessarily based upon estimates and assumptions that are inherently subject to significant business, economic, and competitive uncertainties and contingencies, many of which are beyond our control and many of which, with respect to future business decisions, are subject to change. These uncertainties and contingencies can affect actual results and could cause actual results to differ materially from those expressed in any forward looking statements made by, or on behalf of, our company. Uncertainties and contingencies that might cause such differences include those risk factors disclosed in our annual report on Form 10-K for the year ended December 31, 2022 and other reports filed from time to time with the SEC.

We disclaim any obligation to update forward-looking statements. All references to “we”, “our”, “us”, or “QuoteMedia” refer to QuoteMedia, Inc., and its predecessors, operating divisions, and subsidiaries.

This report should be read in conjunction with our Form 10-K for the fiscal year ended December 31, 2022 filed with the Securities and Exchange Commission.

Overview

We are a developer of financial software and a distributor of market data and research information to online brokerages, clearing firms, banks, media properties, public companies and financial service corporations worldwide. Through the aggregation of information from many direct data, news, and research sources; we offer a comprehensive range of solutions for all market-related information provisioning requirements.

We have three general product lines: Interactive Content and Data APIs, Data Feed Services, and Portfolio Management Systems. For financial reporting purposes, our product categories share similar economic characteristics and share costs; therefore, they are combined into one reporting segment.

Our Interactive Content and Data APIs consist of a suite of software applications that provide publicly traded company and market information to corporate clients via the Internet. Products include stock market quotes, fundamentals, historical and interactive charts, company news, filings, option chains, insider transactions, corporate financials, corporate profiles, screeners, market research information, investor relations provisions, level II, watch lists, and real-time quotes. All of our content solutions are completely customizable and embed directly into client Web pages for seamless integration with existing content. We are continuing to develop and launch new modules of QModTM, our new proprietary Web delivery system. QMod was created for secure market data provisioning as well as ease of integration and unlimited customization. Additionally, QMod delivers search engine optimized (SEO) ready responsive content designed to adapt on the fly when rendered on mobile devices or standard Web pages – automatically resizing and reformatting to fit the device on which it is displayed.

Our Data Feed Services consist of raw streaming real-time market data delivered over the Internet or via dedicated telecommunication lines. We provide supplemental fundamental, historical, and analytical data, keyed to the same symbology, which provides a complete market data solution offered to our customers. Currently, QuoteMedia’s Data Feed services include complete coverage of North American exchanges and over 70 exchanges worldwide. For financial reporting purposes, Data Feed Services revenue is included in the Interactive Content and Data APIs revenue totals.

Our Portfolio Management Systems consist of QuotestreamTM, Quotestream Mobile, Quotestream Professional, and our Web Portfolio Management systems. Quotestream Desktop is an Internet-based streaming online portfolio management system that delivers real-time and delayed market data to both consumer and corporate markets. Quotestream has been designed for syndication and private branding by brokerage, banking, and Web portal companies. Quotestream’s enhanced features and functionality – most notably tick-by-tick true streaming data, significantly enhanced charting features, and a broad range of additional research and analytical content and functionality – offer a professional-level experience to nonprofessional users.

Quotestream Professional is specifically designed for use by financial services professionals, offering exceptional coverage and functionality at extremely aggressive pricing. Quotestream Professional features broad market coverage, reliability, complete flexibility, ultra-low-latency tick-by-tick data, as well as completely customizable screens, advanced charting, comprehensive technical analysis, news and research data.

Quotestream Mobile is a true companion product to the Quotestream desktop products (Quotestream and Quotestream Professional) – any changes made to portfolios in either the desktop or mobile application are automatically reflected in the other.

A key feature of QuoteMedia’s business model is that all of our product lines generate recurring monthly licensing revenue from each client. Contracts to license Quotestream to our corporate clients, for example, typically have a term of one to five years and are automatically renewed unless notice is given at least 90 days prior to the expiration of the current license term. We also generate Quotestream revenue through individual end-user licenses on a monthly or annual subscription fee basis. Interactive Content and Data APIs and Market Data Feeds are licensed for a monthly, quarterly, annual, or semi-annual subscription fee. Contracts to license our Financial Data Products and Data Feeds typically have a term of one to five years and are automatically renewed unless notice is given 90 days prior to the expiration of the contract term.

