0000899751False00008997512023-11-012023-11-01

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): November 1, 2023

TITAN INTERNATIONAL, INC.

(Exact name of Registrant as specified in its Charter)

| | | | | | | | |

| Delaware | 1-12936 | 36-3228472 |

| (State of Incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) |

1525 Kautz Road, Suite 600, West Chicago, IL 60185

(Address of principal executive offices) (Zip Code)

(630) 377-0486

(Registrant's telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligations of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act ☐

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading

Symbol | Name of each exchange on which registered |

| Common stock, $0.0001 par value | TWI | New York Stock Exchange |

Item 2.02 RESULTS OF OPERATIONS AND FINANCIAL CONDITION

On November 1, 2023, Titan International, Inc. issued a press release reporting its third quarter 2023 financial results. A copy of the press release is furnished herewith as Exhibit 99.

Item 9.01 FINANCIAL STATEMENTS AND EXHIBITS

(d)Exhibits

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | |

| TITAN INTERNATIONAL, INC. |

| (Registrant) |

| | | | | | | | | | | |

| Date: | November 1, 2023 | By: | /s/ DAVID A. MARTIN |

| | | David A. Martin |

| | | SVP and Chief Financial Officer |

| | | (Principal Financial Officer) |

FOR IMMEDIATE RELEASE

Wednesday, November 1, 2023

Titan International, Inc. Reports Third Quarter Financial Performance

Delivers solid profitability with EPS of $0.31, adjusted EPS of $0.29 and adjusted EBITDA of $41 million

Continued to drive strong operating cash flow and free cash flow of $51 million and $37 million, respectively

Company maintains full year 2023 outlook

WEST CHICAGO, ILLINOIS, November 1, 2023 - Titan International, Inc. (NYSE: TWI) (“Titan” or the “Company”), a leading global manufacturer of off-highway wheels, tires, assemblies, and undercarriage products, today reported results for the third quarter ended September 30, 2023.

Paul Reitz, President and Chief Executive Officer, stated, “Our One Titan team delivered another strong quarter by serving our customers well with market-leading products. One of the factors that sets Titan apart as a leader and partner of choice for off-the-road tires, wheels and undercarriage solutions is our emphasis on innovation. Farmers are increasingly relying on financial analysis as a key element of their decision making and with that in mind, innovative technologies such as our Low Sidewall, or LSW, offer them significant ROI. We first introduced our LSWs directly to end-users to prove to farmers that making the change they will find more than enough savings through improved fuel efficiency (up to 6%) and yield gains (up to 5%) to pay for the investment in these wheel/tire assemblies. Along with making more money, the improved comfort and performance of their equipment in difficult conditions results in a tremendous upgrade from standard wheel/tire set-ups. Our LSWs have definitively proven to our dealer partners, OEMs, and of course, everyone at Titan, that our LSW wheel/tire assemblies are a win-win for everyone.”

Mr. Reitz continued, “Innovation is at the core of Titan and we are proud of the positive impact our products have on the end-users of Ag equipment. We will be soon taking that story to the airwaves via the documentary Viewpoint, featuring Dennis Quaid, that will highlight our innovation from the perspective of people that really understand the Ag market such as Tom and Jeff Sloan from Sloan Implement and the Stallings Family from Delta New Holland.”

Mr. Reitz concluded, “We are positioned well to finish the year with good momentum and financial results that will rank as one of the best years in Titan’s history. The operating and strategic plans we have put into action over recent years are accomplishing exactly what they were designed to do: mute the cyclicality of certain aspects of our business and drive performance when market conditions are volatile. It’s well known that OEMs in the Ag sector significantly overstocked on wheels and tires, and I am especially satisfied in our ability to work through the industry destocking, which we expect will be substantially complete by year-end based on where customer order books currently stand, to drive solid financial performance. We are confident in our ability to finish 2023 with momentum to set the stage for continuing healthy financial results into the future. The mid and long-term demand picture for our products remains healthy in our end markets. Coupled with a balance sheet that allows us the flexibility to invest in our business, both organically and through tactical M&A, should the right opportunity arise, we are highly confident in Titan’s long-term prospects.”

