0001081745

false

0001081745

2023-08-14

2023-08-14

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of

The

Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): August 14, 2023

INTELLINETICS,

INC.

(Exact

name of Registrant as specified in its charter)

| Nevada |

|

001-41495 |

|

87-0613716 |

(State

or other jurisdiction

of

incorporation) |

|

(Commission

File

Number) |

|

(I.R.S

Employer

Identification

No.) |

| 2190

Dividend Dr., Columbus, Ohio |

|

43228 |

| (Address

of principal executive offices) |

|

(Zip

code) |

Registrant’s

telephone number, including area code: (614) 388-8908

Intellinetics,

Inc.

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the Registrant under

any of the following provisions (see General Instruction A.2. below):

| |

☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

|

| |

☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

|

| |

☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

|

| |

☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock, $0.001 par value |

|

INLX |

|

NYSE

American |

Securities

registered pursuant to Section 12(g) of the Act: Common Stock, $0.001 par value

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

2.02 Results of Operations and Financial Condition.

On

August 14, 2023, the Company issued a press release announcing its financial results for the fiscal quarter ended June 30, 2023. A copy

of the press release is attached hereto as Exhibit 99.1 and incorporated herein by reference.

The

information reported under this Item 2.02 of Form 8-K, including Exhibit 99.1, is being furnished and shall not be deemed to be “filed”

for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject

to the liabilities of such section, nor shall such information be deemed incorporated by reference in any filing under the Securities

Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

Item

9.01 Financial Statements and Exhibits

(d)

Exhibits

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this report to be signed on its

behalf by the undersigned hereunto duly authorized.

| |

INTELLINETICS,

INC. |

| |

|

|

| |

By: |

/s/

James F. DeSocio |

| |

|

James

F. DeSocio |

| |

|

President

and Chief Executive Officer |

| |

|

|

| Dated:

August 14, 2023 |

|

|

Exhibit

99.1

Intellinetics

Grows Revenues 25% in Q2 2023; 38% Year-to-Date

Net

Income improved over $500,000, EPS of $0.03 vs. $(0.09)

COLUMBUS,

OH – August 14, 2023 – Intellinetics, Inc. (NYSE American: INLX), a digital transformation solutions provider,

announced financial results for the three and six months ended June 30, 2023.

2023

Second Quarter Financial Highlights

| |

● |

Total

Revenue increased 24.7% over the same period in 2022. |

| |

|

○ |

The

growth in Q2 was fully organic, being the first quarter of year over year Yellow Folder contributions. |

| |

● |

Software

as a Service revenue increased 10.3% over the same period in 2022. |

| |

● |

Total

operating expenses declined 1.2% against 24.7% revenue increase, leading to $430,087 positive swing in operating income. |

| |

● |

Net

Income of $135,734, or $0.03 per fully diluted share, compared to net loss of $374,167, or $(0.09) per fully diluted share, for the

same period in 2022. |

| |

● |

Adjusted

EBITDA increased 28.2% to $651,646, compared to $507,743 from the same period in 2022. |

| | |

Three months

ended

June 30, 2023 | | |

Three months

ended

June 30, 2022 | |

| Revenues by revenue source | |

| | | |

| | |

| Sale of software | |

$ | 63,646 | | |

$ | 11,105 | |

| Software as a service | |

| 1,277,918 | | |

| 1,158,456 | |

| Software maintenance services | |

| 349,139 | | |

| 343,881 | |

| Professional services | |

| 2,298,316 | | |

| 1,625,765 | |

| Storage and retrieval services | |

| 269,411 | | |

| 276,436 | |

| Total revenues | |

$ | 4,258,430 | | |

$ | 3,415,643 | |

James

F. DeSocio, President & CEO of Intellinetics, stated, “This was another strong quarter for Intellinetics, with double-digit

revenue growth, combined with lower operating expenses, driving significant positive swings in operating income, net income, and Adjusted

EBITDA. Growth in SaaS revenue was somewhat lower in the quarter, due largely to timing of orders and renewals, but we anticipate re-acceleration

in the second-half of the year as we continue to see strong demand. Intellinetics has built a stable, profitable platform for continued

robust top- and bottom-line growth, and we are investing in marketing to help us capture share in the large, growing markets that we

serve.”

