Filed

Pursuant to Rule 424(b)(3)

File

No. 333-269453

PROSPECTUS

SUPPLEMENT NO. 1 TO

PROSPECTUS,

DATED FEBRUARY 8, 2023

533,334

Shares

Common

Stock

This

prospectus supplement amends and supplements the prospectus, dated February 8, 2023 (the “Prospectus”), which forms a part

of our Registration Statement on Form S-1 (No. 333-269453). This prospectus supplement is being filed to update and supplement the information

in the Prospectus with the information set forth below under the headings “Reverse Stock Split” and “Amendment to January

2023 Warrant.” This prospectus supplement updates and supplements the information in the Prospectus and is not complete without,

and may not be delivered or utilized except in combination with, the Prospectus, including any amendments or supplements thereto. This

prospectus supplement should be read in conjunction with the Prospectus and if there is any inconsistency between the information in

the Prospectus and this prospectus supplement, you should rely on the information in this prospectus supplement.

On

October 27, 2023, we effected a one-for-twenty-five (1-for-25) reverse split of our common stock (the “Reverse Split”). Unless

otherwise indicated herein, all share and per share information in this prospectus supplement has been amended retroactively to give

effect to the Reverse Split.

The

Prospectus and this prospectus supplement relate to the offer for sale of up to an aggregate of 533,333 (13,333,334 pre-Reverse Split)

shares of common stock, par value $0.0001 per share, of Vivos Therapeutics, Inc., by the stockholder of our company named in the Prospectus

(who we refer to as the selling stockholder), which is comprised of: (i) 80,000 shares (2,000,000 shares pre-Reverse Split) of common

stock (the “Shares”), (ii) 186,667 shares (4,666,667 shares pre-Reverse Split) of common stock (the “PFW Shares”)

underlying a pre-funded warrant (the “Pre-Funded Warrant”) held by the selling stockholder and (iii) 266,667 shares (6,666,667

shares pre-Reverse Split) of common stock underlying a warrant held by the selling stockholder (the “January 2023 Warrant”),

all of which securities were issued to the selling stockholder in a private placement which closed on January 9, 2023.

Our

registration of the securities covered by the Prospectus and this prospectus supplement does not mean that either we or the selling stockholder

will issue, offer or sell, as applicable, any of the securities hereby registered; provided, however, that based on information available

to us, the selling stockholder has, prior to the date of this prospectus supplement (i) sold all of the Shares pursuant to the Prospectus

and (ii) exercised the entirety of the Pre-Funded Warrant and sold all of the PFW Shares. The selling stockholder may offer, sell, or

distribute all or a portion of the securities hereby registered publicly or through private transactions at prevailing market prices

or at negotiated prices as further described in the Prospectus. We have not received and will not receive any of the proceeds

from such sales of our common stock by the selling stockholder pursuant to the Prospectus and this prospectus supplement, except with

respect to amounts received by us upon exercise of the January 2023 Warrant, if and to the extent the January 2023 Warrant is exercised

for cash. We will bear all costs, expenses and fees in connection with the registration of these securities. The selling stockholder

will bear all commissions and discounts, if any, attributable to their sale of shares of our common stock.

Our

common stock is listed on the Nasdaq Stock Market LLC under the symbol “VVOS.” On November 2, 2023, the last reported sale

price of the shares of our common stock as reported on Nasdaq was $3.62 per share.

We

are an “emerging growth company” as defined in Section 2(a) of the Securities Act of 1933, as amended, and, as such, have

elected to comply with certain reduced disclosure and regulatory requirements.

Investing

in our common stock is highly speculative and involves a significant degree of risk. See “Risk Factors” beginning on

page 13 of the Prospectus for a discussion of information that should be considered before making a decision to purchase our common stock.

You should read the Prospectus, this prospectus supplement and any additional prospectus supplement or amendment carefully before you

invest in our securities.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined

if the Prospectus or this prospectus supplement is truthful or complete. Any representation to the contrary is a criminal offense.

The

date of this prospectus supplement is November 3, 2023.

