0001278027

false

0001278027

2023-09-12

2023-09-12

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

As filed with the

Securities and Exchange Commission on September 12, 2023

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report (Date of earliest event reported):

September 12, 2023

| |

B&G Foods, Inc. |

|

|

(Exact name of Registrant as specified in its charter) |

| Delaware |

|

001-32316 |

|

13-3918742 |

| (State or Other Jurisdiction |

|

(Commission |

|

(IRS Employer |

| of Incorporation) |

|

File Number) |

|

Identification No.) |

| Four Gatehall Drive, Parsippany, New Jersey |

|

07054 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant’s telephone number, including

area code: (973) 401-6500

Securities registered pursuant to Section 12(b) of

the Act:

| Title of each class |

Trading Symbol |

Name of each exchange on which registered |

| Common Stock, par value $0.01 per share |

BGS |

New York Stock Exchange |

Check the appropriate box below if the

Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written communications pursuant to Rule 425 under the Securities

Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange

Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under

the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under

the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the

registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 7.01. Regulation FD Disclosure

Proposed

Credit Agreement Amendment. B&G Foods recently launched a proposal to amend our amended and restated credit agreement,

dated as of October 2, 2015, and previously amended on March 30, 2017, November 20, 2017, October 10, 2019, December 16, 2020, June 28,

2022 and June 6, 2023, among B&G Foods, as borrower, the several banks and other financial institutions or entities from time to time

party thereto as lenders and Barclays Bank PLC, as administrative agent and collateral agent.

The proposed amendment would permit us to incur

first lien secured debt in the form of notes or term loans outside of our senior secured credit agreement on a pari passu basis

with the indebtedness under our credit agreement if certain conditions are met. The proposed amendment would also reduce the current amount

of the “available amount” (as defined in the credit agreement) available for certain restricted payments to $600 million as

of the end of the second quarter of fiscal 2023, and add certain collateral-related protections for the lenders (commonly known as “Serta

protections”).

We have already obtained consents to the proposed

amendment from the majority of the required lenders necessary to approve the proposed amendment and expect to complete the amendment prior

to the completion of the senior secured notes offering described below.

At-The-Market

Equity Offering Program Sales; Debt Repurchases. During the third quarter of fiscal 2023 through the date of this report, we

sold 6,332,846 shares of our common stock under our “at-the-market” (ATM) equity offering program. We generated $75.3 million

in gross proceeds, or $11.90 per share, from the sales and paid commissions to the sales agents of approximately $1.5 million.

We used a portion of the proceeds to repurchase

$20.2 million aggregate principal amount of our 5.25% senior notes due 2025 in open market purchases at a discounted repurchase price

of $19.5 million (or 96.92% of such principal amount) plus accrued and unpaid interest of $0.4 million. We intend to use the remaining

net proceeds to repay, redeem or repurchase long-term debt, to pay offering fees and expenses, and for general corporate purposes.

As of the date of this report, 3,667,154 shares

of our common stock remain authorized and available for issuance and sale under our ATM equity offering program and $855.4 million aggregate

principal amount of our 5.25% senior notes due 2025 remains outstanding.

Senior

Secured Notes Offering. On September 12, 2023, we issued a press release announcing our intention to offer, subject to market

and other conditions, $500.0 million aggregate principal amount of senior secured notes due 2028 in a transaction exempt from registration

under the Securities Act of 1933, as amended. The senior secured notes will be guaranteed on a senior secured basis by certain domestic

subsidiaries of B&G Foods.

We intend to use the proceeds of the

offering, together with cash on hand to redeem $555.4 million aggregate principal amount of our 5.25% senior notes due 2025 and pay

related fees and expenses. However, we cannot assure you that the offering of the notes will be completed as described herein or at

all.

On September 12, 2023, B&G Foods will be making

a slide presentation to prospective investors in connection with the offering.

The offering of the senior secured notes and the

related guarantees has not been registered under the Securities Act or the securities laws of any other jurisdiction and the senior secured

notes and the related guarantees may not be offered or sold in the United States absent registration or an applicable exemption from the

registration requirements of the Securities Act and applicable state laws.

This current report does not constitute an offer

to sell or a solicitation of an offer to buy the senior secured notes and the related guarantees, nor shall there be any sale of the senior

secured notes and the related guarantees in any state or jurisdiction in which such offer, solicitation or sale would be unlawful prior

to registration or qualification under the securities laws of any such state or jurisdiction.

A copy of the press release announcing the offering,

which is attached to this report as Exhibit 99.1, and a copy of the slide presentation, which is attached to this report

as Exhibit 99.2, are incorporated by reference herein and are furnished pursuant to Item 7.01, “Regulation FD Disclosure.”

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURE

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

B&G FOODS, INC. |

| |

|

| Dated: September 12, 2023 |

By: |

/s/ Scott E. Lerner |

| |

|

Scott E. Lerner |

| |

|

Executive Vice President, |

| |

|

General Counsel and Secretary |

Exhibit 99.1

B&G Foods

Announces Proposed Offering of $500 Million of Senior Secured Notes

PARSIPPANY, N.J., September 12, 2023 — B&G Foods, Inc.

(NYSE: BGS) announced today its intention to offer, subject to market and other conditions, $500.0 million aggregate principal amount

of senior secured notes due 2028 in a transaction exempt from registration under the Securities Act of 1933, as amended.