“We

remain specifically focused on cross-selling, and this initiative is driving results,” continued Mr. DeSocio. “The number

of customers using more than one of our services has continued to grow as we expand our wallet-share with clients. As a result, we anticipate

continued organic growth, both in terms of new customers and expanding our relationships with existing customers, throughout 2023 and

into 2024.”

Summary

– 2023 Second Quarter Results

Revenues

for the three months ended June 30, 2023 were $4,258,430, an increase of 24.7%, organically, as compared with $3,415,643 for the same

period in 2022. The increase was driven by a 10.3% increase in SaaS revenue, and a 41.4% increase in professional services fees. The

increase in professional services was enabled by our ability to hire and retain people in our document conversion segment.

Total

operating expenses decreased 1.2% to $2,294,045, compared to $2,322,717 due to the absence of transaction costs associated with the acquisition

of Yellow Folder in the prior-year quarter, as well as a 7% reduction in sales and marketing expenses, partially offset by higher depreciation

and amortization (a non-cash expense) and general and administrative costs associated with higher revenue. As a result of higher revenue

and lower expenses, income from operations was $296,388, a positive swing of $430,087 compared to a loss from operations of $133,699

in the second quarter last year.

Intellinetics

reported net income of $135,734 for the three months ended June 30, 2023 compared to net loss of $374,167 for the same period in 2022,

representing an improvement of $509,901. Basic and diluted net income per share for the three months ended June 30, 2023 was $0.03. Basic

and diluted net loss per share for the three months ended June 30, 2022 was $(0.09). Adjusted EBITDA improved year over year by $143,903

which was driven by the strong revenue growth.

Summary

– 2023 Year-to-Date Results

Yellow

Folder, acquired April 1, 2022, contributed $1,738,893 in revenue in the six months ended June 30, 2023, compared to $790,368 in revenue

in the six months ended June 20, 2022. Inclusive of the contribution from Yellow Folder, revenues for the six months ended June 30, 2023

were $8,445,263, an increase of 38.0% as compared with $6,119,155 for the same period in 2022. Total operating expenses increased 20.6%

to $4,655,885, compared to $3,862,079. Income from operations was $580,387, a positive swing of $621,611 compared to a loss from operations

of $41,224 last year. Intellinetics reported net income of $248,297, or $0.06 per basic and diluted share, compared to net loss of $394,293,

or $(0.11) per basic and diluted share, for the same period in 2022. Adjusted EBITDA was $1,281,525 compared to $932,235.

2023

Outlook

Based

on management’s current plans and assumptions, the Company reiterated expectations that it will continue to grow revenues and Adjusted

EBITDA on a year-over-year basis for 2023.

Conference

Call

Intellinetics

is holding a conference call to discuss these results on a live webcast at 4:30 p.m. ET today. Interested parties can access the webcast

through the Intellinetics website at https://ir.intellinetics.com/. Investors can also dial in to the webcast by calling (877)

407-8133 (toll-free) or (201) 689-8040. A replay of the call can also be accessed via phone through August 28, 2023 by dialing (877)

660-6853 (toll-free) or (201) 612-7415 and using replay access code 13740337.

About

Intellinetics, Inc.

Intellinetics,

Inc. (NYSE American: INLX) is enabling the digital transformation. Intellinetics empowers organizations to manage, store and protect

their important documents and data. The Company’s flagship solution, the IntelliCloud™ content management platform,

delivers advanced security, compliance, workflow and collaboration features critical for highly regulated, risk-intensive markets. IntelliCloud

connects documents to users and the processes they support anytime, anywhere to accelerate innovation and empower organizations to think

and work in new ways. In addition, Intellinetics offers business process outsourcing (BPO), document and micrographics scanning services,

and records storage. From highly regulated industries like Healthcare/Human Service Providers, K-12, Public Safety, and State and Local

Governments, to businesses looking to move away from paper-based processes, Intellinetics is the all-in-one, compliant, document management

solution. Intellinetics is headquartered in Columbus, Ohio. For additional information, please visit www.intellinetics.com.