Business Environment and Trends

While our licensed-based revenue is generally more recurring in nature, the uncertainty caused by the recent market volatility, rising inflation and federal debt level payment uncertainty may result in some clients to delay purchasing decisions, product and service implementations or cancel or reduce spending with us. Recent events in the Ukraine and Russia have also caused disruptions in the global financial markets. While we do not have any operations or customers in the Ukraine or Russia, we will continue to monitor the situation as a prolonged conflict could impact our business.

Approximately 38% of our consolidated revenue, and 39% of our consolidated expenses are denominated in Canadian dollars. The Canadian dollar depreciated 5% against the U.S. dollar when comparing the average exchange rate for the nine-months ended September 30,2023 versus the comparative 2022 period. This decreased both Canadian dollar revenues and expenses by approximately 2% once translated into U.S. dollars but had a minimal impact on our net income and cash flow.

Our revenue increased 10% for the nine-months ended September 30, 2023 versus the comparative 2022 period. Based on revenue already under contract, we expect lower revenue growth but an improvement in net income for the remainder of fiscal 2023 and for 2024.

Plan of Operation

For the remainder of 2023 and for 2024 we plan to continue to expand our product lines and improve our infrastructure. We plan to continue to add more features and data to our existing products and release newer versions with improved performance and flexibility for client integration. This expansion is expected to result in both increased revenue and costs for the remainder of fiscal 2023.

We will maintain our focus on marketing Quotestream for deployments by brokerage firms to their retail clients and continue our expansion into the investment professional market with Quotestream Professional. We also plan to continue the growth of our Data Feed Services client base, particularly through the addition of major new international data feed coverage, as well as new data delivery products.

QuoteMedia will continue to focus on increasing the sales of its Interactive Content and Data APIs, particularly in the context of large-scale enterprise deployments encompassing solutions ranging across several product lines. QMod is a major component of this strategy, given the broad demand for mobile-ready, SEO-friendly Web content.

Important development projects for the remainder of 2023 include broad expansion of data and news coverage, including the addition of a wide array of international exchange data and news, video feeds, expansion of fixed-income coverage, and the introduction of several new and upgraded market information products.

New deployments of our trade integration capabilities, which allow our Quotestream applications to interact with our brokerage clients’ back-end trade execution and reporting platforms (enabling on-the-fly trade execution and tracking of holdings) are underway and will continue to be a priority in the coming year.

We are also creating new proprietary data sets, analytics, and scoring mechanisms. We are now aggregating data direct from the sources to produce data sets that are proprietary to QuoteMedia. This allows us to offer our clients new data products and lower our product costs structure as we replace some of our existing data providers with our own lower cost data.

Opportunistically, efforts will be made to evaluate and pursue the development of additional new products that may eventually be commercialized by our company. Although not currently anticipated, we may require additional capital to execute our proposed plan of operation. There can be no assurance that such additional capital will be available to our company on commercially reasonable terms or at all.

Our future performance will be subject to a number of business factors, including those beyond our control, such as a continuation of market uncertainty and evolving industry needs and preferences, as well as the level of competition and our ability to continue to successfully market our products and technology. There can be no assurance that we will be able to successfully implement our marketing strategy, continue our revenue growth, or maintain profitable operations.

Critical Accounting Policies and Estimates

Critical Accounting Policies and Estimates

In the 2022 Annual Report, we disclose our critical accounting policies and estimates upon which our consolidated financial statements are derived. There have been no material changes to these policies since December 31, 2022. Readers are encouraged to read the 2022 Annual Report in conjunction.

Results of Operations

Revenue

Three-months ended September 30, | | 2023 | | | 2022 | | | Change ($) | | | Change (%) | |

| | | | | | | | | | | | |

Corporate Quotestream | | $ | 1,782,581 | | | $ | 1,708,627 | | | $ | 73,954 | | | | 4 | % |

Individual Quotestream | | | 458,428 | | | | 512,142 | | | | (53,714 | ) | | | (11 | %) |

Total Portfolio Management Systems | | | 2,241,009 | | | | 2,220,769 | | | | 20,240 | | | | 1 | % |

| | | | | | | | | | | | | | | | |

Interactive Content and Data APIs | | | 2,521,433 | | | | 2,169,898 | | | | 351,535 | | | | 16 | % |

| | | | | | | | | | | | | | | | |

Total subscription revenue | | $ | 4,762,442 | | | $ | 4,390,667 | | | $ | 371,775 | | | | 8 | % |

