0001750155

false

A1

0001750155

2023-09-12

2023-09-12

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported):

September 12, 2023

Charlotte’s

Web Holdings, Inc.

(Exact name of Registrant as Specified in Its Charter)

| British Columbia |

000-56364 |

98-1508633 |

|

(State or Other Jurisdiction

of Incorporation) |

(Commission

File Number) |

(IRS Employer

Identification No.) |

|

700 Tech Court

Louisville, Colorado

|

80027 |

|

(Address of Principal Executive Offices)

|

(Zip Code) |

Registrant’s Telephone Number, Including

Area Code: (720) 617-7303

Not applicable

(Former Name or Former Address, if Changed Since

Last Report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instructions A.2.

below):

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading Symbol |

Name of exchange on which registered |

| N/A |

N/A |

N/A |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange

Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act.

| Item 5.02. | Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of

Certain Officers. |

On

September 13, 2023, Charlotte’s Web Holdings, Inc. (the “Company”) announced the appointment of William Morachnick,

age 59, as the Company’s Chief Executive Officer effective immediately. Along with assuming the role of Chief Executive Officer,

Mr. Morachnick will be appointed as a non-independent director for the Board of Directors of the Company. Mr. Morachnick will replace

the Company’s Chief Executive Officer, Jacques Tortoroli, who will depart the Company effective September 13, 2023. Mr. Tortoroli’s

departure is not based on any disagreement with the Company’s accounting principles, practices or financial statement disclosures.

Mr.

Morachnick brings a track record of building differentiated products within the consumer goods and wellness space. Mr. Morchnick began

his career at Eastman Kodak Company where he rose to the position of Director of Consumer Products, Asia-Pacific. Following Eastman Kodak

Company, Mr. Morachnick was the founder and President of Tsunami International, Inc., and in 2006, assumed the position of Chief Executive

Officer of SFRTI, creating collaborative relationships with tobacco farmers to enable sustainable farming practices and living wages.

From 2016 through 2018, Mr. Morachnick was the CEO and Chairman of True Spirit Tobacco Company, where he built the international arm of

the RJ Reynolds owned Santa Fe tobacco brand from 4 employees in a single office to a 450-employee global premium brand, culminating in

an unsolicited $5B cash acquisition by market leader Japan Tobacco. Since 2018, he has leveraged his learnings from these experiences

to advise a variety of start-ups in the wellness industry, including cannabis growers and medical device makers. Mr. Morachnick received

his B.A from the University of Maryland and his MBA from the Thunderbird School of Global Management.

Pursuant

to the terms of his offer letter, Mr. Morachnick’s base salary will be $450,000 per annum

and will be subject to applicable withholding taxes. Mr. Morachnick is required to relocate to Colorado by March 13, 2023

and will receive relocation assistance of up to $25,000. Prior to his relocation, Mr. Morachnick will be eligible for reimbursement for

travel expenses in accordance with the Company’s guidelines.

Effective

on or before October 13, 2023, the Company will award Mr. Morachnick an equity grant of 4,500,000 restricted stock units (the “Time-vested

RSUs”) priced and issued in accordance with the terms of the Company’s Amended 2018 Long-Term Incentive Plan (the “2018

LTIP”), provided that vesting of the RSU’s will occur as to 8.3334 % on December 31, 2023 and as to 8.3333% every three

months (i.e., on March 31, June 30, September 30 and December 31) thereafter over a three (3) year period provided that the vesting of

all Time-vested RSUs shall accelerate upon a Change of Control. In addition to the Time-vested RSUs, and effective as of the Start Date,

Mr. Morachnick will be issued a one-time equity grant consisting of 500,000 restricted stock units of the Company (the “Initial

Equity Grant”) under the 2018 LTIP, which will be immediately and fully vested. The Initial Equity Grant (and not the Time-vested

RSUs) shall be subject to the terms of a lock-up agreement (the “Lock-up Agreement”), which will restrict any sale

or transfer of the shares representing the Initial Equity Grant prior to the earlier of (i) cessation of employment for any reason; and

(ii) September 13, 2026.