Cautionary

Statement

Statements

in this press release which are not purely historical, including statements regarding future business and growth, future revenues, including

2023 revenues, outlook, and organic revenue growth from both new and existing customers, market share, growth of our markets, demand

for our SaaS solutions, sustainable profitability, continued growth of SaaS revenue, cross-selling efforts and other synergies associated

with our acquisition of Yellow Folder; execution of Intellinetics’ business plan, strategy, direction and focus; and other intentions,

beliefs, expectations, representations, projections, plans or strategies regarding future growth, financial results, and other future

events are forward-looking statements. The forward-looking statements involve risks and uncertainties including, but not limited to,

the risks associated with the effect of changing economic conditions including inflationary pressures, challenges with hiring and maintaining

a stable workforce, Intellinetics’ ability to execute on its business plan and strategy, customary risks attendant to acquisitions,

trends in the products markets, variations in Intellinetics’ cash flow or adequacy of capital resources, market acceptance risks,

the success of Intellinetics’ solutions providers, including human services, health care, and education, technical development

risks, and other risks, uncertainties and other factors discussed from time to time in its reports filed with or furnished to the Securities

and Exchange Commission, including in Intellinetics’ most recent annual report on Form 10-K as well as subsequently filed reports

on Form 8-K. Intellinetics cautions investors not to place undue reliance on the forward-looking statements contained in this press release.

Intellinetics disclaims any obligation and does not undertake to update or revise any forward-looking statements in this press release.

Expanded and historical information is made available to the public by Intellinetics on its website at www.intellinetics.com or

at www.sec.gov.

CONTACT:

FNK

IR

Tom

Baumann / Rob Fink

646.349.6641

/ 646.809.4048

INLX@fnkir.com

Joe

Spain, CFO

Intellinetics,

Inc.

614.921.8170

investors@intellinetics.com

Non-GAAP

Financial Measures

Intellinetics

uses non-GAAP Adjusted EBITDA as supplemental measures of our performance that are not required by, or presented in accordance with,

accounting principles generally accepted in the United States (GAAP). A non-GAAP financial measure is a numerical measure of a company’s

financial performance that excludes or includes amounts so as to be different from the most directly comparable measure calculated and

presented in accordance with GAAP in the statement of income, balance sheet or statement of cash flows of a company.

Adjusted

EBITDA: Adjusted EBITDA is not a measurement of financial performance under GAAP and should not be considered as an alternative to

net income, operating income, or any other performance measure derived in accordance with GAAP, or as an alternative to cash flow from

operating activities or a measure of our liquidity. Intellinetics urges investors to review the reconciliation of non-GAAP Adjusted EBITDA

to the comparable GAAP Net Loss, which is included in this press release, and not to rely on any single financial measure to evaluate

Intellinetics’ financial performance.

We

believe that Adjusted EBITDA is a useful performance measure and is used by us to facilitate a comparison of our operating performance

on a consistent basis from period-to-period and to provide for a more complete understanding of factors and trends affecting our business

than measures under GAAP can provide alone. We define “Adjusted EBITDA” as earnings before interest expense, any income taxes,

depreciation and amortization expense, stock-based compensation, note conversion and note or equity offer warrant or stock expense, gain

or loss on debt extinguishment, change in fair value of contingent consideration, and transaction costs.

