Sonida Senior Living, Inc. (the “Company,” “we,” “our,” or “us”)

(NYSE: SNDA) announced results for the second quarter ended June

30, 2023.

“The Company’s consistent occupancy and revenue growth

year-over-year and the additional financial flexibility created by

successful agreements with our two largest lending partners enable

us to continue building on our strong operational momentum and

prepare for strategic expansion,” said Brandon Ribar, CEO and

President. “Demand for senior housing continues to accelerate, and

inventory supply remains slow. With our strong, stable leadership

across the portfolio and dedication to operational excellence,

Sonida is well positioned to serve the growing aging population and

drive significant operating income growth for the Company.”

Second Quarter Highlights

- Weighted average occupancy for the Company’s consolidated

portfolio increased 120 basis points to 83.9% year-over-year.

- Resident revenue increased $5.0 million, or 9.5%

year-over-year.

- Net loss for the second quarter was $12.2 million.

- Adjusted EBITDA, a non-GAAP measure, was $7.5 million for Q2

2023, an increase of 78.0% year-over-year.

- Net cash provided by operating activities was $5.5 million

year-to-date as compared to a use of cash of $2.1 million for the

same period in 2022.

- Results for the Company’s consolidated portfolio of

communities:

- Q2 2023 vs. Q2 2022:

- Revenue Per Available Unit (“RevPAR”) increased 9.9% to

$3,300.

- Revenue Per Occupied Unit (“RevPOR”) increased 8.3% to

$3,932.

- Community Net Operating Income, a non-GAAP measure, increased

$2.9 million. Adjusted Community Net Operating Income, a non-GAAP

measure, which excludes $0.4 million and $0.5 million of state

grant revenue received in Q2 2023 and Q2 2022, respectively, was

$13.5 million and $10.6 million for Q2 2023 and Q2 2022,

respectively.

- Community Net Operating Income Margin and Adjusted Community

Net Operating Income Margin (non-GAAP measures with the latter

adjusted for non-recurring state grant revenue) were 23.8% and

23.2%, for Q2 2023, respectively, and were 20.4% and 19.6% for Q2

2022, respectively.

- Q2 2023 vs. Q1 2023:

- RevPAR increased 0.5% to $3,300.

- RevPOR increased 0.6% to $3,932.

- Community Net Operating Income increased $0.2 million. Adjusted

Community Net Operating Income, excluding $0.4 million and $2.0

million of state grant revenue received in Q2 2023 and Q1 2023,

respectively, was $13.1 million and $11.4 million for Q2 2023 and

Q1 2023, respectively.

- Community Net Operating Income Margin and Adjusted Community

Net Operating Income Margin (adjusted for non-recurring state grant

revenue) were 23.8% and 23.2% for Q2 2023, respectively, and 23.7%

and 20.9% for Q1 2023, respectively.

SONIDA SENIOR LIVING,

INC.

SUMMARY OF CONSOLIDATED

FINANCIAL RESULTS

THREE MONTHS ENDED JUNE 30,

2023

(in thousands)

Three Month Ended June

30,

Three Month Ended March

31,

2023

2022

2023

Consolidated results

Resident revenue (1)

$

56,960

$

51,996

$

56,606

Management fees

531

600

505

Operating expenses

44,662

41,510

43,808

General and administrative expenses

6,574

9,439

7,063

Gain (loss) on extinguishment of debt

—

—

36,339

Income (loss) before provision for income

taxes (1)

(12,159

)

(7,410

)

24,214

Net income (loss) (1)

(12,212

)

(7,410

)

24,145

Adjusted EBITDA (1) (2)

7,538

4,236

7,794

Net cash provided by (used in) operating

activities

2,288

(1,380

)

3,249

Community net operating income (NOI)

(2)

13,549

10,642

13,402

Community net operating income margin

(2)

23.8

%

20.4

%

23.7

%

Weighted average occupancy

83.9

%

82.7

%

84.0

%

(1) Includes $0.4 million, $0.5 million,

and $2.0 million of state grant revenue received in Q2 2023, Q2

2022, and Q1 2023, respectively.

(2) Adjusted EBITDA, Community Net

Operating Income, and Community Net Operating Income Margin are

financial measures that are not calculated in accordance with U.S.

Generally Accepted Accounting Principles (“GAAP”). See

“Reconciliation of Non-GAAP Financial Measures” for the Company's

definition of such measures, reconciliations to the most comparable

GAAP financial measures, and other information regarding the use of

the Company's non-GAAP financial measures.

