UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

14A

(Rule 14a - 101)

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ |

Preliminary Proxy Statement |

| ☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a - 6(e)(2)) |

| ☒ |

Definitive Proxy Statement |

| ☐ |

Definitive Additional Materials |

| ☐ |

Soliciting Material Pursuant to §240.14a - 12 |

SHUTTLE

PHARMACEUTICALS HOLDINGS INC.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other

Than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

| |

☒ |

No fee required. |

| |

☐ |

Fee paid previously with preliminary materials. |

| |

☐ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a–6(i)(1) and 0–11 |

| |

|

|

SHUTTLE

PHARMACEUTICALS HOLdIngS InC.

2023 Annual Meeting of Stockholders

October 20, 2023

Letter to Shareholders

Dear Shareholders,

Following the Company’s successful initial public

offering, the priority for Shuttle Pharma’s leadership team has been focused on advancing the development of Ropidoxuridine, our

clinical phase radiation sensitizer. The active pharmaceutical ingredient (API) was manufactured under good manufacturing practice (GMP)

by TCG GreenChem, Inc. and the University of Iowa Pharmaceuticals, Inc. formulated the drug product, producing 25,000 capsules to enable

the planned Phase II clinical trial. To advance the testing of Ropidoxuridine sensitization of glioblastoma brain tumors to radiation

therapy, pre-IND regulatory guidance has been received from the FDA to inform the final preparation of the chemical manufacturing and

control (CMC) processes and the clinical protocol design. To provide regulatory support for the investigational new drug (IND) application,

the final clinical protocol development and clinical trial monitoring, we have engaged the clinical research organization (CRO), Theradex

Oncology, with the expectation of completing IND and clinical protocol submission and FDA review in Q4 of 2023 to initiate protocol enrollment.

Our leadership team has been supported

by the addition of senior consultants; Gary Russo, PhD, providing pharmacology and FDA filings expertise, and Steven Bayern, providing

business development expertise and advice. To address the need for laboratory support to test protocol related clinical specimens, we

have moved from the previously leased incubator laboratories to 2,209 sq ft of leased research offices and laboratory space in Gaithersburg,

MD. Pre-clinical cellular studies will be performed in these laboratories, while in vivo studies will be performed by contract with Dr.

Alejandro Villagra at Georgetown University.

Our intellectual properties continue to receive approvals

in the U.S., Canada and internationally, numbering more than 22 approved patents to date. This intellectual property was discovered in

Shuttle Pharma laboratories and is owned by the Company. The HDAC6 selective inhibitors are the next priority for pre-IND enabling and

testing in a Phase I clinical trial. In addition, we have collaborated with Georgetown University to submit patent applications for “Predictive

biomarkers of radiation late effects.” We have completed negotiations with Georgetown University for exclusive license of the patent

for development of a diagnostic test of patients undergoing radiation therapy for prostate cancers.

As you may be aware, financial markets continue to

be erratic, restricting access to the public capital markets. Our plans for use of capital will be prioritized on expediting the Phase

II clinical trial of Ropidoxuridine and we will continue with a project targeted capital raise as well as applications for non-dilutive

funding through the NIH SBIR program.

I thank our shareholders, members of the board of

directors, leadership team and employees for their continued support of the Company. I look forward to meeting the scheduled scientific

milestones in the coming year.

Sincerely,

/s/ Anatoly Dritschilo, MD

Anatoly Dritschilo, MD

CEO and Chairman of the Board of Directors

Shuttle Pharmaceuticals Holdings, Inc.

Notice of Annual Meeting of Stockholders of Shuttle

Pharmaceuticals Holdings, Inc.

|

|

|

|

|

| DATE AND TIME |

|

VIRTUAL MEETING |

|

RECORD DATE |

| Monday, December 18, 2023 at 12:00 P.M. EST |

|

This year’s meeting will be held online

at: www.virtualshareholdermeeting.com/SHPH2023 |

|

October 19, 2023 |

| ITEMS OF BUSINESS |

|

BOARD VOTING RECOMMENDATION |

| Proposal No. 1: Elect six (6) Directors named in the attached Proxy Statement to serve until the 2024 Annual Meeting of Stockholders. |

|

FOR each director nominee |

| Proposal

No. 2: To ratify appointment of FORVIS LLP as the Company’s independent auditor for the fiscal year ending December

31, 2023. |

|

FOR |

| Proposal No. 3: To approve (on an advisory basis) the Company’s executive compensation. |

|

FOR |

| Proposal No. 4: To transact any other business as may properly be presented at the Annual Meeting or any adjournment thereof. |

|

|

This notice, proxy statement and voting instructions

are being mailed to stockholders beginning on or about October 20, 2023.

Your vote

is important

Regardless of whether you plan to attend the live

meeting, we encourage you to vote as soon as possible in one of the following ways:

| /s/ Anatoly Dritschilo |

|

| Anatoly Dritschilo, MD |

|

| CEO & Chairman |

|

Important Notice Regarding the Availability of Proxy Materials

for the Stockholder Meeting to Be Held on December 18, 2023. Our Proxy Statement is available online on our website at https://shuttlepharma.com/.

For further information about the Company, including copies of our audited financial statements for the periods ended December 31, 2022

and December 31, 2021, please see our annual report on Form 10-K filed with the Securities and Exchange Commission, or the SEC, on March

15, 2023, as well as any other SEC filings made since that date.

Table of Contents

Proxy Summary

About the

Meeting

|

DATE AND TIME

December 18, 2023 at 12:00 P.M. EST

MEETING

You can attend the annual meeting virtually via the Internet by visiting

www.virtualshareholdermeeting.com/SHPH2023. |

RECORD DATE

October 19, 2023

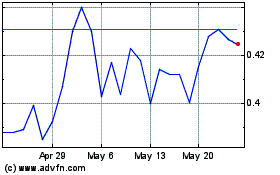

STOCK EXCHANGE

The common stock of Shuttle Pharmaceuticals is listed on The Nasdaq Capital

Market under the symbol “SHPH.” |

| PROXY VOTING |

|

|

|

|

| Internet |

Meeting |

Phone |

Mail |

| Visit the web site listed on your proxy card |

Vote at the Annual Meeting online at www.virtualshareholdermeeting.com/SHPH2023 |

Call the telephone number on your proxy card |

Sign, date and return your proxy card in the enclosed envelope |

| PROPOSAL 1: ELECTION OF DIRECTORS |

|

| |

|

| The Board of Directors recommends that you vote FOR each director nominee. These individuals bring a range of relevant experiences and overall diversity of perspectives that is essential to good governance and leadership of our company. |

| |

| PROPOSAL 2: RATIFICATION OF INDEPENDENT PUBLIC ACCOUNTING FIRM |

|

| |

|

| The Board of Directors recommends that you vote FOR the ratification of the Company’s independent auditor, FORVIS LLP. |

| |

| PROPOSAL 3: EXECUTIVE COMPENSATION |

|

| |

|

| The

Board of Directors recommends that you vote FOR approval of the Company’s executive compensation plan, on an advisory basis.

We believe the existing executive compensation structure for our named executive officers, as presented herein, is fair and

in the best interest of the Company’s executives and stockholders alike. |

introduction

to our Board of Directors

| |

|

|

|

|

|

Committee Memberships |

| Name and Position |

|

Age |

|

Other Public Board

Memberships |

|

Audit |

|

Compensation |

|

Nominating

& Corporate

Governance |

|

ANATOLY DRITSCHILO, MD

CEO & CHAIRMAN |

|

79 |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

MILTON BROWN, MD, PhD

DIRECTOR |

|

57 |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

CHRISTOPHER H.

