false

0001622345

0001622345

2023-11-03

2023-11-03

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): November 3, 2023

POLAR

POWER, INC.

(Exact

Name of Registrant as Specified in Charter)

| Delaware |

|

001-37960 |

|

33-0479020 |

(State

or Other Jurisdiction

of

Incorporation) |

|

(Commission

File

Number) |

|

(IRS

Employer

Identification

No.) |

249

E. Gardena Boulevard, Gardena, California 90248

(Address

of Principal Executive Offices) (Zip Code)

(310)

830-9153

(Registrant’s

telephone number, including area code)

N/A

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock, par value $0.0001 per share |

|

POLA |

|

The

NASDAQ Stock Market, LLC |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

1.01 Entry into of a Material Definitive Agreement.

On

November 3, 2023, Polar Power, Inc. (the “Company”) entered into a Warrant Exchange Agreement (the “Agreement”)

with entities affiliated with Empery Asset Management, LP (the “Empery Entities”), who are holders of the Company’s

outstanding warrants (the “Warrants”) to purchase an aggregate of 24,122 shares of the Company’s common stock, par

value $0.0001 per share (the “Common Stock”), which Warrants were originally issued pursuant to the offering described in

the Company’s Current Report on Form 8-K filed with the Securities and Exchange Commission on July 8, 2020. Pursuant to the Agreement,

the Company expects to issue an aggregate of 12,062 shares of Common Stock to the Empery Entities in exchange for the surrender

and cancellation of the Warrants held by the Empery Entities (which Warrants represent all outstanding Warrants of the Company) on

or about November 7, 2023. Upon issuance of such shares and cancellation of the Warrants, the Company will no longer have

any Warrants outstanding.

The

Company’s entry into the Agreement was the result of a separate private negotiation between the Company and the Empery Entities.

The

above summary of the Agreement does not purport to be complete and is qualified in its entirety to the full text of the form of Agreement,

which is filed as Exhibit 10.1 to this Current Report on Form 8-K and is qualified herein by this reference.

Item

3.02 Unregistered Sales of Equity Securities.

The

disclosures set forth above under Item 1.01 are incorporated herein by reference. The issuance by the Company of the shares of Common

Stock in exchange for the surrender and cancellation of the Warrants is being made in a transaction exempt from registration under the

Securities Act of 1933, as amended (the “Act”) in reliance on Section 3(a)(9) of the Act.

Item

9.01 Financial Statements and Exhibits.

(d)

Exhibits.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

Date:

November 6, 2023

| |

POLAR

POWER, INC. |

| |

|

|

| |

By: |

/s/

Arthur D. Sams |

| |

|

Arthur

D. Sams President, Chief Executive Officer

and

Secretary |

Exhibit

10.1

November

3, 2023

The

Holder of Common Stock Purchase Warrants of Polar Power, Inc.

Dear

Holder:

Polar

Power, Inc. (the “Company”) issued, among other securities, the Exchange Warrants (as defined below) pursuant to that

certain Securities Purchase Agreement, dated as of July 2, 2020, by and between the Company and the purchaser signatory thereto (the

“Purchase Agreement”). Capitalized terms not otherwise defined herein shall have the meanings set forth in the

Purchase Agreement.

We

understand that you (collectively with your Affiliates) are the holder (the “Holder”) of the number of Common Stock

purchase warrants of the Company listed on your signature pages attached hereto issued pursuant to the Purchase Agreement, each with

an expiration date of July 7, 2025 (the “Exchange Warrants”), which represent all Exchange Warrants of the Company

currently outstanding.

The

Company hereby offers you the opportunity to exchange (the “Exchange”) each of the Exchange Warrants held by you (the “Warrant

Exchange”), in exchange for 0.5 shares of Common Stock (“Exchange Shares”) for each Exchange Warrant being

exchanged (rounded up to the nearest whole share), in a transaction exempt from registration pursuant to Section

3(a)(9) of the Securities Act. Within two Trading Days of the Effective Date (as defined below), the Company shall instruct its

transfer agent to deliver the Exchange Shares to the DTC account of the Holder via the DWAC system in accordance with the DTC Instructions

provided by the Holder on the Signature page hereto. The terms of the Warrant Exchange, including but not limited to the obligations

to deliver the Exchange Shares, shall remain in effect as if the acceptance of this offer was a formal Notice of Exercise (including

but not limited to any liquidated damages and compensation in the event of the late delivery of the Exchange Shares). The Holder hereby

acknowledges that upon receipt of the Exchange Shares, such Holder’s Exchange Warrants exchanged for such Exchange Shares shall

be deemed to be cancelled without further action required by either the Company or the Holder. The Holder shall use its reasonable commercial

efforts to surrender its Exchange Warrants to the Company for cancellation, or to confirm in writing to the Company that the Exchange

Warrants have been destroyed, within five (5) Trading Days of the Effective Date. In connection with the Exchange, the Holder relinquishes

all rights, title and interest in the Exchange Warrants (including any claims the Holder may have against the Company related thereto)

and assigns the same to the Company.

