UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

6-K

REPORT

OF FOREIGN PRIVATE ISSUER

PURSUANT

TO RULE 13a-16 OR 15d-16

UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For

the month of October 2023

Commission

File Number: 001-41467

Magic

Empire Global Limited

3/F,

8 Wyndham Street

Central,

Hong Kong

(Address

of Principal Executive Offices)

Indicate

by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form

20-F ☒ Form 40-F ☐

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

Annual

Shareholder Meeting

In

connection with the annual meeting of shareholders of Magic Empire Global Limited, a British Virgin Islands company (the “Company”),

the Company hereby furnishes the following documents:

Exhibits

SIGNATURES

Pursuant

to the requirements of the Securities and Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned, thereunto duly authorized.

| |

Magic Empire Global Limited |

| |

|

|

| Date: October 31, 2023 |

By: |

/s/ Sze

Hon, Johnson Chen |

| |

|

Sze Hon, Johnson Chen |

| |

|

Chief Executive Officer |

Exhibit

99.1

MAGIC

EMPIRE GLOBAL LIMITED

3/F, 8 Wyndham Street, Central

Hong Kong

PROXY

STATEMENT AND NOTICE OF

ANNUAL MEETING OF SHAREHOLDERS

| To

the shareholders of |

|

October 31,

2023 |

| Magic

Empire Global Limited |

|

Hong Kong |

Dear

Shareholders:

You

are cordially invited to attend the annual meeting of the shareholders of Magic Empire Global Limited (“MEGL”, the “Company”,

“we”, “our” or “us”), which will be held at 3:00 p.m., local time, on November 29, 2023 (the

“Annual Meeting”). The Annual Meeting will be held at our office at 3/F, 8 Wyndham Street, Central, Hong Kong.

Shareholders will be able to attend the meeting in-person and vote.

The

matters to be acted upon at the Annual Meeting are described in the Notice of Annual Meeting of Shareholders and Proxy Statement.

YOUR

VOTE IS VERY IMPORTANT. WHETHER OR NOT YOU PLAN TO ATTEND THE ANNUAL MEETING OF SHAREHOLDERS, WE URGE YOU TO VOTE AND SUBMIT YOUR PROXY

ON THE INTERNET OR BY MAIL. IF YOU ARE A REGISTERED SHAREHOLDER AND ATTEND THE ANNUAL MEETING, YOU MAY REVOKE YOUR PROXY AND VOTE

YOUR SHARES IN PERSON. IF YOU HOLD YOUR SHARES THROUGH A BANK OR BROKER AND WANT TO VOTE YOUR SHARES IN PERSON AT THE ANNUAL MEETING,

PLEASE CONTACT YOUR BANK OR BROKER TO OBTAIN A LEGAL PROXY. THANK YOU FOR YOUR SUPPORT.

| |

By order of

the Board of Directors, |

| |

|

| |

/s/

Sze Hon, Johnson Chen |

| |

Sze Hon, Johnson Chen |

| |

Chief Executive Officer |

NOTICE

OF ANNUAL MEETING OF SHAREHOLDERS

MAGIC EMPIRE GLOBAL LIMITED (THE “COMPANY”)

| TIME: |

3:00

P.M., Hong Kong Time, on November 29, 2023

(2:00

A.M., Eastern Time, on November 29, 2023) |

| |

|

| PLACE: |

3/F, 8 Wyndham Street,

Central, Hong Kong |

ITEMS

OF BUSINESS:

| Proposal One |

By

a resolution of members, to approve the re-appointment of five directors, Mr. Wai Ho Chan, Mr. Sze Hon Johnson Chen,

Mr. Yiu Sing Chan, Mr. Chi Wai Siu and Ms. Ka Lee Lam, each to serve a term expiring at the next annual meeting of shareholders or

until their successors are duly elected and qualified; |

| |

|

| Proposal

Two |

By

a resolution of members, to ratify the appointment of Marcum Asia CPAs LLP as the Company’s independent registered public

accounting firm for the fiscal year ending December 31, 2023; and |

| |

|

| Proposal

Three |

By

a resolution of members, to amend and restate the Company’s Memorandum and Articles of Association by adopting the Second

Amended and Restated Memorandum and Articles of Association to create a new class of shares in the Company, such that the Company

is authorized to issue a maximum number of 300,000,000 Ordinary Shares with a par value of US$0.0001 each and 300,000,000 Non-voting

Ordinary Shares with a par value of US$0.0001 each, and to allow notice to be sent to a shareholder by publishing that notice

and document on a website. |

| |

|

| WHO

MAY VOTE: |

You may vote if you were

a shareholder of record on October 31, 2023. |

| |

|

| ANNUAL

REPORT: |

A

copy of our 2022 Annual Report on Form 20-F (the “Annual Report”) is available on the Company’s website

at http://meglmagic.com under SEC filing and in print upon request. |

| |

|

| DATE

OF MAILING: |

This

notice and the proxy statement are first being mailed to shareholders on or about November 6, 2023. |

| |

By order of

the Board of Directors, |

| |

|

| |

/s/ Sze Hon,

Johnson Chen |

| |

Sze Hon, Johnson Chen |

| |

Chief Executive Officer |

ABOUT

THE ANNUAL MEETING OF SHAREHOLDERS

What

am I voting on?