SENANAYAKE, PhD

INDEPENDENT DIRECTOR |

|

65 |

|

|

|

M |

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

STEVEN RICHARDS

INDEPENDENT DIRECTOR |

|

54 |

|

|

|

C |

|

M |

|

C |

| |

|

|

|

|

|

|

|

|

|

|

|

JOSHUA SCHAFER

INDEPENDENT DIRECTOR |

|

52 |

|

|

|

|

|

C |

|

M |

| |

|

|

|

|

|

|

|

|

|

|

|

BETTE JACOBS, PhD

INDEPENDENT DIRECTOR |

|

72 |

|

|

|

M |

|

|

|

M |

C = Chair | M = Member

Compensation

Highlights

| |

|

WHAT WE DO |

|

| |

|

| |

Our Board of Directors has established standing committees in connection with the discharge of its responsibilities. These committees include an Audit Committee, a Compensation Committee, and a Nominating and Corporate Governance Committee. Our Board of Directors has adopted written charters for each of these committees. Copies of the charters are available on our website at www.shuttlepharma.com. Our Board of Directors may establish other committees as it deems necessary or appropriate from time to time. |

| |

|

WHAT WE DO NOT DO |

|

| |

|

| |

|

|

| |

● |

We do not allow repricing of stock options without stockholder approval. |

| |

● |

We do not provide change of control payments or gross-up of related excise taxes. |

| |

● |

Dividend equivalents will not be paid unless vesting and performance conditions for Restricted Stock Units (RSUs), to which such rights attach, are met. |

| |

● |

We do not provide significant perquisites to our named executive officers. |

Board of Directors and Corporate Governance

Below is biographical information about each of our

Directors:

Anatoly Dritschilo, M.D. Dr.

Dritschilo is a co-founder of the Company and has served as Chief Executive Officer and Chairman of the Board of Directors since the Company’s

formation in December 2012. Dr. Dritschilo is a radiation oncologist by training and has held multiple leadership positions in health

care. At Georgetown University Medical School in Washington, D.C., he served principally as Department Chair from 1980 to 2022; Chief

of Radiation Oncology at MedStar-Georgetown University Hospital from 2005 to 2022; Medical Director of Georgetown University Hospital

from 1994 to 1997; and Interim Director of the NCI-funded Lombardi Comprehensive Cancer Center from 2005 to 2007. He has also served on

the boards of directors of MedStar-Georgetown University Hospital, the National Capital Rehabilitation Hospital, and the MedStar Health

Research Institute. Previously, he was a founding director of Oncomed, Inc. and a member of the board of directors of Neopharm, Inc. His

250+ scientific publications and 12 issued patents have earned him election as a Fellow of the National Academy of Inventors. Dr. Dritschilo

holds a Bachelor of Science degree in Chemical Engineering from the University of Pennsylvania, a medical degree from the College of Medicine

of New Jersey and residency training from the Harvard, Joint Center for Radiation Therapy. His qualifications support his service as our

Chief Executive Officer and Chairman of the Board of Directors.

Milton Brown, M.D., Ph.D., FNAI. Dr.

Brown is a co-founder of our Company, previously served as our Chief Scientific Officer for Chemistry, and has served a member of our

Board of Directors since the Company’s formation in December 2012. Since August 2022, Dr. Brown has also served as Vice Dean of

Research, Professor of Internal Medicine and the Prudence and Louis Ryan endowed chair in translational research at Eastern Virginia Medical

School. Previously, he was Director of the Center for Drug Discovery at the George Mason University from 2020 to 2022 and Director of

the Inova Center for Drug Discovery and Development from 2016 to 2020. Dr. Brown was a founder of Rivanna Pharmaceuticals in 2004 and

co-founder, Chairman and CEO of Trocar Pharma in 2020, both of which are Virginia-based biopharmaceutical companies engaged in the discovery

and development of novel small molecule therapeutics for the treatment of neurological, oncological, and infectious diseases. Dr. Brown

has also served as Director of the Drug Discovery Center at Georgetown University Medical School from 2012 to 2016 and principal investigator

of the NIH/NCI funded Chemical Diversity Center from 2010 to 2015. Dr. Brown brings to Shuttle Pharma 25 years of experience in drug discovery

with over 100 publications and 67 issued patents, including discovery of novel HDAC inhibitors. Dr. Brown was a 2015 recipient of the

Percy Julian Award by the National Organization of Black Chemists and Chemical Engineers for significant contributions in pure and/or

applied research in science. He has served on government committees including the NIH Experimental Therapeutics Study Section, the NIH

Drug Discovery and Molecular Pharmacology Study Section and was a scientific counselor to the U.S. Secretary of Health. Dr. Brown holds

a Ph.D. in synthetic chemistry from the University of Alabama, and an M.D. from the University of Virginia. He is an elected fellow of

the National Academy of Inventors (FNAI). His extensive experience and expertise in drug discovery makes him uniquely qualified to guide

the company’s drug discovery program as a member of our Board of Directors.

Chris H.

Senanayake, Ph.D. Dr. Senanayake was appointed to be a member of the Company’s Board of Directors in 2021. In 2019, Dr. Senanayake

founded TCG GreenChem, Inc., a U.S. subsidiary of TCG Lifesciences Pvt. Ltd., a leading global Contract Research and Manufacturing Services

(CRAMS) company in the area of drug discovery, development and commercialization, where he serves as chief executive officer. Dr. Senanayake

has more than 30 years of pharmaceutical industry experience, making him an invaluable asset to Shuttle Pharma’s mission as the

Company advances its pharmaceutical candidates in clinical trials. He has held positions of Senior Scientist at Dow Chemical, and Research

Fellow at Merck & Co, Inc. (from 1990 to 1996), Director and Executive Director of Process Research at Sepracor, Inc. (1996 to 2002),

Director of Chemical Development and Vice President of Chemical Development for Boehringer Ingelheim Pharmaceuticals, Inc. In 2018, he

was appointed as the CEO of Asta GreenChem, Inc in Richmond VA and Astatech (Chengdu) Biopharmaceuticals Corp. in China. He has a record

of leading and delivering high complexity APIs for manufacturing. Dr. Senanayake participated in development activities of many drugs,

including multi-billion-dollar blockbuster drugs, such as Crixivan, Lunesta, Jardiance, Formotorol, Desvenlafaxine and other drug candidates.

He is co-author of 425 scientific publications and is co-inventor of more than 150 patents. Dr. Senanayake received his Ph.D. in synthetic

organic chemistry at Wayne State University, where he developed the total synthesis of complex natural products and completed the first

total synthesis of grosshemin in the guaianolide family. In his postdoctoral fellowship, he conducted total synthesis of polyol systems

such as amphotericin B, compactin and C-nucleosides. We believe Dr. Senanayake’s

detailed and in-depth experience as an executive and developer of pharmaceuticals will enable him to provide value to us by introducing

potential joint venture partners, as well as enhancing our oversight through his in-depth understanding of and experience in the pharmaceuticals

industry.

Steven Richards.

Mr. Richards was appointed to be a member of our Board of Directors in 2019. He is CEO and Founder of Endurance Media, a media finance

company based in Santa Monica, California, that launched in 2014 with a strategic alliance with eOne Entertainment and a mandate to produce

and finance commercially driven feature films. From 2006 to 2014, Mr. Richards served as Co-President and Chief Operating Officer of Silver

Pictures where he oversaw all business activities and managed a team of more than 20 people responsible for film development, production,

and financial information. From 2000 to 2006, he served as Chief Financial Officer at Silver Pictures and from 1995 to 2000 as Vice President,

Finance, at Silver Pictures. Mr. Richards holds an MBA in Finance from UCLA, a BBA in accounting from Temple University, and holds his

CPA license. We believe his experience as a chief financial officer and his knowledge of accounting will assist in providing guidance

and oversight to our Board of Directors as we grow our Company.

Joshua Schafer. Mr.

