UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

Under the Securities Exchange Act of 1934

GLASSBRIDGE ENTERPRISES, INC.

(Name of Issuer)

Common Stock

Series B Preferred Stock

(Title of Class of Securities)

377185202

(CUSIP Number)

|

TACORA CAPITAL, LP

Attention: Keri Findley

2505 Pecos Street

Austin, Texas 78703

Tel: 310-741-1070

|

|

(Name, Address and Telephone Number of Person

Authorized to Receive Notices and Communications)

|

October 5, 2023

(Date of Event which Requires Filing of this Statement)

If the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of §§240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box. ☐

Note : Schedules filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See §240.13d-7 for other parties to whom copies are to be sent.

* The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior cover page.

The information required on the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see the Notes).

|

CUSIP No. 377185202

|

| |

1.

|

Name of Reporting Person

Tacora Capital LP

|

| |

|

|

| |

2.

|

Check the Appropriate Box if a Member of a Group (See Instructions)

|

| |

|

(a) ☐

|

| |

|

(b) ☒

|

| |

3.

|

SEC Use Only

|

| |

4.

|

Source of Funds (See Instructions)

OO

|

| |

5.

|

Check if Disclosure of Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e) ☐

|

| |

6.

|

Citizenship or Place of Organization

Delaware

|

|

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person With

|

7.

|

Sole Voting Power

0

|

|

8.

|

Shared Voting Power

7,578 Common Stock

13,725 Series B Preferred Stock (1)

|

|

9.

|

Sole Dispositive Power

0

|

|

10.

|

Shared Dispositive Power

7,578 Common Stock

13,725 Series B Preferred Stock

|

|

|

11.

|

Aggregate Amount Beneficially Owned by Each Reporting Person

7,578 Common Stock

13,725 Series B Preferred Stock

|

|

|

12.

|

Check if the Aggregate Amount in Row (11) Excludes Certain Shares (See Instructions) ☐

|

|

|

13.

|

Percent of Class Represented by Amount in Row (11)

30% Common Stock(2)

100% Series B Preferred Stock(3)

|

|

|

14.

|

Type of Reporting Person (See Instructions)

PN

|

(1) The Series B Preferred Stock of the Issuer is non-voting except for specific matters over which the holders of Series B Preferred Stock have negative voting control, as further set forth and described in the Certificate of Designation attached as Exhibit 3.1 to the Issuer’s 8-K filing dated September 25, 2023.

(2) Based on 25,170 outstanding shares of Common Stock, being the sum of 7,578 shares of Common Stock issued pursuant to the Purchase Agreement (defined below) and 25,170 shares of Common Stock outstanding, as provided by the Issuer in its Form 10-Q dated August 14, 2023, minus 7,578 shares of Common Stock repurchased by the Issuer pursuant to that certain redemption agreement as described in the Issuer’s 8-K filing dated September 25, 2023.

(3) The Series B Preferred Stock was authorized in connection with the Purchase Agreement and no other shares of Series B Preferred Stock are outstanding based on the Issuer’s representations therein.

|

CUSIP No. 377185202

|

|

|

1.

|

Name of Reporting Person

Tacora Capital GP, LLC

|

|

|

|

|

|

|

2.

|

Check the Appropriate Box if a Member of a Group (See Instructions)

|

|

|

|

(a) ☐

|

|

|

|

(b) ☒

|

|

|

3.

|

SEC Use Only

|

|

|

4.

|

Source of Funds (See Instructions)

OO

|

|

|

5.

|

Check if Disclosure of Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e) ☐

|

|

|

6.

|

Citizenship or Place of Organization

Delaware

|

|

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person With

|

7.

|

Sole Voting Power

0

|

|

8.

|

Shared Voting Power

7,578 Common Stock

13,725 Series B Preferred Stock (1)

|

|

9.

|

Sole Dispositive Power

0

|

|

10.

|

Shared Dispositive Power

7,578 Common Stock

13,725 Series B Preferred Stock

|

|

|

11.

|

Aggregate Amount Beneficially Owned by Each Reporting Person

7,578 Common Stock

13,725 Series B Preferred Stock

|

|

|

12.

|

Check if the Aggregate Amount in Row (11) Excludes Certain Shares (See Instructions) ☐

|

|

|

13.

|

Percent of Class Represented by Amount in Row (11)

30% Common Stock(2)

100% Series B Preferred Stock(3)

|

|

|

14.

|

Type of Reporting Person (See Instructions)

OO

|

(1) The Series B Preferred Stock of the Issuer is non-voting except for specific matters over which the holders of Series B Preferred Stock have negative voting control, as further set forth and described in the Certificate of Designation attached as Exhibit 3.1 to the Issuer’s 8-K filing dated September 25, 2023.