Reconciliation

of Net Income to Adjusted EBITDA

| | |

For the Three Months Ended June 30, | |

| | |

2023 | | |

2022 | |

| Net income (loss) - GAAP | |

$ | 135,734 | | |

$ | (374,167 | ) |

| Interest expense, net | |

| 160,654 | | |

| 240,468 | |

| Depreciation and amortization | |

| 239,803 | | |

| 200,919 | |

| Stock-based compensation | |

| 115,455 | | |

| 102,992 | |

| Change in fair value of earnout liabilities | |

| - | | |

| 52,301 | |

| Transaction costs | |

| - | | |

| 285,230 | |

| Adjusted EBITDA | |

$ | 651,646 | | |

$ | 507,743 | |

| | |

For the Six Months Ended June 30, | |

| | |

2023 | | |

2022 | |

| Net income (loss) - GAAP | |

$ | 248,297 | | |

$ | (394,293 | ) |

| Interest expense, net | |

| 332,090 | | |

| 353,069 | |

| Depreciation and amortization | |

| 467,521 | | |

| 318,221 | |

| Stock-based compensation | |

| 233,617 | | |

| 183,452 | |

| Change in fair value of earnout liabilities | |

| - | | |

| 116,505 | |

| Transaction costs | |

| - | | |

| 355,281 | |

| Adjusted EBITDA | |

$ | 1,281,525 | | |

$ | 932,235 | |

Recurring

Revenue: Recognized revenue for any applicable period that we characterize as being recurring in nature, without regard to contract

start or end dates or renewal rates. It includes the following revenue types: SaaS subscription agreements, maintenance contracts related

to perpetual software licenses, storage and retrieval services, and professional services revenues in the nature of business process

outsourcing. It excludes revenues of a type that are not expected to recur, primarily perpetual licenses, most document conversion services,

and other professional services that are project based. Recurring revenue is not determined by reference to deferred revenue, unbilled

revenue, or any other GAAP financial measure over any period, so the Company has not reconciled the Recurring Revenues to any GAAP measure.

Recurring revenue should not be extrapolated into a precise prediction of future revenues, because it does not take into account our

contract start and end dates and our renewal rates. Management believes that reviewing this metric, in addition to GAAP results, helps

investors and financial analysts understand the value of Intellinetics’ recurring revenue streams versus prior periods.

Reconciliation

of revenues to recurring revenues:

| | |

For the three months ended

June 30, | |

| | |

2023 | | |

2022 | |

| | |

| | |

| |

| Revenues as reported: | |

| | | |

| | |

| Sale of software | |

$ | 63,646 | | |

$ | 11,105 | |

| Software as a service | |

| 1,277,918 | | |

| 1,158,456 | |

| Software maintenance services | |

| 349,139 | | |

| 343,881 | |

| Professional services | |

| 2,298,316 | | |

| 1,625,765 | |

| Storage and retrieval services | |

| 269,411 | | |

| 276,436 | |

| Total revenues | |

$ | 4,258,430 | | |

$ | 3,415,643 | |

| Revenues – recurring only: | |

| | | |

| | |

| Sale of software – recurring | |

$ | - | | |

$ | - | |

| Software as a service – recurring | |

| 1,182,483 | | |

| 1,072,323 | |

| Software maintenance services – recurring | |

| 349,139 | | |

| 343,881 | |

| Professional services – recurring | |

| 704,835 | | |

| 664,494 | |

| Storage and retrieval services – recurring | |

| 230,609 | | |

| 203,237 | |

| Total recurring revenues | |

$ | 2,467,066 | | |

$ | 2,283,935 | |

| | |

| | | |

| | |

| Revenues – non-recurring only: | |

| | | |

| | |

| Sale of software – non-recurring only | |

$ | 63,646 | | |

$ | 11,105 | |

| Software as a service – non-recurring only1 | |

| 95,435 | | |

| 86,133 | |

| Software maintenance services – non-recurring only | |

| - | | |

| - | |

| Professional services – non-recurring only | |

| 1,593,481 | | |

| 961,271 | |

| Storage and retrieval services – non-recurring only | |

| 38,802 | | |

| 73,199 | |

| Total non-recurring revenues | |

$ | 1,791,364 | | |

$ | 1,131,708 | |

| | |

| | | |

| | |

| Total recurring and non-recurring revenues | |

$ | 4,258,430 | | |

$ | 3,415,643 | |

Note

1 – Software as a service non-recurring revenue is comprised of professional services setup fees which are recognized ratably over

the initial contract period. They do not renew, and are therefore non-recurring. Under ASC 606, they are deemed essential to the functionality

of the subscription Software as a service, and are therefore recognized together with the subscription Software as a service revenue.