Schafer was appointed to be a member of our Board of Directors in 2019. From January 2023 until present, Mr. Schafer has been serving

as the Chief Commercial Officer, and EVP Business Development at Zevra Therapeutics, a rare disease company. From November 2022 until

January 2023, Mr. Schafer was interim CEO and Chair of the board of directors at PHARNEXT, an entity he has served on the board of directors

since July 2020. From December 2020 until November 2022, Mr. Schafer served as Senior Vice President and General Manager, Autoimmune and

Rare Disease Business for Mallinckrodt Pharmaceuticals Incorporated. In addition, he served as Chief Strategy and Business Development

Officer from September 2019 until December 2020, and from 2015 to September 2019 he was SCP of Business Development and General Manager

of International Operations at Mallinckrodt Pharmaceuticals. From 2009 until 2015, he served as Vice President and Oncology Therapeutic

Area Head at Astellas Pharmaceuticals Incorporated, where he was responsible for building the company’s global oncology franchise.

From 2000 until 2009, Mr. Schafer served in positions of increasing seniority at Takeda Pharmaceuticals North America, including Manager

and Senior Manager, New Product and New Business Development; Senior Product Manager, Gastrointestinal Marketing; and Director, Oncology

and Renal Marketing and Commercial Development. He began working in the healthcare and pharmaceutical industry in 1998 and has served

in various positions including management consulting at Accenture (formerly Anderson Consulting), G.D. Searle & Co. (later acquired

by Pfizer) and Cognia Corporation. He received his Bachelor of Arts in Biology and German at the University of Notre Dame, his MS in Biotechnology

from Northwestern University and his MBA from Northwestern University. We believe Mr. Schafer’s extensive experience in pharmaceutical

strategy, marketing and business development will assist our Board of Directors’ oversight role as we build and develop our Company.

Bette Jacobs,

Ph.D. Dr. Jacobs was appointed to be a member of the Company’s Board of Directors in October 2022. Dr. Jacobs is an experienced

researcher, administrator, and businesswoman currently serving as a professor in the department of health systems administration at Georgetown

University and as a distinguished scholar at the O’Neill Institute for National and Global Health Law. Dr. Jacobs holds her Ph.D.

from the University of Texas and is noted for her groundbreaking transdisciplinary and cross-sector work in systems design. As

a voting member of the Cherokee Nation, she has lifetime involvement in equity programs and has testified before Congress. In addition

to serving on several start-up boards, Dr. Jacobs founded the National Coalition of Ethnic Minority Nurse Associations funded by the NIH

National Institute of General Medical Sciences. Prior to her current role at Georgetown, she served as dean at the Georgetown School of

Nursing and Health Studies, vice president for Honda of America Manufacturing, associate director of applied research at UAB Civitan International

Research Center and acting dean of graduate studies and research at California State University. She has been a fellow and visiting professor

at the University of Oxford and an academic guest scholar and lecturer at several acclaimed universities worldwide. Her wealth of experience

in research, administration and serving on boards coupled with her unique background and perspectives makes her ideally suited to serving

as a member of our Board of Directors.

Family Relationships

There are no family relationships

among our directors.

BOARD DIVERSITY

matrix

We believe that our Board

of Directors should consist of individuals reflecting the diversity represented by our employees and the communities in which we operate.

The below table provides information related to the composition of members and nominees of the Board of Directors. Each of the categories

listed in the below table has the meaning as it is used in Nasdaq Rule 5605(f).

| Total Number of Directors: Six |

|

Female |

|

Male |

|

Non-Binary |

|

Did Not Disclose Gender |

| Part I: Gender Identity |

|

|

|

|

|

|

|

|

| Directors |

|

1 |

|

5 |

|

- |

|

- |

| Part II: Demographic Background |

|

|

|

|

|

|

|

|

| African American or Black |

|

- |

|

1 |

|

- |

|

- |

| Alaskan Native or Native American |

|

1 |

|

- |

|

- |

|

- |

| Asian |

|

- |

|

1 |

|

- |

|

- |

| Hispanic or Latinx |

|

- |

|

- |

|

- |

|

- |

| Native Hawaiian or Pacific Islander |

|

- |

|

- |

|

- |

|

- |

| White |

|

- |

|

3 |

|

- |

|

- |

| Two or More Races or Ethnicities |

|

- |

|

- |

|

- |

|

- |

| LGBTQ+ |

|

- |

|

|

|

|

|

|

| Did Not Disclose Demographics Background |

|

- |

|

|

|

|

|

|

nominees

for Director

|

Anatoly Dritschilo, M.D.

Chief Executive Officer and Chairman |

|

Age: 79

Director since: December 2012

Committees: N/A |

| |

|

|

|

Milton Brown, MD, Ph.D., FNAI

Chief Scientific Officer and Director |

|

Age: 57

Director since: December 2012

Committees: N/A |

| |

|

|

|

Chris H.

Senanayake, Ph.D.

Independent Director |

|

Age: 65

Director since: January 2021

Committees: Audit Committee Member |

| |

|

|

|

Steven Richards

Independent Director |

|

Age: 54

Director since: December 2012

Committees: Chair of Audit Committee, Chair of Corporate Governance

Committee and Compensation Committee Member |

| |

|

|

|

Joshua Schafer

Independent Director |

|

Age: 52

Director since: May 2019

Committees: Chair of Compensation Committee and Corporate Governance

Committee Member |

| |

|

|

|

Bette Jacobs, Ph.D.

Independent Director |

|

Age: 72

Director since: October 2022

Committees: Audit Committee Member and Corporate Governance Committee

Member |

Director

Independence

As of the date of this proxy statement, Steven Richards,

Dr. Chris H. Senanayake, Joshua Schafer, and Dr. Bette Jacobs are our independent directors. As a Nasdaq listed company, we believe that

the foregoing directors satisfy the definition of “Independent Director” under Nasdaq Rule 5605(a)(2). In making this determination,

our Board of Directors considered the relationships that each of these non-employee directors has with us and all other facts and circumstances

our Board of Directors deemed relevant in determining their independence. As required under applicable Nasdaq rules, we anticipate that

our independent directors will meet on a regular basis as often as necessary to fulfill their responsibilities, including at least annually

in executive session without the presence of non-independent directors and management.

Board Leadership

Structure

Dr. Dritschilo holds the positions of Chief Executive

Officer and Chairman of the Board of Directors of the Company. The Board of Directors believes that Dr. Dritschilo’s services as

both Chief Executive Officer and Chairman of the Board is in the best interest of the Company and its stockholders. Through his extensive

educational and professional experiences, Dr. Dritschilo possesses detailed and in-depth knowledge of the issues, opportunities and challenges

facing us in our business and is thus best positioned to develop agendas that ensure that the Board of Directors’ time and attention

are focused on the most critical matters relating to the Company’s operation. His combined role enables decisive leadership, ensures

clear accountability, and enhances the Company’s ability to communicate its message and strategy clearly and consistently to our

stockholders, employees, and collaborators.

The Board of Directors has not designated a lead independent

director. The independent directors can call and plan their executive sessions collaboratively and, between meetings of the Board of Directors,

communicate with management and one another directly. Under these circumstances, the independent directors believe designating a lead

independent director to take on responsibility for functions in which they all currently participate might detract from rather than enhance

performance of their responsibilities as independent director.

The Board of Directors receives regular reports from

the Chief Executive Officer and members of senior management on operational, financial, legal, and regulatory issues and risks. The Audit

Committee of the Board of Directors additionally is charged under its charter with oversight of financial risk, including the Company’s

internal controls, and it receives regular reports from management and the Company’s independent auditor. Whenever a committee of

the Board of Directors receives a report involving risk identification, risk management or risk mitigation, the chairman of the relevant

committee reports on that discussion, as appropriate, to the full Board of Directors during the next meeting of the Board of Directors.

Board Meetings

and Committees

The Board of Directors held four meetings

and held seven actions by written consent during the year ended December 31, 2022. During 2022, all directors attended 100% of the meetings

of the Board of Directors and board committees of which the director was a member. Our Board of Directors has become substantially more

active during the process of preparing to go public and becoming public, holding a total of five meetings in 2022, along with multiple

committee meetings. Below is the current make-up of each of the committees of our Board of Directors:

| AUDIT |

|

COMPENSATION |

|

NOMINATING

&

CORPORATE GOVERNANCE |

|

Steven Richards (Chair)

Chris H. Senanayake, Ph.D.