By

executing this letter agreement (this “Agreement”), the Holder understands that certain obligations of the Company

to the Holder under the Purchase Agreement, including without limitation, pursuant to Section 4.12 thereof, will no longer apply.

This

Agreement shall be effective immediately upon the Company’s receipt of the fully-executed Agreement from the Holder (such date

being the “Effective Date”).

The

Exchange Shares are being issued in a cashless exchange for the Exchange Warrants and the parties acknowledge and agree that in accordance

with Section 3(a)(9) of the Securities Act, the holding period of the Exchange Shares under Rule 144 shall be tacked on to the holding

period of the Exchange Warrants and shall contain no restrictive legends. The Company agrees not to take any position contrary to this

covenant.

Expressly

subject to the paragraph immediately following this paragraph, Holder may accept this offer by signing this letter below, with such acceptance

constituting Holder’s exchange in full of the Exchange Warrant for Exchange Shares, effective on the Effective Date.

Additionally,

the Company agrees to the representations, warranties and covenants set forth on Annex A attached hereto and the Holder agrees

to the representations, warranties and covenants set forth on Annex B attached hereto.

On

or before 8:30 am (New York City time) on November 6, 2023, the Company shall file a Current Report on Form 8-K with the Securities and

Exchange Commission disclosing all material terms of the transactions contemplated hereunder, including a form of this Agreement as an

exhibit thereto (“8-K Filing”). Effective upon the filing of the 8-K Filing, the Company represents to the Holder

that the Holder shall not be in possession of any material, nonpublic information received from the Company, any of its Subsidiaries

and each of their respective officers, directors, employees or agents that is not disclosed in the 8-K Filing. Effective upon the filing

of the 8-K Filing, the Company acknowledges and agrees that any and all confidentiality or similar obligations under any agreement, whether

written or oral, between the Company, any of its Subsidiaries or any of their respective officers, directors, employees or agents, on

the one hand, and the Holder or any of its affiliates, on the other hand, shall terminate. The Company shall not, and shall cause each

of its Subsidiaries and its and each of their respective officers, directors, employees and agents not to, provide the Holder with any

material, non-public information regarding the Company or any of its Subsidiaries from and after the Effective Date without the express

prior written consent of the Holder. To the extent that the Company, any of its Subsidiaries or any of their respective officers, directors,

employees and agents delivers any material non-public information to the Holder without the Holder’s consent, the Company hereby

covenants and agrees that the Holder shall not have any duty of confidentiality with respect to, or a duty to not trade of the basis

of, such material, non-public information, provided that the Holder shall remain subject to applicable law.

Except

as expressly set forth herein, each party shall pay the fees and expenses of its advisers, counsel, accountants and other experts, if

any, and all other expenses incurred by such party incident to the negotiation, preparation, execution, delivery and performance of this

Agreement. The Company shall pay all transfer agent fees, stamp taxes and other taxes and duties levied in connection with the delivery

of any Exchange Shares. This Agreement shall be governed by the laws of the State of New York without regard to the principles of conflicts

of law thereof.

This

Agreement is intended for the benefit of the parties hereto, and is not for the benefit of, nor may any provision hereof be enforced

by, any other person.

Each

party shall do and perform, or cause to be done and performed, all such further acts and things, and shall execute and deliver all such

other agreements, certificates, instruments and documents, as any other party may reasonably request in order to carry out the intent

and accomplish the purposes of this Agreement and the consummation of the transactions contemplated hereby.

***************

To

accept this offer, Holder must counter execute this letter agreement and return the fully-executed letter to the Company at e-mail: LZavala@polarpowerinc.com,

attention: Luis Zavala, CFO.

Please

do not hesitate to call me if you have any questions.

| |

Sincerely

yours, |

| |

|

| |

POLAR

POWER, INC. |

| |

|

|

| |

By: |

|

| |

Name:

|

|

| |

Title: |

|

[Form

of POLA HOLDER SIGNATURE PAGES]

Accepted

and Agreed to:

Name

of Holder: ___________________________________

Signature

of Authorized Signatory of Holder: _________________________________

Name

of Authorized Signatory: __________________________________

Title

of Authorized Signatory: _____________________

Number

of Exchange Warrants Held: _____________________

Exchange

Shares (0.5 of Exchange Warrant Shares): _____________________

DTC

Instructions:

Annex

A

Representations,

Warranties and Covenants of the Company. The Company hereby makes the following representations and warranties to the Holder:

| |

(a) |

Authorization;

