UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a)-

of the Securities Exchange Act of 1934

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

|

☐

|

Preliminary Proxy Statement

|

|

☐

|

Confidential, for Use of the SEC Only (as permitted by Rule 14a-6(e)(2))

|

|

☒

|

Definitive Proxy Statement

|

|

☐

|

Definitive Additional Materials

|

|

☐

|

Soliciting Material Pursuant to 14a-12

|

PARK CITY GROUP, INC.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

☒

|

No fee required

|

|

☐

|

Fee paid previously with preliminary materials

|

|

☐

|

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11

|

PARK CITY GROUP, INC.

5282 South Commerce Drive, Suite D292

Murray, Utah 84107

(435) 645-2000

October 3, 2023

Dear Fellow Shareholder:

On behalf of the Board of Directors and management of Park City Group, Inc. (the “Company”, “we”, “us” and “our”), you are invited to attend the Company’s 2023 Annual Meeting of Shareholders (the “Annual Meeting” or “Meeting”). The Meeting will be held at our corporate offices located at 5282 South Commerce Drive, Suite D292, Murray, Utah on November 20, 2023 at 9:00 A.M., Mountain Time.

Details of the business to be conducted at the Annual Meeting are described in the Notice of Internet Availability of Proxy Materials (the “Notice”) you received in the mail, and in the accompanying proxy statement (the “Proxy Statement”). We have also made available a copy of our Annual Report on Form 10-K for the year ended June 30, 2023 (the “Annual Report”) with the Proxy Statement. We encourage you to read our Annual Report. It includes our audited financial statements and provides information about our business and services.

As part of our efforts to conserve environmental resources and prevent unnecessary corporate expenses, we have elected to provide access to our proxy materials over the Internet, rather than mailing paper copies. Our management team believes that providing our proxy materials over the Internet increases the ability of our shareholders to access the information they need, while lowering the costs of our Annual Meeting and conserving natural resources.

Your vote is important. Regardless of whether you plan to attend the Annual Meeting in person, please read the Proxy Statement and then vote by Internet, telephone or e-mail as promptly as possible. Please refer to the Notice for instructions on submitting your vote. Voting promptly will save us additional expense in soliciting proxies and will ensure that your shares are represented at the Annual Meeting.

Our Board of Directors has unanimously approved the proposals set forth in the Proxy Statement and we recommend that you vote in favor of each such proposal. We look forward to seeing you at the Annual Meeting.

| |

Sincerely,

|

| |

|

| |

/s/ Randall K. Fields |

| |

RANDALL K. FIELDS

Chairman and Chief Executive Officer

|

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

November 20, 2023

|

Date and Time

|

|

November 20, 2023 at 9:00 A.M., Mountain Time.

|

| |

|

|

|

Place

|

|

Our corporate offices, located at 5282 South Commerce Drive, Suite D292, Murray, Utah 84107.

|

| |

|

|

|

Items of Business

|

|

1.

|

Election of the four director nominees named in the accompanying proxy statement (the “Proxy Statement”), each for a term of one year expiring at the Company’s 2024 annual meeting of shareholders or until their respective successors are duly elected and qualified;

|

| |

|

|

|

| |

|

2.

|

Approval of the 2023 Omnibus Equity Incentive Plan (“2023 Plan”);

|

| |

|

|

|

| |

|

3.

|

Approval of the 2023 Employee Stock Purchase Plan (“2023 ESPP”);

|

| |

|

|

|

| |

|

4.

|

Ratification of Haynie & Company as our independent registered public accounting firm for the fiscal year ending June 30, 2024; and

|

| |

|

|

|

| |

|

5.

|

To transact other business that may properly come before the Company’s 2023 annual meeting of shareholders (the “Annual Meeting” or, the “Meeting”) or any adjournments or postponements thereof.

|

| |

|

|

|

Adjournments and Postponements

|

|

Any action on the items of business described above may be considered at the Annual Meeting at the time and on the date specified above or at any time and date to which the Annual Meeting may be properly adjourned or postponed.

|

| |

|

|

|

Record Date

|

|

September 28, 2023 (the “Record Date”).

|

| |

|

|

| |

|

Only holders of record of our common stock, par value $0.01 per share (“Common Stock”), and/or Series B Convertible Preferred Stock, par value $0.01 per share (“Series B Preferred”), as of the Record Date are entitled to notice of and to vote at the Annual Meeting.

|

| |

|

|

|

Meeting Admission

|

|

You are invited to attend the Annual Meeting if you are a shareholder of record or a beneficial owner of shares of the Company’s Common Stock or Series B Preferred as of the Record Date.

|

| |

|

|

|

Availability of Proxy Materials

|

|

The Company’s proxy materials and the Annual Report on Form 10-K for the year ended June 30, 2023 are also available on the internet at: www.iproxydirect.com/PCYG.

|

| |

|

|

|

Voting

|

|

If your shares are held in the name of a bank, broker or other fiduciary, please follow the instructions on the proxy card. Whether or not you expect to attend in person, we urge you to vote your shares as promptly as possible by following the instruction on the Notice of Internet Availability of Proxy Material you received in the mail so that your shares may be represented and voted at the Annual Meeting. Your vote is very important.

|

| |

BY ORDER OF THE BOARD OF DIRECTORS,

|

| |

/s/ Edward L. Clissold

|

|

Murray, Utah

October 3, 2023

|

EDWARD L. CLISSOLD

General Counsel and Corporate Secretary

|

PARK CITY GROUP, INC.

5282 South Commerce Drive, Suite D292

Murray, Utah 84107

(435) 645-2000

PROXY STATEMENT

The enclosed proxy is solicited on behalf of the Board of Directors (the “Board”) of Park City Group, Inc., a Nevada corporation (the “Company”, “we”, “us” and “our”), for use at our upcoming 2023 Annual Meeting of Shareholders (the “Annual Meeting”, or the “Meeting”) to be held on November 20, 2023 at 9:00 A.M. Mountain Time, and at any adjournment or postponement thereof, at our corporate offices located at 5282 South Commerce Drive, Suite D292, Murray, Utah 84107.

We have elected to provide access to this year’s proxy materials primarily over the Internet, under the Securities and Exchange Commission’s (the "SEC") “notice and access” rules. On or about October 4, 2023, we mailed a Notice of Internet Availability of Proxy Materials (the “Notice”) to each of our shareholders entitled to notice of and to vote at the Annual Meeting. This Notice contained instructions on how to access this proxy statement (“Proxy Statement”), our Annual Report on Form 10-K for the year ended June 30, 2023 (“Annual Report”) and how to submit your vote via the Internet, telephone and/or e-mail. The Notice also included instructions on how you can receive a paper copy of your proxy materials. The Proxy Statement and the Annual Report both are available online at: http://www.iproxydirect.com/PCYG.

Voting

The specific proposals to be considered and acted upon at our Annual Meeting were summarized in the Notice and are described in more detail throughout this Proxy Statement. As of September 28, 2023 (the “Record Date”), we had 18,175,480 shares of our common stock, par value $0.01 per share (“Common Stock”), outstanding, and 625,375 shares of our Series B Convertible Preferred Stock, par value $0.01 per share (“Series B Preferred”), outstanding, each of which are entitled to vote at the Annual Meeting. Each holder of Common Stock is entitled to one vote per share of Common Stock held, and each holder of Series B Preferred is entitled to 2.5 votes per share of Series B Preferred held as the Record Date. As of the Record Date, outstanding shares represented 19,738,917 votes, consisting of 18,175,480 attributable to Common Stock and 1,563,437 attributable to Series B Preferred.

