0001409171false00014091712023-10-172023-10-17

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of report (Date of earliest event reported): October 17, 2023

TITAN MACHINERY INC.

(Exact Name of Registrant as Specified in Its Charter)

Delaware

(State or Other Jurisdiction of Incorporation)

| | | | | | | | |

| 001-33866 | | 45-0357838 |

| (Commission File Number) | | (I.R.S. Employer Identification Number) |

644 East Beaton Drive, West Fargo, ND 58078-2648

(Address of Principal Executive Offices)(Zip Code)

(701) 356-0130

(Registrant’s Telephone Number, Including Area Code)

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, $0.00001 par value per share | TITN | The Nasdaq Stock Market LLC |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2). Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

(b), (c), (d) and (e) On October 18, 2023, Titan Machinery Inc. (the “Company”) announced the implementation of a leadership transition plan whereby David J. Meyer, the Company’s current Chief Executive Officer, will transition the role of Chief Executive Officer to Bryan J. Knutson, the Company’s current President and Chief Operating Officer, effective February 1, 2024, and Mr. Knutson will thereafter hold the position of President and Chief Executive Officer. Mr. Meyer will continue to serve as the Company’s Chief Executive Officer until the effective date of Mr. Knutson’s appointment as Chief Executive Officer, and will thereafter serve as Executive Chairman of the Board of Directors (the “Board”) until January 31, 2025.

Mr. Knutson, age 45, became the Company’s Chief Operating Officer in August 2017, adding the position of President in 2022. Mr. Knutson joined the Company in 2002, beginning his career in equipment sales and later advancing to store manager, complex manager, region manager and then became the Company’s Vice President – Ag Operations in 2016. Mr. Knutson is a current board member and Chairman of the Pioneer Equipment Dealers Association.

In conjunction with Mr. Knutson’s appointment as the Company’s President and Chief Executive Officer, the Board voted to increase in the size of the Board from seven directors to eight directors and elected Mr. Knutson as a director of the Company, in each case effective as of February 1, 2024. Mr. Knutson was not appointed to serve on any committees of the Board at this time. Upon joining the Board on February 1, 2024, Mr. Knutson will serve as a Class I director of the Company, holding office until the Company’s 2026 annual meeting of stockholders, unless his earlier death, resignation or removal.

In addition, in connection therewith, the Company entered into an Executive Employment Agreement with Mr. Knutson on October 17, 2023 (the “Employment Agreement”). The Employment Agreement has a three-year term beginning February 1, 2024, with automatic one-year extensions (with such automatic extensions subject to termination by either the Company or Mr. Knutson).

The Employment Agreement provides Mr. Knutson with (i) a starting annualized base salary of $575,000, which base salary is subject to upward adjustment on an annual basis, (ii) eligibility to participate in the Company’s annual performance cash bonus plan with an opportunity to earn a cash incentive award ranging from 0% to 200% of his then-current base salary, with the target award set at 100% of base salary, and (iii) the right to receive an annual long-term equity incentive award grant in the form of restricted stock and/or restricted stock units with a value equal to his then-current base salary.

Under the terms of the Employment Agreement, if Mr. Knutson’s employment is terminated without Cause or he resigns for Good Reason (each as defined in the Employment Agreement), which termination does not occur in connection with a Change in Control (as defined in the Employment Agreement), he will be entitled to receive a severance payment in an amount equal to the sum of (i) his then-current annual base salary plus (ii) the amount of the average annual incentive bonus paid to Mr. Knutson under the Employment Agreement in the three years preceding termination (or, if a termination without Cause or a resignation for Good Reason occurs prior to any annual incentive bonus having been paid to Mr. Knutson, the amount of Mr. Knutson’s target annual incentive bonus for the year in which the termination or resignation occurs), and Mr. Knutson will be eligible to continue to participate in the Company group medical and dental plans at Company expense for a period of 12 months after termination. In addition, if Mr. Knutson’s employment is terminated without Cause or he resigns for Good Reason, in either such case with such termination occurring within 12 months following a Change in Control, he will be entitled to receive a severance payment in an amount equal to two times the sum of (i) his then-current annual base salary plus (ii) the amount of the average annual incentive bonus paid to Mr. Knutson in the three years preceding the termination (or, if a termination without Cause or a resignation for Good Reason occurs within 12 months following a Change in Control and prior to any annual incentive bonus having been paid to Mr. Knutson, the amount of Mr. Knutson’s target annual incentive bonus for the year in which the termination or resignation occurs), and Mr. Knutson will be eligible to continue to participate in the Company group medical and dental plans at Company expense for a period of 24 months after termination. Mr. Knutson’s eligibility for these severance benefits is subject to his execution of a release of claims against the Company and his compliance with post-employment covenants.

