Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

October 25 2023 - 6:05AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN ISSUER

PURSUANT TO RULE 13a-16 OR 15b-16 OF

THE SECURITIES EXCHANGE ACT OF 1934

For the month of October 2023

Commission File Number 001-35991

AENZA S.A.A.

(Exact name of registrant as specified in its charter)

N/A

(Translation of registrant’s name into English)

Republic of Peru

(Jurisdiction of incorporation or organization)

Av. Petit Thouars 4957

Miraflores

Lima 34, Peru

(Address of principal executive offices)

Indicate by check mark whether the registrant files

or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ☒ Form 40-F ☐

October 24, 2023

Pursuant to the provisions of Article 30 of the

Securities Market Law, Sole Ordered Text approved by Supreme Decree No. 020-2023-EF, and the Regulation of Relevant and Reserved Information,

approved by Resolution SMV No. 005-2014-SM/01, we hereby communicate the following, as a Relevant Information Communication:

By means of the General Shareholders’ Meeting

of AENZA S.A.A. (the “Company”), held on this date, on first call, it was agreed the following:

| 1. | Capital increase by new monetary contributions and consequent amendment of the Company’s by-laws. |

The following was approved with the

favorable vote of 99.324% of the subscribed shares with voting rights represented at the Meeting:

| a) | To increase the capital by new monetary contributions in local currency up to an amount equivalent to

US$ 22,500,000, with the corresponding issuance of new common shares, with voting rights, of a par value of S/ 1.00 each, at a unit placement

value equal to S/ 0.4971, in order to use the funds from said capital increase for the partial repayment of the Company’s financial obligations

and, in general, to strengthen the equity of the Company and/or its subsidiaries; and, |

| b) | To delegate to the Board of Directors sufficient powers to: (1) determine the terms and conditions for

the exercise of the preemptive subscription right in accordance with the provisions of applicable laws, including the establishment of

the record date and delivery date, as well as the trading term of the preemptive subscription certificates, and the power to determine

the procedure to be followed in the event that shares remain to be subscribed after the preemptive subscription rounds, including the

possibility of offering the shares to third parties; (2) to fix the exchange rate applicable for the conversion of the monetary contributions

from U.S. Dollars to Soles, considering market values; (3) establish the form of representation of the securities to be issued, in accordance

with the provisions of the applicable laws; (4) determine whether provisional share certificates will be issued and establish the delivery

date for this purpose; (5) establish the amount by which the capital will be increased after the share subscription procedure is concluded;

(6) establish the delivery date for the issuance of shares; (7) establish the new wording of article 5 of the bylaws, which must reflect

the results of the share subscription procedure; and, (8) approve, determine or execute, as well as authorize the Management to approve,

determine or execute, any term, condition or complementary act that may be convenient or necessary in order to formalize and perfect the

capital increase, and delegate to the Management any or all of the powers granted to it, all without requiring additional approval from

the General Shareholders’ Meeting or the Board of Directors, if applicable. |

| 2. | Exercise of pre-emptive subscription rights. |

The following was approved with the

favorable vote of 99.324% of the subscribed shares with voting rights represented at the Meeting:

| a) | That the preemptive subscription right be exercised in two rounds, under the terms set forth in the General

Corporations Law, the Single Ordered Text of the Securities Market Law, approved by Supreme Decree No. 093-2002-EF, and the Securities

Law, Law No. 27287 and those established by the Board of Directors by virtue of the delegation of powers approved in the first agenda

item of the Meeting (numeral 1(b) above); and, |

| b) | That the preemptive subscription certificates to subscribe the shares of the Company that are created

within the framework of the approved capital increase, as well as the shares that are issued from the exercise of the preemptive subscription

right and those that are issued as a result of a potential private offering of the remaining shares that are not subscribed after the

end of the preemptive subscription rounds, be issued to comply with the legal mandate established in the aforementioned provisions, and

not be registered or offered in the United States of America or to persons of said country, according to the details explained by the

Board of Directors. |

| 3. | Delegation and granting of powers to formalize agreements. |

With the favorable vote of 99.324%

of the subscribed voting shares represented at the Meeting, shareholders approved the appointment of Mr. Dennis Fernando Fernandez Armas,

Vice President of People, Public Affairs and Shared Services, identified with ID No. 15971076 and Ms. Zoila María Horna Zegarra,

Corporate Legal Vice President, identified with ID No. 10220900, so that either of them, acting individually, may formalize the resolutions

adopted by the Shareholders’ Meeting.

We hereby certify that the preemptive subscription

certificates resulting from the capital increase approved at the Meeting, as well as the shares to be issued upon exercise of the subscription

rights included in such certificates and those to be issued as a result of a potential private placement of the remaining shares that

are not subscribed after the end of the preemptive subscription rounds, have not been and will not be registered under the U.S. Securities

Act of 1933, as amended, or under the securities laws of any state or jurisdiction outside of Peru.

In this regard, the securities issued will be

available to investors only in Peru in accordance with the provisions of applicable Peruvian legislation (Ley General de Sociedades, Ley

Nº 26887, Ley del Mercado de Valores, Texto Único Ordenado aprobado por Decreto Supremo Nº 020-2023-EF y Ley de Títulos

Valores, Ley Nº 27287), as amended from time to time, and may not be offered, sold, resold, transferred, delivered or distributed,

directly or indirectly, in or into the United States of America under the securities laws of that country or in other jurisdictions where

this is prohibited. In addition, the shares to be issued may not be offered, sold or subscribed for except in a transaction that is exempt

from, or not subject to, the registration requirements of the U.S. Securities Act of 1933.

This communication is not an offer to sell or

a solicitation of an offer to buy any securities in the United States of America or to U.S. persons.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

AENZA S.A.A.

| By: |

/s/ CRISTIAN RESTREPO HERNANDEZ |

|

| Name: |

Cristian Restrepo Hernandez |

|

| Title: |

VP of Corporate Finance |

|

| Date: |

October 24, 2023 |

|

3

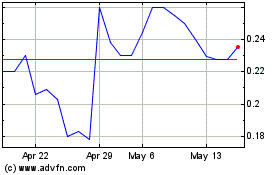

Gold Flora (PK) (USOTC:GRAM)

Historical Stock Chart

From Mar 2024 to Apr 2024

Gold Flora (PK) (USOTC:GRAM)

Historical Stock Chart

From Apr 2023 to Apr 2024