Full Year 2023 Outlook

The Company is maintaining its previously communicated outlook for FY 2023:

•Revenues are expected to range between $1.85 to $1.9 billion

•Adjusted EBITDA of $200 to $210 million

•Free cash flow to range between $110 to $120 million

•Capital expenditures to range between $55 to $60 million

David Martin, Chief Financial Officer, added, “As we head into year-end, our third quarter results have us on track for one of the best years in the history of the Company. In particular, our margins continue to be a bright spot, helping drive solid profitability and sustainable free cash flow generation.”

Mr. Martin concluded, “That strong free cash flow has allowed us to continue fortifying our balance sheet while also returning capital to shareholders via our share repurchase program. During the third quarter, we generated $37 million of free cash flow, which allowed us to pay down $4 million of debt. We also used cash to repurchase just over one million additional shares during the quarter, at an average cost of $12.31. As of quarter-end, we had spent a total of $19 million under the Board authorized $50 million share repurchase program, and at the same time, increased our cash position to $212 million.”

Results of Operations

Net sales for the third quarter ended September 30, 2023, were $401.8 million, compared to $530.7 million in the comparable quarter of 2022. Net sales change was primarily due to sales volume decrease caused by elevated inventory levels at our customers in the Americas, particularly OEM customers, lower levels of end customer demand in small agricultural equipment, and economic softness in Brazil. The net sales change was also impacted by negative price/mix from lower raw material costs and unfavorable currency translation of 1.1%.

Gross profit for the third quarter ended September 30, 2023, was $66.1 million, or 16.4% of net sales, compared to $87.6 million, or 16.5% of net sales, for the three months ended September 30, 2022. The decrease in gross profit was primarily due to the lower sales volume, while gross margin remained relatively flat period to period.

Selling, general and administrative expenses for the three months ended September 30, 2023 were $33.6 million, compared to $31.4 million for the three months ended September 30, 2022. The change in SG&A for the three months ended September 30, 2023 as compared to the prior year period was due to personnel related inflationary cost impacts.

Income from operations for the three months ended September 30, 2023 was $27.0 million, compared to income from operations of $50.5 million for the three months ended September 30, 2022. The decrease in income from operations was primarily due to lower net sales and the net result of the items previously discussed.

Segment Information

Agricultural Segment

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (Amounts in thousands, except percentages) | Three months ended | | Nine months ended |

| September 30, | | September 30, |

| | 2023 | | 2022 | | % Increase / (Decrease) | | 2023 | | 2022 | | % Increase / (Decrease) |

| Net sales | $ | 212,967 | | | $ | 289,259 | | | (26.4) | % | | $ | 787,973 | | | $ | 917,443 | | | (14.1) | % |

| Gross profit | 37,026 | | | 45,949 | | | (19.4) | % | | 135,012 | | | 155,794 | | | (13.3) | % |

| Profit margin | 17.4 | % | | 15.9 | % | | 9.4 | % | | 17.1 | % | | 17.0 | % | | 0.6 | % |

| Income from operations | 21,383 | | | 31,125 | | | (31.3) | % | | 86,071 | | | 106,126 | | | (18.9) | % |

Net sales in the agricultural segment were $213.0 million for the three months ended September 30, 2023, as compared to $289.3 million for the comparable period in 2022. The net sales change was primarily due to actions taken by customers in North and South America to reduce elevated inventory levels, most notably OEM customers, overall softness in demand for small agricultural equipment, and decline in Brazilian economic activity. In addition, the change in net sales was due to negative price/product mix partly impacted by contractual price reductions to customers that are reflective of raw material and other input cost reductions, and an unfavorable impact of foreign currency translation of 3.6%.

Gross profit in the agricultural segment was $37.0 million for the three months ended September 30, 2023, as compared to $45.9 million in the comparable period in 2022. The change in gross profit was due to lower sales volume, which also resulted in lower fixed cost leverage. The increase in profit margin was due to actions taken to improve financial performance, including cost reductions and productivity initiatives executed across global operations in addition to lower production input costs.