Quorum

In order for any business to be conducted at the Annual Meeting, the holders of a majority of the voting power must be present, either in person or by properly executed proxy, regardless of whether the proxy has authority to vote on any matter. If a quorum is not present at the scheduled time of the Annual Meeting, the shareholders who are present may adjourn the Annual Meeting until a quorum is present. The time and place of the adjourned Annual Meeting will be announced at the time the adjournment is taken, and no other notice will be given. An adjournment will have no effect on the business that may be conducted at the Annual Meeting.

Required Vote for Approval

|

No.

|

Proposal

|

| |

|

|

1.

|

Election of Directors. The four director nominees who receive the greatest number of votes cast at the Annual Meeting by shares present, either in person or by proxy, and entitled to vote will be elected.

|

|

2.

|

Approval of the Company’s 2023 Omnibus Equity Incentive Plan. Our Board unanimously approved the Company’s 2023 Omnibus Equity Incentive Plan (the “2023 Plan”) on August 29, 2023. A copy of the 2023 Plan is attached to this Proxy Statement as Appendix A. The affirmative “FOR” vote of a majority of the shares present in person or by proxy at the Annual Meeting and entitled to vote is necessary for approval of this proposal. |

| |

|

|

3.

|

Approval of the Company’s 2023 Employee Stock Purchase Plan. Our Board unanimously approved the Company’s 2023 Employee Stock Purchase Plan (the “2023 ESPP”) on August 29, 2023. A copy of the 2023 ESPP is attached to this Proxy Statement as Appendix B. The affirmative “FOR” vote of a majority of the shares present in person or by proxy at the Annual Meeting and entitled to vote is necessary for approval of this proposal. |

| |

|

|

4.

|

Ratification of Appointment of Auditors. To ratify the appointment of Haynie & Company as our independent auditors for the fiscal year ending June 30, 2024, the number of votes cast “FOR” must exceed the number of votes cast “AGAINST” this proposal.

|

Abstentions and Broker Non-Votes

All votes will be tabulated by the inspector of election appointed for the Annual Meeting, who will separately tabulate affirmative and negative votes, abstentions and broker non-votes. An abstention is the voluntary act of not voting by a shareholder who is present at a meeting and entitled to vote. A broker “non-vote” occurs when a broker nominee holding shares for a beneficial owner does not vote on a particular proposal because the nominee does not have discretionary power for that particular item and has not received instructions from the beneficial owner. If you hold your shares in “street name” through a broker or other nominee, your broker or nominee may not be permitted to exercise voting discretion with respect to some of the matters to be acted upon. If you do not give your broker or nominee specific instructions regarding such matters, your proxy will be deemed a “broker non-vote.”

Under Nevada law, abstentions and broker non-votes are not counted as votes cast on an item and therefore will not affect the outcome of any proposal presented in this Proxy Statement, although they are counted for purposes of determining whether there is a quorum present at the Annual Meeting.

Voting and Revocation of Proxies

If your proxy is properly returned to the Company, the shares represented thereby will be voted at the Annual Meeting in accordance with the instructions specified thereon. If you return your proxy without specifying how the shares represented thereby are to be voted, the proxy will be voted (i) “FOR” the election of the four director nominees identified in this Proxy Statement, each of whom has been nominated by our Board; (ii) “FOR” the adoption of the 2023 Plan; (iii) “FOR” the adoption of the 2023 ESPP; (iv) “FOR” ratification of the appointment of Haynie & Company as our independent auditors for fiscal year ending June 30, 2024; and (v) at the discretion of the proxy holders, on any other matter that may properly come before the Annual Meeting or any adjournment or postponement thereof.

You may revoke or change your proxy at any time before the Annual Meeting by submission to our Corporate Secretary at our corporate offices at 5282 South Commerce Drive, Suite D292, Murray, Utah, 84107, a notice of revocation or another signed proxy with a later date. You may also revoke your proxy by attending the Annual Meeting and voting in person. Attendance at the Annual Meeting alone will not revoke your proxy. If you are a shareholder whose shares are not registered in your own name, you will need additional documentation from your broker or record holder to vote personally at the Annual Meeting.

Solicitation

We will bear the entire cost of solicitation, including the preparation, assembly, printing and mailing of proxy materials, any requested copies of this Proxy Statement and our Annual Report, form of proxy, as well as any additional solicitation materials that may be furnished to our shareholders. Copies of any solicitation materials will be furnished to brokerage houses, fiduciaries and custodians holding shares in their names that are beneficially owned by others so that they may forward this solicitation material to such beneficial owners. In addition, we may reimburse such persons for their costs in forwarding the solicitation materials to such beneficial owners. The original solicitation of proxies by mail may be supplemented by a solicitation by telephone, facsimile or other means by our directors, officers or employees. No additional compensation will be paid to these individuals for any such services. Except as described above, we do not presently intend to solicit proxies other than by mail and telephone.

PROPOSAL NO. 1

ELECTION OF DIRECTORS

General

The Company’s Articles of Incorporation, as amended (“Charter”), and Amended and Restated Bylaws (“Bylaws”) provide that our Board will consist of no less than one director, and that upon a change in the number of directors, any newly created or eliminated directorships will be apportioned by the remaining members of the Board or by shareholders.

Our Board currently consists of four directors. Each of the director nominees identified below has confirmed that he is able and willing to serve as a director if elected. If any of the director nominees become unable or unwilling to serve, your proxy will be voted for the election of a substitute director nominee recommended by the current Board.

Upon recommendation of the Nominating and Corporate Governance Committee, the Board has nominated Randall K. Fields, Robert W. Allen, Ronald C. Hodge and Peter J. Larkin for election at the Meeting, each to serve for one-year terms until our 2024 annual meeting of shareholders or until his successor is duly elected and qualified.

Please see “Directors” below for more information, including background information, business experience, and the Nominating and the Corporate Governance Committee’s recommendation of each director nominee.

Required Vote and Recommendation

Directors are elected by a plurality vote of the shares present or represented by proxy and entitled to vote at the Annual Meeting. The four director nominees receiving the highest number of affirmative votes will be elected. Accordingly, under Nevada law, our Charter and Bylaws, abstentions and broker non-votes will not have any effect on the election of a particular director nominee. Unless otherwise instructed or unless authority to vote is withheld, shares represented by executed proxies will be voted “FOR” the election of each of the nominees.

The Board recommends that shareholders vote “FOR” the election of Messrs. Fields, Allen, Hodge and Larkin.

DIRECTORS

The sections below set forth certain information regarding the director nominees for election as directors of the Company. There are no family relationships between any of the directors and the Company’s Named Executive Officers.

|

Director Nominee, Title

|

Age

|

|

Randall K. Fields – Chairman, President and Chief Executive Officer

|

76

|

|

Robert W. Allen – Independent Director

|

80

|

|

Ronald C. Hodge – Independent Director

|

75

|

|

Peter J. Larkin – Independent Director

|

69

|

Randall K. Fields founded the Company in 1990 and has been the Chairman of the Board, President and Chief Executive Officer of the Company since its inception and is responsible for the strategic direction of the Company. Mr. Fields also serves as the Company’s Chief Operating Officer and Head of Sales. Mr. Fields co-founded Mrs. Fields Cookies with his then wife, Debbi Fields, in 1977. He served as Chairman of the Board of Mrs. Fields Cookies from 1978 to 1990. In the early 1970’s, Mr. Fields established Fields Investment Group, a financial and economic consulting firm. Mr. Fields received a Bachelor of Arts degree and a Master of Arts degree from Stanford University, where he was Phi Beta Kappa, Danforth Fellow, and National Science Foundation Fellow.