Bette Jacobs, Ph.D. |

|

Joshua M. Schafer, MBA (Chair)

Steve Richards |

|

Steve Richards (Chair)

Joshua M. Schafer, MBA

Bette Jacobs, Ph.D. |

Our Board of Directors has established

three committees consisting of an Audit Committee, a Compensation Committee, and a Nominating and Corporate Governance Committee. The

members of each committee qualify as “independent” as defined under Nasdaq listing standards and Rule 10A-3(b)(1) of the

Securities Act of 1933, as amended (the “Securities Act”). Moreover, at least one member of the Audit Committee qualifies

as an “audit committee financial expert” as the term is defined under Nasdaq listing standards and applicable rules and regulations

of the SEC, based on his respective business and professional experience in the financial and accounting fields.

Audit Committee. According to its charter,

the Audit Committee is to consist of at least three members, each of whom shall be a non-employee director who has been determined by

the Board of Directors to meet the independence requirements under Nasdaq rules, and also Rule 10A-3(b)(1) of the Securities Act, subject

to the exemptions provided in Rule 10A-3(c). A copy of our Audit Committee Charter is located under the “Investor Relations-Governance”

tab on our website at www.shuttlepharma.com. At present, the Audit Committee, which consists of Steve Richards, MBA, CPA (Chair), Dr.

Chris H. Senanayake, and Dr. Bette Jacobs, assists our Board of Directors in its oversight of the Company’s accounting and financial

reporting processes and the audits of the Company’s financial statements, including (a) the quality and integrity of the Company’s

financial statements (b) the Company’s compliance with legal and regulatory requirements, (c) the independent auditor’s qualifications

and independence and (d) the performance of the Company’s internal audit functions and independent auditor, as well as other matters

which may come before it as directed by the Board of Directors. Further, the Audit Committee, to the extent it deems necessary or appropriate,

among its several other responsibilities, is responsible for annually reviewing the qualifications, performance and independence of the

independent auditor and the audit plan, fees, and audit results. Our Board of Directors had previously determined Steve Richards meets

the requirements of being an “audit committee financial expert,” as defined by the rules and regulations of the SEC, and,

as a result, he serves as chair of the Audit Committee.

Compensation Committee. The Compensation Committee

members are Steve Richards and Joshua M. Schafer (Chair). The Compensation Committee aids our Board of Directors in meeting its responsibilities

relating to the compensation of the Company’s executive officers and to administer all incentive compensation plans and equity-based

plans of the Company, including the plans under which Company securities may be acquired by directors, executive officers, employees,

and consultants. A copy of our Compensation Committee Charter is located under the “Investor Relations-Governance” tab on

our website at www.shuttlepharma.com.

Nominating

and Corporate Governance Committee. The Nominating and Corporate Governance Committee, which consists of Joshua M. Schafer,

Steve Richards (Chair) and Dr. Bette Jacobs, recommends to the Board of Directors individuals qualified to serve as directors and on

committees of the Board of Directors. The Nominating and Corporate Governance Committee further serves to advise the Board of

Directors with respect to the Board of Directors composition, procedures and establishment of committees, as needed, to

develop and recommend to the Board of Directors corporate governance principles applicable to the Company, and to oversee the

evaluation of the Board of Directors and management. The Corporate Governance and Nominating Committee will consider stockholder recommendations

for candidates for the Board of Directors in the same manner it considers nominees from other sources. Our Board of Directors retains

the ultimate authority to nominate a candidate for election by the stockholders as a director or to fill any vacancy that may occur.

In identifying prospective director candidates, the Nominating and Corporate Governance Committee may consider all facts and circumstances

that it deems appropriate or advisable, including, among other things, the skills of the prospective director candidate, his or her depth

and breadth of business experience or other background characteristics, his or her independence and the needs of the Board of Directors.

In addition, the Nominating and Corporate Governance Committee will consider diversity of background including diversity of race, ethnicity,

international background, gender and age when evaluating candidates for board membership. All members of the Corporate Governance and

Nominating Committee are independent directors. A copy of our Corporate Governance and Nominating Committee Charter is located under

the “Investor Relations-Governance” tab on our website at www.shuttlepharma.com.

Audit Committee

| MEMBERS |

|

MEETINGS HELD IN 2022: FOUR |

| Steve Richards (Chair) |

|

|

| Chris H. Senanayake, PhD |

|

|

| Bette Jacobs, PhD (joined October 2022) |

|

|

The Audit Committee of our Board of Directors is our

standing audit committee established in accordance with Section 3(a)(58)(A) of the Exchange Act.

KEY RESPONSIBILITIES

| ● |

Reviews and discusses the financial statements for the financial year ended. |

| |

|

| ● |

Oversees the accounting and financial reporting processes of the Company and the audits of the financial statements of the Company. |

| |

|

| ● |

Discusses

with the Company’s independent accountants the matters required to be discussed by the statement on Auditing Standards No.

61, as amended. |

| |

|

| ● |

Reviews written disclosures and letters from the independent accountant required by applicable requirements of the Public Company Accounting Oversight Board regarding the independent accountant’s communications with the Audit Committee concerning independence and discusses with the independent accountant the independent accountant’s independence. |

| |

|

| ● |

Based on the review and discussions with the Company’s independent accountant, recommends to the Board of Directors that such audited financial statements and unaudited interim financial statements be included in the Company’s annual report on Form 10–K and quarterly reports on Form 10-Q, respectively, for the applicable periods for filing with the SEC. |

COMPENSATION

Committee

| MEMBERS |

|

MEETINGS HELD IN 2022: 0

ACTIONS BY WRITTEN CONSENT: 1 |

|

Joshua M. Schafer, MBA (Chair)

Steve Richards |

|

|

KEY RESPONSIBILITIES

| ● |

Makes recommendations to the Board of Directors concerning the salaries and incentive compensation for our officers, including our principal executive officer and employees and administers our stock option plan. |

NOMINATING

AND CORPORATE GOVERNANCE Committee

| MEMBERS |

|

MEETINGS

HELD IN 2022: 0 |

| Steve Richards (Chair) |

|

|

| Joshua Schafer |

|

|

| Bette Jacobs, Ph.D. (joined October 2022) |

|

|

KEY RESPONSIBILITIES

| ● |

Assists the Board of Directors in identifying qualified individuals to become Board members, in determining the composition of the Board of Directors and in monitoring Board of Directors effectiveness. |

Considerations

in Evaluating Director Nominees

The Board of Directors is responsible for overseeing

the Company’s business consistent with its fiduciary duty to the stockholders. This significant responsibility requires highly skilled

individuals with various qualities, attributes and professional experience. There are general requirements for service on the Board of

Directors that are applicable to directors and there are other skills and experience that should be represented on the Board of Directors

as a whole but not necessarily by each director. The Corporate Governance and Nominating Committee considers the qualifications of director

candidates individually and in the broader context of the Board of Directors’ overall composition and the Company’s current

and future needs.

STOCKholder

Recommendations for Nominations to the Board of Directors

We do not currently have a procedure by which security

holders may recommend nominees to the Board of Directors. Prior to the listing of our common stock on Nasdaq, as a private company with

a limited stockholder base, we did not believe that it was important to provide such a procedure. However, as a publicly traded Nasdaq-listed

company with the requirement to hold annual stockholder meetings, we will consider implementing such a policy in the future as our Board

of Directors deems necessary.

Communications

with the Board of Directors

Stockholders can communicate with the Board of Directors

by emailing or calling Robert Blum at Lytham Partners, LLC, who will forward the correspondence to each addressee.

|

|

|

|

BY EMAIL

shph@lythampartners.com |

|

BY PHONE

602-889-9700 |

Corporate

Governance Guidelines and Code of Business Conduct and Ethics

We have adopted

a code of ethics that applies to all of our executive officers, directors, and employees. The code of ethics codifies the business and

ethical principles that govern all aspects of our business. This document will be made available in print, free of charge, to any stockholder

requesting a copy in writing from our secretary at our executive offices in Gaithersburg, Maryland. A copy of our code of ethics is available

on our website at www.shuttlepharma.com. If we make any substantive amendments to, or grant any waivers from, the code of business conduct

and ethics for any officer or director, we will disclose the nature of such amendment or waiver on our website or in a Current Report

on Form 8-K.