Mr.

Morachnick will be eligible for an annual discretionary bonus in accordance with the Company’s annual short-term incentive plan

and on the same terms and conditions as other similarly situated executives (the “Annual Discretionary Bonus”). The

target bonus opportunity will be 100% of the base salary, with a maximum payout opportunity of 150% of the base salary, provided that

the actual amount of any Annual Discretionary Bonus, if any, shall be determined by the Compensation Committee, in its sole and absolute

discretion, based on Company results and individual performance against applicable performance metrics to be jointly developed. For calendar

year 2023, Mr. Morachnick will be paid a guaranteed bonus of $150,000 (representing a 2023 bonus).

Mr.

Morachnick also is entitled to participate in the Company’s benefit programs applicable generally to employees and executive officers.

Such compensation and benefit plans and arrangements are described in the Company’s proxy statement on Schedule 14A filed with the

U.S. Securities and Exchange Commission on April 28, 2023, relating to its 2023 annual general meeting.

Effective

September 12, 2023, in connection with Mr. Tortoroli’s retirement, the Board of Directors approved the acceleration of the vesting

of Mr. Tortoroli’s unvested restricted stock units.

| Item 7.01 |

Regulation FD Disclosure. |

On September 13, 2023,

the Company issued a press release announcing the appointment of Mr. Morachnick as Chief Executive Officer, effective as September 13,

2023 and the departure of Mr. Tortoroli as the Company’s Chief Executive Officer, effective September 13, 2023. The Company also

announced the rejection of the offers to resign of John Held, Thomas Lardieri, Alicia Morga and Jacques Tortoroli that had been offered

pursuant to the Company’s Majority Voting Policy. A copy of the press release is filed as Exhibit 99.1 and incorporated into this

Item 7.01 by reference.

The information in this Item

7.01 of this Form 8-K is furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act

of 1934 (the “Exchange Act”) or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated

by reference in any filing under the Securities Act of 1933 or the Exchange Act, except as expressly set forth by specific reference in

such filing.

†

Indicates a management contract or compensatory plan or arrangement.

*

This Exhibit 99.1 is furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of

1934 (the “Exchange Act”) or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by

reference in any filing under the Securities Act of 1933 or the Exchange Act, except as expressly set forth by specific reference in such

filing.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| |

|

CHARLOTTE’S WEB HOLDINGS, INC. |

| |

|

|

|

| Date: September 13, 2023 |

|

By: |

/s/ Stephen Rogers |

| |

|

|

Stephen Rogers |

| |

|

|

Senior Vice President - General Counsel and Corporate Secretary |

| |

|

|

|

Exhibit 10.1

| CHARLOTTE’S

WEB, INC. |

| 700

TECH COURT, LOUISVILLE, CO 80002 |

September 12, 2023

Via

E-mail

William Morachnick

Re: Offer of

Employment with Charlotte’s Web Holdings, Inc.

Dear Bill,

We

are very pleased to extend to you this offer of employment for the position of Chief Executive Officer of Charlotte’s Web Holdings,

Inc. (the “Company”). This offer letter (the “Agreement”) sets forth the terms and conditions of

your employment with the Company, effective September 13, 2023 (the “Start Date”).

| (a) | In

your capacity as Chief Executive Officer, you will report to the Company’s Board of

Directors (the “Board”) and perform such duties and responsibilities that

are commensurate with your position, as well as such other duties and responsibilities as

may be assigned to you from time to time by the Board. |

| (b) | You

agree to devote your full business time, attention, and best efforts to the performance of

your duties hereunder and to the furtherance of the Company’s interest. During the

period of your employment with the Company, you shall not engage in any business activities

other than being employed by and performing the duties required of you by the Company. Notwithstanding

the foregoing, you will be permitted to participate in (i) charitable, professional and civic

activities and (ii) serve on the board of directors of third-party companies with the express

prior written approval of the Board, which approval the Board may grant or deny in its discretion,

and further provided that such outside activities do not, directly or indirectly, conflict

with the interests of, or create a perceived conflict of interest with, the Company or interfere

with the proper and efficient performance of your duties for the Company. The Company and

its Board of Directors have consented to your serving on the Board of Directors or Managers

of Euroflex USA, LLC and Omega Life Sciences and its subsidiaries. You confirm (i) neither

of these entities compete with the Company; and (ii) your directorship in either entity does

not create a conflict of interest for you in connection with your roles at the Company. |

| (c) | The

Company maintains, and from time to time modify and implement, various policies and procedures.