Nine-months ended September 30, | | 2023 | | | 2022 | | | Change ($) | | | Change (%) | |

| | | | | | | | | | | | |

Corporate Quotestream | | $ | 5,486,732 | | | $ | 5,146,298 | | | $ | 340,434 | | | | 7 | % |

Individual Quotestream | | | 1,420,138 | | | | 1,606,133 | | | | (185,995 | ) | | | (12 | %) |

Total Portfolio Management Systems | | | 6,906,870 | | | | 6,752,431 | | | | 154,439 | | | | 2 | % |

| | | | | | | | | | | | | | | | |

Interactive Content and Data APIs | | | 7,318,597 | | | | 6,200,989 | | | | 1,117,608 | | | | 18 | % |

| | | | | | | | | | | | | | | | |

Total subscription revenue | | $ | 14,225,467 | | | $ | 12,953,420 | | | $ | 1,272,047 | | | | 10 | % |

Total licensing revenue increased 8% and 10% when comparing the three and nine-months ended September 30, 2023 and 2022. The depreciation of the Canadian dollar since the comparative periods, discussed above in the “Business Environment and Trends” section, significantly impacted our revenue across all product lines, reducing our total revenue by approximately 2%.

Corporate Quotestream revenue increased 4% and 7% for the three and nine-months ended September 30, 2023 from the comparative periods in 2022 due to an increase in both the number of customers and average revenue per customer since the comparative periods. We have added new products over the past couple years that are continuing to gain traction in the market, and we have made improvements and upgrades to our existing Portfolio Management products as we continue to improve functionality and add new data offerings. These improvements have allowed us to attract larger customers and increase the average revenue for our existing customers.

Individual Quotestream revenue decreased 11% and 12% for the three and nine-months ended September 30, 2023 from the comparative periods in 2022 due to decreases in both total subscribers and average revenue per subscriber.

Interactive Content and Data APIs revenue increased 16% and 18% for the three and nine-months ended September 30, 2023 from the comparative periods in 2022. The increases are attributable to an increase in the average revenue per client as the launch of new products and the expansion of our data coverage have allowed us to attract larger clients.

Cost of Revenue and Gross Profit Summary

Three-months ended September 30, | | 2023 | | | 2022 | | | Change ($) | | | Change (%) | |

| | | | | | | | | | | | |

Cost of revenue | | $ | 2,296,736 | | | $ | 2,096,773 | | | $ | 199,963 | | | | 10 | % |

Gross profit | | $ | 2,465,706 | | | $ | 2,293,894 | | | $ | 171,812 | | | | 7 | % |

Gross margin % | | | 52 | % | | | 52 | % | | | | | | | | |

Nine-months ended September 30, | | 2023 | | | 2022 | | | Change ($) | | | Change (%) | |

| | | | | | | | | | | | |

Cost of revenue | | $ | 6,941,469 | | | $ | 6,599,396 | | | $ | 342,073 | | | | 5 | % |

Gross profit | | $ | 7,283,998 | | | $ | 6,354,024 | | | $ | 929,974 | | | | 15 | % |

Gross margin % | | 51% | | | | 49 | % | | | | | | | | |

Our cost of revenue consists of fixed and variable stock exchange fees and data feed provisioning costs. Cost of revenue also includes amortization of capitalized internal-use software costs. We capitalize the costs associated with developing new products during the application development stage.

Our cost of revenue increased 10% and 5% for the three and nine-months ended September 30, 2023 from the comparative periods in 2022. This was mainly due to increased amortization expenses associated with internally developed application software resulting from our major growth initiative, which included investing in infrastructure, new product development, data collection, and the expansion of our global market coverage.

For the three-months ended September 30, 2023, our cost of revenue was unchanged as a percentage of sales, as evidenced by our gross margin percentage that was 52% for the three-month ended September 30, 2023 and 2022. For the nine-months ended September 30, 2023, our cost of revenue decreased as a percentage of sales, as evidenced by our gross margin percentage that increased to 51% from 49% in the comparative 2022 period. New contracts signed since the comparative periods have higher gross margins than our other customer contracts typically have on average, resulting in an increase in our gross margin percentage.