Results of Operations

Three months ended June 30, 2023 as compared to three months

ended June 30, 2022

Revenues

Resident revenue for the three months ended June 30, 2023 was

$57.0 million as compared to $52.0 million for the three months

ended June 30, 2022, an increase of $5.0 million, or 9.5%. The

increase in revenue was primarily due to increased occupancy and

increased average rent rates.

Expenses

Operating expenses for the three months ended June 30, 2023 were

$44.7 million as compared to $41.5 million for the three months

ended June 30, 2022, an increase of $3.2 million, or 7.7%. The

increase is primarily due to a $2.3 million increase in labor and

employee-related expenses and $0.9 million in other expenses.

General and administrative expenses for the three months ended

June 30, 2023 were $6.6 million as compared to $9.4 million for the

three months ended June 30, 2022, representing a decrease of $2.8

million. This decrease is primarily due to a $1.6 million decrease

in stock-based compensation expense from the prior period and a

$1.2 million net decrease in recurring corporate expenses.

The Company reported a net loss of $12.2 million for the three

months ended June 30, 2023, compared to net loss of $7.4 million

for the three months ended June 30, 2022. A major factor impacting

the comparison of net loss for the three months ended June 30, 2023

and June 30, 2022 includes federal grants received of $9.1 million

in Q2 2022.

Adjusted EBITDA for the three months ended June 30, 2023 was

$7.5 million compared to $4.2 million for the three months ended

June 30, 2022. See “Reconciliation of Non-GAAP Financial Measures”

below.

Six months ended June 30, 2023 as compared to six months

ended June 30, 2022

Revenues

Resident revenue for the six months ended June 30, 2023 was

$113.6 million as compared to $102.8 million for the six months

ended June 30, 2022, an increase of $10.8 million, or 10.5%. The

increase in revenue was primarily due to increased occupancy and

increased average rent rates.

Expenses

Operating expenses for the six months ended June 30, 2023 were

$88.5 million as compared to $83.4 million for the six months ended

June 30, 2022, an increase of $5.1 million, or 6.1%. The increase

is primarily due to a $3.6 million increase in labor and

employee-related expenses, a $0.4 million increase in service

contracts, a $0.5 million increase in computer software/internet

costs and $0.6 million increase in other expenses.

General and administrative expenses for the six months ended

June 30, 2023 were $13.6 million as compared to $17.7 million for

the six months ended June 30, 2022, representing a decrease of $4.1

million. This decrease is primarily due to a $2.6 million decrease

in stock-based compensation expense from the prior year period and

a $1.5 million net decrease in recurring corporate expenses.

The Company reported a net income of $11.9 million for the six

months ended June 30, 2023 compared to a net loss of $24.1 million

for the six months ended June 30, 2022, primarily due to the $36.3

million of gain on extinguishment of debt during the three months

ended March 31, 2023.

Significant Transactions

Fannie Mae Loan Modification

On June 29, 2023, the Company entered into a binding forbearance

agreement with the Federal National Mortgage Association (“Fannie

Mae”) and (“Fannie Forbearance”) for all 37 of its encumbered

communities, effective as of June 1, 2023. Under the Fannie

Forbearance, Fannie Mae agreed to forbear on its legal and

equitable remedies otherwise available under the community loan

agreements and mortgages and Master Credit Facility (“MCF”) in

connection with reduced debt service payments made by the Company

during the Fannie Forbearance period, which expires on October 1,

2023. The Fannie Forbearance is the first of a two-step process to

modify all existing mortgage agreements with Fannie Mae under a

proposed loan modification agreement, as defined in the Fannie

Forbearance (“Loan Modification Agreement”). The terms outlined in

the agreed upon term sheet accompanying the Fannie Forbearance will

be included in the proposed subsequent Loan Modification Agreement.

In the second step, the Company and Fannie Mae have agreed to

exercise commercially reasonable efforts to enter into the Loan

Modification Agreement for each of their existing mortgage

agreements before October 1, 2023. The execution of the Loan

Modification Agreement is subject to certain conditions, including

Sonida continuing to perform under the Forbearance Agreement, the

completion of the definitive documentation, and the absence of any

other events of default under the community mortgages and MCF. The

forbearance and subsequent loan modification provide the Company

with additional financial flexibility and increases its liquidity

position.

