0000095552false00000955522023-08-312023-08-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): August 31, 2023 |

SUPERIOR INDUSTRIES INTERNATIONAL, INC.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

001-06615 |

95-2594729 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

26600 Telegraph Road Suite 400 |

|

Southfield, Michigan |

|

48033 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: 248 352-7300 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Stock, $0.01 par value |

|

SUP |

|

The New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.01 Completion of Acquisition or Disposition of Assets

On August 31, 2023 (the “Filing Date”), Superior Industries International, Inc.’s (“Superior”) wholly owned subsidiary, Superior Industries Production Germany GmbH (“SPG”), filed voluntary petitions for preliminary insolvency proceedings in the Neustadt an der Weinstrasse, Germany Insolvency Court (the “Insolvency Court”) seeking relief under the German Insolvency Code (the "Insolvency Code") pursuant to Sections 270ss. SPG filed motions with the Insolvency Court seeking authorization to continue to operate its business as a “debtor-in-possession” under the jurisdiction of the Insolvency Court and in accordance with the applicable provisions of the Insolvency Code and orders of the Insolvency Court.

The Company determined that the deconsolidation of SPG does not meet the criteria requiring presentation as discontinued operations in accordance with U.S. generally accepted accounting principles ("U.S. GAAP") because it does not represent a strategic shift that will have a major effect on the Company's operations or financial results. The deconsolidation of SPG is considered a disposition of a significant business under Item 2.01 of Form 8-K. As a result, the Company prepared the unaudited pro forma condensed consolidated financial statements included herein, which were prepared in accordance with Article 11 of Regulation S-X and are based on the historical financial statements of the Company. The historical consolidated financial statements have been adjusted in the accompanying unaudited pro forma condensed consolidated financial statements to give effect to the deconsolidation of SPG. Certain information and disclosures normally included in financial statements prepared in accordance with U.S. GAAP have been condensed or omitted from this report, as is permitted by Securities and Exchange Commission rules and regulations.

Through the Filing Date, SPG's results continue to be consolidated into Superior’s financial statements and Superior recognizes SPG’s losses in its earnings. Effective as of the Filing Date, Superior will no longer consolidate SPG's results in its financial statements. Following deconsolidation, Superior will account for its interest in SPG in accordance with the measurement alternative under ASC 321, "Investments - Equity Securities" and initially record its investment in SPG at the estimated fair value on the Filing Date. Superior's carrying value of SPG at June 30, 2023 was $91.5 million.

In connection with the deconsolidation, Superior expects to recognize a non-cash charge of approximately $81.7 million in the third quarter of 2023, representing the excess of the carrying value over the estimated preliminary fair value of its interest in, and receivable from, SPG as of the Filing Date (based on the carrying value as of June 30, 2023). If the preliminary fair value estimates increase (or decrease) by 10%, 20% or 30%, the resulting charge would decrease (or increase) by $1.0 million, $2.0 million or $2.9 million, respectively.

The SPG bankruptcy filing will not result in any default under Superior debt agreements.

Item 2.06 Material Impairments

As noted above under Item 2.01, Superior expects to recognize a non-cash charge in connection with the deconsolidation of SPG.

Item 9.01 Financial Statements and Exhibits

(b) Pro Forma Financial Information.

Unaudited Pro Forma Condensed Consolidated Financial Information of the Registrant, which reflects the loss on deconsolidation of SPG described in Item 2.01, is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

(d) Exhibits.

A copy of the press release issued by the Registrant is attached hereto as Exhibit 99.2 and is incorporated herein by reference. The press release is being furnished and not filed.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

SUPERIOR INDUSTRIES INTERNATIONAL, INC. |

|

|

|

|

Date: |

August 31, 2023 |

By: |

/s/ David M. Sherbin |

|

|

|

David M. Sherbin

Senior Vice President, General Counsel, Chief Compliance Officer and Corporate Secretary |

Exhibit 99.1

SUPERIOR INDUSTRIES INTERNATIONAL, INC.