Operating Expenses Summary

Three-months ended September 30, | | 2023 | | | 2022 | | | Change ($) | | | Change (%) | |

| | | | | | | | | | | | |

Sales and marketing | | $ | 711,861 | | | $ | 784,094 | | | $ | (72,233 | ) | | | (9 | %) |

General and administrative | | | 924,249 | | | | 757,318 | | | | 166,931 | | | | 22 | % |

Software development | | | 725,449 | | | | 544,525 | | | | 180,924 | | | | 33 | % |

Total operating expenses | | $ | 2,361,559 | | | $ | 2,085,937 | | | $ | 275,622 | | | | 13 | % |

Nine-months ended September 30, | | 2023 | | | 2022 | | | Change ($) | | | Change (%) | |

| | | | | | | | | | | | |

Sales and marketing | | $ | 2,365,626 | | | $ | 2,276,526 | | | $ | 89,100 | | | | 4 | % |

General and administrative | | | 2,546,950 | | | | 2,213,189 | | | | 333,761 | | | | 15 | % |

Software development | | | 2,039,537 | | | | 1,549,454 | | | | 490,083 | | | | 32 | % |

Total operating expenses | | $ | 6,952,113 | | | $ | 6,039,169 | | | $ | 912,944 | | | | 15 | % |

Sales and Marketing

Sales and marketing consist primarily of sales and customer service salaries, investor relations, travel and advertising expenses. Sales and marketing expenses decreased 9% for the three-months ended September 30, 2023 due to a one-time bonus accrual made in the comparative 2022 period. Sales and marketing expenses increased 4% for the nine-months ended September 30, 2023 when compared to the same period in 2022. The increase is a result of additional sales personnel hired since the comparative periods to support our product growth initiatives and salary increases for existing personnel. The increases were offset by the depreciation of the Canadian dollar from the comparative periods as most of our sales personnel are located in Canada.

General and Administrative

General and administrative expenses consist primarily of salaries expense, office rent, insurance premiums, and professional fees. General and administrative expenses increased 22% and 15% for the three and nine-months ended September 30, 2023 when compared to the same periods in 2022. The increases for the three and nine-months ended September 30, 2023 are mainly a result of additional professional fees resulting from the change of principal accountants in January 2023 as well as an increase in bad debt expenses from the comparative periods in 2022.

Software Development

Software development expenses consist primarily of costs associated with the design, programming, and testing of our software applications during the preliminary project stage. Software development expenses also include costs incurred to maintain our software applications.

Software development expenses increased 33% and 32% for the three and nine-months ended September 30, 2023 when compared to the same periods in 2022, primarily due to new personnel hired since the comparative periods to improve our infrastructure, security, and business continuity management. The increases in development personnel costs were offset by the depreciation of the Canadian dollar from the comparative periods as most of our development personnel are located in Canada.

We capitalized $812,428 and $2,387,774 of development costs for the three and nine-month periods ended September 30, 2023 compared to $735,169 and $2,022,885 in the same periods in 2022. These costs relate to the development of application software used by subscribers to access, manage, and analyze information in our databases. Capitalized costs associated with application software are amortized over their estimated economic life of three years.

Other Income (Expenses)

Three-months ended September 30, | | 2023 | | | 2022 | |

| | | | | | |

Foreign exchange gain | | $ | 21,803 | | | $ | 102,327 | |

Interest income, net | | | 825 | | | | 10 | |

Total other expenses, net | | $ | 22,628 | | | $ | 102,337 | |

Nine-months ended September 30, | | 2023 | | | 2022 | |

| | | | | | |

Foreign exchange loss | | $ | (16,271 | ) | | $ | (15,309 | ) |

Interest expense, net | | | (1,031 | ) | | | (1,721 | ) |

Total other expenses, net | | $ | (17,302 | ) | | $ | (17,030 | ) |

Foreign Exchange Gain

We incurred foreign exchange gains of $21,803 and $102,327 for the three-months ended September 30, 2023 and 2022, respectively. We incurred foreign exchange losses of $16,271 and $15,309 for the nine-months ended September 30, 2023 and 2022, respectively. Foreign exchange gains and losses arise from the re-measurement of Canadian dollar monetary assets and liabilities into U.S. dollars and from exchange rate fluctuations between transaction and settlement dates for foreign currency denominated transactions.

