false

2023-09-17

0001790169

00-0000000

Flora Growth Corp.

0001790169

2023-09-17

2023-09-17

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

___________________________

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

September 17, 2023

FLORA GROWTH CORP.

(Exact name of registrant as specified in its charter)

|

Ontario

|

001-40397

|

Not Applicable |

| (State or other jurisdiction |

(Commission |

(IRS Employer |

| of incorporation) |

File Number) |

Identification No.) |

3406 SW 26th Terrace, Suite C-1

Fort Lauderdale, Florida, United States

33132

(Address of principal executive offices) (ZIP Code)

Registrant’s telephone number, including area code: (954) 842-4989

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbols |

|

Name of each exchange on which registered |

|

Common Shares, no par value

|

|

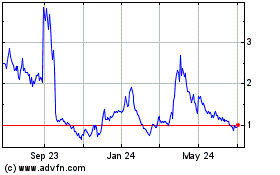

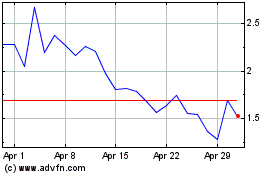

FLGC

|

|

NASDAQ Capital Market

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b -2 of this chapter).

Emerging growth company ☑

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement

On September 17, 2023, Flora Growth Corp., a corporation under the laws of the Province of Ontario ("Flora" or the "Company") and Lifeist Wellness Inc. ("Lifeist") entered into a Sale and Purchase Agreement (the "Purchase Agreement") pursuant to which Flora will acquire all the issued and outstanding common shares (the "AV Common Shares") of Australian Vaporizers Pty Ltd. ("AV"), an online retailer of vaporizers, hardware, and accessories in Australia.

Under the terms of the Purchase Agreement, Flora will acquire 100% of the issued and outstanding AV Common Shares in exchange for the issuance to Lifeist of an aggregate maximum of 600,676 common shares in the capital of Flora (the "Flora Shares"), valued at $1.7 million based on the closing price of Flora's common shares on September 15, 2023, subject to a reduction based on the cash, inventory and inventory deposits, and working capital positions of AV on the date of closing.

The Agreement contains customary representations, warranties and covenants made by each of the parties. Completion of the transaction is subject to customary closing conditions, including, among others, (i) the delivery of non-competition agreements by Lifeist, (ii) the entry into an employment agreement with a certain key employee of AV, (iii) the subject to certain materiality exceptions, the accuracy of certain representations and warranties of Lifeist contained in the Agreement and the compliance in all material respects by each party with the covenants contained in the Agreement, and (iv) the absence of a material adverse effect with respect to AV. Closing of the transaction is anticipated to occur in the Company's fourth quarter of fiscal 2023, although there can be no assurance the transaction will occur within the expected timeframe or at all.

The above description of the Agreement does not purport to be complete and is qualified in its entirety by reference to the Purchase Agreement, which will be filed by an amendment to this Current Report on Form 8-K and incorporated by reference herein

Item 3.02 Unregistered Sales of Equity Securities

Item 1.01 of this Current Report on Form 8-K is incorporated by reference into this Item 3.02 with respect to the Flora Shares that will be issued to Lifeist at the closing of the transaction. The Company intends to issue the Flora Shares described herein in reliance upon the exemptions from registration afforded by Section 4(a)(2) and/or Rule 506 of Regulation D promulgated under the Securities Act of 1933, as amended.

Item 7.01 Regulation FD Disclosure

On September 18, the Company issued a press release announcing the execution of the Agreement. A copy of this press release is filed as Exhibit 99.1 hereto and is incorporated herein by reference.

The information in this Item 7.01, including Exhibit 99.1, is furnished and shall not be deemed "filed" for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), or otherwise subject to liabilities under that section, and shall not be deemed to be incorporated by reference into the filings of the Company under the Securities Act or the Exchange Act, regardless of any general incorporation language in such filings.

Forward-Looking Statements

Certain information contained in this Current Report on Form 8-K and in the exhibits hereto includes forward-looking statements. These forward-looking statements, which include statements regarding the anticipated benefits of the acquisition, the expected timing of the closing of the acquisition, risks relating to the Company's integration of the acquired business; risks relating to the possibility that the acquisition does not close when expected or at all because any conditions to the closing are not satisfied on a timely basis or at all; and other risks described in the Company's Annual Report on Form 10-K and other filings with the SEC, available at the SEC's website at www.sec.gov. These forward-looking statements speak only as of the date of this Current Report on Form 8-K, and the Company undertakes no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events or otherwise.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| |

FLORA GROWTH CORP. |

| |

|

|

| Date: September 18, 2023 |

By: |

/s/ Clifford Starke |

| |

Name: |

Clifford Starke |

| |

Title: |

Chief Executive Officer |

SHARE PURCHASE AGREEMENT

BETWEEN

LIFEIST WELLNESS INC.

- and -

FLORA GROWTH CORP.

SEPTEMBER 17, 2023

TABLE OF CONTENTS

-i-

TABLE OF CONTENTS

(continued)

-ii-

TABLE OF CONTENTS

(continued)

-iii-

SHARE PURCHASE AGREEMENT

THIS AGREEMENT is dated as of September 17, 2023.

BETWEEN:

LIFEIST WELLNESS INC., a company incorporated under the laws of British Columbia, Canada

(the "Seller")

- and -

FLORA GROWTH CORP., a company incorporated under the laws of Ontario, Canada

(the "Buyer")

CONTEXT:

A. Australian Vaporizers Pty Ltd. (the "Company") is a company existing under the laws of Queensland, Australia.

B. The Seller is the owner of all of the issued and outstanding shares in the capital of the Company.

C. The Seller wants to sell to the Buyer and the Buyer wants to purchase from the Seller all of the issued and outstanding shares in the capital of the Company.

THEREFORE, the Parties agree as follows:

ARTICLE 1

INTERPRETATION

1.1 Definitions

In this Agreement, in addition to terms defined elsewhere in this Agreement, the following terms have the following meanings:

1.1.1 "Accounts Payable" means any obligation for payment for goods or services received by the Company.

1.1.2 "Accounts Receivable" means any right to payment for goods sold by the Company less an allowance for doubtful accounts for uncollectible accounts.

1.1.3 "Accrued Expenses" or "Accrued Liabilities" means any expense that is recognized under IFRS before it has been paid.

1.1.4 "Affiliate" means a body corporate that is the subsidiary of the other or both are subsidiaries of the same body corporate or each of them is controlled by the same Person.

1.1.5 "Agreement" means this share purchase agreement, including all Schedules and Exhibits, as it may be confirmed, amended, modified, supplemented or restated by written agreement between the Parties.

1.1.6 "Books and Records" means books, ledgers, files, lists, reports, plans, logs, deeds, surveys, correspondence, operating records, Tax Returns and other data and information, including all data and information stored on computer-related or other electronic media, maintained with respect to the Business and the Company.

1.1.7 "Business" means the business of selling aromatherapy products online, specializing in vaporizers, carried on by the Company.

1.1.8 "Business Day" means any day excluding a Saturday, Sunday or statutory holiday in the Province of Ontario, and also excluding any day on which the principal chartered banks located in the City of Toronto are not open for business during normal banking hours.

1.1.9 "Buyer" is defined in the recital of the Parties above.

1.1.10 "Cash Balance" is defined as cash in hand or in the bank accounts.

1.1.11 "Claim" means any claim, demand, action, cause of action, suit, arbitration, investigation, proceeding, complaint, grievance, charge, prosecution, assessment or reassessment, including any appeal or application for review.

1.1.12 "Closing" means the completion of the sale to and purchase by the Buyer of the Purchased Shares pursuant to this Agreement.

1.1.13 "Closing Date" means the date on which the Closing takes place as agreed by the Parties.

1.1.14 "Closing Time" means the time on the Closing Date at which the Closing takes place.