PRO FORMA CONDENSED CONSOLIDATED FINANCIAL INFORMATION

(Unaudited)

On August 31, 2023 (the “Filing Date”), Superior Industries International, Inc.’s (“Superior” or the “Company”) subsidiary, Superior Industry Production Germany GmbH (“SPG”) filed voluntary petitions for preliminary insolvency proceedings in the Neustadt an der Weinstrasse, Germany Insolvency Court (the “Insolvency Court”) seeking relief under the German Insolvency Code (the "Insolvency Code") pursuant to Sections 270ss. As a result of SPG’s filing and applicable U.S. generally accepted accounting principles, the Company has concluded that it will no longer control SPG, and therefore, SPG will be deconsolidated from the Company’s consolidated financial statements effective as of the Filing Date.

The Company determined that the deconsolidation of SPG does not meet the criteria requiring presentation as discontinued operations in accordance with U.S. generally accepted accounting principles ("U.S. GAAP") because it does not represent a strategic shift that will have a major effect on the Company's operations or financial results. The deconsolidation of SPG is considered a disposition of a significant business under Item 2.01 of Form 8-K. As a result, the Company prepared the unaudited pro forma condensed consolidated financial statements included herein, which were prepared in accordance with Article 11 of Regulation S-X and are based on the historical financial statements of the Company. The historical consolidated financial statements have been adjusted in the accompanying unaudited pro forma condensed consolidated financial statements to give effect to the deconsolidation of SPG. Certain information and disclosures normally included in financial statements prepared in accordance with U.S. GAAP have been condensed or omitted from this report, as is permitted by Securities and Exchange Commission rules and regulations.

Under the SEC rules applicable to preparation of pro forma financial statements, the following pro forma financial information does not reflect any projected synergies, including any administrative or manufacturing cost savings, resulting from the preliminary insolvency proceedings.

The unaudited condensed consolidated pro forma balance sheet as of June 30, 2023 is presented as if the deconsolidation of SPG had occurred on June 30, 2023. The unaudited condensed consolidated pro forma statements of income for the six months ended June 30, 2023 and the year ended December 31, 2022 are presented as if the deconsolidation of SPG had occurred as of January 1, 2022. Through the Filing Date, SPG’s results continue to be consolidated into the Company’s financial statements and Superior recognizes SPG’s losses in its earnings. Following deconsolidation, Superior will account for its interest in SPG in accordance with the measurement alternative under ASC 321, "Investments - Equity Securities" and initially recognize its investment at the estimated fair value on the Filing Date. The unaudited condensed consolidated pro forma financial information is subject to adjustment and is presented for informational purposes only and does not purport to represent what the Company’s results of operations or financial position would actually have been if deconsolidation had in fact occurred on the dates discussed above. It also does not project or forecast the Company’s consolidated results of operations or financial position for any future date or period.

In connection with the deconsolidation, Superior expects to recognize a non-cash charge of approximately $81.7 million in the third quarter of 2023, representing the excess of the carrying value over the estimated preliminary fair value of its interest in, and receivable from, SPG as of the Filing Date (based on the carrying value as of June 30, 2023). As a result, the Company has reduced the value of its investment in SPG to zero in the accompanying unaudited pro forma condensed consolidated balance sheet, as the fair value of SPG's liabilities, including amounts owed to the Company, substantially exceed the fair value of its assets. In addition, as a result of the deconsolidation, the Company has recognized an affiliated receivable due from SPG in the amount of $9.8 million, the estimated fair value of the Company’s claim as a creditor of SPG. The preliminary fair value estimates are subject to further refinement upon completion of the valuation of SPG's property, plant and equipment and definite-lived intangible assets expected to be finalized in connection with the 2023 third quarter close. If the preliminary fair value estimates increase (or decrease) by 10%, 20% or 30%, the resulting charge would decrease (or increase) by $1.0 million, $2.0 million or $2.9 million, respectively. Any increase or decrease in the fair value would result in an increase or decrease in the affiliated receivable due from SPG.

