Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

SCHEDULE 14A

(RULE 14a-101)

SCHEDULE 14A INFORMATION

PROXY STATEMENT PURSUANT TO SECTION 14(a)

OF THE SECURITIES EXCHANGE ACT OF 1934

☒ Filed by the Registrant

☐ Filed by a Party other than the Registrant

Check the appropriate box:

☐ Preliminary Proxy Statement

☐ Confidential, for Use of the Commission only (as permitted by Rule 14a-6(e)(2))

☒ Definitive Proxy Statement

☐ Definitive Additional Materials

☐ Soliciting Material Pursuant to Rule 240.14a-12

TRIO-TECH INTERNATIONAL

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

☒ No fee required

☐ Fee paid previously with preliminary materials

☐ Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11

October 27, 2023

Letter to Shareholders

To Our Shareholders:

Challenging conditions in the global semiconductor industry had a significant impact on Trio-Tech’s performance this past year, especially in the fourth fiscal quarter. By aggressively managing the business, we nevertheless maintained solid operating margins, significantly improved cash flow, and delivered a profitable year. Manufacturing and Distribution backlog at the end of the fiscal year reached a near-record, which is an encouraging sign for the future.

What’s more, we enhanced our cash-rich balance sheet, reduced debt, and increased shareholders’ equity to a new record. Our focus on improving our balance sheet has positioned Trio-Tech to invest in promising opportunities to develop new revenue streams, improve profitability, and continue to enhance shareholder value.

Our distribution segment is expected to recover strongly from its slow fiscal 2023 performance. We have positioned ourselves as value-added resellers by enhancing the value of the distributed products by customizing them to the needs of our customers through our expert engineering, integration, and sub-assembly services, and serving as an extended research & development arm in product designing for our customers.

Our manufacturing segment has opportunities for additional growth in the coming year. Among other encouraging developments, we received an initial $1,000,000 order from a lead customer for dynamic test systems for electric vehicles. We are actively engaged with other potential new customers for similar applications and expect this new test system to contribute significantly to Trio-Tech’s long-term growth and profitability.

CEO Siew Wai Yong Appointed Chairman of the Board of Directors

Trio-Tech’s Board of Directors announced the election of CEO Siew Wai (S.W.) Yong to the additional post of Chairman, effective September 20, 2023. Mr. Yong joined the Company in 1976 and has been an exceptional leader during his tenure as President and CEO since September 1990. With his appointment as Chairman, Mr. Yong will continue to play a key role shaping the direction of the Company and its long-term success.

Fiscal 2023 Results

Trio-Tech’s testing services revenue increased 19%, primarily related to additional revenue at our China joint venture subsidiary. Manufacturing revenue was essentially flat for the year, while our distribution segment was most severely affected by industry weakness last year with revenue down 43%. Total revenue for fiscal 2023 was $43,250,000 compared to revenue of $44,065,000 for fiscal 2022.

Gross margin declined slightly to $11,705,000 compared to $11,733,000 for fiscal 2022 and improved to 27.1% of revenue compared to 26.6% of revenue for fiscal 2022.

Operating expenses increased to $9,477,000, or 21.9% of revenue, compared to $9,380,000, or 21.3% of revenue for fiscal 2022.

Net income attributable to our common shareholders for fiscal 2023 was $1,544,000, or $0.37 per diluted share. This compares to net income of $2,395,000, or $0.57 per diluted share, for fiscal 2022.

Strong Balance Sheet

Our fiscal 2023 cash from operations increased nearly fourfold, to $8,110,000, compared to only $2,123,000 in fiscal 2022. Cash, cash equivalents and short-term deposits also increased to $14,210,000, versus $13,118,000 at June 30, 2022. Significant reductions in short-term liabilities, bank debt and operating leases helped reduce total liabilities 18%, to $12,615,000 from $15,419.000, leading to an increase in shareholders' equity at June 30, 2023 of $29,571,000, or $7.22 per outstanding share, compared to $28,002,000, or $6.88 per outstanding share, a year earlier. There were approximately 4,096,680 and 4,071,680 common shares outstanding at June 30, 2023 and June 30, 2022, respectively.

A Look Ahead

In our constant pursuit for enhancing shareholder value, we are channeling our resources into accentuating Trio-Tech as a manufacturer and distributor of semiconductor equipment, which has been the core business of Trio-Tech since its inception. Trio-Tech is also experiencing a stronger demand recovery in electronics component and display products from our customers than in fiscal 2023. While the semiconductor industry has experienced periods of rapid growth and slowdowns over the years, we are minimizing our exposure by penetrating new markets in the medical and gaming industries.

We believe that our wide range of products will enable the Company to develop and supply customized, integrated module solutions to our large, diversified customer base.

Consequently, Trio-Tech is redoubling efforts to expand these lines of business and reduce the variability associated with our semiconductor industry focus and customer concentration.

With due caution regarding the overall tone of the semiconductor industry, we nevertheless remain optimistic for continued growth in fiscal 2024 and believe the demand for Trio-Tech’s products will improve in the new fiscal year. We appreciate the accomplishments and hard work of the Company’s employees and want to tender our best wishes and thanks to our former Chairman, A. Charles Wilson, for his many years of service and support to Trio-Tech International. We look forward to reporting our progress to you.

Sincerely,

Yong Siew Wai

Chairman and Chief Executive Officer

Trio-Tech International

Block 1008 Toa Payoh North, Unit 03-09

Singapore 318996, Singapore

Tel. (65) 6265 3300

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

To Be Held On December 11, 2023

NOTICE IS HEREBY GIVEN that the 2023 Annual Meeting of Shareholders (the “Annual Meeting”) of Trio‑Tech International, a California corporation (the “Company”), will be held at our U.S. corporate office, located at 16139 Wyandotte Street, Van Nuys, California 91406, on, December 11, 2023 at 10:00 A.M. Pacific Standard Time, for the following purposes, as set forth in the attached proxy statement (the “Proxy Statement”):

| |

1.

|

to elect four directors to our Board of Directors, each to serve until our next annual meeting of shareholders, or until their respective successor is duly elected and qualified;

|

| |

2.

|

to approve an amendment to the 2017 Director Equity Incentive Plan to increase the number of shares of the Company’s common stock, no par value (“Common Stock”), that may be issued as equity incentive awards (including incentive stock options) pursuant thereto from 600,000 shares to 900,000 shares of Common Stock;

|

| |

3.

|

to approve an amendment to our Amended and Restated Bylaws (the “Bylaws”) to give the Board, in its sole discretion, flexibility to set the number of directors to serve on our Board, with a minimum of four directors, and a maximum of seven directors;

|

| |

4.

|

to approve the ratification of Mazars LLP as our registered public accounting firm for the year ended June 30, 2024; and

|

| |

5.

|

transaction of such other business as may properly come before the meeting or any adjournment thereof.

|

The Board of Directors of the Company (the “Board of Directors” or the “Board”) has fixed the close of business on October 13, 2023 (the “Record Date”) as the record date for determining the shareholders entitled to notice of and to vote at the Annual Meeting and any adjournment and postponements thereof.

The Securities and Exchange Commission permits proxy materials to be furnished over the Internet rather than in paper form. Accordingly, most shareholders will receive a notice (the "Notice") regarding the availability of the Proxy Statement, Annual Report on Form 10-K for the fiscal year ended June 30, 2023 (the “Annual Report”), and other proxy materials (collectively, the “Materials”) via the Internet. This electronic process provides fast, convenient access to the Materials, reduces the impact on the environment and reduces our printing and mailing costs. If you received a Notice by mail, you will not receive a printed copy of the Materials in the mail. The Notice instructs you on how to access and review all of the important information contained in the Materials. The Notice also instructs you on how you may submit your vote over the Internet. If you would like to receive a printed copy of the Materials, please follow the instructions for requesting such materials included in the Notice. The Proxy Statement and this Notice are expected to be first sent or given to stockholders on or about October 27, 2023.