You will be expected to comply with all such policies and procedures that have been delivered

or made available to you and with any applicable laws or regulatory requirements which govern

your conduct in respect of the Company’s operations or its employees. |

2. Work

Location. Your principal place of employment shall be the Company’s headquarters in Louisville, Colorado, subject to business

travel as needed to properly fulfill your employment duties and responsibilities. The Company agrees that it shall reimburse you up to

$25,000 for expenses actually incurred in connection with your relocation to the Louisville, Colorado metropolitan area within six (6)

months following the Start Date (the “Relocation Reimbursement”). To receive the Relocation Reimbursement, you must

submit documentation satisfactory to the Company detailing expenses actually incurred. In the event that your employment with the Company

ceases prior to the second anniversary of the Start Date other than as the result of a termination without Cause, you agree to repay

to the Company the full amount of the Relocation Reimbursement actually paid to you by the Company within ten (10) business days of your

final day of employment. In addition to the forgoing, the Company will provide, at no cost to you and provided you are employed at the

Company during the relevant periods (i) an apartment located in Boulder, Colorado leased by the Company for a period commencing on the

Start Date and terminating December 31, 2023; and (ii) a vehicle for a period commencing on the Start Date and terminating February 2025.

The Company acknowledges that you will not be required to relocate to Louisville until the six-month anniversary of the date of this

Agreement.

| CHARLOTTE’S WEB, INC. |

| 700 TECH COURT, LOUISVILLE, CO 80002 |

3. Board

Seat. Effective as of the Start Date, you will be appointed as a non-independent director serving on the Board in your role of

Chief Executive Officer.

4. Base

Salary. In consideration of your services, you will be paid an initial base salary of Four Hundred Fifty Thousand Dollars ($450,000.00)

per year (“Base Salary”), subject to review by the Compensation Committee from time to time, payable in accordance

with standard payroll practices of the Company and subject to applicable withholdings and deductions. You will be entitled to four (4)

weeks of vacation per year.

5. Annual

Discretionary Bonus. You will be eligible for an annual discretionary bonus in accordance with the Company’s annual short-term

incentive plan and on the same terms and conditions as other similarly situated executives (the “Annual Discretionary Bonus”).

Your target bonus opportunity will be 100% of your base salary, with a maximum payout opportunity of 150% of your base salary, provided

that the actual amount of any Annual Discretionary Bonus, if any, shall be determined by the Compensation Committee, in its sole and

absolute discretion, based on Company results and individual performance against applicable performance metrics to be jointly developed

between you and the Company. For calendar year 2023, you shall be paid a guaranteed bonus of $150,000 (representing a 2023 bonus). Any

such Annual Discretionary Bonus payment, if any, will be subject to applicable taxes and withholdings and is generally paid within three

and a half (3.5) months following the end of the applicable calendar year. Subject to paragraph 11, notwithstanding the foregoing, to

be eligible to earn any such Annual Discretionary Bonus for a given calendar year, you must be actively employed, in good standing, and

not have given or received notice of termination of your employment as of the date such Annual Discretionary Bonus is paid. For the avoidance

of doubt, you will not be eligible to receive an Annual Discretionary Bonus if either you or the Company has given notice of termination

of your employment prior to the payment of such Annual Discretionary Bonus.