Total

Contract Value: Estimated total future revenues from contracts signed during the period. This refers to contracts or projects that

have been awarded by our customers, and it presumes the provision of all software, subscription services, and/or professional services,

with no termination of any awarded contracts. There can be no guarantee that all work will be completed during any fiscal period, or

that the contracts will not be terminated before all the estimated future revenues are earned, received, and/or recognized. Total Contract

Value is a performance measure that the Company believes provides useful information to its management and investors as it allows the

Company to better track the Company’s current sales performance, without any adjustment to exclude revenues that will not be earned,

received, or recognized until future periods. Total Contract Value includes new sales in all our revenue categories, including SaaS,

perpetual software licenses, maintenance, storage and retrieval, and professional services, to new or existing customers. It excludes

renewals (and price increases on renewals if any). Total Contract Value is not a substitute for total revenue. There is no GAAP measure

that is comparable to Total Contract Value, so the Company has not reconciled the Total Contract Value to any GAAP measure.

INTELLINETICS,

INC. and SUBSIDIARIES

Condensed

Consolidated Balance Sheets

| | |

(unaudited) | | |

| |

| | |

June 30, 2023 | | |

December 31, 2022 | |

| ASSETS | |

| | | |

| | |

| Current assets: | |

| | | |

| | |

| Cash | |

$ | 1,130,487 | | |

$ | 2,696,481 | |

| Accounts receivable, net | |

| 1,326,986 | | |

| 1,121,083 | |

| Accounts receivable, unbilled | |

| 1,038,013 | | |

| 596,410 | |

| Parts and supplies, net | |

| 72,569 | | |

| 73,221 | |

| Contract assets | |

| 96,470 | | |

| 80,378 | |

| Prepaid expenses and other current assets | |

| 337,373 | | |

| 325,466 | |

| Total current assets | |

| 4,001,898 | | |

| 4,893,039 | |

| | |

| | | |

| | |

| Property and equipment, net | |

| 1,024,776 | | |

| 1,068,706 | |

| Right of use assets, operating | |

| 2,895,784 | | |

| 3,200,191 | |

| Right of use asset, finance | |

| 170,194 | | |

| 154,282 | |

| Intangible assets, net | |

| 4,164,492 | | |

| 4,419,646 | |

| Goodwill | |

| 5,789,821 | | |

| 5,789,821 | |

| Other assets | |

| 540,121 | | |

| 417,457 | |

| Total assets | |

$ | 18,587,086 | | |

$ | 19,943,142 | |

| | |

| | | |

| | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | |

| | | |

| | |

| | |

| | | |

| | |

| Current liabilities: | |

| | | |

| | |

| Accounts payable | |

$ | 356,545 | | |

$ | 370,300 | |

| Accrued compensation | |

| 336,317 | | |

| 411,683 | |

| Accrued expenses | |

| 181,961 | | |

| 114,902 | |

| Lease liabilities, operating - current | |

| 711,229 | | |

| 692,074 | |

| Lease liability, finance - current | |

| 28,303 | | |

| 22,493 | |

| Deferred revenues | |

| 2,067,744 | | |

| 2,754,064 | |

| Earnout liabilities - current | |

| - | | |

| 700,000 | |

| Notes payable - current | |

| 709,083 | | |

| 936,966 | |

| Total current liabilities | |

| 4,391,182 | | |

| 6,002,482 | |

| | |

| | | |

| | |

| Long-term liabilities: | |

| | | |

| | |

| Notes payable - net of current portion | |

| 2,147,139 | | |

| 2,085,035 | |

| Notes payable - related party | |

| 544,843 | | |

| 529,084 | |

| Lease liabilities, operating - net of current portion | |

| 2,307,326 | | |

| 2,624,608 | |

| Lease liability, finance - net of current portion | |

| 145,880 | | |

| 133,131 | |

| Total long-term liabilities | |

| 5,145,188 | | |

| 5,371,858 | |

| Total liabilities | |

| 9,536,370 | | |

| 11,374,340 | |

| | |

| | | |

| | |

| Stockholders’ equity: | |

| | | |

| | |

| Common stock, $0.001 par value, 25,000,000 shares authorized; 4,073,757 shares issued and outstanding at June 30, 2023 and December 31, 2022 | |

