Himax Technologies, Inc. (Nasdaq: HIMX) (“Himax” or “Company”), a

leading supplier and fabless manufacturer of display drivers and

other semiconductor products, announced its financial results for

the third quarter 2023 ended September 30, 2023.

“Ongoing macro headwinds are limiting our

visibility as panel customers remain tentative about demand

prospects, leading to shortened forecasts and more frequent

last-minute orders. Having said that, our longer-term outlook for

the automotive business, our largest revenue contributor, remains

positive, as we maintain a dominant position in the

sector. The majority of our design-wins in TDDI and local

dimming Tcon, both relatively new technologies for automotive

sector, are slated to commence mass production during the next two

years, thereby further fortifying our market share leadership

amidst growing competition,” said Mr. Jordan Wu, President and

Chief Executive Officer of Himax.

“Amidst the prevailing challenging economic

conditions, we continue to implement a range of measures to reduce

costs, including improving manufacturing and operational

efficiencies, and leveraging diverse partners in foundries and

backend sources. The recently announced partnership alliance with

Nexchip in automotive is an illustration of Himax’s foundry supply

diversification strategy. The collaboration expands Himax’s foundry

supply while optimizing cost structure for the thriving automotive

market, especially in China. In terms of inventory, the destocking

process is progressing nicely with Q3 seeing a meaningful

reduction. Currently, we are nearing historical average levels

after several quarters of aggressive inventory depletion,”

concluded Mr. Jordan Wu.

Third Quarter 2023 Financial

Results

Himax net revenues registered $238.5 million, an

increase of 1.5% sequentially and up 11.6% on a year over year

basis, exceeding the guidance range of a 7.0% decline to flat

sequentially. This can be credited to positive order momentum

across all business segments. Gross margin came in at 31.4%, a

substantial increase from 21.7% of last quarter, and at the upper

end of guidance range of 30.5% to 32.0%. The Q3 gross margin

improvement reflected the absence of the one-time expense incurred

in Q2 related to the strategic termination of certain high-cost

foundry capacity agreements, in addition to a favorable product

mix, primarily driven by the remarkable performance of automotive

product line which maintains a higher margin profile than corporate

average. Q3 profit per diluted ADS was 6.4 cents, exceeding the

guidance range of 1.5 cents to 6.0 cents.

Revenue from large display drivers was $43.7

million, a decrease of 3.7% sequentially but up 5.9%

year-over-year. TV IC sales declined as expected as customers

already replenished their inventory in previous quarters and

suspended further pull-ins. Monitor and notebook IC sales were up

single digit and a nice double digit respectively in the third

quarter, predominantly driven by rush orders from key customers.

Large panel driver IC sales accounted for 18.3% of total revenues

for this quarter, compared to 19.3% last quarter and a year

ago.

Small and medium-sized display driver revenue was $161.1

million, an increase of 7.2% sequentially and up 13.9% compared to

same period last year, surpassing the guidance range due to

better-than-expected sales performance, particularly in automotive

sector and TDDI products. Q3 automotive driver sales saw a decent

double digit sequential increase thanks to a strong uptick in both

TDDI and traditional DDIC as clients worldwide resumed order

replenishment. Smartphone and tablet driver sales, on the other

hand, decreased double digit and mid-teens sequentially, reflecting

continued soft market demand. In the third quarter, the automotive

business remained Himax’s largest revenue contributor, accounting

for nearly 45% of total sales. One notable highlight during the

quarter was Company’s commencement of the world’s first mass

production of LTDI. This further demonstrates Himax’s leadership

position in the lucrative automotive display battlefield. Small and

medium-sized driver IC segment accounted for 67.6% of total sales

for the quarter, compared to 63.9% in the previous quarter and

66.2% a year ago.

Third quarter revenues from its non-driver business also

exceeded guidance with revenue of $33.7 million, down 14.4% from a

quarter ago but up 9.0% compared to same period last year. The

better-than-expected performance was a result of higher shipment of

WLO and CMOS image sensor. Tcon business represented over 8% of

total sales in Q3 yet experienced a low teens sequential decline,

hampered by decreased demand for both large display panels and

AMOLED displays for tablet. On a positive note, Himax continues to

solidify its leadership in the automotive Tcon market with local

dimming technology adoption rising rapidly by leading panel makers,

Tier 1s and car makers across the board. With numerous project

awards already in hand, Himax expects a strong growth trajectory

for automotive Tcon in the next few years. Non-driver products

accounted for 14.1% of total revenues, as compared to 16.8% in the

previous quarter and 14.5% a year ago.

Operating expenses for the third quarter were

$63.7 million, an increase of 19.8% from the previous quarter but

down 12.5% from a year ago. As a reminder, Company grants annual

bonuses to employees at the end of September each year, including

RSU and cash awards. 2023 annual bonus compensation of $10.4

million was in line with guidance, out of which $9.7 million, or

4.4 cents per diluted ADS, was immediately vested and expensed in

the third quarter. In comparison, the annual bonuses for 2022 and

2021 were $39.6 million and $74.7 million respectively, of which

$18.5 million and $24.8 million were vested and expensed

immediately. The changes in Q3 operating expenses were mainly

associated with the way Company expenses the employee annual bonus

grants based on IFRS accounting. To clarify, the Q3 bonus expense

includes two portions. First, $9.7 million for the immediately

vested and recognized portion of the current year bonus grant that

is based on the expected profit for the full year. Second, $6.2

million for the amortized tranches of the prior year bonuses. As a

reference, the amortized expense of the prior year employee bonuses

for full year 2023 would be as high as $21.8 million due to

substantially higher profits in 2021 and 2022 leading to a

significantly increased bonus carryover amortization expense. This

has caused volatility in IFRS figures for 2023 while, for the

annual bonus grants, Himax has always followed a consistent

compensation policy and rules for employees. Amidst prevailing

macroeconomic headwinds, Company is currently exercising strict

budget and expense control with full year 2023 OPEX poised to

decline compared to last year.

Q3 operating income was $11.1 million or 4.6% of

sales, compared to 1.8% of sales for the same period last year and

-0.9% last quarter. The sequential increase was primarily a result

of increased sales and gross margin, partially offset by higher

operating expenses in the third quarter. The year-over-year

increase was primarily a result of lower operating expenses brought

by lower annual bonus compensation, partially offset by lower gross

margin compared to same period last year. Third quarter after-tax

profit was $11.2 million, or 6.4 cents per diluted ADS, compared to

$0.9 million, or 0.5 cents per diluted ADS last quarter and $8.3

million, or 4.8 cents in the same period last year.

