false

2023-08-10

0001456189

Leatt Corp.

0001456189

2023-08-10

2023-08-10

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

___________________________

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

August 10, 2023

LEATT CORP.

(Exact name of registrant as specified in its charter)

|

Nevada

|

000-54693

|

20-2819367

|

| (State or other jurisdiction |

(Commission |

(IRS Employer |

| of incorporation) |

File Number) |

Identification No.) |

12 Kiepersol Drive, Atlas Gardens, Contermanskloof Road

Durbanville, Western Cape, South Africa

7550

(Address of principal executive offices) (ZIP Code)

Registrant’s telephone number, including area code:

+27-21-557-7257

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbols |

|

Name of each exchange on which registered |

| — |

|

— |

|

— |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b -2 of this chapter).

Emerging growth company ☑

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☑

ITEM 2.02 RESULTS OF OPERATIONS AND FINANCIAL CONDITION

On August 10, 2023, the Company issued a press release announcing its financial results for the quarter ended June 30, 2023. A copy of the press release, which the Company is furnishing to the Securities and Exchange Commission (the "Commission") is attached as Exhibit 99.1 and incorporated by reference herein.

In accordance with General Instruction B.2 of Current Report on Form 8-K, the information contained in this Report and the exhibit attached hereto shall not be deemed to be "filed" for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), or otherwise subject to the liabilities of that section, nor shall such information or such exhibits be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

ITEM 7.01 REGULATION FD DISCLOSURE.

The information set forth in Item 2.02 above is incorporated by reference herein.

ITEM 9.01 FINANCIAL STATEMENTS AND EXHIBITS.

(d) Exhibits.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

LEATT CORPORATION |

| |

|

|

| Dated: August 10, 2023 |

By: |

/s/ Sean Macdonald |

| |

|

Sean Macdonald |

| |

|

Chief Executive Officer and Chief Financial Officer |

EXHIBIT INDEX

Leatt Corp Announces Results for the Second Quarter 2023

CAPE TOWN, South Africa, (August 10 , 2023) - Leatt Corporation (OTCQB: LEAT), a leading developer and marketer of protective equipment and ancillary products for many forms of sports, especially extreme high-velocity sports, today announced financial results for the second quarter ending June 30, 2023. All financial numbers are in U.S. dollars.

Second Quarter 2023 Snapshot

• Global revenues were $12.35 million, down 31%, compared to the second quarter of 2022.

• Gross profit margins increased from 41% to 44% for the first six months of 2023, compared to same period of 2022.

• Net Income was $776,139, down 72%, compared to the second quarter of 2022.

• Helmet sales were $3.52 million, an increase of 48%, compared to the second quarter of 2022.

• Cash and cash equivalents for the first six months increased 69% to $12 million.

• Cash flow generated from operations was $6.82 million for the first six months of 2023.

• Leatt brand momentum continues at consumer level despite constrained industry wide ordering patterns.

• Global shipping and logistic costs continue to stabilize.

Chief Executive Officer, Sean Macdonald commented: "Compared to 2022, the best year in our Company's history, 2023 continues to be challenging for the entire MOTO and MTB industry due largely to post-Covid stocking and sell through dynamics. Although international distribution remains constrained, we are enthusiastic about the momentum that the Leatt brand continues to maintain and expect the early stages of a moderate recovery in domestic consumer sales to continue to appear in results over the next several quarters.

"Total global sales for the second quarter were $12.35 million, a decrease of 31%, compard to the second quarter of 2022. Total global revenues for the first six months of 2023 were $25.43 million, a decrease of 40% compared to the first six months of 2022. Gross profit for the second quarter was $5.34 million. Net income after taxes for the second quarter was $776,139. The sales decreases come in the context of continued temporary distributor and dealer adjustments to ordering patterns as high Covid-era inventory levels continue to be digested and participation remains strong.