Whether you plan to attend the Annual Meeting or not, please vote by telephone or electronically via the Internet. Alternatively, if you received a paper copy, you may sign, and date the enclosed proxy card and return it without delay in the enclosed postage-prepaid envelope. If you do attend the Annual Meeting, you may withdraw your proxy and vote personally on each matter brought before the Annual Meeting.

|

October 27, 2023

|

By Order of the Board of Directors

S.W. Yong

Chairman and Chief Executive Officer

|

IMPORTANT

WHETHER OR NOT YOU PLAN TO ATTEND THE ANNUAL MEETING, YOU ARE REQUESTED TO VOTE PROMPTLY OVER THE INTERNET, BY TELEPHONE, OR IF YOU REQUESTED TO RECEIVE PRINTED PROXY MATERIALS, BY MAILING A PROXY OR VOTING INSTRUCTION CARD IN THE ENCLOSED POSTAGE-PREPAID RETURN ENVELOPE TO ENSURE YOUR REPRESENTATION AT THE ANNUAL MEETING.

THANK YOU FOR ACTING PROMPTLY

Important Notice Regarding the Availability of Proxy Materials for the Shareholder Meeting to be held on

December 11, 2023: The Proxy Statement and our 2023 Annual Report to Shareholders are available at

http://www.triotech.com/investors/, which does not have “cookies” that identify visitors to the site.

TABLE OF CONTENTS

Trio-Tech International

Block 1008 Toa Payoh North, Unit 03-09

Singapore 318996, Singapore

PROXY STATEMENT

FOR THE ANNUAL MEETING OF SHAREHOLDERS

OF

TRIO-TECH INTERNATIONAL

To Be Held on December 11, 2023

This proxy statement (“Proxy Statement”) is furnished in connection with the solicitation of the enclosed proxy (the “Proxy”) on behalf of the Board of Directors (the “Board”) of Trio‑Tech International, a California corporation (“Trio‑Tech”, or, the “Company”), for use at the 2023 annual meeting of shareholders of the Company (the “Annual Meeting”, or, the “Meeting”) to be held at our U.S. Corporate office, located at 16139 Wyandotte Street, Van Nuys, California 91406, on December 11, 2023 at 10.00 A.M. Pacific Standard Time.

For directions to our U.S. Corporate office, please email us at CRT.Reports@triotech.com.sg. The Notice, this Proxy Statement and the enclosed proxy card (the “Proxy Card”) are intended to be electronically available to shareholders on or about October 27, 2023.

Voting

The Board fixed the close of business on October 13, 2023 as the record date (“Record Date”) for shareholders entitled to notice of and to vote at the Annual Meeting. As of the Record Date, there were 4,096,680 shares of the Company’s common stock, no par value (the “Common Stock”), outstanding and entitled to vote, the holders of which are entitled to one vote per share.

The presence in person or by proxy of holders of one-third (1/3) of the shares entitled to vote at the Annual Meeting is necessary to constitute a quorum at the Annual Meeting. Abstentions and broker non-votes will be counted for purposes of determining the presence of a quorum. Broker non-votes occur when a shareholder who beneficially owns shares that are held in street name, that is through a broker, does not provide the broker with instructions on how to vote those shares on matters that are considered non-routine. Brokers can vote without instruction from the beneficial owners only on routine matters, such as the ratification of the appointment of our independent auditors. The election of directors, and Proposals 2 and 3 are non-routine matters and brokers are not authorized to vote on these matters without instruction.

Because a shareholder’s broker may not vote on behalf of the shareholder on the election of directors, or on Proposal 2, or Proposal 3 unless the shareholder provides specific instructions by completing and returning the voting instruction form, for a shareholder’s vote to be counted, we ask that our shareholders communicate their voting decisions to the broker or other nominee before the date of the Annual Meeting or give a proxy to vote their shares at the Annual Meeting.

Required Vote for Approval

The vote required for each proposal and the treatment and effect of abstentions and broker non-votes with respect to each proposal is as follows:

Proposal No. 1: Election of Directors. Directors are elected by a plurality of the votes cast, either in person or represented by proxy, and entitled to vote at the Annual Meeting. This means that the four persons receiving the highest number of “FOR” votes cast at the Annual Meeting by the shares present, either in person or by proxy, and entitled to vote will be elected to serve on our Board of Directors until our 2024 Annual Meeting of Shareholders, or until her or his successor is duly elected and qualified. Withholding authority to vote your shares with respect to one or more director nominees will have no effect on the election of those nominees. Broker non-votes are not considered votes cast and will also have no effect on the election of the nominees. Pursuant to California law, cumulative voting is available for the election of directors. Under cumulative voting, you would have four votes for each share of Common Stock you own. You may cast all of your votes for one candidate, or you may distribute your votes among different candidates as you choose. However, you may cumulate votes (cast more than one vote per share) for a candidate only if the candidate is nominated before the voting and at least one shareholder gives notice at the Annual Meeting, before the voting, that he or she intends to cumulate votes. If you do not specify how to distribute your votes, by giving your Proxy you are authorizing the proxyholders (the individuals named on your Proxy Card) to cumulate votes in their discretion. The four persons properly placed in nomination at the Annual Meeting and receiving the most affirmative votes will be elected as directors.

Proposal No. 2: Approval of an Amendment to our 2017 Director Equity Incentive Plan. Our Board unanimously approved an amendment to our Amended and Restated 2017 Director Equity Incentive Plan (the “2017 Directors Plan”), increasing the number of shares of the common stock authorized for issuance thereunder from 600,000 to 900,000 shares. The affirmative vote “FOR” vote of a majority of the votes present, in person or by proxy at the Annual Meeting, and entitled to vote on the matter, is required to approve the amendment to the 2017 Directors Plan. A properly executed proxy marked “ABSTAIN” will not be voted, although it will be counted as present and entitled to vote for purposes of this proposal. Accordingly, an abstention will have the effect of a vote against this proposal. A broker or nominee will not have discretionary authority to vote on this proposal because it is considered a non-routine matter. Accordingly, broker non-votes will have no effect on the outcome of this proposal.

Proposal No. 3: Approval of an Amendment to our Amended and Restated Bylaws. This proposal requests shareholders approve the amendment to our Amended and Restated Bylaws (the “Bylaws”), attached hereto as Appendix A (the “Amendment”), which, if approved, would give the Board, in its sole discretion, flexibility to set the number of directors to serve on our Board, from a minimum of four directors, to a maximum of seven directors. Currently, the Bylaws require stockholder approval to lower the number of directors serving on our Board and sets the number of directors serving on our board at five. Our Board unanimously approved the Amendment, subject to approval of the shareholders. The affirmative vote “FOR” vote of a majority of the shares outstanding and entitled to vote on the matter, is required to approve the Amendment. For this proposal, broker non-votes and abstentions will be counted as votes against this proposal.

Proposal No. 4: Ratification of Appointment of our Independent Registered Public Accounting Firm. This proposal requests shareholders to ratify the appointment of Mazars LLP as our independent registered public accounting firm for our current fiscal year ending June 30, 2024. The affirmative “FOR” vote of a majority of the votes present, either in person or by proxy, and entitled to vote on this matter at the Annual Meeting, is required for the ratification of the selection of Mazars LLP as our independent registered public accounting firm for our current fiscal year ending June 30, 2024. A properly executed proxy marked “ABSTAIN” will not be voted, although it will be counted as present and entitled to vote for purposes of the proposal. Accordingly, an abstention will have the effect of a vote against this proposal. A broker or other nominee will generally have discretionary authority to vote on this proposal because it is considered a routine matter, and therefore we do not expect broker non-votes with respect to this proposal. However, any broker non-votes received will have no effect on the outcome of this proposal.

Deadline for Voting by Proxy

In order to be counted, votes cast by proxy must be received prior to the Annual Meeting.