Role of

the Board of Directors in Risk Oversight

Members of the

Board of Directors have periodic meetings with management and the Company’s independent auditor to perform risk oversight with respect

to the Company’s internal control processes. The Company believes that the Board of Directors’ role in risk oversight does

not materially affect the leadership structure of the Company. The Company believes that its founders, leadership team and members of

the Board of Directors exemplify diversity and inclusivity with respect to race, sex and ethnic origin. The Board of Directors presently

has three diverse directors, including one female director, and is now in full compliance with Nasdaq’s diversity requirements.

Director

Compensation

Each of our

non-employee directors are compensated in accordance with their director offer letters, with each receiving compensation on an annual

basis consisting of (i) $25,000 in cash, payable in quarterly installments commencing 90 days after completion of our initial public offering

and (ii) $75,000 in restricted stock units (“RSUs”) for those directors appointed in 2019 and $100,000 in RSUs for those appointed

in 2021 and thereafter, with the per share value of such RSUs determined as of the grant date. Pursuant to director offer letters entered

into between each director and our Company, the RSUs vest over a two-year period in one third increments, with one-third vesting immediately

upon signing and then one-third vesting on each of the first and second anniversary of election. In addition, non-employee directors are

also reimbursed for out-of-pocket costs incurred in connection with attending meetings.

Proposal 1: Election of Directors

| What am I voting on and how should I vote? |

|

You are being asked to elect six (6) directors

at the Annual Meeting. Each of the directors elected at the Annual Meeting will commence their term at the end of the Annual Meeting and

serve until the next Annual Meeting, until a successor has been elected and qualified, or until such director’s earlier resignation

or removal.

We believe that each of the nominees brings a set

of experience and qualifications that positions our Board of Directors well to lead the Company in the best interest of stockholders.

The Board of Directors therefore recommends

you vote “FOR” each of the nominees set forth below. |

Nominees

Vote Required

A majority of

the shares present in person or by proxy and entitled to vote at our 2023 Annual Meeting is required to approve Proposal No. 1.

Proposal 2: Ratification of Appointment of Independent

Registered Public Accounting Firm

|

What

am I voting on and how should I vote? |

|

You

are being asked to ratify the appointment of FORVIS LLP as the Company’s independent auditor for the fiscal year ending

December 31, 2023.

We do not anticipate a representative from FORVIS

LLP will be present at the Annual Meeting. However, should a representative from FOVIS LLP choose to attend, they will have the opportunity

to participate and respond to appropriate questions that may be posed at the Annual Meeting and will have an opportunity to make a statement

if he or she so desires.

Although our governing documents do not require

us to submit this matter to stockholders, the Audit Committee and the Board of Directors believe that asking stockholders to ratify the

appointment of FORVIS LLP is consistent with best practices in corporate governance. If the stockholders fail to ratify the appointment,

the Audit Committee will reconsider whether to retain FORVIS LLP and may retain that firm or another independent accounting firm without

resubmitting the matter to the stockholders of the Company for their approval. Even if the appointment is ratified, the Audit Committee

may, in its discretion, direct the appointment of different independent accountants at any time during the year if it determines that

such a change would be in the best interests of the Company and its stockholders.

We believe that FORVIS LLP offers professional

services in their industry and is sufficiently qualified to conduct their duties as independent auditor.

The Board of Directors recommends that you vote

“FOR” the ratification of the appointment of FORVIS LLP as the Company’s independent registered public accounting

firm for the fiscal year ending December 31, 2023. |

On March 21, 2023, the Company’s Audit Committee

selected FORVIS LLP to serve as the Company’s independent registered public accounting firm for the review of its Quarterly Reports

on Form 10-Q and Annual Report on Form 10-K for the year ending December 31, 2023. As a result, the Audit Committee determined that BF

Borgers CPA PC (“BF Borgers”) would no longer serve as the Company’s independent registered public accounting firm,

effective as of March 21, 2023. In conjunction with our engagement of FORVIS LLP, we disclosed on our Current Report on Form 8-K dated

March 21, 2023 (the “Form 8-K”) the following:

| |

● |

BF Borgers’s audit reports on our financial statements for the years ended December 31, 2021 and 2022 contained no adverse opinion or disclaimer of opinion, nor was it qualified or modified as to uncertainty, audit scope or accounting principles, except that the audit report on the financial statements of the Company for the year ended December 31, 2021 contained an uncertainty about the Company’s ability to continue as a going concern (the “Going Concern Opinion”). BF Borgers’s Going Concern Opinion was resolved following the Company’s completion of its approximately $11.4 million initial public offering in September 2022 and subsequent $4.0 million private placement in January 2023. |

| |

|

|

| |

● |

For the years ended December 31, 2022 and 2021 and through March 31, 2023, the Company had no “disagreements” (as defined in Regulation S-K, Item 304(a)(1)(iv) and the related instructions) with BF Borgers on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedures, which disagreements if not resolved to the satisfaction of the BF Borgers would have caused them to make reference thereto in their reports on the financial statements for such periods. |

| |

|

|

| |

● |

There were no reportable events for the years ended December 31, 2022 or 2021 and through March 31, 2023, there were no reportable events as defined in item 304(a)(1)(v) of Regulation S-K. Prior to retaining FORVIS LLP, the Company did not consult with the FORVIS LLP regarding either: (i) the application of accounting principles to a specified transaction, either contemplated or proposed, or the type of audit opinion that might be rendered on the Company’s financial statements; or (ii) any matter that was the subject of a “disagreement” or a “reportable event” (as those terms are defined in Item 304(a)(1)(iv) and (a)(1)(v) of Regulation S-K, respectively). |

| |

|

|

| |

● |

The Company provided BF Borgers with the above disclosures contained in the Form 8-K disclosing the dismissal of BF Borgers and requested in writing that BF Borgers furnish the Company with a letter addressed to the SEC stating whether or not they agree with such disclosures. The Form 8-K was filed with SEC on March 21, 2023 and BF Borgers’s response was filed as Exhibit 16.1 to the Form 8-K. |

Fees Paid

to the Independent Public Accounting Firm

The following table represents

fees for professional audit services for the audit of the Company’s annual financial statements for the fiscal years ended December

31, 2022 and 2021, which services were rendered by BF Borgers.

| | |

2022 | | |

2021 | |

| | |

| | |

| |

| Audit Fees 1 | |

$ | 57,000 | | |

$ | 42,000 | |

| Tax Fees 2 | |

$ | 11,000 | | |

$ | 4,637 | |

| Audit-related and Other Fees 3 | |

$ | 5,000 | | |

| 13,500 | |

| Total Fees | |

$ | 73,000 | | |

$ | 60,139 | |

| |

1. |

Audit fees consist of fees for professional services rendered by the principal accountant for the audit of the Company’s annual financial statements and review of the financial statements included in the Company’s Registration Statement on Form S-1 and the related Prospectus filed in relation to the Company’s initial public offering, which closed on September 2, 2022, and for services that are normally provided by the accountant in connection with statutory and regulatory filings or engagements. |

| |

2. |

Tax fees include the preparation of federal tax returns as well as tax planning and consultation on new tax legislation, regulations, rulings, and developments. |

| |

|

|

| |

3. |

Audit-related fees consist primarily of fees for assurance and related services by the accountant that are reasonably related to the performance of the audit or review of the Company’s financial statements. |

Audit Committee Pre-Approval

Policies

The Audit Committee is tasked

with pre-approving any non-audit services proposed to be provided to the Company by the independent auditor.