Under the terms of the Fannie Forbearance and anticipated Loan

Modification Agreement, the mortgage principal payments on 18

community mortgages, ranging from July 2024 to December 2026, will

be extended to December 2026. The remaining 19 communities under

the MCF have existing maturities in December 2028. The Company will

not be required to make scheduled principal payments due under the

18 community mortgages and 19 communities under the MCF through the

revised maturity date of December 2026 and 36 months from June 1,

2023, respectively. The monthly interest rate will be reduced by a

1.5% weighted average on all 37 communities for 12 months.

Ally Loan Amendment

On June 29, 2023 and concurrent with the Fannie Forbearance, the

Company executed a second amendment (“Ally Amendment”) to its

refinance facility (“Ally Term Loan”) and limited payment guaranty

with Ally Bank (“Second Amended and Restated Limited Payment

Guaranty”) with terms that include a waiver of its current $13.0

million liquid assets requirement through June 30, 2024. During the

waiver period (June 30, 2023 through July 1, 2024, the “Waiver

Period”), a new and temporary liquid assets minimum threshold will

be established at $6.0 million and measured weekly. Beginning on

July 1, 2024, a new liquid assets requirement of $7.0 million will

be effective, with such threshold increasing $1.0 million per month

through the earlier of the release of the Waiver Period or December

31, 2024. In addition, the Company must replace its current $2.3

million interest rate cap (“IRC”) on the $88.1 million notional

value of the Ally Term Loan at a 2.25% SOFR strike rate once the

current IRC expires on November 30, 2023. On July 3, the Company

funded the $2.3 million interest rate cap reserve to Ally Bank.

Conversant Equity Commitment

In connection with the Fannie Forbearance and Ally Amendment

signed on June 29, 2023, the Company entered into a $13.5 million

equity commitment agreement (“Equity Commitment”) with Conversant

Dallas Parkway (A) LP and Conversant Dallas Parkway (B) LP,

(together “Conversant”) for a term of 18 months. The Equity

Commitment had a commitment fee of $675,000 payable through the

issuance of 67,500 shares of common stock of the Company. Sonida

shall have the right, but not the obligation, to utilize

Conversant’s equity commitment and may draw on the commitment in

whole or in part. The Company made a $6.0 million equity draw on

July 3, 2023 in exchange for 600,000 shares of common stock of the

Company.

The foregoing description of the Fannie Forbearance, the Ally

Amendment, Second Amended & Restated Limited Payment Guaranty,

and Equity Commitment and related transactions contemplated do not

purport to be complete and are subject to, and qualified in their

entirety by, the full text of the Fannie Forbearance, the Ally

Amendment, Second Amended and Restated Limited Payment Guaranty,

and Equity Commitment which are filed as Exhibits 10.1, 10.2, 10.3

and 10.4, respectively, to the Company’s Form 8-K filed on July 5,

2023, incorporated herein by reference.

Liquidity and Capital

Resources

Cash flows

The table below presents a summary of the Company’s net cash

provided by (used in) operating, investing, and financing

activities (in thousands):

Six months ended June

30,

2023

2022

Net cash provided by (used in) operating

activities

$

5,537

$

(2,070

)

Net cash used in investing activities

(9,355

)

(24,491

)

Net cash used in financing activities

(6,304

)

(19,946

)

Decrease in cash and cash equivalents

$

(10,122

)

$

(46,507

)

In addition to $7.2 million of unrestricted cash on hand as of

June 30, 2023, our future liquidity will depend in part upon our

operating performance, which will be affected by prevailing

economic conditions, including those related to the COVID-19

pandemic, and financial, business and other factors, some of which

are beyond our control. Principal sources of liquidity are expected

to be cash flows from operations, proceeds from debt refinancings

or loan modifications, proceeds from the issuance of common or

preferred stock, COVID-19 or related relief grants from various

state agencies, and/or proceeds from the sale of owned assets. In

June 2023, the Company entered into the Fannie Forbearance, the

Ally Amendment, Second Amended and Restated Limited Payment

Guaranty, and the Equity Agreement, as disclosed above. These

transactions are expected to provide additional financial

flexibility to the Company and increase its liquidity position. In

March 2022, the Company completed the refinancing of certain

existing mortgage debt, which was further amended in December 2022

and June 2023.

The Company has implemented plans, which include strategic and

cash-preservation initiatives, designed to provide the Company with

adequate liquidity to meet its obligations for at least the

12-month period following the date its second quarter 2023

financial statements are issued. While the Company’s plans are

designed to provide it with adequate liquidity to meet its

financial obligations, the remediation plan is dependent on

conditions and matters that may be outside of the Company’s

control, and no assurance can be given that certain options will be

available on terms acceptable to the Company, or at all. If the

Company is unable to successfully execute all of the planned

initiatives or if the plan does not fully mitigate the Company’s

liquidity challenges, the Company’s operating plans and resulting

cash flows along with its cash and cash equivalents and other

sources of liquidity may not be sufficient to fund operations for

the 12-month period following the date the financial statements are

issued.