Revocation of Proxies

Any Proxy given may be revoked by the shareholder at any time before it is voted by delivering written notice of revocation to the Secretary of the Company, by filing with the Secretary of the Company a Proxy bearing a later date, or by attending the Annual Meeting and voting in person. All Proxies properly executed and returned will be voted in accordance with the instructions specified thereon. If no instructions are specified, Proxies will be voted (i) FOR the election of the four nominees for directors named under “Election of Directors” (“Proposal No. 1”); (ii) FOR the approval of the amendment to our 2017 Directors Equity Incentive Plan (“Proposal No. 2”); (iii) FOR the approval of the Amendment (“Proposal No. 3”); (iv) FOR the ratification of the appointment of Mazars LLP as our independent registered public accounting firm for our current fiscal year ending June 30, 2024 (“Proposal No. 4”); and (v) at the discretion of the proxy holders on any other matter that may properly come before the Annual Meeting or any adjournment or postponement thereof.

PROPOSAL NO. 1

ELECTION OF DIRECTORS

A majority of the independent directors of our Board have nominated the four persons listed below for election to the Board at the Annual Meeting, to hold office until the next annual meeting of shareholders, or until their respective successors are elected and qualified. There are currently five authorized seats on the Company’s Board. The Board has nominated four persons to fill the five authorized seats at this meeting. The Amendment proposed for adoption in Proposal No. 3, if approved, would allow the Board to fix the number of directors at four, removing the vacant seat on the Board. If Proposal No. 3 does not pass, the Board does not intend to fill the vacancy at this time due to the costs associated therewith. Should the Board choose to fill the vacancy in the future, but prior to the next annual meeting of stockholders, vacancies on the Board will be filled by the affirmative vote of a majority of the remaining directors then in office, even if less than a quorum is present, It is intended that the proxies received, unless otherwise specified, will be voted “FOR” the four nominees named below, all of whom are incumbent directors of the Company and, with the exception of Messrs. Yong and Ting, are “independent” as specified in Section 803 of the NYSE American (formerly The NYSE MKT) rules and Rule 10A-3 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). It is not contemplated that any of the nominees will be unable or unwilling to serve as a director but, should that occur, the persons designated as proxies will vote in accordance with their best judgment. In no event will proxies be voted for a greater number of persons than the number of nominees named in this Proxy Statement.

The following section sets forth certain information regarding the nominees for election as directors of the Company.

|

NAME

|

|

AGE

|

|

POSITIONS

|

|

S. W. Yong

|

|

70

|

|

Chairman and Chief Executive Officer

|

|

Richard M. Horowitz

|

|

82

|

|

Director

|

|

Victor H. M. Ting

|

|

69

|

|

Director

|

|

Jason T. Adelman

|

|

54

|

|

Director

|

S. W. Yong

Mr. Yong has served as a director, Chief Executive Officer and President of the Company since 1990 and was elected Chairman of the Board in September 2023. He joined Trio‑Tech International Pte. Ltd. in Singapore in 1976 and was appointed as its Managing Director in August 1980. Mr. Yong holds a Master’s Degree in Business Administration, a Graduate Diploma in Marketing Management and a Diploma in Industrial Management.

In determining that Mr. Yong should serve on the Company’s Board, the Board has considered, among other qualifications, his 47 years of history with the Company, his intimate knowledge of the Company’s business and operations and the markets in which the Company operates, as well as the Company’s customers and suppliers, and his detailed in-depth knowledge of the issues, opportunities, and challenges facing the Company and its principal industries.

Richard M. Horowitz

Mr. Horowitz has served as a director of the Company since 1990. He has been the President of Management Brokers Insurance, Inc. since 1974. Mr. Horowitz holds a Master’s Degree in Business Administration from Pepperdine University. Mr. Horowitz was the subject of a Securities and Exchange Commission (“SEC”) administrative proceeding arising out of the sale of certain annuity products in 2007 by Management Brokers Insurance, Inc. The proceeding was wholly unrelated to the Company’s business and was settled in March 2014 without requiring Mr. Horowitz to admit to any of the allegations. The Board believes that the proceeding and the actions alleged thereunder do not impinge upon Mr. Horowitz’s ability or integrity as a director of the Company.

In determining that Mr. Horowitz should serve on the Company’s Board, the Board has considered, among other qualifications, his extensive experience and expertise in administration and management based on his position as President of Management Brokers, Inc. for more than 49 years and his broad range of knowledge of the Company’s history and business through his 33 years of service as a director of the Company.

Victor H. M. Ting

Mr. Ting was appointed as a director of the Company on September 16, 2010, and served as Corporate Vice‑President and Chief Financial Officer of the Company from November 1992 until his retirement on June 30, 2022. Mr. Ting joined the Company as the Financial Controller for the Company’s Singapore subsidiary in 1980. He was promoted to the level of Business Manager in 1985, in December 1989 he was promoted to the level of Director of Finance and Sales & Marketing, and later he was promoted to the level of General Manager of the Singapore subsidiary. Mr. Ting holds a Bachelor of Accountancy Degree and Master’s Degree in Business Administration.

In determining that Mr. Ting should serve on the Company’s Board, the Board has considered, among other qualifications, his expertise in finance, accounting and management based on his 30 years of history as Vice‑President and Chief Financial Officer of the Company and his intimate knowledge of the Company’s operations.

Jason T. Adelman

Mr. Adelman was elected to the Board of the Company in April 1997. Mr. Adelman is the Founder and Chief Executive Officer of Burnham Hill Capital Group, LLC, a privately held financial services holding company headquartered in New York. Mr. Adelman also serves as the Managing Member of Cipher Capital Partners LLC, a private investment fund. Prior to founding Burnham Hill Capital Group, LLC in 2003, Mr. Adelman served as the Managing Director of Investment Banking at H.C. Wainwright and Co., Inc. Mr. Adelman currently serves on the Board of Oblong, Inc. Mr. Adelman graduated Cum Laude with a B.A. in Economics from the University of Pennsylvania and earned a JD from Cornell Law School where he served as Editor of the Cornell International Law Journal.

In determining that Mr. Adelman should serve on the Company’s Board, the Board has considered, among other qualifications, his experience and expertise in finance, accounting, banking and management based on his positions as Chief Executive Officer of Burnham Hill Capital Group LLC for 20 years, as the Managing Member of Cipher Capital Partners LLC as well as his position as Managing Director of Investment Banking in the New York offices of H. C. Wainwright & Co.

Required Vote and Recommendation

At the recommendation of the Nominating and Corporate Governance Committee, the Board has nominated Messrs. S. W. Yong, Richard M. Horowitz, Victor H. M. Ting and Jason T. Adelman, each for a one-year term. Directors are elected by a plurality of the votes cast, either in person or represented by proxy, and entitled to vote at the Annual Meeting. This means that the four persons receiving the highest number of “FOR” votes cast at the Annual Meeting by the shares present, either in person or by proxy, and entitled to vote will be elected to serve on our Board of Directors until our 2024 Annual Meeting of Shareholders, or until her or his successor is duly elected and qualified. Withholding authority to vote your shares with respect to one or more director nominees will have no effect on the election of those nominees. Broker non-votes are not considered votes cast and will also have no effect on the election of the nominees. Unless otherwise instructed or unless authority to vote is withheld, shares represented by executed proxies will be voted “FOR” the election of the nominees.

The Board recommends that shareholders vote “FOR” the election of Messrs. S. W. Yong, Richard M. Horowitz, Victor H. M. Ting and Jason T. Adelman.

PROPOSAL NO. 2

APPROVAL OF AMENDMENT TO 2017 DIRECTORS EQUITY INCENTIVE PLAN

On December 4, 2017, shareholders approved the adoption of the 2017 Directors Equity Incentive Plan (“2017 Directors Plan”). The purpose of the 2017 Directors Plan is to create an incentive for members to serve on the Board of Directors of the Company and contribute to its long-term growth and profitability objectives. Up to 300,000 shares of Common Stock (subject to adjustment in the event of stock splits and other similar events) were initially issuable pursuant to awards granted under the 2017 Directors Plan. An amendment to the 2017 Directors Plan was approved by the Board on October 27, 2020 and by shareholders on December 8, 2020, increasing the authorized shares issuable under the 2017 Directors Plan to 600,000 shares.