Earthmoving/Construction Segment

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (Amounts in thousands, except percentages) | Three months ended | | Nine months ended |

| September 30, | | September 30, |

| | 2023 | | 2022 | | % Decrease | | 2023 | | 2022 | | % Decrease |

| Net sales | $ | 155,045 | | | $ | 199,921 | | | (22.4) | % | | $ | 528,652 | | | $ | 611,550 | | | (13.6) | % |

| Gross profit | 22,257 | | | 34,959 | | | (36.3) | % | | 88,583 | | | 102,651 | | | (13.7) | % |

| Profit margin | 14.4 | % | | 17.5 | % | | (17.7) | % | | 16.8 | % | | 16.8 | % | | — | % |

| Income from operations | 8,501 | | | 21,836 | | | (61.1) | % | | 46,561 | | | 59,952 | | | (22.3) | % |

Net sales in earthmoving/construction segment were $155.0 million for the three months ended September 30, 2023, as compared to $199.9 million in the comparable period in 2022. The change in earthmoving/construction sales was primarily due to decreased volume in the Americas and the undercarriage business which were caused by elevated customer inventory levels and a slowdown with certain global construction OEM customers. In addition, the net sales change was impacted by negative price/product mix from decreased raw material and other input costs. Net sales were favorably impacted by foreign currency translation of 2.5%.

Gross profit in the earthmoving/construction segment was $22.3 million for the three months ended September 30, 2023, as compared to $35.0 million for the three months ended September 30, 2022. The changes in gross profit and margin were primarily due to the lower sales volume, which also resulted in lower fixed cost leverage primarily in the Americas.

Consumer Segment

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (Amounts in thousands, except percentages) | Three months ended | | Nine months ended |

| September 30, | | September 30, |

| | 2023 | | 2022 | | % Increase / (Decrease) | | 2023 | | 2022 | | % Increase / (Decrease) |

| Net sales | $ | 33,769 | | | $ | 41,542 | | | (18.7) | % | | $ | 114,976 | | | $ | 130,621 | | | (12.0) | % |

| Gross profit | 6,790 | | | 6,725 | | | 1.0 | % | | 23,930 | | | 25,570 | | | (6.4) | % |

| Profit margin | 20.1 | % | | 16.2 | % | | 24.1 | % | | 20.8 | % | | 19.6 | % | | 6.1 | % |

| Income from operations | 4,526 | | | 4,856 | | | (6.8) | % | | 17,183 | | | 18,976 | | | (9.4) | % |

Consumer segment net sales were $33.8 million for the three months ended September 30, 2023, as compared to $41.5 million for the three months ended September 30, 2022. The change was due to negative price/product mix, and lower sales volumes, mainly in Latin America for light utility truck tires, which experienced a decline in demand due to elevated customer inventories and a general economic slowdown in the region. In addition, net sales were unfavorably impacted by foreign currency translation of 0.8%.

Gross profit from the consumer segment was $6.8 million for the three months ended September 30, 2023, as compared to $6.7 million for the three months ended September 30, 2022. The increases in gross profit and margin were primarily due to lower raw material and other input costs, mainly in the North American wheel and the undercarriage operations.

Non-GAAP Financial Measures

Adjusted EBITDA was $40.5 million for the third quarter of 2023, compared to $61.2 million in the comparable prior year period. The Company utilizes EBITDA and adjusted EBITDA, which are non-GAAP financial measures, as a means to measure its operating performance. A reconciliation of net income to EBITDA and adjusted EBITDA can be found at the end of this release.

Adjusted net income applicable to common shareholders for the third quarter of 2023 was income of $18.4 million, equal to income of $0.29 per basic and diluted share, compared to adjusted net income of $34.1 million, equal to income of $0.54 per basic and diluted share, in the third quarter of 2022. The Company utilizes adjusted net income applicable to common shareholders, which is a non-GAAP financial measure, as a means to measure its operating performance. A reconciliation of net income applicable to common shareholders and adjusted net income applicable to common shareholders can be found at the end of this release.

Financial Condition

The Company ended the third quarter of 2023 with total cash and cash equivalents of $211.9 million, compared to $159.6 million at December 31, 2022. Long-term debt at September 30, 2023, was $409.7 million, compared to $414.8 million at December 31, 2022. Short-term debt was $17.6 million at September 30, 2023, compared to $30.9 million at December 31, 2022. Net debt (total debt less cash and cash equivalents) was $215.4 million at September 30, 2023, compared to $286.0 million at December 31, 2022.

Net cash provided by operating activities for the first nine months of 2023 was $140.1 million, compared to net cash provided by operating activities of $102.2 million for the comparable prior year period. Capital expenditures were $41.5 million for the first nine months of 2023, compared to $32.8 million for the comparable prior year period. Capital expenditures during the first nine months of 2023 and 2022 represent equipment replacement and improvements, along with new tools, dies and molds related to new product development, as the Company seeks to enhance the Company’s manufacturing capabilities and drive productivity gains.