"We are particularly enthused by global sales of our helmets featuring our innovative 360 Turbine technology. Overall helmet sales increased by 48% to $3.52 million over last year's second quarter and accounted for 29% of our total revenues for the second quarter of 2023. Our award-winning MTB helmet lineup was our leader, generating a sales revenue increase of 116% led by initial shipments of our highly-anticipated MTB 3.0 helmet designed to reach a wide rider audience of elite and amateur athletes. Additionally, our redesigned MOTO helmets also generated strong demand, with sales volumes increasing by 141%.

"We remain energized by continued growth in consumer and athlete direct sales in the U.S. and moderate improvement in buying activity at the domestic dealer level as inventory is digested. Our leatt.com site activity and consumer purchasing continued to grow during the second quarter, increasing by 11%, and representing 7% of our global revenues year-to-date.

"Other important highlights include our improvements in gross margins from 41% to 44%, year-to-date, as we continue to maintain brand equity; global supply and shipping costs stabilized, and cash and cash equivalents increased from $5 million to $12 million, which we see as a testament to the resilience of our business model."

Financial Summary

Total revenues for the second quarter of 2023 were $12.35 million, down 31%, compared to $ 17.94 million for the second quarter of 2022.

The decrease in global revenues during the 2023 period is attributable to a $4.14 million decrease in body armor sales, a $1.82 million decrease in other products, parts, and accessories sales, and a $0.77 million decrease in neck brace sales, that was partially offset by a $1.15 million increase in helmet sales.

Income from operations for the second quarter of 2023 was $1.31 million, down 65%, compared to $3.73 million for the second quarter of 2022.

Net income for the second quarter of 2023 was $776,139 or $0.13 per basic and $0.12 per diluted share, down 72%, as compared to net income of $ 2.73 million, or $0.47 per basic and $0.44 per diluted share, for the second quarter of 2022.

Leatt continued to meet its working capital needs from cash on hand and internally generated cash flow from operations. At June 30, 2023, the Company had cash and cash equivalents of $12.0 million and a current ratio of 6:1.

Founder and Chairman Dr. Christopher Leatt remarked: "Our design and engineering team continues to focus on innovating products to add to our growing pipeline of exceptional products to reach a much wider audience around the world."

Business Outlook

Mr. Macdonald added: "While industry-wide inventory stocking dynamics continue to delay new orders, we continue to focus heavily on areas that we believe will stimulate growth moving forward.

"We are actively refining and building our multi-channel sales organization in established and emerging markets, building internal and partner-level e-commerce capabilities, and investing in product launch and brand-building campaigns that leverage the tremendous momentum that the Leatt brand has achieved.

"Our international distributors continue to evaluate dealer purchasing patterns and report that Leatt brand momentum remains positive as the riding season gains traction.

"We are looking forward to the launch of some exciting new market segment opportunities and a return to revenue growth as stock is digested and riders continue to participate in outdoor activities around the world.

"We believe that a clear focus on financial resilience and cashflow and our ability to attract and invest in world class industry talent forms the foundation of our strong position to gain market share and deliver strong long term shareholder value moving forward."

Conference Call

The Company will host a conference call at 10:00 am ET on Thursday, August 10, 2023, to discuss the second quarter 2023 results.

Participants should dial in to the call ten minutes before the scheduled time, using the following numbers: 1-877-407-9716 (U.S.A) or +1-201-493-6779 (international) to access the call.

Audio Webcast

There will also be a simultaneous live webcast through the Company's website, www.leatt-corp.com. Participants should register on the website approximately ten minutes prior to the start of the webcast.

Replay

An audio replay of the conference call will be available for seven days and can be accessed by dialing 1-844-512-2921 (U.S.A) or +1-412-317-6671 (international) and using passcode 13740487.

For those unable to attend the call, a recording of the live webcast will be archived shortly following the event for 30 days on the Company's website.

About Leatt Corp

Leatt Corporation develops personal protective equipment and ancillary products for all forms of sports, especially extreme motorsports. The Leatt-Brace® is an award-winning neck brace system considered the gold standard for neck protection for anyone wearing a crash helmet in two-wheeled sports as a form of protection. It was designed for participants in extreme sports or riding motorcycles, bicycles, mountain bicycles, all-terrain vehicles, snowmobiles, and other vehicles. For more information, visit www.leatt.com.