There are no other arrangements or understandings between Mr. Knutson and any other persons pursuant to which Mr. Knutson was named President and Chief Executive Officer or a director of the Company. Mr. Knutson does not have any family relationship with any of the Company’s directors or executive officers or any persons nominated or chosen by the Company to be a director or executive officer. Mr. Knutson does not have any direct or indirect material interest in any transaction or proposed transaction required to be reported under Item 404(a) of Regulation S-K.

In order to implement Mr. Knutson’s succession to Chief Executive Officer, on October 17, 2023, the Company and Mr. Meyer entered into an amendment to Mr. Meyer’s existing employment letter agreement with the Company. This amendment provides that Mr. Meyer’s employment as the Company’s Chief Executive Officer will end effective February 1, 2024, and that Mr. Meyer will accept the role of Executive Chairman of the Board of Directors beginning February 1, 2024 and continuing until January 31, 2025. Mr. Meyer will continue to earn his current base salary of $500,000 under the amended employment letter agreement, but will not be eligible for annual cash bonuses or equity incentive awards or severance.

On October 18, 2023, the Company issued a press release announcing the leadership transition from Mr. Meyer to Mr. Knutson. A copy of the press release is attached hereto as Exhibit 99.1, and is incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

| | | | | | | | |

| Exhibit No. | | Description of Exhibit |

| | Press Release dated October 18, 2023 |

| 104 | | Cover page interactive data file (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| Titan Machinery Inc. |

| | |

| Date: October 18, 2023 | By | /s/ Robert Larsen |

| Name: | Robert Larsen |

| Title: | Chief Financial Officer |

Titan Machinery Inc. Announces Leadership Succession to Drive Next Phase of Growth

President and COO Bryan Knutson to Become President and CEO

Chairman, and CEO David Meyer to Assume Role of Executive Chairman

WEST FARGO, N.D., October 18, 2023 (GLOBE NEWSWIRE) -- Titan Machinery Inc. (Nasdaq: TITN) (the “Company), a leading network of full-service agricultural and construction equipment stores, today announced as part of its leadership succession plan, David Meyer, the Company’s Founder, Chairman, and Chief Executive Officer, will transition to Executive Chairman effective February 1, 2024 and will also continue to serve as Chairman of the Board. At that time Bryan Knutson, the Company’s President and Chief Operating Officer will succeed Mr. Meyer as Chief Executive Officer, holding the position of President and Chief Executive Officer, and will become a member of the Company’s Board of Directors.

David Meyer co-founded Titan Machinery in 1980 on the principle of best-in-class product support, and as an early pioneer of dealer consolidation saw the benefits of consolidating dealership resources to leverage scale, equipment and parts inventories, training, and other industry expertise to provide world-class equipment support to all our agricultural and construction customers. As the Company’s long-time CEO and largest shareholder, Mr. Meyer has driven the expansion of the Company’s footprint from its initial two store locations in 1980 to an international dealership network which now spans 3 continents with nearly 150 locations.

“I am very proud of what our team at Titan Machinery has achieved since my early days in the dealership nearly 50 years ago and the breadth and depth of our operation is a testament to the talent that we’ve attracted to the organization,” commented Mr. Meyer. “Bryan is a natural leader with a successful track record and has proven his ability to excel across all aspects of our business. As his career has progressed through senior management positions with increased levels of responsibility, Bryan has been an integral member of our executive team and has demonstrated a thorough and insightful approach to strategy and operational execution, while at the same time showing an ability to build lasting relationships that have served our customers, employees, suppliers, and shareholders extremely well. I am extremely confident in Bryan’s capabilities and have watched his development over the last 20 plus years as he has excelled in both store and central leadership roles, which makes him uniquely qualified to lead Titan Machinery in our next stage of growth.”

In his new role as Executive Chairman, Mr. Meyer will focus his efforts on leading the Board of Directors, providing counsel to Mr. Knutson and the leadership team, and continuing to advance Titan’s acquisition strategy.

Mr. Knutson has established a successful track record at Titan Machinery for more than two decades, most recently as Chief Operating Officer since 2017, and adding the position of President in 2022. Prior to these executive roles, Mr. Knutson led Titan Machinery’s North American Agriculture and Construction Equipment Operations and has implemented lasting positive changes across the organization, leveraging his first-hand experience as a Sales Consultant, General Manager, and various Senior Field positions. Mr. Knutson has an extensive understanding of the Titan Machinery business and will bring his deep appreciation of Titan’s culture to grow upon the success that Mr. Meyer established during his time as Chief Executive Officer. In addition to his involvement in several industry organizations and dealer groups, Bryan is Chairman of the Board of the Pioneer Equipment Dealers Association representing Industry Equipment Dealers in Minnesota, North Dakota and South Dakota and has served long tenures on both the Case IH Agriculture and Case Construction Dealer Advisory Boards. Bryan graduated from Concordia College in Moorhead, MN with honors where he played varsity hockey and was a member of the academic all-conference team.