Teleconference and Webcast

Titan will be hosting a teleconference and webcast to discuss the third quarter financial results on Thursday, November 2, 2023, at 9:00 a.m. Eastern Time.

The real-time, listen-only webcast can be accessed using the following link https://events.q4inc.com/attendee/675080000 or on our website at www.titan-intl.com within the “Investor Relations” page under the “News & Events” menu (https://ir.titan-intl.com/news-and-events/events/default.aspx). Listeners should access the website at least 10 minutes prior to the live event to download and install any necessary audio software.

A webcast replay of the teleconference will be available on our website (https://ir.titan-intl.com/news-and-events/events/default.aspx) soon after the live event.

In order to participate in the real-time teleconference, with live audio Q&A, participants should use one of the following dial in numbers:

United States Toll Free: 1 833 470 1428

All other locations: https://www.netroadshow.com/conferencing/global-numbers?confId=56511

Participants Access Code: 834199

About Titan

Titan International, Inc. (NYSE: TWI) is a leading global manufacturer of off-highway wheels, tires, assemblies, and undercarriage products. Headquartered in West Chicago, Illinois, the Company globally produces a broad range of products to meet the specifications of original equipment manufacturers (OEMs) and aftermarket customers in the agricultural, earthmoving/construction, and consumer markets. For more information, visit www.titan-intl.com.

Safe Harbor Statement

This press release contains forward-looking statements. These forward-looking statements are covered by the safe harbor for "forward-looking statements" provided by the Private Securities Litigation Reform Act of 1995. The words “believe,” “expect,” “anticipate,” “plan,” “would,” “could,” “potential,” “may,” “will,” and other similar expressions are intended to identify forward-looking statements, which are generally not historical in nature. These forward-looking statements are based on our current expectations and beliefs concerning future developments and their potential effect on us. Although we believe the assumptions upon which these forward-looking statements are based are reasonable, these assumptions are subject to significant risks and uncertainties, and are subject to change based on various factors, some of which are beyond Titan International, Inc.'s control. As a result, any of these assumptions could prove to be inaccurate and the forward-looking statements based on these assumptions could be incorrect. The matters discussed in these forward-looking statements are subject to risks, uncertainties, and other factors that could cause actual results and trends to differ materially from those made, projected, or implied in or by the forward-looking statements depending on a variety of uncertainties or other factors including, but not limited to, the effect of the COVID-19 pandemic on our operations and financial performance; the effect of a recession on the Company and its customers and suppliers; changes in the Company’s end-user markets into which the Company sells its products as a result of domestic and world economic or regulatory influences or otherwise; changes in the marketplace, including new products and pricing changes by the Company’s competitors; the Company's ability to maintain satisfactory labor relations; unfavorable outcomes of legal proceedings; the Company's ability to comply with current or future regulations applicable to the Company's business and the industry in which it competes or any actions taken or orders issued by regulatory authorities; availability and price of raw materials; levels of operating efficiencies; the effects of the Company's indebtedness and its compliance with the terms thereof; changes in the interest rate environment and their effects on the Company's outstanding indebtedness; unfavorable product liability and warranty claims; actions of domestic and foreign governments, including the imposition of additional tariffs; geopolitical and economic uncertainties relating to the countries in which the Company operates or does business; risks associated with acquisitions, including difficulty in integrating operations and personnel, disruption of ongoing business, and increased expenses; results of investments; the effects of potential processes to explore various strategic transactions, including potential dispositions; fluctuations in currency translations; risks associated with environmental laws and regulations; risks relating to our manufacturing facilities, including that any of our material facilities may become inoperable; risks relating to financial reporting, internal controls, tax accounting, and information systems; and the other risks and factors detailed in the Company’s periodic reports filed with the Securities and Exchange Commission, including the disclosures under "Risk Factors" in those reports. These forward-looking statements are made only as of the date hereof. The Company cautions that any forward-looking statements included in this press release are subject to a number of risks and uncertainties, and the Company undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, changed circumstances or future events, or for any other reason, except as required by law.

Titan International, Inc.