Follow Leatt® on Facebook, Twitter, and Instagram.

Forward-looking Statements

This press release may contain forward-looking statements regarding Leatt Corporation (the "Company") within the meaning of the "safe harbor" provisions of the Private Securities Litigation Reform Act of 1995. All statements, other than statements of historical fact included herein are "forward-looking statements" including statements regarding the likelihood that the Company's double digit revenue growth will continue; the ability of the Company to continue to building its multi-channel sales organization and e-commerce capabilities in the market; the likelihood that the Company will maintain its innovative and cutting-edge pipeline of branded products or leverage this momentum into new market segment opportunities and return revenue growth; the financial outlook of the Company, including the likelihood that customer ordering patterns will stabilize in the near term; the general ability of the Company to achieve its commercial objectives; the business strategy, plans and objectives of the Company and its subsidiaries; and any other statements of non-historical information. These forward-looking statements are often identified by the use of forward-looking terminology such as "believes," "expects," "anticipates," "seeks," "should," "could," "intends," or "projects" or similar expressions, and involve known and unknown risks and uncertainties. These statements are based upon the Company's current expectations and speak only as of the date hereof. Any indication of the merits of a claim does not necessarily mean the claim will prevail at trial or otherwise. Financial performance in one period does not necessarily mean continued or better performance in the future. The Company's actual results in any endeavor may differ materially and adversely from those expressed in any forward-looking statements as a result of various factors and uncertainties, which factors or uncertainties may be beyond our ability to foresee or control. Other risk factors include the status of the Company's common stock as a "penny stock" and those listed in other reports posted on The OTC Markets Group, Inc.

Contact:

Michael Mason

Investor Relations

Investor-info@leatt.com

(917) 841-8371

[FINANCIAL TABLES TO FOLLOW]