You

will be voting on the following:

| Proposal

One |

By

a resolution of members, to approve the re-appointment of five directors, Mr. Wai Ho Chan, Mr. Sze Hon Johnson Chen,

Mr. Yiu Sing Chan, Mr. Chi Wai Siu and Ms. Ka Lee Lam, each to serve a term expiring at the next annual meeting of shareholders or

until their successors are duly elected and qualified; |

| |

|

| Proposal

Two |

By

a resolution of members, to ratify the appointment of Marcum Asia CPAs LLP as the Company’s independent registered public

accounting firm for the fiscal year ending December 31, 2023; and |

| |

|

| Proposal

Three |

By

a resolution of members, to amend and restate the Company’s Memorandum and Articles of Association by adopting the Second

Amended and Restated Memorandum and Articles of Association to create a new class of shares in the Company, such that the Company

is authorized to issue a maximum number of 300,000,000 Ordinary Shares with a par value of US$0.0001 each and 300,000,000 Non-voting

Ordinary Shares with a par value of US$0.0001 each, and to allow notice to be sent to a shareholder by publishing that notice

and document on a website |

Who

is entitled to vote?

You

may vote if you owned ordinary shares of the Company as of the close of business on October 31, 2023, which we refer to as the “Record

Date”. Each ordinary share is entitled to one vote. As of October 31, 2023, we had 20,256,099 ordinary shares issued and outstanding.

What

is the difference between holding shares as a shareholder of record and as a beneficial owner?

Certain

of our Shareholders hold their shares in an account at a brokerage firm, bank or other nominee holder, rather than holding share certificates

in their own name. As summarized below, there are some distinctions between shares held of record and those owned beneficially.

Shareholder

of Record/Registered Shareholders

If,

on the Record Date, your shares were registered directly in your name with our transfer agent, VStock Transfer LLC, you are a “Shareholder

of Record” who may vote at the Annual Meeting, and we are sending these proxy materials directly to you. As the Shareholder

of Record, you have the right to direct the voting of your shares by returning the enclosed proxy card to us or to vote in person at

the Annual Meeting. Whether or not you plan to attend the Annual Meeting, please complete, date and sign the enclosed proxy

card to ensure that your vote is counted.

Beneficial

Owner

If,

on the Record Date, your shares were held in an account at a brokerage firm or at a bank or other nominee holder, you are considered

the beneficial owner of shares held “in street name,” and these proxy materials are being forwarded to you by your broker

or nominee who is considered the Shareholder of Record for purposes of voting at the Annual Meeting. As the beneficial owner,

you have the right to direct your broker on how to vote your shares and to attend the Meeting. However, since you are not the Shareholder

of Record, you may not vote these shares in person at the Annual Meeting unless you receive a valid proxy from your brokerage

firm, bank or other nominee holder. To obtain a valid proxy, you must make a special request of your brokerage firm, bank or other nominee

holder. If you do not make this request, you can still vote by using the voting instruction card enclosed with this proxy statement;

however, you will not be able to vote in person at the Annual Meeting.

How

do I vote before the Annual Meeting?

If

you are a registered shareholder, meaning that you hold your shares in certificate form, you have the following voting options:

(1)

By Internet, which we encourage if you have Internet access, at the address shown on your proxy card;

(2)

By mail, by completing, signing, and returning the enclosed proxy card; or

(3)

During the Annual Meeting in person.

If

you vote via the internet, your electronic vote authorizes the named proxies in the same manner as if you signed, dated, and returned

your proxy card. If you vote via the internet, do not return your proxy card.

If

you hold your shares through an account with a bank or broker, your ability to vote by the Internet depends on their voting procedures.

Please follow the directions that your bank or broker provides.

Can

I change my mind after I return my proxy?

You

may change your vote at any time before the polls close at the conclusion of voting at the Annual Meeting. You may do this by (1) signing

another proxy card with a later date and returning it to us before the Annual Meeting, (2) voting again over the Internet prior to the

time of the Annual Meeting, or (3) voting at the Annual Meeting if you are a registered shareholder or have followed the necessary procedures

required by your bank or broker.

What

if I return my proxy card but do not provide voting instructions?