Balance Sheet and Cash Flow

Himax had $155.4 million of cash, cash

equivalents and other financial assets as of September 30, 2023,

compared to $227.9 million at the same time last year and $219.5

million a quarter ago. Third quarter cash flows were impacted

primarily by two cash payouts, $83.7 million for annual dividend

and $29.5 million for employee bonus. The employee bonus is

comprised of $9.3 million for the immediately vested portion of

this year’s award and $20.2 million for vested awards granted over

the last 3 years. Despite the substantial payouts in Q3, Himax

delivered strong positive operating cash flow of $16.0 million,

again, due to the ongoing destocking progress across major product

lines with inventory experiencing a meaningful reduction compared

to the past few quarters. Himax had $42.0 million of long-term

unsecured loans as of the end of the third quarter, of which $6.0

million was the current portion.

The Company’s inventories as of September 30,

2023 were $259.6 million, markedly lower than $297.3 million last

quarter. Accounts receivable at the end of September 2023 was

$248.5 million, up from $239.0 million last quarter and down from

$253.3 million a year ago. DSO was 95 days at the quarter end, as

compared to 90 days last quarter and 74 days a year ago. Third

quarter capital expenditures were $2.6 million, versus $2.9 million

last quarter and $3.4 million a year ago. The third quarter capex

was mainly for IC design business.

Outstanding Share

As of September 30, 2023, Himax had 174.7

million ADS outstanding, little changed from last quarter. On a

fully diluted basis, total number of ADS outstanding for the third

quarter was 174.8 million.

Q4 2023 Outlook

Himax expects Q4 sales growth to be relatively

subdued compared to typical seasonal trends primarily due to

sluggish end market demand as well as cautious inventory management

and rigorous procurement scrutiny by customers. Additionally,

ongoing macro headwinds are limiting Company’s visibility as panel

customers remain tentative about demand prospects, leading to

shortened forecasts and more frequent last-minute orders. Having

said that, Himax’s longer-term outlook for the automotive business,

its largest revenue contributor, remains positive, as it maintains

a dominant position in the sector. The majority of Company’s

design-wins in TDDI and local dimming Tcon, both relatively new

technologies for automotive sector, are slated to commence mass

production during the next two years, thereby further fortifying

Himax’s market share leadership amidst growing competition. When

coupled with the megatrend of increasing quantity, size and

sophistication of displays inside vehicles, Himax is poised to

enjoy sustainable growth in the automotive market for years to come

regardless of auto industry headwinds or macroeconomic

challenges.

Amidst the prevailing challenging economic

conditions, Himax continues to implement a range of measures to

reduce costs, including improving manufacturing and operational

efficiencies, and leveraging diverse partners in foundries and

backend sources. The recently announced partnership alliance with

Nexchip in automotive is an illustration of Himax’s foundry supply

diversification strategy. The collaboration expands Himax’s foundry

supply while optimizing cost structure for the thriving automotive

market, especially in China. In terms of inventory, the destocking

process is progressing nicely with Q3 seeing a meaningful

reduction. Currently, Himax is nearing historical average levels

after several quarters of aggressive inventory depletion.

Thanks to accelerating growth in automotive

business, improved cost structure, normalized inventory levels,

favorable product mix, and Company’s emphasis on higher margin,

high value-added areas, like Tcon, OLED and AI, Himax is well

positioned to deliver sustainable long term revenue growth and

profitability.

Display Driver IC

Businesses

LDDIC

Q4 large display driver IC revenue is projected to decline by

double digit sequentially, reflecting the absence of festival

season shopping this year and intensified China local competition.

In the TV IC business, leading end brands continue to implement

stringent production control measures amidst soft demand and are

maintaining low inventory levels. Consequently, Himax expects a

double-digit quarter-over-quarter decline in Q4 TV IC sales.

Notebook and monitor IC are also facing a challenging business

environment where Company expects sales for both product lines to

decrease by double digit sequentially.

SMDDIC

Q4 SMDDIC revenue is expected to decline single digit, on the

backdrop of a muted festival season where demand for consumer

electronics remains sluggish. Smartphone sales are projected to

decline double digit, while tablet sales are expected to increase

single digit sequentially in Q4. Automotive revenue is expected to

be flat or slightly down sequentially following a surge in orders

resuming for both traditional DDIC and TDDI during the previous

quarter. Q4 automotive TDDI sales are poised to continue to

increase by low teens sequentially, fueled by strong customer

orders across the board and supportive governmental policies,

especially in China and the U.S., aimed at incentivizing new

vehicle purchases. Secured design-win projects for automotive TDDI

continue to expand across the board and now total nearly 400,

significantly ahead of peers. Remarkably, automotive TDDI sales are

expected to account for almost 40% of total automotive driver sales

in Q4. Automotive driver sales are now Himax’s largest revenue

contributor and, if combined with automotive Tcon, is set to

represent almost half of Himax total sales in Q4.

On LTDI, Himax is the first in the world to

commence mass production of LTDI for certain customers’ NEVs

starting in Q3 this year. Himax expects LTDI adoption to further

proliferate as it gains traction in car models featuring large

size displays as car makers look to distinguish their vehicle

products. Additionally, Company is seeing an increasing number of

customers choosing to adopt its integrated LTDI and local dimming

Tcon solution as the standard platform for their ultra large

automotive display development. These newly designed automotive

displays are typically larger than 30 inches, deliver a sharp

detailed visual experience, and incorporate high-density touch

functionality, which typically necessitates the utilization of six

or more LTDI chips, together with at least one local dimming Tcon,

representing much higher content value for Himax on a per panel

basis. This not only ramps up a new revenue stream, but also

reinforces Himax’s leadership position in the automotive display

market as it moves into 2024.

Himax stands at the forefront of the automotive

display IC market with a diverse product portfolio covering a full

range of specifications and technologies, including DDIC, TDDI,

local dimming Tcon, LTDI, and AMOLED. These holistic offerings

cater to a wide range of customer preferences and needs, fostering

strong customer loyalty and collaborations with global panel

makers, Tier 1s, and car makers. Himax expects its automotive

segment to continue to be a key growth driver for the Company.

On smartphone and tablet product lines, Himax

continues to see lackluster demand in the market. On a positive

note, Himax’s inventory has substantially rebalanced to a

satisfactory level after consecutive quarters of inventory

depletion. With the destocking process nearly complete, the Company

placed wafer starts for select products starting in Q2 this year

and continue to work on improving cost structure with the aim of

improving its efficiency for when demand returns.

On AMOLED, by partnering with leading panel

manufacturers in Korea and China, Himax is accelerating its AMOLED

driver IC advancements, covering various applications from

automotive and tablets to smartphones, notebooks and TVs. In the

automotive AMOLED sector, Himax’s design-wins are steadily

increasing from both traditional car manufacturers and NEV vendors

worldwide. For smartphone AMOLED display driver, sluggish demand in

the smartphone market has resulted in a slight delay from Himax’s

original targeted timeline. Nevertheless, Company continues

collaborations with customers from Korea and China where ongoing

verification and partnership projects are in progress.

Non-Driver Product

Categories

Timing Controller (Tcon)

The Company anticipates Q4 Tcon sales to

decrease double digit sequentially, hampered by reduced shipment

for large-sized displays and OLED displays for tablet as customer

inventory offloading continues due to subdued end market demand.

Despite the soft market sentiment, Himax is actively developing the

next generation Tcon IC for OLED tablet, notebook and automotive,

aiming to diversify its offerings and strategically position itself

for a resurgence in demand. On automotive Tcon business for LCD

panels, Himax’s position remains unchallenged in local dimming

Tcon, evidenced by growing validation and widespread deployment

globally in both premium and mainstream new car models. Himax plans

to roll out a series of Tcon for automotive to expand its product

offerings catering to different needs of global customers. Local

dimming technology has found increasing application in automotive

display, initially in high-end car models and gradually into

mainstream vehicles. One emerging use case is in heads-up display

(HUD) thanks to Himax Tcon’s unique ability to deliver a high

contrast ratio for selected content, along with low heat

dissipation and minimal power consumption. Himax’s local dimming

Tcon can effectively eliminate the frequently occurring “postcard

effect” in HUD application, caused by backlight leakage in TFT LCD

panels that shows a square-shaped display images on the windshield.

Company’s automotive Tcon business is poised to experience

explosive growth with strong momentum expected into 2024 and years

to come, serving as one of Himax’s major growth engines.

WiseEye™ Smart Image

Sensing

Himax’s WiseEye Smart Image Sensing total

solution incorporates the Company’s proprietary ultralow power AI

processor, always-on CMOS image sensor, and CNN-based AI algorithm.

For notebook, Himax continues to support the mass production of

Dell’s notebook. Given the growing prevalence of the human presence

detection feature in notebooks, its engagement with global notebook

names for their next generation products are progressing nicely.

Himax’s WiseEye solution is also in broad adoption across a range

of endpoint AI applications, including video conference device,

automotive, access control, shared bike parking, door lock and

smart agriculture, among others.

WiseEye adoption is also going smoothly in door

lock application, where Himax joins forces with leading door lock

players in China with mass production expected to commence starting

the end of this year. Moreover, the latest smart door lock design

surpasses the existing human presence detection feature and takes a

step forward to support an additional camera set, enabling

dual-camera functionality. The secondary camera can be oriented

downward for ground-level status monitoring for events such as

parcel delivery or placed indoors to enhance security detection.

More innovative features are also under development together with

key customers in the field targeting their next generation smart

door lock. Himax anticipates that WiseEye adoption in surveillance

will significantly increase starting in 2024.

On WE2 AI processor. Compared to WE1, its

predecessor, the WE2 processor offers further advancements in

inference speed and ultralow power. In context aware AI, WE2

enables detailed, real-time computer vision object analysis, such

as facial landmark, hand landmark, and human pose and skeleton,

among others, at extremely low power consumption. This enables

sophisticated human expression detection for smart notebook and

broader AIoT applications. Alongside ongoing collaboration with end

customers, Himax has also made significant progress in partnerships

with major CPU and AP SOC players, in preparation for their target

markets in next generation smart notebooks, surveillance and a host

of other endpoint AI applications. Himax will provide more details

as they come about.

In addition to the WiseEye total solution, Himax

is also focused on expanding its Intelli-Sensing Module business by

targeting users that may be less familiar with AI or wish to

incorporate AI capabilities into their applications without

significant development effort. This particularly applies to small

volume or early-stage market engagement applications. The module

offerings, incorporating WiseEye technology, provide clients with a

series of highly integrated, plug-and-play module boards which are

extremely compact in size, user-programmable and loaded with

Himax’s pre-trained AI models for straightforward system

integration. This can effectively shorten customers’ time-to-market

and reduce development costs. To broaden market reach, a series of

Intelli-Sensing Modules will be rolled out to cover more diverse

markets that cater to various AI needs. The Intelli-Sensing Module

solution will also be made available through online resellers like

DigiKey and other SI partners.

Throughout recent quarters, Himax’s

Intelli-Sensing Module has received excellent feedback with

adoptions from various applications. One particularly successful

adoption is in parking systems which has been deployed by several

vendors in different regions of Asia. Himax’s module offers precise

real-time motion and occupancy detection to streamline the billing

procedure for vehicles. Additionally, Company’s module operates

efficiently with ultralow power, making it a viable choice for

battery-powered parking systems, thereby greatly simplifying the

installation process and reducing maintenance costs. Moreover, its

AI’s functionality can include vehicle type recognition, which

enhances the effective utilization of parking spaces. Beyond the

parking solution, there is a growing interest in applications

for Intelli-Sensing Module in areas such as retail shelf management

and human flow monitoring, among others. The Company is excited

about the upcoming growth prospects for this product.

Himax’s leading position in ultralow power AI

processing and image sensing for endpoint AI applications

demonstrates Company’s commitment and conviction to the ongoing

development and growth of WiseEye AI business. By leveraging broad

ecosystem partners and customers, Himax aims to maximize market

reach and explore more potential endpoint AI applications. While

adoption is at an early stage, Company believes its WiseEye AI

business will serve as a multi-year structural growth driver for

Himax.

Optical Related Product Lines /

Metaverse

On Himax’s optical related product lines. With

over a decade of optical and optoelectronics know-how and

capabilities under its belt, Himax has been offering various

technologies, including WLO, 3D Sensing, and LCoS, driving

continuous advancements in diverse fields related to emerging

metaverse applications. Additionally, Himax has other innovative

solutions under development to further expand its technological

portfolio. The recent introduction of Liqxtal™ Graph display

technology, unveiled by Himax’s subsidiary Liqxtal Technology, is

one illustration of Himax’s capability to provide more diverse

offerings to the industry. This liquid crystal based optical

product provides one-of-a-kind technology that defies imagination

through the display of personalized and colored content on the

exterior lens of glasses for external viewers to enjoy, while also

providing wearers with unobstructed visibility. Himax expects

Liqxtal Graph display technology to create a broad array of

application possibilities for wearable devices in the future.

On LCoS. Following the unveiling of Company’s

cutting-edge Color Sequential Front-Lit LCoS microdisplay at the

Display Week in May, several tech giants in the industry have

shifted their focus away from micro-OLED to Himax’s Front-Lit LCoS

for their AR goggles. This shift is demonstrative of its

exceptional achievements in both performance and functionality,

marked by breakthroughs not only in the luminance performance in

full RGB color, but also in terms of superior optical efficiency,

tiny form factor and ultra-lightweight design. These factors are

critical and represent technological advancements that can readily

meet rigorous requirements to support next generation see-through

goggles.

On WLO. Himax initiated volume production of WLO

technology to a leading North American customer in Q2. The WLO

solution is integrated into the customer’s new generation VR

goggles to enable 3D gesture control. A decent shipment was made in

Q3 in preparation for the upcoming seasonal shopping sales.

For non-driver IC business, the Company expects

revenue to decline mid-teens sequentially in the fourth

quarter.

|

Fourth Quarter 2023

Guidance |

| Net Revenue: |

To Decline 5.0% to 11.0% sequentially |

| Gross Margin: |

To be around 30%, depending on final product mix |

| Profit: |

To be 9.0 cents to 13.0 cents per diluted ADS |

| |

|

| HIMAX TECHNOLOGIES THIRD QUARTER 2023

EARNINGS CONFERENCE CALL |

| DATE: |

Thursday, November 9, 2023 |

| TIME: |

U.S. 8:00 a.m. EST |

| |

Taiwan 9:00 p.m. |

| WEBCAST: |

https://edge.media-server.com/mmc/p/ss9i3udd/ |

| PHONE REGISTRATION:

https://register.vevent.com/register/BI0b427a1b5ab14db08404bf0f66ee6dd2 |

| |

If you choose to attend by phone, you need to

register first to obtain dial-in numbers for the call. Once

registered you will be emailed the dial-ins along with an option to

receive a call back at the start of the earnings call. Each

registrant will receive a unique personal PIN. A replay of the call

will be available beginning two hours after the call. The

conference webcast link is

https://edge.media-server.com/mmc/p/ss9i3udd/. This call is being

webcast by Nasdaq and can be accessed by clicking on this link or

Himax’s website, where the webcast can be accessed through November

9, 2024.

About Himax Technologies,

Inc.

Himax Technologies, Inc. (NASDAQ: HIMX) is a

leading global fabless semiconductor solution provider dedicated to

display imaging processing technologies. The Company’s display

driver ICs and timing controllers have been adopted at scale across

multiple industries worldwide including TVs, PC monitors, laptops,

mobile phones, tablets, automotive, ePaper devices, industrial

displays, among others. As the global market share leader in

automotive display technology, the Company offers innovative and

comprehensive automotive IC solutions, including traditional driver

ICs, advanced in-cell Touch and Display Driver Integration (TDDI),

local dimming timing controllers (Local Dimming Tcon), Large Touch

and Display Driver Integration (LTDI) and AMOLED display

technologies. Himax is also a pioneer in tinyML visual-AI and

optical technology related fields. The Company’s industry-leading

WiseEye™ Smart Sensing technology which incorporates Himax

proprietary ultralow power AI processor, always-on CMOS image

sensor, and CNN-based AI algorithm has been widely deployed in

consumer electronics and AIoT related applications. While Himax

optics technologies, such as diffractive wafer level optics, LCoS

micro-displays and 3D sensing solutions, are critical for

facilitating emerging AR/VR/metaverse technologies. Additionally,

Himax designs and provides touch controllers, AMOLED ICs, LED

drivers, EPD drivers, power management ICs, and CMOS image sensors

for diverse display application coverage. Founded in 2001 and

headquartered in Tainan, Taiwan, Himax currently employs around

2,200 people from three Taiwan-based offices in Tainan, Hsinchu and

Taipei and country offices in China, Korea, Japan, Germany, and the

US. Himax has 2,838 patents granted and 376 patents pending

approval worldwide as of September 30, 2023.

Forward Looking Statements

Factors that could cause actual events or results to differ

materially from those described in this conference call include,

but are not limited to, the effect of the Covid-19 pandemic on the

Company’s business; general business and economic conditions and

the state of the semiconductor industry; market acceptance and

competitiveness of the driver and non-driver products developed by

the Company; demand for end-use applications products; reliance on

a small group of principal customers; the uncertainty of continued

success in technological innovations; our ability to develop and

protect our intellectual property; pricing pressures including

declines in average selling prices; changes in customer order

patterns; changes in estimated full-year effective tax rate;

shortage in supply of key components; changes in environmental laws

and regulations; changes in export license regulated by Export

Administration Regulations (EAR); exchange rate fluctuations;

regulatory approvals for further investments in our subsidiaries;

our ability to collect accounts receivable and manage inventory and

other risks described from time to time in the Company's SEC

filings, including those risks identified in the section entitled

"Risk Factors" in its Form 20-F for the year ended December 31,

2022 filed with the SEC, as may be amended.

Company Contacts:

Eric Li, Chief IR/PR

OfficerHimax Technologies, Inc.Tel: +886-6-505-0880 Fax:

+886-2-2314-0877Email: hx_ir@himax.com.twwww.himax.com.tw

Karen Tiao, Investor RelationsHimax

Technologies, Inc.

Tel: +886-2-2370-3999Fax: +886-2-2314-0877Email:

hx_ir@himax.com.twwww.himax.com.tw

Mark Schwalenberg, DirectorInvestor

Relations - US RepresentativeMZ North America

Tel: +1-312-261-6430Email:

HIMX@mzgroup.uswww.mzgroup.us

-Financial Tables-

|

Himax Technologies, Inc. |

|

Unaudited Condensed Consolidated Statements of Profit or

Loss |

|

(These interim financials do not fully comply with IFRS

because they omit all interim disclosure required by

IFRS) |

|

(Amounts in Thousands of U.S. Dollars, Except Share and Per

Share Data) |

|

|

|

|

Three

MonthsEndedSeptember

30, |

|

3 MonthsEndedJune

30, |

|

|

|

2023 |

|

|

|

2022 |

|

|

|

2023 |

|

|

|

|

|

|

|

|

|

Revenues |

|

|

|

|

|

|

Revenues from third parties, net |

$ |

238,466 |

|

|

$ |

213,586 |

|

|

$ |

234,988 |

|

|

Revenues from related parties, net |

|

49 |

|

|

|

45 |

|

|

|

43 |

|

|

|

|

238,515 |

|

|

|

213,631 |

|

|

|

235,031 |

|

|

|

|

|

|

|

|

|

Costs and expenses: |

|

|

|

|

|

|

Cost of revenues |

|

163,692 |

|

|

|

136,828 |

|

|

|

183,961 |

|

|

Research and development |

|

49,444 |

|

|

|

55,749 |

|

|

|

41,433 |

|

|

General and administrative |

|

7,050 |

|

|

|

8,554 |

|

|

|

6,115 |

|

|

Sales and marketing |

|

7,239 |

|

|

|

8,555 |

|

|

|

5,664 |

|

|

Total costs and expenses |

|

227,425 |

|

|

|

209,686 |

|

|

|

237,173 |

|

|

|

|

|

|

|

|

|

Operating income (loss) |

|

11,090 |

|

|

|

3,945 |

|

|

|

(2,142 |

) |

|

|

|

|

|

|

|

|

Non operating income (loss): |

|

|

|

|

|

|

Interest income |

|

1,837 |

|

|

|

1,387 |

|

|

|

2,648 |

|

|

Changes in fair value of financial assets at fair value through

profit or loss |

|

(432 |

) |

|

|

(67 |

) |

|

|

336 |

|

|

Foreign currency exchange gains, net |

|

764 |

|

|

|

1,181 |

|

|

|

528 |

|

|

Finance costs |

|

(1,482 |

) |

|

|

(843 |

) |

|

|

(1,717 |

) |

|

Share of losses of associates |

|

(220 |

) |

|

|

(164 |

) |

|

|

(175 |

) |

|

Other income |

|

409 |

|

|

|

120 |

|

|

|

4 |

|

|

|

|

876 |

|

|

|

1,614 |

|

|

|

1,624 |

|

|

Profit (loss) before income taxes |

|

11,966 |

|

|

|

5,559 |

|

|

|

(518 |

) |

|

Income tax expense (benefit) |

|

1,214 |

|

|

|

(2,449 |

) |

|

|

(1,247 |

) |

|

Profit for the period |

|

10,752 |

|

|

|

8,008 |

|

|

|

729 |

|

| Loss attributable to

noncontrolling interests |

|

484 |

|

|

|

311 |

|

|

|

159 |

|

| Profit attributable to

Himax Technologies, Inc. stockholders |

$ |

11,236 |

|

|

$ |

8,319 |

|

|

$ |

888 |

|

|

|

|

|

|

|

|

| Basic earnings per ADS

attributable to Himax Technologies, Inc. stockholders |

$ |

0.064 |

|

|

$ |

0.048 |

|

|

$ |

0.005 |

|

| Diluted earnings per

ADS attributable to Himax Technologies, Inc.

stockholders |

$ |

0.064 |

|

|

$ |

0.048 |

|

|

$ |

0.005 |

|

| |

|

|

|

|

|

|

Basic Weighted Average Outstanding ADS |

|

174,420 |

|

|

|

174,695 |

|

|

|

174,417 |

|

|

Diluted Weighted Average Outstanding ADS |

|

174,773 |

|

|

|

174,735 |

|

|

|

174,672 |

|

|

Himax Technologies, Inc. |

|

Unaudited Condensed Consolidated Statements of Profit or

Loss |

|

(Amounts in Thousands of U.S. Dollars, Except Share and Per

Share Data) |

|

|

|

|

|

|

Nine MonthsEnded September

30, |

|

|

|

|

|

2023 |

|

|

|

2022 |

|

|

|

|

|

|

|

|

|

Revenues |

|

|

|

|

|

|

Revenues from third parties, net |

|

|

$ |

717,645 |

|

|

$ |

938,879 |

|

|

Revenues from related parties, net |

|

|

|

105 |

|

|

|

170 |

|

|

|

|

|

|

717,750 |

|

|

|

939,049 |

|

|

|

|

|

|

|

|

|

Costs and expenses: |

|

|

|

|

|

|

Cost of revenues |

|

|

|

523,262 |

|

|

|

531,994 |

|

|

Research and development |

|

|

|

130,304 |

|

|

|

135,399 |

|

|

General and administrative |

|

|

|

19,206 |

|

|

|

21,852 |

|

|

Sales and marketing |

|

|

|

18,447 |

|

|

|

19,743 |

|

|

Total costs and expenses |

|

|

|

691,219 |

|

|

|

708,988 |

|

|

|

|

|

|

|

|

|

Operating income |

|

|

|

26,531 |

|

|

|

230,061 |

|

|

|

|

|

|

|

|

|

Non operating income (loss): |

|

|

|

|

|

|

Interest income |

|

|

|

6,812 |

|

|

|

2,823 |

|

|

Changes in fair value of financial assets at fair value through

profit or loss |

|

|

|

(55 |

) |

|

|

361 |

|

|

Foreign currency exchange gains, net |

|

|

|

757 |

|

|

|

5,949 |

|

|

Finance costs |

|

|

|

(4,940 |

) |

|

|

(1,451 |

) |

|

Share of losses of associates |

|

|

|

(584 |

) |

|

|

(573 |

) |

|

Other income |

|

|

|

520 |

|

|

|

215 |

|

|

|

|

|

|

2,510 |

|

|

|

7,324 |

|

|

Profit before income taxes |

|

|

|

29,041 |

|

|

|

237,385 |

|

|

Income tax expense |

|

|

|

2,905 |

|

|

|

43,916 |

|

|

Profit for the period |

|

|

|

26,136 |

|

|

|

193,469 |

|

| Loss attributable to

noncontrolling interests |

|

|

|

915 |

|

|

|

1,357 |

|

| Profit attributable to

Himax Technologies, Inc. stockholders |

|

|

$ |

27,051 |

|

|

$ |

194,826 |

|

|

|

|

|

|

|

|

| Basic earnings per ADS

attributable to Himax Technologies, Inc. stockholders |

|

|

$ |

0.155 |

|

|

$ |

1.115 |

|

| Diluted earnings per

ADS attributable to Himax Technologies, Inc.

stockholders |

|

|

$ |

0.155 |

|

|

$ |

1.115 |

|

| |

|

|

|

|

|

|

Basic Weighted Average Outstanding ADS |

|

|

|

174,418 |

|

|

|

174,694 |

|

|

Diluted Weighted Average Outstanding ADS |

|

|

|

174,701 |

|

|

|

174,753 |

|

|

Himax Technologies, Inc. |

|

IFRS Unaudited Condensed Consolidated Statements of

Financial Position |

|

(Amounts in Thousands of U.S. Dollars) |

| |

| |

|

September 30,2023 |

|

September 30,2022 |

|

June 30,2023 |

| Assets |

|

|

|

|

|

|

| Current

assets: |

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

147,257 |

|

|

$ |

219,745 |

|

|

$ |

211,425 |

|

|

Financial assets at amortized cost |

|

|

8,139 |

|

|

|

8,147 |

|

|

|

8,079 |

|

|

Accounts receivable, net (including related parties) |

|

|

248,507 |

|

|

|

253,284 |

|

|

|

239,039 |

|

|

Inventories |

|

|

259,610 |

|

|

|

410,071 |

|

|

|

297,268 |

|

|

Income taxes receivable |

|

|

22 |

|

|

|

41 |

|

|

|

28 |

|

|

Restricted deposit |

|

|

453,000 |

|

|

|

369,300 |

|

|

|

369,300 |

|

|

Other receivable from related parties |

|

|

1,190 |

|

|

|

1,230 |

|

|

|

1,171 |

|

|

Other current assets |

|

|

102,652 |

|

|

|

109,734 |

|

|

|

109,334 |

|

|

Total current assets |

|

|

1,220,377 |

|

|

|

1,371,552 |

|

|

|

1,235,644 |

|

| Financial assets at

fair value through profit or loss |

|

|

18,655 |

|

|

|

14,466 |

|

|

|

19,094 |

|

| Financial assets at

fair value through othercomprehensive

income |

|

|

289 |

|

|

|

352 |

|

|

|

313 |

|

| Equity method

investments |

|

|

5,801 |

|

|

|

3,293 |

|

|

|

6,127 |

|

| Property, plant and

equipment, net |

|

|

119,231 |

|

|

|

127,598 |

|

|

|

121,674 |

|

| Deferred tax

assets |

|

|

11,244 |

|

|

|

6,199 |

|

|

|

11,651 |

|

| Goodwill |

|

|

28,138 |

|

|

|

28,138 |

|

|

|

28,138 |

|

| Other intangible

assets, net |

|

|

851 |

|

|

|

5,571 |

|

|

|

876 |

|

| Restricted

deposit |

|

|

31 |

|

|

|

32 |

|

|

|

32 |

|

| Refundable

deposits |

|

|

205,383 |

|

|

|

162,924 |

|

|

|

205,237 |

|

| Other non-current

assets |

|

|

7,734 |

|

|

|

10,809 |

|

|

|

9,371 |

|

|

|

|

|

397,357 |

|

|

|

359,382 |

|

|

|

402,513 |

|

|

Total assets |

|

$ |

1,617,734 |

|

|

$ |

1,730,934 |

|

|

$ |

1,638,157 |

|

| Liabilities and

Equity |

|

|

|

|

|

|

| Current

liabilities: |

|

|

|

|

|

|

|

Short-term unsecured borrowings |

|

$ |

279 |

|

|

$ |

- |

|

|

$ |

289 |

|

|

Current portion of long-term unsecured borrowings |

|

|

6,000 |

|

|

|

6,000 |

|

|

|

6,000 |

|

|

Short-term secured borrowings |

|

|

453,000 |

|

|

|

369,300 |

|

|

|

369,300 |

|

|

Accounts payable (including related parties) |

|

|

109,554 |

|

|

|

191,971 |

|

|

|

127,652 |

|

|

Income taxes payable |

|

|

19,061 |

|

|

|

66,517 |

|

|

|

18,894 |

|

|

Other payable to related parties |

|

|

1,937 |

|

|

|

2,385 |

|

|

|

2,266 |

|

|

Contract liabilities-current |

|

|

16,774 |

|

|

|

34,481 |

|

|

|

19,913 |

|

|

Other current liabilities |

|

|

89,342 |

|

|

|

65,943 |

|

|

|

176,379 |

|

|

Total current liabilities |

|

|

695,947 |

|

|

|

736,597 |

|

|

|

720,693 |

|

| Long-term unsecured

borrowings |

|

|

36,000 |

|

|

|

42,000 |

|

|

|

37,500 |

|

| Deferred tax

liabilities |

|

|

658 |

|

|

|

754 |

|

|

|

682 |

|

| Contract

liabilities-non-current |

|

|

- |

|

|

|

12,356 |

|

|

|

46 |

|

| Other non-current

liabilities |

|

|

47,454 |

|

|

|

90,672 |

|

|

|

53,001 |

|

|

|

|

|

84,112 |

|

|

|

145,782 |

|

|

|

91,229 |

|

|

Total liabilities |

|

|

780,059 |

|

|

|

882,379 |

|

|

|

811,922 |

|

| Equity |

|

|

|

|

|

|

|

Ordinary shares |

|

|

107,010 |

|

|

|

107,010 |

|

|

|

107,010 |

|

|

Additional paid-in capital |

|

|

114,097 |

|

|

|

111,404 |

|

|

|

113,761 |

|

|

Treasury shares |

|

|

(5,157 |

) |

|

|

(5,594 |

) |

|

|

(5,594 |

) |

|

Accumulated other comprehensive income |

|

|

(715 |

) |

|

|

(2,247 |

) |

|

|

(617 |

) |

|

Retained earnings |

|

|

622,077 |

|

|

|

637,149 |

|

|

|

610,841 |

|

|

Equity attributable to owners of Himax Technologies,

Inc. |

|

|

837,312 |

|

|

|

847,722 |

|

|

|

825,401 |

|

| Noncontrolling

interests |

|

|

363 |

|

|

|

833 |

|

|

|

834 |

|

|

Total equity |

|

|

837,675 |

|

|

|

848,555 |

|

|

|

826,235 |

|

|

Total liabilities and equity |

|

$ |

1,617,734 |

|

|

$ |

1,730,934 |

|

|

$ |

1,638,157 |

|

|

Himax Technologies, Inc. |

|

Unaudited Condensed Consolidated Statements of Cash

Flows |

|

(Amounts in Thousands of U.S. Dollars) |

|

|

|

Three MonthsEnded September

30, |

|

Three Months EndedJune

30, |

|

|

|

|

2023 |

|

|

|

2022 |

|

|

|

2023 |

|

|

|

|

|

|

|

|

|

| Cash flows from

operating activities: |

|

|

|

|

|

|

| Profit for the period |

|

$ |

10,752 |

|

|

$ |

8,008 |

|

|

$ |

729 |

|

| Adjustments for: |

|

|

|

|

|

|

|

Depreciation and amortization |

|

|