LEATT CORPORATION

CONSOLIDATED BALANCE SHEETS

ASSETS

| |

|

June 30, 2023 |

|

|

December 31, 2022 |

|

| |

|

Unaudited |

|

|

Audited |

|

| Current Assets |

|

|

|

|

|

|

| Cash and cash equivalents |

$ |

11,997,597 |

|

$ |

7,102,945 |

|

| Accounts receivable, net |

|

10,349,776 |

|

|

12,839,597 |

|

| Inventory, net |

|

19,158,929 |

|

|

22,805,462 |

|

| Payments in advance |

|

1,042,058 |

|

|

1,047,137 |

|

| Deferred asset, net |

|

292,321 |

|

|

1,016,815 |

|

| Prepaid expenses and other current assets |

|

2,013,106 |

|

|

2,878,112 |

|

| Total current assets |

|

44,853,787 |

|

|

47,690,068 |

|

| |

|

|

|

|

|

|

| Property and equipment, net |

|

3,228,198 |

|

|

3,104,336 |

|

| Operating lease right-of-use assets, net |

|

945,901 |

|

|

1,092,170 |

|

| Other Assets |

|

|

|

|

|

|

| Deposits |

|

39,872 |

|

|

40,796 |

|

| |

|

|

|

|

|

|

| Total Assets |

$ |

49,067,758 |

|

$ |

51,927,370 |

|

| LIABILITIES AND STOCKHOLDERS' EQUITY |

|

| Current Liabilities |

|

|

|

|

|

|

| Accounts payable and accrued expenses |

$ |

5,152,630 |

|

$ |

6,011,390 |

|

| Notes payable, current |

|

110,484 |

|

|

108,398 |

|

| Operating lease liabilities, current |

|

266,057 |

|

|

280,743 |

|

| Deferred compensation, current |

|

- |

|

|

400,000 |

|

| Income taxes payable |

|

1,356,195 |

|

|

3,382,700 |

|

| Short term loan, net of finance charges |

|

291,968 |

|

|

1,030,196 |

|

| Total current liabilities |

|

7,177,334 |

|

|

11,213,427 |

|

| |

|

|

|

|

|

|

| Notes payable, net of current portion |

|

87,740 |

|

|

141,967 |

|

| Operating lease liabilities, net of current portion |

|

679,844 |

|

|

811,427 |

|

| Deferred tax liability, net |

|

66,200 |

|

|

66,200 |

|

| Commitments and contingencies |

|

|

|

|

|

|

| Preferred stock, $.001 par value, 1,120,000 shares |

|

|

|

|

|

|

| authorized, 120,000 shares issued and outstanding |

|

3,000 |

|

|

3,000 |

|

| Common stock, $.001 par value, 28,000,000 shares |

|

|

|

|

|

|

| authorized, 5,971,340 and 5,971,340 shares issued |

|

|

|

|

|

|

| and outstanding |

|

130,309 |

|

|

130,309 |

|

| Additional paid - in capital |

|

10,645,497 |

|

|

10,645,497 |

|

| Accumulated other comprehensive loss |

|

(1,518,212 |

) |

|

(1,081,143 |

) |

| Retained earnings |

|

31,796,046 |

|

|

29,996,686 |

|

| Total stockholders' equity |

|

41,056,640 |

|

|

39,694,349 |

|

| |

|

|

|

|

|

|

| Total Liabilities and Stockholders' Equity |

$ |

49,067,758 |

|

$ |

51,927,370 |

|

The accompanying notes are an integral part of these consolidated financial statements.

LEATT CORPORATION

CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE INCOME

| |

|

Three Months Ended |

|

|

Six Months Ended |

|

| |

|

June 30 |

|

|

June 30 |

|

| |

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

| |

|

Unaudited |

|

|

Unaudited |

|

|

Unaudited |

|

|

Unaudited |

|

| Revenues |

$ |

12,350,224 |

|

$ |

17,938,310 |

|

$ |

25,429,567 |

|

$ |

42,166,418 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Cost of Revenues |

|

7,007,442 |

|

|

10,294,238 |

|

|

14,314,015 |

|

|

24,895,256 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Gross Profit |

|

5,342,782 |

|

|

7,644,072 |

|

|

11,115,552 |

|

|

17,271,162 |

|

| Product Royalty Income |

|

10,248 |

|

|

46,971 |

|

|

23,384 |

|

|

125,810 |

|

| Operating Expenses |

|

|

|

|

|

|

|

|

|

|

|

|

| Salaries and wages |

|

1,228,491 |

|

|

1,325,177 |

|

|

2,469,927 |

|

|

2,623,139 |

|

| Commissions and consulting expenses |

|

110,925 |

|

|

150,634 |

|

|

207,249 |

|

|

313,220 |

|

| Professional fees |

|

111,785 |

|

|

79,653 |

|

|

449,028 |

|

|

338,768 |

|

| Advertising and marketing |

|

863,378 |

|

|

746,114 |

|

|

1,704,472 |

|

|

1,360,004 |

|

| Office lease and expenses |

|

161,572 |

|

|

193,878 |

|

|

311,812 |

|

|

400,899 |

|

| Research and development costs |

|

632,968 |

|

|

480,843 |

|

|

1,217,959 |

|

|

1,014,543 |

|

| Bad debt expense (recovery) |

|

(230,616 |

) |

|

(13,969 |

) |

|

(181,221 |

) |

|

4,355 |

|

| General and administrative expenses |

|

868,595 |

|

|

710,351 |

|

|

1,686,774 |

|

|

1,422,103 |

|

| Depreciation |

|

292,374 |

|

|

287,943 |

|

|

572,184 |

|

|

564,867 |

|

| Total operating expenses |

|

4,039,472 |

|

|

3,960,624 |

|

|

8,438,184 |

|

|

8,041,898 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Income from Operations |

|

1,313,558 |

|

|

3,730,419 |

|

|

2,700,752 |

|

|

9,355,074 |

|

| Other Expenses |

|

|

|

|

|

|

|

|

|

|

|

|

| Interest and other expenses, net |

|

(16,874 |

) |

|

(8,349 |

) |

|

(37,798 |

) |

|

(2,192 |

) |

| Total other expenses |

|

(16,874 |

) |

|

(8,349 |

) |

|

(37,798 |

) |

|

(2,192 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Income Before Income Taxes |

|

1,296,684 |

|

|

3,722,070 |

|

|

2,662,954 |

|

|

9,352,882 |

|

| Income Taxes |

|

520,545 |

|

|

995,150 |

|

|

863,594 |

|

|

2,403,207 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Net Income Available to Common Shareholders |