The senior secured notes will be guaranteed on a senior secured basis

by certain domestic subsidiaries of B&G Foods (that guarantee B&G Foods’ existing senior secured credit agreement and existing

senior unsecured notes). The senior secured notes will be secured by a first-priority security interest in certain collateral, which generally

includes most of B&G Foods’ and the guarantors’ right or interest in or to property of any kind, except for real property

and certain intangible assets, and which collateral also secures B&G Foods’ existing senior secured credit agreement on

a pari passu basis.

B&G Foods intends to use the net proceeds of the offering, together

with cash on hand, to redeem a portion of B&G Foods’ 5.25% senior notes due 2025 and pay related fees and expenses. However,

there can be no assurances that the offering of the senior secured notes will be completed as described herein or at all.

The senior secured notes and related guarantees will be offered only

to persons reasonably believed to be qualified institutional buyers in reliance on an exemption from registration pursuant to Rule 144A

under the Securities Act, and to certain non-U.S. persons in transactions outside of the United States in reliance on Regulation S under

the Securities Act. The senior secured notes and the related guarantees have not been and will not be registered under the Securities

Act, any state securities laws or the securities laws of any other jurisdiction. Accordingly, the senior secured notes and the related

guarantees may not be offered or sold in the United States absent registration or an applicable exemption from the registration requirements

of the Securities Act and any applicable securities laws of any state or other jurisdiction.

This press release does not constitute a redemption notice with respect

to the 5.25% senior notes due 2025 and shall not constitute an offer to sell or the solicitation of an offer to buy the senior secured

notes and the related guarantees, nor shall there be any sale of the senior secured notes and the related guarantees in any state or jurisdiction

in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such

state or jurisdiction.

About B&G Foods, Inc.

Based in Parsippany, New Jersey, B&G Foods and its subsidiaries

manufacture, sell and distribute high-quality, branded shelf-stable and frozen foods across the United States, Canada and Puerto Rico.

With B&G Foods’ diverse portfolio of more than 50 brands you know and love, including B&G, B&M, Bear Creek,

Cream of Wheat, Crisco, Dash, Green Giant, Las Palmas, Le Sueur, Mama Mary’s,

Maple Grove Farms, New York Style, Ortega, Polaner, Spice Islands and Victoria,

there’s a little something for everyone.

Forward-Looking Statements

Statements in this press release that are not statements of historical

or current fact constitute “forward-looking statements.” The forward-looking statements contained in this press release include,

without limitation, statements related to B&G Foods’ intention to offer senior secured notes and the use of proceeds of such

senior secured notes offering, including the redemption of a portion of the 5.25% senior notes due 2025. Such forward-looking statements

involve known and unknown risks, uncertainties and other unknown factors that could cause the actual results of B&G Foods to be materially

different from the historical results or from any future results expressed or implied by such forward-looking statements. In addition

to statements that explicitly describe such risks and uncertainties, readers are urged to consider statements labeled with the terms “believes,”

“belief,” “expects,” “projects,” “intends,” “anticipates,” “assumes,”

“could,” “should,” “estimates,” “potential,” “seek,” “predict,”

“may,” “will” or “plans” and similar references to future periods to be uncertain and forward-looking.

Factors that may affect actual results include, without limitation: the Company’s substantial leverage; the effects of rising costs

for and/or decreases in supply of the Company’s commodities, ingredients, packaging, other raw materials, distribution and labor;

crude oil prices and their impact on distribution, packaging and energy costs; the Company’s ability to successfully implement sales

price increases and cost saving measures to offset any cost increases; intense competition, changes in consumer preferences, demand for

the Company’s products and local economic and market conditions; the Company’s continued ability to promote brand equity successfully,

to anticipate and respond to new consumer trends, to develop new products and markets, to broaden brand portfolios in order to compete

effectively with lower priced products and in markets that are consolidating at the retail and manufacturing levels and to improve productivity;

the ability of the Company and its supply chain partners to continue to operate manufacturing facilities, distribution centers and other

work locations without material disruption, and to procure ingredients, packaging and other raw materials when needed despite disruptions

in the supply chain or labor shortages; the impact pandemics or disease outbreaks, such as the COVID-19 pandemic, may have on the Company’s

business, including among other things, the Company’s supply chain, manufacturing operations or workforce and customer and consumer

demand for the Company’s products; the Company’s ability to recruit and retain senior management and a highly skilled and

diverse workforce at the Company’s corporate offices, manufacturing facilities and other locations despite a very tight labor market

and changing employee expectations as to fair compensation, an inclusive and diverse workplace, flexible working and other matters; the

risks associated with the expansion of the Company’s business; the Company’s possible inability to identify new acquisitions

or to integrate recent or future acquisitions or the Company’s failure to realize anticipated revenue enhancements, cost savings

or other synergies from recent or future acquisitions; the Company’s ability to successfully complete the integration of recent

or future acquisitions into the Company’s enterprise resource planning (ERP) system; tax reform and legislation, including the effects

of the Infrastructure Investment and Jobs Act, U.S. Tax Cuts and Jobs Act and the U.S. CARES Act, and future tax reform or legislation;

the Company’s ability to access the credit markets and the Company’s borrowing costs and credit ratings, which may be influenced

by credit markets generally and the credit ratings of the Company’s competitors; unanticipated expenses, including, without limitation,

litigation or legal settlement expenses; the effects of currency movements of the Canadian dollar and the Mexican peso as compared to

the U.S. dollar; the effects of international trade disputes, tariffs, quotas, and other import or export restrictions on the Company’s

international procurement, sales and operations; future impairments of the Company’s goodwill and intangible assets; the Company’s

ability to protect information systems against, or effectively respond to, a cybersecurity incident, other disruption or data leak; the