(2) Based on 25,170 outstanding shares of Common Stock, being the sum of 7,578 shares of Common Stock issued pursuant to the Purchase Agreement (defined below) and 25,170 shares of Common Stock outstanding, as provided by the Issuer in its Form 10-Q dated August 14, 2023, minus 7,578 shares of Common Stock repurchased by the Issuer pursuant to that certain redemption agreement as described in the Issuer’s 8-K filing dated September 25, 2023.

(3) The Series B Preferred Stock was authorized in connection with the Purchase Agreement and no other shares of Series B Preferred Stock are outstanding based on the Issuer’s representations therein.

|

CUSIP No. 377185202

|

|

|

1.

|

Name of Reporting Person

Keri Findley

|

|

|

|

|

|

|

2.

|

Check the Appropriate Box if a Member of a Group (See Instructions)

|

|

|

|

(a) ☐

|

|

|

|

(b) ☒

|

|

|

3.

|

SEC Use Only

|

|

|

4.

|

Source of Funds (See Instructions)

OO

|

|

|

5.

|

Check if Disclosure of Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e) ☐

|

|

|

6.

|

Citizenship or Place of Organization

United States

|

|

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person With

|

7.

|

Sole Voting Power

0

|

|

8.

|

Shared Voting Power

7,578 Common Stock

13,725 Series B Preferred Stock (1)

|

|

9.

|

Sole Dispositive Power

0

|

|

10.

|

Shared Dispositive Power

7,578 Common Stock

13,725 Series B Preferred Stock

|

|

|

11.

|

Aggregate Amount Beneficially Owned by Each Reporting Person

7,578 Common Stock

13,725 Series B Preferred Stock

|

|

|

12.

|

Check if the Aggregate Amount in Row (11) Excludes Certain Shares (See Instructions) ☐

|

|

|

13.

|

Percent of Class Represented by Amount in Row (11)

30% Common Stock(2)

100% Series B Preferred Stock(3)

|

|

|

14.

|

Type of Reporting Person (See Instructions)

IN

|

(1) The Series B Preferred Stock of the Issuer is non-voting except for specific matters over which the holders of Series B Preferred Stock have negative voting control, as further set forth and described in the Certificate of Designation attached as Exhibit 3.1 to the Issuer’s 8-K filing dated September 25, 2023.

(2) Based on 25,170 outstanding shares of Common Stock, being the sum of 7,578 shares of Common Stock issued pursuant to the Purchase Agreement (defined below) and 25,170 shares of Common Stock outstanding, as provided by the Issuer in its Form 10-Q dated August 14, 2023, minus 7,578 shares of Common Stock repurchased by the Issuer pursuant to that certain redemption agreement as described in the Issuer’s 8-K filing dated September 25, 2023.

(3) The Series B Preferred Stock was authorized in connection with the Purchase Agreement and no other shares of Series B Preferred Stock are outstanding based on the Issuer’s representations therein.

ITEM 1. SECURITY AND ISSUER

The name of the issuer is GlassBridge Enterprises, Inc., a Delaware corporation (the “Issuer”). This Schedule 13D relates to the Issuer’s Common Stock, par value $0.01 per share (the “Common Stock”) and Series B Preferred Stock, par value $0.01 per share (the “Series B Preferred Stock”).

ITEM 2. IDENTITY AND BACKGROUND

This Schedule 13D is being filed by Tacora Capital, LP, a Delaware limited partnership (“Tacora”), Tacora Capital GP, LLC, a Delaware limited liability company (“Tacora GP”) and Keri Findley (each of Ms. Findley, Tacora and Tacora GP is a “Reporting Person” and together the “Reporting Persons”). Tacora GP is the general partner of Tacora. Ms. Findley, a citizen of the United States, is the Chief Executive Officer of Tacora and the controlling person of Tacora GP.