1.1.15 "Communication" means any notice, demand, request, consent, approval or other communication which is required or permitted by this Agreement to be given or made by a Party.

1.1.16 "Confidential Information" means any information relating to the Company or its business, including Personal Information, whether communicated in written form, orally, visually, demonstratively, technically or by any other electronic form or other media, or committed to memory, but excluding information, other than Personal Information, which:

1.1.16.1 was available to or known by the public before the date of this Agreement; or

1.1.16.2 is or becomes available to or known by the public other than as a result of improper disclosure by the Buyer or any of its representatives, advisors or lenders.

1.1.17 "Contract" means any agreement, understanding, undertaking, commitment, licence, or Lease, whether written or oral.

1.1.18 "Corporate Articles" means the certificate of registration of the Company dated August 18, 2010 and the constitution of the Company dated June 29, 2014.

1.1.19 "Company" is defined in the "Context" above.

1.1.20 "Consequential Loss" means special, indirect, contingent or consequential loss, including but not limited to, loss of profits, loss of business opportunity, loss of future contracts, loss of sales, losses from business interruption, loss of bargain, loss which does not fairly and reasonably arise from a breach of this Agreement, and loss which could not reasonably have.

1.1.21 "Consideration Shares" is defined in Section 2.3.1.

1.1.22 "Current Assets" is defined as the Cash Balance plus Inventories, Inventory Deposits, Accounts Receivable, Income Tax Receivable, Prepaid Expenses and Other Current Assets.

1.1.23 "Current Liabilities" is defined as Accounts Payable plus Accrued Expenses, Accrued Liabilities, Payroll Accrual, Sales Tax Payable and Deferred Tax Liabilities.

1.1.24 "Deferred Tax Liabilities" means any and all amounts owing a Government Authority, including but not limited to, the definition under IFRS.

1.1.25 "Direct Claim" is defined in Section 7.7.

1.1.26 "Disclosure Schedule" is defined at Article 3.

1.1.27 "Employees" means all personnel and independent contractors employed, engaged or retained by the Company in connection with the Business, including any that are on medical or long-term disability leave, or other statutory or authorized leave or absence.

1.1.28 "Encumbrance" means any security interest, mortgage, charge, pledge, hypothec, lien, encumbrance, restriction, option, adverse claim, right of others or other encumbrance of any kind.

1.1.29 "Environment" means the ambient air, all layers of the atmosphere, all water including surface water and underground water, all land, all living organisms and the interacting natural systems that include components of air, land, water, living organisms and organic and inorganic matter, and includes indoor spaces.

1.1.30 "Environmental Laws" means any Laws relating to the Environment and protection of the Environment, the regulation of chemical substances or products, health and safety including occupational health and safety, and the transportation of dangerous goods.

1.1.31 "Exchange" means the National Association of Securities Dealers Automated Quotations ("NASDAQ").

1.1.32 "Financial Statements" means:

1.1.32.1 the unaudited consolidated balance sheet and audited consolidated statement of income of the Company for the financial year ended November 30, 2022; and

1.1.32.2 the unaudited consolidated balance sheet and unaudited consolidated statement of income of the Company for the period ended May 31, 2023.

1.1.33 "Governmental Authority" means:

1.1.33.1 any federal, provincial, state, local, municipal, regional, territorial, aboriginal, or other government, governmental or public department, branch, ministry, or court, domestic or foreign, including any district, agency, commission, board, arbitration panel or authority and any subdivision of any of them exercising or entitled to exercise any administrative, executive, judicial, ministerial, prerogative, legislative, regulatory, or taxing authority or power of any nature; and

1.1.33.2 any quasi-governmental or private body exercising any regulatory, expropriation or taxing authority under or for the account of any of them, and any subdivision of any of them.

1.1.34 "Income Tax Receivable" means the money that is due to the Company from an Australian Government Authority.

1.1.35 "IFRS" is defined in Section 1.2.3.

1.1.36 "Indemnity Claim" is defined in Section 7.7

1.1.37 "Indemnity Notice" is defined in Section 7.7

1.1.38 "Insurance Policies" means the insurance policies maintained by the Company with respect to the Business.

1.1.39 "Intellectual Property" means trade-marks and trade-mark applications, trade names, certification marks, patents and patent applications, copyrights, domain names, industrial designs, trade secrets, know-how, formulae, processes, inventions, technical expertise, research data and other similar property, all associated registrations and applications for registration, and all associated rights, including moral rights.

1.1.40 "Inventories" means all inventories of every nature and kind owned by the Company and pertaining to the Business including raw materials, packaging materials, work-in-progress and finished goods.

1.1.41 "Inventory Deposits" means finished goods that have been allocated to an order and with respect to which the vendor has received and holds a deposit from the Company.

1.1.42 "ITA" means the Income Tax Act (Canada).

1.1.43 "Key Employee" means Max Kuebler.

1.1.44 "Knowledge of the Seller" means the actual knowledge that the Seller either has, or would have obtained, after having made or caused to be made all reasonable inquiries necessary to obtain informed knowledge, including inquiries of the records and Employees of the Seller and the Company who are reasonably likely to have knowledge of the relevant matter, but without any requirement to make any inquiries of third parties or Governmental Authorities or to perform any search of any public registry office or system.

1.1.45 "Law" or "Laws" means all laws, statutes, codes, ordinances, decrees, rules, regulations, by-laws, statutory rules, principles of law, published policies and guidelines, judicial or arbitral or administrative or ministerial or departmental or regulatory judgments, orders, decisions, rulings or awards, including general principles of common and civil law, and the terms and conditions of any grant of approval, permission, authority or licence of any Governmental Authority, and the term "applicable" with respect to Laws and in a context that refers to one or more Persons, means that the Laws apply to the Person or Persons, or its or their business, undertaking, property or Securities, and emanate from a Governmental Authority having jurisdiction over the Person or Persons or its or their business, undertaking, property or Securities.

1.1.46 "Leased Premises" means all of the lands and premises which are leased by the Company.

1.1.47 "Leases" means the leases relating to the Business other than the Real Property Leases.

1.1.48 "Loss" means any loss, liability, damage, cost, expense, charge, fine, penalty or assessment including the costs and expenses of any action, suit, proceeding, demand, assessment, judgment, settlement or compromise and all interest, fines, penalties and all professional fees and disbursements on a complete indemnity basis but excluding loss of value and the monetary value of lost opportunity and/or Consequential Loss.

1.1.49 "Material Adverse Effect" means a material adverse effect on the Business or financial position, condition, assets or properties of the Company, the knowledge and direct effect of which would demonstrate and persuade the Buyer, acting reasonably, that the value of the Purchased Shares is materially lower than the Purchase Price, provided, however, that each of the following events and circumstances (and any event or circumstance directly or indirectly relating to, arising out of, resulting from, or attributable to any of the following events or circumstances) shall not constitute, and shall not be taken into account in determining whether there has been or could be, a material adverse effect: (1) any change in general in Canada, the United States of America, Australia or foreign economies, securities markets, financial markets, currency markets, or capital markets (including changes in interest rates or the availability of financing); (2) any event or circumstance that affects one or more of the industries in which the Business operates; (3) the parties' entry into this Agreement, the announcement of this Agreement or the transactions contemplated hereby (including (A) the disclosure of the identity of the Buyer, (B) any communication by the Buyer regarding the plan or intentions of the Buyer with respect to the conduct of the business or relating to the transactions contemplated hereby, and (C) any action required by this Agreement); (4) any acts of war (whether or not declared), insurrection, sabotage, terrorism, or public enemy, or any national or international political or social conditions; or (5) any pandemic, including without limitation COVID-19/coronavirus or derivatives thereof, or any earthquake, hurricane, tornado, storm, flood, fire or other natural disaster,

1.1.50 "Material Contract" means a Contract that:

1.1.50.1 involves or may result in the payment of money or money's worth by or to the Company in an amount in excess of $20,000;

1.1.50.2 has an unexpired term of more than one year (including renewals);

1.1.50.3 cannot be terminated by the Company without penalty upon less than 30 days' notice; or

1.1.50.4 the termination of which, or under which the loss of rights, would constitute a Material Adverse Effect.