Audit Committee Report

In accordance with its written charter adopted by

the Board of Directors, the Audit Committee assists the Board of Directors in fulfilling its responsibility of oversight of the quality

and integrity of our accounting, auditing and financial reporting practices. Our management has primary responsibility for our financial

statements, financial reporting process and internal controls over financial reporting. The independent auditors are responsible for performing

an independent audit of our financial statements in accordance with the standards of the Public Company Accounting Oversight Board (“PCAOB”).

The Audit Committee’s responsibility is to select the independent auditors and monitor and oversee our accounting and financial

reporting processes, including our internal controls over financial reporting, and the audits of our financial statements.

In 2022, the Audit Committee met and held discussions

with management and the independent auditors. In the discussions related to our financial statements for fiscal year 2022, management

represented to the Audit Committee that such financial statements were prepared in accordance with U.S. generally accepted accounting

principles. The Audit Committee reviewed and discussed with management the financial statements for fiscal year 2022. In fulfilling its

responsibilities, the Audit Committee discussed with the independent auditors those matters required to be discussed by the applicable

requirements of the PCAOB and the Securities and Exchange Commission. In addition, the Audit Committee received from the independent auditors

the written disclosures and letter required by applicable requirements of the PCAOB regarding the independent auditor’s communications

with the Audit Committee concerning independence, and the Audit Committee discussed with the independent auditors that firm’s independence.

Based upon the Audit Committee’s discussions

with management and the independent auditors and the Audit Committee’s review of the representations of management and the written

disclosures and letter of the independent auditors provided to the Audit Committee, the Audit Committee recommended to the Board that

the audited consolidated financial statements for the year ended December 31, 2022 be included in our 2022 annual report on Form 10-K

for filing with the SEC.

Respectfully submitted,

The Audit Committee of the Board of Directors

Steve Richards (Chair)

Chris H. Senanayake, Ph.D.

Bette Jacobs, Ph.D.

The immediately preceding report of the Audit Committee

does not constitute soliciting material and should not be deemed filed or incorporated by reference into any of previous filings under

the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, except to the extent that we specifically

incorporate such report by reference.

Vote Required

The Board of

Directors recommends a vote “FOR” Proposal No. 2. A majority of the shares present in person or by proxy and entitled to vote

at our 2023 Annual Meeting is required to approve Proposal No. 2.

Proposal 3: Advisory Vote on Executive Compensation

(“Say on Pay”)

| What am I voting on and how should I vote? |

|

This proposal gives our stockholders the opportunity

to vote to approve, on an advisory, non-binding basis, in accordance with Section 14A of the Securities Exchange Act of 1934, as Amended,

or the Exchange Act, the compensation of our Named Executive Officers (or NEOs), as disclosed in this Proxy Statement.

The Board of Directors therefore recommends

you vote “FOR” the resolution that the compensation paid to the Company’s NEOs, as disclosed pursuant to Item

402 of Regulation S-K, including the Executive Compensation, compensation tables, and narrative discussions to be hereby APPROVED. |

Approval on an advisory basis of the compensation

of our NEOs is an ordinary resolution and must receive the affirmative vote of a majority of the votes cast in person or by proxy

at the 2023 Annual Meeting in order to be approved.

THE TEXT OF THE RESOLUTION IN RESPECT OF PROPOSAL

3 IS AS FOLLOWS:

“RESOLVED, that the Company’s stockholders

approve, on an advisory basis, the compensation paid to the Company’s named executive officers, as disclosed pursuant to Item 402

of Regulation S-K in this proxy statement in the section entitled “Executive Compensation,” including the compensation tables

and narrative discussions set forth therein.”

ADVISORY

VOTE ONLY

This vote is advisory, and therefore not binding on

the Company, the Compensation Committee, or the Board of Directors. However, the Compensation Committee will consider the outcome of the

vote when considering future executive compensation arrangements. Abstentions and broker non-votes will have no effect on the vote on

this proposal.

Executive Compensation

Summary

Compensation Table

The table below summarizes

all compensation awarded to, earned by, or paid to our Chief Executive Officer and Chief Financial Officer and certain of our other executive

officers for 2022 and 2021.

SUMMARY COMPENSATION TABLE

| Name and principal position | |

Year | | |

Salary ($) | | |

Bonus ($) | | |

Stock Awards ($) | | |

Option Awards ($) | | |

Non-Equity Incentive Plan Compensation ($) | | |

Nonqualified Deferred Compensation Earnings ($) | | |

All Other Compensation ($) | | |

Total ($) | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| Anatoly Dritschilo M.D., CEO | |

| 2022 | | |

| 91,418 | | |

| - | | |

| 171,668 | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 263,086 | |

| | |

| 2021 | | |

| 18,829 | | |

| - | | |

| 171,668 | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 190,497 | |

| Michael Vander Hoek, CFO, VP | |

| 2022 | | |

| 79,480 | | |

| - | | |

| 46,000 | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 125,480 | |

| | |

| 2021 | | |

| 18,338 | | |

| - | | |

| 46,000 | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 64,338 | |

| Peter Dritschilo, President and COO | |

| 2022 | | |

| 94,289 | | |

| - | | |

| 78,333 | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 172,622 | |

| | |

| 2021 | | |

| 31,534 | | |

| - | | |

| 78,333 | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 109,867 | |

| Tyvin Rich, Chief Medical Officer | |

| 2022 | | |

| 65,065 | | |

| - | | |

| 29,000 | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 94,065 | |

| | |

| 2021 | | |

| - | | |

| - | | |

| 29,000 | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 29,000 | |

Outstanding

Equity Awards at fiscal year-end

As of December 31, 2022,

on a post-reverse split basis, a total of 410,754 RSUs have been granted to our executive officers under our 2018 Equity Incentive Plan

(the “Plan”), of which 21,748 remain subject to vesting. The Company has filed a registration statement on Form S-8 (SEC File

No. 333-268758), as amended, to register the shares granted under our 2018 Equity Incentive Plan.

The following table sets

forth information concerning the number of shares of common stock underlying outstanding equity incentive awards for each of our executive

officers as of December 31, 2022:

| | |

Option Awards | |

| | |

Stock Awards | |

| Name | |

Grant Date | |

Number of Securities Underlying Unexercised Options Exercisable (#) | | |

Number of Securities Underlying Unexercised Options Unexercisable (#) | | |

Option Exercise Price ($) | | |

Option Expiration Date | | |

Number of Shares or Units of Stock not yet Vested (#)) | | |

Market Value of Shares or Units not yet Vested ($) | |

| Bette Jacobs | |

10/28/2022 | |

| - | | |

| - | | |

| - | | |

| - | | |

| 23,725 | (1) | |

| 46,501 | |

| (1) |

These restricted stock units vest in two installments on the anniversary of the grant date. |

Employment

Arrangements with Our Named Executive Officers

Each of our executive officers

has entered into an employment agreement with us. The employees each will receive compensation on an annual basis in cash, payable in

monthly installments commencing at the completion of our IPO, as well as RSUs subject to achieving certain key performance indicators.

Certain of our executive officers are entitled to various target bonuses, upon achievement of certain milestones. The terms of the employment

agreements are as follows:

Employment Agreement

with Anatoly Dritschilo, M.D.

On June 28, 2019, we entered

into an employment agreement with our Chief Executive Officer and Chairman of the Board of Directors, Anatoly Dritschilo, M.D. Under Dr.

Dritschilo’s employment agreement, Dr. Dritschilo will receive base compensation of $274,000 per year. Dr. Dritschilo also received

an initial restricted stock unit grant of 45,495 restricted stock units (“RSUs”) (22,747 on a post-reverse split basis) issuable

under the Company’s 2018 Equity Incentive Plan, which RSUs vested over three years in substantially equal one-third installments

on each one year anniversary of the agreement. Under his employment agreement, if Dr. Dritschilo terminates his employment for “Good

Reason,” as defined in the agreement, Dr. Dritschilo will be entitled to his then applicable base salary for period of 12 months,

subject to his continued compliance with certain requirements of his employment agreement. Dr. Dritschilo accepted a reduced salary prior

to the Company’s completion of its initial public offering in September 2022.