6. Initial

Equity Grant. Effective on or before October 13, 2023, the Company will award you an equity grant of 4,500,000 restricted stock

units (the “Time-vested RSUs”) priced per and issued in accordance with the terms of the Company’s Amended

2018 Long-Term Incentive Plan (the “2018 LTIP”), provided that vesting of the RSU’s will occur as to 8.3334

% on December 31, 2023 and as to 8.3333% every three months (i.e., on March 31, June 30, September 30 and December 31) thereafter over

a three (3) year period provided that the vesting of all Time-vested RSUs shall accelerate upon a Change of Control. In addition to the

Time-vested RSUs, and effective as of the Start Date, you will be issued a one-time equity grant consisting of 500,000 restricted

stock units of the Company (the “Initial Equity Grant”) under the 2018 LTIP, which will be immediately and fully vested.

The Initial Equity Grant (and not the Time-vested RSUs) shall be subject to the terms of a lock-up agreement (the “Lock-up Agreement”),

which will restrict you from any sale or transfer of the shares representing the Initial Equity Grant prior to the earlier of (i) your

cessation of employment for any reason; and (ii) September 13, 2026. You will be responsible for any and all tax liabilities incurred

by you in connection with the Initial Equity Grant but taxes may be withheld at your discretion from future equity grants upon vesting

in accordance with the 2018 LTIP.

| CHARLOTTE’S WEB, INC. |

| 700 TECH COURT, LOUISVILLE, CO 80002 |

7. Long

Term Incentive Program. You will be eligible to participate in the Company’s long-term incentive program on similar terms

and conditions as other similarly situated executives, as determined by the Compensation Committee, in its sole and absolute discretion.

Any and all equity awards shall in all respects be subject to the terms and conditions of the Company’s long-term incentive program,

the applicable grant and/or award document(s), and such other terms and conditions as the Board or Compensation Committee may impose

from time to time in its discretion. For certainty, the Initial Equity Grant is intended to serve as your long term incentive award package

for 2023, 2024 and 2025 and, subject to ongoing review, the Company does not currently intend to grant you additional long term incentive

awards during this period.

8. Benefits

and Perquisites. You will be eligible to participate in the employee benefit plans and programs that the Company may establish

and make generally available to the Company’s executives, subject to the terms and conditions of such plans and programs, which

are anticipated to include: (i) health, dental, and vision plans; (ii) disability and life insurance; (iii) 401(k) (with Company

match at 100% of first 3%); and (iv) access to free company products in accordance with Company plans and programs. The Company reserves

the right to amend, modify, suspend or terminate any of its benefit plans or programs at any time and for any reason, subject to applicable

law.

9. Withholdings.

All forms of compensation paid to you as an employee of the Company shall be subject to all applicable taxes and withholdings.

10. Restrictive

Covenant Agreement. Like all Company employees, you will be required, as a condition of your employment with the Company, to

sign and abide by the Company’s standard Employee Confidentiality, Non-Disclosure, Non-Compete and Conflict of Interest Agreement

(the “Restrictive Covenant Agreement”), the terms of which are incorporated herein by reference.

11. At-Will

Employment; Termination of Employment.

| (a) | Your

employment with the Company will be for no specified period of time. Rather, your employment

will be on an at-will basis, meaning that you or the Company may terminate the employment

relationship at any time, for any reason or no reason, with or without cause, and with or

without notice, provided, however, that you agree to provide the Company with not less than

ninety (90) days’ advance written notice of your intent to resign, during which period

you shall be expected to continue to perform your full duties and responsibilities with respect

to the Company, provided that the Company may, in its discretion, place you on garden leave

or terminate your employment early with no further payments owing, as determined in its discretion.

Although your job duties, compensation and benefits, as well as the Company’s personnel

policies and procedures, may change from time to time, the at-will nature of your employment

may only be changed by an express written agreement approved by the Board and signed by you

and a duly authorized representative of the Company (other than yourself). |

| CHARLOTTE’S WEB, INC. |

| 700 TECH COURT, LOUISVILLE, CO 80002 |

| (b) | (i)

If the Company terminates your employment without Cause or you terminate your employment

for Good Reason, the Company agrees to pay you, as severance (A) an amount equal to your

then-existing base salary for a period of twelve (12) months plus; (B) an amount equal to

the amount of the target bonus (as provided for in Section 5) for the year in which you are

terminated pro-rated to the date of termination, or (ii) if the Company (or

any successor thereof) terminates your employment without Cause within the ninety (90) day

period prior to the consummation of the Change of Control transaction or during the twelve