Condensed Consolidated Statements of Operations (Unaudited)

Amounts in thousands, except per share data

| | | | | | | | | | | | | | | | | | | | | | | |

| | Three months ended | | Nine months ended |

| September 30, | | September 30, |

| | 2023 | | 2022 | | 2023 | | 2022 |

| | | | | | | |

| | | | | | | |

| Net sales | $ | 401,781 | | | $ | 530,722 | | | $ | 1,431,601 | | | $ | 1,659,614 | |

| Cost of sales | 335,708 | | | 443,089 | | | 1,184,076 | | | 1,375,599 | |

| | | | | | | |

| Gross profit | 66,073 | | | 87,633 | | | 247,525 | | | 284,015 | |

| Selling, general and administrative expenses | 33,587 | | | 31,410 | | | 102,917 | | | 102,306 | |

| Research and development expenses | 3,167 | | | 2,434 | | | 9,399 | | | 7,592 | |

| Royalty expense | 2,344 | | | 3,298 | | | 7,200 | | | 9,217 | |

| | | | | | | |

| Income from operations | 26,975 | | | 50,491 | | | 128,009 | | | 164,900 | |

| Interest expense, net | (3,931) | | | (7,221) | | | (16,185) | | | (22,835) | |

| Foreign exchange gain (loss) | 876 | | | 1,198 | | | (882) | | | 8,749 | |

| Other income | 461 | | | 9,691 | | | 2,409 | | | 24,526 | |

| Income before income taxes | 24,381 | | | 54,159 | | | 113,351 | | | 175,340 | |

| Provision for income taxes | 4,718 | | | 11,446 | | | 28,363 | | | 39,128 | |

| Net income | 19,663 | | | 42,713 | | | 84,988 | | | 136,212 | |

| Net income (loss) attributable to noncontrolling interests | 383 | | | (456) | | | 3,663 | | | 1,950 | |

| Net income attributable to Titan and applicable to common shareholders | $ | 19,280 | | | $ | 43,169 | | | $ | 81,325 | | | $ | 134,262 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Earnings per common share: | | | | | | | |

| Basic | $ | 0.31 | | | $ | 0.69 | | | $ | 1.29 | | | $ | 2.13 | |

| Diluted | $ | 0.31 | | | $ | 0.68 | | | $ | 1.29 | | | $ | 2.11 | |

| Average common shares and equivalents outstanding: | | | | | | | |

| Basic | 62,598 | | | 62,803 | | | 62,810 | | | 63,107 | |

| Diluted | 63,095 | | | 63,229 | | | 63,271 | | | 63,587 | |

Titan International, Inc.

Condensed Consolidated Balance Sheets

Amounts in thousands, except share data

| | | | | | | | | | | |

| | September 30, 2023 | | December 31, 2022 |

| |

| (unaudited) | | |

| Assets | | | |

| Current assets | | | |

| Cash and cash equivalents | $ | 211,902 | | | $ | 159,577 | |

| | | |

| Accounts receivable, net | 238,595 | | | 266,758 | |

| Inventories | 360,142 | | | 397,223 | |

| | | |

| Prepaid and other current assets | 70,682 | | | 86,070 | |

| Total current assets | 881,321 | | | 909,628 | |

| Property, plant and equipment, net | 302,481 | | | 296,605 | |

| Operating lease assets | 10,635 | | | 8,932 | |

| Deferred income taxes | 32,361 | | | 38,736 | |

| Other long-term assets | 30,937 | | | 30,729 | |

| Total assets | $ | 1,257,735 | | | $ | 1,284,630 | |

| | | |

| Liabilities | | | |

| Current liabilities | | | |

| Short-term debt | $ | 17,556 | | | $ | 30,857 | |

| Accounts payable | 194,501 | | | 263,376 | |

| | | |

| Other current liabilities | 162,761 | | | 151,928 | |

| Total current liabilities | 374,818 | | | 446,161 | |

| Long-term debt | 409,747 | | | 414,761 | |

| Deferred income taxes | 2,834 | | | 3,425 | |

| Other long-term liabilities | 37,147 | | | 37,145 | |

| Total liabilities | 824,546 | | | 901,492 | |

| | | |

| Equity | | | |

| Titan shareholders' equity | | | |

| Common stock ($0.0001 par value, 120,000,000 shares authorized, 66,525,269 issued at September 30, 2023 and 66,525,269 at December 31, 2022) | — | | | — | |

| Additional paid-in capital | 567,402 | | | 565,546 | |

| Retained earnings | 172,188 | | | 90,863 | |

| Treasury stock (at cost, 4,825,031 shares at September 30, 2023 and 3,681,308 shares at December 31, 2022) | (39,389) | | | (23,418) | |

| | | |

| Accumulated other comprehensive loss | (266,983) | | | (251,755) | |

| Total Titan shareholders’ equity | 433,218 | | | 381,236 | |

| Noncontrolling interests | (29) | | | 1,902 | |

| Total equity | 433,189 | | | 383,138 | |

| Total liabilities and equity | $ | 1,257,735 | | | $ | 1,284,630 | |

Titan International, Inc.