| 4,074 | | |

| 4,074 | |

| Additional paid-in capital | |

| 30,412,634 | | |

| 30,179,017 | |

| Accumulated deficit | |

| (21,365,992 | ) | |

| (21,614,289 | ) |

| Total stockholders’ equity | |

| 9,050,716 | | |

| 8,568,802 | |

| Total liabilities and stockholders’ equity | |

$ | 18,587,086 | | |

$ | 19,943,142 | |

INTELLINETICS,

INC. and SUBSIDIARIES

Condensed

Consolidated Statements of Operations

(unaudited)

| | |

For the Three Months Ended June 30, | | |

For the Six Months Ended June 30, | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| | |

| | |

| | |

| | |

| |

| Revenues: | |

| | | |

| | | |

| | | |

| | |

| Sale of software | |

$ | 63,646 | | |

$ | 11,105 | | |

$ | 78,939 | | |

$ | 75,596 | |

| Software as a service | |

| 1,277,918 | | |

| 1,158,456 | | |

| 2,516,350 | | |

| 1,589,677 | |

| Software maintenance services | |

| 349,139 | | |

| 343,881 | | |

| 698,681 | | |

| 680,483 | |

| Professional services | |

| 2,298,316 | | |

| 1,625,765 | | |

| 4,597,605 | | |

| 3,213,713 | |

| Storage and retrieval services | |

| 269,411 | | |

| 276,436 | | |

| 553,688 | | |

| 559,686 | |

| Total revenues | |

| 4,258,430 | | |

| 3,415,643 | | |

| 8,445,263 | | |

| 6,119,155 | |

| | |

| | | |

| | | |

| | | |

| | |

| Cost of revenues: | |

| | | |

| | | |

| | | |

| | |

| Sale of software | |

| 7,344 | | |

| 7,392 | | |

| 15,525 | | |

| 33,585 | |

| Software as a service | |

| 258,382 | | |

| 191,188 | | |

| 479,022 | | |

| 282,437 | |

| Software maintenance services | |

| 15,117 | | |

| 19,185 | | |

| 31,833 | | |

| 37,485 | |

| Professional services | |

| 1,307,341 | | |

| 918,542 | | |

| 2,494,457 | | |

| 1,766,709 | |

| Storage and retrieval services | |

| 79,813 | | |

| 90,318 | | |

| 188,154 | | |

| 178,084 | |

| Total cost of revenues | |

| 1,667,997 | | |

| 1,226,625 | | |

| 3,208,991 | | |

| 2,298,300 | |

| | |

| | | |

| | | |

| | | |

| | |

| Gross profit | |

| 2,590,433 | | |

| 2,189,018 | | |

| 5,236,272 | | |

| 3,820,855 | |

| | |

| | | |

| | | |

| | | |

| | |

| Operating expenses: | |

| | | |

| | | |

| | | |

| | |

| General and administrative | |

| 1,561,939 | | |

| 1,254,862 | | |

| 3,116,550 | | |

| 2,190,553 | |

| Change in fair value of earnout liabilities | |

| - | | |

| 52,301 | | |

| - | | |

| 116,505 | |

| Transaction costs | |

| - | | |

| 285,230 | | |

| - | | |

| 355,281 | |

| Sales and marketing | |

| 492,303 | | |

| 529,405 | | |

| 1,071,814 | | |

| 881,519 | |

| Depreciation and amortization | |

| 239,803 | | |

| 200,919 | | |

| 467,521 | | |

| 318,221 | |

| | |

| | | |

| | | |

| | | |

| | |

| Total operating expenses | |

| 2,294,045 | | |

| 2,322,717 | | |

| 4,655,885 | | |

| 3,862,079 | |

| | |

| | | |

| | | |

| | | |

| | |

| Income (loss) from operations | |

| 296,388 | | |

| (133,699 | ) | |

| 580,387 | | |

| (41,224 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Interest expense | |

| (160,654 | ) | |

| (240,468 | ) | |

| (332,090 | ) | |

| (353,069 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Net income (loss) | |