(12) month period immediately following a Change in Control, the Company agrees to pay you

as severance (A) an amount equal to your then-existing base salary for a period of twenty-four

(24) months plus; (B) an amount equal to the amount of the target bonus (provided for in

Section 5) for the year in which you are terminated pro-rated to the date of termination

(each such period under the preceding subparts (i) and (ii), as applicable, a “Severance

Period”), less applicable taxes and withholdings, to be paid in substantially equal

installments over the Severance Period pursuant to the Company’s normal payroll practices

(each such payment under the preceding subparts (i) and (ii), as applicable, a “Severance

Payment”). The Company’s obligation to provide you with the Severance Payment

is expressly conditioned upon your execution and delivery within forty-five (45) days after

presentation by the Company, and non-revocation within any time provided by the Company to

do so, of a release of all claims in favor of the Company in a form provided by to the Company,

and your strict compliance with the terms of your post-employment obligations, including

without limitation those set forth in the Restrictive Covenant Agreement. The Company shall

begin to make any Severance Payments required hereunder on the first administratively feasible

payroll date following the effective date of the Release. In the event that you do not timely

execute the Release as set forth above, or if you revoke such Release within any time provided

by the Company to do so, or in the event you violate the Restrictive Covenant Agreement,

you shall not be entitled to any Severance Payments, the Company shall have no further obligation

or liability under this Agreement, and you shall be required to immediately repay any Severance

Payments already paid, if any. |

| (c) | Immediately

upon the termination of your employment hereunder for any reason, you will be deemed to have

resigned from any and all directorships, committee memberships and any other offices or positions

you may hold with the Company and/or any affiliate thereof (if any), and, at the Company’s

request, you will provide the Company with a formal written resignation from any such directorships,

committee memberships and any other offices or positions, provided that receipt of such written

resignation will not be required for such deemed resignation to be effective. |

| (d) | “Cause”

means your (a) alcohol abuse or the use of controlled drugs (other than in accordance with

a physician’s orders); (b) repeated refusal, failure or inability to perform any of

your material duties hereunder (other than due to illness or Disability) and following notice

thereof; (c) your negligence or willful misconduct in the performance of your duties that

are damaging to the Company, its reputation, products, services, or customers; or material

failure to carry out the reasonable directives of the Board; (d) your breach of your obligations

under this Agreement or the Restrictive Covenant Agreement, or any act constituting a breach

of any common law or fiduciary obligation that you may owe to the Company; (e) conduct involving

dishonesty, fraud, embezzlement, corruption, theft or misuse of property; (f) commission

of any criminal offense constituting a felony, a misdemeanor or a crime involving moral turpitude,

whether or not in the course of your duties or resulting in a criminal indictment or conviction;

or (g) intentional, material violation of any policy of the Company. |

| CHARLOTTE’S WEB, INC. |

| 700 TECH COURT, LOUISVILLE, CO 80002 |

| (e) | “Change

in Control” means, for purposes of this Section 11, the occurrence of any of the

following events: (1) the acquisition by any person, entity or group (other than the Company

or any affiliate thereof) of ownership of more than 50% of the total fair market value or

total voting power of the equity interests of the Company (other than in connection with

a bona fide financing transaction); (2) a majority of members of the Board is replaced during

any 12-month period by directors whose appointment or election is not endorsed by a majority

of the members of the Board before the date of the appointment or election; or (3) the acquisition

by any person, entity or group (other than any affiliate of the Company) of all or substantially

all of the Company’s assets, provided in either case that the transaction is also a

“change in control event” as defined in Section 409A of the Code and the Treasury

Regulations thereunder. |

| (f) | For

purposes of this Agreement, “Good Reason” means any of the following events:

(i) a material reduction in the base salary or bonus opportunity or failure to pay any compensation

hereunder within thirty days of the due date therefor; (ii) a substantial reduction in your

responsibilities or duties; or (iii) a change in the geographic location of your principal

place of employment more than fifty (50) miles from the current principal place of employment |

12. Governing

Law. This offer letter shall be governed by the laws of the State of Colorado, without giving effect to any principles thereof

relating to conflicts of laws.