As the founder of the Company, Mr. Fields’ expertise in the Company’s industry and markets, his extensive sales, marketing and technical background, and his expansive business experience allow him to bring a unique understanding of the industries and markets in which the Company operates, as well as an entrepreneurial vision to the Company and the Board.

Robert W. Allen joined the Board in October 2007. Mr. Allen is a seasoned executive with many years of prior experience in positions such as Chairman, President, and Chief Executive Officer of businesses ranging in size from $200 million to $2.5 billion. Mr. Allen has over thirty years of experience in the dairy industry, most notably as a catalyst for developing companies and a turn-around agent for troubled companies or divisions. Mr. Allen was Chief Executive Officer of Tuscan Lehigh Dairies from July 1994 to December 1998, where he established a leadership team that repositioned the company and developed a position in the marketplace for the branding of its products. Prior to this, from September 1991 to April 1994, he served as Executive Vice President of Borden, Inc., where he was recruited to turn around the largest and most troubled division of the company. He is also a past Chair of Kid Peace International, a $160 million non-profit agency assisting children in crises.

Mr. Allen’s years of experience in an area of growth for the Company, the dairy industry, as well as his extensive experience developing and managing companies in senior executive roles, add significant value to the Company and its Board of Directors in assessing challenges in one of its growth markets, and in addressing organizational and development issues facing the Company.

Ronald C. Hodge joined the Board in February 2013. Mr. Hodge was an advisor to Delhaize America, LLC, a role he transitioned into following his time as Delhaize America’s Chief Executive Officer from March 2011 to October 2012. Prior to Delhaize America, Mr. Hodge served as Executive Vice President of Delhaize Group and Chief Executive Officer of Hannaford Bros. Co. He joined Hannaford in 1980 and served in various executive roles, including Vice President and General Manager of Hannaford’s New York Division, Senior Vice President of Retail Operations, Executive Vice President of Sales and Marketing, and Executive Vice President and Chief Operating Officer. He became President of Hannaford in December 2000 and Chief Executive Officer in 2001. While leading the start-up of Hannaford’s entry into upstate New York, Mr. Hodge was elected Chairman of the New York State Food Merchant’s Association and served on several Community Agency Boards of Directors. He chaired the Northeastern New York United Way Campaign in 1995 and was selected as the New York Capital Region’s Citizen of the Year in 1996. Mr. Hodge holds a Bachelor of Science degree in business administration from Plymouth State College in New Hampshire.

Mr. Hodge’s 38 years of management experience in the grocery industry, including leading the successful expansion of Hannaford Bros. Co., provides the Company with valuable industry knowledge and insight as the Company continues to grow its scan-based technologies to a growing client base.

Peter J. Larkin joined the Board in August 2019. Mr. Larkin is the former President and Chief Executive Officer of the National Grocers Association (“NGA”), a national trade association representing the retail and wholesale grocers that comprise the independent sector of the food distribution industry, and the not-for-profit NGA Foundation where he served from 2010 until his resignation effective September 1, 2019. Prior to that, Mr. Larkin served as President of Larkin Public Affairs from 2007 to 2010, as President and Chief Executive Officer for the California Grocers Association from 1996 to 2007 and in several positions within the food service industry in state and governmental affairs between 1976 to 1988, including serving as Vice President of State Government Relations and Environmental Affairs with the Food Marketing Institute from 1989 to 1996. Mr. Larkin holds a B.A. degree in Political Science from the University of Vermont and has served as a director and advisory board member with various industry-related companies and organizations throughout his career spanning over four decades.

Mr. Larkin provides the Board with valuable industry insight stemming from his extensive career representing retail and wholesale grocers, including an understanding of matters unique to independent grocers.

There have been no events under any bankruptcy act, no criminal proceedings and no judgments or injunctions material to the evaluation of the ability and integrity of any director or director nominee during the past ten years.

Director Compensation

Currently, each of our non-executive directors, consisting of Messrs. Allen, Hodge and Larkin, receive an annual retainer of $75,000 for their service on the Board, which retainer is payable in either cash or shares of Common Stock in quarterly installments, at the Company’s discretion. During the year ended June 30, 2023, the Company elected to pay director fees to two non-executive directors in shares of Common Stock and one non-executive director in cash.

In addition to the annual retainer, any newly appointed outside independent directors to the Board receive a one-time grant of $150,000, payable in shares of the Company’s restricted Common Stock, calculated based on the market value of the shares of Common Stock on the date of grant. The shares vest ratably over a five-year period.

The following table provides information regarding 2023 compensation paid to non-employee directors. Information regarding executive compensation paid to Mr. Fields during the year ended June 30, 2023 is reflected in the Summary Compensation table below under “Executive Compensation” of this Proxy Statement.

|

Director

|

|

Fees Earned

or Paid

in Cash ($)(1)

|

|

|

Stock

Awards ($)

|

|

|

Total

($)

|

|

|

Robert W. Allen

|

|

$

|

75,000

|

|

|

|

-

|

|

|

$

|

75,000

|

|

|

Ronald C. Hodge

|

|

$

|

75,000

|

|

|

|

-

|

|

|

$

|

75,000

|

|

|

Peter J. Larkin (2)

|

|

$

|

75,000

|

|

|

|

-

|

|

|

$

|

75,000

|

|

|

(1)

|

Amounts reported in this table represent the amounts earned by each non-employee director for their service on the Company’s Board during the year ended June 30, 2023, of which two directors were paid in shares of Common Stock and one was paid in cash. The amounts in this column represent the aggregate grant date fair value of the shares of Common Stock issued to each non-employee director in fiscal 2021, calculated in accordance with Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Topic 718.

|

|

(2)

|

Mr. Larkin was appointed to the Board in August 2019, at which time he received a one-time grant of $150,000 worth of Common Stock, which shares vest ratably over a five-year period beginning on the one-year anniversary of the grant date. Accordingly, 19,801 shares of Common Stock were vested as of September 28, 2023. The remaining 4,951 shares of Common Stock will vest ratably over the remaining year.

|

GOVERNANCE AND BOARD MATTERS

Term of Office

The Company’s Charter provides for a Board comprised of one class of directors. Directors serve from the time they are duly elected and qualified until the conclusion of the next annual meeting of shareholders or their earlier death, resignation, or removal from office.

Director Independence

The Board has determined that all of its members, other than Mr. Fields, who serves as the Company’s President and Chief Executive Officer, are “independent” within the meaning of Rule 5605(a)(2) of the NASDAQ Stock Market Rules, and the Securities and Exchange Commission (the “SEC”) rules regarding independence.

Director Nomination Process

The Nominating and Corporate Governance Committee of the Board identifies director nominees by first considering those current members of the Board who are willing to continue service. Current members of the Board who possess the skills and experience that are relevant to our business and are willing to continue service are considered for re-election. Additionally, the Nominating and Corporate Governance Committee endeavors to take into consideration the appropriate balance of the value that the existing members of the Board provide in continuing their service to the Board in addition to the new perspective that new directors may bring to the Board. Nominees for director are selected by a majority of the members of the Board. Although the Company does not have a formal policy on Board diversity, in considering the suitability of director nominees, the Nominating and Corporate Governance Committee considers such factors as it deems appropriate to develop a Board and committees that are diverse in nature and comprised of experienced and seasoned advisors. Factors considered by the Nominating and Corporate Governance Committee include judgment, knowledge, skill, diversity, integrity, experience with businesses and other organizations of comparable size, including experience in the grocery industry, business, finance, administration or public service, the relevance of a potential nominee’s experience to our needs and experience of other Board members, experience with accounting rules and practices, the desire to balance the considerable benefit of continuity with the periodic injection of the fresh perspective provided by new members, and the extent to which a potential nominee would be a desirable addition to the Board and/or any committees of the Board.