REVERSE

STOCK SPLIT

On

October 25, 2023, we filed a Certificate of Amendment to our Certificate of Incorporation with the Secretary of State of Delaware to

effectuate the Reverse Split. The Reverse Split became effective at 4:01 p.m., Eastern Standard Time, on October 25, 2023. Our common

stock began trading on a post-Reverse Split basis on the Nasdaq Capital Market on October 27, 2023. The new CUSIP number for our common

stock following the Reverse Split is 92859E207. The Reverse Split was approved by our board of directors under authority granted by our

stockholders at our 2023 Annual Meeting of Stockholders which was held on September 22, 2023.

As

a result of the Reserve Split, every twenty-five (25) shares of our issued and outstanding common stock were combined into one share

of common stock. As a result, our issued and outstanding common stock was proportionally reduced from approximately 29,928,786 shares

to approximately 1,197,151 shares. The ownership percentage of each of our stockholders remained unchanged, other than as a result of

fractional shares. No fractional shares of common stock will be issued in connection with the Reverse Split, and stockholders that would

hold a fractional share of common stock as a result of the Reverse Split will have such fractional shares of common stock rounded up

to the nearest whole share of common stock.

The

number of shares of common stock available for issuance under our equity incentive plans and the common stock issuable pursuant to outstanding

equity awards and common stock purchase warrants immediately prior to the Reverse Split were proportionately adjusted by the ratio of

the Reverse Split. The exercise prices of such outstanding options and warrants were also adjusted in accordance with their respective

terms. The number of authorized shares of common stock were not affected by the Reverse Split.

Among

other considerations, we effected the Reverse Split to satisfy the $1.00 minimum bid price requirement for continued listing on the Nasdaq

Capital Market under Rule 5550(a)(2) of the Nasdaq Listing Rules.

AMENDMENT

TO JANUARY 2023 WARRANT

On

October 31, 2023, we announced that we entered into a securities purchase agreement with an institutional investor for the purchase and

sale of 980,393 shares of our common stock (or pre-funded warrants in lieu thereof) at a purchase price of $4.08 per share in a private

placement priced at-the-market for purposes of Nasdaq rules. In addition, we agreed to issue to the investor a five-year Series A Warrant

to purchase up to an aggregate of 980,393 shares of common stock and an eighteen (18) month Series B Warrant to purchase up to an aggregate

of 980,393 shares of common stock. The Series A and Series B Warrants will have an exercise price of $3.83 per share and will be exercisable

immediately following the date of issuance. This private placement closed on November 2, 2023, resulting in gross proceeds of $4 million

to our company and approximately $3.5 million in net proceeds (after deducting offering expenses).

As

part of the private placement, we agreed to amend the January 2023 Warrant. Originally, the January 2023 Warrant provided the selling

stockholder the right to purchase up to an aggregate of 266,667 shares of common stock at an exercise price of $30.00 per share, and

with an expiration date of July 5, 2028. Pursuant to the amendment, which became effective as of the closing of the private placement

on November 2, 2023, the exercise price of the January 2023 was reduced to $3.83 per share and the expiration date was extended November

2, 2028. The other terms of the January 2023 Warrant remain unchanged, except that the definition of ‘Black Scholes Value”

in the January 2023 Warrant was modified to match the definition of such term appearing in the Series A and Series B Warrants issued

in the private placement, with the intention of eliminating an embedded derivative liability associated with the January 2023 Warrant.

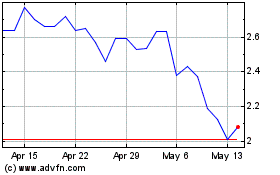

Vivos Therapeutics (NASDAQ:VVOS)

Historical Stock Chart

From Mar 2024 to Apr 2024

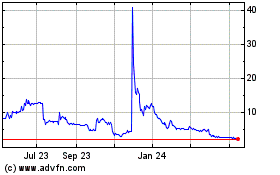

Vivos Therapeutics (NASDAQ:VVOS)

Historical Stock Chart

From Apr 2023 to Apr 2024