The principal business of the Reporting Persons is investments in, and providing capital solutions, to early- and growth-stage businesses.

The address of the principal place of business of the Reporting Persons is: 2505 Pecos Street Austin, Texas 78703.

There are no criminal convictions or civil proceedings involving the Reporting Persons in the last five years.

ITEM 3. SOURCE AND AMOUNT OF FUNDS OR OTHER CONSIDERATION

The information set forth in Item 4 of this Schedule 13D is incorporated by reference.

ITEM 4. PURPOSE OF TRANSACTION

The responses of each Reporting Person to Rows (7) through (13), including the footnotes thereto, of the cover pages of this Schedule 13D are hereby incorporated by reference in this Item 4.

Tacora and the Issuer are parties to that certain Series B Stock Purchase Agreement, dated as of September 25, 2023 (the “Purchase Agreement”). Pursuant to the Purchase Agreement, Tacora, among other things: (a) purchased all of its 7,578 shares of Common Stock, 13,725 shares of Series B Preferred Stock, 7,500 Series 1 RSUs (as defined in the Purchase Agreement) and 15,000 Series 2 RSUs (as defined in the Purchase Agreement), (b) may purchase up to 32,775 additional shares of Series B Preferred Stock, 17,500 additional Series 1 RSUs and 35,000 Series 2 RSUs upon the terms and conditions set forth in the Purchase Agreement; and (c), as a condition to closing of the transactions contemplated by the Purchase Agreement, the Issuer has appointed two individuals designated by Tacora as directors on the Issuer’s board of directors.

Except as set forth in this Schedule 13D, the Reporting Persons currently have no plans or proposals that relate to or would result in any transaction, event or action enumerated in paragraphs (a) through (j) of Item 4 of Schedule 13D. The Reporting Persons reserve the right to, at any time and from time to time, review or reconsider their position and/or change their purpose and/or, either separately or together with other persons, formulate plans or proposals with respect to those items in the future depending upon then existing factors.

ITEM 5. INTEREST IN SECURITIES OF THE ISSUER

(a)-(b) The responses of each Reporting Person to Rows (7) through (13), including the footnotes thereto, of the cover pages of this Schedule 13D are hereby incorporated by reference in this Item 5. The information set forth in Item 2 above is hereby incorporated by reference.

(c) Except as described in Item 4, during the past 60 days, the Reporting Persons have not effected any transactions with respect to the Common Stock or the Series B Preferred Stock.

(d) No other person has the right to receive or the power to direct the receipt of dividends from, or the proceeds from the sale of, the shares of Common Stock or Preferred Stock beneficially owned by any of the Reporting Persons.

(e) Not applicable.

ITEM 6. CONTRACTS, ARRANGEMENTS, UNDERSTANDINGS OR RELATIONSHIPS WITH RESPECT TO SECURITIES OF THE ISSUER

The information set forth in Item 4 of this Schedule 13D is hereby incorporated by reference in this Item 6.

ITEM 7. MATERIALS TO BE FILED AS EXHIBITS

None.

SIGNATURE

After reasonable inquiry and to the best of my knowledge and belief, the undersigned certify that the information set forth in this statement is true, complete and correct.

Dated: October 5, 2023

|

|

Tacora Capital, LP, by its general partner, Tacora Capital GP, LLC

|

|

|

|

|

|

|

|

|

By:

|

/s/ Keri Findley

|

|

|

|

|

Name: Keri Findley

Title: Authorized Signatory

|

|

|

|

Tacora Capital GP, LLC

|

|

|

|

|

|

|

|

|

By:

|

/s/ Keri Findley

|

|

|

|

|

Name: Keri Findley

Title: Authorized Signatory

|

|

|

|

Keri Findley

|

|

|

|

|

|

|

|

|

By:

|

/s/ Keri Findley

|

|

|

|

|

Name: Keri Findley

|

|

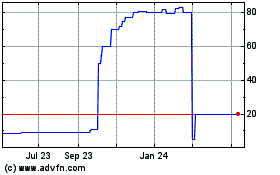

GlassBridge Enterprises (CE) (USOTC:GLAE)

Historical Stock Chart

From Apr 2024 to May 2024

GlassBridge Enterprises (CE) (USOTC:GLAE)

Historical Stock Chart

From May 2023 to May 2024