Company’s ability to successfully implement the Company’s sustainability initiatives and achieve the Company’s sustainability

goals, and changes to environmental laws and regulations; and other factors that affect the food industry generally, including: recalls

if products become adulterated or misbranded, liability if product consumption causes injury, ingredient disclosure and labeling laws

and regulations and the possibility that consumers could lose confidence in the safety and quality of certain food products; competitors’

pricing practices and promotional spending levels; fluctuations in the level of the Company’s customers’ inventories and credit

and other business risks related to the Company’s customers operating in a challenging economic and competitive environment; and

the risks associated with third-party suppliers and co-packers, including the risk that any failure by one or more of the Company’s

third-party suppliers or co-packers to comply with food safety or other laws and regulations may disrupt the Company’s supply of

raw materials or certain finished goods products or injure the Company’s reputation. The forward-looking statements contained herein

are also subject generally to other risks and uncertainties that are described from time to time in B&G Foods’ filings with

the Securities and Exchange Commission, including under Item 1A, “Risk Factors” in the Company’s most recent Annual

Report on Form 10-K and in its subsequent reports on Forms 10-Q and 8-K. Investors are cautioned not to place undue reliance on any

such forward-looking statements, which speak only as of the date they are made. B&G Foods undertakes no obligation to publicly update

or revise any forward-looking statement, whether as a result of new information, future events or otherwise.

Contacts:

Investor Relations:

ICR, Inc.

Dara Dierks

866.211.8151 |

Media Relations:

ICR, Inc.

Matt Lindberg

203.682.8214 |

Exhibit 99.2

| Confidential

Investor Presentation

09.12.2023 |

| Confidential

Disclaimer

2

This presentation, the information contained herein and the materials accompanying it (this “presentation”) has been prepared solely for informational purposes supplied

by or on behalf of, and constitutes confidential information of, B&G Foods, Inc. and its direct and indirect subsidiaries (“B&G Foods”, the “Company”, “us” or “we”) and is

provided to you (the “Recipient”) on the condition that you agree to hold it in strict confidence and not photocopy, disseminate, reproduce, disclose, divulge, forward or

distribute it directly or indirectly in whole or in part, to any person or entity. This presentation is intended for the recipient hereof and is for informational purposes only. By

accepting this presentation, each Recipient expressly agrees to treat this presentation and any information contained herein or accompanying it in a confidential manner.

Each Recipient further agrees that the foregoing obligations shall apply to all other written or oral communications transmitted to the recipient by or on behalf of the

Company, together with all memoranda, notes and other documents and analyses developed by the Recipient using any of the presentation, any information contained in

or accompanying the presentation or all such communications (collectively, the “information”). The Recipient agrees that the information is for informational purposes only.

The securities offered pursuant to the preliminary offering memorandum have not been registered under the Securities Act of 1933, as amended (the “Securities Act”) or

any state securities laws, and may not be offered or sold within the United States, or to or for the account or benefit of U.S. persons, unless an exemption from the

registration requirements of the Securities Act is available or they are otherwise sold pursuant to an effective registration statement filed with the Securities and Exchange

Commission. This presentation does not constitute an offer to sell or the solicitation of an offer to buy any securities. Any offer or sale of such securities will only be made

(i) within the United States, or to or for the account or benefit of U.S. persons, only to persons reasonably believed to be qualified institutional buyers (“QIBs”) and (ii)

outside the United States in offshore transactions in accordance with Regulation S. Any purchaser of such securities in the United States, or to or for the account of U.S.

persons, will be deemed to have made certain representations and acknowledgments, including, without limitation, that the purchaser is a QIB.

The Company has prepared a preliminary offering memorandum for the proposed offering to which the information in this presentation relates. Before you invest, you

should read the detailed information in that preliminary offering memorandum for more complete information about the Company and the offering. This presentation is

intended for the recipient hereof and is for informational purposes only. By accepting this presentation, each recipient expressly agrees to treat this presentation and the

information contained herein or accompanying it in a confidential manner and each recipient shall ensure that any person to whom it discloses any of this information

complies with this paragraph. The preliminary offering memorandum modifies and supersedes in its entirety any information in this presentation or which has otherwise

been previously provided. Barclays Capital Inc. and the several other initial purchasers with respect to the notes have not independently verified the information contained

herein or any other information that has or will be provided to you.

The information and opinions contained in this presentation (including forward-looking statements) are made as of this presentation unless otherwise stated herein. They

are subject to change without notice and neither the Company nor any other person is under any obligation to update or keep current the information contained in this

document and neither the Company nor any other person intends to update or otherwise revise such information or opinions (including any forward looking statements) to

reflect the occurrence of future events or developments even if any of the assumptions, judgments and estimates on which the information contained herein is based

proves to be incorrect, made in error or become outdated. No representation or warranty, express or implied, is made as to, and no reliance should be placed on, the

fairness, accuracy, completeness or correctness of the information or opinions contained herein, and any reliance you place on them will be at your sole risk. The

Company, its affiliates and advisors do not accept any liability whatsoever for any loss howsoever arising, directly or indirectly, from the use of this document or its

contents, or otherwise arising in connection with this document. For more information, please refer to the information discussed in the preliminary offering memorandum

under the captions entitled “Cautionary note regarding forward-looking information” and “Risk Factors.”