1.1.51 "Other Current Assets" means any asset that is expected to be converted to cash within 365 days of its recognition.

1.1.52 "Parties" means the Seller and the Buyer, collectively, and "Party" means either of them.

1.1.53 "Payroll Accrual" means any expense related to the Company's Employees that has been recognized under IFRS before it has been paid.

1.1.54 "Permits" means the authorizations, registrations, permits, certificates of approval, approvals, grants, licences, quotas, consents, commitments, rights or privileges (other than those relating to the Intellectual Property) issued or granted by any Governmental Authority to the Company.

1.1.55 "Permitted Encumbrances" means any Encumbrance which the Buyer has expressly agreed to assume or accept pursuant to this Agreement as set forth in Schedule 1.1.55.

1.1.56 "Person" will be broadly interpreted and includes:

1.1.56.1 a natural person, whether acting in his or her own capacity, or in his or her capacity as executor, administrator, estate trustee, trustee or personal or legal representative, and the heirs, executors, administrators, estate trustees, trustees or other personal or legal representatives of a natural person;

1.1.56.2 a Company or a company of any kind, a partnership of any kind, a sole proprietorship, a trust, a joint venture, an association, an unincorporated association, an unincorporated syndicate, an unincorporated organization or any other association, organization or entity of any kind; and

1.1.56.3 a Governmental Authority.

1.1.57 "Personal Information" means information about an individual who can be identified by the Person who holds that information.

1.1.58 "Plans" means all plans that provide pension benefits for the benefit of Employees or former Employees, and their respective beneficiaries, and all Employee benefit, fringe benefit, supplemental unemployment benefit, bonus, incentive, profit sharing, termination, change of control, compensation, retirement, salary continuation, stock option, stock purchase, stock appreciation, health, welfare, medical, dental, accident, disability, life insurance and other plans, arrangements, agreements, programs, policies, practices or undertakings, whether oral or written, funded or unfunded, registered or unregistered, insured or self-insured:

1.1.58.1 that are sponsored or maintained or funded, in whole or in part, by the Company, or to which the Company contributes or is obligated to contribute for the benefit of Employees or former Employees, and their respective beneficiaries; or

1.1.58.2 under which the Company has any liability or contingent liability.

1.1.59 "Prepaid Expenses" means an amount paid for a good or service in advance of receiving it.

1.1.60 "Price Calculation" is defined in Section 2.2.

1.1.61 "Privacy Laws" means any Laws that regulate the collection, use or disclosure of Personal Information.

1.1.62 "Purchase Price" is defined in Section 2.2.

1.1.63 "Purchased Shares" means all of the issued and outstanding shares in the capital of the Company.

1.1.64 "Real Property Leases" means the leases between the Company, as tenant, and the applicable landlords, and all amendments to those leases, relating to the leasing by the Company of the Leased Premises.

1.1.65 "Regulation S" means Regulation S under the U.S. Securities Act.

1.1.66 "Representatives" means the Affiliates of any Person, and the advisors, agents, consultants, directors, officers, management, employees, subcontractors, and other representatives, including accountants, auditors, financial advisors, lenders and lawyers of any Person and of that Person's Affiliates.

1.1.67 "Sales Tax Payable" means all amounts owing to a Government Authority in Australia for any sale of goods.

1.1.68 "Securities" has the meaning given to that term in the Securities Act (Ontario).

1.1.69 "Seller" is defined in the recital of the Parties above.

1.1.70 "Straddle Period" means any taxation period of the Company ending after the Closing Date which commenced before the Closing Date and includes a period before the Closing Date.

1.1.71 "Stub Period Returns" is defined in Section 5.4.

1.1.72 "Tax" means all taxes, duties, fees, premiums, assessments, imposts, levies, rates, withholdings, dues, government contributions and other charges of any kind whatsoever, whether direct or indirect, together with all interest, penalties, fines, additions to tax or other additional amounts, imposed by any Governmental Authority.

1.1.73 "Tax Act" means the Income Tax Assessment Act 1936 of Australia or the Income Tax Assessment Act 1997 of Australia or both the Income Tax Assessment Act 1936 or Australia and the Income Tax Assessment Act 1997 of Australia, as appropriate.

1.1.74 "Tax Law" means any Law that imposes Taxes or that deals with the administration or enforcement of liabilities for Taxes.

1.1.75 "Tax Return" means any return, report, declaration, designation, election, undertaking, waiver, notice, filing, information return, statement, form, certificate or any other document or materials relating to Taxes, including any related or supporting information with respect to any of those documents or materials listed above in this Section 1.1.75, filed or to be filed with any Governmental Authority in connection with the determination, assessment, collection or administration of Taxes.

1.1.76 "Third Party Claim" is defined in Section 7.6.

1.1.77 "U.S. Person" means "U.S. person" as defined in Rule 902(k) of Regulation S (the definition of which includes, but is not limited to, (i) any natural person resident in the United States, (ii) any partnership or corporation organized or incorporated under the laws of the United States, (iii) any partnership or corporation organized outside of the United States by a U.S. Person principally for the purpose of investing in securities not registered under the U.S. Securities Act, unless it is organized, or incorporated, and owned, by accredited investors who are not natural persons, estates or trusts, and (iv) any estate or trust of which any executor or administrator or trustee is a U.S. Person.

1.1.78 "U.S. Securities Act" means the United States Securities Act of 1933, as amended.

1.1.79 "United States" means the United States of America, its territories and possessions, any state of the United States and the District of Columbia.

1.1.80 "Verification Accountants" is defined in Section 2.5.

1.1.81 "Verification Notice" is defined in Section 2.5.

1.1.82 "Working Capital" is defined as Current Assets minus Current Liabilities.

1.2 Certain Rules of Interpretation

1.2.1 In this Agreement, words signifying the singular number include the plural and vice versa, and words signifying gender include all genders. Every use of the words "including" or "includes" in this Agreement is to be construed as meaning "including, without limitation" or "includes, without limitation", respectively.

1.2.2 The division of this Agreement into Articles and Sections, the insertion of headings and the inclusion of a table of contents are for convenience of reference only and do not affect the construction or interpretation of this Agreement.

1.2.3 Wherever in this Agreement reference is made to a calculation to be made in accordance with International Financial Reporting Standards ("IFRS"), the reference is to International Financial Reporting Standards applicable as at the date of this Agreement.

1.2.4 References in this Agreement to an Article, Section, Schedule or Exhibit are to be construed as references to an Article, Section, Schedule or Exhibit of or to this Agreement unless otherwise specified.

1.2.5 Unless otherwise specified in this Agreement, time periods within which or following which any calculation or payment is to be made, or action is to be taken, will be calculated by excluding the day on which the period begins and including the day on which the period ends. If the last day of a time period is not a Business Day, the time period will end on the next Business Day.

1.2.6 Unless otherwise specified, any reference in this Agreement to any statute includes all regulations and subordinate legislation made under or in connection with that statute at any time, and is to be construed as a reference to that statute as amended, modified, restated, supplemented, extended, re-enacted, replaced or superseded at any time.

1.3 Governing Law

This Agreement is governed by, and is to be construed and interpreted in accordance with, the Laws of the Province of Ontario and the Laws of Canada applicable in that Province.

1.4 Entire Agreement

This Agreement, and any other agreement or agreements and other documents to be delivered under this Agreement, constitutes the entire agreement between the Parties pertaining to the subject matter of this Agreement and supersedes all prior agreements, understandings, negotiations and discussions, whether oral or written, of the Parties, and there are no representations, warranties or other agreements between the Parties, express or implied, in connection with the subject matter of this Agreement except as specifically set out in this Agreement or in any of the other agreements and documents delivered under this Agreement. No Party has been induced to enter into this Agreement in reliance on, and there will be no liability assessed, either in tort or contract, with respect to, any warranty, representation, opinion, advice or assertion of fact, except to the extent it has been reduced to writing and included as a term in this Agreement or in any of the other agreements and documents delivered under this Agreement.