The SPG bankruptcy filing will not result in any default under Superior debt agreements.

The unaudited pro forma condensed consolidated financial statements of Superior should be read in conjunction with the historical consolidated financial statements of Superior and the related notes included in our 2022 Annual Report on Form 10-K and subsequent Quarterly Reports on Form 10-Q.

SUPERIOR INDUSTRIES INTERNATIONAL, INC.

PRO FORMA CONDENSED CONSOLIDATED BALANCE SHEET

(Dollars in thousands)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

As Of June 30, 2023 |

As Reported |

|

|

Transaction Accounting Adjustments |

|

|

|

Pro Forma |

|

ASSETS |

|

|

|

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

$ |

181,115 |

|

|

$ |

(2,403 |

) |

(a) |

|

$ |

178,712 |

|

Accounts receivable, net |

|

101,017 |

|

|

|

(4,010 |

) |

(a) |

|

|

97,007 |

|

Inventories, net |

|

181,860 |

|

|

|

(23,513 |

) |

(a) |

|

|

158,347 |

|

Income taxes receivable |

|

1,959 |

|

|

|

— |

|

|

|

|

1,959 |

|

Other current assets |

|

58,421 |

|

|

|

(4,103 |

) |

(a) |

|

|

54,318 |

|

Total current assets |

|

524,372 |

|

|

|

(34,029 |

) |

|

|

|

490,343 |

|

Property, plant and equipment, net |

|

476,834 |

|

|

|

(71,963 |

) |

(a) |

|

|

404,871 |

|

Deferred income tax assets, net |

|

22,408 |

|

|

|

(1,685 |

) |

(a) |

|

|

20,723 |

|

Intangibles, net |

|

42,492 |

|

|

|

— |

|

|

|

|

42,492 |

|

Other noncurrent assets |

|

94,106 |

|

|

|

(2,013 |

) |

(a) |

|

|

92,093 |

|

Affiliated receivable from SPG |

$ |

— |

|

|

|

9,800 |

|

(d) |

|

|

9,800 |

|

Total assets |

$ |

1,160,212 |

|

|

$ |

(99,890 |

) |

|

|

$ |

1,060,322 |

|

LIABILITIES, MEZZANINE EQUITY AND SHAREHOLDERS’ EQUITY (DEFICIT) |

|

|

|

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

|

|

|

Accounts payable |

$ |

148,455 |

|

|

$ |

(5,442 |

) |

(a) |

|

$ |

143,013 |

|

Short-term debt |

|

7,236 |

|

|

|

(447 |

) |

(a) |

|

|

6,789 |

|

Accrued expenses |

|

73,616 |

|

|

|

(8,293 |

) |

(a) |

|

|

65,323 |

|

Income taxes payable |

|

1,568 |

|

|

|

— |

|

|

|

|

1,568 |

|

Total current liabilities |

|

230,875 |

|

|

|

(14,182 |

) |

|

|

|

216,693 |

|

Long-term debt (less current portion) |

|

607,902 |

|

|

|

(859 |

) |

(a) |

|

|

607,043 |

|

Noncurrent income tax liabilities |

|

7,882 |

|

|

|

— |

|

|

|

|

7,882 |

|

Deferred income tax liabilities, net |

|

4,583 |

|

|

|

(1,256 |

) |

(a) |

|

|

3,327 |

|

Other noncurrent liabilities |