Condensed Consolidated Statements of Cash Flows (Unaudited)

All amounts in thousands

| | | | | | | | | | | |

| Nine months ended September 30, |

| Cash flows from operating activities: | 2023 | | 2022 |

| Net income | $ | 84,988 | | | $ | 136,212 | |

| Adjustments to reconcile net income to net cash provided by operating activities: | | | |

| Depreciation and amortization | 31,598 | | | 32,283 | |

| Loss on sale of the Australian wheel business | — | | | 10,890 | |

| Deferred income tax provision (benefit) | 5,868 | | | (1,631) | |

| Income on Brazilian indirect tax credits | (3,096) | | | (32,043) | |

| Gain on fixed asset and investment sale | (409) | | | (256) | |

| Stock-based compensation | 3,700 | | | 3,113 | |

| Issuance of stock under 401(k) plan | 1,329 | | | 1,186 | |

| Foreign currency gain | (2,348) | | | (4,176) | |

| (Increase) decrease in assets: | | | |

| Accounts receivable | 17,503 | | | (43,499) | |

| Inventories | 32,197 | | | (44,180) | |

| Prepaid and other current assets | 18,386 | | | 6,361 | |

| Other assets | (410) | | | (4,352) | |

| Increase (decrease) in liabilities: | | | |

| Accounts payable | (62,751) | | | (9,516) | |

| Other current liabilities | 12,241 | | | 49,885 | |

| Other liabilities | 1,310 | | | 1,963 | |

| Net cash provided by operating activities | 140,106 | | | 102,240 | |

| Cash flows from investing activities: | | | |

| Capital expenditures | (41,480) | | | (32,755) | |

| | | |

| | | |

| Proceeds from the sale of the Australian wheel business | — | | | 9,293 | |

| Proceeds from sale of fixed assets | 1,795 | | | 680 | |

| Net cash used for investing activities | (39,685) | | | (22,782) | |

| Cash flows from financing activities: | | | |

| Proceeds from borrowings | 6,628 | | | 88,907 | |

| Repayments of debt | (25,017) | | | (120,728) | |

| Repurchase of common stock | (19,064) | | | (25,000) | |

| | | |

| Other financing activities | (2,540) | | | (720) | |

| Net cash used for financing activities | (39,993) | | | (57,541) | |

| Effect of exchange rate changes on cash | (8,103) | | | (3,444) | |

| Net increase in cash and cash equivalents | 52,325 | | | 18,473 | |

| Cash and cash equivalents, beginning of period | 159,577 | | | 98,108 | |

| Cash and cash equivalents, end of period | $ | 211,902 | | | $ | 116,581 | |

| | | |

| Supplemental information: | | | |

| Interest paid | $ | 15,971 | | | $ | 16,813 | |

| Income taxes paid, net of refunds received | $ | 17,581 | | | $ | 27,723 | |

| | | |

| | | |

| | | |

Titan International, Inc.

Reconciliation of GAAP to Non-GAAP Financial Measures (Unaudited)

Amounts in thousands, except earnings per share data

The Company reports its financial results in accordance with generally accepted accounting principles in the United States (GAAP). These supplemental schedules provide a quantitative reconciliation between each of adjusted net income attributable to Titan, EBITDA, adjusted EBITDA, net sales on a constant currency basis, net debt, and net cash provided by operating activities to free cash flow, each of which is a non-GAAP financial measure and the most directly comparable financial measures calculated and reported in accordance with GAAP.

We present adjusted net income attributable to Titan, adjusted earnings per common share, EBITDA, adjusted EBITDA, net sales on a constant currency basis, net debt and net cash provided by operating activities to free cash flow, as we believe that they assist investors with analyzing our business results. In addition, management reviews these non-GAAP financial measures in order to evaluate the financial performance of each of our segments, as well as the Company’s performance as a whole. We believe that the presentation of these non‑GAAP financial measures will permit investors to assess the performance of the Company on the same basis as management.