The Company, from time to time, considers and evaluates

financial and capital raising transactions related to its

portfolio, including debt refinancings and modifications, purchases

and sales of assets and other transactions. There can be no

assurance that the Company will continue to generate cash flows at

or above current levels, or that the Company will be able to obtain

the capital necessary to meet the Company’s short and long-term

capital requirements.

Recent changes in the current economic environment, and other

future changes, could result in decreases in the fair value of

assets, slowing of transactions, and the tightening of liquidity

and credit markets. These impacts could make securing debt or

refinancings for the Company or buyers of the Company’s properties

more difficult or on terms not acceptable to the Company. The

Company’s actual liquidity and capital funding requirements depend

on numerous factors, including its operating results, its capital

expenditures for community investment, and general economic

conditions, as well as other factors described in “Item 1A. Risk

Factors” of our Annual Report on Form 10-K for the fiscal year

ended December 31, 2022, filed with the SEC on March 30, 2023 and

“Item. 1A. Risk Factors” in our Quarterly Report on Form 10-Q for

the quarterly period ended June 30, 2023, filed with the SEC on

August 14, 2023.

Conference Call

Information

The Company will host a conference call with senior management

to discuss the Company’s financial results for the three months

ended June 30, 2023, on Monday August 14, 2023, at 12:30 p.m.

Eastern Time. To participate, dial 877-407-0989 (no passcode

required). A link to the simultaneous webcast of the teleconference

will be available at:

https://www.webcast-eqs.com/register/sonidaseniorliving_q22023_en/en.

For the convenience of the Company’s shareholders and the

public, the conference call will be recorded and available for

replay starting August 15, 2023 through August 29, 2023. To access

the conference call replay, call 877-660-6853, passcode 13740287. A

transcript of the call will be posted in the Investor Relations

section of the Company’s website.

About the Company

Dallas-based Sonida Senior Living, Inc. is a leading

owner-operator of independent living, assisted living and memory

care communities and services for senior adults. As of June 30,

2023, the Company operated 72 communities, with capacity for

approximately 8,000 residents across 18 states, which provide

comfortable, safe, affordable environment where residents can form

friendships, enjoy new experiences and receive personalized care

from dedicated team members who treat them like family. For more

information, visit www.sonidaseniorliving.com or connect with the

Company on Facebook, Twitter or LinkedIn.

Definitions of RevPAR and

RevPOR

RevPAR, or average monthly revenue per available unit, is

defined by the Company as resident revenue for the period, divided

by the weighted average number of available units in the

corresponding portfolio for the period, divided by the number of

months in the period.

RevPOR, or average monthly revenue per occupied unit, is defined

by the Company as resident revenue for the period, divided by the

weighted average number of occupied units in the corresponding

portfolio for the period, divided by the number of months in the

period.

Safe Harbor

This release contains forward-looking statements which are

subject to certain risks and uncertainties that could cause our

actual results and financial condition of Sonida Senior Living,

Inc. (the “Company,” “we,” “our” or “us”) to differ materially from

those indicated in the forward-looking statements, including, among

others, the risks, uncertainties and factors set forth under “Item.

1A. Risk Factors” in our Annual Report on Form 10-K for the fiscal

year ended December 31, 2022, filed with the Securities and

Exchange Commission (the “SEC”) on March 30, 2023 and “Item. 1A.