The Nominating and Corporate Governance Committee and the Board may consider recommendations for director candidates that are submitted by shareholders, provided such nominations are submitted in accordance with the procedure set forth in our Bylaws. The Nominating and Corporate Governance Committee will evaluate shareholder suggestions for director nominees in the same manner as it evaluates suggestions for director nominees made by management, then-current directors or other appropriate sources.

Code of Ethics and Business Conduct

The Company’s Code of Ethics and Business Conduct is posted at the Company’s website located at www.parkcitygroup.com.

The Role of the Board in Risk Oversight

The Board’s role in the Company’s risk oversight process includes reviewing and discussing with members of management areas of material risk to the Company, including strategic, operational, financial and legal risks. The Board, as a whole, primarily deals with matters related to strategic and operational risk. The Audit Committee deals with matters of financial and legal risk. The Compensation Committee addresses risks related to compensation and other related matters. The Nominating and Governance Committee manages risks associated with Board independence and corporate governance. Committees report to the full Board regarding their respective considerations and actions.

The Board’s Leadership Structure

Our Board has discretion to determine whether to separate or combine the roles of Chairman of the Board and Chief Executive Officer. Our founder, Mr. Fields, has served in both roles since 2001, and our Board continues to believe that his combined role is most advantageous to the Company and its shareholders. Our technology has its genesis in the operations of Mrs. Fields Cookies, co-founded by Mr. Fields, and Mr. Fields possesses in-depth knowledge of the issues, opportunities and risks facing us, our business and our industry and is best positioned to fulfill the Chairman’s responsibility to develop meeting agendas that focus the Board’s time and attention on critical matters and to facilitate constructive dialogue among Board members on strategic issues.

In addition to Mr. Fields’ leadership, the Board maintains effective independent oversight through a number of governance practices, including, open and direct communication with management, input on meeting agendas, and regular executive sessions.

Meetings And Committees of The Board

The Board met four times and acted four times by unanimous written consent during the fiscal year ended June 30, 2023. The current committees of the Board are the Audit Committee, Compensation Committee, and Nominating and Corporate Governance Committee. Each of the Company’s directors who served during fiscal 2023 attended or participated in no less than 75% or more of the aggregate of (i) the total number of meetings of the Board; and (ii) the total number of meetings held by all committees of the Board on which such director served as a member during fiscal 2023. Directors are not required to attend the Company’s annual meeting of shareholders.

The following table represents the current composition of each committee of the Board and meetings held during the fiscal year ended June 30, 2023:

| |

|

Committees

|

|

Director

|

|

Audit

|

|

|

Compensation

|

|

|

Nominating

and

Corporate

Governance

|

|

Randall K. Fields

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

Robert W. Allen

|

|

|

X

|

|

|

|

CC

|

|

|

|

-

|

|

Ronald C. Hodge

|

|

|

CC

|

|

|

|

X

|

|

|

|

X

|

|

Peter J. Larkin

|

|

|

X

|

|

|

|

-

|

|

|

|

CC

|

|

Meetings Held in Fiscal 2023

|

|

|

4

|

|

|

|

1

|

|

|

|

1

|

|

CC – Committee Chair

X – Member

|

|

|

|

|

|

|

|

|

|

|

|

Audit Committee. Pursuant to the Company’s Audit Committee Charter, the Audit Committee assists the Board in fulfilling its legal and fiduciary obligations in matters involving our accounting, auditing, financial reporting, internal control and legal compliance functions by approving the services performed by our independent accountants and reviewing their reports regarding our accounting practices and systems of internal accounting controls. The Audit Committee also oversees the audit efforts of our independent accountants and takes those actions as it deems necessary to satisfy it that the accountants are independent of management. The current members of the Audit Committee are Messrs. Hodge, Allen and Larkin each of whom are non-executive members of our Board. Mr. Hodge also serves as the Audit Committee Chair and Mr. Allen is the designated Audit Committee financial expert, as that term is defined under SEC rules implementing Section 407 of the Sarbanes Oxley Act of 2002 (“SOX”), and possesses the requisite financial sophistication, as defined under applicable rules. We believe the composition of our Audit Committee meets the criteria for independence under, and the functioning of our Audit Committee complies with, the applicable requirements of the NASDAQ Stock Market Rules, SOX and SEC rules and regulations.

Compensation Committee. Pursuant to the Company’s Compensation Committee Charter, the Compensation Committee determines our general compensation policies and the compensation provided to our directors and officers. The Compensation Committee also reviews and determines bonuses for our officers and other employees. In addition, the Compensation Committee reviews and determines equity-based compensation for our directors, officers, employees and consultants and administers our stock option plans and employee stock purchase plan. During the year ended June 30, 2023, the Compensation Committee consisted of Messrs. Allen and Hodge with Mr. Allen also serving as Compensation Committee Chair. We believe that the composition of our Compensation Committee meets the criteria for independence under, and the functioning of our Compensation Committee complied with, the applicable requirements of the NASDAQ Stock Market Rules, SOX and SEC rules and regulations during the year ended June 30, 2023, and will continue to do so in future periods.

Nominating and Corporate Governance Committee. Pursuant to the Company’s Nominating and Corporate Governance Committee Charter, the Nominating and Corporate Governance Committee is responsible for making recommendations to the Board regarding candidates for directorships and the size and composition of the Board. In addition, the Nominating and Corporate Governance Committee is responsible for overseeing our corporate governance guidelines and reporting and making recommendations to the Board concerning corporate governance matters. The current members of the Nominating and Corporate Governance Committee are Messrs. Hodge and Larkin. Mr. Larkin also serves as Nominating and Corporate Governance Committee Chair. We believe that the composition of our Nominating and Corporate Governance Committee meets the criteria for independence under, and the functioning of our Nominating and Corporate Governance Committee complies with, the applicable requirements of the NASDAQ Stock Market Rules, SOX and SEC rules and regulations.

Board Diversity

The table below provides certain information with respect to the composition of our Board. Each of the categories listed in the table has the meaning ascribed to it in Nasdaq Listing Rule 5605(f).

|

Board Diversity Matrix

(As of October 3, 2023)

|

|

Total Number of Directors

|

4

|

| |

Female

|

Male

|

Non-Binary

|

Did Not

Disclose

Gender

|

|

Gender Identity

|

|

|

|

|

|

Directors

|

—

|

4

|

—

|

—

|

|

Demographic Background

|

|

|

|

|

|

African American or Black

|

—

|

—

|

—

|

—

|

|

Alaskan Native or Native American

|

—

|

—

|

—

|

—

|

|

Asian

|

—

|

—

|

—

|

—

|

|

Hispanic or Latinx

|

—

|

—

|

—

|

—

|

|

Native Hawaiian or Pacific Islander

|

—

|

—

|

—

|

—

|

|

White

|

—

|

3

|

—

|

—

|

|

Two or More Races or Ethnicities

|

—

|

—

|

—

|

—

|

|

LGBTQ+

|

—

|

|

Did Not Disclose Demographic Background

|

1*

|

* Did not disclose with respect to LGBTQ+ background.

|

Board Diversity Matrix

(As of October 4, 2022)

|

|

Total Number of Directors

|

4

|

| |

Female

|

Male

|

Non-Binary

|

Did Not

Disclose

Gender

|

|

Gender Identity

|

|

|

|

|

|

Directors

|

—

|

4

|

—

|

—

|

|

Demographic Background

|

|

|

|

|

|

African American or Black

|

—

|

—

|

—

|

—

|

|

Alaskan Native or Native American

|

—

|

—

|

—

|

—

|

|

Asian

|

—

|

—

|

—

|

—

|

|

Hispanic or Latinx

|

—

|

—

|

—

|

—

|

|

Native Hawaiian or Pacific Islander

|

—

|

—

|

—

|

—

|

|

White

|

—

|

3

|

—

|

—

|

|

Two or More Races or Ethnicities

|

—

|

—

|

—

|

—

|

|

LGBTQ+

|

—

|

|

Did Not Disclose Demographic Background

|

1*

|

* Did not disclose with respect to LGBTQ+ background.