$ |

776,139 |

|

$ |

2,726,920 |

|

$ |

1,799,360 |

|

$ |

6,949,675 |

|

| Net Income per Common Share |

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

$ |

0.13 |

|

$ |

0.47 |

|

$ |

0.30 |

|

$ |

1.20 |

|

| Diluted |

$ |

0.12 |

|

$ |

0.44 |

|

$ |

0.29 |

|

$ |

1.12 |

|

| Weighted Average Number of Common Shares Outstanding |

|

|

|

|

|

|

|

|

|

|

| Basic |

|

5,971,340 |

|

|

5,815,285 |

|

|

5,971,340 |

|

|

5,790,510 |

|

| Diluted |

|

6,268,520 |

|

|

6,255,537 |

|

|

6,268,520 |

|

|

6,230,763 |

|

| Comprehensive Income |

|

|

|

|

|

|

|

|

|

|

|

|

| Net Income |

$ |

776,139 |

|

$ |

2,726,920 |

|

$ |

1,799,360 |

|

$ |

6,949,675 |

|

| Other comprehensive income, net of $0 deferred income |

|

|

|

|

|

|

|

|

|

|

| taxes in 2023 and 2022 |

|

|

|

|

|

|

|

|

|

|

|

|

| Foreign currency translation |

|

(163,320 |

) |

|

(382,782 |

) |

|

(437,069 |

) |

|

(125,048 |

) |

| Total Comprehensive Income |

$ |

612,819 |

|

$ |

2,344,138 |

|

$ |

1,362,291 |

|

$ |

6,824,627 |

|

The accompanying notes are an integral part of these consolidated financial statements.