Risk Factors” in our Quarterly Report on Form 10-Q for the

quarterly period ended June 30, 2023, filed with the SEC on August

14, 2023, and also include the following: the impact of COVID-19,

including the actions taken to prevent or contain the spread of

COVID-19, the transmission of its highly contagious variants and

sub-lineages and the development and availability of vaccinations

and other related treatments, or another epidemic, pandemic or

other health crisis; the Company’s ability to generate sufficient

cash flows from operations, additional proceeds from debt

financings or refinancings, and proceeds from the sale of assets to

satisfy its short- and long-term debt obligations and to make

capital improvements to the Company’s communities; increases in

market interest rates that increase the cost of certain of our debt

obligations; increased competition for, or a shortage of, skilled

workers, including due to the COVID-19 pandemic or general labor

market conditions, along with wage pressures resulting from such

increased competition, low unemployment levels, use of contract

labor, minimum wage increases and/or changes in overtime laws; the

Company’s ability to obtain additional capital on terms acceptable

to it; the Company’s ability to extend or refinance its existing

debt as such debt matures, including the Company’s ability to

complete the modifications to its loan agreements; the Company’s

compliance with its debt agreements, including certain financial

covenants and the risk of cross-default in the event such

non-compliance occurs; the Company’s ability to complete

acquisitions and dispositions upon favorable terms or at all; the

risk of oversupply and increased competition in the markets which

the Company operates; the Company’s ability to improve and maintain

controls over financial reporting and remediate the identified

material weakness discussed in its recent Quarterly and Annual

Reports filed with the SEC; the departure of the Company’s key

officers and personnel; the cost and difficulty of complying with

applicable licensure, legislative oversight, or regulatory changes;

risks associated with current global economic conditions and

general economic factors such as inflation, the consumer price

index, commodity costs, fuel and other energy costs, competition in

the labor market, costs of salaries, wages, benefits, and

insurance, interest rates, and tax rates; and changes in accounting

principles and interpretations.

For information about Sonida Senior Living, visit www.sonidaseniorliving.com

Sonida Senior Living,

Inc.

Condensed Consolidated

Statements of Operations (Unaudited)

(in thousands, except per

share data)

Three Months Ended

June 30,

Six Months Ended

June 30,

2023

2022

2023

2022

Revenues:

Resident revenue

$

56,960

$

51,996

$

113,566

$

102,830

Management fees

531

600

1,036

1,228

Managed community reimbursement

revenue

5,363

7,041

10,325

14,063

Total revenues

62,854

59,637

124,927

118,121

Expenses:

Operating expense

44,662

41,510

88,470

83,439

General and administrative expense

6,574

9,439

13,637

17,712

Depreciation and amortization expense

9,927

9,671

19,808

19,249

Managed community reimbursement

expense

5,363

7,041

10,325

14,063

Total expenses

66,526

67,661

132,240

134,463

Other income (expense):

Interest income

188

2

382

3

Interest expense

(8,558

)

(7,920

)

(17,425

)

(15,523

)

Gain (loss) on extinguishment of debt,

net

—

—

36,339

(641

)

Gain on sale of assets, net

—

—

251

—

Other income (expense), net

(117

)

8,532

(179

)

8,669

Income (loss) before provision for

income taxes

(12,159

)

(7,410

)

12,055

(23,834

)

Provision for income taxes

(53

)

—

(122

)

(254

)

Net income (loss)

(12,212

)

(7,410

)

11,933

(24,088

)

Dividends on Series A convertible

preferred stock

—

(1,134

)

—

(2,267

)

Undeclared dividends on Series A

convertible preferred stock

(1,230

)

—

(2,428

)

—

Undistributed net income allocated to

participating securities

—

—

(1,419

)

—

Net income (loss) attributable to

common stockholders

$

(13,442

)

$

(8,544

)

$

8,086

$

(26,355

)

Weighted average common shares outstanding

— basic

6,381

6,358

6,374

6,350

Weighted average common shares outstanding

— diluted

6,381

6,358

6,856

6,350

Basic net income (loss) per common

share

$

(2.11

)

$

(1.34

)

$

1.27

$

(4.15

)

Diluted net income (loss) per common

share

$

(2.11

)

$

(1.34

)

$

1.18

$

(4.15

)

Sonida Senior Living,

Inc.

Condensed Consolidated Balance

Sheets (Unaudited)

(in thousands, except per

share amounts)

June 30, 2023

December 31,

2022

Assets

Current assets:

Cash and cash equivalents

$

7,203

$

16,913

Restricted cash

13,417

13,829

Accounts receivable, net

7,586

6,114

Prepaid expenses and other assets

5,008

4,099

Derivative assets

1,600

2,611

Total current assets

34,814

43,566

Property and equipment, net

606,069

615,754

Other assets, net

1,226

1,948

Total assets

$

642,109

$

661,268

Liabilities and Equity

Current liabilities:

Accounts payable

$

10,005

$

7,272

Accrued expenses

36,008

36,944

Current portion of notes payable, net of

deferred loan costs

88,636

46,029

Deferred income

4,142

3,419

Federal and state income taxes payable

61

—

Other current liabilities

554

653

Total current liabilities

139,406

94,317

Notes payable, net of deferred loan costs

and current portion

547,381

625,002

Other liabilities

77

113

Total liabilities

686,864

719,432

Commitments and contingencies

Redeemable preferred stock:

