BASF to Reduce Investment Spending After Swinging to a Net Loss -- Update

October 31 2023 - 5:25AM

Dow Jones News

By Pierre Bertrand

BASF said that it will reduce its spending in the years to come

after lower prices and volumes swung the company to a third-quarter

net loss.

The German chemical company said Tuesday that it plans to reduce

its capex by 4 billion euros ($4.25 billion) for the five-year

period to 2027, due to macroeconomic conditions.

The reduction means BASF is planning to spend EUR24.8 billion

from 2023 to 2027, compared with EUR28.8 billion previously.

"We are reducing the overall investments for BASF Group, but we

remain fully committed to our growth projects and our

transformation towards climate neutrality. Moreover, we are not

simply postponing investments. We are reducing the number of

projects and will implement alternative measures that involve lower

capex," Chief Executive Martin Brudermueller said in a

statement.

He added that BASF has trimmed its spending by EUR1 billion to

EUR5.3 billion this year.

BASF posted a EUR249 million net loss compared with EUR909

million in profit in the prior year, on revenue that fell 28% to

EUR15.73 billion.

The company's earnings before interest and taxes before special

items fell 57% to EUR575 million.

The result compares with analysts' expectations of EUR282

million in net profit and EUR17.58 billion in sales, according to a

company-compiled consensus.

BASF said that prices fell particularly in its Materials,

Chemicals and Surface Technologies divisions while they increased

at its Agricultural Solutions unit.

Sales volumes also fell across all customer end-markets with the

exception of the automotive sector, BASF said.

Chemical production slowed considerably in Europe due to lower

demand as a result of high inflation, increased interest rates and

a rise in natural gas prices. There was also a slowdown in consumer

spending, BASF said, which added that chemical production on the

continent declined by 6.6% on year while energy prices were around

40% higher than their average between 2019 and 2021.

The earnings decline also reflected the third-quarter net loss

reported by oil and gas company Wintershall Dea, in which BASF has

a 72.7% stake.

BASF is still working on various options regarding its goal of

selling its stake in the company, Chief Financial Officer, Dirk

Elvermann, said in a post-earnings statement.

The DAX-listed company said it expects to achieve more than

EUR600 million in non-production cost savings by the end of next

year, and more than EUR700 million by the end of 2026.

Global chemical production is expected to further stabilize in

the fourth quarter, the company said. But it warned that the

macroeconomic outlook remains uncertain.

"If chemical production does not further stabilize, there are

risks from a further decline in volumes and a sharper-than-expected

price reduction," Brudermueller said.

He added that BASF doesn't expect an easy start to 2024.

BASF backed its 2023 guidance although said it expected its

sales and EBIT before special items at the lower end of their

respective ranges.

BASF backed its 2023 sales forecast of between EUR73 billion and

EUR76 billion and its pre-special-item EBIT forecast between EUR4

billion and EUR4.4 billion.

Write to Pierre Bertrand at pierre.bertrand@wsj.com

(END) Dow Jones Newswires

October 31, 2023 05:10 ET (09:10 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

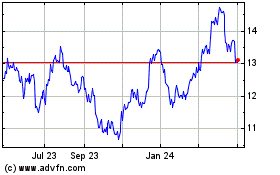

BASF (QX) (USOTC:BASFY)

Historical Stock Chart

From Apr 2024 to May 2024

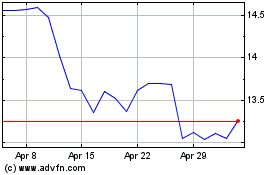

BASF (QX) (USOTC:BASFY)

Historical Stock Chart

From May 2023 to May 2024