Interest Expense, Net

Interest expense is netted against interest earned on cash balances. Net interest income of $825 and $10 was earned for the three-months ended September 30, 2023 and 2022. Net interest expenses of $1,031 and $1,721 were incurred for the nine-months ended September 30, 2023 and 2022..

Provision for Income Taxes

For the three and nine-months ended September 30, 2023, the Company recorded $739 and $2,221 in Canadian income tax expense compared to $751 and $2,321 in the respective comparative periods in 2022.

Net Income for the Period

As a result of the foregoing, our net income for the three and nine-month ended September 30, 2023 was $126,036 and $312,362 compared to $309,543 and $295,504 in the respective comparative periods in 2022. Basic and diluted earnings per share were $0.00 for the three and nine-months periods ended September 30, 2023 and 2022, respectively.

Liquidity and Capital Resources

Our cash totaled $820,939 at September 30, 2023, as compared with $477,987 at December 31, 2022, an increase of $342,952. Net cash of $2,801,975 was provided by operations for the nine-months ended September 30, 2023, primarily due to adjustments for non-cash charges and the increase in deferred revenue, offset by a decrease in accounts payable and accrued liabilities and an increase in accounts receivable. Net cash used in investing activities for the nine-months ended September 30, 2023 was $2,459,023, primarily due to capitalized application software costs and the purchases of fixed assets.

We typically operate with a working capital deficit. As of September 30, 2023, our working capital deficit was $1,979,800, however current liabilities include $1,676,949 in deferred revenue. The expected costs necessary to realize the deferred revenue are minimal. If circumstances dictate, we have the flexibility to reduce development spending to maintain a strong liquidity position.

Based on the factors discussed above, we believe that our cash on hand and cash generated from operations will be sufficient to fund our current operations for at least the next 12 months through July 2024. However, implementing our business plan may require additional financing. Additional financing may come from future equity or debt offerings that could result in dilution to our stockholders. Further, current adverse capital and credit market conditions could limit our access to capital. We may be unable to raise capital or bear an unattractive cost of capital that could reduce our financial flexibility.

Our long-term liquidity requirements will depend on many factors, including the rate at which we expand our business and whether we do so internally or through acquisitions. To the extent that the funds generated from operations are insufficient to fund our activities in the long term, we may be required to raise additional funds through public or private financing. No assurance can be given that additional financing will be available or that, if it is available, it will be on terms acceptable to us.

Preferred Stock Redemption Rights

At September 30, 2023, 123,685 shares of Series A Redeemable Convertible Preferred Stock were outstanding and 1,000 shares may be redeemed at the holder’s option at the liquidation value of $25 per share if the cash balance of the Company as reported at the end of each fiscal quarter exceeds $400,000. See Financial Statement Note 7 a) “Preferred shares”.

Foreign Exchange Risk

Currently, approximately 38% of our consolidated revenue, and 39% of our consolidated expenses are denominated in Canadian dollars. Since currently our Canadian dollar revenue and expenses are closely matched, our consolidated cashflows are not significantly impacted by foreign exchange fluctuations.

Off-Balance Sheet Arrangements

At September 30, 2023 and December 31, 2022, we did not have any unconsolidated entities or financial partnerships, or other off-balance sheet arrangements.

ITEM 4. Controls and Procedures

Evaluation of Disclosure Controls and Procedures

Our management, with the participation and supervision of our Chairman of the Board and Chairman of the Audit Committee, Chief Executive Officer and Chief Financial Officer, have evaluated our disclosure controls and procedures (as defined in Rules 13a-15(e) and 15d-15(e) to the Securities Exchange Act of 1934, as amended (the “Exchange Act”)) as of September 30, 2023, and concluded that our disclosure controls and procedures were not effective due to material weaknesses in internal control over financial reporting. Management recognizes that any controls and procedures, no matter how well designed and operated, can provide only reasonable assurance of achieving their objectives, and management necessarily applies its judgment in evaluating the cost-benefit relationship of possible controls and procedures. Based on that evaluation, our management identified the following material weaknesses in our internal control over financial reporting, as described below.

Notwithstanding the material weaknesses described below our management has concluded that our consolidated financial statements for the periods covered by and included in this Quarterly Report are prepared in accordance with accounting principles generally accepted in the United States (“GAAP”) and fairly present, in all material respects, our financial position, results of operations and cash flows for each of the periods presented herein.

The following material weaknesses were identified during the preparation and review of the current period financial statements: