0001386570FALSE00013865702023-11-082023-11-08

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 8, 2023

CHROMADEX CORPORATION

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 001-37752 | | 26-2940963 |

| (State or other jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

10900 Wilshire Blvd. Suite 600, Los Angeles, California 90024

(Address of principal executive offices, including zip code)

(310) 388-6706

(Registrant's telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

Common Stock, par value $0.001 per share | CDXC | The Nasdaq Capital Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On November 8, 2023, ChromaDex Corporation (the “Company”) issued a press release announcing its earnings for the quarter ended September 30, 2023. A copy of the press release is attached hereto as Exhibit 99.1.

The information in this Item 2.02 and the exhibit hereto are being furnished and shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liability of that section, nor shall they be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, (the “Securities Act”) or the Exchange Act, except as expressly set forth by specific reference in such filing.

Item 7.01. Regulation FD Disclosure.

On November 8, 2023, the Company released a corporate presentation which it made available on its website. A copy of the corporate presentation is attached hereto as Exhibit 99.2.

The information in this Item 7.01 and the exhibit hereto are being furnished and shall not be deemed to be “filed” for purposes of Section 18 of the Exchange Act, or otherwise subject to the liability of that section, nor shall they be deemed incorporated by reference in any filing under the Securities Act or the Exchange Act, except as expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

| | | | | | | | |

Exhibit Number | | Description |

| | |

| | |

| | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| CHROMADEX CORPORATION |

| | |

Dated: November 8, 2023 | By: | /s/ BRIANNA L. GERBER |

| | Brianna L. Gerber |

| | Chief Financial Officer |

| | (principal financial officer and duly authorized on behalf of the registrant) |

ChromaDex Corporation Reports Third Quarter 2023 Financial Results

Total net sales of $19.5 million, a gross margin of 61.4% and a net loss of $1.0 million while achieving a positive Adjusted EBITDA of $0.5 million and positive operating cash flows for the three months ended September 30, 2023.

LOS ANGELES, CA - November 8, 2023 - ChromaDex Corp. (NASDAQ:CDXC) today announced financial results for the third quarter of 2023.

Third Quarter 2023 and Recent Highlights

•Total net sales were $19.5 million, with $17.4 million from Tru Niagen®, up 14% and 19% from the prior year quarter, respectively.

•Strong gross margin of 61.4%, an increase of 160 basis points, compared to 59.8% from the prior year quarter.

•Sales and marketing expense as a percentage of net sales was 31.0%, an improvement of 340 basis points, compared to 34.4% from the prior year quarter.

•Net loss was $1.0 million or $(0.01) per share, remaining stable compared to the prior year quarter, a notable achievement as the prior year's results included the one-time Employee Retention Tax Credit recognition of $2.1 million ($0.03 per share).

•Adjusted EBITDA, a non-GAAP measure, was a positive $0.5 million, a $1.7 million improvement from the prior year quarter.

•In August 2023, launched Tru Niagen® on iHerb, a global destination for supplements, expanding ChromaDex’s worldwide reach.

•Clinical study published in August 2023 in the peer-reviewed journal Cell Reports found that supplementation of NR effectively reduced inflammation in both healthy subjects and immune cells derived from psoriasis patients.

•In October 2023, launched Tru Niagen® 1,000 mg, the most researched dosage in clinical studies, empowering customers to elevate their NAD levels by up to 150% after three weeks.

•In October 2023, Zesty Paws, a prominent name in pet supplements, partnered with ChromaDex to launch a Healthy Aging NAD+ Precursor supplement for pets, featuring Niagen®. This partnership marks the entry into the longevity category for pets and extends the power of Niagen® to animal companions.

“We had a solid quarter, delivering 14% year-over-year revenue growth, a net loss of only $1.0 million, positive Adjusted EBITDA of $0.5 million, and positive operating cash flows for the third consecutive quarter, ending with $26.8 million in cash and no debt,” said ChromaDex Chief Executive Officer, Rob Fried. “These results serve as a testament to our commitment to financial discipline and operational efficiency. ChromaDex is in its strongest financial position to date, and we expect to unlock commercial opportunities driven by new innovation in 2024 and beyond.”

Results of operations for the three months ended September 30, 2023 compared to the prior year quarter

ChromaDex reported a net sales increase of 14%, or $2.4 million, to $19.5 million. The increase in total net sales was driven by growth in Tru Niagen® sales, partially offset by lower Niagen® ingredient sales.

Gross margin percentage improved 160 basis points to 61.4%. The improvement in gross margin percentage is primarily driven by supply chain management optimization efforts, including improvements in yield loss, and benefits from economies of scale, partly offset by changes in business mix.

Operating expense decreased 1%, or $0.2 million, to $13.1 million due to a $0.3 million reduction in general and administrative expense, partially offset by a slight increase in sales and marketing expense.

Net loss was $1.0 million, or $0.01 loss per share, consistent with the net loss of $1.0 million or $0.01 loss per share for the third quarter of 2022. Notably, the third quarter of 2022 included a one-time recognition of the Employee Retention Tax Credit recognition of $2.1 million, or $0.03 per share, further underlining the improvements in performance this quarter compared to the prior year quarter. Adjusted EBITDA, a non-GAAP measure, was a positive $0.5 million, a $1.7 million improvement from the third quarter of 2022. See “Reconciliation of Non-GAAP Financial Measures” for a reconciliation of non-GAAP Adjusted EBITDA to net loss, the most directly comparable GAAP measure.

Net cash inflow from operating activities was $6.5 million for the nine months ended September 30, 2023, showing a significant improvement compared to a net cash outflow of $14.8 million in the prior year. This improvement can be attributed to a $10.1 million reduction in net loss and positive cash impacts of $4.1 million from inventory management, $3.0 million from lower prepaid expenses and other assets, $1.5 million from reduced trade receivables, $1.6 million from higher accrued expenses and $0.9 million from higher provisions for doubtful trade receivables.

2023 Full Year Outlook

Looking forward, for the full year, the Company expects between 14% - 16% revenue growth year-over-year, driven by its global e-commerce business, steady growth from new and existing partnerships, upside realized from new partnerships in the first nine months of 2023 and realistic opportunities in the pipeline for the fourth quarter of 2023. The Company projects that gross margin will remain stable year over year as cost savings initiatives and benefits from economies of scale are expected to largely offset continued inflationary pressures. Moreover, further optimization, coupled with new and focused customer acquisition strategies are expected to result in reduced selling and marketing expense as a percentage of net sales. The Company plans to increase investments in research and development to drive innovation, and expects general and administrative expense to be flat to down $1 million year over year.

Investor Conference Call

A live webcast will be held Wednesday, November 8, 2023 at 4:30 p.m. Eastern time (1:30 p.m. Pacific time) to discuss ChromaDex’s third-quarter financial results and provide a general business update.

To listen to the webcast, or to view the earnings press release and its accompanying financial exhibits, please visit the Investors Relations section of ChromaDex’s website at http://chromadex.com. The toll-free dial-in information for this call is 1-888-330-2446 with Conference ID: 4126168.

The webcast will be recorded, and will be available for replay via the website from 7:30 p.m. Eastern time on November 8, 2023 through 11:59 p.m. Eastern time on November 15, 2023. The replay of the call can also be accessed by dialing 800-770-2030, using the Replay ID: 4126168.

Important Note on Forward Looking Statements:

This release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, and Section 21E of the Securities Exchange Act of 1934. Statements that are not a description of historical facts constitute forward-looking statements and may often, but not always, be identified by the use of such words as “expects,” “anticipates,” “intends” “estimates,” “plans,” “potential,” “possible,” “probable,” “believes” “seeks,” “may,” “will,” “should,” “could,” “predicts,” “projects,” “continue,” “would” or the negative of such terms or other similar expressions. Forward-looking statements include statements regarding our intentions, beliefs, projections, outlook, analyses or current expectations concerning, among other things: the quotation from ChromaDex’s Chief Executive Officer, and statements related to the Company’s 2023 financial outlook including but not limited to revenue growth, gross margin, expenses, and investment plans. Risks that contribute to the uncertain nature of the forward-looking statements include: inflationary conditions and adverse economic conditions; our history of operating losses and need to obtain additional financing; the growth and profitability of our product sales; our ability to maintain sales, marketing and distribution capabilities; changing consumer perceptions of our products; our reliance on a single or limited number of third-party suppliers; risks of conducting business in China; and the risks and uncertainties associated with our business and financial condition in general, described in our filings with the Securities and Exchange Commission (SEC), including, without limitation, our most recent Annual Report on Form 10-K and Quarterly Report on Form 10-Q as filed with the SEC. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof, and actual results may differ materially from those suggested by these forward-looking statements. All forward-looking statements are qualified in their entirety by this cautionary statement and ChromaDex undertakes no obligation to revise or update this release to reflect events or circumstances after the date hereof.

About ChromaDex:

ChromaDex Corporation is a global bioscience company dedicated to healthy aging. The ChromaDex team, which includes world-renowned scientists, is pioneering research on nicotinamide adenine dinucleotide (NAD+), an essential coenzyme that is a key regulator of cellular metabolism and is found in every cell of the human body. NAD+ levels in humans have been shown to decline with age, among other factors, and may be increased through supplementation with NAD+ precursors. ChromaDex is the innovator behind the NAD+ precursor nicotinamide riboside (NR), commercialized as the flagship ingredient Niagen®. Nicotinamide riboside and other NAD+ precursors are protected by ChromaDex’s patent portfolio.

The Company delivers Niagen® as the sole active ingredient in its consumer product Tru Niagen® available at www.truniagen.com and through partnerships with global retailers and distributors. The Company also develops and commercializes proprietary-based ingredient technologies and supplies these ingredients as raw materials to the manufacturers of consumer products. The Company further offers natural product fine chemicals, known as phytochemicals, and related research and development services. Follow us on X (formerly Twitter) @ChromaDex and Instagram @TruNiagen and subscribe to our latest news via our website accessible at www.chromadex.com to which ChromaDex regularly posts copies of its press releases as well as additional updates and financial information about the Company.

Contacts:

| | | | | |

| Investor Relations | |

| +1 (949) 356-1620 | |

| InvestorRelations@ChromaDex.com | |

| |

| Media Relations | |

| Kendall Knysch | |

| Director of Media Relations | |

| +1 (310) 388-6706 Ext. 689 | |

Kendall.Knysch@ChromaDex.com | |

ChromaDex Corporation and Subsidiaries

Unaudited Condensed Consolidated Statements of Operations

| | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended September 30, | | Nine Months Ended September 30, |

| 2023 | | 2022 | | 2023 | | 2022 |

(In thousands, except per share data) | | | | | | | |

| Sales, net | $ | 19,495 | | | $ | 17,063 | | | $ | 62,374 | | | $ | 51,054 | |

| Cost of sales | 7,526 | | 6,856 | | 24,531 | | 20,273 |

| Gross profit | 11,969 | | 10,207 | | 37,843 | | 30,781 |

| Operating expenses: | | | | | | | |

| Sales and marketing | 6,035 | | 5,868 | | 19,918 | | 22,126 |

| Research and development | 1,241 | | 1,224 | | 3,799 | | 3,547 |

| General and administrative | 5,840 | | 6,180 | | 19,557 | | 22,292 |

| Total operating expenses | 13,116 | | 13,272 | | 43,274 | | 47,965 |

| Operating loss | (1,147) | | (3,065) | | (5,431) | | (17,184) |

| | | | | | | |

| Nonoperating income (expenses): | | | | | | | |

| Other income, net - Employee Retention Tax Credit | — | | 2,085 | | — | | 2,085 |

| Interest income (expense), net | 188 | | (5) | | 379 | | (23) |

| Net loss | $ | (959) | | | $ | (985) | | | $ | (5,052) | | | $ | (15,122) | |

| | | | | | | |

| Basic and diluted loss per share attributable to common stockholders: | $ | (0.01) | | | $ | (0.01) | | | $ | (0.07) | | | $ | (0.22) | |

| Basic and diluted weighted average common shares outstanding | 75,050 | | 68,345 | | 74,938 | | 68,331 |

ChromaDex Corporation and Subsidiaries

Unaudited Condensed Consolidated Balance Sheets

| | | | | | | | | | | |

(In thousands except par values, unless otherwise indicated) | September 30, 2023 | | December 31, 2022 |

| Assets | | | |

| Current assets: | | | |

| Cash and cash equivalents, including restricted cash of $152 for both periods presented | $ | 26,773 | | | $ | 20,441 | |

| Trade receivables, net of allowances of $993 and $122, respectively; Including receivables from Related Party of $2.9 million and $3.1 million, respectively | 5,601 | | 8,482 |

| Inventories | 12,624 | | 14,677 |

| Prepaid expenses and other assets | 2,183 | | 2,967 |

| Total current assets | 47,181 | | 46,567 |

| | | |

| Leasehold improvements and equipment, net | 2,293 | | 2,799 |

| Intangible assets, net | 552 | | 671 |

| Right-of-use assets | 3,003 | | 3,523 |

| Other long-term assets | 454 | | 497 |

| Total assets | $ | 53,483 | | | $ | 54,057 | |

| | | |

| Liabilities and Stockholders' Equity | | | |

| Current liabilities: | | | |

| Accounts payable | $ | 9,198 | | | $ | 9,679 | |

| Accrued expenses | 9,193 | | 7,337 |

| Current maturities of operating lease obligations | 854 | | 680 |

| Current maturities of finance lease obligations | 10 | | 16 |

| Customer deposits | 189 | | 157 |

| Total current liabilities | 19,444 | | 17,869 |

| Deferred revenue | 3,806 | | 3,955 |

| Operating lease obligations, less current maturities | 2,911 | | 3,539 |

| Finance lease obligations, less current maturities | 14 | | 22 |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

Total stockholders’ equity | 27,308 | | 28,672 |

Total liabilities and stockholders’ equity | $ | 53,483 | | | $ | 54,057 | |

ChromaDex Corporation and Subsidiaries

Unaudited Condensed Consolidated Statements of Cash Flows

| | | | | | | | | | | |

| Nine Months Ended September 30, |

| (In thousands) | 2023 | | 2022 |

| Net cash provided by / (used in): | | | |

| Operating activities | $ | 6,468 | | | $ | (14,770) | |

| Investing activities | (122) | | | (162) | |

| Financing activities | (14) | | | (25) | |

| Net increase (decrease) in cash and cash equivalents | 6,332 | | | (14,957) | |

| Cash and cash equivalents beginning of period | 20,441 | | | 28,219 | |

| Cash and cash equivalents at end of period | $ | 26,773 | | | $ | 13,262 | |

ChromaDex Corporation and Subsidiaries

Unaudited Reconciliation of Non-GAAP Financial Measures

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Reconciliation of Net Loss to Adjusted EBITDA |

(In thousands) | Q3 2023 | | Q2 2023 | | Q1 2023 | | Q4 2022 | | Q3 2022 |

| | | | | | | | | |

| Net loss, as reported | $ | (959) | | | $ | (2,191) | | | $ | (1,902) | | | $ | (1,418) | | | $ | (985) | |

| Adjustments: | | | | | | | | | |

| Interest (income) expense, net | (188) | | (125) | | (66) | | (26) | | 5 |

| Depreciation | 233 | | 232 | | 228 | | 221 | | 235 |

| Amortization of intangibles | 39 | | 39 | | 41 | | 43 | | 44 |

| Amortization of right of use assets | 176 | | 173 | | 171 | | 191 | | 170 |

| Share-based compensation | 1,117 | | 1,324 | | 1,273 | | 1,326 | | 1,229 |

| Severance and restructuring | 86 | | 766 | | 186 | | 13 | | 181 |

| Other income - Employee Retention Tax Credit | — | | | — | | | — | | | — | | | (2,085) | |

| Adjusted EBITDA | $ | 504 | | | $ | 218 | | | $ | (69) | | | $ | 350 | | | $ | (1,206) | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

Non-GAAP Financial Information:

To supplement ChromaDex’s unaudited financial data presented in accordance with generally accepted accounting principles (GAAP), the Company has presented Adjusted EBITDA, a non-GAAP financial measure. ChromaDex believes the presentation of such non-GAAP financial measure provides important supplemental information to management and investors and enhances the overall understanding of the Company’s historical and current financial operating performance. The Company believes disclosure of the non-GAAP financial measure has substance because the excluded expenses are infrequent in nature, are variable in nature or do not represent current cash expenditures. Further, such non-GAAP financial measure is among the indicators the Company uses as a basis for evaluating the Company’s financial performance as well as for planning and forecasting purposes. Accordingly, disclosure of this non-GAAP financial measure provides investors with the same information that management uses to understand the Company’s economic performance year-over-year.

Adjusted EBITDA is defined as net income before (a) interest, (b) depreciation, (c) amortization, (d) non-cash share-based compensation costs, (e) severance and restructuring expense and (f) Other income from the Employee Retention Tax Credit. While ChromaDex believes that this non-GAAP financial measure provides useful supplemental information to investors, there are limitations associated with the use of such measure. This measure is not prepared in accordance with GAAP and may not be directly comparable to similarly titled measures of other companies due to potential differences in the method of calculation. Management compensates for these limitations by relying primarily on the Company’s GAAP results and by using Adjusted EBITDA only supplementally and by reviewing the reconciliation of the non-GAAP financial measure to its most comparable GAAP financial measure.

Non-GAAP financial measures are not in accordance with, or an alternative for, generally accepted accounting principles in the United States. The Company’s non-GAAP financial measure is not meant to be considered in isolation or as a substitute for comparable GAAP financial measures and should be read only in conjunction with the company’s consolidated financial statements prepared in accordance with GAAP.

ChromaDex Earnings Conference Call Third Quarter 2023 Rob Fried Chief Executive Officer Brianna Gerber Chief Financial Officer Andrew Shao SVP Scientific & Regulatory Affairs Nasdaq: CDXC | November 8, 2023

SAFE HARBOR STATEMENT SAFE HARBOR STATEMENT 2 This presentation and other written or oral statements made from time to time by representatives of ChromaDex contain “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements reflect the current view about future events. Statements that are not historical in nature, such as 2023 financial outlook, and which may be identified by the use of words like “expects,” “anticipates,” “intends,” “estimates,” “plans,” “potential,” “possible,” “probable,” “believes,” “seeks,” “may,” “will,” “should,” “could,” “predicts,” “projects,” “continue,” “would” or the negative of these terms and other words of similar meaning, are forward-looking statements. Such statements include, but are not limited to, statements contained in this presentation relating to our expected sales, cash flows, planned investments, and financial performance, business, business strategy, expansion, growth, key drivers (including cost savings and increased investments), products and services we recently offered and their impact on our performance or products and services we may offer in the future and the timing of their development, sales and marketing strategy and capital outlook. Forward-looking statements are based on management’s current expectations and assumptions regarding our business, the economy and other future conditions and are subject to inherent risks, uncertainties and changes of circumstances that are difficult to predict and may cause actual results to differ materially from those contemplated or expressed. We caution you therefore against relying on any of these forward-looking statements. These risks and uncertainties include those risk factors discussed in Part I, “Item 1A. Risk Factors” of our most recent Annual Report on Form 10-K and Quarterly Report on Form 10-Q filed with the Securities Exchange Commission (the “Commission”), and in subsequent filings with the Commission. Any forward-looking statements are qualified in their entirety by reference to the factors discussed in these filings with the Commission. Should one or more of these risks or uncertainties materialize, or should the underlying assumptions prove incorrect, actual results may differ significantly from those anticipated, believed, estimated, expected, intended or planned. Important factors that could cause actual results to differ materially from those in the forward looking statements include but are not limited to: inflationary conditions and adverse economic conditions; our history of operating losses and need to obtain additional financing; the growth and profitability of our product sales; our ability to maintain sales, marketing and distribution capabilities; changing consumer perceptions of our products; our reliance on a single or limited number of third-party suppliers; risks of conducting business in China; and the risks and uncertainties associated with our business and financial condition in general. Factors or events that could cause our actual results to differ may emerge from time to time, and it is not possible for us to predict all of them. We cannot guarantee future results, levels of activity, performance or achievements. Except as required by applicable law, including the securities laws of the United States, we do not intend to update any of the forward-looking statements to conform these statements to actual results. About Non-GAAP Financial Measures ChromaDex’s non-GAAP financial measure, Adjusted EBITDA, is defined as net income before interest, depreciation, amortization, non-cash share-based compensation costs, severance and restructuring expense and other income from the Employee Retention Tax Credit. ChromaDex used this non-GAAP measures when evaluating its financial results as well as for internal resource management, planning and forecasting purposes. This non-GAAP measure should not be viewed in isolation from or as a substitute for ChromaDex’s financial results in accordance with GAAP. Reconciliation of this non-GAAP measure to the most directly comparable GAAP measure is attached to this presentation. FDA Disclaimer Statements made in this presentation have not been evaluated by the Food and Drug Administration. ChromaDex products are not intended to diagnose, treat, cure, or prevent any disease. The statements in this presentation are for investor relations and educational purposes only and not intended for consumers or vendors.

3 Q3 2023 & Recent Highlights (1) See slide 11 for the non-GAAP reconciliation Delivered solid top-line growth and strong bottom-line results, underlining continued operational discipline. Expectations for heavier R&D in fourth quarter of 2023 to fund strategic initiatives and further develop new NAD+ precursors. • Total company and Tru Niagen® net sales up 14% and 19% YoY, respectively. • Total sales and marketing expense was up $0.2 million while decreasing as a percentage of net sales YoY (31.0% vs 34.4%). • Delivered strong gross margins of 61.4%, up 160 basis points YoY, compared to 59.8%. • Net loss was $1.0 million or, $0.01 loss per share, remaining stable YoY, a notable achievement as the prior year's results included a one-time recognition for the Employee Retention Tax Credit of $2.1 million ($0.03 per share). • Underlying business, as measured by Adjusted EBITDA, was a positive $0.5 million, an improvement of $1.7 million YoY. (1) • Achieved positive operating cash flows for a third consecutive quarter, ending with $26.8 million in cash and no debt. • In August 2023, launched Tru Niagen® on iHerb, a global destination for supplements, expanding ChromaDex’s worldwide reach. • Clinical study published in August 2023 in the peer-reviewed journal Cell Reports found that supplementation of NR effectively reduced inflammation in both healthy subjects and immune cells derived from psoriasis patients. • In October 2023, launched Tru Niagen® 1,000 mg, the most researched dosage in clinical studies, empowering customers to elevate their NAD levels by up to 150% after three weeks. • Narrowed full year 2023 revenue outlook to between 14% - 16% growth (previously at least 15% growth) to reflect year-to-date performance and realistic opportunities in the pipeline for the fourth quarter

Management Team 4 Rob Fried Chief Executive Officer E-commerce & entertainment industry executive Savoy Pictures, Columbia Pictures, Fried Films, FeeIn, WHN, Healthspan Research Brianna Gerber Chief Financial Officer Over 20 years of diverse experience in investment management and finance at the Capital Group, Mattel, and ChromaDex Heather Van Blarcom SVP, Legal & Corporate Secretary Over two decades of industry experience with extensive knowledge of FDA and FTC regulations Andrew Shao SVP, Global Regulatory & Scientific Affairs Over two decades of global nutrition industry experience at Amway, Herbalife Nutrition, and the Council for Responsible Nutrition David Kroes SVP, People Matter(s) Over 20 years of diverse Human Resources experience consulting in companies at various stages of growth to enhance culture, improve productivity, and promote diversity, equity, and inclusion Jason Campbell SVP, Business Development Over 25 years of life science business experience specialized in clinical research, biotechnology, drug discovery and development, and food and nutrition quality and safety

The information contained in this documents is confidential, privileged and only for the information of the intended recipient and may not be used, published or redistributed without the prior written consent (2019) 5 Financial Highlights

6 Q3 2023 Net Sales Mix E-Commerce 66% Watson's & Other B2B 19% Niagen® Ingredient 11% Analytical Reference Standards & Services 4% Q3 2022 $17.1 MM E-Commerce 65% Watson's & Other B2B 24% Niagen® Ingredient 7% Analytical Reference Standards & Services 4% $19.5 MM Q3 2023 • Tru Niagen® net sales increased to 89% of net sales for Q3 2023 compared to 85% in Q3 2022(1) • Niagen®-related net sales remained stable at approximately 96% of net sales in both Q3 2023 and Q3 2022(2) Higher mix of Tru Niagen® sales in Q3 2023 compared to the prior year reflects stronger sales to distributor partners and higher E-Commerce sales. (1) Tru Niagen® net sales include E-Commerce, Watson’s/Other B2B (2) Niagen®-related sales include Tru Niagen® and Niagen® ingredient

7 Q3 2023 Net Sales Q3 2023 Net Sales ($ in millions) 12.7 4.7 1.4 0.7 0.0 E-Commerce Watson's & Other B2B Niagen® Ingredient Analytical Reference Standards & Services Other Ingredients $17.4 YoY % (vs Q3 2022) +13% +43% (21)% (2)% (100)% +14% Tru Niagen® business was up 19% year-over-year, partially offset by lower Niagen Ingredient sales. Total Growth Rates

8 Niagen®-related business(1), up 23% year-over-year, driven by increased E-Commerce activity, higher Watson’s sales and a surge in Niagen® ingredient sales, driven by new and existing partners. Year-to-Date 2023 Net Sales YTD 2023 Net Sales ($ in millions) Total +22% +11% +42% +78% (6)% +34% YoY % (vs YTD 2022) $51.9 37.9 14.0 7.8 2.2 0.4 E-Commerce Watson's & Other B2B Niagen® Ingredient Analytical Reference Standards & Services Other Ingredients Growth Rates (1) Niagen®-related sales include Tru Niagen® and Niagen® ingredient

9 2021 – 2023 YTD Net Sales Summary ($ in millions) 2021 2022 2023 Description Q1 Q2 Q3 Q4 FY Q1 Q2 Q3 Q4 FY Q1 Q2 Q3 E-Commerce 9.6 10.6 10.5 11.1 41.8 10.9 12.0 11.3 11.1 45.3 12.2 13.0 12.7 Watsons 1.6 2.9 2.6 2.2 9.3 2.6 1.5 2.6 3.3 10.0 3.7 3.0 3.1 Other B2B 1.3 1.8 1.6 0.8 5.6 1.4 1.0 0.7 1.7 4.8 1.7 0.9 1.6 Total TRU NIAGEN 12.4 15.4 14.8 14.1 56.7 14.9 14.5 14.6 16.1 60.1 17.6 16.9 17.4 NIAGEN Ingredient 1.2 1.3 1.7 2.5 6.7 1.1 1.5 1.8 3.9 8.3 3.9 2.5 1.4 NIAGEN Related Revenues 13.6 16.7 16.4 16.6 63.4 16.0 16.0 16.4 20.0 68.4 21.5 19.4 18.8 Other Ingredients 0.1 0.2 0.1 0.2 0.7 0.3 0.0 0.0 0.1 0.4 0.2 0.2 0.0 Analytical Reference Standards & Services 0.9 0.8 0.8 0.9 3.4 0.9 0.7 0.7 0.9 3.2 0.8 0.7 0.7 Total Net Sales 14.7 17.7 17.3 17.8 67.4 17.2 16.7 17.1 21.0 72.0 22.5 20.3 19.5 TRU NIAGEN as % of Total Net Sales 85 % 87 % 85 % 80 % 84 % 87 % 87 % 85 % 77 % 84 % 78 % 83 % 89 % NIAGEN Related Revenues as % of Total Net Sales 93 % 94 % 95 % 94 % 94 % 93 % 95 % 96 % 96 % 95 % 95 % 95 % 97 % YOY Growth Rate - Net Sales Total Company 2 % 16 % 22 % 15 % 14 % 18 % (5) % (1) % 19 % 7 % 31 % 21 % 14 % NIAGEN Related 4 % 22 % 29 % 14 % 17 % 18 % (4) % (1) % 20 % 8 % 34 % 21 % 15 % Total TRU NIAGEN 12 % 31 % 24 % 14 % 20 % 20 % (6) % (1) % 14 % 6 % 18 % 16 % 19 %

10 Q3 2023 vs Q3 2022 Key P&L Metrics (in thousands) Q3 2023 Q3 2022 Notes Net Sales $19,495 $17,063 Tru Niagen® business up 19% driven by E-Commerce growth (up +13%) and higher sales to distributor partners, including Watson’s, partially offset by lower Niagen® ingredient sales primarily due to the timing of orders from partners. Gross Profit % of Net Sales 11,969 61.4% 10,207 59.8% Up 160bps largely driven by benefits from economies of scale and supply chain management optimization efforts, partly offset by changes in business mix. Sales and Marketing % of Net Sales 6,035 31.0% 5,868 34.4% Improvements reflect an ongoing commitment to optimizing marketing investments, with focus on initiatives that drive direct & efficient returns. Research and Development 1,241 1,224 Stable YoY, with increased R&D investments in strategic initiatives offset by a refund from a discontinued project. General and Administrative 5,840 6,180 Driven by lower legal and severance and restructuring expense. Total Operating Expense 13,116 13,272 Reduced G&A expense, partially offset by higher sales and marketing investments. Operating Loss $(1,147) $(3,065) Reflects higher net sales, improved gross margins and lower operating expense.

11 Adjusted EBITDA Summary ChromaDex Corporation and Subsidiaries Reconciliation of Non-GAAP Finanical Measures (In thousands) Three months ended Q1 2021 Q2 2021 Q3 2021 Q4 2021 Q1 2022 Q2 2022 Q3 2022 Q4 2022 Q1 2023 Q2 2023 Q3 2023 Net loss, as reported $ (7,381) $ (5,566) $ (8,856) $ (5,325) $ (7,740) $ (6,397) $ (985) $ (1,418) $ (1,902) $ (2,191) $ (959) Adjustments Interest (income) expense 19 12 15 9 8 10 5 (26) (66) (125) (188) Depreciation 221 226 232 211 201 212 235 221 228 232 233 Amortization of intangibles 60 61 53 51 49 50 44 43 41 39 39 Amortization of right of use assets 126 128 131 126 299 169 170 191 171 173 176 Share-based compensation 1,284 1,616 1,822 1,473 1,888 1,296 1,229 1,326 1,273 1,324 1,117 Severance and restructuring (10) 13 342 6 821 17 181 13 186 766 86 Other income - Employee Retention Tax Credit — — — — — — (2,085) — — — — Adjusted EBITDA $ (5,681) $ (3,510) $ (6,261) $ (3,449) $ (4,474) $ (4,643) $ (1,206) $ 350 $ (69) $ 218 $ 504 Q3 2023 Adjusted EBITDA was a positive $0.5 million, a $1.7 million improvement YoY, driven by improvements in net loss after excluding the one-time Employee Retention Tax Credit recognition in Q3 2022, largely due to increased sales.

12 Q3 2023 Operating Loss vs Q3 2022 (in millions) -$0.3 MM+$2.3 MM (3.1) 1.5 0.3 0.2 0.2 0.1 (0.1) (0.2) (1.1) Q3 2022 Operating Loss Volume Gross Margin Improvement Legal Other G+A Severance and Restructuring Equity Comp (G+A) Sales & Marketing Q3 2023 Operating Loss (3.0) (2.0) (1.0) —

13 Quarterly Balance Sheet Highlights (in thousands) 12/31/20 12/31/21 3/31/22 6/30/22 9/30/22 12/31/22 3/31/23 6/30/23 9/30/23 Key Drivers (YoY for 2023 YTD) Cash $16,697 $28,219 $20,993 $17,072 $13,262 $20,441 $23,141 $26,406 $26,773 Driven by cash inflows from operations Inventory 11,683 13,601 15,307 15,753 15,636 14,677 11,908 11,973 12,624 Driven by higher net sales and improvements in inventory management Trade Receivables 2,694 5,226 6,310 4,228 4,744 8,482 9,221 6,118 5,601 Driven by higher total net sales, increased reserves and timing of purchases and collections Accrued Liabilities 6,133 6,481 8,126 6,696 6,756 7,337 8,610 8,079 9,193 Driven by timing of expenses Accounts Payable 9,445 10,423 9,780 10,197 9,119 9,679 8,951 10,031 9,198 Driven by timing of disbursements Equity $16,424 $31,727 $25,877 $20,778 $21,023 $28,672 $28,017 $27,150 $27,308 Driven by net loss, partially offset by share- based compensation Reflects disciplined cash management and optimization measures throughout 2023, while continuing to invest in key areas.

14 Quarterly Cash Flow Highlights Maintained positive net cash flows from operations for a third consecutive quarter. (in thousands) FY 2020 FY 2021 3/31/22 6/30/22 9/30/22 12/31/2022 FY 2022 3/31/23 6/30/23 9/30/23 Net Loss $ (19,925) $(27,128) $(7,740) $(6,397) $(985) (4) $(1,418) $(16,540) (4) $(1,902) $(2,191) $(959) Working Capital 383 (1) (4,915) (1,923) 923 (4,461) (4) (466) (5,927) (4) 2,644 3,401 (422) Cash From / (Used for) Operations (10,600) (24,163) (7,198) (3,832) (3,740) (328) (15,098) 2,792 3,280 396 Cash Used for Investing (165) (409) (25) (85) (52) (172) (334) (91) (5) (26) Cash From / (Used for) Financing 8,650 (2) 36,094 (3) (3) (4) (18) 7,679 (5) 7,654 (5) (1) (10) (3) Net Increase / (Decrease) in Cash $ (2,115) $11,522 $(7,226) $(3,921) $(3,810) $7,179 $(7,778) $2,700 $3,265 $367 Ending Cash Balance $ 16,697 $28,219 $20,993 $17,072 $13,262 $20,441 $20,441 $23,141 $26,406 $26,773 1. Includes $1 million deferred revenue related to the product launch fee received from Nestlé. 2. Includes $5 million issuance of common stock, net of $144,000 issuance costs and includes $4.1 million proceeds from exercise of stock options. 3. Includes $27.2 million issuance of common stock, net of $428,000 issuance costs and includes $9.5 million in proceeds from exercise of stock options. 4. Includes $2.1 million related to the Employee Retention Tax Credit (no net cash flow impact). 5. Includes $7.7 million issuance of common stock, net of $353,000 issuance costs.

15 2023 Financial Outlook (in thousands) 2021 Actual 2022 Actual 2023 Full Year Outlook Key Drivers Net Sales $67,449 $72,050 Between 14% - 16% growth (previously at least 15% growth, with opportunities for greater growth) • Includes steady growth from e-commerce business, recurring revenues from established partnerships, upside realized from newer partnerships year-to-date and realistic opportunities in pipeline for Q4 2023 Gross Margin % (as a % of net sales) 61.5% 59.4% Stable YoY (unchanged from last quarter's outlook) • Cost savings initiatives and economies of scale offsetting continued inflationary pressures Selling, Marketing & Advertising (as a % of net sales) 42.0% 39.3% Down as a % of net sales (unchanged from last quarter's outlook) • Focused and optimized investments to drive Tru Niagen® brand awareness, following the larger brand campaign in Q1 2023 Research & Development $3,832 $4,826 Up in absolute dollars YoY (unchanged from last quarter's outlook) • Increased investment in future innovation, including new NAD precursor development • Higher investments planned in Q4 2023 General & Administrative $36,379 $28,286 Flat to down $1 million YoY (unchanged from last quarter's outlook) • Disciplined overall expense management, offset by higher bad debt expense and infrastructure investments to support growth Strong 2023 net sales growth and further optimization of cost structure, with selective investments in brand building initiatives and R&D to drive future innovation.

The information contained in this documents is confidential, privileged and only for the information of the intended recipient and may not be used, published or redistributed without the prior written consent (2019) The Science 16

17 Science Continues to Expand (1) There are 88 ongoing, completed, and published clinical studies currently registered on clinicaltrials.gov to investigate the pharmacokinetics and therapeutic effects of NR alone or in combination with other ingredients. 70 of these use NR only. Clinicaltrials.gov also includes two niacin studies and one device monitoring registry for a total of 91 under the search term “nicotinamide riboside.” (As of October 30, 2023) (2) 275+ research collaborations for Niagen® signed with research institutes and universities around the world. More than 90% of the studies are investigator-initiated and were developed to support applications for or receipt of third-party funding. The studies may not have been initiated if investigators were unable to secure funding. • Four new human trials on nicotinamide riboside have registered since prior update.¹ • Antonio J. Conde Moreno & University of Valencia (June 2023) • To evaluate a skin cream's radioprotective and radiomitigation effect when used as a preventative treatment of acute radiation-induced radiodermatitis. • Radiodermatitis is a skin condition that can occur as a side effect of radiation therapy. • Five participants will apply a skin cream that contains standard skin cream components plus 2% NR, 2% pterostilbene, and 1% silibinin for an average of four months. • Charite University Berlin (August 2023) • The objective is to investigate the impact of taking the dietary supplement NR on the concentration of extracellular NAD+ (eNAD+) in human plasma over time using an NAD+ Assay. • The investigators aim to examine the increase of eNAD+ after oral NR intake and provide initial data on the effects of a 1000 mg/day dosage. • 54 participants will receive 1000 mg of NR daily for 10 days. • National Heart, Lung, and Blood Institute (NHLBI) (September 2023) • The primary objective is to evaluate the effect of NR on immunometabolic and inflammatory remodeling in female subjects with systemic lupus erythematosus (SLE). The exploratory objective is to compare how the energy and immune-related features of specific immune cells, known as myeloid cells, differ between female SLE subjects and healthy controls. • This trial aims to build on findings from a previous study demonstrating boosting NAD+ with NR lowered inflammation in healthy subjects and in white blood cells derived from SLE (lupus) patients. • 78 participants will receive NR daily for 12 weeks. • National Institute of Diabetes and Digestive and Kidney Diseases (NIDDK) (September 2023) • The objective is to test how a low-carbohydrate diet and NR affect how a person’s body uses dietary fat. • 100 participants will take 2000 mg NR or placebo daily for 14 days. For 9 days, volunteers will consume a normal American diet, followed by a ketogenic, low-carbohydrate diet for 5 days. • One new research study signed through ChromaDex External Research Program (CERP).²

18 Recent Peer-Reviewed Clinical Publications • Movement Disorders – Presterud et al., 2023 – “Long-Term Nicotinamide Riboside Use Improves Coordination and Eye Movements in Ataxia Telangiectasia” – October 2023 • The study examined the safety and efficacy of long-term NR supplementation on neuromotor function in patients with ataxia telangiectasia (AT). • NR supplementation effectively increased whole blood NAD+ levels by up to four-fold compared to baseline. • NR also improved coordination and enhanced eye movement in individuals with AT, while maintaining biomarkers of stable liver and kidney function. • This is the second clinical study investigating the effects of NR supplementation in children and adults with AT. • Notably, this is the longest NR supplementation study conducted to date, spanning over two years. • Cell Reports Medicine – Han et al., 2023 – "Boosting NAD Preferentially Blunts TH17 Inflammation via Arginine Biosynthesis and Redox Regulatory Control in Control and Psoriasis Subjects” – August 2023 • The study examined how ex vivo NR supplementation affects adaptive immunity in CD4+ T cells extracted from healthy subjects and those with mild-moderate psoriasis and investigated the in vivo effects of oral NR supplementation in healthy volunteers on immune responsiveness. • The in vivo component of the study used samples obtained from a prior randomized, double-blind, placebo-controlled pilot study in 25 young, healthy subjects supplemented with NR (1000 mg/day for 7 days) • Ex Vivo: • NAD+/NADH ratio was reduced in psoriatic T cells compared to cells from healthy subjects. • NR treatment supported the immune system by reducing the overactivity of specific immune cells from both healthy individuals and those with psoriasis. • In Vivo: • NR supplementation replicated the immune-modulating effects observed with ex vivo NR administration, resulting in a decrease in inflammatory markers while enhancing antioxidant gene expression in immune cells.

19 Scientific Advisory Board Charles Brenner, Ph.D. Alfred E Mann Family Foundation Chair, Department of Diabetes & Cancer Metabolism City of Hope World's Foremost Authority on NAD Metabolism Roger Kornberg, Ph.D. Chairman Professor of Structural Biology Stanford University Nobel Prize Winner, Chemistry, 2006 Rudolph Tanzi, Ph.D. Kennedy Professor of Neurology Harvard University Leading Alzheimer's Researcher, TIME 100 Most Influential 2015 Dr. Bruce German Chairman of Food, Nutrition, & Health University of California, Davis Leader in Food, Nutrition, & Wellness Innovation Professor Sir John Walker, Ph.D. Emeritus Director, MRC Mitochondrial Biology University of Cambridge Nobel Prize Winner, Chemistry, 1997 Brunie H. Felding, Ph.D. Associate Professor of Molecular Medicine Scripps Research Institute Renowned Breast Cancer Researcher focused on NAD+ supplementation Dr. David Katz President of True Health Initiative CEO of Diet ID World renowned physician & preventive medicine expert Dr. Vilhelm (Will) Bohr, M.D., Ph.D., D.Sc. Professor in Genome Instability and Neurodegeneration, Department of Cellular and Molecular Medicine, University of Copenhagen. One of the world’s most published researchers on aging and neurodegenerative disease NOBEL PRIZE WINNERS | CHEMISTRY

20 Basic Physiological Functions are NAD+ Dependent INTRINSIC CAPACITY DOMAIN Based on World Health Organization’s definition VITALITY Energy metabolism Hormonal function Cardio-respiratory function Number of clinical trials (active)* 14 Number of clinical trials (complete)* 12 % of all registered Niagen® clinical trials** 50% Type II Diabetes (Insulin Sensitivity) Altered Glucose and Lipid Metabolism Non-Alcoholic Fatty Liver Heart Failure Hypertension Arterial Stiffness Vascular Function Immunity/Inflammation Chronic Kidney Disease Conditions Studied LOCOMOTION Muscle strength Balance Gait 8 7 Parkinson’s Disease Ataxia Telangiectasia Exercise Capacity/ Performance Muscle Function/Strength Sarcopenia COGNITION Memory Intelligence Problem-solving 2 5 13% Mild Concussion Mild Cognitive Impairment Alzheimer’s Disease SENSORY Vision Hearing 3 0 6% Neuropathies (e.g. Diabetic Neuropathy, Peripheral Neuropathy) Small Nerve Fiber Degeneration PSYCHOLOGICAL Mood Emotional vitality 1 0 2%29% *Source: Based on Niagen® NR trials registered on clinicaltrials.gov. Used ChromaDex classification into intrinsic capacity domains. As of October 30, 2023. Chart includes suspended trials but does not include pharmacokinetic or terminated trials. **Based on Niagen® nicotinamide riboside (NR) clinical trials listed on clinicaltrials.gov Anxiety Depression

The information contained in this documents is confidential, privileged and only for the information of the intended recipient and may not be used, published or redistributed without the prior written consent (2019) Contact Info: T: +1(949) 356-1620 InvestorRelations@ChromaDex.com www.chromadex.com Where to buy TRU NIAGEN® TruNiagen.com Amazon.com 21

v3.23.3

Cover

|

Nov. 08, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Nov. 08, 2023

|

| Entity Registrant Name |

CHROMADEX CORPORATION

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-37752

|

| Entity Tax Identification Number |

26-2940963

|

| Entity Address, Address Line One |

10900 Wilshire Blvd.

|

| Entity Address, Address Line Two |

Suite 600

|

| Entity Address, City or Town |

Los Angeles

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

90024

|

| City Area Code |

(310)

|

| Local Phone Number |

388-6706

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.001 per share

|

| Trading Symbol |

CDXC

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001386570

|

| Amendment Flag |

false

|

| Security Owned Not Readily Marketable, Name [Domain] |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

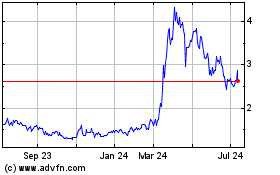

ChromaDex (NASDAQ:CDXC)

Historical Stock Chart

From Mar 2024 to Apr 2024

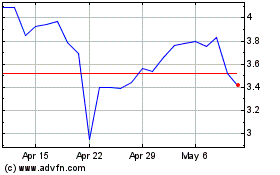

ChromaDex (NASDAQ:CDXC)

Historical Stock Chart

From Apr 2023 to Apr 2024