Disclosure Pursuant to Rule 5605(f)(3) of the Nasdaq Listing Rules

Rule 5605(f)(2)(B) of the Nasdaq Listing Rules requires us to have, or to explain why we do not have, at least two members of our Board of Directors who are “Diverse” directors, at least one of whom self-identifies as “Female,” subject to transition periods specified by Rule 5605(f)(7) of the Nasdaq Listing Rules. For purposes of Rule 5605(f)(2)(B), the term “Diverse” means an individual who self-identifies as one or more of Female, LGBTQ+, or an underrepresented individual based on national, racial, ethnic, indigenous, cultural, religious or linguistic identity in the country of our principal executive offices; and the term “Female” means an individual who self-identifies her gender as a woman, without regard to the individual’s designated sex at birth.

Rule 5605(f)(7) of the Nasdaq Listing Rules requires us to have, or explain why we do not have, (i) by December 31, 2023, at least one Diverse director and (ii) by December 31, 2025, at least two Diverse directors, at least one of whom self-identifies as Female.

As of the date of this Proxy Statement, our Board of Directors has determined that we will satisfy the requirements of Rule 5605(f)(2)(B) of the Nasdaq Listing Rules by explaining why we will not have any Diverse directors by either December 31, 2023 or December 31, 2025. We acknowledge and support the general principles behind the diversity objectives set forth in Rule 5606(f)(2)(B) of the Nasdaq Listing Rules. However, the Company’s Board does not believe achieving Nasdaq’s diversity objectives are feasible given the Company’s current circumstances. We believe that the current composition of our Board is suitable for the current scale of and goals for our business and operations. Most members of our Board have served as our directors for a number of years and all incumbent directors are familiar with our Company’s history and business operations; provide us with a variety of personal, professional and industry backgrounds, with appropriate experience and skill sets. We intend to continually assess our industry and the status of our business and may decide in the future, should future circumstances make it appropriate, to seek to meet the diversity objectives contemplated by Rule 5606(f)(2)(B) of the Nasdaq Listing Rules.

Shareholder Communications

If you wish to communicate with the Board, you may send your communication in writing to:

Park City Group, Inc.

c/o Corporate Secretary

5282 South Commerce Drive, Suite D292

Murray, Utah 84107

You must include your name and address in the written communication and indicate whether you are a shareholder of the Company. Our Corporate Secretary will review any communication received from a shareholder, and all material and appropriate communications from shareholders will be forwarded to the appropriate director(s) or committee of the Board based on the subject matter.

EXECUTIVE OFFICERS

The following table sets forth information regarding the Company’s current executive officers and significant employees:

|

Executive Officer

|

|

Age

|

|

Title

|

|

Randall K. Fields

|

|

76

|

|

Chairman, President and Chief Executive Officer

|

|

John R. Merrill

|

|

53

|

|

Chief Financial Officer

|

|

Edward L. Clissold

|

|

67

|

|

General Counsel and Corporate Secretary

|

The executive officers and significant employees named above were appointed by the Board, each to serve in such position until their respective successors have been duly appointed and qualified or until their earlier death, resignation or removal from office.

Executive Officers

Randall K. Fields Please see Mr. Fields’ biography under the “Directors” section of this Proxy Statement.

John R. Merrill joined the Company in May 2019 and currently serves as the Company’s Chief Financial Officer. Mr. Merrill has held a variety of financial roles within public and private organizations including United Health Group, Clear Channel, IMG, and Sports Authority. Most recently, Mr. Merrill served as Chief Financial Officer of 360 Touch Advertising from 2016 to 2018, as Chief Financial Officer of Track Group, Inc. (OTCQX: TRCK) from 2014 to 2016, and as a merger and acquisition consultant for UnitedHealth Group (NYSE: UNH) from 2010 to 2014. In addition, Mr. Merrill previously served as the Company’s Chief Financial Officer from 2006 to 2010. Mr. Merrill began his career with KPMG and holds a Bachelor’s and Master’s degrees in Accounting from the University of South Florida.

Edward L. Clissold joined the Company in March 2002 and currently serves as the Company’s General Counsel and Corporate Secretary. Mr. Clissold previously served as the Company’s Chief Financial Officer from August 2012 until September 2015. Prior to his time with the Company, Mr. Clissold served as General Counsel for Mrs. Fields Cookies from August 1987 to April 1995 and was also in private practice. Mr. Clissold holds a Bachelor’s degree in Finance from the University of Utah and a Juris Doctorate from Brigham Young University.

EXECUTIVE COMPENSATION

Summary Compensation Table

The table set forth below reflects certain information about the compensation paid or accrued during the years ended June 30, 2023 and 2022 to our Chief Executive Officer and our executive officers, other than our Chief Executive Officer, who were serving as an executive officer as of June 30, 2023, and whose annual compensation exceeded $100,000 during such year (collectively the “Named Executive Officers”).

|

Name and Principal Position

|

|

Year

|

|

Salary

($)

|

|

|

Bonus

($)

|

|

|

Stock Awards

($)(1)

|

|

All Other

Compensation

($)(4)

|

|

|

Total

($)

|

|

|

Randall K. Fields

|

|

2023

|

|

|

1,034,869

|

|

(2)

|

|

500,000

|

|

(3) |

|

-

|

|

|

130,816

|

|

(4) |

|

1,665,685

|

|

|

Chief Executive Officer and Chairman of the Board

|

|

2022

|

|

|

1,039,198

|

|

(2)

|

|

200,000

|

|

(3) |

|

295,000

|

|

|

130,816

|

|

(4) |

|

1,665,014

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

John R. Merrill

|

|

2023

|

|

|

275,000

|

|

|

|

165,625

|

|

|

|

48,200

|

|

|

-

|

|

|

|

488,825

|

|

|

Chief Financial Officer

|

|

2022

|

|

|

225,000

|

|

|

|

84,375

|

|

|

|

-

|

|

|

-

|

|

|

|

309,375

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Edward L. Clissold

|

|

2023

|

|

|

217,245

|

|

|

|

-

|

|

|

|

-

|

|

|

-

|

|

|

|

217,245

|

|

|

General Counsel and Corporate Secretary

|

|

2022

|

|

|

214,255

|

|

|

|

-

|

|

|

|

-

|

|

|

-

|

|

|

|

214,255

|

|

|

(1)

|

Stock awards consist solely of shares of restricted Common Stock. Amounts shown do not reflect compensation actually received by the Named Executive Officer. Instead, the amounts shown are the compensation costs recognized by the Company during the fiscal years for stock awards as determined pursuant to FASB ASC 718.