1.5 Schedules and Exhibits

The following is a list of Schedules and Exhibits:

| Schedule |

Subject Matter |

| |

|

| 1.1.55 |

Permitted Encumbrances |

| |

|

| 3 |

Disclosure Schedule |

ARTICLE 2

PURCHASE AND SALE

2.1 Agreement of Purchase and Sale

Subject to the terms and conditions of this Agreement, on the Closing Date the Seller will sell, and the Buyer will purchase, the Purchased Shares.

2.2 Purchase Price

The aggregate purchase price payable by the Buyer to the Seller for the Purchased Shares (the "Purchase Price") shall be equal to the amount determined by the formula (A - B - C - D) (the "Price Calculation"), where:

A is US$1,900,000.

B is calculated as follows:

If the Company's Cash Balance on the Closing Date is less than CAD$450,000, B shall be CAD$450,000 less the Company's Cash Balance on the Closing Date.

If the Company's Cash Balance on the Closing Date is CAD$450,000 or greater, B shall be zero.

C is calculated as follows:

If the Company's Working Capital on the Closing Date is less than CAD$1,500,000, C shall be CAD$1,500,000 less the Company's Working Capital on the Closing Date.

If the Company's Working Capital on the Closing Date is CAD$1,500,000 or greater, C shall be zero; and

D is calculated as follows:

If the Company's Inventory plus Inventory Deposits on the Closing Date is less than CAD$1,100,000, D shall be CAD$1,100,000 less the Company's Inventory and Inventory Deposits on the Closing Date.

If the Company's Inventory plus Inventory Deposits on the Closing Date is CAD$1,100,000 or greater, D shall be the amount of the Company's Inventory and Inventory Deposits on the Closing Date that exceeds CAD$1,100,000.

On the Closing Date, the Seller will provide the Buyer with the Price Calculation used to determine the Purchase Price.

2.3 Payment of Purchase Price

The Buyer will pay and satisfy the Purchase Price at the Closing Time as follows:

2.3.1 100% of the Purchase Price shall be satisfied by the Buyer on the Closing Date with common shares in the capital of the Buyer (the "Consideration Shares") at a deemed issue price per Consideration Share equal to the 5-day Volume Weighted Average Price according to Bloomberg of the Buyer's common stock immediately prior to the signing of this agreement.

2.4 Details of the Consideration Shares

The Consideration Shares shall be issued at the Closing Time and shall be registered and delivered as directed by the Seller. The certificate evidencing the Consideration Shares shall contain the following legend:

"THE SECURITIES REPRESENTED HEREBY HAVE NOT BEEN REGISTERED UNDER THE UNITED STATES SECURITIES ACT OF 1933, AS AMENDED (THE "U.S. SECURITIES ACT"), OR UNDER ANY OTHER APPLICABLE SECURITIES LAWS OF ANY STATE OF THE UNITED STATES AND MAY NOT BE TRANSFERRED, SOLD, ASSIGNED, PLEDGED, HYPOTHECATED OR OTHERWISE DISPOSED EXCEPT (A) PURSUANT TO A REGISTRATION STATEMENT EFFECTIVE UNDER THE U.S. SECURITIES ACT AND APPLICABLE STATE SECURITIES LAWS, OR (B) PURSUANT TO AN EXEMPTION FROM REGISTRATION THEREUNDER. HEDGING TRANSACTIONS INVOLVING SUCH SECURITIES MAY NOT BE CONDUCTED UNLESS IN COMPLIANCE WITH THE U.S. SECURITIES ACT."

"UNLESS PERMITTED UNDER SECURITIES LEGISLATION, THE HOLDER OF THIS SECURITY MUST NOT TRADE THE SECURITY BEFORE [INSERT THE DATE THAT IS 6 MONTHS AND A DAY AFTER THE DISTRIBUTION DATE]."

2.5 Purchase Price Calculation Adjustment

At any time during the first 90 days after the Closing Date, the Buyer may advise the Seller by notice in writing that it wishes to have the Price Calculation, along with the back up data used in the Price Calculation verified by independent accountants (the "Verification Notice"). Upon receipt of the Verification Notice by the Seller, the Buyer and the Seller shall appoint a firm of accountants (the "Verification Accountants") that are mutually agreeable to the Parties to verify the Price Calculation. If the Parties cannot agree on a mutually acceptable firm of accountants within 30 days of the Seller receiving the Verification Notice, Davidson & Company LLP shall be appointed as the Verification Accountants. If the Verification Accountants determine that the Price Calculation was incorrect and that the Purchase Price should have been equal to an amount that is 95% or less than what the Buyer paid to the Seller on the Closing Date, the Seller shall pay to the Buyer in cash within 30 days of the Verification Accountants' determination an amount equal to the difference between the Purchase Price paid on the Closing Date and the amount the Verification Accountants determine should have been the Purchase Price. If the Verification Accountants determine that the Purchase Price should have been equal to an amount that is 95% or less of the Purchase Price paid on the Closing Date, the Buyer shall pay the fees of the Verification Accountants. If the Verification Accountants determine that the Purchase Price should have been equal to an amount that is 105% or more of the Purchase Price paid on the Closing Date, the Seller shall pay the fees of the Verification Accountants. In all other circumstances where the Verification Accountants determine that the Purchase Price is between 95-105% of the Purchase Price paid on the Closing Date, the Buyer and the Seller shall equally pay for the fees of the Verification Accountants. The Price Calculation will be determined using IFRS, and will be accompanied by a certificate of the Seller acceptable to the Buyer, to the effect that the Price Calculation represents the Seller's best estimate of the Purchase Price, made in good faith and that the Seller has no reason to believe that this estimate cannot be relied upon for purposes of the Closing. The Price Calculation will also be accompanied by a copy of the working papers of the Seller used in his preparation, together with any other evidence supporting the amounts specified in the Price Calculation as the Buyer may reasonably request.

ARTICLE 3

REPRESENTATIONS AND WARRANTIES OF THE SELLER

The Seller represents and warrants to the Buyer as follows, and acknowledges that the Buyer is relying upon these representations and warranties in connection with the purchase of the Purchased Shares, despite any investigation made by or on behalf of the Buyer, and that this reliance is a right that has been bargained for, and forms part of the consideration in the transactions contemplated by this Agreement. Each exception to the following representations and warranties that is set out in the disclosure schedule attached as Schedule 3 (the "Disclosure Schedule") is identified by reference to one or more specific individual Sections of this Agreement and is only effective to create an exception to each specific individual Section listed. Any statement in this Agreement that is not expressly qualified by a reference to an exception in the Disclosure Schedule will prevail, despite anything to the contrary that is disclosed in the Disclosure Schedule.

3.1 Capacity to Enter Agreement

The Seller has all necessary capacity to enter into and perform his obligations under this Agreement.

3.2 Binding Obligation

The execution and delivery of this Agreement and the completion of the transactions contemplated by this Agreement have been duly authorized by all necessary action on the part of the Seller. This Agreement has been duly executed and delivered by the Seller and constitutes a valid and binding obligation of the Seller, enforceable against the Seller in accordance with its terms, subject to applicable bankruptcy, insolvency and other Laws of general application limiting the enforcement of creditors' rights generally and to the fact that equitable remedies, including specific performance, are discretionary and may not be ordered in respect of certain defaults.