Enforcement. The Company has the requisite corporate power and authority to enter into and to consummate the transactions contemplated

by this Agreement and otherwise to carry out its obligations hereunder. The execution and delivery of this Agreement by the Company

and the consummation by the Company of the transactions contemplated hereby have been duly authorized by all necessary action on

the part of the Company and no further action is required by the Company, its board of directors or its stockholders in connection

therewith. This letter agreement has been duly executed by the Company and, when delivered in accordance with the terms hereof, will

constitute the valid and binding obligation of the Company enforceable against the Company in accordance with its terms, except (i)

as limited by general equitable principles and applicable bankruptcy, insolvency, reorganization, moratorium and other laws of general

application affecting enforcement of creditors’ rights generally, (ii) as limited by laws relating to the availability of specific

performance, injunctive relief or other equitable remedies and (iii) insofar as indemnification and contribution provisions may be

limited by applicable law. |

| |

|

|

| |

(b) |

No

Conflicts. The execution, delivery and performance of this Agreement by the Company and the consummation by the Company of the

transactions contemplated hereby do not and will not: (i) conflict with or violate any provision of the Company’s certificate

or articles of incorporation, bylaws or other organizational or charter documents; or (ii) conflict with, or constitute a default

(or an event that with notice or lapse of time or both would become a default) under, result in the creation of any Lien upon any

of the properties or assets of the Company in connection with, or give to others any rights of termination, amendment, acceleration

or cancellation (with or without notice, lapse of time or both) of, any material agreement, credit facility, debt or other material

instrument (evidencing Company debt or otherwise) or other material understanding to which such Company is a party or by which any

property or asset of the Company is bound or affected; or (iii) conflict with or result in a violation of any law, rule, regulation,

order, judgment, injunction, decree or other restriction of any court or governmental authority to which the Company is subject (including

federal and state securities laws and regulations), or by which any property or asset of the Company is bound or affected. |

| |

|

|

| |

(c) |

Nasdaq

Corporate Governance. The transactions contemplated under this Agreement, comply with all applicable rules of the Nasdaq Stock

Market. |

| |

|

|

| |

(d) |

Shell

Company. The Company has never been an issuer subject to Rule 144(i) under the Securities Act. |

| |

|

|

| |

(e) |

Neither

the Company nor anyone acting on the Company’s behalf has paid or given any person a commission or other remuneration directly

or indirectly in connection with or in order to solicit or facilitate the Exchange. |

Annex

B

Representations,

Warranties and Covenants of the Holder. The Holder hereby makes the following representations and warranties to the Company:

| |

(a) |

Ownership;

Authorization; Enforcement. The Holder is the record and beneficial owner of all the Exchange Warrants described on the signature

page hereof, free and clear of all Liens, and has no interest in any other Exchange Warrants. The Holder has not transferred and

will not transfer any of the Exchange Warrants to any third party, and no third party has any interest in the Exchange Warrants.

The Holder has the full power and authority to transfer and dispose of the Exchange Warrants free and clear of any Lien other than

restrictions under the Securities Act and applicable state securities laws. Other than the transactions contemplated by this Agreement,

there is no outstanding vote, plan, pending proposal, or other right of any person to acquire all or any portion of the Exchange

Warrants. The Holder has the requisite corporate power and authority to enter into and to consummate the transactions contemplated

by this Agreement and otherwise to carry out its obligations hereunder. The execution and delivery of this Agreement by the Holder

and the consummation by the Holder of the transactions contemplated hereby have been duly authorized by all necessary action on the

part of the Holder and no further action is required by the Holder, its board of directors or its stockholders in connection therewith.

This Agreement has been duly executed by the Holder and, when delivered in accordance with the terms hereof, will constitute the

valid and binding obligation of the Holder enforceable against the Holder in accordance with its terms, except (i) as limited by

general equitable principles and applicable bankruptcy, insolvency, reorganization, moratorium and other laws of general application

affecting enforcement of creditors’ rights generally, (ii) as limited by laws relating to the availability of specific performance,

injunctive relief or other equitable remedies and (iii) insofar as indemnification and contribution provisions may be limited by

applicable law. |

| |

|

|

| |

(b) |

No

Conflicts. The execution, delivery and performance of this Agreement by the Holder and the consummation by the Holder of the

transactions contemplated hereby do not and will not: (i) conflict with or violate any provision of the Holder’s certificate

or articles of incorporation, bylaws or other organizational or charter documents; or (ii) conflict with, or constitute a default