Series A convertible preferred stock,

$0.01 par value; 41 shares authorized, 41 shares issued and

outstanding as of June 30, 2023 and December 31, 2022

45,978

43,550

Shareholders’ deficit:

Authorized shares - 15,000 as of June 30,

2023 and December 31, 2022; none issued or outstanding, except

Series A convertible preferred stock as noted above

—

—

Authorized shares - 15,000 as of June 30,

2023 and December 31, 2022; 7,178 and 6,670 shares issued and

outstanding as of June 30, 2023 and December 31, 2022,

respectively

72

67

Additional paid-in capital

294,320

295,277

Retained deficit

(385,125

)

(397,058

)

Total shareholders’ deficit

(90,733

)

(101,714

)

Total liabilities, redeemable preferred

stock and shareholders’ deficit

$

642,109

$

661,268

Sonida Senior Living,

Inc.

Condensed Consolidated

Statements of Cash Flows (Unaudited)

(in thousands)

Six Months Ended June

30,

2023

2022

Cash flows from operating

activities:

Net income (loss)

$

11,933

$

(24,088

)

Adjustments to reconcile net income (loss)

to net cash provided by operating activities:

Depreciation and amortization

19,808

19,249

Amortization of deferred loan costs

788

519

Gain on sale of assets, net

(251

)

—

Write-off of other assets

—

535

Unrealized loss on interest rate cap,

net

1,103

45

(Gain) loss on extinguishment of debt

(36,339

)

641

Provision for bad debt

334

522

Non-cash stock-based compensation

expense

1,503

4,067

Other non-cash items

(1

)

4

Changes in operating assets and

liabilities:

Accounts receivable, net

(1,807

)

(1,387

)

Prepaid expenses and other assets

1,316

700

Other assets, net

294

(301

)

Accounts payable and accrued expense

6,100

(2,524

)

Federal and state income taxes payable

61

(421

)

Deferred income

723

352

Other current liabilities

(28

)

17

Net cash provided by (used in)

operating activities

5,537

(2,070

)

Cash flows from investing

activities:

Acquisition of new communities

—

(12,342

)

Capital expenditures

(9,698

)

(12,149

)

Proceeds from sale of assets

343

—

Net cash used in investing

activities

(9,355

)

(24,491

)

Cash flows from financing

activities:

Proceeds from notes payable

—

80,000

Repayments of notes payable

(5,893

)

(94,247

)

Purchase of common stock

—

(219

)

Dividends paid on Series A convertible

preferred stock

—

(2,985

)

Purchase of interest rate cap

—

(258

)

Deferred loan costs paid

(327

)

(2,180

)

Other financing costs

(84

)

(57

)

Net cash used in financing

activities

(6,304

)

(19,946

)

Decrease in cash and cash equivalents and

restricted cash

(10,122

)

(46,507

)

Cash, cash equivalents, and restricted

cash at beginning of period

30,742

92,876

Cash, cash equivalents, and restricted

cash at end of period

$

20,620

$

46,369

RECONCILIATION OF NON-GAAP FINANCIAL

MEASURES (UNAUDITED)

This earnings release contains the financial measures (1)

Community Net Operating Income and Adjusted Community Net Operating

Income, (2) Community Net Operating Income Margin and Adjusted

Community Net Operating Income Margin, (3) Adjusted EBITDA, (4)

Revenue per Occupied Unit (RevPOR) and (5) Revenue per Available

Unit (RevPAR), all of which are not calculated in accordance with

U.S. GAAP. Presentations of these non-GAAP financial measures are

intended to aid investors in better understanding the factors and

trends affecting the Company’s performance and liquidity. However,

investors should not consider these non-GAAP financial measures as

a substitute for financial measures determined in accordance with

GAAP, including net income (loss), income (loss) from operations,

net cash provided by (used in) operating activities, or revenue.

Investors are cautioned that amounts presented in accordance with

the Company’s definitions of these non-GAAP financial measures may

not be comparable to similar measures disclosed by other companies

because not all companies calculate non-GAAP measures in the same

manner. Investors are urged to review the following reconciliations

of these non-GAAP financial measures from the most comparable

financial measures determined in accordance with GAAP.