|

49,923 |

|

|

|

(1,933 |

) |

(a) |

|

|

47,990 |

|

Commitments and contingent liabilities |

|

— |

|

|

|

— |

|

|

|

|

— |

|

Mezzanine equity: |

|

|

|

|

|

|

|

|

|

Preferred stock |

|

235,143 |

|

|

|

— |

|

|

|

|

235,143 |

|

European noncontrolling redeemable equity |

|

1,087 |

|

|

|

— |

|

|

|

|

1,087 |

|

Shareholders’ equity (deficit): |

|

|

|

|

|

|

|

|

|

Common stock |

|

110,802 |

|

|

|

— |

|

|

|

|

110,802 |

|

Accumulated other comprehensive loss |

|

(17,632 |

) |

|

|

— |

|

|

|

|

(17,632 |

) |

Retained earnings |

|

(70,353 |

) |

|

|

(81,660 |

) |

(b) |

|

|

(152,013 |

) |

Total shareholders’ equity (deficit) |

|

22,817 |

|

|

|

(81,660 |

) |

|

|

|

(58,843 |

) |

Total liabilities, mezzanine equity and shareholders’ equity |

$ |

1,160,212 |

|

|

$ |

(99,890 |

) |

|

|

$ |

1,060,322 |

|

Refer to accompanying notes to the Unaudited Pro Form Condensed Consolidated Financial Information.

2

SUPERIOR INDUSTRIES INTERNATIONAL, INC.

PRO FORMA CONDENSED CONSOLIDATED STATEMENTS OF INCOME (LOSS)

(Dollars in thousands, except per share amounts)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

Six Months Ended June 30, 2023 |

|

|

As Reported |

|

|

Transaction Accounting Adjustments (c) |

|

|

Pro Forma |

|

NET SALES |

$ |

753,569 |

|

|

$ |

(64,361 |

) |

|

$ |

689,208 |

|

Cost of sales |

|

677,958 |

|

|

|

(73,349 |

) |

|

|

604,609 |

|

GROSS PROFIT |

|

75,611 |

|

|

|

8,988 |

|

|

|

84,599 |

|

Selling, general and administrative expenses |

|

36,458 |

|

|

|

(2,938 |

) |

|

|

33,520 |

|

INCOME FROM OPERATIONS |

|

39,153 |

|

|

|

11,926 |

|

|

|

51,079 |

|

Interest expense, net |

|

(31,388 |

) |

|

|

332 |

|

|

|

(31,056 |

) |

Other expense, net |

|

(2,787 |

) |

|

|

116 |

|

|

|

(2,671 |

) |

INCOME BEFORE INCOME TAXES |

|

4,978 |

|

|

|

12,374 |

|

|

|

17,352 |

|

Income tax provision |

|

(9,092 |

) |

|

|

(98 |

) |

|

|

(9,190 |

) |

NET (LOSS) INCOME |

$ |

(4,114 |

) |

|

$ |

12,276 |

|

|

$ |

8,162 |

|

LOSS PER SHARE – BASIC (f) |

$ |

(0.84 |

) |

|

|

|

|

$ |

(0.40 |

) |

LOSS PER SHARE – DILUTED (f) |

$ |

(0.84 |

) |

|

|

|

|

$ |

(0.40 |

) |

|

|

|

|

|

|

|

|

|

Weighted average shares outstanding – Basic |

|

27,669 |

|

|

|

|

|

|

27,669 |

|

Weighted average shares outstanding – Diluted |

|

27,669 |

|

|

|

|

|

|

27,669 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Year Ended December 31, 2022 |

