PetIQ, Inc. (“PetIQ” or the “Company”) (Nasdaq: PETQ), a leading

pet medication and wellness company, today reported financial

results for the second quarter and six months ended June 30, 2023.

Cord Christensen, PetIQ’s Chairman & CEO commented, “We are

pleased to continue the year with second-quarter sales and adjusted

EBITDA significantly exceeding our guidance. The strategic

investments to drive awareness and consumption across both our

Products and Services segments along with our operational

excellence enabled us to deliver better-than-projected results. We

outperformed the broader categories we compete in and gained share

across PetIQ’s strategic, manufactured brands. We had record cash

generation in the quarter and substantially improved the Company’s

net leverage year-over-year. Based on these

year-to-date results and our expectations for the second half of

2023, we are raising our annual outlook.”

Second Quarter 2023 Highlights Compared to Prior Year

Period

- Record net sales of $314.5 million, an increase of 24.8%, and

above the Company’s guidance for the quarter of $270.0 million to

$280.0 million

- Products segment net sales of $278.2 million compared to $219.0

million, an increase of 27.0%

- Services segment net revenues of $36.4 million compared to

$33.0 million, an increase of 10.2%

- Gross profit was $73.9 million, an increase of 19.2%, compared

to $62.0 million

- Net income of $9.6 million, or earnings per diluted share

("EPS") of $0.32, an increase of 104.2%, compared to net income of

$4.7 million, or EPS of $0.16

- Adjusted net income of $13.4 million, or adjusted EPS of $0.46,

an increase of 39.4% compared to adjusted net income of $9.8

million, or adjusted EPS of $0.33

- EBITDA of $29.2 million, compared to $19.6 million, an increase

of 49.2%

- Record quarterly adjusted EBITDA of $32.9 million, compared to

$24.1 million, an increase of 36.3% and above the Company's

guidance for the quarter of $24.0 million to $26.0 million

- Adjusted EBITDA margin increased 80 basis points to 10.4%

- Record second quarter cash from operations of $57.7

million

- Net leverage as measured under the Company's credit agreement

was 3.6x as of June 30, 2023, compared to 5.0x

Six Month 2023 Highlights Compared to

Prior Year Period

- Net sales of $605.0 million, an increase of 14.6%

- Products segment net sales of $537.2 million compared to $466.8

million, an increase of 15.1%

- Services segment net revenues of $67.9 million compared to

$60.9 million, an increase of 11.3%

- Gross profit was $136.1 million, an increase of 13.8%, compared

to $119.6 million

- Net income of $19.3 million, or EPS of $0.66, an increase of

147.6%, compared to net income of $7.8 million, or EPS of

$0.26

- Adjusted net income of $27.6 million, or adjusted EPS of $0.95,

an increase of 39.7% compared to adjusted net income of $19.9

million, or adjusted EPS of $0.68

- EBITDA of $56.0 million, compared to $37.2 million, an increase

of 50.5%

- Adjusted EBITDA of $63.6 million, compared to $48.5 million, an

increase of 31.0%

- Adjusted EBITDA margin increased 130 basis points to 10.5%

Second Quarter 2023 Financial Results

Net sales were $314.5 million for the second quarter of 2023, an

increase of 24.8% compared to net sales of $252.0 million in the

prior year period, driven by an increase in sales from both the

Products and Services segments. Products segment net sales of

$278.2 million increased 27.0% compared to the prior year period

reflecting broad-based growth across product categories and sales

channels as well as from the previously announced acquisition of

Rocco & Roxie LLC ("Rocco & Roxie") completed on January

13, 2023. The Company experienced continued strength across flea

and tick and health and wellness product offerings with favorable

consumption trends and a significant recovery in distributed

product offerings. PetIQ’s manufactured products net sales

increased 21.2% (including the acquisition of Rocco & Roxie)

and were 29.1% of Product segment net sales compared to 31.2% in

the prior year period. Services revenue for the second quarter of

2023 increased 10.2% to $36.4 million driven by operational

improvements that allowed for increases in average revenue per

clinic and average dollar per pet served during the second quarter

of 2023.

Second quarter 2023 gross profit was $73.9 million, an increase

of 19.2%, compared to $62.0 million in the prior year period. Gross

margin decreased 110 basis points to 23.5% from 24.6% in the prior

year period due to a shift in the mix of Product segment sales to

more health and wellness products which carry a lower margin.