3.3 Absence of Conflict

None of the execution and delivery of this Agreement, the performance of the Seller's obligations under this Agreement, or the completion of the transactions contemplated by this Agreement will:

3.3.1 result in or constitute a breach of any term or provision of, or constitute a default under, the Corporate Articles or the by-laws of the Company, or any Material Contract to which the Seller or the Company is a party or by which the Purchased Shares are bound;

3.3.2 constitute an event which would permit any party to any Contract with the Company to terminate or sue for damages with respect to that Contract, or to accelerate the maturity of any indebtedness of the Company, or other obligation of the Company under that Contract;

3.3.3 result in the creation or imposition of any Encumbrance on the Purchased Shares;

3.3.4 contravene any applicable Law; or

3.3.5 contravene any judgment, order, writ, injunction or decree of any Governmental Authority.

3.4 Restrictive Covenants

The Company is not a party to, or bound or affected by, any Contract containing any covenant expressly limiting its ability to compete in any line of business, or transfer or move any of its assets or operations, or which could reasonably be expected to have a Material Adverse Effect.

3.5 Title to Purchased Shares

The Seller is the legal and beneficial owner of the Purchased Shares and has good title to them, free and clear of any Encumbrance except for any restriction on transfer contained in the Corporate Articles. At Closing, the Seller will have the absolute and exclusive right to sell the Purchased Shares to the Buyer as contemplated by this Agreement.

3.6 Regulatory Approvals

Except for the conditional and final approvals of the TSX Venture Exchange in respect of the transaction contemplated by this Agreement, no authorization, approval, order, consent of, or filing with, any Governmental Authority is required on the part of the Seller or the Company in connection with the execution, delivery and performance of this Agreement or any other documents and agreements to be delivered under this Agreement.

3.7 Consents

Except as disclosed in the Disclosure Schedule and except as would not reasonably be expected to result in a Material Adverse Effect, there is no requirement to obtain any consent, approval or waiver of a party under any Material Contract to which the Seller or the Company is a party in order to complete the transactions contemplated by this Agreement.

3.8 Subsidiaries and Investments

Except as disclosed in the Disclosure Schedule, the Company has no subsidiaries. Except as disclosed in the Disclosure Schedule, the Company does not own or hold, directly or indirectly, any Securities of, or have any other interest in, any Person, and the Company has not entered into any agreement to acquire any such interest.

3.9 Corporate Existence of Company

The Company has been duly incorporated and organized, is validly existing and in good standing as a company under the Corporations Act 2001 (Australia). No proceedings have been taken or authorized by the Company in respect of the bankruptcy, insolvency, liquidation, dissolution or winding up of the Company.

3.10 Corporate Articles

The Corporate Articles constitute all of the charter documents of the Company and are in full force and effect; no action has been taken to further amend the Corporate Articles and no changes to the Corporate Articles are planned.

3.11 Capacity and Powers of Company

The Company has all necessary corporate power, authority and capacity to own or lease its assets and to carry on the Business as currently being conducted.

3.12 Jurisdictions

The Disclosure Schedule lists every jurisdiction in which the Company is qualified to do business. Neither the character nor location of the Leased Premises, nor the nature of the Business, requires qualification to do business in any other jurisdiction.

3.13 Issued Capital

The Purchased Shares comprise the entire issued share capital of the Company and:

3.13.1 as at the Closing Date have been validly allotted and issued and are fully paid up and no money are owing in respect of them.

3.13.2 no Person has any right or option to subscribe for or to otherwise acquire any unissued shares in the capital of the Company or any securities convertible into or exchangeable for or which otherwise confer on the holder of it any right (whether or not upon the happening of any contingency or after any lapse of time and whether or not upon the payment or delivery of any consideration) to acquire any unissued shares in the capital of the Company nor is the Company committed to grant or issue any such option, right or security;

3.13.3 the Seller is the sole legal and beneficial owner of the Purchased Shares;

3.13.4 there are no outstanding subscription agreements, options, contracts, calls, rights of first refusal, commitments, rights or demands of any kind relating to the issued or unissued shares in the capital of the Company;

3.13.5 the Purchase Shares are free from any Claim by, or entitlement of, any previous shareholder of the Company, the former partner or business associate of the Seller or any third party;

3.13.6 there is no shareholder agreement, voting trust, proxy or other agreement or understanding relating to the Purchased Shares;

3.13.7 none of the Purchased Shares have been issued in violation of any pre-emptive or similar rights; and

3.13.8 at Closing, the Buyer will acquire full legal and beneficial title to the Purchased Shares free from any Encumbrance or Claim of any Person.

3.14 Options

3.14.1 No person has any written or oral agreement or option or any right or privilege (whether by Law, pre-emptive, contractual or otherwise) capable of becoming an agreement or option, including Securities, warrants or convertible obligations of any nature, for:

3.14.1.1 the purchase of any Securities of the Company; or

3.14.1.2 the purchase of any of the assets of the Company other than in the ordinary course of the Business.

3.15 Corporate Records

The corporate records and minute books of the Company which have been made available to the Buyer contain complete and accurate written resolutions passed by, the directors and shareholders of the Company, held or passed since incorporation. All those resolutions were passed, and the share certificate books, registers of shareholders, registers of transfers and registers of directors of the Company are complete and accurate in all material respects.

3.16 Books and Records

The Books and Records fairly and correctly set out and disclose the financial position of the Company, and all financial transactions of the Company have been accurately recorded in the Books and Records.

3.17 Financial Statements

Copies of the Financial Statements are attached in the Disclosure Schedule. The Financial Statements have been prepared in accordance with IFRS and present fairly:

3.17.1 the assets, liabilities (whether accrued, absolute, contingent or otherwise) and the financial condition of the Company, on a consolidated basis, as at the respective dates of the Financial Statements; and

3.17.2 the sales, earnings and results of the operations of the Company during the periods covered by the Financial Statements,

but the unaudited interim financial statements:

3.17.3 do not contain all notes required under IFRS; and

3.17.4 are subject to normal year-end audit adjustments, which individually or in the aggregate would not be material to any buyer contemplating the purchase of the Purchased Shares.

3.18 Tax Matters

3.18.1 The Company has filed all Tax Returns, has paid all Taxes, and has deducted, withheld or collected, and remitted, all amounts to be deducted, withheld, collected or remitted, with respect to any Taxes, as required under all applicable Tax Laws. The Company does not have any outstanding liability, obligation or commitment for the payment of any Taxes, except as reflected in the Financial Statements or which relate to Taxes not yet due which have arisen in the usual and ordinary course of the Business since the end of the most recent financial period addressed in the Financial Statements and for which adequate provision in the accounts of the Company has been made. There are no Claims in progress or pending, or, to the Knowledge of the Seller, threatened against the Company, in connection with any Taxes, and the Company has not filed any waiver for any taxation year under any applicable Tax Law.

3.18.2 All Tax which has been or is deemed to have been assessed or imposed on the Company or has been required to be withheld from any payment made by the Company to another person:

3.18.2.1 Which is due and payable, has been paid by the final date for payment by the Company; and

3.18.2.2 Which is not yet payable but become payable before Closing, will be paid by the due date.

3.18.3 The Company:

3.18.3.1 Maintains and has retained for the period required by law, accurate records of franking credits and franking debits (as defined in the Tax Act) in respect of its current and earlier accounting periods;

3.18.3.2 Has franked to the required amount any dividend paid; and

3.18.3.3 Has not franked any dividend paid to the extent that a franking deficit has arisen or will arise at the end of the succeeding franking year.

3.18.4 The Company maintains and has retained for the period required by law accurate records of all assets to which Part 3-1 and Part 3-3 of the Tax Act applies or has applied.

3.18.5 All supplies or acquisitions of property or services by the Company has been made on arms' length terms and no additional Tax will be payable in respect of any supply or acquisition prior to the Closing Date consequent upon the operation of division 13 of part III of the Tax Act.

3.18.6 All stamp duty and other similar taxes payable in respect of every Material Contract or significant transaction to which the Company is or has been a party, or by which the Company derives, has derived or will derive a substantial benefit, has been duly paid. No Material Contract which is required by law to be stamped is unstamped or insufficiently stamped. No event has occurred as a result of which any duty has become payable, from which the Company have obtained relief.