This presentation does not constitute or form part of, and should not be construed as, an offer to sell or issue or the solicitation of an offer to buy or acquire securities of

the Company, nor shall there be any sale of securities in any state or other jurisdiction to any person or entity to which it is unlawful to make such offer, solicitation or sale

in such state or jurisdiction. |

| Confidential

Forward Looking Statements

3

Various statements contained in this presentation, the offering memorandum and the documents incorporated by reference in the offering memorandum contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. We intend such forward-looking statements to be covered by the safe

harbor provisions for forward-looking statements contained in Section 27A of the Securities Act and, as applicable, Section 21E of the Securities Exchange Act of 1934, as

amended (the Exchange Act). The words “believes,” “belief,” “expects,” “projects,” “intends,” “anticipates,” “assumes,” “could,” “should,” “estimates,” “potential,” “seek,”

“predict,” “may,” “will” or “plans” and similar references to future periods are intended to identify forward-looking statements. These forward looking statements involve

known and unknown risks, uncertainties and other factors that may cause our actual results, performance and achievements, or industry results, to be materially different

from any future results, performance, or achievements expressed or implied by any forward-looking statements. We believe important factors that could cause actual

results to differ materially from our expectations include the following: our substantial leverage; the effects of rising costs for and/or decreases in the supply of

commodities, ingredients, packaging, other raw materials, distribution and labor; crude oil prices and their impact on distribution, packaging and energy costs; our ability to

successfully implement sales price increases and cost saving measures to offset any cost increases; intense competition, changes in consumer preferences, demand for

our products and local economic and market conditions; our continued ability to promote brand equity successfully, to anticipate and respond to new consumer trends, to

develop new products and markets, to broaden brand portfolios in order to compete effectively with lower priced products and in markets that are consolidating at the retail

and manufacturing levels and to improve productivity; the ability of our company and our supply chain partners to continue to operate manufacturing facilities, distribution

centers and other work locations without material disruption, and to procure ingredients, packaging and other raw materials when needed despite disruptions in the supply

chain or labor shortages; the impact pandemics or disease outbreaks, such as the COVID-19 pandemic, may have on our business, including among other things, our

supply chain, our manufacturing operations, our workforce and customer and consumer demand for our products; our ability to recruit and retain senior management and

a highly skilled and diverse workforce at our corporate offices, manufacturing facilities and other work locations despite a very tight labor market and changing employee

expectations as to fair compensation, an inclusive and diverse workplace, flexible working and other matters; the risks associated with the expansion of our business; our

possible inability to identify new acquisitions or to integrate recent or future acquisitions, or our failure to realize anticipated revenue enhancements, cost savings or other

synergies from recent or future acquisitions; our ability to successfully complete the integration of recent or future acquisitions into our enterprise resource planning

system; tax reform and legislation, including the effects of the Infrastructure Investment and Jobs Act, the Inflation Reduction Act, U.S. Tax Cuts and Jobs Act and the

U.S. CARES Act, and any future tax reform or legislation; our ability to access the credit markets and our borrowing costs and credit ratings, which may be influenced by

credit markets generally and the credit ratings of our competitors; unanticipated expenses, including, without limitation, litigation or legal settlement expenses; the effects

of currency movements of the Canadian dollar and the Mexican peso as compared to the U.S. dollar; the effects of international trade disputes, tariffs, quotas, and other

import or export restrictions on our international procurement, sales and operations; future impairments of our goodwill and intangible assets; our ability to protect

information systems against, or effectively respond to, a cybersecurity incident, other disruption or data leak; our ability to successfully implement our sustainability

initiatives and achieve our sustainability goals, and changes to environmental laws and regulations; other factors that affect the food industry generally, including: recalls if

products become adulterated or misbranded, liability if product consumption causes injury, ingredient disclosure and labeling laws and regulations and the possibility that

consumers could lose confidence in the safety and quality of certain food products; competitors’ pricing practices and promotional spending levels; fluctuations in the level

of our customers’ inventories and credit and other business risks related to our customers operating in a challenging economic and competitive environment; the risks

associated with third-party suppliers and co-packers, including the risk that any failure by one or more of our third-party suppliers or co-packers to comply with food safety

or other laws and regulations may disrupt our supply of raw materials or certain finished goods products or injure our reputation; our ability to complete the transactions

described in the preliminary offering memorandum; and other factors discussed under “Risk Factors” or elsewhere in the preliminary offering memorandum and the

documents incorporated therein by reference.

All forward-looking statements included in this presentation or the offering memorandum or documents filed with the SEC and incorporated by reference into the offering

memorandum are based on information available to us on the date of this offering memorandum or such document. We undertake no obligation to publicly update or

revise any forward-looking statement, whether as a result of new information, future events or otherwise. |

| Confidential

Non-GAAP Measures and Unaudited Financial Information

4

Base business net sales, EBITDA, Adjusted EBITDA, Adjusted EBITDA (before share-based compensation), Covenant Adjusted EBITDA, Adjusted EBITDA less Capex,

and Adjusted EBITDA margin as presented in this presentation, are supplemental measures that are not required by, or presented in accordance with, generally accepted

accounting principles in the United States (“GAAP”). They are not measurements of our financial performance under GAAP and should not be considered, as applicable,

as alternatives to net income or any other performance measures derived in accordance with GAAP or any other measure of our liquidity derived in accordance with

GAAP. For additional information on these non-GAAP financial measures and our use thereof, see “Summary—Summary Historical Consolidated Financial Data” in the

preliminary offering memorandum and a reconciliation of these non-GAAP measures to the most directly comparable GAAP measures is provided on pages 23 and 24 of

this presentation. Because of the limitations discussed therein, our base business net sales, EBITDA, Adjusted EBITDA, Adjusted EBITDA (before share-based

compensation) and Covenant Adjusted EBITDA measures should not be considered as measures of discretionary cash available to us to invest in the growth of our

business, or as measures of cash that will be available to us to meet our obligations.