Selling, general and administrative expenses (“SG&A”) was

$55.2 million for the second quarter of 2023 compared to $50.6

million in the prior year period. As a percentage of net sales,

SG&A was 17.5% for the second quarter of 2023, a decrease of

260 basis points compared to the prior year period. Adjusted

SG&A was $51.5 million for the second quarter of 2023 compared

to $46.1 million in the prior year period. As a percentage of net

sales adjusted SG&A was 16.4%, a decrease of 190 basis points

compared to the prior year period. The leverage in SG&A and

adjusted SG&A was primarily due to continued leverage of costs

and increased business expense efficiencies relative to the growth

in sales, partially offset by increased advertising and promotional

expense as compared to the second quarter of 2022.

Second quarter 2023 net income increased 104.2% to $9.6 million

and EPS was $0.32, compared to net income of $4.7 million and EPS

of $0.16 in the prior year period. Adjusted net income for the

second quarter of 2023 increased 36.4% to $13.4 million and

adjusted EPS was $0.46, compared to adjusted net income of $9.8

million, and adjusted EPS of $0.33 in the prior year period.

EBITDA was $29.2 million for the second quarter of 2023 compared

to $19.6 million in the prior year period, an increase of 49.2%.

Second quarter Adjusted EBITDA was $32.9 million, an increase of

36.3%, compared to $24.1 million in the prior year period and above

the Company's guidance of $24.0 million to $26.0 million. Adjusted

EBITDA margin increased 80 basis points to 10.4% compared to 9.6%

in the prior year period.

Adjusted SG&A, adjusted net income, adjusted EPS, adjusted

EBITDA, and adjusted EBITDA margin are non-GAAP financial measures.

The Company believes these non-GAAP financial measures provide

investors with additional insight into the way management views

reportable segment operations. See “Non-GAAP Financial Measures”

for a definition of these measures and the financial tables that

accompany this release for a reconciliation to the most comparable

GAAP measure.

Cash Flow and Balance Sheet

The Company ended the second quarter of 2023 with total cash and

cash equivalents of $78.4 million. For the second quarter ended

June 30, 2023, the Company generated a record $57.7 million of cash

from operations which was driven by increased earnings as well as

$34.2 million from working capital benefits. The Company’s total

debt, which is comprised of its term loan, ABL, convertible notes

and capital leases, was $449.6 million as of June 30, 2023. The

Company had total liquidity, which it defines as cash on hand plus

debt availability, of $203.4 million as of June 30, 2023. The

Company's net leverage as measured under the Company's credit

agreement was 3.6x as of June 30, 2023, down from 5.0x in the prior

year period, driven by higher earnings and improved working

capital. Please refer to the financial table within this press

release for a calculation of the Company’s net leverage under the

credit agreement.

Outlook

For the full year 2023 the Company is raising its outlook

previously provided, and now expects:

- Net sales of $1,010 million to $1,050 million, an increase of

approximately 12.0% compared to 2022 based on the mid-point of the

guidance

- Adjusted EBITDA of $93 million to $97 million, an increase of

approximately 22.0% compared to 2022 based on the mid-point of the

guidance

For the third quarter of 2023 the Company expects:

- Net sales of $220 million to $240 million, an increase of

approximately 10.0% compared to the prior year period based on the

mid-point of the guidance

- Adjusted EBITDA of $18 million to $20 million, an increase of

approximately 17.0% compared to the prior year period based on the

mid-point of the guidance

The Company does not provide guidance for net income, the most

directly comparable GAAP measure to Adjusted EBITDA, and similarly

cannot provide a reconciliation between its forecasted adjusted

EBITDA and net income without unreasonable effort due to the

unavailability of reliable estimates for certain components of net

income and the respective reconciliations. These forecasted items

are not within the Company’s control, may vary greatly between

periods and could significantly impact future financial results for

the third quarter ending September 30, 2023, and full year ending

December 31, 2023.

Conference Call and Webcast

The Company will host a conference call with members of the

executive management team to discuss these results. The conference

call is scheduled to begin today at 4:30 p.m. ET. To participate on

the live call listeners in North America may dial 833-816-1410 and

international listeners may dial 412-317-0503.