5,094 |

|

|

|

5,359 |

|

|

|

5,025 |

|

|

Share-based compensation expenses |

|

|

789 |

|

|

|

662 |

|

|

|

723 |

|

|

Changes in fair value of financial assets at fair value through

profit or loss |

|

|

432 |

|

|

|

67 |

|

|

|

(336 |

) |

|

Interest income |

|

|

(1,837 |

) |

|

|

(1,387 |

) |

|

|

(2,648 |

) |

|

Finance costs |

|

|

1,482 |

|

|

|

843 |

|

|

|

1,717 |

|

|

Income tax expense (benefit) |

|

|

1,214 |

|

|

|

(2,449 |

) |

|

|

(1,247 |

) |

|

Share of losses of associates |

|

|

220 |

|

|

|

164 |

|

|

|

175 |

|

|

Inventories write downs |

|

|

5,263 |

|

|

|

7,282 |

|

|

|

5,047 |

|

|

Unrealized foreign currency exchange losses (gains) |

|

|

(878 |

) |

|

|

1,034 |

|

|

|

(1,201 |

) |

| |

|

|

22,531 |

|

|

|

19,583 |

|

|

|

7,984 |

|

| Changes in: |

|

|

|

|

|

|

|

Accounts receivable (including related parties) |

|

|

(9,468 |

) |

|

|

117,749 |

|

|

|

13,116 |

|

|

Inventories |

|

|

32,395 |

|

|

|

(80,041 |

) |

|

|

32,920 |

|

|

Other receivable from related parties |

|

|

(19 |

) |

|

|

152 |

|

|

|

3 |

|

|

Other current assets |

|

|

4,157 |

|

|

|

2,804 |

|

|

|

(3,318 |

) |

|

Accounts payable (including related parties) |

|

|

(18,096 |

) |

|

|

(51,323 |

) |

|

|

10,207 |

|

|

Other payable to related parties |

|

|

(329 |

) |

|

|

219 |

|

|

|

(588 |

) |

|

Contract liabilities |

|

|

(2,885 |

) |

|

|

(1,671 |

) |

|

|

(13,097 |

) |

|

Other current liabilities |

|

|

(2,145 |

) |

|

|

(424 |

) |

|

|

1,665 |

|

|

Other non-current liabilities |

|

|

(9,697 |

) |

|

|

(4,151 |

) |

|

|

2,351 |

|

|

Cash generated from operating activities |

|

|

16,444 |

|

|

|

2,897 |

|

|

|

51,243 |

|

|

Interest received |

|

|

1,185 |

|

|

|

443 |

|

|

|

3,262 |

|

|

Interest paid |

|

|

(1,482 |

) |

|

|

(843 |

) |

|

|

(1,717 |

) |

|

Income tax paid |

|

|

(104 |

) |

|

|

(6,171 |

) |

|

|

(51,093 |

) |

|

Net cash provided by (used in) operating

activities |

|

|

16,043 |

|

|

|

(3,674 |

) |

|

|

1,695 |

|

|

|

|

|

|

|

|

|

| Cash flows from

investing activities: |

|

|

|

|

|

|

|

Acquisitions of property, plant and equipment |

|

|

(2,619 |

) |

|

|

(3,402 |

) |

|

|

(2,874 |

) |

|

Acquisitions of intangible assets |

|

|

(64 |

) |

|

|

- |

|

|

|

- |

|

|

Acquisitions of financial assets at amortized cost |

|

|

(675 |

) |

|

|

(720 |

) |

|

|

(1,092 |

) |

|

Proceeds from disposal of financial assets at amortized cost |

|

|

640 |

|

|

|

660 |

|

|

|

1,134 |

|

|

Acquisitions of financial assets at fair value through profit or

loss |

|

|

(21,210 |

) |

|

|

(30,179 |

) |

|

|

(33,821 |

) |

|

Proceeds from disposal of financial assets at fair value through

profit or loss |

|

|

21,217 |

|

|

|

33,188 |

|

|

|

52,482 |

|

|

Decrease (increase) in refundable deposits |

|

|

6,133 |

|

|

|

(6,131 |

) |

|

|

1,193 |

|

|

Cash received in advance from disposal of land |

|

|

2,821 |

|

|

|

- |

|

|

|

- |

|

|

Net cash provided by (used in) investing

activities |

|

|

6,243 |

|

|

|

(6,584 |

) |

|

|

17,022 |

|

| |

|

|

|

|

|

|

| Cash flows from

financing activities: |

|

|

|

|

|

|

|

Payments of cash dividends |

|

|

(83,720 |

) |

|

|

(217,873 |

) |

|

|

- |

|

|

Payments of dividend equivalents |

|

|

(148 |

) |

|

|

- |

|

|

|

- |

|

|

Proceeds from short-term unsecured borrowings |

|

|

- |

|

|

|

- |

|

|

|

10,294 |

|

|

Repayments of short-term unsecured borrowings |

|

|

- |

|

|

|

- |

|

|

|

(10,000 |

) |

|

Proceeds from long-term unsecured borrowings |

|

|

- |

|

|

|

40,000 |

|

|

|

- |

|

|

Repayments of long-term unsecured borrowings |

|

|

(1,500 |

) |

|

|

(41,500 |

) |

|

|

(1,500 |

) |

|

Proceeds from short-term secured borrowings |

|

|

530,800 |

|

|

|

668,700 |

|

|

|

139,200 |

|

|

Repayments of short-term secured borrowings |

|

|

(447,100 |

) |

|

|

(450,800 |

) |

|

|

(139,200 |

) |

|

Pledge of restricted deposit |

|

|

(83,700 |

) |

|

|

(217,900 |

) |

|

|

- |

|

|

Payment of lease liabilities |

|

|

(1,205 |

) |

|

|

(601 |

) |

|

|

(1,202 |

) |

|

Guarantee deposits received (refunded) |

|

|

200 |

|

|

|

(882 |

) |

|

|

5 |

|

|

Net cash used in financing activities |

|

|

(86,373 |

) |

|

|

(220,856 |

) |

|

|

(2,403 |

) |

| Effect of foreign

currency exchange rate changes on cash and cash

equivalents |

|

|

(81 |

) |

|

|

(2,043 |

) |

|

|

(1,175 |

) |

| Net increase

(decrease) in cash and cash equivalents |

|

|

(64,168 |

) |

|

|

(233,157 |

) |

|

|

15,139 |

|

| Cash and cash

equivalents at beginning of period |

|

|

211,425 |

|

|

|

452,902 |

|

|

|

196,286 |

|

| Cash and cash

equivalents at end of period |

|

$ |

147,257 |

|

|

$ |

219,745 |

|

|

$ |

211,425 |

|

|

|

|

|

|

|

|

|

|

Himax Technologies, Inc. |

|

Unaudited Condensed Consolidated Statements of Cash

Flows |

|

(Amounts in Thousands of U.S. Dollars) |