|

|

As Reported |

|

|

Transaction Accounting Adjustments (c) |

|

|

Pro Forma |

|

NET SALES |

$ |

1,639,902 |

|

|

$ |

(129,736 |

) |

|

$ |

1,510,166 |

|

Cost of sales |

|

1,473,515 |

|

|

|

(141,811 |

) |

|

|

1,331,704 |

|

GROSS PROFIT |

|

166,387 |

|

|

|

12,075 |

|

|

|

178,462 |

|

Selling, general and administrative expenses |

|

68,347 |

|

|

|

(1,253 |

) |

|

|

67,094 |

|

Loss on deconsolidation of SPG |

|

— |

|

|

|

81,660 |

|

|

|

81,660 |

|

INCOME FROM OPERATIONS |

|

98,040 |

|

|

|

(68,332 |

) |

|

|

29,708 |

|

Interest expense, net |

|

(46,314 |

) |

|

|

— |

|

|

|

(46,314 |

) |

Other expense, net |

|

(588 |

) |

|

|

(131 |

) |

|

|

(719 |

) |

INCOME BEFORE INCOME TAXES |

|

51,138 |

|

|

|

(68,463 |

) |

|

|

(17,325 |

) |

Income tax provision |

|

(14,104 |

) |

|

|

5,039 |

|

|

|

(9,065 |

) |

NET (LOSS) INCOME |

$ |

37,034 |

|

|

$ |

(63,424 |

) |

|

$ |

(26,390 |

) |

EARNINGS (LOSS) PER SHARE – BASIC (g) |

$ |

0.02 |

|

|

|

|

|

$ |

(2.34 |

) |

EARNINGS (LOSS) PER SHARE – DILUTED (g) |

$ |

0.02 |

|

|

|

|

|

$ |

(2.34 |

) |

|

|

|

|

|

|

|

|

|

Weighted average shares outstanding – Basic |

|

26,839 |

|

|

|

|

|

|

26,839 |

|

Weighted average shares outstanding – Diluted |

|

27,590 |

|

|

|

|

|

|

26,839 |

|

Refer to accompanying notes to the Unaudited Pro Forma Condensed Consolidated Financial Information.

3

SUPERIOR INDUSTRIES INTERNATIONAL, INC.

PRO FORMA CONDENSED CONSOLIDATED FINANCIAL INFORMATION

(Unaudited)

(a)To eliminate assets and liabilities related to the deconsolidation of SPG.

(b)To adjust stockholders’ equity and recognize the loss on deconsolidation of SPG necessary to adjust the carrying value to fair value.

(c)To eliminate revenues and expenses related to the deconsolidation of SPG and recognize the loss on deconsolidation of $81.7 million.

(d)To adjust Superior’s affiliated receivable from SPG to its realizable value of $9.8 million.

(e)There has been no tax benefit recognized on the loss on deconsolidation since the Company does not believe that the related deferred tax assets would more likely than not be realizable.

(f)The basic and diluted pro forma loss per share for the six months ended June 30, 2023 of $(0.40) consists of the sum of the pro forma net income of $8.2 million less dividends and accretion on the redeemable preferred stock of $19.1 million divided by the weighted average shares of 27.7 million.

(g)The basic and diluted pro forma loss per share for the year ended December 31, 2022 of $(2.34) consists of the sum of the net loss of $(26.4) million less dividends and accretion on the redeemable preferred stock of $36.5 million divided by the weighted average shares of 26.8 million.

4

Exhibit 99.2

Press Release

Superior Announces Strategic Action in German Production Facility to

Further Enhance Competitiveness

•Strategic action in German manufacturing facility follows comprehensive assessment as part of Company’s ongoing focus on portfolio optimization

•Anticipated improvement in profitability of European operations

•Actions expected to enhance Superior’s Adjusted EBITDA1 and cash generation

SOUTHFIELD, MICHIGAN – August 31, 2023 – Superior Industries International, Inc. (“Superior” or the “Company”) (NYSE:SUP) today announced that its subsidiary, Superior Industries Production Germany GmbH ("SPG"), has entered into Protective Shield Proceedings, a court-administered reorganization. These proceedings are strictly limited to SPG and its German-based manufacturing facility operating at the production site in Werdohl, Germany. The Company’s operations in the U.S., Mexico and Poland are not impacted, and its other German operations and aftermarket business are not part of these proceedings.

“We have made substantial progress in aligning our business to a rapidly evolving operating environment while elevating our footprint to a competitively advantaged position. Today, the vast majority of Superior’s capacity is high-performing and is strategically placed in two low-cost locations, Mexico and Poland, creating an attractive ‘local for local’ solution for our customers as they seek shorter supply chains to mitigate production risks. The action we are taking represents a continuation of our plan and the transformation of the remaining 6% of our footprint,” commented Majdi Abulaban, President and Chief Executive Officer of Superior. “Our competitive differentiators, including our ability to capture customer demand for larger, premium wheels, will continue to support our business well into the future.”