In addition, the call will be broadcast live over the Internet

hosted at the “Investors” section of the Company's website at

www.PetIQ.com. A telephonic playback will be available through

August 29, 2023. North American listeners may dial 844-512-2921 and

international listeners may dial 412-317-6671; the passcode is

10180442.

About PetIQ

PetIQ is a leading pet medication and wellness company

delivering a smarter way for pet parents to help their pets live

their best lives through convenient access to affordable veterinary

products and services. The Company engages with customers through

more than 60,000 points of distribution across retail and

e-commerce channels with its branded and distributed medications as

well as health and wellness items, which are further supported by

its world-class medications manufacturing facility in Omaha,

Nebraska and health and wellness manufacturing facility in

Springville, Utah. The Company’s national service platform operates

in over 2,600 retail partner locations in 41 states providing cost

effective and convenient veterinary wellness services. PetIQ

believes that pets are an important part of the family and deserve

the best products and care we can give them.

Investors: katie.turner@petiq.com or

208.513.1513

Media: kara.schafer@petiq.com or

407.929.6727

Forward Looking Statements

This press release contains forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of 1995

that involve risks and uncertainties, such as statements about our

plans, objectives, expectations, assumptions or future events. In

some cases, you can identify forward-looking statements by

terminology such as “anticipate,” “estimate,” “plan,” “project,”

“continuing,” “ongoing,” “expect,” “believe,” “intend,” “may,”

“will,” “should,” “could” and similar expressions. Forward-looking

statements involve estimates, assumptions, known and unknown risks,

uncertainties and other factors that could cause actual results to

differ materially from any future results, performances, or

achievements expressed or implied by the forward-looking

statements. Forward-looking statements should not be read as a

guarantee of future performance or results and will not necessarily

be accurate indications of the times at, or by, which such

performance or results will be achieved. Forward-looking statements

are based on information available at the time those statements are

made or management's good faith belief as of that time with respect

to future events and are subject to risks and uncertainties that

could cause actual performance or results to differ materially from

those expressed in or suggested by the forward-looking statements.

Important factors that could cause such differences include, but

are not limited to, general economic or market conditions, global

economic slowdown, increased inflation, rising interest rates,

recent and potential future bank failures and the impacts of

COVID-19; our ability to successfully grow our business through

acquisitions and our ability to integrate acquisitions, including

Rocco & Roxie; our dependency on a limited number of customers;

our ability to implement our growth strategy effectively; our

ability to manage our manufacturing and supply chain effectively;

disruptions in our manufacturing and distribution chains;

competition from veterinarians and others in our industry;

reputational damage to our brands; economic trends and spending on

pets; the effectiveness of our marketing and trade promotion

programs; recalls or withdrawals of our products or product

liability claims; our ability to introduce new products and improve

existing products; our ability to protect our intellectual

property; costs associated with governmental regulation; our

ability to keep and retain key employees; our ability to sustain

profitability; and the risks set forth under the “Risk Factors”

section of our Annual Report on Form 10-K for the year ended

December 31, 2022 and other reports filed time to time with the

Securities and Exchange Commission. Additional risks and

uncertainties not currently known to us or that we currently deem

to be immaterial may materially adversely affect our business,

financial condition or operating results. The forward-looking

statements speak only as of the date on which they are made, and,

except as required by law, we undertake no obligation to update any

forward-looking statement to reflect events or circumstances after

the date on which the statement is made or to reflect the

occurrence of unanticipated events. In addition, we cannot assess

the impact of each factor on our business or the extent to which

any factor, or combination of factors, may cause actual results to

differ materially from those contained in any forward-looking

statements. Consequently, you should not place undue reliance on

forward-looking statements.

Non-GAAP Financial Measures

In addition to financial results reported in accordance with

U.S. GAAP, PetIQ uses the following non-GAAP financial measures:

adjusted net income, adjusted earnings per share, adjusted

SG&A, adjusted EBITDA, and adjusted EBITDA margin.

Adjusted net income consists of net income adjusted for tax

expense, acquisition expenses, integration costs, litigation costs,

and stock-based compensation expense. Adjusted net income is

utilized by management to evaluate the effectiveness of our

business strategies. Non-GAAP adjusted earnings per share is

defined as non-GAAP adjusted net income divided by the weighted

average number of shares of common stock outstanding during the

period.

Adjusted SG&A consists of SG&A adjusted for acquisition

expenses, stock-based compensation expense, integration costs, and

litigation expense.