Community Net Operating Income and Consolidated Community Net

Operating Income Margin are non-GAAP performance measures for the

Company’s consolidated owned portfolio of communities that the

Company defines as net income (loss) excluding: general and

administrative expenses (inclusive of stock-based compensation

expense), interest income, interest expense, other income/expense,

provision for income taxes, settlement fees and expenses, revenue

and operating expenses from the Company’s disposed properties; and

further adjusted to exclude income/expense associated with

non-cash, non-operational, transactional, or organizational

restructuring items that management does not consider as part of

the Company’s underlying core operating performance and impacts the

comparability of performance between periods. For the periods

presented herein, such other items include depreciation and

amortization expense, gain(loss) on extinguishment of debt,

gain(loss) on disposition of assets, long-lived asset impairment,

and loss on non-recurring settlements with third parties. The

Community Net Operating Income Margin is calculated by dividing

Community Net Operating Income by community resident revenue.

Adjusted Community Net Operating Income and Adjusted Community Net

Operating Income Margin are further adjusted to exclude the impact

from non-recurring state grant funds received.

The Company believes that presentation of Community Net

Operating Income, Community Net Operating Income Margin, Adjusted

Community Net Operating Income, and Adjusted Community Net

Operating Income Margin as performance measures are useful to

investors because (i) they are one of the metrics used by the

Company’s management to evaluate the performance of our core

consolidated owed portfolio of communities, to review the Company’s

comparable historic and prospective core operating performance of

the consolidated owned communities, and to make day-to-day

operating decisions; (ii) they provide an assessment of operational

factors that management can impact in the short-term, namely

revenues and the controllable cost structure of the organization,

by eliminating items related to the Company’s financing and capital

structure and other items that management does not consider as part

of the Company’s underlying core operating performance, and impacts

the comparability of performance between periods.

Community Net Operating Income, Net Community Operating Income

Margin, Adjusted Community Net Operating Income, and Adjusted

Community Net Operating Income Margin have material limitations as

a performance measure, including: (i) excluded general and

administrative expenses are necessary to operate the Company and

oversee its communities; (ii) excluded interest is necessary to

operate the Company’s business under its current financing and

capital structure; (iii) excluded depreciation, amortization, and

impairment charges may represent the wear and tear and/or reduction

in value of the Company’s communities, and other assets and may be

indicative of future needs for capital expenditures; and (iv) the

Company may incur income/expense similar to those for which

adjustments are made, such as gain (loss) on debt extinguishment,

gain(loss) on disposition of assets, loss on settlements, non-cash

stock-based compensation expense, and transaction and other costs,

and such income/expense may significantly affect the Company’s

operating results.

(in thousands)

Three Months Ended

June 30,

Three Months Ended March

31,

2023

2022

2023

Consolidated Community Net Operating

Income

Net income (loss)

$

(12,212

)

$

(7,410

)

$

24,145

General and administrative expenses

6,574

9,439

7,063

Depreciation and amortization expense

9,927

9,671

9,881

Interest income

(188

)

(2

)

(194

)

Interest expense

8,558

7,920

8,867

Gain on extinguishment of debt

—

—

(36,339

)

Gain on sale of assets, net

—

—

(251

)

Other (income) expense (1)

117

(8,532

)

62

Provision for income taxes

53

—

69

Settlement fees and expenses, net (2)

559

39

404

Other taxes

161

(483

)

(305

)

Consolidated community net operating

income

13,549

10,642

13,402

Resident revenue

$

56,960

$

51,996

$

56,606

Consolidated community net operating

income margin

23.8

%

20.4

%

23.7

%

COVID-19 state relief grants (3)

411

524

2,037

Adjusted community net operating

income

$

13,138

$

10,118

$

11,365

Adjusted community net operating income

margin

23.2

%

19.6

%

20.8

%

(1) Includes $9.1 million federal relief

funds received for Q2 2022.

(2) Settlement fees and expenses relate to

non-recurring settlements with third parties for contract

terminations, insurance claims, and related fees.

(3) COVID-19 relief revenue are grants and

other funding received from third parties to aid in the COVID-19

response and includes state relief funds received.

ADJUSTED EBITDA (UNAUDITED)

Adjusted EBITDA is a non-GAAP performance measures that the

Company defines as net income (loss) excluding: depreciation and

amortization expense, interest income, interest expense, other

expense/income, provision for income taxes; and further adjusted to

exclude income/expense associated with non-cash, non-operational,

transactional, or organizational restructuring items that

management does not consider as part of the Company’s underlying

core operating performance and impacts the comparability of

performance between periods. For the periods presented herein, such

other items include stock-based compensation expense, provision for

bad debts, gain (loss) on extinguishment of debt, gain on sale of

assets, long-lived asset impairment, casualty losses, and

transaction and conversion costs.