The Board of Directors believes that the 2017 Directors Plan has proved to be of substantial value in stimulating the efforts of members of the Board of Directors by aligning a portion of their compensation with the interest of the shareholders of the Company. As of October 13, 2023, there remained only 80,000 shares available for grant under the 2017 Directors Plan. Thus, on October 11, 2023, the Board of Directors adopted an amendment to the 2017 Directors Plan, subject to shareholder approval, to increase the number of shares available for grant under the 2017 Directors Plan from 600,000 shares to 900,000 shares of Common Stock. No other changes are proposed to be made to the terms of Directors Plan.

A summary of the principal provisions of the 2017 Directors Plan is set forth below:

Description of the 2017 Directors Equity Incentive Plan

The 2017 Directors Plan provides for the grant to directors of the Company of stock options or restricted stock awards to purchase up to 600,000 shares of Common Stock (the “Shares”). The 2017 Directors Plan is administered by the Board or a committee of the Board (the “Administrator”). The person eligible to participate (the “Participant”) in the 2017 Directors Plan are the duly elected directors of the Company. The Administrator determines the meaning and application of the provisions of the 2017 Directors Plan and related option agreements.

Options granted under the 2017 Directors Plan may only be nonqualified options. The exercise price of each option granted under the 2017 Directors Plan must be 100% of the fair market value of the underlying shares on the date of grant. Fair market value will be determined as provided in the 2017 Directors Plan, which valuation methodology is intended to come within the parameters of Section 409A of the Internal Revenue Code of 1986, as amended (the “Code”) and the regulations thereunder. Each option may be fully exercisable on the date of the grant and has a term of five years from the date of the grant. Options granted under the 2017 Directors Plan are in addition to the cash fee paid to each Director. Generally, options may be exercised only by the individual to whom the option is granted, and are not transferable or assignable, except that in the event of a Participant’s death or legal disability, the Participant’s heirs or legal representatives may exercise the options for a period not to exceed twelve months.

Options will cease to be exercisable, except for a director who has served as a non-employee on the Board for more than five years, within thirty days after termination of the Participant’s services as a director, other than upon termination due to death, disability or retirement or upon termination for cause. Options will be exercisable within twelve months of death or disability and within three months of retirement. Upon termination for cause, a director’s options will terminate immediately.

With the approval of the Board or an appropriate committee, a director may be granted one or more restricted stock awards under the 2017 Directors Plan. Such awards will be grants of shares on such terms and conditions, consistent with the other provisions of the Plan, as may be determined by the Board or the committee and set forth in a restricted stock agreement with the directors. To date, no restricted stock awards have been granted.

The Board may terminate or amend the 2017 Directors Plan without the approval of the Company’s shareholders, but shareholder approval is required in order to amend the 2017 Directors Plan to increase the number of shares, to change the class of person eligible to participate in the Plan, to extend the maximum five-year exercise period or to permit an option exercise price to be fixed at less than 100% of the fair market value as of the date of grant.

The amount of shares reserved for issuance under the 2017 Directors Plan and the terms of outstanding options will be adjusted in the event of changes in the outstanding Common Stock by reason of stock dividends, stock splits, reverse stock splits, split-ups, consolidations, recapitalizations, reorganizations or like events.

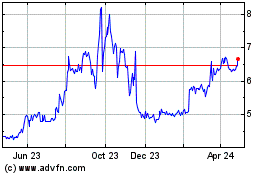

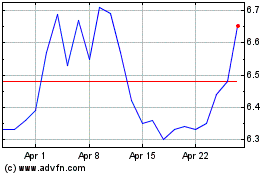

The closing sales price of the Company’s Common Stock as reported on the NYSE American on October 13, 2023 was $6.82.

Certain Federal Income Tax Consequences

The following is a brief summary of the principal federal income tax consequences to the Company and an eligible person (who is a citizen or resident of the United States for U.S. federal income tax purposes) of options and restricted stock awards granted under the 2017 Directors Plan. The summary is not intended to be exhaustive and, among other things, does not describe state, local or foreign tax consequences. The federal income tax consequences of an eligible person’s award under the 2017 Directors Plan are complex, are subject to change and differ from person to person. Each Participant should consult with his or her own tax adviser as to his or her own particular situation.

This discussion is based on the Code, Treasury Regulations promulgated under the Code, Internal Revenue Service rulings, judicial decisions and administrative rulings as of the date of this Proxy Statement, all of which are subject to change or differing interpretations, including changes and interpretations with retroactive effect. No assurance can be given that the tax treatment described herein will remain unchanged at the time that grants of stock options and/or restricted stock are made under the 2017 Directors Plan.

Options. A Participant generally recognizes no taxable income as the result of the grant of a nonqualified option. Upon exercise of such a nonqualified option, the Participant generally recognizes ordinary income in an amount equal to the excess of the fair market value of the shares on the date of exercise over the option price paid for such shares. Upon the sale of stock acquired by the exercise of a nonqualified option, any gain or loss, based on the difference between the sale price and the amount recognized as ordinary income upon exercise of the option, will be taxed as short-term or long-term capital gain or loss, depending upon the length of time the Participant has held the stock from the date of exercise. No tax deduction is available to the Company upon either the grant of the option or the sale of stock acquired pursuant to the exercise of such option. The Company is entitled to a deduction at the time the option is exercised in an amount equal to the amount of ordinary income recognized by the Participant upon exercise of the option. Special rules apply under Section 16(b) of the Exchange Act if a participant exercises an option within six months of the date of grant.

Under the terms of the 2017 Directors Plan, all options must be granted with an exercise price per share equal to the fair market value of a share of the Company’s Common Stock on the grant date. The final Treasury Regulations under Section 409A exclude from the provisions of that section any stock options granted with an exercise price of not less than the fair market value of the stock on the grant date, provided that the number of shares subject to the option is fixed on the date of grant. The stock options granted pursuant to the 2017 Directors Equity Incentive Plan are intended to be exempt from Section 409A, and the 2017 Directors Plan contains definitions of “fair market value” and “grant date” that are consistent with those set forth in the Treasury Regulations under Section 409A. As a result, nonqualified options granted pursuant to the 2017 Directors Plan should not be subject to the accelerated income tax and excise tax provisions of Section 409A of the Code.

Restricted Stock Issuances. As long as restricted stock remains both nontransferable and subject to a substantial risk of forfeiture, there are generally no tax consequences resulting from the issuance of such restricted stock for either the Participant or the Company. At such time as the restricted stock either becomes transferable or is no longer subject to a substantial risk of forfeiture, the Participant will recognize ordinary income in an amount equal to the excess of the fair market value of the stock at such time over the amount, if any, that the recipient paid for the stock. However, the Participant may elect under Section 83(b) of the Code, within 30 days after the issuance of such restricted stock, to recognize as ordinary income at the time of issuance the excess, if any, of the fair market value of such restricted stock (valued at the date of issuance as if it were unrestricted) over the amount that the recipient paid for it, as ordinary income. The Company will be entitled to a compensation deduction at the time the Participant recognizes ordinary income equal to the amount of ordinary income recognized by the Participant. If such an election under Section 83(b) is made and the stock is ultimately forfeited, the Participant will not be entitled to a deduction for the amount previously recognized as ordinary income.

When stock that was formerly restricted stock is sold or otherwise disposed of, the tax treatment will depend on whether the Participant made the election described in the previous paragraph. If the Participant did not make the election, disposition of the stock will result in a long or short term capital gain or loss, depending on the length of time from the date the restrictions lapsed to the date of sale or other disposition, in an amount equal to the difference between the amount received on disposition and the sum of any amount paid by the Participant for the restricted stock and the amount recognized by the Participant as ordinary income on the date the restrictions lapsed. If the Participant made the election, disposition of the stock will result in a long or short term capital gain or loss, depending on the length of time from the date of the restricted stock issuance to the date of disposition, in an amount equal to the difference between the amount received on disposition and the sum of any amount paid by the Participant for the restricted stock and the amount recognized by the recipient as ordinary income at the time of the grant.