13. Representations.

By accepting this offer, you represent that you are able to accept this job and carry out the work that it would involve without breach

of any legal restrictions on your activities, such as non-competition, non-solicitation, or other work-related restrictions imposed by

a current or former employer. You also represent that you will inform the Company about any such restrictions and provide the Company

with as much information about them as possible, including any agreements between you and any current or former employer, or other entities

to whom you provided services, describing such restrictions to your activities. You further confirm that you will not remove or take

any documents or proprietary data or materials of any kind, electronic or otherwise, with you from your current or former employer to

the Company without written authorization from your current or former employer, nor will you use or disclose any such confidential information

during the course and scope of your employment with the Company. If you have any questions about the ownership of a particular document

or other information, you should discuss such questions with your former employer (or other applicable third-party) before removing or

copying the documents or information.

14. Entire

Agreement. This offer letter, together with the Restrictive Covenant Agreement, sets forth the entire terms of your employment

and supersedes any and all prior understandings, whether written or oral, relating to the terms of your employment; provided,

however, nothing in this offer letter or the Restrictive Covenant Agreement shall impair your obligations or the rights of the

Company under any confidentiality, non-disclosure, non-competition, non-solicitation, trade secret, and/or assignment of inventions and

other intellectual property provisions entered into between you and the Company. The parties hereto acknowledge that in entering into

this offer letter, neither party has relied on any representation or undertaking (whether oral or in writing) except as expressly set

forth in this offer letter and the Restrictive Covenant Agreement. This offer letter may only be amended by a written agreement, approved

by the Board and signed by both you and a duly authorized representative of the Company (other than yourself).

| CHARLOTTE’S WEB, INC. |

| 700 TECH COURT, LOUISVILLE, CO 80002 |

15. Successors

and Assigns. Your rights and obligations under this offer letter are personal and may not be assigned by you. The Company, however,

may assign its rights and obligations under this offer letter at any time, without your consent and without notice to you, to any successor

or affiliate of the Company. In addition, this offer letter shall be binding upon and inure to the benefit of the heirs, successors,

and permitted assigns of both you and the Company.

If

this offer letter correctly sets forth the terms under which you will be employed by the Company, please sign in the space provided below

and return a signed copy of this offer letter and the Restrictive Covenant to me.

We

are all extremely excited to have you join Charlotte’s Web in this new capacity and look forward to working with you as we build

Charlotte’s Web into one of the world’s premier companies. Please feel free to contact me if you have any questions about

this offer or the benefits described above.

Sincerely,

_/s/ John Held_

John Held, Chair

On behalf of Charlotte’s

Web Holdings, Inc.

Accepted and Agreed to as of the

date first above written:

_/s/ William Morachnick_

William Morachnick

Date: September 12, 2023

Exhibit 99.1

PRESS RELEASE

Charlotte's Web Announces Appointment of Bill Morachnick

as Chief Executive Officer

Provides Update on Majority Voting Policy Process

LOUISVILLE, CO. - September 13, 2023

- (TSX:CWEB) (OTCQX:CWBHF) Charlotte's Web Holdings, Inc. ("Charlotte's Web" or the "Company") is pleased

to announce the appointment of William (Bill) Morachnick who has joined the Company as its Chief Executive Officer. Mr. Morachnick has

also been appointed to the Company’s Board of Directors as a non-independent director. He replaces CEO Jacques Tortoroli who has

elected to resign from his roles at Charlotte’s Web.

Mr. Morachnick is a global business executive

with a track record of building premium, differentiated products and brands across multiple channels

throughout the world and across a broad range of product categories. He is a proven entrepreneurial professional skilled in taking companies

global and creating and managing strategies for consistent and sustained growth.