In addition, we have included in this presentation unaudited financial information for the twelve months ended July 1, 2023, which has been calculated by adding the

financial information for the twenty-six weeks ended July 1, 2023 to the financial information for the fiscal year ended December 31, 2022 and subtracting the financial

information for the twenty-six weeks ended July 2, 2022. The unaudited financial information for the twelve months ended July 1, 2023 has been prepared solely for the

purpose of this presentation and the preliminary offering memorandum, is for illustrative purposes only and is not necessarily indicative of our results of operations for any

future period or our financial condition at any future date. |

| 5

Confidential

Today’s Presenters

5

Bruce Wacha, Exec. Vice President of Finance and CFO

Casey Keller, President and CEO |

| 6

Confidential

Transaction Overview |

| 7

Confidential

Summary Overview

Note: Adj. EBITDA and Covenant Adj. EBITDA are non-GAAP measures. Please refer to p. 4 and the non-GAAP reconciliation schedule on p. 23 for further detail.

1. All ratios are based on Covenant Adj. EBITDA, which reflects Adj. EBITDA before share-based compensation and pro forma for acquisitions and divestitures.

Company Overview

► B&G Foods manufactures, sells and distributes a diverse portfolio of branded, high quality, shelf stable and frozen food and

household products across the United States, Canada and Puerto Rico

► On August 3, 2023, B&G Foods announced financial results for fiscal Q2-2023:

For the LTM period ended July 1, 2023, the Company generated Adj. EBITDA of $324.7 million, up 7.8% compared to

FY-2022

Q2-2023 Adj. EBITDA was $68.5 million, up $14.3 million or 26.4% from the prior year period

As of the end of Q2-2023, as adjusted for subsequent equity sales and bond repurchases, Total Net Leverage was 6.5x,

based on LTM Q2-2023 Covenant Adj. EBITDA of $328.4 million, down ~1.1x compared to FY-2022 (1)

Transaction

Overview

► The Company proposes to issue $500mm of Senior Secured Notes due 2028 (the “New Secured Notes”) and use the proceeds,

combined with cash on hand, to refinance a portion of B&G Foods’ existing Senior Unsecured Notes due 2025

The New Secured Notes will be pari passu with the Company’s existing credit facility

► During Q3-2023, B&G Foods raised $73.8mm of net proceeds through the issuance of 6.3mm shares via the at-the-market equity

program to help reduce the 5.25% Senior Unsecured Notes due 2025 ahead of and in conjunction with the proposed transaction

► As further adjusted for this transaction:

Secured Net Leverage will be just under 4.0x and Total Net Leverage will be 6.5x (1)

There will be approximately $300mm of the 5.25% Senior Unsecured Notes due 2025 remaining

Credit Agreement

Amendment

► In order to permit the issuance of the proposed New Secured Notes, the Company has launched a proposed amendment for its

credit agreement to allow for incurrence of incremental equivalent debt

The proposed amendment is expected to close ahead of the New Secured Notes

► The proposed amendment also adds the following lender-friendly changes:

Reset of Available Amount to $600mm as of the end of Q2-2023; represents a reduction of over 50% from the existing

Available Amount as of the end of Q2-2023

Addition of “Serta” protection

Timing ► We expect to price and allocate the New Secured Notes today

7 |

| 8

Confidential

As of July 1, 2023

Actual Adj. As Adjusted Adj. As Further

Adjusted

Cash & Equivalents $43 54 $97 (63) $33

Revolving Credit Facility (3) 280 -- 280 -- 280

Term Loan B 551 -- 551 -- 551

New Secured Notes -- -- -- 500 500

Total First Lien Debt $831 $831 $1,331

5.25% Senior Notes due 2025 876 (20) 855 (555) 300

5.25% Senior Notes due 2027 550 -- 550 -- 550

Total Debt $2,256 $2,236 $2,181

Operating Metrics

Covenant Adj. EBITDA (4) $328 -- $328 -- $328

Credit & Coverage Statistics (4)

First Lien Debt / Covenant Adj. EBITDA 2.5x 2.5x 4.1x

Net First Lien Debt / Covenant Adj. EBITDA 2.4x 2.2x 4.0x

Total Debt / Covenant Adj. EBITDA 6.9x 6.8x 6.6x

Net Debt / Covenant Adj. EBITDA 6.7x 6.5x 6.5x

As Adjusted Capitalization

8

1. We plan to issue a conditional notice of partial redemption to the holders of our outstanding 2025 notes, notifying such holders that we intend to redeem $555.4 million of the outstanding 2025

notes. The redemption price of the 2025 notes is 100% of the principal amount, plus accrued and unpaid interest to the redemption date. Use of funds does not reflect the cash needed to pay

the accrued and unpaid interest.