Proxies

that are signed and returned but do not contain instructions will be voted “FOR” Proposals One, Two and Three in accordance

with the best judgment of the named proxies on any other matters properly brought before the Annual Meeting.

What

does it mean if I receive more than one proxy card or instruction form?

It

indicates that your ordinary shares are registered differently and are in more than one account. To ensure that all shares are voted,

please either vote each account on the Internet, or sign and return all proxy cards. We encourage you to register all your accounts in

the same name and address. Those holding shares through a bank or broker should contact their bank or broker and request consolidation.

How

many votes must be present to hold the Annual Meeting?

Your

shares are counted as present at the Annual Meeting if you attend the Annual Meeting and vote in person or if you properly return a proxy

by internet or mail. In order for us to conduct our Annual Meeting, at the commencement of the Annual Meeting, there are present

in person or by proxy not less than fifty per cent (50%) of the votes of our outstanding ordinary shares as of October 31, 2023. This

is referred to as a quorum. Abstentions and broker non-votes will be counted for purposes of establishing a quorum at the Annual Meeting.

If a quorum is not present or represented, the chairman of the Annual Meeting may adjourn the Annual Meeting from time to time, without

notice other than announcement at the Annual Meeting, until a quorum is present or represented.

How

many votes are needed to approve the Company’s proposals?

Proposal

One. The re-appointment of directors. This proposal requires affirmative (“FOR”) votes of a majority of votes cast by shares

present or represented by proxy and entitled to vote at the Annual Meeting.

Proposal

Two. The ratification of auditor. This proposal requires affirmative (“FOR”) votes of a majority of votes cast by shares

present or represented by proxy and entitled to vote at the Annual Meeting.

Proposal

Three. The amendment and restatement of the Memorandum and Articles of Association to create a new class of shares in the Company,

such that the Company is authorized to issue a maximum number of 300,000,000 Ordinary Shares with a par value of US$0.0001 each and 300,000,000

Non-voting Ordinary Shares with a par value of US$0.0001 each. This proposal requires affirmative (“FOR”) votes of a

majority of votes cast by shares present or represented by proxy and entitled to vote at the Annual Meeting.

What

are Abstentions and Broker Non-Votes?

All

votes will be tabulated by the inspector of election appointed for the Annual Meeting, who will separately tabulate affirmative and negative

votes, abstentions and broker non-votes. An abstention is the voluntary act of not voting by a shareholder who is present at the Annual

Meeting and entitled to vote. A broker “non-vote” occurs when a broker nominee holding shares for a beneficial owner does

not vote on a particular proposal because the nominee does not have discretionary power for that particular item and has not received

instructions from the beneficial owner. If you hold your shares in “street name” through a broker or other nominee, your

broker or nominee may not be permitted to exercise voting discretion with respect to some of the matters to be acted upon at the Annual

Meeting. If you do not give your broker or nominee specific instructions regarding such matters, your proxy will be deemed a “broker

non-vote.”

The

question of whether your broker or nominee may be permitted to exercise voting discretion with respect to a particular matter depends

on whether the particular proposal is deemed to be a “routine” matter and how your broker or nominee exercises any discretion

they may have in the voting of the shares that you beneficially own. Brokers and nominees can use their discretion to vote “uninstructed”

shares with respect to matters that are considered to be “routine,” but not with respect to “non-routine” matters.

Under the rules and interpretations of the Nasdaq, “non-routine” matters are matters that may substantially affect the rights

or privileges of shareholder, such as mergers, shareholder proposals, elections of directors (even if not contested), executive compensation

(including any advisory shareholder votes on executive compensation and on the frequency of shareholder votes on executive compensation),

and certain corporate governance proposals, even if management-supported.

For

any proposal that is considered a “routine” matter, your broker or nominee may vote your shares in its discretion either

for or against the proposal even in the absence of your instruction. For any proposal that is considered a “non-routine”

matter for which you do not give your broker instructions, the shares will be treated as broker non-votes. “Broker non-votes”

occur when a beneficial owner of shares held in street name does not give instructions to the broker or nominee holding the shares as

to how to vote on matters deemed “non-routine.” Broker non-votes will not be considered to be shares “entitled to vote”

on any “non-routine” matter and therefore will not be counted as having been voted on the applicable proposal. Therefore,

if you are a beneficial owner and want to ensure that shares you beneficially own are voted in favor or against any or all of the proposals

in this proxy statement, the only way you can do so is to give your broker or nominee specific instructions as to how the shares are

to be voted.

Abstentions

and broker non-votes are not counted as votes cast on an item and therefore will not affect the outcome of any proposal presented in

this proxy statement. Abstention and broker non-votes, if any, will be counted for purposes of determining whether there is a quorum

present at the Annual Meeting.