LEATT CORPORATION

CONSOLIDATED STATEMENTS OF CASH FLOWS

FOR THE SIX MONTHS ENDED JUNE 30, 2023 AND 2022

| |

|

2023 |

|

|

2022 |

|

| |

|

|

|

|

|

|

| Cash flows from operating activities |

|

|

|

|

|

|

| Net income |

$ |

1,799,360 |

|

$ |

6,949,675 |

|

| Adjustments to reconcile net income to net cash provided by |

|

|

|

|

| operating activities: |

|

|

|

|

|

|

| Depreciation |

|

572,184 |

|

|

564,867 |

|

| Stock-based compensation |

|

- |

|

|

323,010 |

|

| Bad debts reserve |

|

(202,905 |

) |

|

(7,871 |

) |

| Inventory reserve |

|

180,164 |

|

|

94,269 |

|

| Deferred asset allowance |

|

(37,518 |

) |

|

- |

|

| (Gain) loss on sale of property and equipment |

|

12 |

|

|

(22,905 |

) |

| (Increase) decrease in: |

|

|

|

|

|

|

| Accounts receivable |

|

2,692,726 |

|

|

(1,155,162 |

) |

| Deferred asset |

|

762,012 |

|

|

- |

|

| Inventory |

|

3,466,369 |

|

|

(866,061 |

) |

| Payments in advance |

|

5,079 |

|

|

258,974 |

|

| Prepaid expenses and other current assets |

|

865,006 |

|

|

729,338 |

|

| Deposits |

|

924 |

|

|

(7,994 |

) |

| Increase (decrease) in: |

|

|

|

|

|

|

| Accounts payable and accrued expenses |

|

(858,760 |

) |

|

(6,649,900 |

) |

| Income taxes payable |

|

(2,026,505 |

) |

|

703,220 |

|

| Deferred compensation |

|

(400,000 |

) |

|

40,000 |

|

| Net cash provided by operating activities |

|

6,818,148 |

|

|

953,460 |

|

| |

|

|

|

|

|

|

| Cash flows from investing activities |

|

|

|

|

|

|

| Capital expenditures |

|

(265,819 |

) |

|

(435,537 |

) |

| Proceeds from sale of property and equipment |

|

- |

|

|

42,773 |

|

| Increase in short-term investments, net |

|

- |

|

|

(1 |

) |

| Net cash used in investing activities |

|

(265,819 |

) |

|

(392,765 |

) |

| |

|

|

|

|

|

|

| Cash flows from financing activities |

|

|

|

|

|

|

| Issuance of common stock |

|

- |

|

|

255,800 |

|

| Repayment of note payable to bank |

|

(52,141 |

) |

|

(36,146 |

) |

| Repayment of short-term loan, net |

|

(738,228 |

) |

|

(747,845 |

) |

| Net cash used in financing activities |

|

(790,369 |

) |

|

(528,191 |

) |

| |

|

|

|

|

|

|

| Effect of exchange rates on cash and cash equivalents |

|

(867,308 |

) |

|

(105,169 |

) |

| |

|

|

|

|

|

|

| Net increase (decrease) in cash and cash equivalents |

|

4,894,652 |

|

|

(72,665 |

) |

| |

|

|

|

|

|

|

| Cash and cash equivalents - beginning of period |

|

7,102,945 |

|

|

5,022,436 |

|

| |

|

|

|

|

|

|

| Cash and cash equivalents - end of period |

$ |

11,997,597 |

|

$ |

4,949,771 |

|

| |

|

|

|

|

|

|

| SUPPLEMENTAL DISCLOSURE OF CASH FLOW INFORMATION: |

|

| Cash paid for interest |

$ |

42,127 |

|

$ |

30,178 |

|

| Cash paid for income taxes |

$ |

2,846,403 |

|

$ |

1,699,987 |

|

| |

|

|

|

|

|

|

| Other noncash investing and financing activities |

|

|

|

|

|

|

| Common stock issued for services |

$ |

- |

|

$ |

323,010 |

|

The accompanying notes are an integral part of these consolidated financial statements.

v3.23.2

Document and Entity Information Document

|

Aug. 10, 2023 |

| Document Information [Line Items] |

|

| Document Type |

8-K

|

| Document Creation Date |

Aug. 10, 2023

|

| Document Period End Date |

Aug. 10, 2023

|

| Amendment Flag |

false

|

| Entity Registrant Name |

Leatt Corp.

|

| Entity Address, Address Line One |

12 Kiepersol Drive, Atlas Gardens, Contermanskloof Road

|

| Entity Address, City or Town |

Durbanville

|

| Entity Address, Country |

ZA

|

| Entity Address, Postal Zip Code |

7550

|

| Entity Incorporation, State Country Name |

NV

|

| City Area Code |

21

|

| Region code of country |

+27

|

| Local Phone Number |

557-7257

|

| Entity File Number |

000-54693

|

| Entity Central Index Key |

0001456189

|

| Entity Emerging Growth Company |

true

|

| Entity Tax Identification Number |

20-2819367

|

| Entity Ex Transition Period |

true

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe date the document was made available and submitted, in YYYY-MM-DD format. The date of submission, date of acceptance by the recipient, and the document effective date are all potentially different.

| Name: |

dei_DocumentCreationDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

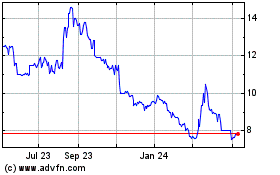

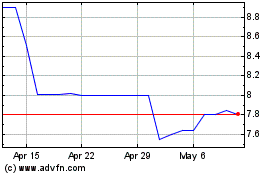

Leatt (QB) (USOTC:LEAT)

Historical Stock Chart

From Mar 2024 to Apr 2024

Leatt (QB) (USOTC:LEAT)

Historical Stock Chart

From Apr 2023 to Apr 2024