Employment Agreement

with Michael Vander Hoek

On September 1, 2019, we

entered into an amended employment agreement with our Chief Financial Officer and Vice President for Operations and Regulatory, Michael

Vander Hoek. Under Mr. Vander Hoek’s employment agreement, he will receive base compensation of $227,000 and is entitled to a target

bonus of $72,000 upon achievement of certain milestones. Mr. Vander Hoek also received an initial restricted stock unit grant of 6,096

RSUs (on a post-reverse split basis) issuable under the Company’s 2018 Equity Incentive Plan, which RSUs vest over three years in

substantially equal installments on each one year anniversary of the agreement. Under Mr. Vander Hoek’s employment agreement, if

he terminates his employment for “Good Reason,” as defined in the agreement, he will be entitled to his then applicable base

salary for period of 12 months, subject to his continued compliance with certain requirements of his employment agreement. Mr. Vander

Hoek accepted a reduced salary prior to the Company’s completion of its initial public offering in September 2022.

Employment Agreement

with Peter Dritschilo

On May 30, 2019, we entered

into an employment agreement with our President and Chief Operating Officer, Peter Dritschilo. Under Mr. Dritschilo’s employment

agreement, Mr. Dritschilo will receive base compensation of $236,000 and is entitled to a target bonus of $72,000 upon achievement of

certain milestones. Mr. Dritschilo also received an initial restricted stock unit grant of 20,760 RSUs (10,380 on a post-reverse split

basis) issuable under the Company’s 2018 Equity Incentive Plan, which RSUs vest over three years in substantially equal installments

on each one year anniversary of the agreement. Under Mr. Dritschilo’s employment agreement, if Mr. Dritschilo terminates his employment

for “Good Reason,” as defined in the agreement, he will be entitled to his then applicable base salary for period of 12 months,

subject to his continued compliance with certain requirements of his employment agreement. Mr. Dritschilo accepted a reduced salary prior

the Company’s completion of its initial public offering in September 2022.

Employment Agreement

with Tyvin Rich, M.D.

On May 31, 2019, we entered

into an employment agreement with our Chief Clinical Officer, Tyvin Rich, M.D. Under Dr. Rich’s employment agreement, Dr. Rich receives

base compensation of $218,000 per year and is entitled to a target bonus of $43,000 upon achievement of certain milestones. Dr. Rich also

received an initial restricted stock unit grant of 3,843 RSUs (on a post-reverse split basis) issuable under the Company’s 2018

Equity Incentive Plan, which RSUs vest over three years in substantially equal installments on each one year anniversary of the agreement.

Under Dr. Rich’s employment agreement, if Dr. Rich terminates his employment for “Good Reason,” as defined in the agreement,

he is entitled to his then applicable base salary for period of 12 months, subject to his continued compliance with certain provisions

of his employment agreement. Dr. Rich accepted a reduced salary prior to the Company’s completion of its initial public offering

in September 2022.

Employment Agreement

with Mira Jung, Ph.D.

On May 30, 2019, we entered

into an employment agreement with our Chief Scientific Officer, Mira Jung, Ph.D. Under Dr. Jung’s employment agreement, Dr. Jung

receives base compensation of $46,800 and is entitled to a target bonus of $14,200 upon achievement of certain milestones. Dr. Jung also

received an initial restricted stock unit grant of 892 RSUs (on a post-reverse split basis) issuable under the Company’s 2018 Equity

Incentive Plan, which RSUs vest over three years in substantially equal installments on each one year anniversary of the agreement. Under

Dr. Jung’s employment agreement, if Dr. Jung terminates her employment for “Good Reason,” as defined in the agreement,

Dr. Jung is then entitled to her then applicable base salary for period of 12 months, subject to her continued compliance with certain

requirements of her employment agreement. Dr. Jung accepted a reduced salary prior to the Company’s completion of its initial public

offering in September 2022.

Equity

Compensation Plan Information

2018

Equity incentive Plan

Our 2018 Equity

Incentive Plan, which was previously approved by the Company’s stockholders, provides for equity incentive grants to be made to

our employees, executive officers and directors, as well as to key advisers and consultants. Equity incentive grants may be in the form

of stock options with an exercise price of not less than the fair market value of the underlying shares as determined pursuant to the

2018 Equity Incentive Plan, restricted stock awards, other stock-based awards, or any combination of the foregoing. The 2018 Equity Incentive

Plan is administered by the Company’s Compensation Committee. We have reserved 3,000,000 shares of our common stock for issuance

under the 2018 Equity Incentive Plan, of which 419,754 shares have been granted as of the date of this proxy statement.

Security

Ownership of Certain Beneficial Owners and Management

The

following table sets forth the beneficial ownership of our common stock held by each director and executive officer, by each person

known by us to beneficially own 5% or more of our common stock and by directors and executive officers as a group, based on a total

of 15,984,125 shares of common stock outstanding as of October 19, 2023.

Unless otherwise

stated, the address of the persons set forth in the table is c/o Shuttle Pharmaceuticals Holdings, Inc., 401 Professional Drive, Suite

260, Gaithersburg, MD 20879

Beneficial ownership is determined

in accordance with SEC rules and generally includes voting or investment power with respect to securities. Unless otherwise indicated,

the stockholders listed in the table below have sole voting and investment power with respect to the shares indicated.

| Names and addresses | |

Number of shares of common stock beneficially owned (#) | | |

Percentage of shares of common stock beneficially owned (%) | |

| Directors and Named Executive Officers: | |

| | | |

| | |

| Anatoly Dritschilo, M.D.(1) | |

| 4,309,607 | | |

| 27.0 | |

| Milton Brown, M.D., Ph.D.(2) | |

| 1,080,864 | | |

| 6.8 | |

| Mira Jung, Ph.D. | |

| 1,071,388 | | |

| 6.7 | |

| Michael Vander Hoek | |

| 3,852 | | |

| - | |

| Peter Dritschilo | |

| 6,560 | | |

| - | |

| Tyvin A. Rich, M.D. | |

| 2,429 | | |

| - | |

| Steve Richards | |

| 1,707 | | |

| - | |

| Joshua Schafer | |

| 1,707 | | |

| - | |

| Chris H. Senanayake | |

| 2,791 | | |

| - | |

| Bette Jacobs(3) | |

| 11,862 | | |

| 0.1 | |

| All directors and officers as a group (ten persons) | |

| 6,492,767 | | |

| 40.6 | |

| - |

Denotes the holder owns less than one percent of the outstanding common stock. |

| |

|

| ± |

The persons named above have full voting and investment power with respect to the shares indicated. Under the rules of the SEC, a person (or group of persons) is deemed to be a “beneficial owner” of a security if he or she, directly or indirectly, has or shares the power to vote or to direct the voting of such security, or the power to dispose of or to direct the disposition of such security. Accordingly, more than one person may be deemed to be a beneficial owner of the same security. |

| |

|

| (1) |

Consists of (i) 1,085,200 shares of common stock held of record by Dr. Anatoly Dritschilo, (ii) 1,104,407 shares of common stock and warrants to purchase 20,000 shares of commons stock, each held of record by Joy Dritschilo, his spouse, and (iii) 2,100,000 shares held by PAL Trust, a trust formed for the benefit of Dr. and Mrs. Dritschilo’s adult children and for which a third party serves as external trustee and two of their children serve as co-trustees . Dr. Dritschilo disclaims beneficial ownership over all securities held by Mrs. Dritschilo and PAL Trust. |

| |

|

| (2) |

Does not include options to purchase 16,667 shares of common stock, which remain subject to vesting. |

| |

|

| (3) |

Does not include 23,725 restricted stock units which remain subject to vesting conditions. |

Related

Party Transactions

Loan Agreements

| |

● |

On

December 1, 2020, the Company consolidated certain loans, originally dated January 2018 and April 2018, entered into with Joy Dritschilo,

the wife of our Chief Executive Officer, into a single loan between Mrs. Dritschilo and the Company (the “2018 Consolidated