EBITDA represents net income before interest, income taxes, and

depreciation and amortization. Adjusted EBITDA represents EBITDA

plus adjustments for transactions that management does not believe

are representative of our core ongoing business including

acquisition costs, stock-based compensation expense, and

integration costs. Adjusted EBITDA margin is adjusted EBITDA stated

as a percentage of net sales.

Adjusted EBITDA is utilized by management as a factor in

evaluating the Company's performance and the effectiveness of our

business strategies. The Company presents EBITDA because it is a

necessary component for computing adjusted EBITDA.

We believe that the use of these non-GAAP measures provides

additional tools for investors to use in evaluating ongoing

operating results and trends. In addition, you should be aware when

evaluating these non-GAAP measures that in the future we may incur

expenses similar to those excluded when calculating these measures.

Our presentation of these measures should not be construed as an

inference that our future results will be unaffected by these or

other unusual or non-recurring items. Our computation of non-GAAP

measures may not be comparable to other similarly titled measures

computed by other companies, because all companies do not calculate

these non-GAAP measures in the same manner. Our management does

not, and you should not, consider the non-GAAP financial measures

in isolation or as an alternative to financial measures determined

in accordance with GAAP. The principal limitation of non-GAAP

financial measures is that they exclude significant expenses and

income that are required by GAAP to be recorded in our financial

statements. See a reconciliation of each non-GAAP measure to the

most comparable GAAP measure, in the financial tables that

accompany this release.

PetIQ, Inc.Condensed

Consolidated Balance Sheets(Unaudited, in 000’s

except for per share amounts)