Note

that if you are a beneficial holder and do not provide specific voting instructions to your broker, the broker that holds your shares

will not be authorized to vote on Proposals One or Three because each is considered a non-routine matter. Proposal Two is considered

to be a routine matters and, accordingly, if you do not instruct your broker, bank or other nominee on how to vote the shares in your

account for Proposal Two, brokers will be permitted to exercise their discretionary authority to vote for the approval of such proposal.

Accordingly,

we encourage you to provide voting instructions to your broker, whether or not you plan to attend the Annual Meeting.

PROPOSAL

ONE

BY

A RESOLUTION OF MEMBERS, TO APPROVE THE RE-APPOINTMENT OF FIVE DIRECTORS, MR. WAI HO CHAN, MR. SZE HON JOHNSON CHEN, MR.

YIU SING CHAN, MR. CHI WAI SIU AND MS. KA LEE LAM, EACH TO SERVE A TERM EXPIRING AT THE NEXT ANNUAL MEETING OF SHAREHOLDERS OR UNTIL

THEIR SUCCESSORS ARE DULY ELECTED AND QUALIFIED

(ITEM 1 ON THE PROXY CARD)

Background

Our

Board of Directors currently consists of five directors, Mr. Wai Ho Chan, Mr. Sze Hon Johnson Chen, Mr. Yiu Sing Chan, Mr. Chi

Wai Siu and Ms. Ka Lee Lam. At the Annual Meeting, the shareholders will vote on the re-election of all of the existing directors. All

directors will hold office until our next annual meeting of shareholders, at which time shareholders will vote on the election and qualification

of their successors.

All

shares duly voted will be voted for the election of directors as specified by the shareholders. No proxy may be voted for more people

than the number of nominees listed below. Unless otherwise instructed, the proxy holders will vote the proxies received by them FOR

the election of each of the nominees named below, all of whom are presently directors. If any nominee is unable or declines to serve

as a director at the time of the Annual Meeting, although we know of no reason to anticipate that this will occur, the proxies will be

voted for any nominee designated by the present Board to fill the vacancy.

The

following paragraphs set forth information regarding the current ages, positions, and business experience of the nominees.

Wai

Ho Chan

Director and Chairman of the Board of Directors

Mr.

Wai Ho Chan, aged 42 is our Director and chairman of the Board of Directors. Mr. Chan is a co-founder of the Group. Mr. Chan also

serves as a director of Giraffe Financial Holdings Limited (“GFHL”), Giraffe Capital Limited (“GCL”), Giraffe

Investment Limited (“GIL”), Magic Empire Investment Limited (“MEIL”) and Giraffe Corporate Services Limited (“GCSL”).

Mr. Chan has more than 19 years of experience in investment banking and accounting industry. Prior to the establishment of our Group,

Mr. Chan had worked in the corporate finance division of CCB International Capital Limited for about nine years from January 2008 to

August 2016, with his last position as director of corporate finance. Prior to joining CCB International Capital Limited, Mr. Chan had

worked as an auditor at international audit firms from September 2003 to December 2007. Mr. Chan is a Chartered Financial Analyst (“CFA”),

a member of the Hong Kong Institute of Certified Public Accountants (“HKICPA”), and a fellow member of the Association of

Chartered Certified Accountants (“FCCA”). Mr. Chan graduated from the Faculty of Business Administration of the Chinese University

of Hong Kong, with major in Professional Accountancy in December 2003. We believe Mr. Chan’s access to contacts and sources, ranging

from private and public company contacts, private equity funds and investment bankers will allow us to explore more business opportunities.

Sze

Hon, Johnson Chen

Director and Chief Executive Officer

Mr.

Sze Hon, Johnson Chen, aged 42, is our Director and chief executive officer. Mr. Chen also serves as a director of GFHL, GCL, GIL, MEIL

and GCSL. Mr. Chen has more than 19 years of experience in investment banking and auditing services. Prior to the establishment of our

Group, Mr. Chen had worked in the corporate finance division of Guotai Junan Capital Limited for more than 8 years from 2008 to 2016.

Prior to joining Guotai Junan Capital Limited, Mr. Chen had worked as an auditor in KPMG from 2004 to 2007. Mr. Chen is a CFA, Certified

Financial Risk Manager, a member of the HKICPA and American Institute of Certified Public Accountants (“AICPA”) and a FCCA.

Mr. Chen graduated from the Faculty of Business Administration of the Chinese University of Hong Kong, with major in Professional Accountancy

and minors in Economics and French Studies in 2004. We believe Mr. Chen’s experience in investment banking and auditing services,

as well as his professional qualifications makes him suitable for the position.

Yiu

Sing Chan

Independent Director

Mr.