2. Actual transaction fees and expenses could be greater or less than the amount anticipated.

3. As of September 8, 2023, there was approximately $285.0 million in outstanding borrowings and $510.0 million available to be drawn under the revolving credit facility (net of $5.0 million

reserved for issued and outstanding letters of credit).

4. All ratios are based on Covenant Adj. EBITDA, which reflects Adj. EBITDA before share-based compensation and pro forma for acquisitions and divestitures. Adjusted EBITDA and Covenant

Adj. EBITDA are non-GAAP measures. Please refer to p. 4 and the non-GAAP reconciliation schedule on slides 23 and 24 for further detail.

Sources & Uses – Q3-2023 ATM Issuances As Adjusted Capitalization

Sources & Uses – Proposed Financing

1

2

Note: Dollars in millions. As Further Adjusted Cash & Equivalents does not foot due to rounding.

Sources Amount %

ATM Equity Program Net Proceeds $74 100%

Total Sources $74 100%

Uses of Funds Amount %

Repurchases of 2025 Notes $20 27%

Cash to Balance Sheet 54 73%

Total Uses $74 100%

Sources Amount %

Secured Notes Offered Hereby $500 89%

Cash on Balance Sheet 63 11%

Total Sources $563 100%

Uses of Funds Amount %

Redeem Portion of 2025 Notes (1) $555 99%

Transaction Fees & Expenses (2) 8 1%

Total Uses $563 100%

1 2 |

| 9

Confidential

Summary Terms – Senior Secured Notes

9

Issuer: B&G Foods, Inc. (the “Issuer”)

Description: $500mm Senior Secured Notes due 2028

Maturity: 5 years

Use of Proceeds: Partial redemption of existing Senior Notes due 2025

Security: Same as existing Credit Agreement, including, without limitation, substantially all of the tangible and intangible assets of the

Company and its domestic subsidiaries (other than real property and certain intangible assets)

Guarantees: Same as existing Credit Agreement: All present and future material, domestic subsidiaries

Ranking:

(i) Pari passu in right of payment to all of the Issuer’s and the guarantors’ existing and future senior debt, (ii) effectively senior in right

of payment to the Issuer and such guarantors’ existing and future senior unsecured debt to the extent of the value of the collateral,

(iii) effectively junior to the Issuer and the guarantors’ future secured debt, secured by assets that do not constitute collateral, to the

extent of the value of the collateral securing such debt, (iv) senior in right of payment to the Issuer and such guarantors’ other

existing and future subordinated debt and (v) structurally subordinated to all existing and future indebtedness and other liabilities of

subsidiaries that do not guarantee the notes

Optional Prepayments: Non-callable for the first two years; T+50 make-whole during the non-call period; first call price par + 50% of coupon

Equity Clawback: During the non-call period, can redeem up to 40% of the principal with certain equity proceeds at par + coupon

Change of Control: 101% change of control put

Negative Covenants: Usual and customary for transactions of this type

Registration Rights: None; 144A / Reg S |

| 10

Confidential

Timeline

10

U.S. Bank Holiday

Key Transaction Date

September 2023

S M T W T F S

1 2

3 4 5 6 7 8 9

10 11 12 13 14 15 16

17 18 19 20 21 22 23

24 25 26 27 28 29 30

Timing Event

September 12

Launch notes offering, Investor Call ([12:30]PM EST)

Price and allocate Notes

September 26 Closing (T+10) |

| 11

Confidential

Organizational Chart

11

Key:

Borrower

Guarantors

Non-Guarantors

• $800mm Revolving Credit Facility

• $551mm Term Loan B due 2026

• $500mm New Secured Notes due 2028

• Approx. $300mm Senior Notes due 2025

• $550mm Senior Notes due 2027

B&G Foods North America, Inc.

Operating Company

Domestic Subsidiaries International Subsidiaries

B&G Foods, Inc.

Holding Company

See slide 8 for details of such adjustments.

As adjusted to give effect to Q3-2023 equity sales and bond repurchases, the proposed offering and use of

proceeds therefrom |

| 12

Confidential

Company Highlights |

| 13

Confidential

• Acquire and operate established food brands and maintain relevancy with today’s consumer

• Proven cash flow driven M&A at accretive multiples

• Target moderate top line growth across portfolio

• Maximize growth of high potential brands / manage other brands for flat to moderate growth

• Strong focus on cash flow generation and working capital efficiency

• Maintain high quality products, strong customer service and sales support

• Enduring commitment to reduce leverage

Key Investment Highlights

13

|

| 14

Confidential

We Have Assembled a Portfolio of More than 50 Brands

14 1. Emeril’s® is a registered trademark of Marquee Brands used under license.

2. Crock-Pot® is a registered trademark of Sunbeam Products, Inc. used under license.

3. Skinnygirl™ is a trademark of SG Marks, LLC used under license.

4. Weber® is a registered trademark of Weber-Stephen Products LLC used under license.

14 |

| 15

Confidential

A Portfolio of Large, Established & Defensible Niche Brands

15

plus Spices + Seasonings

accounted for ~74% or

$1.6 billion of FY2022

net sales

7

BRANDS

$400+ Million

$100-$399

Million

$50-$99

Million

<$50 Million

ANNUAL NET

SALES BY BRAND |

| 16

Confidential

We Have Four Business Units

16

Meals

24%

Specialty

33%

Frozen &

Vegetables

23%

Spices & Flavor

Solutions

20%

Q2-2023

Net Sales

by Category

(Approximate) |

| 17

Confidential

We Have Four Business Units

17

▪ We began transitioning to four Business Units in August 2022 – Frozen & Vegetables, Meals,