3.18.7 The Company has not sought, nor has the Tax Act required, capital gains tax relief under subdivision 126-B of part 3-3 of the Tax Act or section 160ZZO of the Tax Act with respect to any asset acquired by the Company and which is still owned by the Company at the Closing Date.

3.19 Absence of Changes

Except as disclosed in the Disclosure Schedule, since May 31, 2023 there has not been:

3.19.1 any change in the financial condition, operations, results of operations, or business of the Company, nor has there been any occurrence or circumstances which with the passage of time might reasonably be expected to have a Material Adverse Effect; or

3.19.2 any Loss, labour trouble, or other event, development or condition of any character (whether or not covered by insurance) suffered by the Company which has had, or may reasonably be expected to have, a Material Adverse Effect.

3.20 Absence of Undisclosed Liabilities

3.20.1 Except to the extent reflected or reserved in the Financial Statements, or incurred subsequent to May 31, 2023 and:

3.20.1.1 disclosed in the Disclosure Schedule; or

3.20.1.2 incurred in the ordinary course of the Business,

the Company has no outstanding indebtedness or any liabilities or obligations (whether accrued, absolute, contingent or otherwise, including under any guarantee of any debt).

3.20.2 There are no deficiencies or defects (whether potential or actual) in any services or products supplied or provided by the Company which may result in Claims being made against the Company or for which the Company may become liable or responsible.

3.20.3 No transaction contemplated by this Agreement could result in the Company being liable to refund the whole or any part of any grant received from any Government Authority.

3.21 Absence of Unusual Transactions

Except as disclosed in the Disclosure Schedule, since May 31, 2023 the Company has not:

3.21.1 given any guarantee of any debt, liability or obligation of any Person;

3.21.2 subjected any of its assets, or permitted any of its assets to be subjected, to any Encumbrance other than the Permitted Encumbrances;

3.21.3 acquired, sold, leased or otherwise disposed of or transferred any assets other than in the ordinary course of the Business;

3.21.4 made or committed to any capital expenditures, except in the ordinary course of the Business;

3.21.5 declared or paid any dividend or otherwise made any distribution or other payment of any kind or nature to any of its shareholders or any other Person, or taken any corporate proceedings for that purpose;

3.21.6 redeemed, purchased or otherwise retired any of its shares or otherwise reduced its stated capital;

3.21.7 entered into or become bound by any Contract, except in the ordinary course of the Business;

3.21.8 modified, amended or terminated any Contract (except for Contracts which expire by the passage of time) resulting in a Material Adverse Effect;

3.21.9 waived or released any right or rights which it has or had, or a debt or debts owed to it resulting, collectively or individually, in a Material Adverse Effect;

3.21.10 made any change in excess of $10,000 in any compensation arrangement or agreement with any Employee, officer, director or shareholder of the Company;

3.21.11 made any change in any method of accounting or auditing practice; or

3.21.12 agreed or offered to do any of the things described in this Section 3.21.

3.22 Title to and Condition of Assets

The Company owns, possesses and has good and marketable title to all of its undertakings, property and assets not otherwise the subject of specific representations and warranties in this Article 3, including all the undertakings, property and assets reflected in the most recent consolidated balance sheet included in the Financial Statements, free and clear of all Encumbrances other than Permitted Encumbrances. The undertakings, property and assets of the Company comprise all of the undertakings, property and assets necessary for it to carry on the Business as it is currently operated. All facilities, machinery, equipment, fixtures, vehicles and other properties owned, leased or used by the Company are in good operating condition and repair, ordinary wear and tear excepted, and are reasonably fit and usable for the purposes for which they are being used.

3.23 Real Property

3.23.1 The Disclosure Schedule contains true and complete copies of the Real Property Leases for the Leased Premises. The Company does not have any freehold or leasehold interest in land except for the Leased Premises. To the knowledge of Seller, the buildings and other structures forming part of the Leased Premises, and their operation and maintenance, comply with all applicable Laws, and none of those buildings or structures encroaches upon any land not leased by the Company. To the knowledge of Seller, there are no restrictive covenants, Laws, Encumbrances, restrictions or other legally binding arrangements which in any way restrict or prohibit any part of the present use of the Leases Premises, other than the Permitted Encumbrances. There are no expropriation or similar proceedings, actual or threatened, of which the Company or the Seller have received notice, against any of the Leased Premises. All of the Real Property Leases are in full force and effect, unamended and none of them are, to the Knowledge of the Seller, under any threat of termination.

3.23.2 The Company has exclusive occupation and quiet enjoyment of the Leased Premises.

3.23.3 The Company has possession of original, duly stamped and executed leases in respect of the Leased Premises (together with the executed mortgagee's consent to such lease).

3.23.4 The Company has not received any notices, orders, declarations, reports, determinations, or recommendations relating to the Leased Premises from any public authority, and to the Knowledge of the Seller, there are no proposals made or intended to be made by any public authority:

3.23.4.1 Concerning the acquisition or resumption of the whole or any part of the Leased Premises;

3.23.4.2 Requiring the doing of work or expenditure of money on it in relation to the Leased Premises or any footpath or adjoining any of the Leased Premises where the total cost would reasonably be expected to exceed CAD$10,000; or

3.23.4.3 Which would adversely affect the whole or any part of the Leased Premises.

3.23.5 The Company does not own freehold title to any land.

3.24 Intellectual Property

The Disclosure Schedule includes a list of all Intellectual Property that is registered with any Governmental Authority and that is used in connection with the conduct of the Business, including all trade-marks and trade-mark applications, trade names, certification marks, patents and patent applications, copyrights, domain names, industrial designs, trade secrets, know-how, formulae, processes, inventions, technical expertise, research data and other similar property, all associated registrations and applications for registration, and all associated rights, including moral rights, the jurisdictions (if any) in which that Intellectual Property is registered (or in which application for registration has been made) and the applicable expiry dates of all listed registrations. All necessary legal steps have been taken by the Company to preserve its rights to the Intellectual Property listed in the Disclosure Schedule. The Disclosure Schedule also includes a list of all licence agreements pursuant to which the Company has been granted a right to use, or otherwise exploit Intellectual Property owned by third parties. The Intellectual Property that is owned by the Company is owned free and clear of any Encumbrances other than Permitted Encumbrances, and no Person other than the Company has any right to use that Intellectual Property except as disclosed in the Disclosure Schedule. The use by the Company of any Intellectual Property owned by third parties is valid, and the Company is not in default or breach of any licence agreement relating to that Intellectual Property, and there exists no state of facts which, after notice or lapse of time or both, would constitute a default or breach. The conduct by the Company of the Business does not infringe the Intellectual Property of any Person.

3.25 Accounts Receivable

All accounts receivable of the Company reflected in the Financial Statements, or which have come into existence since the date of the most recent Financial Statements, were created in the ordinary and customary course of the Business from bona fide arm's length transactions, and, except to the extent that they have been paid in the ordinary course of the Business since the date of the Financial Statements, are valid and enforceable and payable in full, without any right of set-off or counterclaim or any reduction for any credit or allowance made or given, except to the extent of the allowance for doubtful accounts reflected in the Financial Statements and, in the case of accounts receivable which have come into existence since the date of the most recent Financial Statements, of a reasonable allowance for doubtful accounts, which allowances are, and will as of the Closing Date be, adequate and calculated in a manner consistent with the Company's previous accounting practice.

3.26 Inventories

3.26.1 The Inventories have been accumulated by the Company for use or sale in the ordinary course of the Business, and are in good and marketable condition.

3.26.2 The present levels of the Inventories are consistent with the levels of inventories that have been maintained by the Company before the date of this Agreement in the normal course of the Business in light of seasonal adjustments, market fluctuations and the requirements of customers of the Business.