Yiu Sing Chan, aged 44, is our independent director and is the chairman of the audit committee and is a member of the compensation committee

and nominating and corporate governance committee. Mr. Chan has over 15 years of experience in audit, investment, accounting and finance.

He joined an international audit firm in February 2006 and was an audit manager of such audit firm until May 2012 prior to joining Best

Pacific International Holdings Limited as chief financial officer since February 2013. Best Pacific International Holdings Limited was

listed on The Stock Exchange of Hong Kong Limited (stock code: 2111) in May 2014, and Mr. Chan was appointed as chief financial officer

and company secretary since January 2014 and as executive director since February 2021. Mr. Chan graduated from the University of New

South Wales in Australia with a master’s degree in commerce in June 2005 and a bachelor’s degree in accounting and finance

in October 2003. He has been a member of the HKICPA since September 2009. We believe Mr. Chan’s experience in audit, investment,

accounting and finance and his education background makes him suitable for the position.

Chi

Wai Siu

Independent Director

Mr.

Chi Wai Siu, aged 41, is our independent Director and is the chairman of the compensation committee and a member of the audit committee

and nominating and corporate governance committee. Mr. Siu has over 15 years of experience in investment banking, transaction advisory

and valuation fields. From October 2005 to April 2008, Mr. Siu began his career as a financial analyst with Canada’s Ministry of

Finance. Between September 2008 and December 2010, Mr. Siu worked as a Senior Analyst in GCA Professional Services Group, a financial

advisory firm providing valuation, advisory, mining and mineral consultancy as well as corporate services. From December 2010 to December

2014, Mr. Siu worked as an Associate Director in the Investment Banking Division at Daiwa Capital Markets Hong Kong Limited. From January

2015 to December 2015, Mr. Siu joined UBS AG as a director where he originated and executed public and private fundraising transactions.

In January 2016, Mr. Siu founded and worked as the chief executive officer of Impressed Technology Limited, which operates an on-demand,

door-to-door pickup and delivery dry cleaning and laundry online platform in Hong Kong. Since January 2021, Mr. Siu has re-joined GCA

Professional Service Group as the chief executive officer. Mr. Siu graduated from the University of Toronto in commerce in 2005 and is

a CFA and a member of AICPA. We believe Mr. Chan’s experience in investment banking, transaction advisory and valuation fields,

as well as his professional qualifications makes him suitable for the position.

Ms.

Ka Lee Lam

Independent Director

Ms.

Ka Lee Lam, aged 39, is our independent Director and is chairlady of the nominating and corporate governance committee, a member of the

audit committee and compensation committee. Ms. Lam has over 10 years of experience in business management, investment banking and operation

control. Ms. Lam is currently an executive director of GBA Holdings Limited (a company listed on The Stock Exchange of Hong Kong Limited

with stock code: 00261). From June 2009 to October 2011, Ms. Lam worked in the operations department at Bank of America Merrill Lynch.

From October 2011 to August 2012, Ms. Lam worked as an analyst at Barclays Capital Asia Ltd. From September 2012 to August 2016, Ms.

Lam worked in the operations department at ABN AMRO Clearing Hong Kong Limited. From June 2016 to September 2019, Ms. Lam served as

an executive director of Huisheng International Holdings Limited (a company listed on The Stock Exchange of Hong Kong Limited with stock

code: 01340). Ms. Lam obtained a Bachelor of Business (Accounting) degree from Swinburne University of Technology in Australia in

April 2008. We believe Ms. Lam’s experience in business management, investment banking and operation control, as well as her education

background makes her suitable for the position.

Board

Diversity Matrix

This

table below provides certain information regarding the diversity of our Board of Directors as of the date of this proxy statement.

| As

of 10/31/2023 |

| Region of

Principal Executive Offices |

|

Hong Kong |

| Foreign

Private Issuer |

|

Yes |

| Disclosure

Prohibited Under Home Country Law |

|

No |

| Total

Number of Directors |

|

5 |

| |

|

Female |

|

Male |

|

Non-Binary |

|

Did

Not

Disclose

Gender |

| Part

I: Gender Identity |

|

|

|

|

|

|

|

|

| Directors |

|

1 |

|

4 |

|

— |

|

— |

| |

|

|

|

|

|

|

|

|

| Part

II: Demographic Background |

|

|

| Underrepresented

Individual in Home Country Jurisdiction |

|

— |

| LGBTQ+ |

|

— |

| Did

Not Disclose Demographic Background |

|

— |

Involvement

in Certain Legal Proceedings

To

the best of our knowledge, none of our directors or officers has been convicted in a criminal proceeding, excluding traffic violations

or similar misdemeanors, nor has any been a party to any judicial or administrative proceeding during the past five years that resulted

in a judgment, decree or final order enjoining the person from future violations of, or prohibiting activities subject to, federal or

state securities laws, or a finding of any violation of federal or state securities laws, except for matters that were dismissed without

sanction or settlement. Except as set forth in our discussion in “Related Party Transactions” in our Annual Report, our directors

and officers have not been involved in any transactions with us or any of our affiliates or associates which are required to be disclosed

pursuant to the rules and regulations of the SEC.