Specialty and Spices & Flavor Solutions

▪ These Business Units clarify the portfolio focus and future platforms for acquisitions, and push

accountability down to improve management and decision-making

▪ Our Business Unit leadership teams are empowered to manage the P&L, leading to better and faster

decision making, and driving accountability throughout the organization. Business Unit leadership are

driving improved margins, better managing supply and demand, and building stronger growth plans

▪ Each of the Business Units has different characteristics and mandates, and we plan to allocate capital

to achieve key objectives. We plan to invest in the Spices & Flavor Solutions, Meals and Frozen

businesses with the goal of driving profitable growth, while we will manage the Specialty business with

the goal of driving free cash generation

▪ Our Business Unit structure will also clarify M&A decisions and accountability

▪ The transition to four Business Units remains on track and they are largely up and running |

| 18

Confidential

Financial Update |

| 19

Confidential

$114

$140

89.6%

93.0%

1H2022 1H2023

$987 $981

1H2022 1H2023

($6mm)

(0.6%)

$127

$151

12.6% 15.4%

1H2022 1H2023

1H2023 vs. 1H2022 Performance

19

Note: 1H2023 represents the twenty-six weeks ended July 1, 2023; 1H2022 represents the twenty-six weeks ended July 2, 2022.

1. Base Business Net Sales, Adj. EBITDA and Adj. EBITDA less Capex are non-GAAP measures. Please refer to p. 4 and the non-GAAP reconciliation schedules on p. 23

and 24 for further detail.

• Base Business Net Sales were roughly flat (down 0.6%) 1H2023 vs. 1H2022

‒ Primarily driven by pricing increases and favorable product mix, offset by decrease in unit volume

• YTD improvements in Gross Profit, Adj. EBITDA and margins were due to price increases, moderating cost inflation as well as lower

transportation and warehousing costs

‒ Reflects a continuation in the trend beginning in at the end of 2022, when B&G Foods began to more fully realize benefits of

previously implemented list price increases

Adj. EBITDA less Capex Adj. EBITDA (1) (1)

($ in millions)

($ in millions)

($ in millions)

($ in millions)

$178

$217

17.6% 22.1%

1H2022 1H2023

% Margin

% Margin

Adj. EBITDA less CapEx / Adj. EBITDA

Base Business Net Sales (1) Gross Profit |

| 20

Confidential

Demonstrated Commitment to Debt Reduction

20

• Following the sale of Back to Nature in January 2023, B&G Foods used nearly all of the net proceeds to repay $50.0mm of

Term Loan B

Asset Sale

Proceeds

• Concurrently with debt repayment from the Back to Nature sale proceeds, B&G Foods also voluntarily repaid an additional

$11.0mm of Term Loan B

• The Company subsequently made $60.0mm of additional voluntary prepayments of Term Loan B during Q1-2023

Optional

Term Loan B

Prepayments

• During Q2-2023, B&G Foods repurchased $24.4mm aggregate principal amount of 5.25% Senior Notes due 2025

• During Q3-2023, B&G Foods repurchased $20.2mm aggregate principal amount of the 5.25% Senior Notes due 2025

Repurchases

of 2025

Notes

• During fiscal year 2022, B&G Foods generated approximately $65mm of net proceeds from its At-The-Market (ATM) Equity

Offering Program, which were deployed in part to repay revolving credit facility loans

• In Q3-2023, B&G Foods generated $73.8mm of net proceeds from the ATM Equity Offering Program, which were deployed in

part to repurchase $20.2mm aggregate principal amount of the 5.25% Senior Notes due 2025

• Approximately 3.7 million shares of common stock remain authorized and available for sale under the ATM, the proceeds of

which are intended for general corporate purposes, which may include further debt reduction

Equity

Issuances |

| 21

Confidential

Capitalization & Statistics

21

Note: Adj. EBITDA, Adj. EBITDA (before SBC) and Covenant Adj. EBITDA are non-GAAP measures. Please refer to p. 4 and the non-GAAP reconciliation schedule

on p. 23 for further detail.

1. As Adjusted Cash and 5.25% Senior Notes due 2025 balances reflect net proceeds of $73.8mm from ATM equity issuances and subsequent repurchases of

5.25% Senior Notes due 2025 with a portion of those net proceeds in Q3-2023. $20.2mm principal amount of the 5.25% Senior Notes due 2025 were

repurchased for $19.5mm plus $0.4mm of accrued interest.

2. All ratios are based on Covenant Adj. EBITDA, which reflects Adj. EBITDA before share-based compensation and pro forma for acquisitions and divestitures.