|

| |

|

|

(2)

|

On July 1, 2019, the Company and Mr. Fields and Fields Management, Inc. (“FMI”), a management company wholly owned by Mr. Fields, entered into an amended Employment Agreement and an amended Service Agreement, respectively. See “Employment Agreements” below for a more detailed description of Mr. Fields’ amended Employment Agreement and FMI’s amended Service Agreement. $924,060 of Mr. Fields’ cash compensation during each of 2023 and 2022 was paid to FMI pursuant to the terms and conditions of the Service Agreement in effect during the applicable period. |

| |

|

|

(3)

|

The terms and conditions of the amended Employment Agreement by and between Mr. Fields and the Company, first dated June 30, 2013, as amended, provide for an incentive bonus to be paid to Mr. Fields at the discretion of the Compensation Committee and upon approval by the Board, based upon the Company’s achievement of certain performance goals. Upon recommendation of the Compensation Committee, the Board approved a bonus to Mr. Fields for performance in the amount of $500,000 for the year ending June 30, 2023, and in the amount of $200,000 for the year ending June 30, 2022. The amounts granted reflect successful completion of certain business objectives.

|

| |

|

|

(4)

|

These amounts include premiums paid on life insurance policies of $73,416 for each of 2023 and 2022, respectively; computer related expenses of $6,000 for each of 2023 and 2022; Company car related expenses of $14,400 for each of 2023 and 2022; medical premiums of $25,000 for each of 2023 and 2022; and reimbursement for certain accounting services of $12,000 for each of 2023 and 2022.

|

Employment Arrangements

Fields Employment Agreement

The Company has an Employment Agreement with Randall K. Fields, first dated June 30, 2013 and subsequently amended July 1, 2022, (the “Fields Employment Agreement”), pursuant to which Mr. Fields is employed by the Company in the position of Sales Department Manager through June 30, 2027 for annual compensation of $50,000, subject to annual increases equal to 75% of the Company’s percentage annual revenue growth beginning in the 2014 fiscal year. Mr. Fields may also be eligible for an annual incentive bonus, awarded at the discretion of the Compensation Committee.

The Company also has a Services Agreement with Fields Management, Inc. (“FMI”), first dated June 30, 2013, and subsequently amended on July 1, 2022, to provide certain executive management services to the Company, including designating Mr. Fields to perform the functions of President and Chief Executive Officer for the Company through June 30, 2027 (the “Services Agreement”). Pursuant to the Services Agreement, FMI is paid an annual base fee of $500,000, subject to annual increases equal to 75% of the Company’s percentage annual revenue growth beginning in the 2014 fiscal year. FMI may also be eligible for an annual incentive bonus, awarded at the discretion of the Company’s Board.

FMI also receives: (i) up to $1,200 per month for reimbursement of vehicle expenses; (ii) an annual computer equipment allowance of up to $6,000; (iii) 600,000 shares of the Company’s Common Stock, subject to a pro-rata 10-year vesting schedule; and (iv) a retirement annuity or other bonus award to be developed within six months of the effective date. The Company also maintains and pays the premiums for a $5.0 million life insurance policy in the name of Mr. Fields, with the beneficiary to be designated by Mr. Fields at his sole discretion.

Merrill Employment Agreement

On September 6, 2022, the Company and John Merrill entered into an employment agreement (the “Agreement”) in connection with Mr. Merrill’s continued employment as the Company’s Chief Financial Officer. Under the terms of the Agreement, Mr. Merrill shall serve as the Company’s Chief Financial Officer and Principal Accounting Officer until May 15, 2026, subject to further renewal upon agreement of the parties. In consideration for his continued service, the Agreement provides that Mr. Merrill shall (i) be paid a base salary of $22,917 per month, or $275,000 annually (“Base Salary”); (ii) be entitled to a discretionary bonus equal to 50% of his Base Salary, payable quarterly, based on the achievement of personal and Company objectives to be determined by the Chairman of the Board of Directors; and (iii) be granted 50,000 restricted shares of the Company’s Common Stock with a grant date of May 16, 2022 (“Grant Date”), which shares shall vest pro-rata over a five year period beginning on the first anniversary of the Grant Date.

Outstanding Equity Awards at Fiscal Year-End

The following table generally sets forth the number of outstanding equity awards that have not been earned or vested or that have not been exercised for each of the Named Executive Officers as of June 30, 2023. No other equity awards otherwise reportable in this table have been granted to any of our Named Executive Officers.

| |

|

Option Awards

|

|

|

Stock Awards

|

|

|

Name

|

|

Number of

Securities

Underlying

Unexercised

Options

Exercisable

(#)

|

|

|

Number of

Securities

Underlying

Unexercised

Options

Unexercisable

(#)

|

|

|

Option

Exercise

Price

($)

|

|

|

Option

Expiration

Date

|

|

|

Number of

Shares or

Units of

Stock

That Have

Not

Vested

(#)

|

|

|

Market

Value of

Shares or

Units of

Stock That

Have Not

Vested

($)(1)

|

|

|

Randall K. Fields

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

776,744 |

|

|

$ |

7,837,347 |

|

|

Chairman, President and Chief Executive Officer

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

John R. Merrill

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

40,000 |

|

|

$ |

403,600 |

|

|

Chief Financial Officer

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Edward L. Clissold

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

General Counsel and Corporate Secretary

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1)

|

Market value based on the closing market price of $10.09 of the Company’s Common Stock on June 30, 2023, as reported on the NASDAQ Capital Market.

|

Description of Equity Compensation Plans

The following table sets forth information as of June 30, 2023 with respect to compensation plans under which shares of the Company’s Common Stock may be issued:

|

Plan category

|

|

Number of

securities

to be issued

upon

exercise of

outstanding

options,

warrants and

rights

(a)

|

|

|

Weighted-

average

exercise price

of

outstanding

options,

warrants

and rights

(b)

|

|

|

Number of

securities

remaining

available for

future

issuance

under equity

compensation

plans

(excluding

securities

reflected in

column (a))

(c)

|

|

|

Equity compensation plans approved by security holders

|

|

|

- |

|

|

|

- |

|

|

|

843,384 |

|

|

Equity compensation plans not approved by security holders

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

Total

|

|

|

- |

|

|

|

- |

|

|

|

843,384 |

|

|

Second Amended and

Restated 2011 Stock

Incentive Plan

|

|

In January 2013, the Board approved the Second Amended and Restated 2011 Stock Incentive Plan (the “2011 Plan”), which 2011 Plan was approved by shareholders on March 29, 2013. The 2011 Plan was subsequently amended by the Board on October 30, 2015 and August 3, 2017 to increase the number of shares available for issuance. Under the terms of the 2011 Plan, officers, key employees, consultants and directors of the Company are eligible to participate. The maximum aggregate number of shares that may be granted under the 2011 Plan is 1,250,000 shares. Our Compensation Committee administers the 2011 Plan, and may grant incentive stock options, non-qualified stock options and/or restricted stock awards to eligible recipients, as defined in the 2011 Plan. The 2011 Plan terminated at midnight on April 1, 2023. In addition, the Board may, at any time and without shareholder approval, terminate or amend the 2011 Plan to increase the number of shares of Common Stock available for issuance. |

| |

|

Second Amended and

Restated 2011 Employee

Stock Purchase Plan

|

|

In January 2013, the Board approved the Second Amended Employee Stock Purchase Plan (the “ESPP”), which ESPP was approved by shareholders on March 29, 2013. The ESPP was subsequently amended by the Board on October 30, 2015, August 3, 2017, and March 17, 2021 to increase the number of shares available for issuance. The ESPP provides every full-time and part-time employee of the Company an opportunity to acquire and expand their equity interest in the Company by giving each participating employee the opportunity to purchase shares of Common Stock at a discount from fair market value. Additionally, the ESPP may also be used to issue shares of Common Stock in lieu of cash compensation. The ESPP is administered by the Compensation Committee. |

401(k) Retirement Plan

The Company offers an employee benefit plan under Benefit Plan Section 401(k) of the Code. The Company utilizes ADP Retirement Services as its administrator and trustee of the Company’s 401(k) plan. Employees who have attained the age of 18 are immediately eligible to participate. The Company, at its discretion, may match employees’ contributions at a percentage determined annually by the Board. The Company does not currently match contributions.