Board

Leadership Structure

Mr.

Wai Ho Chan serves as the Chairman of the Board of Directors. As a smaller public company, we believe it is in the company’s best

interest to allow the company to benefit from guidance from key members of management in a variety of capacities. We do not have a lead

independent director and do not anticipate having a lead independent director because we will encourage our independent directors to

freely voice their opinions on a relatively small company board. We believe this leadership structure is appropriate because we are a

relatively small public company.

Recommendation

of the Board of Directors

THE

BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT THE SHAREHOLDERS VOTE “FOR” THIS PROPOSAL.

PROPOSAL

TWO

BY A RESOLUTION OF MEMBERS, TO RATIFY THE APPOINTMENT OF MARCUM ASIA CPAS LLP AS THE COMPANY’S INDEPENDENT REGISTERED PUBLIC

ACCOUNTING FIRM FOR THE FISCAL YEAR ENDING DECEMBER 31, 2023

(ITEM 2 ON THE PROXY CARD)

Background

We

are proposing to ratify the appointment of Marcum Asia CPAs LLP (“Marcum Asia”) as the Company’s independent registered

public accounting firm for the fiscal year ending December 31, 2023. The Audit Committee of the Board of Directors has appointed Marcum

Asia to serve as the Company’s fiscal year 2023 independent registered public accounting firm. Although the Company’s governing

documents do not require the submission of this matter to shareholders, the Board of Directors considers it desirable that the appointment

of Marcum Asia be ratified by shareholders.

Audit

services to be provided by Marcum Asia for fiscal year 2023 will include the examination of the consolidated financial statements

of the Company and services related to periodic filings made with the SEC.

A

representative of Marcum Asia is not expected to be present at the Annual Meeting and therefore will not (i) have the opportunity to

make a statement if they so desire or (ii) be available to respond to questions from shareholders.

If

the appointment of Marcum Asia is not ratified, the Audit Committee of the Board of Directors will reconsider the appointment.

Change

of independent registered public accounting firm during the Company’s two most recent fiscal years

Based

on information provided by the independent registered public accounting firm, Friedman LLP (“Friedman”), effective on

September 1, 2022, Friedman combined with Marcum LLP. On November 7, 2022, the Audit Committee of the Company’s Board of Directors

approved the dismissal of Friedman and the engagement of Marcum Asia to serve as the independent

registered public accounting firm of the Company. The services previously provided by Friedman will now be provided by Marcum Asia.

Friedman’s

reports on the Company’s financial statements for the fiscal years ended December 31, 2021 and 2020 did not contain an adverse

opinion or a disclaimer of opinion and were not qualified or modified as to uncertainty, audit scope, or accounting principles. Furthermore,

during the Company’s two most recent fiscal years and through November 7, 2022, there have been no disagreements with Friedman

on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedure, which disagreements,

if not resolved to Friedman’s satisfaction, would have caused Friedman to make reference to the subject matter of the disagreement

in connection with its reports on the Company’s financial statements for such periods.

For

the fiscal years ended December 31, 2021 and 2020 and through November 7, 2022, there were no “reportable events” as that

term is described in Item 304(a)(1)(v) of Regulation S-K.

During

the Company’s two most recent fiscal years and through November 7, 2022, neither the Company nor anyone acting on the Company’s

behalf consulted Marcum Asia with respect to any of the matters or reportable events set forth in Item 304(a)(1)(v) of Regulation S-K.

Audit

Committee Pre-Approval Policies and Procedures

The

audit committee of the Board of Directors (the “Audit Committee”) on an annual basis reviews audit and non-audit services

performed by the independent auditors. All audit and non-audit services are pre-approved by the Audit Committee, which considers, among

other things, the possible effect of the performance of such services on the auditors’ independence.

Recommendation

of the Board of Directors

THE

BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT THE SHAREHOLDERS VOTE “FOR” THIS PROPOSAL.