$ | 135,734 | | |

$ | (374,167 | ) | |

$ | 248,297 | | |

$ | (394,293 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Basic net income (loss) per share: | |

$ | 0.03 | | |

$ | (0.09 | ) | |

$ | 0.06 | | |

$ | (0.11 | ) |

| Diluted net income (loss) per share: | |

$ | 0.03 | | |

$ | (0.09 | ) | |

$ | 0.06 | | |

$ | (0.11 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Weighted average number of common shares outstanding - basic | |

| 4,073,757 | | |

| 4,073,757 | | |

| 4,073,757 | | |

| 3,455,761 | |

| Weighted average number of common shares outstanding - diluted | |

| 4,073,757 | | |

| 4,073,757 | | |

| 4,073,757 | | |

| 3,455,761 | |

INTELLINETICS,

INC. and SUBSIDIARIES

Condensed

Consolidated Statements of Cash Flows

(unaudited)

| | |

For the Six Months Ended June 30, | |

| | |

2023 | | |

2022 | |

| | |

| | |

| |

| Cash flows from operating activities: | |

| | | |

| | |

| Net income (loss) | |

$ | 248,297 | | |

$ | (394,293 | ) |

| Adjustments to reconcile net income (loss) to net cash used in / provided by operating activities: | |

| | | |

| | |

| Depreciation and amortization | |

| 467,521 | | |

| 318,221 | |

| Bad debt expense | |

| 27,528 | | |

| 2,327 | |

| Amortization of deferred financing costs | |

| 95,152 | | |

| 90,801 | |

| Amortization of debt discount | |

| 17,778 | | |

| 53,332 | |

| Amortization of right of use asset, financing | |

| 14,959 | | |

| - | |

| Stock issued for services | |

| - | | |

| 57,500 | |

| Stock option compensation | |

| 233,617 | | |

| 125,952 | |

| Change in fair value of earnout liabilities | |

| - | | |

| 116,505 | |

| Changes in operating assets and liabilities: | |

| | | |

| | |

| Accounts receivable | |

| (233,431 | ) | |

| 370,617 | |

| Accounts receivable, unbilled | |

| (441,603 | ) | |

| 9,703 | |

| Parts and supplies | |

| 652 | | |

| (8,442 | ) |

| Prepaid expenses and other current assets | |

| (27,999 | ) | |

| (146,026 | ) |

| Accounts payable and accrued expenses | |

| (22,062 | ) | |

| 64,641 | |

| Operating lease assets and liabilities, net | |

| 6,280 | | |

| 15,333 | |

| Deferred compensation | |

| - | | |

| (50,414 | ) |

| Deferred revenues | |

| (686,320 | ) | |

| (553,108 | ) |

| Total adjustments | |

| (547,928 | ) | |

| 466,942 | |

| Net cash (used in) provided by operating activities | |

| (299,631 | ) | |

| 72,649 | |

| | |

| | | |

| | |

| Cash flows from investing activities: | |

| | | |

| | |

| Cash paid to acquire business, net | |

| - | | |

| (6,383,269 | ) |

| Capitalization of internal use software | |

| (208,417 | ) | |

| (171,205 | ) |

| Purchases of property and equipment | |

| (82,684 | ) | |

| (98,199 | ) |

| Net cash used in investing activities | |

| (291,101 | ) | |

| (6,652,673 | ) |

| | |

| | | |

| | |

| Cash flows from financing activities: | |

| | | |

| | |

| Payment of earnout liabilities | |

| (700,000 | ) | |

| (1,018,333 | ) |

| Proceeds from issuance of common stock | |

| - | | |

| 5,740,758 | |

| Offering costs paid on issuance of common stock and notes | |