Indemnification for Securities Act Liabilities

Nevada law authorizes, and the Company’s Amended and Restated Bylaws provide for, indemnification of the Company’s directors and officers against claims, liabilities and amounts paid in settlement, and expense in a variety of circumstances. Indemnification for liabilities arising under the Securities Act of 1933, as amended (the “Securities Act”), may be permitted for directors, officers and controlling persons of the Company pursuant to the foregoing or otherwise. However, the Company has been advised that, in the opinion of the SEC, such indemnification is against public policy as expressed in the Securities Act and is, therefore, unenforceable.

Compensation Committee Interlocks and Insider Participation

No executive officers of the Company serve on the Compensation Committee (or in a like capacity) for the Company or any other entity.

Related Party Transactions

During the year ended June 30, 2023, the Company continued to be a party to a Service Agreement with Fields Management, Inc. (“FMI”), pursuant to which FMI provided certain executive management services to the Company, including designating Mr. Fields to perform the functions of President and Chief Executive Officer for the Company. Mr. Fields, FMI’s designated Executive, who also serves as the Company’s Chairman of the Board of Directors, controls FMI. During each of the fiscal years ended June 30, 2023 and 2022, the Company paid FMI $924,060 under the terms of the Service Agreement. The Company had no payables to FMI on June 30, 2023 and 2022, respectively, under the Service Agreement.

Policy and Procedures Governing Related Party Transactions

The Board is committed to upholding the highest legal and ethical conduct in fulfilling its responsibilities and recognizes that related party transactions can present a heightened risk of potential or actual conflicts of interest.

The SEC rules define a related party transaction to include any transaction, arrangement or relationship which: (i) we are a participant; (ii) the amount involved exceeds $120,000; and (iii) executive officer, director or director nominee, or any person who is known to be the beneficial owner of more than 5% of our Common Stock, or any person who is an immediate family member of an executive officer, director or director nominee or beneficial owner of more than 5% of our Common Stock had or will have a direct or indirect material interest.

Although we do not maintain a formal written procedure for the review and approval of transactions with such related persons, it is our policy for the disinterested members of our Board to review all related party transactions on a case-by-case basis. To receive approval, a related-party transaction must have a legitimate business purpose for us and be on terms that are fair and reasonable to us and our shareholders and as favorable to us and our shareholders as would be available from non-related entities in comparable transactions.

All related party transactions must be disclosed in our applicable filings with the SEC as required under SEC rules.

Section 16 Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Act requires our officers, directors and persons who beneficially own more than ten percent of our Common Stock (collectively, “Reporting Persons”) to file reports of ownership on Form 3 and changes in ownership on Form 4 or Form 5 with the SEC. The Reporting Persons are also required by SEC rules to furnish us with copies of all reports that they file pursuant to Section 16(a).

Based solely on review of these forms that were furnished to us, we believe that all reports required to be filed by these individuals and persons under Section 16(a) were filed during the fiscal year ended June 30, 2023, and that such filings were timely.

PAY VERSUS PERFORMANCE

The following table presents certain information regarding compensation paid to the Company’s Principal Executive Officer (“PEO”) and other Named Executive Officers (“Other NEOs” or “Non-PEOs”), and certain measures of financial performance, for the years ended June 30, 2023 and 2022. The amounts shown below are calculated in accordance with Item 402(v) of Regulation S-K. The Compensation Committee believes that the 2023 compensation decisions for the PEO and Non-PEOs are reflective of the Company’s overall operating, strategic, financial and stock price performance and thus are aligned with shareholders.

Pay Versus Performance Table

|

Year

|

|

Summary

Compensation

Table

Total for

PEO (1)

|

|

|

Compensation

Actually

Paid to

PEO (1)

|

|

|

Average

Summary

Compensation

Total for

Non-PEO Named

Executive

Officers (2)

|

|

|

Value of

Initial

$100

Investment

based on Total

Shareholder

Return (3)

|

|

|

Net Income

($)

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2023

|

|

$

|

1,665,685

|

|

|

$

|

6,085,358

|

|

|

$

|

471,185

|

|

|

$

|

183

|

|

|

$

|

5,003,845

|

|

|

2022

|

|

$

|

1,665,014

|

|

|

$

|

432,848

|

|

|

$

|

249,812

|

|

|

$

|

80

|

|

|

$

|

3,416,651

|

|

|

(1)

|

Randall K. Fields served as the Company’s PEO during the fiscal years presented. The following amounts were added and deducted from the Summary Compensation Table (“SCT”) amount to determine the compensation actually paid to the PEO in accordance with SEC regulations:

|

|

Adjustments to Determine Compensation “Actually Paid”

|

|

Year Ended

June 30, 2023

|

|

|

Year Ended

June 30,

2022

|

|

|

Deduction for Amount Reported under the “Stock Awards” column in the SCT

|

|

$ |

- |

|

|

$ |

(295,000 |

)

|

|

Deduction for Amount Reported under the “Option Awards” column in the SCT

|

|

|

- |

|

|

|

- |

|

|

Increase for the Fair Value of Awards Granted during year that remain unvested as of year-end

|

|

|

- |

|

|

|

- |

|

|

Decrease for the Fair Value of Awards Granted during year that remain vested as of year-end

|

|

|

- |

|

|

|

(75,000 |

)

|

|

Increase/deduction for Change in Fair Value from prior year-end to current year-end of Awards Granted prior to year-end that were outstanding and unvested as of year-end

|

|

|

4,419,673 |

|

|

|

(862,166 |

)

|

|

Increase/deduction for Change in Fair Value from prior year-end to Vesting Date of Awards Granted prior to year-end that vested during year

|

|

|

- |

|

|

|

- |

|

|

Total Adjustments

|

|

$ |

4,419,673 |

|

|

$ |

(1,232,166 |

)

|

|

(2)

|

For the year ended June 30, 2023, John R. Merrill and Edward L. Clissold were our Other NEOs.