| |

|

June 30, 2023 |

|

December 31, 2022 |

| Current assets |

|

|

|

|

|

Cash and cash equivalents |

|

$ |

78,437 |

|

|

$ |

101,265 |

|

|

Accounts receivable, net |

|

|

193,570 |

|

|

|

118,004 |

|

|

Inventories |

|

|

141,647 |

|

|

|

142,605 |

|

|

Other current assets |

|

|

8,788 |

|

|

|

8,238 |

|

|

Total current assets |

|

|

422,442 |

|

|

|

370,112 |

|

|

Property, plant and equipment, net |

|

|

69,776 |

|

|

|

73,395 |

|

|

Operating lease right of use assets |

|

|

15,440 |

|

|

|

18,231 |

|

|

Other non-current assets |

|

|

2,426 |

|

|

|

1,373 |

|

|

Intangible assets, net |

|

|

169,182 |

|

|

|

172,479 |

|

|

Goodwill |

|

|

204,204 |

|

|

|

183,306 |

|

|

Total assets |

|

$ |

883,470 |

|

|

$ |

818,896 |

|

|

Liabilities and equity |

|

|

|

|

|

Current liabilities |

|

|

|

|

|

Accounts payable |

|

$ |

154,141 |

|

|

$ |

112,995 |

|

|

Accrued wages payable |

|

|

11,826 |

|

|

|

11,512 |

|

|

Accrued interest payable |

|

|

1,465 |

|

|

|

1,912 |

|

|

Other accrued expenses |

|

|

9,909 |

|

|

|

7,725 |

|

|

Current portion of operating leases |

|

|

6,211 |

|

|

|

6,595 |

|

|

Current portion of long-term debt and finance leases |

|

|

8,152 |

|

|

|

8,751 |

|

|

Total current liabilities |

|

|

191,704 |

|

|

|

149,490 |

|

|

Operating leases, less current installments |

|

|

9,957 |

|

|

|

12,405 |

|

|

Long-term debt, less current installments |

|

|

440,582 |

|

|

|

443,276 |

|

|

Finance leases, less current installments |

|

|

837 |

|

|

|

907 |

|

|

Other non-current liabilities |

|

|

4,787 |

|

|

|

1,025 |

|

|

Total non-current liabilities |

|

|

456,163 |

|

|

|

457,613 |

|

|

Equity |

|

|

|

|

|

Additional paid-in capital |

|

|

383,020 |

|

|

|

378,709 |

|

|

Class A common stock, par value $0.001 per share, 125,000 shares

authorized; 29,551 and 29,348 shares issued, respectively |

|

|

29 |

|

|

|

29 |

|

|

Class B common stock, par value $0.001 per share, 8,402 shares

authorized; 244 and 252 shares issued and outstanding,

respectively |

|

|

— |

|

|

|

— |

|

|

Class A treasury stock, at cost, 373 shares |

|

|

(3,857 |

) |

|

|

(3,857 |

) |

|

Accumulated deficit |

|

|

(143,566 |

) |

|

|

(162,733 |

) |

|

Accumulated other comprehensive loss |

|

|

(1,990 |

) |

|

|

(2,224 |

) |

|

Total stockholders' equity |

|

|

233,636 |

|

|

|

209,924 |

|

|

Non-controlling interest |

|

|

1,967 |

|

|

|

1,869 |

|

|

Total equity |

|

|

235,603 |

|

|

|

211,793 |

|

|

Total liabilities and equity |

|

$ |

883,470 |

|

|

$ |

818,896 |

|

PetIQ, Inc. Condensed

Consolidated Statements of Operations (Unaudited,

in 000’s, except for per share amounts)

| |

|

For the Three Months Ended |

|

For the Six Months Ended |

| |

|

June 30, 2023 |

|

June 30, 2022 |

|

June 30, 2023 |

June 30, 2022 |

| |

|

|

|

|

|

|

|

|

Product sales |

|

$ |

278,167 |

|

|

$ |

219,014 |

|

|

$ |

537,160 |

|

$ |

466,764 |

|

|

Services revenue |

|

|

36,380 |

|

|

|

33,000 |

|

|

|

67,858 |

|

|

60,945 |

|

|

Total net sales |

|

|

314,547 |

|

|

|

252,014 |

|

|

|

605,018 |

|

|

527,709 |

|

| Cost of products sold |

|

|

210,428 |

|

|

|

163,568 |

|

|

|

411,330 |

|

|

354,419 |

|

| Cost of

services |

|

|

30,240 |

|

|

|

26,472 |

|

|

|

57,549 |

|

|

53,681 |

|

|

Total cost of sales |

|

|

240,668 |

|

|

|

190,040 |

|

|

|

468,879 |

|

|

408,100 |

|

|

Gross profit |

|

|

73,879 |

|

|

|

61,974 |

|

|

|

136,139 |

|

|

119,609 |

|

| Operating expenses |

|

|

|

|

|

|

|

|

Selling, general and administrative expenses |

|

|

55,159 |

|

|

|

50,595 |

|

|

|

98,486 |

|

|

98,831 |

|

|

Operating income |

|

|

18,720 |

|

|

|

11,379 |

|

|

|

37,653 |

|

|

20,778 |

|

|

Interest expense, net |

|

|

8,824 |

|

|

|

6,299 |

|

|

|

17,556 |

|

|

12,420 |

|

|

Other expense (income), net |

|

|

151 |

|

|

|

(201 |

) |

|

|

123 |

|

|

(204 |

) |

|

Total other expense, net |

|

|

8,975 |

|

|

|

6,098 |

|

|

|

17,679 |

|

|

12,216 |

|

|

Pretax net income |

|

|

9,745 |

|

|

|

5,281 |

|

|

|

19,974 |

|

|

8,562 |

|

|

Income tax expense |

|

|

(192 |

) |

|

|

(603 |

) |

|

|

(640 |

) |

|

(724 |

) |

|

Net income |

|

|

9,553 |

|

|

|

4,678 |

|

|

|

19,334 |

|

|

7,838 |

|

|

Net income attributable to non-controlling interest |

|

|

85 |

|

|

|

46 |

|

|

|

167 |

|

|

75 |

|

|

Net income attributable to PetIQ, Inc. |

|

$ |

9,468 |

|

|

$ |

4,632 |

|

|

$ |

19,167 |

|

$ |

7,763 |

|

|

Net income per share attributable to PetIQ, Inc. Class A

common stock |

|

|

|

|

|

|

|

|

Basic |

|

$ |

0.32 |

|

|

$ |

0.16 |

|

|

$ |

0.66 |

|

$ |

0.27 |

|

|

Diluted |

|

$ |

0.32 |

|

|

$ |

0.16 |

|

|

$ |

0.66 |

|

$ |

0.26 |

|

| Weighted Average

shares of Class A common stock outstanding |

|

|

|

|

|

|

|

|

Basic |

|

|

29,136 |

|

|

|

29,283 |

|

|

|

29,083 |

|

|

29,223 |

|

|

Diluted |

|

|

29,373 |

|

|

|

29,329 |

|

|

|

29,218 |

|

|

29,304 |

|

PetIQ, Inc.Condensed

Consolidated Statements of Cash Flows(Unaudited,

in 000’s)