“I’m excited, honored and humbled by the opportunity to lead the Titan Machinery organization, which has been such an important part of my life for over 20 years,” stated Mr. Knutson. “During my time at Titan Machinery, David and I built a very strong relationship, working together with our global team to deliver on our growth strategy through a track record of robust and consistent organic growth, M&A execution, advancing our customer care strategy and employee engagement, and instilling a culture of operational excellence that has resulted in an improved margin profile across all segments of our business. I look forward to continuing to work with David, our Board, our executive leadership team, and our more than 3,000 global team members to continue providing world class service to our customers and building significant value for our stakeholders.”

About Titan Machinery Inc.

Titan Machinery Inc., founded in 1980 and headquartered in West Fargo, North Dakota, owns and operates a network of full service agricultural and construction equipment dealer locations across three continents –North America, Europe and Australia – servicing farmers, ranchers and commercial applicators. The network consists of: US locations in Colorado, Idaho, Iowa, Kansas, Minnesota, Missouri, Montana, Nebraska, North Dakota, South Dakota, Washington, Wisconsin and Wyoming; European stores located in Bulgaria, Germany, Romania, and Ukraine; and Australian stores located in the regions of Victoria, New South Wales, and South Australia. Titan Machinery’s locations represent one or more of the CNH Industrial Brands, including Case IH, New Holland Agriculture, Case Construction, New Holland Construction, and CNH Industrial Capital. Additional information about Titan Machinery Inc. can be found at www.titanmachinery.com.

Forward Looking Statements

Except for historical information contained herein, the statements in this release are forward-looking and made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. The words “potential,” “believe,” “estimate,” “expect,” “intend,” “may,” “could,” “will,” “plan,” “anticipate,” and similar words and expressions are intended to identify forward-looking statements. These statements are based upon the current beliefs and expectations of our management. Forward-looking statements made in this release may include statements regarding Agriculture, Construction, Europe, and Australia segment initiatives and improvements, growth and profitability expectations, acquisition growth opportunities, employee engagement, customer service expectations, and agricultural and construction equipment industry conditions and trends, involve known and unknown risks and uncertainties that may cause Titan Machinery’s actual results in future periods to differ materially from the forecasted assumptions and expected results. The Company’s risks and uncertainties include, among other things, the impact of the Russia-Ukraine conflict on our Ukrainian subsidiary, our substantial dependence on CNH Industrial including CNH Industrial's ability to design, manufacture and allocate inventory to our stores necessary to satisfy our customers' demands, supply chain disruptions impacting our suppliers, including CNH Industrial, the continued availability of organic growth and acquisition opportunities, difficulties in integrating acquired stores and achieving desired financial performance, industry supply levels and related market conditions, fluctuating agriculture and construction industry economic conditions, the success of initiatives within the Company’s operating segments, the uncertainty and fluctuating conditions in the capital and credit markets, difficulties in conducting international operations, foreign currency risks, governmental agriculture policies, seasonal fluctuations, the ability of the Company to manage inventory levels, weather conditions, disruption in receiving ample inventory financing, and increased competition in the geographic areas served. These and other risks are more fully described in Titan Machinery’s filings with the Securities and Exchange Commission, including the Company’s most recently filed Annual Report on Form 10-K, as updated in subsequently filed Quarterly Reports on Form 10-Q, as applicable. Titan Machinery conducts its business in a highly competitive and rapidly changing environment. Accordingly, new risks and uncertainties may arise. It is not possible for management to predict all such risks and uncertainties, nor to assess the impact of all such risks and uncertainties on Titan Machinery’s business or the extent to which any individual risk or uncertainty, or combination of risks and uncertainties, may cause results to differ materially from those contained in any forward-looking statement. Other than as required by law, Titan Machinery disclaims any obligation to update such risks and uncertainties or to publicly announce results of revisions to any of the forward-looking statements contained in this release to reflect future events or developments.

Investor Relations Contact:

ICR, Inc.

Jeff Sonnek, jsonnek@icrinc.com.

Managing Director

646-277-1263

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

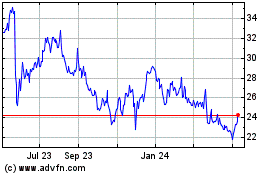

Titan Machinery (NASDAQ:TITN)

Historical Stock Chart

From Mar 2024 to Apr 2024

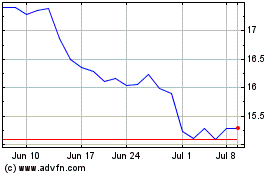

Titan Machinery (NASDAQ:TITN)

Historical Stock Chart

From Apr 2023 to Apr 2024