Adjusted net income attributable to Titan, adjusted earnings per common share, EBITDA, adjusted EBITDA, net sales on a constant currency basis, net debt, and free cash flow should be considered supplemental to, not a substitute for, the financial measures calculated in accordance with GAAP. One should not consider these measures in isolation or as a substitute for our results reported under GAAP. These measures have limitations in that they do not reflect all of the costs associated with the operations of our businesses as determined in accordance with GAAP. In addition, these measures may be calculated differently than non-GAAP financial measures reported by other companies, limiting their usefulness as comparative measures. We attempt to compensate for these limitations by analyzing results on a GAAP basis as well as a non-GAAP basis, prominently disclosing GAAP results and providing reconciliations from GAAP results to non-GAAP results.

The table below provides a reconciliation of adjusted net income attributable to Titan to net income applicable to common shareholders, the most directly comparable GAAP financial measure, for the three and nine-month periods ended September 30, 2023 and 2022.

| | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended | | Nine months ended |

| September 30, | | September 30, |

| 2023 | | 2022 | | 2023 | | 2022 |

| | | | | | | |

| Net income attributable to Titan and applicable to common shareholders | $ | 19,280 | | | $ | 43,169 | | | $ | 81,325 | | | $ | 134,262 | |

| Adjustments: | | | | | | | |

| Foreign exchange (gain) loss | (876) | | | (1,198) | | | 882 | | | (8,749) | |

| Loss on sale of Australian wheel business | — | | | — | | | — | | | 10,890 | |

| Proceeds from government grant | — | | | — | | | — | | | (1,324) | |

| | | | | | | |

| Income on Brazilian indirect tax credits, net | — | | | (7,881) | | | (3,096) | | | (22,594) | |

| Adjusted net income attributable to Titan and applicable to common shareholders | $ | 18,404 | | | $ | 34,090 | | | $ | 79,111 | | | $ | 112,485 | |

| | | | | | | |

| Adjusted earnings per common share: | | | | | | | |

| Basic | $ | 0.29 | | | $ | 0.54 | | | $ | 1.26 | | | $ | 1.78 | |

| Diluted | $ | 0.29 | | | $ | 0.54 | | | $ | 1.25 | | | $ | 1.77 | |

| | | | | | | |

| Average common shares and equivalents outstanding: | | | | | | | |

| Basic | 62,598 | | | 62,803 | | | 62,810 | | | 63,107 | |

| Diluted | 63,095 | | | 63,229 | | | 63,271 | | | 63,587 | |

The table below provides a reconciliation of net income to EBITDA and adjusted EBITDA, which are non-GAAP financial measures, for the three and nine-month periods ended September 30, 2023 and 2022.

| | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended | | Nine months ended |

| September 30, | | September 30, |

| 2023 | | 2022 | | 2023 | | 2022 |

| | | | | | | |

| Net income | $ | 19,663 | | | $ | 42,713 | | | $ | 84,988 | | | $ | 136,212 | |

| Adjustments: | | | | | | | |

| Provision for income taxes | 4,718 | | | 11,446 | | | 28,363 | | | 39,128 | |

| Interest expense, excluding interest income | 7,009 | | | 7,792 | | | 21,789 | | | 23,756 | |

| Depreciation and amortization | 10,033 | | | 10,038 | | | 31,598 | | | 32,283 | |

| EBITDA | $ | 41,423 | | | $ | 71,989 | | | $ | 166,738 | | | $ | 231,379 | |

| Adjustments: | | | | | | | |

| Foreign exchange (gain) loss | (876) | | | (1,198) | | | 882 | | | (8,749) | |

| Loss on sale of Australian wheel business | — | | | — | | | — | | | 10,890 | |

| Proceeds from government grant | — | | | — | | | — | | | (1,324) | |

| Income on Brazilian indirect tax credits | — | | | (9,593) | | | (475) | | | (32,043) | |

| Adjusted EBITDA | $ | 40,547 | | | $ | 61,198 | | | $ | 167,145 | | | $ | 200,153 | |

The table below sets forth, for the three and nine-month period ended September 30, 2023, the impact to net sales of currency translation (constant currency) by geography (in thousands, except percentages):