Strategic Action Details

In conjunction with the proceedings, Superior has developed a revised operating plan at its SPG facility to reduce costs, enhance revenues, and to better address critical customer needs. The actions the Company is undertaking are expected to drive long-term improvement in margins and cash flow while enabling a more efficient and effective footprint to support long-term growth. Superior maintains a strong financial position with ample liquidity, enabling the Company to focus on providing the highest level of service for its customers throughout the proceedings.

The Company expects to recognize a non-cash charge of approximately $82 million in the third quarter of 2023, representing the excess of the carrying value of the net assets over the estimated preliminary fair value of its interest in SPG.

1 See “Non-GAAP Financial Measures” below for a definition and reconciliation to the most comparable GAAP measure.

Superior expects to incur cash charges associated with these proceedings of €15 to 18 million and a benefit to adjusted EBITDA, which is expected to be fully realized in 2024 on a run rate basis, that reflects a payback of approximately one year.

2023 Outlook

Superior re-affirmed its full year 2023 outlook, which remains as follows:

|

|

|

|

|

|

|

|

|

|

FY 2023 Outlook |

|

|

Unit Shipments |

15.0 - 15.8 million |

|

|

Net Sales |

$1.55 - $1.63 billion |

|

|

Value-Added Sales |

$755 - $795 million |

|

|

Adjusted EBITDA |

$170 - $190 million |

|

|

Cash Flow from Operations |

$110 - $130 million |

|

|

Capital Expenditures |

~$65 million |

|

|

|

|

|

Value-Added Sales and Adjusted EBITDA are Non-GAAP measures, as defined below. In reliance on the safe harbor provided under section 10(e) of Regulation S-K, Superior has not quantitatively reconciled from net income, the most comparable GAAP measure, to Adjusted EBITDA presented in the 2023 outlook, as Superior is unable to quantify certain amounts included in net income without unreasonable efforts and due to the inherent uncertainty regarding such variables. Superior also believes that such reconciliation would imply a degree of precision that could potentially be confusing or misleading to investors. However, the magnitude of these amounts may be significant.

Conference Call

Superior will host a conference call beginning at 9:00 AM ET on Thursday, August 31, 2023 to address the strategic action and may disclose material information in response to questions posed by participants during the call. The conference call may be accessed by dialing +1 786 697 3501 for participants in the U.S./Canada or 866 378 3566 for participants outside the U.S./Canada using the required conference ID 8312023 when prompted by the operator. The live conference call can also be accessed by logging into the Company’s website at www.supind.com or by clicking this link: investor call webcast. A replay of the webcast will be available on the Company’s website immediately following the conclusion of the call.

About Superior Industries

Superior is one of the world’s leading aluminum wheel suppliers. Superior’s team collaborates with customers to design, engineer, and manufacture a wide variety of innovative and high-quality products utilizing the latest light weighting and finishing technologies. Superior serves the European aftermarket with the brands ATS®, RIAL®, ALUTEC®, and ANZIO®. Headquartered in Southfield, Michigan, Superior is listed on the New York Stock Exchange. For more information, please visit www.supind.com.

Non-GAAP Financial Measures

2

In addition to the results reported in accordance with GAAP included throughout this release, this release refers to the following Non-GAAP measures:

“Adjusted EBITDA,” defined as earnings before interest income and expense, income taxes, depreciation, amortization, restructuring charges and other closure costs and impairments of long-lived assets and investments, changes in fair value of redeemable preferred stock embedded derivative, acquisition and integration, certain hiring and separation related costs, proxy contest fees, gains associated with early debt extinguishment and accounts receivable factoring fees. “Value-Added Sales," defined as net sales less the value of aluminum and other costs, as well as outsourced service provider (“OSP”) costs that are included in net sales.