The Company believes that presentation of Adjusted EBITDA’s

impact as a performance measure is useful to investors because it

provides an assessment of operational factors that management can

impact in the short-term, namely revenues and the controllable cost

structure of the organization, by eliminating items related to the

Company’s financing and capital structure and other items that

management does not consider as part of the Company’s underlying

core operating performance and that management believes impact the

comparability of performance between periods.

Adjusted EBITDA has material limitations as a performance

measure, including: (i) excluded interest is necessary to operate

the Company’s business under its current financing and capital

structure; (ii) excluded depreciation, amortization and impairment

charges may represent the wear and tear and/or reduction in value

of the Company’s communities and other assets and may be indicative

of future needs for capital expenditures; and (iii) the Company may

incur income/expense similar to those for which adjustments are

made, such as bad debts, gain(loss) on sale of assets, or

gain(loss) on debt extinguishment, non-cash stock-based

compensation expense and transaction and other costs, and such

income/expense may significantly affect the Company’s operating

results.

(In thousands)

Three Months Ended

June 30,

Three Months Ended

March 31,

2023

2022

2023

Adjusted EBITDA

Net income (loss)

$

(12,212

)

$

(7,410

)

$

24,145

Depreciation and amortization expense

9,927

9,671

9,881

Stock-based compensation expense

601

2,240

902

Provision for bad debt

96

416

238

Interest income

(188

)

(2

)

(194

)

Interest expense

8,558

7,920

8,867

Gain on extinguishment of debt, net

—

—

(36,339

)

Gain on sale of assets, net

—

—

(251

)

Other (income) expense, net (1)

117

(8,532

)

62

Provision for income taxes

53

—

69

Casualty losses (2)

456

(114

)

—

Transaction and conversion costs (3)

130

47

414

Adjusted EBITDA

$

7,538

$

4,236

$

7,794

(1) Includes COVID-19 relief revenue and

grants received from federal relief funds of $9.1 million for Q2

2022.

(2) Casualty losses relate to

non-recurring insured claims for unexpected events.

(3) Transaction and conversion costs

relate to legal and professional fees incurred for transactions,

restructure projects, or related projects.

SUPPLEMENTAL

INFORMATION

Second Quarter

(Dollars in thousands)

2023

2022

Increase (decrease)

First Quarter 2023

Sequential increase

(decrease)

Selected Operating Results

I. Consolidated community

portfolio

Number of communities

62

62

—

62

—

Unit capacity

5,753

5,774

(21

)

5,749

4

Weighted average occupancy (1)

83.9

%

82.7

%

1.2

%

84.0

%

(0.1

)%

RevPAR

$

3,300

$

3,002

$

298

$

3,282

$

18

RevPOR

$

3,932

$

3,629

$

303

$

3,909

$

23

Consolidated community net operating

income

$

13,549

$

10,642

$

2,907

$

13,402

$

147

Consolidated community net operating

income margin (3)

23.8

%

20.4

%

3.4

%

23.7

%

0.1

%

Consolidated community net operating

income, net of general and administrative expenses (2)

$

7,576

$

3,443

$

4,133

$

7,241

$

335

Consolidated community net operating

income margin, net of general and administrative expenses (2)

13.3

%

6.6

%

6.7

%

12.8

%

0.5

%

II. Consolidated Debt

Information

(Excludes insurance premium

financing)

Total variable rate mortgage debt (4)

$

137,253

$

130,261

N/A

$

137,453

N/A

Total fixed rate debt

$

499,078

$

540,714

N/A

$

500,721

N/A

(1) Weighted average occupancy represents

actual days occupied divided by total number of available days

during the quarter.

(2) General and administrative expenses

exclude stock-based compensation expense in order to remove the

fluctuation in fair value due to market volatility.

(3) Includes $0.4 million, $0.5 million,

and $2.0 million of state grant revenue received in Q2 2023, Q2

2022, and Q1 2023, respectively. Excluding the grant revenue, Q2

2023 consolidated community NOI margin was 23.2%.

(4) As of June 30, 2023, the entire

balance of our outstanding variable-rate debt obligations were

covered by interest rate cap agreements.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230814447134/en/

Investor Contact: Kevin J. Detz, Chief Financial Officer, at

972-308-8343 Press Contact: media@sonidaliving.com.

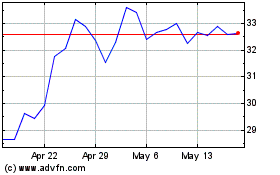

Sonida Senior Living (NYSE:SNDA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Sonida Senior Living (NYSE:SNDA)

Historical Stock Chart

From Apr 2023 to Apr 2024