PROPOSAL

THREE

BY A RESOLUTION OF MEMBERS, TO AMEND AND RESTATE THE COMPANY’S MEMORANDUM AND ARTICLES OF ASSOCIATION BY ADOPTING THE SECOND

AMENDED AND RESTATED MEMORANDUM AND ARTICLES OF ASSOCIATION TO CREATE A NEW CLASS OF SHARES IN THE COMPANY AND TO ALLOW NOTICE TO BE

SENT TO A SHAREHOLDER BY PUBLISHING THAT NOTICE AND DOCUMENT ON A WEBSITE

(ITEM 3 ON THE PROXY CARD)

General

On

October 30, 2023, the Board of Directors of the Company approved, and directed that there be submitted to the holders of the

Company’s ordinary shares for approval, the proposed amendment and restatement of the Company’s Amended and Restated Memorandum

and Articles of Association (the “Current M&A”) in order to create a new class of 300,000,000 Non-voting Ordinary

Shares of par value of US$0.0001 each (the “Non-voting Ordinary Shares”), such that the Company is authorized to

issue a maximum number of 300,000,000 Ordinary Shares with a par value of US$0.0001 each and 300,000,000 Non-voting Ordinary Shares with

a par value of US$0.0001 each. Following such creation of a new class of shares, each Ordinary Share would be entitled to one (1)

vote and each Non-voting Ordinary Share would not be entitled to any votes on all matters subject to vote at general meetings of the

Company and with such other rights, preferences and privileges as set forth in the Second Amended and Restated Memorandum and Articles

of Association (the “New M&A”) to be adopted by the Company.

The

text of the proposed changes to the Current M&A is set forth in Annex A to this Proxy Statement and is incorporated by reference

into this Proxy Statement. Provided this proposal is approved by our shareholders, we will create a new class of Non-voting Ordinary

Shares in accordance with the Current M&A. The favorable vote of the majority of our outstanding ordinary shares entitled to vote,

in person or by proxy, at this annual meeting is required to approve the proposed amendment to the Current M&A and adoption of the

New M&A. The Company also proposed to add a new provision to the Current M&A, which shall become Regulation 8.2 of the New M&A,

to allow the Company to send any notice or other document pursuant to the New M&A to a shareholder by publishing that notice or other

document on a website subject to the New M&A.

The

proposed change will not affect in any way the validity or transferability of stock certificates outstanding, the capital structure of

the Company or the trading of the Company’s ordinary shares on the NASDAQ Capital Market. If the amendment is passed by our shareholders,

it will not be necessary for shareholders to surrender their existing share certificates. Instead, when certificates are presented for

transfer, new certificates representing Ordinary Shares or Non-voting Ordinary Shares, as the case may be, will be issued.

Reasons for the proposal

The Board believes it would be prudent and advisable

to create the new class of Non-voting Ordinary Shares to provide flexibility on the potential use of shares for business and financial

purposes in the future. Having the additional authorized but unissued shares of Non-voting Ordinary Shares would allow the Company to

take prompt action with respect to corporate opportunities that develop, without affecting the voting rights of existing stockholders.

The additional shares of Non-voting Ordinary Shares could be used for various purposes including: (i) raising capital, if we have an

appropriate opportunity, through offerings of Non-voting Ordinary Shares or securities that are convertible into Non-voting Ordinary

Shares; (ii) expanding our business through potential mergers and acquisitions through issuance of Non-voting Ordinary Shares or securities

that are convertible into Non-voting Ordinary Shares as consideration; and (iii) providing equity incentives to attract and retain key

employees, officers or consultants of the Company.

Potential

Effects

If

shareholders approve this proposal, the additional authorized shares of Non-voting Ordinary Shares would have rights identical to the

Company’s currently outstanding Ordinary Shares except for that each holder of Non-voting Ordinary Shares shall not be entitled

to vote on any and all matters subject to vote at general meetings of the Company. Future issuances of shares of Non-voting Ordinary Shares

or securities convertible into shares of Non-voting Ordinary Shares could have a dilutive effect on the Company’s earnings per share,

book value per share and the equity interest since holders of Ordinary Shares are not entitled to preemptive rights.

Recommendation

of the Board

THE

BOARD UNANIMOUSLY RECOMMENDS THAT THE SHAREHOLDERS VOTE “FOR” THIS PROPOSAL.

OTHER

MATTERS

GENERAL

The

Board of Directors does not know of any matters other than those stated in this Proxy Statement that are to be presented for action at

the Annual Meeting. If any other matters should properly come before the Annual Meeting, it is intended that proxies in

the accompanying form will be voted on any such other matters in accordance with the judgment of the persons voting such proxies. Discretionary

authority to vote on such matters is conferred by such proxies upon the persons voting them.

The

Company will bear the cost of preparing, printing, assembling and mailing the proxy card, Proxy Statement and other material which may

be sent to shareholders in connection with this solicitation. It is contemplated that brokerage houses will forward the proxy materials

to beneficial owners at our request. In addition to the solicitation of proxies by use of the mails, officers and regular employees of

the Company may solicit proxies without additional compensation, by telephone or telegraph. We may reimburse brokers or other persons

holding Shares in their names or the names of their nominees for the expenses of forwarding soliciting material to their principals and

obtaining their proxies.