Mr. Morachnick was President at Santa

Fe Reynolds Tobacco International (SFRTI) GmbH in Zurich, Switzerland, an international business division of Reynolds American, Inc. from

2006 to 2016. He took SFRTI from a start-up to a highly profitable organization, managing several hundred employees and a network of importers/distributors

operating in Europe, Asia, and the Middle East. SFRTI was acquired by Japan Tobacco Group in 2016 for $5 billion. Mr. Morachnick led the

subsequent integration of the combined companies as Chief Executive Officer and Chairman based in Tokyo, Japan for two years before returning

to the U.S. in 2018.

Since returning to the U.S. he has served

as an executive advisor or board member for several companies seeking to launch and/or expand their businesses in the U.S. and overseas

markets.

Mr. Morachnick has a Masters of Business

Administration from the Thunderbird School of Global Management and is an Adjunct Professor of Global Business Strategy at the University

of Nevada Las Vegas.

“Bill

has an accomplished career building businesses in multiple categories,” said John Held, Chairman of Charlotte’s Web. “With

his proven operational expertise Bill is well-suited to take the reins to lead the

Charlotte’s Web team through the next phase of the Company’s growth opportunities.”

The

Company extends its gratitude to Mr. Tortoroli for his years of valued contributions.

“Jacques served on the Company’s Board since November of 2019, and as CEO since late 2021 in a difficult environment

devoid of regulatory oversight and clarity. Under his leadership as CEO, Jacques streamlined the organization, reduced the cash burn,

and recapitalized the Company through a strategic $57 million investment from BAT (LSE: BATS and NYSE: BTI) via

a convertible loan. He was instrumental in the successful launch of ReCreate™, the world’s first NSF

certified for Sport® broad spectrum CBD, which is the official CBD of Major League Baseball©. We are grateful to Jacques for

his valuable contributions,” said Mr. Held.

Board of Directors Majority Voting

Policy Decision

As disclosed in the Company’s press

release of June 16, 2023, each of John Held, Thomas Lardieri, Alicia Morga and Jacques Tortoroli did not receive the requisite majority

of votes at Company’s June 15, 2023 annual meeting of shareholders. In accordance with the Company’s Majority Voting Policy

(the “Policy”), these directors tendered offers to resign, which the Board referred to a committee of independent Board members

(the “Committee”) for consideration and to make a recommendation to the Board as to whether to accept the offers to resign.

The Committee carefully considered all

relevant factors and determined that there are exceptional circumstances that warrant the rejection of the offers to resign. The majority

voting objectives of the Toronto Stock Exchange and the Policy are the continuous improvement of corporate governance standards through

provision of a meaningful means for security holders to hold individual directors accountable. The withhold campaign launched by the activist

shareholders, however, was not aligned with those objectives. The withhold campaign was instead designed to circumvent the procedures

and processes in place to allow shareholders to vote based on full and complete disclosure with respect to director nominees and to make

an informed decision with respect to the election of directors to the Board. Based on these principles, the Committee recommended the

Board reject the offers to resign. The Board considered the Committee’s recommendation along with other relevant factors, including

the subject directors’ significant past contributions to the Board, expertise, and integral role in stewarding the Company, and

determined to reject the offers to resign.

The Board is focused on effective corporate

governance and on maximizing value for all Company stakeholders and believes that the current Board composition aligns with this objective.

In accordance with its mandate, the Company’s Corporate Governance and Nominating Committee regularly considers potential candidates

to be considered for the Board.

About Charlotte’s Web Holdings, Inc.

Charlotte's

Web Holdings, Inc., a Certified B Corporation headquartered in Louisville, Colorado, is the market leader in innovative hemp extract

wellness products under a family of brands that includes Charlotte's Web™, ReCreate™, CBD Medic™, and CBD Clinic™.

Charlotte’s Web whole-plant CBD extracts come in full-spectrum and broad-spectrum options, including ReCreate™

by Charlotte’s Web, broad-spectrum CBD certified NSF for Sport®. ReCreate is the official

CBD of Major League Baseball©, Angel City Football Club and the Premier Lacrosse League. Charlotte's Web branded premium quality

products start with proprietary hemp genetics that are North American farm-grown using organic and regenerative cultivation practices.