($ in millions) FY As Adjusted (1)

2022 July 1, 2023

Revolver $ 282.5 $ 280.0

Tranche B Term Loan due 2026 671.6 550.6

5.25% Senior Notes due 2025 900.0 855.4

5.25% Senior Notes due 2027 550.0 550.0

Total Debt $ 2,404.1 $ 2,236.0

Cash (45.4) (96.7)

Net Debt $ 2,358.7 $ 2,139.3

Net Debt / Covenant Adjusted EBITDA (2) 7.62 x 6.51 x

Adj. EBITDA $ 301.0 $ 324.7

Adj. EBITDA (before SBC) 304.9 329.6

Covenant Adjusted EBITDA (2)

309.6 328.4 |

| 22

Confidential

Historical Financial Performance

22

($ in millions) Fiscal Year LTM Ended

2020 2021 2022 July 1, 2023

Net Sales $1,968 $2,056 $2,163 $2,133

% growth 18.5% 4.5% 5.2% --

Gross Profit $482 $437 $410 $448

% margin 24.5% 21.3% 18.9% 21.0%

Adj. EBITDA (1) $361 $358 $301 $325

% margin 18.4% 17.4% 13.9% 15.2%

Depreciation and Amortization $64 $83 $81 $76

% of net sales 3.2% 4.0% 3.7% 3.5%

Net Cash Provided by Operating Activities $281 $94 $6 $117

Capex $27 $44 $22 $20

% of net sales 1.4% 2.1% 1.0% 0.9%

Adj. EBITDA less Capex (1) $334 $314 $279 $305

1. Adj. EBITDA and Adj. EBITDA less Capex are non-GAAP measures. Please refer to p. 4 and the non-GAAP reconciliation schedules on p. 23 for further detail. |

| 23

Non-GAAP Reconciliations – Confidential

Net Income to EBITDA and Adjusted EBITDA

23

($ in millions) Fiscal Year LTM Ended

2020 2021 2022 July 1, 2023

Net Income (Loss) $132 $67 ($11) $24 $14 ($21)

Income Tax Expense (Benefit) 45 26 (8) 6 24 10

Interest Expense, Net 102 107 125 57 75 143

Depreciation and Amortization 64 83 81 40 35 76

EBITDA $343 $283 $187 $127 $149 $208

% margin 17.4% 13.8% 8.6% 12.6% 15.1% 9.7%

Acquisition / Divestiture-Related and Non-Recurring Expenses 17 33 13 5 2 10

Impairment of Intangible Assets - 23 - - - -

Gain (Loss) on Sale of Assets - - (5) (5) - -

Amortization of Acquisition-Related Inventory Step-Up 1 5 - - - -

Accrual for Pension Plan Withdrawal Liability - 14 - - - -

Impairment of Assets Held for Sale - - 106 - - 106

Adj. EBITDA $361 $358 $301 $127 $151 $325

% margin 18.4% 17.4% 13.9% 12.6% 15.4% 15.2%

Share-Based Compensation (SBC) 8 4 4 2 3 5

Adj. EBITDA (before SBC) $369 $362 $305 $129 $154 $330

Impact of Acquisitions / Divestitures 60 - 4 4 - (1)

COVID-19 Expenses 14 5 1 1 - -

Covenant Adj. EBITDA $442 $367 $310 $134 $154 $328

Adj. EBITDA $361 $358 $301 $127 $151 $325

Capex 27 44 22 13 11 20

Adj. EBITDA less Capex $335 $315 $279 $114 $140 $305

1H2022 1H2023

(2) (2)

(2)

(1)

Note: 1H2023 represents the twenty-six weeks ended July 1, 2023; 1H2022 represents the twenty-six weeks ended July 2, 2022.

1. For fiscal 2020, reflects the estimated benefit that the Crisco acquisition would have had on our fiscal 2020 adjusted EBITDA had the acquisition been completed on the first day of fiscal 2020.

We completed the Crisco acquisition on December 1, 2020. For fiscal 2022 and the first half of fiscal 2022, primarily reflects the estimated benefit that the Yuma acquisition would have had on

our adjusted EBITDA for those periods had the acquisition been completed on the first day of those periods. We completed the Yuma acquisition on May 5, 2022. For the twelve months

ended July 1, 2023, primarily reflects the estimated benefit that the Back to Nature divestiture would have had on our adjusted EBITDA for the twelve months ended July 1, 2023 had the

divestiture been completed on the first day of such twelve-month period. We completed the Back to Nature divestiture on January 3, 2023. The estimates contained herein have been

prepared solely for the purpose of determining the calculations under our senior secured credit agreement for use in this presentation, are for illustrative purposes only and are not necessarily

indicative of our results of operations for any future period or our financial condition at any future date.

2. Numbers do not foot due to rounding. |

| 24

Non-GAAP Reconciliations – Confidential

Net Sales to Base Business Net Sales

24

1. Reflects net sales from the Yuma acquisition, for which there is no comparable period of net sales during the first four months of the first two quarters of 2022. The

Yuma acquisition was completed on May 5, 2022.

2. For the first two quarters of 2022, reflects net sales of the Back to Nature brand, which was sold on January 3, 2023, and net sales of the SnackWell’s and Farmwise

brands, which have been discontinued. For the first two quarters of 2023, reflects a net credit paid to customers relating to the discontinued brands.

($ in millions)

Net Sales $ 1,011 $ 981

Net Sales from Acquisitions (1)

- (1)

Net sales from Discontinued or Divested Brands (2) (24) -

Base Business Net Sales $ 987 $ 981

1H2022 1H2023 |

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

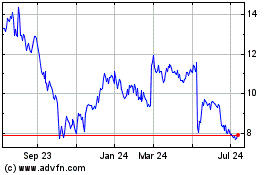

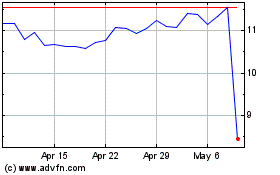

B and G Foods (NYSE:BGS)

Historical Stock Chart

From Mar 2024 to Apr 2024

B and G Foods (NYSE:BGS)

Historical Stock Chart

From Apr 2023 to Apr 2024