If

you have questions about the Annual Meeting or other information related to the proxy solicitation, you may contact the Company at +852

35778770.

COMMUNICATIONS

WITH THE BOARD OF DIRECTORS

Shareholders

wishing to communicate with the Board of Directors or any individual director may write to the Board of Directors or the individual director

to Magic Empire Global Limited, 3/F, 8 Wyndham Street, Central, Hong Kong. Any such communication must state the number of Shares

beneficially owned by the shareholder making the communication. All such communications will be forwarded to the Board of Directors or

to any individual director or directors to whom the communication is directed unless the communication is clearly of a marketing nature

or is unduly hostile, threatening, illegal, or similarly inappropriate, in which case the Company has the authority to discard the communication

or take appropriate legal action regarding the communication.

WHERE

YOU CAN FIND MORE INFORMATION

The

Company files reports and other documents with the SEC under the Exchange Act. The Company’s SEC filings made electronically through

the SEC’s EDGAR system are available to the public at the SEC’s website at http://www.sec.gov. You may also read and

copy any document we file with the SEC at the SEC’s public reference room located at 100 F Street, NE, Room 1580, Washington, DC

20549. Please call the SEC at (800) SEC-0330 for further information on the operation of the public reference room.

| |

By order of

the Board of Directors, |

| |

|

| |

/s/ Sze Hon,

Johnson Chen |

| |

Sze Hon, Johnson Chen |

| |

Chief Executive Officer |

| |

|

Control Number: |

|

Number of Shares: |

|

Registered Shareholder: |

|

|

MAGIC

EMPIRE GLOBAL LIMITED

3/F, 8 Wyndham Street, Central

Hong Kong

PROXY

Solicited

on Behalf of the Board of Directors for the Annual Meeting of Shareholders

on November 29, 2023 at 3:00 P.M., Hong Kong Time

(November 29, 2023, at 2:00 A.M., Eastern Time)

The

undersigned hereby appoints Sze Hon Johnson Chen as proxy with full power of substitution, to represent and to vote as set forth

herein all the ordinary shares of Magic Empire Global Limited which the undersigned is entitled to vote at the Annual Meeting of Shareholders

and any adjournments or postponements thereof, as designated below. If no designation is made, the proxy, when properly executed,

will be voted “FOR” in Item 1, 2 and 3.

| Item

1 |

By

a resolution of members, to approve the re-appointment of five directors, Mr. Wai Ho Chan, Mr. Sze Hon Johnson Chen,

Mr. Yiu Sing Chan, Mr. Chi Wai Siu and Ms. Ka Lee Lam, each to serve a term expiring at the next annual meeting of shareholders or

until their successors are duly elected and qualified. |

| 1a. Wai Ho

Chan |

|

☐ For |

|

☐ Against |

|

☐ Abstain |

| 1b.

Sze Hon Johnson Chen |

|

☐ For |

|

☐ Against |

|

☐ Abstain |

| 1c. Yiu Sing Chan |

|

☐ For |

|

☐ Against |

|

☐ Abstain |

| 1d.

Chi Wai Siu |

|

☐ For |

|

☐ Against |

|

☐ Abstain |

| 1e.

Ka Lee Lam |

|

☐ For |

|

☐ Against |

|

☐ Abstain |

| Item

2 |

By

a resolution of members, to ratify the appointment of Marcum Asia CPAs LLP as the Company’s independent registered public

accounting firm for the fiscal year ending December 31, 2023. |

| |

|

☐ For |

|

☐ Against |

|

☐ Abstain |

| Item

3 |

By a resolution of members,

to amend and restate the Company’s Memorandum and Articles of Association by adopting the Second Amended and Restated Memorandum

and Articles of Association to create a new class of shares in the Company, such that the Company is authorized to issue a maximum

number of 300,000,000 Ordinary Shares with a par value of US$0.0001 each and 300,000,000 Non-voting Ordinary Shares with a par value

of US$0.0001 each, and to allow notice to be sent to a shareholder by publishing that notice and document on a website. |

| |

|

☐ For |

|

☐ Against |

|

☐ Abstain |

In

her discretion, the proxy is authorized to vote upon any other matters which may properly come before the Annual Meeting, or any adjournment

or postponement thereof.

Exhibit 99.2

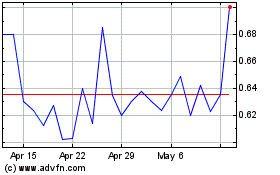

Magic Empire Global (NASDAQ:MEGL)

Historical Stock Chart

From Mar 2024 to Apr 2024

Magic Empire Global (NASDAQ:MEGL)

Historical Stock Chart

From Apr 2023 to Apr 2024