|

| |

|

Year Ended

June 30, 2023

|

|

|

Year Ended

June 30,

2022

|

|

|

Deduction for Amount Reported under the “Stock Awards” column in the SCT

|

|

$ |

(48,200 |

)

|

|

$ |

- |

|

|

Deduction for Amount Reported under the “Option Awards” column in the SCT

|

|

|

- |

|

|

|

- |

|

|

Decrease for the Fair Value of Awards Granted during year that remain unvested as of year-end

|

|

|

- |

|

|

|

(21,000 |

)

|

|

Increase for the Fair Value of Awards Granted during year that remain vested as of year-end

|

|

|

- |

|

|

|

- |

|

|

Increase/deduction for Change in Fair Value from prior year-end to current year-end of Awards Granted prior to year-end that were outstanding and unvested as of year-end

|

|

|

227,600 |

|

|

|

- |

|

|

Increase/deduction for Change in Fair Value from prior year-end to Vesting Date of Awards Granted prior to year-end that vested during year

|

|

|

56,900 |

|

|

|

(3,006 |

)

|

|

Total Adjustments

|

|

$ |

236,300 |

|

|

$ |

(24,006 |

)

|

|

(3)

|

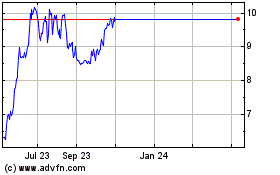

Represents the cumulative shareholder return of a fixed investment of $100 made at the closing price of the Company’s Common Stock on June 30, 2021 for the measurement period beginning on such date and continuing through and including the end of the applicable fiscal year reflected in the table. |

Analysis of the Information Presented in the Pay Versus Performance Table

We generally seek to incentivize long-term performance, and therefore do not specifically align our performance measures with “compensation actually paid” (as computed in accordance with Item 402(v) of Regulation S-K) for a particular year. In accordance with Item 402(v) of Regulation S-K, we are providing the following descriptions of the relationships between information presented in the Pay Versus Performance table.

PEO

From fiscal 2022 to fiscal 2023, compensation actually paid to the PEO increased by $5,652,510 or 1,306%. Over the same period, the Company’s Total Shareholder Return (“TSR”) increased by 50%, from $0.18 per share to $0.27 per share. Key factors that drove the increase in pay during this period were the change in fair value of unvested stock grants.

Other NEOs

From fiscal 2022 to fiscal 2023, compensation paid to the other NEOs increased by $221,373 or 89%. Over the same period, the Company’s TSR increased by 50%. Key factors that drove the increase in pay during this period were the change in fair value of unvested stock grants.

Compensation Actually Paid and Net Income

Our Company has not historically looked to net income as a performance measure for our executive compensation program. In fiscal 2023, our net income was up 40%, or $1,587,194 from fiscal 2022, and the compensation actually paid for our PEO and non-PEO NEOs increased between fiscal 2022 and fiscal 2023.

Compensation Actually Paid and Cumulative TSR

Historically we have not used financial performance measures such as TSR to align with compensation actually paid to our NEO’s. As described in more detail above, part of the compensation our NEOs are eligible to receive consists of annual performance-based cash bonuses and equity awards that are designed to provide appropriate incentives to our executives to achieve defined annual corporate goals.

All information provided above under the “Pay Versus Performance” heading will not be deemed to be incorporated by reference in any filing of our Company under the Securities Act, whether made before or after the date hereof and irrespective of any general incorporation language in any such filing.

PROPOSAL NO. 2

APPROVAL OF THE 2023 OMNIBUS EQUITY INCENTIVE PLAN

General

On August 29, 2023, our Board unanimously approved our 2023 Omnibus Equity Incentive Plan (the “2023 Plan”), authorizing 400,000 shares of Common Stock available for issuance thereunder, a copy of which is attached hereto as Appendix A.

The Company’s Second Amended and Restated 2011 Stock Incentive Plan (the “2011 Plan”) terminated on April 1, 2023, and no new awards were granted under the 2011 Plan thereafter. Awards outstanding under the 2011 Plan as of the date of this Information Statement will remain subject to the 2011 Plan. Upon approval of our 2023 Plan, any shares subject to outstanding awards under the 2011 Plan that subsequently expire, terminate, or are surrendered or forfeited for any reason without issuance of shares will automatically become available for issuance under our 2023 Plan.

The following summary of the 2023 Plan does not purport to be complete and is qualified, in its entirety, by the specific language of the 2023 Plan, as found in Appendix A.

Key Features

Purpose. The purposes of our 2023 Plan are to enhance our ability to attract and retain highly qualified officers, non-employee directors, key employees and consultants, providing those individuals an opportunity to acquire or increase a direct proprietary interest in our operations and future success. The 2023 Plan will also allow us to promote greater ownership in our Company in order to align the individuals’ interests more closely with the interests of our shareholders. Awards granted under the 2023 Plan are designed to qualify for special tax treatment under Section 422 of the Internal Revenue Code of 1986 (the “Code”).

Limitation on terms of stock options and stock appreciation rights. The maximum term of each stock option and stock appreciation right “(SAR”) is ten years.

No grant of discounted stock options. The 2023 Plan prohibits the granting of stock options or SARs with an exercise price less than the fair market value of the Common Stock on the date of grant.

No liberal share recycling. Shares used to pay the exercise price or withholding taxes related to an outstanding award and unissued shares resulting from the net settlement of outstanding options and SARs do not become available for issuance as future awards under the plan.

Limits on immediate vesting. The 2023 Plan limits the number of shares that may be vested on the grant date of an award to no more than 25% of any equity-based awards. Certain limited exceptions are permitted.

No single-trigger acceleration. Under the 2023 Plan, we do not automatically accelerate vesting of awards in connection with a change in control of the Company.

Dividends. We do not pay dividends or dividend equivalents on stock options, SARs or other unearned awards, whether time- or performance-vesting.

Summary of the 2023 Plan

The principal features of our 2023 Plan are summarized below. The following summary of our 2023 Plan does not purport to be a complete description of all of the provisions of the 2023 Plan. It is qualified in its entirety by reference to the complete text of the 2023 Plan, which is attached to this Proxy Statement as Appendix A.

Eligibility

Awards may be granted under the 2023 Plan to officers, employees and consultants of our Company and our subsidiaries and to our non-employee directors. Incentive stock options may be granted only to employees of our Company or one of our subsidiaries.

Administration

The 2023 Plan will be administered by the Compensation Committee of the Board. The Compensation Committee, in its discretion, selects the individuals to whom awards may be granted, the time or times at which such awards are granted, and the terms of such awards. The Compensation Committee may delegate its authority to the extent permitted by applicable law.

Number of Authorized Shares

A total of 400,000 shares of Common Stock are authorized for issuance under the 2023 Plan. In addition, any awards then outstanding under the 2011 Plan will remain subject to the 2011 Plan. As of the date of this Proxy Statement, no shares of Common Stock remain authorized and available for issuance under the 2011 Plan; however, any shares then subject to outstanding awards under the 2011 Plan that subsequently expire, terminate, or are surrendered or forfeited for any reason without issuance of shares will automatically become available for issuance under the 2023 Plan.

If any award is canceled, terminates, expires or lapses for any reason prior to the issuance of shares or if shares are issued under the 2023 Plan and thereafter are forfeited to us, the shares subject to such awards and the forfeited shares will again be available for grant under the 2023 Plan. In addition, the following items will not count against the aggregate number of shares of Common Stock available for grant under the 2023 Plan:

| |

●

|

the payment in cash of dividends or dividend equivalents under any outstanding award;

|

| |

●

|

any award that is settled in cash rather than by issuance of shares of Common Stock; and

|

| |

●

|

any awards granted in assumption of or in substitution for awards previously granted by an acquired company.

|

Shares tendered or withheld to pay the option exercise price or tax withholding for any award (including restricted stock and restricted stock units) will continue to count against the aggregate number of shares of Common Stock available for grant under the 2023 Plan. In addition, the total number of shares covering stock-settled stock appreciation rights (“SARs”), or net-settled options will be counted against the pool of available shares, not just the net shares issued upon exercise. Any shares of Common Stock repurchased by us with cash proceeds from the exercise of options will not be added back to the pool of shares available for grant under the 2023 Plan.

Adjustments