For the reconciliation of Value-Added Sales to the most directly comparable GAAP measure, see the attached supplemental data pages. Management believes these Non-GAAP measures are useful to management and may be useful to investors in their analysis of Superior’s financial position and results of operations. Further, management uses these Non-GAAP financial measures for planning and forecasting purposes. This Non-GAAP financial information is provided as additional information for investors and is not in accordance with or an alternative to GAAP and may be different from similar measures used by other companies.

Forward-Looking Statements

This press release contains statements that are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements include all statements that do not relate solely to historical or current facts and can generally be identified by the use of future dates or words such as “assumes,”, “may,” “should,” “could,” “will,” “expects,” “expected,” “seeks to,” “anticipates,” “plans,” “believes,” “estimates,” “foresee,” “intends,” “outlook,” “guidance,” “predicts,” “projects,” “projecting,” “potential,” “targeting,” “will likely result,” or “continue,” or the negative of such terms and other comparable terminology. These statements also include, but are not limited to, the 2023 outlook included herein, the results of the protective shield proceedings and the operating plan at the SPG facility discussed herein as well as the expected costs and efficiencies associated therewith, the impact of COVID-19 and the resulting supply chain disruptions, increased energy costs, semiconductor shortages, and rising interest rates, as well as the Russian military invasion of Ukraine, on our future growth and earnings. These statements include our belief regarding general automotive industry market conditions and growth rates, as well as domestic and international economic conditions. These statements are not guarantees of future performance and involve risks, uncertainties, and assumptions that are difficult to predict. Therefore, actual outcomes and results may differ materially from what is expressed or forecasted in such forward-looking statements due to numerous factors, risks, and uncertainties discussed in Superior's Securities and Exchange Commission filings and reports, including Superior’s current Annual Report on Form 10-K, and other reports from time to time filed with the Securities and Exchange Commission. You are cautioned not to unduly rely on such forward-looking statements when evaluating the information presented in this release.

Contact:

Superior Investor Relations

(248) 234-7104

Investor.Relations@supind.com

3

SUPERIOR INDUSTRIES INTERNATIONAL, INC.

Non-GAAP Financial Measures (Unaudited)

(Dollars in Millions)

|

|

|

|

|

|

|

|

|

|

Outlook for Full Year 2023 Value-Added Sales |

|

|

Outlook Range |

|

Net Sales Outlook |

|

|

$ |

1,550.0 |

|

|

$ |

1,630.0 |

|

Less: Aluminum, Other Costs, and Outside Service Provider Costs |

|

|

|

(795.0 |

) |

|

|

(835.0 |

) |

Value-Added Sales Outlook |

|

|

$ |

755.0 |

|

|

$ |

795.0 |

|

4

v3.23.2

Document And Entity Information

|

Aug. 31, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Aug. 31, 2023

|

| Entity Registrant Name |

SUPERIOR INDUSTRIES INTERNATIONAL, INC.

|

| Entity Central Index Key |

0000095552

|

| Entity Emerging Growth Company |

false

|

| Securities Act File Number |

001-06615

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Tax Identification Number |

95-2594729

|

| Entity Address, Address Line One |

26600 Telegraph Road

|

| Entity Address, Address Line Two |

Suite 400

|

| Entity Address, City or Town |

Southfield

|

| Entity Address, State or Province |

MI

|

| Entity Address, Postal Zip Code |

48033

|

| City Area Code |

248

|

| Local Phone Number |

352-7300

|

| Entity Information, Former Legal or Registered Name |

Not Applicable

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $0.01 par value

|

| Trading Symbol |

SUP

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

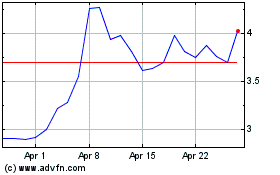

Superior Industries (NYSE:SUP)

Historical Stock Chart

From Mar 2024 to Apr 2024

Superior Industries (NYSE:SUP)

Historical Stock Chart

From Apr 2023 to Apr 2024