| |

|

For the Six Months Ended June 30, |

|

|

|

|

2023 |

|

|

|

2022 |

|

| Cash flows from operating

activities |

|

|

|

|

|

Net income |

|

$ |

19,334 |

|

|

$ |

7,838 |

|

|

Adjustments to reconcile net income to net cash provided by (used

in) operating activities |

|

|

|

|

|

Depreciation and amortization of intangible assets and loan

fees |

|

|

19,769 |

|

|

|

17,660 |

|

|

Stock based compensation expense |

|

|

5,208 |

|

|

|

6,666 |

|

|

Other non-cash activity |

|

|

(135 |

) |

|

|

48 |

|

|

Changes in assets and liabilities, net of business acquisition |

|

|

|

|

|

Accounts receivable |

|

|

(74,468 |

) |

|

|

(54,969 |

) |

|

Inventories |

|

|

2,901 |

|

|

|

(63,771 |

) |

|

Other assets |

|

|

(481 |

) |

|

|

(409 |

) |

|

Accounts payable |

|

|

40,320 |

|

|

|

26,481 |

|

|

Accrued wages payable |

|

|

252 |

|

|

|

(2,359 |

) |

|

Other accrued expenses |

|

|

1,703 |

|

|

|

(2,569 |

) |

|

Net cash provided by (used in) operating activities |

|

|

14,403 |

|

|

|

(65,384 |

) |

|

Cash flows from investing activities |

|

|

|

|

|

Business acquisition (net of cash acquired) |

|

|

(27,634 |

) |

|

|

— |

|

|

Purchase of property, plant, and equipment |

|

|

(4,128 |

) |

|

|

(8,026 |

) |

|

Investment in subsidiary undertaking |

|

|

— |

|

|

|

— |

|

|

Net cash used in investing activities |

|

|

(31,762 |

) |

|

|

(8,026 |

) |

|

Cash flows from financing activities |

|

|

|

|

|

Proceeds from issuance of long-term debt |

|

|

35,000 |

|

|

|

44,000 |

|

|

Principal payments on long-term debt |

|

|

(38,800 |

) |

|

|

(42,800 |

) |

|

Principal payments on finance lease obligations |

|

|

(801 |

) |

|

|

(744 |

) |

|

Tax withholding payments on Restricted Stock Units |

|

|

(969 |

) |

|

|

(865 |

) |

|

Exercise of options to purchase Class A common stock |

|

|

— |

|

|

|

115 |

|

|

Net cash used in financing activities |

|

|

(5,570 |

) |

|

|

(294 |

) |

|

Net change in cash and cash equivalents |

|

|

(22,929 |

) |

|

|

(73,704 |

) |

| Effect of exchange rate

changes on cash and cash equivalents |

|

|

101 |

|

|

|

(306 |

) |

| Cash

and cash equivalents, beginning of period |

|

|

101,265 |

|

|

|

79,406 |

|

|

Cash and cash equivalents, end of period |

|

$ |

78,437 |

|

|

$ |

5,396 |

|

PetIQ, Inc.Summary

Segment Results(Unaudited, in 000’s)

| |

|

For the Three Months Ended |

|

For the Six Months Ended |

|

$'s in 000's |

|

June 30, 2023 |

|

June 30, 2022 |

|

June 30, 2023 |

|

June 30, 2022 |

|

Products segment sales |

|

$ |

278,167 |

|

$ |

219,014 |

|

$ |

537,160 |

|

$ |

466,764 |

| Services segment revenue: |

|

|

|

|

|

|

|

|

|

Same-store sales |

|

|

33,633 |

|

|

28,264 |

|

|

62,161 |

|

|

48,989 |

|

Non same-store sales |

|

|

2,747 |

|

|

4,736 |

|

|

5,697 |

|

|

11,956 |

|

Total services segment revenue |

|

$ |

36,380 |

|

$ |

33,000 |

|

$ |

67,858 |

|

$ |

60,945 |

|

Total net sales |

|

$ |

314,547 |

|

$ |

252,014 |

|

$ |

605,018 |

|

$ |

527,709 |

PetIQ,

Inc.Reconciliation between Selling, General &

Administrative (“SG&A”) and Adjusted

SG&A(Unaudited, in 000’s)