| - | | |

| (746,342 | ) |

| Proceeds from notes payable | |

| - | | |

| 2,364,500 | |

| Proceeds from notes payable - related parties | |

| - | | |

| 600,000 | |

| Principal payments on financing lease liability | |

| (12,312 | ) | |

| - | |

| Repayment of notes payable | |

| (262,950 | ) | |

| - | |

| Net cash (used in) provided by financing activities | |

| (975,262 | ) | |

| 6,940,583 | |

| | |

| | | |

| | |

| Net (decrease) increase in cash | |

| (1,565,994 | ) | |

| 360,559 | |

| Cash - beginning of period | |

| 2,696,481 | | |

| 1,752,630 | |

| Cash - end of period | |

$ | 1,130,487 | | |

$ | 2,113,189 | |

| | |

| | | |

| | |

| Supplemental disclosure of cash flow information: | |

| | | |

| | |

| Cash paid during the period for interest | |

$ | 226,570 | | |

$ | 208,935 | |

| Cash paid during the period for income taxes | |

$ | 7,708 | | |

$ | 9,576 | |

| | |

| | | |

| | |

| Supplemental disclosure of non-cash financing activities: | |

| | | |

| | |

| Discount on notes payable for warrants | |

$ | - | | |

$ | 169,900 | |

| Discount on notes payable - related parties for warrants | |

| - | | |

| 43,113 | |

| Warrants issued and extended for common stock issuance costs | |

| - | | |

| 412,500 | |

| | |

| | | |

| | |

| Supplemental disclosure of non-cash investing activities relating to business acquisitions: | |

| | | |

| | |

| Accounts receivable | |

$ | - | | |

$ | 68,380 | |

| Prepaid expenses | |

| - | | |

| 38,913 | |

| Property and equipment | |

| - | | |

| 30,018 | |

| Intangible assets | |

| - | | |

| 3,888,000 | |

| Goodwill | |

| - | | |

| 3,466,934 | |

| Accounts payable | |

| - | | |

| (36,446 | ) |

| Deferred revenues | |

| - | | |

| (1,072,530 | ) |

| Net assets acquired in acquisition | |

| - | | |

| 6,383,269 | |

| Cash used in business acquisition | |

$ | - | | |

$ | 6,383,269 | |

v3.23.2

Cover

|

Aug. 14, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Aug. 14, 2023

|

| Entity File Number |

001-41495

|

| Entity Registrant Name |

INTELLINETICS,

INC.

|

| Entity Central Index Key |

0001081745

|

| Entity Tax Identification Number |

87-0613716

|

| Entity Incorporation, State or Country Code |

NV

|

| Entity Address, Address Line One |

2190

Dividend Dr.

|

| Entity Address, City or Town |

Columbus

|

| Entity Address, State or Province |

OH

|

| Entity Address, Postal Zip Code |

43228

|

| City Area Code |

(614)

|

| Local Phone Number |

388-8908

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common

Stock, $0.001 par value

|

| Trading Symbol |

INLX

|

| Security Exchange Name |

NYSEAMER

|

| Entity Emerging Growth Company |

false

|

| Entity Information, Former Legal or Registered Name |

Intellinetics,

Inc.

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

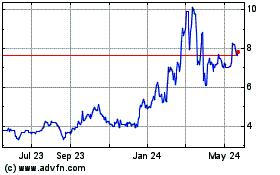

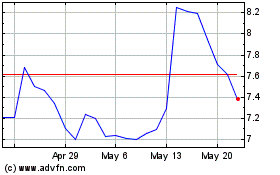

Intellinetics (AMEX:INLX)

Historical Stock Chart

From Mar 2024 to Apr 2024

Intellinetics (AMEX:INLX)

Historical Stock Chart

From Apr 2023 to Apr 2024