The Company's hemp extracts have naturally occurring botanical compounds including cannabidiol ("CBD"), CBC, CBG, terpenes,

flavonoids, and other beneficial compounds. Charlotte’s Web product categories include CBD oil tinctures (liquid products) CBD

gummies (sleep, calming, exercise recovery, immunity), CBD capsules, CBD topical creams and lotions, as well as CBD pet products for

dogs. Through its substantially vertically integrated business model, Charlotte’s Web maintains stringent control over product

quality and consistency with analytic testing from soil to shelf for quality assurance. Charlotte’s Web products are distributed

to retailers and health care practitioners throughout the U.S.A, and online through the Company's website at www.charlottesweb.com.

Shares of Charlotte's Web trade on the Toronto Stock Exchange

(TSX) under the symbol “CWEB” and are quoted in U.S. Dollars in the United States on the OTCQX under the symbol “CWBHF”.

Subscribe

to Charlotte's Web investor news.

© Major League Baseball trademarks

and copyrights are used with permission of Major League Baseball. Visit MLB.com.

Forward-Looking Information

Certain information in this news release

constitutes forward-looking statements and forward-looking information within the meaning of applicable securities laws (collectively,

"forward-looking information"). In some cases, but not necessarily in all cases, forward looking information can be identified

by the use of forward-looking terminology such as "plans", "targets", "expects" or "does not expect",

"is expected", "an opportunity exists", "is positioned", "estimates", "intends", "assumes",

"anticipates" or "does not anticipate" or "believes", or variations of such words and phrases or state that

certain actions, events or results "may", "could", "would", "might", "will" or "will

be taken", "occur" or "be achieved". In addition, any statements that refer to expectations, projections or other

characterizations of future events or circumstances contain forward-looking information.

Statements containing forward-looking

information are not historical facts, but instead represent management's current expectations, estimates and projections regarding the

future of our business, future plans, strategies, projections, anticipated events and trends, the economy and other future conditions.

Forward-looking information is necessarily based on a number of opinions, assumptions and estimates that, while considered reasonable

by the Company as of the date of this news release, are subject to known and unknown risks, uncertainties, assumptions and other factors

that may cause the actual results, level of activity, performance or achievements to be materially different from those expressed or implied

by such statements containing forward-looking information. Although these statements containing forward-looking information are based

on assumptions the Company considers to be reasonable based on the information available on the date such statements are made, such statements

are not guarantees of future performance and readers are cautioned against placing undue reliance on forward-looking information.

The material factors and assumptions used

to develop the forward-looking information herein include, but are not limited to, international and political considerations; regulatory

changes; and the factors discussed throughout the "Risk Factors" section of the Company's most recently filed annual information

form available on www.SEDAR.com and in the Company's most recently filed Annual Report on Form 10-K

and quarterly report on Form 10-Q as amended, and other filings with the Securities and Exchange Commission available on www.SEC.gov.

Except as required by applicable securities laws, the Company undertakes no obligation to publicly update any forward-looking information,

whether written or oral, that may be made from time to time, whether as a result of new information, future developments or otherwise.

For more information:

Shareholder Contact:

Cory Pala | Director of Investor Relations

(720) 484-8930

Cory.Pala@CharlottesWeb.com

Charlotte’s Web Holdings,

Inc.

THE WORLD’S MOST TRUSTED

HEMP EXTRACT

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

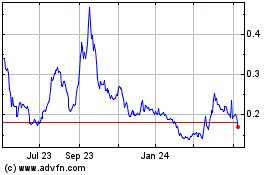

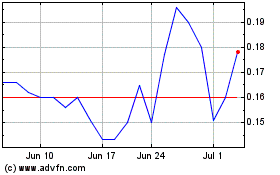

Charlottes Web (QX) (USOTC:CWBHF)

Historical Stock Chart

From Mar 2024 to Apr 2024

Charlottes Web (QX) (USOTC:CWBHF)

Historical Stock Chart

From Apr 2023 to Apr 2024