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three months ended September 30, | | Change due to currency translation | | Three months ended September 30, |

| 2023 | | 2022 | | % Change from 2022 | | $ | | % | | Constant Currency |

| United States | $ | 173,300 | | | $ | 266,815 | | | (35.0) | % | | $ | — | | | — | % | | $ | 173,300 | |

| Europe / CIS | 119,749 | | | 131,980 | | | (9.3) | % | | (4,258) | | | (3.2) | % | | 124,007 | |

| Latin America | 89,258 | | | 112,419 | | | (20.6) | % | | 3,005 | | | 2.7 | % | | 86,253 | |

| Other International | 19,474 | | | 19,508 | | | (0.2) | % | | (4,480) | | | (23.0) | % | | 23,954 | |

| $ | 401,781 | | | $ | 530,722 | | | (24.3) | % | | $ | (5,733) | | | (1.1) | % | | $ | 407,514 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Nine months ended September 30, | | Change due to currency translation | | Nine months ended September 30, |

| 2023 | | 2022 | | % Change from 2022 | | $ | | % | | Constant Currency |

| United States | $ | 654,324 | | | $ | 836,748 | | | (21.8) | % | | $ | — | | | — | % | | $ | 654,324 | |

| Europe / CIS | 424,412 | | | 425,976 | | | (0.4) | % | | (10,907) | | | (2.6) | % | | 435,319 | |

| Latin America | 283,132 | | | 324,149 | | | (12.7) | % | | (3,446) | | | (1.1) | % | | 286,578 | |

| Other International | 69,733 | | | 72,741 | | | (4.1) | % | | (12,517) | | | (17.2) | % | | 82,250 | |

| $ | 1,431,601 | | | $ | 1,659,614 | | | (13.7) | % | | $ | (26,870) | | | (1.6) | % | | $ | 1,458,471 | |

The table below provides a reconciliation of net debt, which is a non-GAAP financial measure (in thousands):

| | | | | | | | | | | | | | | | | |

| | September 30, 2023 | | December 31, 2022 | | September 30, 2022 |

| | |

| | | | | |

| Long-term debt | $ | 409,747 | | | $ | 414,761 | | | $ | 414,566 | |

| Short-term debt | 17,556 | | | 30,857 | | | 32,300 | |

| Total debt | $ | 427,303 | | | $ | 445,618 | | | $ | 446,866 | |

| Cash and cash equivalents | 211,902 | | | 159,577 | | | 116,581 | |

| Net debt | $ | 215,401 | | | $ | 286,041 | | | $ | 330,285 | |

The table below provides a reconciliation of net cash provided by operating activities to free cash flow, which is a non-GAAP financial measure (in thousands):

| | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended | | Nine months ended |

| September 30, | | September 30, |

| 2023 | | 2022 | | 2023 | | 2022 |

| | | | | | | |

| Net cash provided by operating activities | $ | 51,216 | | | $ | 53,322 | | | $ | 140,106 | | | $ | 102,240 | |

| Capital expenditures | (13,913) | | | (13,291) | | | (41,480) | | | (32,755) | |

| Free cash flow | $ | 37,303 | | | $ | 40,031 | | | $ | 98,626 | | | $ | 69,485 | |

Cover Document

|

Nov. 01, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Nov. 01, 2023

|

| Entity Registrant Name |

TITAN INTERNATIONAL, INC.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

1-12936

|

| Entity Tax Identification Number |

36-3228472

|

| Entity Address, Address Line One |

1525 Kautz Road, Suite 600

|

| Entity Address, City or Town |

West Chicago

|

| Entity Address, State or Province |

IL

|

| Entity Address, Postal Zip Code |

60185

|

| City Area Code |

(630)

|

| Local Phone Number |

377-0486

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Title of 12(b) Security |

Common stock, $0.0001 par value

|

| Trading Symbol |

TWI

|

| Security Exchange Name |

NYSE

|

| Entity Central Index Key |

0000899751

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

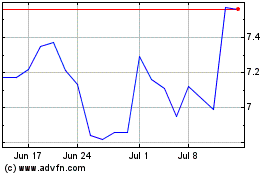

Titan (NYSE:TWI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Titan (NYSE:TWI)

Historical Stock Chart

From Apr 2023 to Apr 2024