Loan”) such that, with accrued interest, the 2018 Consolidated Loan had a principal balance of $426,243, bears interest at

a rate of 7.5% per annum, and has a maturity date of December 31, 2021. The 2018 Consolidated Loan was extended until June 30, 2022,

pursuant to an amendment to the 2018 Consolidated Loan agreement dated January 24, 2022. On July 29, 2022, the Company and Mrs. Dritschilo

entered into an amendment to the 2018 Consolidated Loan, pursuant to which repayment was extended through June 30, 2023. In the

period ended June 30, 2023, the 2018 Consolidated Loan was paid off in full. |

| |

● |

On

December 1, 2020, the Company consolidated certain loans, originally dated May 2018 and September 2019, with our Chief Executive

Officer (the “2019 Consolidated Loan”), such that, with accrued interest, the 2019 Consolidated Loan had a principal

balance of $139,229, bears interest at the rate of 7.5% per annum, and has a maturity date of December 31, 2021. The 2019 Consolidated

Loan was extended until June 30, 2022, pursuant to an amendment to the 2019 Consolidated Loan agreement dated January 24, 2022. On

July 29, 2022, the Company and our Chief Executive Officer entered into an amendment to the 2019 Consolidated Loan, pursuant to which

repayment was extended through June 30, 2023. In the period ended June 30, 2023, the 2019 Consolidated Loan was paid in full. |

| |

● |

On

June 21, 2021, the Company entered into an additional loan agreement with Mrs. Dritschilo in the amount of $120,000 (principal),

bearing interest at the rate of 7.5% per annum, with a single balloon payment due at maturity on June 21, 2022 (the “June 2021

Loan Agreement”). On July 29, 2022, the Company and Mrs. Dritschilo entered into an amendment to the June 2021 Loan Agreement,

pursuant to which repayment was extended through June 30, 2023. In the period ended June 30, 2023, the June 2021 Loan Agreement

was paid in full. |

Sales,

purchases, and payments

| |

● |

On September 22, 2021, Mrs. Dritschilo, who is one of our major stockholders, transferred 210,000 shares (105,000 shares post-split) of common stock of the Company in a private transaction to Steven Bayern, who had also been engaged by the Company to perform certain consulting services for the Company. Such shares, which represent approximately three percent of her total share ownership, were sold at par value pursuant to an exemption from registration under Section 4 (a)(7) of the Securities Act. As a result of the transfer, the Company recognized $420,000 in non-cash stock compensation in legal and professional fees. |

| |

● |

On August 1, 2022, in conjunction with our private placement of $125,000 of units consisting of 10% notes and warrants to purchase common stock, which were sold to three accredited investors in total, Mrs. Dritschilo purchased a $50,000 note and received warrants to purchase 20,000 shares of common stock at $2.50 per share. The notes and warrants were sold pursuant to an exemption from registration pursuant to Rule 506(b) of Regulation D of the Securities Act. |

Related

Party Transaction Policy

Unless described

above, during the last two fiscal years, there were no transactions or series of similar transactions to which we were a party or will

be a party, in which:

| |

● |

the amounts involved exceed or will exceed $120,000; and |

| |

● |

any of our directors, executive officers or holders of more than 5% of our capital stock, or any member of the immediate family of any of the foregoing had, or will have, a direct or indirect material interest. |

All related

party transactions are subject to the review, approval, or ratification by our Board of Directors or an appropriate committee thereof.

Delinquent

Section 16(a) Reports

Section 16(a) of the Exchange Act requires our executive

officers and directors, and persons who own more than 10% of our common stock, to file reports regarding ownership of, and transactions

in, our securities with the SEC and to provide us with copies of those filings.

To the Company’s knowledge, based solely on

our review of the copies of such reports furnished to us and written representations that no other reports were required, during the fiscal

year ended December 31, 2022, all of the Company’s officers, directors, and greater than 10% stockholders complied with all applicable

Section 16(a) filing requirements, except the following:

| Name |

|

Late Reports |

|

Transactions Covered |

|

Number of Shares |

| Bette Jacobs |

|

Form 3 |

|

N/A |

|

N/A |

Questions and Answers About the Meeting

Why am

I receiving these materials?

You are receiving

these materials because you were a stockholder of Shuttle Pharmaceuticals Holdings, Inc. (the “Company”) as of October 19,

2023 (the “Record Date”), which is the record date of our 2023 Annual Meeting of Stockholders, which will be held virtually

on Monday, December 18, 2023 at www.virtualshareholdermeeting.com/SHPH2023.

What proposals

will be voted on at the Annual Meeting and how does the Board of Directors recommend that i vote?

| PROPOSAL 1: ELECTION OF DIRECTORS |

|

| The Board of Directors recommends that you vote FOR each director nominee. These individuals bring a range of relevant experiences and overall diversity of perspectives that is essential to good governance and leadership of our Company. |

|

| PROPOSAL 2: RATIFICATION OF INDEPENDENT PUBLIC ACCOUNTING FIRM |

|

| The Board of Directors recommends that you vote FOR the ratification of the Company’s independent auditor, FORVIS LLP. |

|

| PROPOSAL 3: EXECUTIVE COMPENSATION |

|

| The Board of Directors recommends that you vote FOR approval of the Company’s executive compensation plan, on an advisory basis. We believe the numbers that we have prepared are fair and in the best interest of the Company’s executives and stockholders. |

|

Who is

entitled to vote at the Annual Meeting?

You can vote your shares of common stock if our records

show that you owned the shares on the Record Date. As of the close of business on the Record Date, a total of 15,984,125 shares of common

stock are entitled to vote at the Annual Meeting. Each share of common stock is entitled to one vote on all matters presented at the Annual

Meeting.

What do

I need to do to attend the VIRTUAL Meeting?

To

attend the meeting online, you will need to log into our 2023 Annual Meeting approximately 10 - 15 minutes before the start of the meeting,

which commences at 12:00 P.M. EST on December 18, 2023, at www.virtualshareholdermeeting.com/SHPH2023. You may attend as a stockholder,

which will entitle you to vote and ask questions, or you may attend as a guest.

What is

the difference between holding shares as a sTOCKholder of record and as a beneficial owner?

Stockholders

of Record (shares registered in your name):

You hold your

shares directly and may vote your shares in accordance with the instructions on your proxy card.

Beneficial

Owners (shares registered in the name of your broker, bank or other nominee):

You hold your

shares through a brokerage firm and will have to provide instructions to your broker to vote your shares for you.

How do

I vote and what are the voting deadlines?

Stockholders

of Record (shares registered in your name):

VIA THE INTERNET |

|

VOTE BY INTERNET - www.proxyvote.com or scan the QR Barcode available on your proxy card. Use the Internet to transmit your voting instructions and for electronic delivery of information. Vote by 11:59 P.M. EST on December 17, 2023. Have your proxy card in hand when you access the web site and follow the instructions to obtain your records and to create an electronic voting instruction form. |

| |

|

|

BY TELEPHONE |

|

VOTE BY PHONE - 1 - 800 - 690 - 6903 - Use any touch-tone telephone to transmit your voting instructions. Vote by 11:59 P.M. EST on December 17, 2023. Have your proxy card in hand when you call and then follow the instructions. |

| |

|

|

BY MAIL |

|

VOTE BY MAIL - Mark, sign and date your proxy card and return it in the postage-paid envelope we have provided or return it to Vote Processing, c/o Broadridge, 51 Mercedes Way, Edgewood, NY 11717. |

| |

|

|

AT

THE VIRTUAL MEETING |

|

Attend the virtual meeting by going to www.virtualshareholdermeeting.com/SHPH2023 and logging in using the information contained on your proxy card. |

| |

|

|

DEADLINE |

|

In order for your vote to count, you must vote by December 17, 2023 at 11:59 P.M. EST. After that, the only way to cast your vote will be by attending the meeting on December 18, 2023 at 12 pm EST. |