3.27 Material Contracts

The Disclosure Schedule contains a list of all Material Contracts to which the Company is a party or bound. Except as disclosed in the Disclosure Schedule, the Company is not in default or breach of any Material Contract, and there exists no state of facts which, after notice or lapse of time or both, would constitute a default or breach. No counterparty to any Material Contract is in default of any of its obligations under any Material Contract, the Company is entitled to all benefits under each Material Contract, and the Company has not received any notice of termination of any Material Contract.

3.28 Accounts and Powers of Attorney

The Disclosure Schedule lists:

3.28.1 the name of each bank or other depository in which the Company maintains any bank account, trust account or safety deposit box and the names of all individuals authorized to draw on them or who have access to them; and

3.28.2 the name of each Person holding a general or special power of attorney from the Company and a summary of its terms.

3.29 Compliance with Laws, Permits

3.29.1 The Company is conducting the Business in compliance with all applicable Laws.

3.29.2 All Permits are listed in the Disclosure Schedule. The Permits are the only authorizations, registrations, permits, approvals, grants, licences, quotas, consents, commitments, rights or privileges (other than those relating to Intellectual Property) required to enable the Company to carry on the Business as currently conducted and to enable it to own, lease and operate its assets. All Permits are valid, subsisting, in full force and effect and unamended, and the Company is not in default or breach of any Permit; no proceeding is pending or, to the Knowledge of the Seller, threatened to revoke or limit any Permit, and the completion of the transactions contemplated by this Agreement will not result in the revocation of any Permit or the breach of any term, provision, condition or limitation affecting the ongoing validity of any Permit.

3.30 Environmental Conditions

Without limiting the generality of Section 3.29, and except as disclosed in the Disclosure Schedule, the Company's conduct of the Business, and the current use and condition of the real property that is leased by the Company, and the premises located on that real property, have been and are in compliance with all applicable Environmental Laws, and, to the Knowledge of the Seller, there are no facts which would give rise to non-compliance of the Company with any Environmental Laws, either in the conduct by the Company of the Business, or in the current uses and condition of any of the real property that is leased by the Company, or the premises that are located on that real property.

3.31 Suppliers

3.31.1 The Disclosure Schedule lists each supplier of goods and services from whom the Company has purchased goods or services in excess of $25,000 since the beginning of the last financial year of the Company.

3.32 Rights to Use Personal Information

3.32.1 All Personal Information in the possession of the Company has been collected, used and disclosed in compliance with all applicable Privacy Laws in those jurisdictions in which the Company conducts, or is deemed by operation of law in those jurisdictions to conduct, the Business.

3.32.2 The Seller has disclosed to the Buyer all Contracts and facts concerning the collection, use, retention, destruction and disclosure of Personal Information, and there are no other Contracts, or facts which, on completion of the transactions contemplated by this Agreement, would restrict or interfere with the use of any Personal Information by the Company in the continued operation of the Business as conducted before the Closing.

3.32.3 Except as disclosed in the Disclosure Schedule, there are no Claims pending or, to the Knowledge of the Seller, threatened, with respect to the Company's collection, use or disclosure of Personal Information.

3.33 Product Warranties

Except as disclosed in the Disclosure Schedule and to the Knowledge of the Seller there are no Claims against the Company on account of warranties or with respect to the production or sale of defective or inferior products or the provision of services, nor is there any basis for any liability to, Claim against, or Loss on the part of, the Company arising from, relating to, or in connection with the production or sale of the products or the provision of services before the date of this Agreement.

3.34 Employees and Employment Contracts

3.34.1 The Disclosure Schedule lists the names, titles and status (active or non-active, and if not active, reason why and period of time not active) of all Employees, together with particulars of the material terms and conditions of their employment or engagement, including current rates of remuneration, perquisites, commissions, bonus or other incentive compensation (monetary or otherwise), most recent hire date, cumulative years of service, start and end dates of all previous periods of service, benefits, vacation or personal time off entitlements, current positions held and, if available, projected rates of remuneration. Any options held by any Employees to purchase Securities of the Company are listed in the Disclosure Schedule.

3.34.2 No Employee, nor any consultant with whom the Company has contracted, is in violation of any term of any employment contract, contract of engagement, services agreement, proprietary information agreement or any other agreement relating to the right of that individual to be employed, engaged or retained by the Company, and the continued employment or engagement by the Company of its current Employees will not result in any violation. The Company has not received any notice alleging that any violation has occurred.

3.34.3 Except as disclosed in the Disclosure Schedule, all of the Employees are employed, engaged or retained for an indefinite term and none are subject to written employment agreements, contracts of engagement or services agreements. True and complete copies of any employment agreements, contracts of engagement or services agreements listed in the Disclosure Schedule have been provided to the Buyer. No officer or Key Employee has given notice, oral or written, of an intention to cease being employed with the Company, and the Company does not intend to terminate the employment of any officer, Key Employee or group of Key Employees.

3.34.4 Except as disclosed in the Disclosure Schedule, there are no employment Law related Claims or outstanding orders, awards, rulings or discussions relating to the Business, pending or threatened, which have resulted in or might reasonably be expected to result in a Material Adverse Effect.

3.35 Superannuation

3.35.1 The Company has:

3.35.1.1 Paid or remitted all superannuation contributions which are due and payable in respect of the Employees or any contractors of the Company (whether past or present) under any agreement or award relating to contributions which the Company is required to make or to remit; and

3.35.1.2 In respect of each contribution period prior to Closing (within the meaning of the Superannuation Guarantee (Administration) Act 1992), contributed in respect of each Employee or contractor of the Company at a rate sufficient to avoid a liability to a superannuation guarantee shortfall under that act in respect of that Employee or contractor.

3.36 Employee Confidentiality Agreements

The Company has entered into enforceable confidentiality agreements with all relevant Employees, true and complete copies of which have been provided to the Buyer, that protect the Confidential Information and the Intellectual Property of the Company and third party licensors. All current and former officers and Employees who have been involved in the development, modification or use of Intellectual Property of the Company or who have had access to the source code relating to this Intellectual Property have assigned all of their rights, title and interest in and to the Intellectual Property to the Company, have expressly waived any moral rights in the Intellectual Property, and have executed written agreements with the Company to that effect.

3.37 Pension and Benefit Plans

The Company is not a party to or bound by any Plans.

3.38 Insurance Policies

The Disclosure Schedule lists all Insurance Policies, and also specifies the insurer, the amount of the coverage, the type of insurance, the policy number and any pending Claims with respect to each Insurance Policy. The Insurance Policies insure all the property and assets of the Company against Loss by all insurable hazards of risk on a replacement cost basis, and provide the Company with product liability, professional liability, and errors and omissions coverage in amounts that are customary, and that would reasonably be considered adequate and prudent, for a company carrying on a business similar to the Business. All Insurance Policies are in full force and effect and the Company:

3.38.1 is not in default, whether as to the payment of premiums or otherwise, under any material term or condition of any of the Insurance Policies; or

3.38.2 has not failed to give notice or present any Claim under any of the Insurance Policies in a due and timely fashion.

3.39 Litigation

3.39.1 Except as disclosed in the Disclosure Schedule, there are no Claims, whether or not purportedly on behalf of the Company, pending, commenced, or, to the Knowledge of the Seller, threatened, which might reasonably be expected to have a Material Adverse Effect or which might involve the possibility of an Encumbrance against the assets of the Company.

3.39.2 There is no outstanding judgment, decree, order, ruling or injunction involving the Company or relating in any way to the transactions contemplated by this Agreement.

3.39.3 The Company has not been involved in any suit, proceedings, application, Claim, prosecution, litigation, arbitration proceedings or administrative or governmental investigation or challenge as plaintiff, defendant, third party or in any other capacity save as set out in the Disclosure Schedule.