(or an event that with notice or lapse of time or both would become a default) under, result in the creation of any Lien upon any

of the properties or assets of the Holder in connection with, or give to others any rights of termination, amendment, acceleration

or cancellation (with or without notice, lapse of time or both) of, any material agreement, credit facility, debt or other material

instrument (evidencing Holder debt or otherwise) or other material understanding to which such Holder is a party or by which any

property or asset of the Holder is bound or affected; or (iii) conflict with or result in a violation of any law, rule, regulation,

order, judgment, injunction, decree or other restriction of any court or governmental authority to which the Holder is subject (including

federal and state securities laws and regulations), or by which any property or asset of the Holder is bound or affected. |

| |

|

|

| |

(c) |

Holder

Status. Holder is an “accredited investor” as defined in Rule 501(a)(1), (a)(2), (a)(3), (a)(7), (a)(8), (a)(9),

(a)(12) or (a)(13) under the Securities Act. |

| |

|

|

| |

(d) |

Experience

of Holder. Holder is acquiring the Exchange Shares in the ordinary course of its business. Holder, either alone or together with

its representatives, has such knowledge, sophistication and experience in business and financial matters so as to be capable of evaluating

the merits and risks of the prospective investment in the Exchange Shares, and has so evaluated the merits and risks of such investment.

Holder is able to bear the economic risk of an investment in the Exchange Shares and, at the present time, is able to afford a complete

loss of such investment. |

| |

(e) |

No

General Solicitation. Holder is not purchasing the Exchange Shares as a result of any advertisement, article, notice or other

communication regarding the Exchange Shares published in any newspaper, magazine or similar media or broadcast over television or

radio or presented at any seminar or, to the knowledge of Holder, any other general solicitation or general advertisement. |

| |

|

|

| |

(f) |

Holder

acknowledges and understands that (i) the Company may possess material nonpublic information regarding the Company not known

to the Holder that may impact the value of the Exchange Warrants and Exchange Shares, including, without limitation, (x) information

received by principals and employees of the Company in their capacities as directors, officers, significant stockholders and/or affiliates

of the Company, (y) information received on a confidential basis from holders of the securities of the Company or others, and (z)

information received on a privileged basis from the attorneys and financial advisers representing the Company and its Board of Directors

(collectively, the “Information”), and that the Company is not disclosing the Information to the Holder. Holder has chosen,

for its own business reasons, not to request, require or expect that the Company provide any such information, whether or not confidential

to the Holder, except as specifically set forth herein. Holder understands and appreciates, based on its experience, the significance

of information asymmetry and of entering into the transactions contemplated under this Agreement, where the Company may have more

information about the benefits, risks and underlying value of the Exchange Warrants and Exchange Shares. Notwithstanding such disparity,

Holder has deemed it appropriate to enter into this Agreement and to consummate the transactions contemplated under this Agreement. |

| |

|

|

| |

(g)

|

The

Holder understands that the Exchange Shares are being offered and sold in reliance on specific provisions of federal and state securities

laws, specifically Section 3(a)(9) of the Securities Act, and that the Company is relying upon the truth and accuracy of the representations,

warranties, agreements, acknowledgments and understandings of the Holder set forth herein for purposes of qualifying for exemptions

from registration under the Securities Act and applicable state securities laws. |

| |

|

|

| |

(h)

|

Holder

is not (i) an “affiliate” of the Company (as defined in Rule 144 under the Securities Act (“Rule 144”)) or

(ii) the “beneficial owner” (as that term is defined under the Exchange Act) of more than 10% of the Company’s

outstanding Common Stock assuming that the Company’s outstanding shares of common stock are as set forth on the cover page

of its most recent Quarterly Report on Form 10-Q. |

| |

|

|

| |

(i)

|

Neither

the Holder nor anyone acting on the Holder’s behalf has paid or given any person a commission or other remuneration directly

or indirectly in connection with or in order to solicit or facilitate the Exchange. |

| |

|

|

| |

(j) |

Holder

has been given full and adequate access to information relating to the Company, including its business, finances and operations as

Holder has deemed necessary or advisable in connection with Holder’s evaluation of the Exchange. Holder has not relied upon

any representations or statements made by the Company or its agents, officers, directors, employees or stockholders in regard to

this Agreement or the basis thereof. Holder has had the opportunity to review the Company’s filings with the Securities and

Exchange Commission. Holder and its advisors, if any, have been afforded the opportunity to ask questions of the Company. Holder

has sought such accounting, legal and tax advice as it has considered necessary to make an informed investment decision with respect

to its acquisition of the Exchange Shares. Holder is relying solely on its own accounting, legal and tax advisors, and not on any

statements of the Company or any of its agents or representatives, for such accounting, legal and tax advice with respect to its

acquisition of the Exchange Shares and the transactions contemplated by this Agreement. |

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

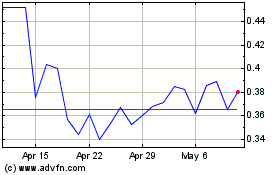

Polar Power (NASDAQ:POLA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Polar Power (NASDAQ:POLA)

Historical Stock Chart

From Apr 2023 to Apr 2024