The final Treasury Regulations under Section 409A exclude from the provisions of that section any restricted stock issued subject to a substantial risk of forfeiture, regardless of whether the recipient makes an election under Section 83(b). As a result, restricted stock issued pursuant the 2017 Directors Plan should not be subject to the accelerated income tax and excise tax provisions of Section 409A of the Code.

Required Vote and Recommendation

An affirmative vote of the holders of at least a majority of the shares present, in person or represented by proxy, and entitled to vote on this Proposal No. 2 at the Annual Meeting is required to adopt the amendment to the 2017 Directors Incentive Plan increasing the number of shares reserved for issuance thereunder from 600,000 shares to 900,000 shares. A properly executed proxy marked “ABSTAIN” will not be voted, although it will be counted as present and entitled to vote for purposes of this proposal. Accordingly, an abstention will have the effect of a vote against this proposal. Broker non-votes will have no effect on the outcome of the vote for this proposal.

The Board recommends that shareholders vote “FOR” the approval of the amendment to the 2017 Director’s Incentive Plan to increase the number of shares reserved for issuance thereunder from 600,000 shares to 900,000 shares of Common Stock.

PROPOPAL NO. 3

APPROVAL OF THE AMENDMENT TO THE COMPANY’S AMENDED AND RESTATED BYLAWS

We are asking our shareholders to approve an amendment to our Amended and Restated Bylaws (the “Amendment”). The Amendment, if approved, would give the Board, in its sole discretion, flexibility to set the number of directors to serve on our Board, from a minimum of four directors to a maximum of seven directors.

Current Bylaw Provision

Currently, Section 3.01 of our Bylaws states that the number of directors serving on our Board must be no less than four and no more than seven, with the exact number set at 5, and that the exact number of directors may only be amended by the vote or written consent of the holders of a majority of the outstanding shares entitled to vote. In addition, Article IX, Section 1 of our Bylaws re-states the requirement to obtain stockholder approval to change the Company’s fixed number of directors.

Summary of Bylaw Amendment and Background

On October 11, 2023, our Board approved, subject to approval by our stockholders at the Annual Meeting, an amendment to Section 3.01 and Section 9.02 of our Bylaws to allow our Board, in its sole discretion, to determine the number of authorized directors. Article III, Section 2 will be amended to read as follows (additions are indicated by underlining and deletions are indicated by strikeouts):

Section 3.01 NUMBER OF DIRECTORS. The authorized number of directors shall be between not less than four and nor more than seven; until changed by a duly adopted amendment to the Articles of Incorporation or written consent of the holders of a majority of the outstanding shares entitled to vote; provided that an amendment reducing the number or the minimum number of directors to a number less than five cannot be adopted if the votes cast against its adoption at a meeting of the shareholders, or the shares not consenting in the action of a written consent, are equal to or more than 16-2/3% of the outstanding shares entitled to vote. No amendment may change the stated maximum number of authorized directors to a number greater than two times the stated minimum number of directors minus one provided that the minimum number or maximum number, or both, may be increased or decreased from time to time by an amendment to these Bylaws duly adopted in accordance with these Bylaws, Section 212 of the California Corporations Code, and other applicable law. The exact number of directors shall be 5 until changed as provided in this Section 2 fixed, within the limits set forth in this Section, by the Board of Directors or shareholders.

Also, Section 9.02 of the Bylaws will be amended as follows:

Section 9.02 AMENDMENT BY DIRECTORS. Subject to the rights of shareholders as provided by Section 9.01 of these Bylaws, bylaws, other than a bylaw or an amendment of a bylaw changing the authorized number of directors may be adopted, amended or repealed by the board of directors under, and any limitations imposed by, the California Corporations Code, the board of directors may adopt, amend, or repeal bylaws.

Reasons for Amendment

The amendment to Section 3.01 and Section 9.02 was approved by the Board to, among other things, provide flexibility to better enable us to quickly and efficiently accommodate our needs of our Board in the future, particularly as it relates to diversity of background, represented communities and skillsets of our directors.

A copy of the Amendment is attached as Appendix A to this Proxy Statement, and a copy of the Second Amended and Restated Bylaws, which incorporates the Amendment and restates the Bylaws, is attached as Appendix B to this Proxy Statement.

The Board has determined that adopting the Amendment is advisable and in the best interests of the Company and our shareholders and has directed that it be submitted to our shareholders for approval. If approved, the Bylaws, as amended by the Amendment, would become effective immediately upon approval by shareholders.

Required Vote and Recommendation

In accordance with our Bylaws, the approval of the Amendment described in this Proposal No. 3 requires the affirmative vote of a majority of our outstanding shares of common stock entitled to vote as of the Record Date. Broker non-votes and abstentions will be counted as votes against this Proposal No. 3. Unless otherwise instructed on the proxy or unless authority to vote is withheld, shares represented by executed proxies will be voted “FOR” the approval of the Amendment.

The Board recommends that shareholders vote “FOR” approval of the Amendment to allow our Board, in its sole discretion, to determine the number of authorized directors.

PROPOSAL NO. 4

RATIFICATION OF THE APPOINTMENT OF MAZARS LLP TO SERVE AS OUR

REGISTERED PUBLIC ACCOUNTING FIRM FOR THE CURRENT FISCAL YEAR

Upon recommendation of the Audit Committee, our Board appointed Mazars LLP (“Mazars”) as our independent registered public accounting firm for the current fiscal year ending June 30, 2024, and hereby recommends that the shareholders ratify such appointment.

The Board may terminate the appointment of Mazars as the Company’s independent registered public accounting firm without the approval of the Company’s shareholders whenever the Board deems such termination necessary or appropriate.

Representatives of Mazars will be present at the Annual Meeting or available by telephone and will have an opportunity to make a statement if they so desire and to respond to appropriate questions from shareholders.

The following table presents fees billed by Mazars for professional services rendered for the fiscal years ended June 30, 2023 and 2022:

| |

|

2023

|

|

|

2022

|

|

|

Audit fees

|

|

$ |

238,388 |

|

|

$ |

201,577 |

|

|

Tax fees

|

|

|

10,972 |

|

|

|

11,051 |

|

|

All other fees

|

|

|

6,497 |

|

|

|

5,950 |

|

|

Total

|

|

$ |

255,857 |

|

|

$ |

218,578 |

|

Audit Fees

The amounts set forth opposite “Audit Fees” above reflect the aggregate fees billed by Mazars or to be billed for professional services rendered for the audit of the Company’s annual financial statements for each of the fiscal years ended June 30, 2023 (“Fiscal 2023”), and 2022 (“Fiscal 2022”), respectively, and for the review of the financial statements included in the Company’s quarterly reports during such periods.

Tax Fees

The amounts set forth opposite “Tax Fees” above reflect the aggregate fees billed for Fiscal 2023 and Fiscal 2022 for professional services rendered for tax compliance and return preparation. The compliance and return preparation services consisted of the preparation of original and amended tax returns and support during the income tax audit or inquiries.

The Audit Committee’s policy is to pre-approve all audit services and all non-audit services that our independent accountants are permitted to perform for us under applicable federal securities regulations. The Audit Committee’s policy utilizes an annual review and general pre-approval of certain categories of specified services that may be provided by the independent accountant, up to pre-determined fee levels. Any proposed services not qualifying as a pre-approved specified service, and pre-approved services exceeding the pre-determined fee levels, require further specific pre-approval by the Audit Committee. The Audit Committee has delegated to the Chairman of the Audit Committee the authority to pre-approve audit and non-audit services proposed to be performed by the independent accountants. Since June 30, 2004, all services provided by our auditors require pre-approval by the Audit Committee. The policy has not been waived in any instance.