| |

|

For the Three Months Ended |

|

For the Six Months Ended |

|

$'s in 000's |

|

June 30, 2023 |

|

June 30, 2022 |

|

June 30, 2023 |

|

June 30, 2022 |

|

SG&A |

|

$ |

55,159 |

|

|

$ |

50,595 |

|

|

$ |

98,486 |

|

|

$ |

98,831 |

|

| % of Sales |

|

|

17.5 |

% |

|

|

20.1 |

% |

|

|

16.3 |

% |

|

|

18.7 |

% |

| Less: |

|

|

|

|

|

|

|

|

|

Acquisition costs(1) |

|

|

297 |

|

|

|

156 |

|

|

|

835 |

|

|

|

156 |

|

|

Stock based compensation expense |

|

|

2,743 |

|

|

|

2,843 |

|

|

|

5,208 |

|

|

|

6,666 |

|

|

Integration costs(2) |

|

|

618 |

|

|

|

404 |

|

|

|

1,594 |

|

|

|

743 |

|

|

Litigation expenses |

|

|

— |

|

|

|

1,141 |

|

|

|

— |

|

|

|

3,802 |

|

| Adjusted SG&A(3) |

|

$ |

51,501 |

|

|

$ |

46,051 |

|

|

$ |

90,849 |

|

|

$ |

87,464 |

|

| % of Sales |

|

|

16.4 |

% |

|

|

18.3 |

% |

|

|

15.2 |

% |

|

|

17.0 |

% |

PetIQ,

Inc.Reconciliation between Net Income and Adjusted

EBITDA(Unaudited, in 000’s)

| |

|

For the Three Months Ended |

|

For the Six Months Ended |

|

$'s in 000's |

|

June 30, 2023 |

|

June 30, 2022 |

|

June 30, 2023 |

|

June 30, 2022 |

|

Net income |

|

$ |

9,553 |

|

|

$ |

4,678 |

|

|

$ |

19,334 |

|

|

$ |

7,838 |

|

| Plus: |

|

|

|

|

|

|

|

|

|

Tax expense |

|

|

192 |

|

|

|

603 |

|

|

|

640 |

|

|

|

724 |

|

|

Depreciation |

|

|

4,164 |

|

|

|

3,515 |

|

|

|

7,685 |

|

|

|

7,197 |

|

|

Amortization |

|

|

6,477 |

|

|

|

4,477 |

|

|

|

10,739 |

|

|

|

9,000 |

|

|

Interest expense, net |

|

|

8,824 |

|

|

|

6,299 |

|

|

|

17,556 |

|

|

|

12,420 |

|

| EBITDA |

|

$ |

29,210 |

|

|

$ |

19,572 |

|

|

$ |

55,954 |

|

|

$ |

37,179 |

|

|

Acquisition costs(1) |

|

|

297 |

|

|

|

156 |

|

|

|

835 |

|

|

|

156 |

|

|

Stock based compensation expense |

|

|

2,743 |

|

|

|

2,843 |

|

|

|

5,208 |

|

|

|

6,666 |

|

|

Integration costs(2) |

|

|

618 |

|

|

|

404 |

|

|

|

1,594 |

|

|

|

743 |

|

|

Litigation expenses |

|

|

— |

|

|

|

1,141 |

|

|

|

— |

|

|

|

3,802 |

|

| Adjusted EBITDA(3) |

|

$ |

32,868 |

|

|

$ |

24,116 |

|

|

$ |

63,591 |

|

|

$ |

48,546 |

|

| Adjusted EBITDA Margin |

|

|

10.4 |

% |

|

|

9.6 |

% |

|

|

10.5 |

% |

|

|

9.2 |

% |

PetIQ,

Inc.Reconciliation between Net Income and Adjusted

Net Income(Unaudited, in 000’s, except for per

share amounts)