|

|

|

|

Nine MonthsEnded September

30, |

|

|

|

|

|

|

2023 |

|

|

|

2022 |

|

|

|

|

|

|

|

|

|

| Cash flows from

operating activities: |

|

|

|

|

|

|

| Profit for the period |

|

|

|

$ |

26,136 |

|

|

$ |

193,469 |

|

| Adjustments for: |

|

|

|

|

|

|

|

Depreciation and amortization |

|

|

|

|

15,207 |

|

|

|

16,146 |

|

|

Share-based compensation expenses |

|

|

|

|

2,317 |

|

|

|

2,002 |

|

|

Changes in fair value of financial assets at fair value through

profit or loss |

|

|

|

|

55 |

|

|

|

(361 |

) |

|

Interest income |

|

|

|

|

(6,812 |

) |

|

|

(2,823 |

) |

|

Finance costs |

|

|

|

|

4,940 |

|

|

|

1,451 |

|

|

Income tax expense |

|

|

|

|

2,905 |

|

|

|

43,916 |

|

|

Share of losses of associates |

|

|

|

|

584 |

|

|

|

573 |

|

|

Inventories write downs |

|

|

|

|

15,813 |

|

|

|

13,107 |

|

|

Unrealized foreign currency exchange gains |

|

|

|

|

(893 |

) |

|

|

(3,586 |

) |

| |

|

|

|

|

60,252 |

|

|

|

263,894 |

|

| Changes in: |

|

|

|

|

|

|

|

Accounts receivable (including related parties) |

|

|

|

|

12,641 |

|

|

|

156,927 |

|

|

Inventories |

|

|

|

|

95,510 |

|

|

|

(224,578 |

) |

|

Other receivable from related parties |

|

|

|

|

34 |

|

|

|

(13 |

) |

|

Other current assets |

|

|

|

|

1,819 |

|

|

|

7,426 |

|

|

Accounts payable (including related parties) |

|

|

|

|

8,303 |

|

|

|

(56,444 |

) |

|

Other payable to related parties |

|

|

|

|

(631 |

) |

|

|

745 |

|

|

Contract liabilities |

|

|

|

|

(36,093 |

) |

|

|

(1,047 |

) |

|

Other current liabilities |

|

|

|

|

(1,768 |

) |

|

|

(214 |

) |

|

Other non-current liabilities |

|

|

|

|

(4,995 |

) |

|

|

1,657 |

|

|

Cash generated from operating activities |

|

|

|

|

135,072 |

|

|

|

148,353 |

|

|

Interest received |

|

|

|

|

5,902 |

|

|

|

1,729 |

|

|

Interest paid |

|

|

|

|

(4,940 |

) |

|

|

(1,451 |

) |

|

Income tax paid |

|

|

|

|

(51,935 |

) |

|

|

(71,189 |

) |

|

Net cash provided by operating activities |

|

|

|

|

84,099 |

|

|

|

77,442 |

|

|

|

|

|

|

|

|

|

| Cash flows from

investing activities: |

|

|

|

|

|

|

|

Acquisitions of property, plant and equipment |

|

|

|

|

(8,326 |

) |

|

|

(9,485 |

) |

|

Acquisitions of intangible assets |

|

|

|

|

(75 |

) |

|

|

(169 |

) |

|

Acquisitions of financial assets at amortized cost |

|

|

|

|

(2,338 |

) |

|

|

(7,979 |

) |

|

Proceeds from disposal of financial assets at amortized cost |

|

|

|

|

2,315 |

|

|

|

24,982 |

|

|

Acquisitions of financial assets at fair value through profit or

loss |

|

|

|

|

(77,253 |

) |

|

|

(103,293 |

) |

|

Proceeds from disposal of financial assets at fair value through

profit or loss |

|

|

|

|

73,894 |

|

|

|

105,201 |

|

|

Increase in refundable deposits |

|

|

|

|

(56,933 |

) |

|

|

(6,131 |

) |

|

Releases of restricted deposit |

|

|

|

|

- |

|

|

|

2,700 |

|

|

Cash received in advance from disposal of land |

|

|

|

|

2,821 |

|

|

|

- |

|

|

Net cash provided by (used in) investing

activities |

|

|

|

|

(65,895 |

) |

|

|

5,826 |

|

|

|

|

|

|

|

|

|

| Cash flows from

financing activities: |

|

|

|

|

|

|

|

Payments of cash dividends |

|

|

|

|

(83,720 |

) |

|

|

(217,873 |

) |

|

Payments of dividend equivalents |

|

|

|

|

(148 |

) |

|

|

- |

|

|

Purchases of subsidiary shares from noncontrolling interests |

|

|

|

|

- |

|

|

|

(301 |

) |

|

Proceeds from short-term unsecured borrowings |

|

|

|

|

10,294 |

|

|

|

- |

|

|

Repayments of short-term unsecured borrowings |

|

|

|

|

(10,000 |

) |

|

|

- |

|

|

Proceeds from long-term unsecured borrowings |

|

|

|

|

- |

|

|

|

40,000 |

|

|

Repayments of long-term unsecured borrowings |

|

|

|

|

(4,500 |

) |

|

|

(44,500 |

) |

|

Proceeds from short-term secured borrowings |

|

|

|

|

956,200 |

|

|

|

854,500 |

|

|

Repayments of short-term secured borrowings |

|

|

|

|

(872,500 |

) |

|

|

(636,600 |

) |

|

Pledge of restricted deposit |

|

|

|

|

(83,700 |

) |

|

|

(217,900 |

) |

|

Payment of lease liabilities |

|

|

|

|

(3,586 |

) |

|

|

(3,036 |

) |

|

Guarantee deposits received |

|

|

|

|

205 |

|

|

|

28,913 |

|

|

Net cash used in financing activities |

|

|

|

|

(91,455 |

) |

|

|

(196,797 |

) |

| Effect of foreign

currency exchange rate changes on cash and cash

equivalents |

|

|

|

|

(1,073 |

) |

|

|

(2,750 |

) |

| Net decrease in cash

and cash equivalents |

|

|

|

|

(74,324 |

) |

|

|

(116,279 |

) |

| Cash and cash

equivalents at beginning of period |

|

|

|

|

221,581 |

|

|

|

336,024 |

|

| Cash and cash

equivalents at end of period |

|

|

|

$ |

147,257 |

|

|

$ |

219,745 |

|

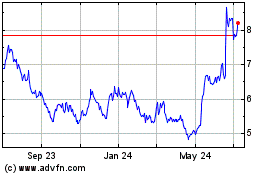

Himax Technologies (NASDAQ:HIMX)

Historical Stock Chart

From Mar 2024 to Apr 2024

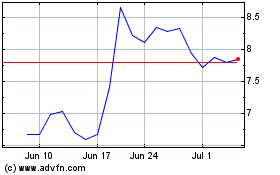

Himax Technologies (NASDAQ:HIMX)

Historical Stock Chart

From Apr 2023 to Apr 2024