All Other Fees

The amounts set forth opposite “All Other Fees” above reflect the aggregate fees billed for Fiscal 2023 and Fiscal 2022 for professional services rendered for the Information Technology (“IT”) audit. This is to ensure rigorous IT controls are in place for maintaining an appropriate internal controls over financial reporting.

Auditor Independence

Our Audit Committee and our full Board of Directors considered that the work done for us in Fiscal 2023 and Fiscal 2022, respectively, by Mazars was compatible with maintaining Mazars independence.

Required Vote and Recommendation

Ratification of the selection of Mazars LLP as the Company’s independent registered public accounting firm for our fiscal year ending June 30, 2024 requires the affirmative vote of a majority of the shares present, either in person or represented by proxy, and entitled to vote on this Proposal No. 4 at the Annual Meeting. A properly executed proxy marked “ABSTAIN” will not be voted, although it will be counted as present and entitled to vote for purposes of this Proposal No. 4. Accordingly, an abstention will have the effect of a vote against this Proposal No. 4. A broker or other nominee will generally have discretionary authority to vote on this Proposal No. 4 because it is considered a routine matter, and therefore we do not expect broker non-votes with respect to this Proposal No. 4. However, any broker non-votes received will have no effect on the outcome of this Proposal No. 4.

Unless otherwise instructed on the proxy or unless authority to vote is withheld, shares represented by executed proxies will be voted “FOR” the ratification of Mazars as the Company’s independent registered public accounting firm for our fiscal year ending June 30, 2024.

Even if the selection is ratified, the Audit Committee in its discretion may direct the appointment of a different independent registered public accounting firm at any time during the year if the Audit Committee determines that such a change would be in the best interests of our Company and our shareholders.

The Board recommends that shareholders vote “FOR” the ratification of the selection of Mazars LLP as our independent registered public accounting firm for our fiscal year ending June 30, 2024.

CORPORATE GOVERNANCE

Corporate Governance Program

Our Board has established a written Corporate Governance Program to address significant corporate governance issues that may arise. It sets forth the responsibilities and qualification standards of the members of the Board and is intended as a governance framework within which the Board, assisted by its committees, directs our affairs.

Policy Against Hedging Stock

Our policy prohibits our directors, officers, and other employees, and their designees, from engaging in short sales or from hedging transactions of any nature that are designed to hedge or offset a decrease in market value of such person’s ownership of the Company’s equity securities.

Code of Ethics

The Company has adopted a written code of business conduct and ethics applicable to all directors, officers, management and employees. A copy of the Company's code of business conduct and ethics may be obtained, without charge, upon written request to the Secretary of the Company at Block 1008 Toa Payoh North #03-09 Singapore 318996. The Code of Ethics is available on the Company’s website at: https://triotech.com/aboutus/

Board Leadership Structure

Our Board has discretion to determine whether to separate or combine the roles of Chairman of the Board and Chief Executive Officer. Our Chairman and Chief Executive Officer, Mr. Yong, has served in executive roles and as a Director of the Company since 1990, and was elected Chairman of the Board in September 2023. Our Board believes that his combined role is advantageous to the Company and its shareholders. A number of factors support the leadership structure chosen by the Board, including, without limitation, Mr. Yong’s possession of in-depth knowledge of the Company, as well as the issues, opportunities and risks facing us, our business and our industry and is best positioned to fulfill the combined role to more effectively execute the Company’s strategic initiatives and business plans, as well as develop meeting agendas that focus the Board’s time and attention on critical matters and to facilitate constructive dialogue among Board members on strategic issues.

In addition to Mr. Yong’s leadership, the Board maintains effective independent oversight through a number of governance practices, including, open and direct communication with management, input on meeting agendas, and regular executive sessions.

Risk Management

The Chief Executive Officer, Chief Financial Officer, and senior management are primarily responsible for identifying and managing the risks facing the Company, and the Board oversees these efforts. The Chief Executive Officer and Chief Financial Officer report to the Board regarding any risks identified and steps the Company is taking to manage those risks. In addition, the Audit Committee identifies, monitors and analyzes the priority of financial risks, and reports to the Board regarding its financial risk assessments.

Certain Relationships and Related Transactions

The Board’s Audit Committee is responsible for review, approval, or ratification of “related-person transactions” between the Company or its subsidiaries and related persons. Under SEC rules, a related person is a director, officer, nominee for director, or 5% shareholder of the Company and their immediate family members. The Company's code of business conduct and ethics provides guidance to the Audit Committee for addressing actual or potential conflicts of interests that may arise from transactions and relationships between the Company and its executive officers or directors. Potential conflicts relating to other personnel must be addressed by the Chief Executive Officer or the Chief Financial Officer. There were no related party transactions during Fiscal 2023 for which disclosure would be required under SEC rules.

BOARD MEETINGS AND COMMITTEES

The Board held 15 regularly scheduled and special meetings during Fiscal 2023. All of the directors attended (in person or by telephone) at least 75% of the meetings of the Board and any committees of the Board on which they served during the last full fiscal year. Directors are expected to use their best efforts to be present at the Annual Meeting of Shareholders. All of our directors attended the Annual Meeting of Shareholders held on December 7, 2022.

The Company does not have a standing nominating committee. The Board consists of five directors, three of whom are “independent” (as defined under the rules of the NYSE American upon which the Company’s securities are listed), including A. Charles Wilson, Richard M. Horowitz and Jason T. Adelman. Pursuant to a resolution adopted by the Board, a majority of the independent directors, following a discussion with the entire Board, has the sole and ultimate responsibility to determine and nominate Board candidates for election at the Annual Meeting. Although nominations are made by a majority of the independent directors, the three current independent directors value the input of the entire Board and thus discuss proposed nominees at the Board level before the ultimate nomination determinations are made by the independent directors. The Board does not believe that it is necessary, at this time, given the Board composition and such Board resolution, to have a separately constituted nominating committee. At such time as the Board composition changes, the Board may elect to establish a separate nominating committee.

The Board has also adopted a resolution addressing the nomination process and related matters and it states, among other things, that the Board believes that the continuing service of qualified incumbents promotes stability and continuity in the boardroom, contributing to the Board's ability to work as a collective body, while giving the Company the benefit of the familiarity and insight into the Company's affairs that its directors have accumulated during their tenure. The resolution further states that the Board will evaluate the performance of its Board members on an annual basis in connection with the nomination process. The Board may solicit recommendations for nominees from persons that the Board believes are likely to be familiar with qualified candidates, including without limitation members of the Board and management of the Company. The Board may also determine to engage a professional search firm to assist in identifying qualified candidates if the need arises. In addition, the Board has the authority to retain third-party consultants to provide advice regarding compensation issues. The Board has not adopted specific minimum qualifications for a position on the Company’s Board or any specific skills or qualities that the Board believes are necessary for one or more of its members to possess. However, the Board will consider various factors including without limitation the candidate’s qualifications, the extent to which the membership of the candidate on the Board will promote diversity among the directors, and such other factors as the Board may deem to be relevant at the time and under the then existing facts and circumstances. The Company does not have a formal policy with regard to the consideration of diversity in identifying nominees for director. The Board seeks to nominate directors with a variety of skills and experience so that the Board will have the necessary expertise to oversee the Company’s business. The Company did not receive any recommendations as to nominees for election of directors for the Annual Meeting of Shareholders to be held on December 11, 2023.

The Board will consider candidates proposed by shareholders of the Company and will evaluate all such candidates upon criteria similar to the criteria used by the Board to evaluate other candidates. Shareholders desiring to propose a nominee for election to the Board must do so in writing sufficiently in advance of an annual meeting so that the Board has the opportunity to make an appropriate evaluation of such candidate and his or her qualifications and skills and to obtain information necessary for preparing all of the disclosures required to be included in the Company’s proxy statement for the related meeting should such proposed candidate be nominated for election by shareholders. Shareholder candidate proposals should be sent to the attention of the Secretary of the Company at Block 1008 Toa Payoh North #03-09 Singapore 318996.