| |

|

For the Three Months Ended |

|

For the Six Months Ended |

|

$'s in 000's |

|

June 30, 2023 |

|

June 30, 2022 |

|

June 30, 2023 |

|

June 30, 2022 |

|

Net income |

|

$ |

9,553 |

|

$ |

4,678 |

|

$ |

19,334 |

|

$ |

7,838 |

| Plus: |

|

|

|

|

|

|

|

|

|

Tax expense |

|

|

192 |

|

|

603 |

|

|

640 |

|

|

724 |

|

Acquisition costs(1) |

|

|

297 |

|

|

156 |

|

|

835 |

|

|

156 |

|

Stock based compensation expense |

|

|

2,743 |

|

|

2,843 |

|

|

5,208 |

|

|

6,666 |

|

Integration costs(2) |

|

|

618 |

|

|

404 |

|

|

1,594 |

|

|

743 |

|

Litigation expenses |

|

|

— |

|

|

1,141 |

|

|

— |

|

|

3,802 |

| Adjusted Net income(3) |

|

$ |

13,403 |

|

$ |

9,825 |

|

$ |

27,611 |

|

$ |

19,929 |

| |

|

|

|

|

|

|

|

|

| Non-GAAP adjusted EPS |

|

|

|

|

|

|

|

|

| Basic |

|

$ |

0.46 |

|

$ |

0.34 |

|

$ |

0.95 |

|

$ |

0.68 |

| Diluted |

|

$ |

0.46 |

|

$ |

0.33 |

|

$ |

0.95 |

|

$ |

0.68 |

| Weighted Average

shares of Class A common stock outstanding used to compute non-GAAP

adjusted EPS |

| Basic |

|

|

29,136 |

|

|

29,283 |

|

|

29,083 |

|

|

29,223 |

| Diluted |

|

|

29,373 |

|

|

29,329 |

|

|

29,218 |

|

|

29,304 |

(1) Acquisition costs include legal, accounting, banking,

consulting, diligence, and other costs related to completed and

contemplated acquisitions.

(2) Integration costs represent costs related to integrating the

acquired businesses including personnel costs such as severance and

retention bonuses, consulting costs, contract termination costs,

and IT conversion costs. The costs are primarily within the

Products segment.

(3) Effective December 31, 2022, the Company no longer includes

non same-store operating results related to the Services segment

wellness centers with less than six full quarters of operating

results, and pre-opening expenses, as an adjustment to its

calculation of its non-GAAP financial measures. As a result, the

following non-GAAP measures have been recast for comparability to

remove non same-store operating results for the three and six

months ended June 30, 2022 as follows:

- Adjusted SG&A - $2.0 and

$4.5 million, respectively

- Adjusted net income - $5.2 and

$12.4 million, respectively

- Adjusted EBITDA - $3.5 and

$10.6 million, respectively

PetIQ, Inc.

Calculation of Net Leverage Ratio Under

Term Loan B(Unaudited, in 000’s, except for

multiples)

| |

June 30, 2023 |

|

Total debt |

$ |

447,849 |

|

| Total Capital Leases |

|

1,722 |

|

| Less Cash |

|

(78,437 |

) |

| Net Debt |

|

371,134 |

|

| LTM Term Loan B Adjusted

EBITDA(1) |

|

102,777 |

|

| Term Loan B net leverage |

3.6x |

(1) Our Term Loan B documentation defines Adjusted EBITDA as net

income before interest, income taxes, depreciation and amortization

and a non-cash goodwill impairment charge, as further adjusted for

acquisition costs, loss on debt extinguishment and related costs,

stock based compensation expense, integration costs, litigation

expenses, and non same-store net income (loss), which we refer to

as “Term Loan B Adjusted EBITDA.” Term Loan B Adjusted EBITDA is

not a non-GAAP measure and is presented solely for purposes of

providing investors an understanding of the Company’s financial

condition and liquidity and should not be relied upon for any

purposes other than an understanding of the Company’s financial

condition and liquidity as it relates to the Company’s Term Loan

B

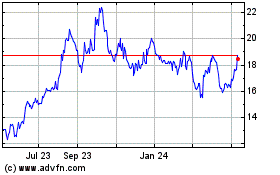

PetIQ (NASDAQ:PETQ)

Historical Stock Chart

From Mar 2024 to Apr 2024

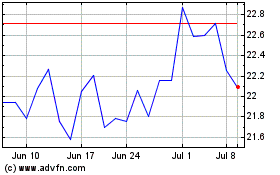

PetIQ (NASDAQ:PETQ)

Historical Stock Chart

From Apr 2023 to Apr 2024