3.40 No Expropriation

No property or asset of the Company has been taken or expropriated by any Governmental Authority and no notice or proceeding in respect of any expropriation has been given or commenced or, to the Knowledge of the Seller, is there any intent or proposal to give any notice or commence any proceeding in respect of any expropriation.

3.41 Disclosure

No representation or warranty or other statement made by the Seller in this Agreement contains any untrue statement or omits to state a material fact necessary to make it, in light of the circumstances in which it was made, not misleading.

3.42 Accuracy of Information

3.42.1 All information given by or on behalf of the Seller or the Company to the Buyer or to any director, agent or adviser of the Buyer concerning the Business or the Company (including the Disclosure Material or Disclosed), is accurate in all material respects. None of that information is misleading in any way, whether by inclusion of misleading information or omission of material information or both.

3.42.2 Prior to the execution of this Agreement the Seller has disclosed in writing to the Buyer all material facts, information and circumstances relating to the Business or assets or liabilities of the Company or otherwise relating to the subject matter of this Agreement of which it is aware (having made all reasonable and proper enquiries) which might, if disclosed, reasonably be expected to affect the decision of a reasonable purchaser to enter into this Agreement or materially affect the price at which or the terms on which a reasonable purchaser might be willing to purchase the Purchased Shares.

3.43 U.S. Securities Laws Matters

3.43.1 The Company is a "foreign issuer" (as that term is defined in Rule 902(e) of Regulation S) and there is no "substantial U.S. market interest" (as that term is defined in Rule 902(j) of Regulation S) with respect to the Purchased Shares.

3.43.2 None of the Seller, the Company, their Affiliates or any person acting on any of their behalf has engaged or will engaged in any "directed selling efforts" (as that term is defined in Rule 902(c) of Regulation S) with respect to the Purchased Shares.

3.43.3 The Purchased Shares are not "restricted securities" within the meaning of Rule 144(a)(3) under the U.S. Securities Act.

3.43.4 With respect to the Consideration Shares to be acquired by the Seller, the Seller acknowledges and represents as follows:

3.43.4.1 The Seller understands the Consideration Shares have not been and will not be registered under the U.S. Securities Act, or the securities laws of any state of the United States and that the Securities may not be offered or sold, directly or indirectly, in the United States or to, or for the account or benefit of, a U.S. Person without registration under the U.S. Securities Act or compliance with the requirements of an exemption from such registration requirements and the applicable laws of all applicable states.

3.43.4.2 The Seller is (A) not in the United States, (B) not a U.S. Person, and, (C) not acquiring the Consideration Shares for the account or benefit of a U.S. Person or a person in the United States.

3.43.4.3 The Seller is not purchasing the Consideration Shares as a result of any "directed selling efforts" (as such term is defined in Regulation S).

3.43.4.4 The Seller understands that the current structure of this transaction and all transactions and activities contemplated hereunder is not a scheme to avoid the registration requirements of the U.S. Securities Act or any applicable securities laws of any state of the United States;

3.43.4.5 The Seller undertakes and agrees that offers and sales of any of the Consideration Shares prior to the expiration of a period of six months after the date of the issuance of such securities (such six-month period hereinafter referred to as the "Distribution Compliance Period") shall not be made to a U.S. Person or for the account or benefit of a U.S. Person (other than a distributor, as such term is defined in Rule 902(d) of Regulation S) and shall only be made in compliance with the safe harbor provisions set forth in Regulation S, pursuant to the registration provisions of the U.S. Securities Act or an exemption therefrom.

3.43.4.6 The Seller agrees that it will not engage in hedging transactions involving any of the Consideration Shares during the Distribution Compliance Period unless such transactions are in compliance with the provisions of the U.S. Securities Act and in each case only in compliance with applicable securities laws of any state of the United States.

3.43.4.7 In the event the Consideration Shares are offered, sold or otherwise transferred by the Seller prior to the expiration of the Distribution Compliance Period, the purchaser or transferee must certify that it is not a U.S. Person and is not acquiring the Consideration Shares for the account or benefit of any U.S. Person or is purchasing the Consideration Shares in a transaction that does not require registration under the U.S. Securities Act (and in which case has furnished an opinion of counsel to that effect reasonably satisfactory to the Buyer), agree not to resell such securities except in compliance with the provisions of Regulation S, pursuant to registration under the U.S. Securities Act, or pursuant to an available exemption from such registration, and in each case, in compliance with all applicable state securities laws; and must further agree not to engage in hedging transactions with regard to such Consideration Shares unless in compliance with the U.S. Securities Act.

3.43.4.8 The Seller consents to the Buyer making a notation on its records or giving instruction to the registrar and transfer agent of the Buyer in order to implement the restrictions on transfer of the Consideration Shares set forth and described herein.

ARTICLE 4

REPRESENTATIONS AND WARRANTIES OF THE BUYER

The Buyer represents and warrants to the Seller as follows, and acknowledges that the Seller is relying upon these representations and warranties in connection with the sale of the Purchased Shares, despite any investigation made by or on behalf of the Seller.

4.1 Corporate Existence of Buyer

The Buyer is a company duly incorporated and validly existing under the laws of Ontario.

4.2 Capacity to Enter Agreement

The Buyer has all necessary corporate power, authority and capacity to enter into and perform its obligations under this Agreement.

4.3 Binding Obligation

The execution and delivery of this Agreement and the completion of the transactions contemplated by this Agreement have been duly authorized by all necessary corporate action on the part of the Buyer. This Agreement has been duly executed and delivered by the Buyer and constitutes a valid and binding obligation of the Buyer, enforceable against the Buyer in accordance with its terms, subject to applicable bankruptcy, insolvency and other Laws of general application limiting the enforcement of creditors' rights generally and to the fact that equitable remedies, including specific performance, are discretionary and may not be ordered in respect of certain defaults.

4.4 Absence of Conflict

None of the execution and delivery of this Agreement, the performance of the Buyer's obligations under this Agreement, or the completion of the transactions contemplated by this Agreement, will result in or constitute a breach of any term or provision of, or constitute a default under, the articles or by-laws of the Buyer, result in the creation or imposition of any Encumbrance on the Consideration Shares; contravene any applicable Law; or contravene any judgment, order, writ, injunction or decree of any Governmental Authority.

4.5 Regulatory Approvals

No authorization, approval, order, consent of, or filing with, any Governmental Authority is required on the part of the Buyer in connection with the execution, delivery and performance of this Agreement, including the issuance and delivery of the Consideration Shares, or any other documents and agreements to be delivered under this Agreement.

4.6 Title to Consideration Shares

On the Closing Date, the Buyer will be the legal and beneficial owner of the Consideration Shares and will have good title to them, free and clear of any Encumbrance except for any restriction on transfer noted on the share certificate evidencing the Consideration Shares.

ARTICLE 5

COVENANTS

5.1 Conduct of Business Before Closing

During the period beginning on the date of this Agreement and ending at the Closing Time, the Seller will cause the Company:

5.1.1 to conduct the Business diligently and prudently and to refrain from entering into any Contract or Real Property Lease except in the ordinary course of the Business, or with the prior written consent of the Buyer;

5.1.2 except as required by applicable Law, or with the prior written consent of the Buyer, to refrain from:

5.1.2.1 increasing, reducing or otherwise altering its share capital or granting any options or other rights for the issue of shares or other Securities or issue any Securities convertible into share capital;

5.1.2.2 altering the provisions of its Corporate Articles;

5.1.2.3 declaring or paying a dividend or making any other distribution of its profits;

5.1.2.4 buying back any of its shares;

5.1.2.5 entering into any abnormal or unusual transaction which relates to, or adversely affects, the Business;

5.1.2.6 making any capital commitment for more than CAD$30,000.00;

5.1.2.7 selling or purchasing any single asset for more than CAD$30,000 or assets that in the aggregate cost more than CAD$30,000;

5.1.2.8 borrowing any further moneys or creating any Encumbrance over or declaring itself trustee of any asset;