The Board has a standing Compensation Committee, which currently consists of the three independent directors: A. Charles Wilson, Richard M. Horowitz, and Jason T. Adelman serving as Chairman of the Compensation Committee. The Compensation Committee determines salary and bonus arrangements. The Compensation Committee met 4 times during Fiscal 2023. The Compensation Committee has a written charter, available on the Company’s website at https://triotech.com/aboutus/. For Fiscal 2023, the Compensation Committee did not retain a third-party consultant to review the Company’s current policies and procedures with respect to executive compensation.

The Board has a separately designated standing Audit Committee established in accordance with Section 3(a)(58)(A) of the Exchange Act. The members thereof consist of A. Charles Wilson, Jason T. Adelman, and Richard M. Horowitz, Chairman of the Audit Committee. The Board has determined that the Audit Committee has at least one financial expert, A. Charles Wilson. The Board has affirmatively determined that Mr. Wilson does not have a material relationship with the Company that would interfere with the exercise of independent judgment and is “independent” as independence is defined in Section 803 of the rules of the NYSE American. Pursuant to its written charter, which charter was adopted by the Board, and is available at https://triotech.com/aboutus/, the Audit Committee is charged with, among other responsibilities, selecting our independent public accountants, reviewing our annual audit and meeting with our independent public accountants to review planned audit procedures. The Audit Committee also reviews with the independent public accountants and management the results of the audit, including any recommendations of the independent public accountants for improvements in accounting procedures and internal controls. The Audit Committee held 7 meetings during Fiscal 2023. Each of the members of the Audit Committee satisfies the independence standards specified in Section 803 of the rules of the NYSE American and Rule 10A-3 under the Exchange Act.

REPORT OF THE AUDIT COMMITTEE

During the fiscal year ended June 30, 2023, the Audit Committee fulfilled its duties and responsibilities as outlined in its charter. The Audit Committee reviewed and discussed the Company’s audited consolidated financial statements and related footnotes for the fiscal year ended June 30, 2023, and the independent auditor’s report on those financial statements, with the Company’s management and Mazars LLP, the Company’s independent auditor. Management presented to the Audit Committee that the Company’s financial statements were prepared in accordance with accounting principles generally accepted in the United States of America. The Audit Committee has discussed with Mazars LLP the matters required to be discussed by the applicable requirements of the Public Company Accounting Oversight Board and the Securities and Exchange Commission. The Audit Committee’s review included a discussion with management and the independent auditor of the quality (not merely the acceptability) of the Company’s accounting principles, the reasonableness of significant estimates and judgments, and the disclosures in the Company’s financial statements, including the disclosures relating to critical accounting policies.

The Audit Committee recognizes the importance of maintaining the independence of the Company’s independent auditor, both in fact and appearance. The Audit Committee has evaluated Mazars LLP’s qualifications, performance, and independence, including that of the lead audit partner. As part of its auditor engagement process, the Audit Committee considers whether to rotate the independent audit firm. The Audit Committee has established a policy pursuant to which all services, audit and non-audit, provided by the independent auditor must be pre-approved by the Audit Committee or its delegate. The Company’s pre-approval policy is more fully described in this Proxy Statement under the heading “Independent Registered Public Accounting Firm.” The Audit Committee has concluded that provision of the non-audit services described in that section is compatible with maintaining the independence of Mazars LLP. In addition, the Audit Committee has received the written disclosure and the letter from Mazars LLP required by the applicable requirements of the Public Company Accounting Oversight Board regarding Mazars LLP’s communications with the Audit Committee concerning independence and has discussed with Mazars LLP its independence.

Based on the above-described review, written disclosures, letter and discussions, the Audit Committee recommended to the Board of the Company that the audited financial statements for the fiscal year ended June 30, 2023 be included in the Company’s Annual Report on Form 10-K.

Dated October 27, 2023

THE AUDIT COMMITTEE

Richard M. Horowitz, Chairman

A. Charles Wilson

Jason T. Adelman

DIRECTOR COMPENSATION

Our directors play a critical role in guiding our strategic direction and overseeing our management. In order to compensate them for their substantial time commitment, we provide a mix of cash and equity-based compensation. We do not provide pension or retirement plans for non-employee directors. S.W. Yong does not receive separate cash compensation for Board service as he is an employee director.

During Fiscal 2023, Richard M. Horowitz, Victor H.M. Ting and Jason T. Adelman, as non‑employee directors, received quarterly fees in an amount equal to $9,000 for each quarter and for service on the various committees of which they are a member. A. Charles Wilson, as a non-employee director, Chairman of the Board, Chairman of the Audit Committee and Chairman of the Compensation Committee until October 2023, received $18,000 in quarterly fees for each quarter and for service on the various committees of which he was a member. The directors were also reimbursed for out-of-pocket expenses incurred in attending meetings.

Each of our directors is entitled to participate in our Directors Plan. Mr. Yong, as an employee of the Company, is entitled to participate in our 2017 Employee Stock Option Plan (the “2017 Employee Plan”) rather than the 2017 Directors Plan. On March 22, 2023, pursuant to the 2017 Directors Plan, Mr. Wilson was granted an option to purchase 40,000 shares, and Messrs. Horowitz, Adelman and Ting each were granted an option to purchase 20,000 shares of Common Stock at an exercise price of $4.51 per share. Each such option vested immediately upon grant and will terminate five years from the date of grant unless terminated sooner upon termination of the optionee’s status as a director or otherwise pursuant to the 2017 Directors Plan. The exercise price under the options was set at 100% of fair market value (as defined in the 2017 Directors Plan) of the Company’s Common Stock on the date of grant of each such option. Information regarding the option grant to Mr. Yong is described under the section titled EXECUTIVE COMPENSATION below.

As of June 30, 2023, there were 80,000 shares available for grant under the 2017 Directors Plan and 267,500 shares available for grant under the 2017 Employee Plan.

The Compensation Committee reviewed the average directors’ fees for comparable public companies. The Compensation Committee believes that the director fees paid to its directors were and are substantially less than the fees paid to directors of comparable public companies. Directors’ compensation may be increased based on the profitability of the Company.

The following table contains information on compensation for our non-employee members of our Board for Fiscal 2023.

DIRECTOR COMPENSATION

|

Name

|

|

Fees Earned

or Paid in

Cash ($)

|

|

|

Option

Awards ($)(1)

|

|

|

Total ($)

|

|

|

A. Charles Wilson (2)

|

|

|

72,000 |

|

|

|

85,200 |

|

|

|

157,200 |

|

|

Richard M. Horowitz (3)

|

|

|

36,000 |

|

|

|

42,600 |

|

|

|

78,600 |

|

|

Victor H.M. Ting (4)

|

|

|

36,000 |

|

|

|

42,600 |

|

|

|

78,600 |

|

|

Jason T. Adelman (5)

|

|

|

36,000 |

|

|

|

42,600 |

|

|

|

78,600 |

|

| |

(1)

|

The option awards are based on the fair value of stock options on the grant date computed in accordance with Financial Accounting Standards Board Accounting Standards Codification Topic 718, Compensation – Stock Compensation (“ASC Topic 718”).

|

| |

(2)

|

The total number of shares underlying option awards held by Mr. Wilson outstanding as of June 30, 2023 were 200,000.

|

| |

(3)

|

The total number of shares underlying option awards outstanding held by Mr. Horowitz as of June 30, 2023 were 100,000.

|

| |

(4)

|

The total number of shares underlying option awards outstanding held by Mr. Ting as of June 30, 2023 were 40,000.

|

| |

(5)

|

The total number of shares underlying option awards outstanding held by Mr. Adelman as of June 30, 2023 were 80,000.

|

EXECUTIVE OFFICERS

The following persons were our only executive officers as of October 13, 2023:

S. W. Yong – Mr. Yong, age 70, is the Company’s Chairman and Chief Executive Officer. Biographical information regarding Mr. Yong is set forth under the section entitled “Election of Directors.”

Anitha Srinivasan – Ms. Srinivasan, age 44, was appointed as the Company’s Chief Financial Officer effective July 1, 2022. Ms. Srinivasan, a Chartered Accountant and a Certified Internal Auditor, has over twenty years of diversified experience in areas of audit, finance and corporate consulting. Ms. Srinivasan has been a consultant to the Company for more than the past 5 years and served as the Internal Audit Team Leader of the Company. She had been employed by the Company from 2006 to 2012. She holds a Bachelor’s Degree in Commerce from the University of Madras, India. She is a member of The Institute of Singapore Chartered Accountants, The Institute of Chartered Accountants of India and The Institute of Internal Auditors.

Hwee Poh Lim – Mr. Lim, age 64, is the Company’s Senior Corporate Vice President and Chief Operating Officer (Testing Group). Mr. Lim joined the Company in 1982 and became the Quality Assurance Manager in 1985. He was promoted to the position of Operations Manager in 1988. In 1990 he was promoted to Business Manager and was responsible for the Malaysian operations in Penang and Kuala Lumpur. Mr. Lim became the General Manager of the Company’s Malaysia subsidiary in 1991. In February 1993, all test facilities in Southeast Asia came under Mr. Lim’s responsibility. He holds diplomas in Electronics & Communications and Industrial Management and a Master’s Degree in Business Administration. He was appointed Corporate Vice‑President‑Testing in July 1998. He was promoted to Senior Corporate Vice President and Chief Operating Officer (Testing Group) in January 2023.

S. K. Soon – Ms. Soon, age 65, joined Trio-Tech Singapore in 1981 and became the Personnel and Administration Manager in 1985. In 1991, she was promoted to Group Logistics Manager and was responsible for the overall logistics and human resources functions for our operations. Effective July 1, 2015, she was appointed as Corporate Vice-President and currently oversees the Company’s Logistics and Human Resources functions.

EQUITY COMPENSATION PLAN INFORMATION

The Company’s 2017 Employee Plan and 2017 Directors Plan were approved by the Board on September 14, 2017, and approved by shareholders on December 4, 2017. An amendment to the 2017 Employee Plan was approved by the Board on October 20, 2021 and by shareholders on December 8, 2021. An amendment to the 2017 Directors Plan was approved by the Board on October 27, 2020 and by shareholders on December 8, 2020. The purpose of these two plans is also to enable the Company to attract and retain top-quality employees, officers, directors and consultants and to provide them with an incentive to enhance shareholder return as well as contributing to the Company’s long-term growth and profitability objectives.

The following table provides information as of June 30, 2023 with respect to the following compensation plans of the Company under which equity securities of the Company are authorized for issuance:

EQUITY COMPENSATION PLAN INFORMATION

| |

|

Number of

securities to be

issued upon

exercise of outstanding

options

|

|

|

Weighted

average exercise

price of

outstanding

options

|

|

|

Number of

securities

remaining

available for

future issuance

under equity compensation

plans (excluding securities

reflected in

|

|

|

Plan Category

|

|

(a)

|

|

|

(b)

|

|

|

column (a))

|

|

|

Equity compensation plans approved by shareholders:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2017 Employee Plan

|

|

|

216,375 |

|

|

$ |

4.89 |

|

|

|

267,500 |

|

|

2017 Directors Plan

|

|

|

420,000 |

|

|

$ |

4.91 |

|

|

|

80,000 |

|

|

Total

|

|

|

636,375 |

|

|

|

|

|

|

|

347,500 |

|

COMPENSATION DISCUSSION AND ANALYSIS

The Compensation Committee

The Compensation Committee reviews and approves corporate goals and objectives relating to the compensation of the Chief Executive Officer; reviews goals and objectives of other executive officers; establishes the performance criteria (including both long-term and short-term goals) to be considered in light of those goals and objectives; evaluates the performance of the executives; determines and approves the compensation level for the Chief Executive Officer; and reviews and approves compensation levels of other key executive officers.

Compensation Objectives

The Company operates in a highly competitive and rapidly changing industry. The key objectives of the Company’s executive compensation programs are to:

| |

●

|

attract, motivate and retain executives who drive the Company’s success and industry leadership;

|

| |

●

|

provide each executive, from Vice-President to Chief Executive Officer, with a base salary based on the market value of that role, and the individual’s demonstrated ability to perform that role;

|

| |

●

|

motivate executives to create sustained shareholder value by ensuring all executives have an “at risk” component of total compensation that reflects their ability to influence business outcomes and financial performance.

|

What Our Compensation Program is Designed to Reward

Our compensation program is designed to reward each individual executive officer’s contribution to the advancement of the Company’s overall performance and execution of our goals, ideas and objectives. It is designed to reward and encourage exceptional performance at the individual level in the areas of organization, creativity and responsibility while supporting the Company’s core values and ambitions. This in turn aligns the interest of our executive officers with the interests of our shareholders, and thus with the interests of the Company.

Determining Executive Compensation

The Compensation Committee reviews and approves the compensation program for executive officers annually after the closing of each fiscal year. Reviewing the compensation program at such time allows the Compensation Committee to consider the overall performance of the past fiscal year and the financial and operating plans for the upcoming fiscal year in determining the compensation program for the upcoming fiscal year.

The Compensation Committee also annually reviews market compensation levels with comparable jobs in the industry to determine whether the total compensation for our officers remains in the targeted median pay range. This assessment includes evaluation of base salary, annual incentive opportunities, and long-term incentives for the key executive officers of the Company. The Company did not hire any compensation consultants in connection with setting executive compensation for Fiscal 2023.

The Compensation Committee’s compensation decisions are based on the Company’s operational performance, the performance and contribution of each individual officer, and the compensation budget and objectives of the Company. The Compensation Committee also considers other factors, such as the experience and potential of the officer and the market compensation level for a similar position.

Role of Executive Officers in Determining Executive Compensation

The Compensation Committee determines compensation for the Chief Executive Officer, which is based on different factors, such as level of responsibility and contributions to the performance of the Company. The Chief Executive Officer recommends the compensation for the Company's executive officers (other than the compensation of the Chief Executive Officer) to the Compensation Committee. The Compensation Committee reviews the recommendations made by the Chief Executive Officer and determines the compensation of the Chief Executive Officer and the other executive officers. The Chief Executive Officer is not present during voting on, or deliberations concerning, his compensation.

Components of Executive Compensation

The Company’s compensation program has three major components: (1) base annual salary; (2) potential annual cash incentive awards that are based primarily on financial performance of the Company or its relevant business operating units; and (3) long-term incentive compensation in the form of stock options.

Base Salary

Base salaries are provided as compensation for day-to-day responsibilities and services to the Company and to meet the objective of attracting and retaining the talent needed to run the business.

Base salary for our executive officers was determined utilizing various factors.

One factor that was taken into account in determining base salary for our executive officers was the compensation policies of other companies comparable in size to and within substantially the same industry as the Company. Keeping our executive officers’ salaries in line with the market ensures the Company’s competitiveness in the marketplace in which the Company competes for talent.

Another factor taken into account in determining base salary for our executive officers was salaries paid by us to our executive officers during the immediately preceding year and increases in the cost of living.

The salary for each of our Named Executive Officers for the year ended June 30, 2023 and the percentage increase in their salary from the prior fiscal year’s salary were as follows:

|

Executives (1)

|

|

Base Salary

|

|

|

Percent

Increased (2)

|

|

|

S. W. Yong, Chairman and Chief Executive Officer

|

|

$ |

272,109 |

|

|

|

0.81 |

%

|

|

Anitha Srinivasan, Chief Financial Officer (3)

|

|

$ |

106,386 |

|

|

|

- |

%

|

|

Hwee Poh Lim, Senior Corporate Vice President and Chief Operating Officer (Testing Group)

|

|

$ |