0000798287

false

0000798287

2023-07-07

2023-07-07

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The Securities

Exchange Act of 1934

Date of report (Date of earliest event

reported): July

7, 2023

PAM TRANSPORTATION SERVICES, INC.

(Exact name of registrant as specified in its charter)

| Delaware |

|

0-15057 |

|

71-0633135 |

| (State or other jurisdiction of incorporation) |

|

(Commission File Number) |

|

(I.R.S. Employer Identification No.) |

297 West Henri De Tonti, Tontitown, Arkansas

72770

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including

area code: (479) 361-9111

| |

N/A |

|

| |

(Former name or former address, if changed since last report) |

|

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| o |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| o |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| o |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| o |

Pre-commencement communications pursuant to Rule 13c-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

| Common Stock, $.01 par value |

PTSI |

NASDAQ Global Market |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company o

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

| Item 5.02 | Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers;

Compensatory Arrangements of Certain Officers. |

Employment Agreement with Lance K. Stewart

On July 7, 2023, P.A.M. Transportation Services,

Inc. (the “Company”) entered into a new employment agreement (the “Employment Agreement”) with its Vice President

of Finance, Chief Financial Officer and Treasurer, Lance K. Stewart. The Employment Agreement, which is effective immediately, updates

and replaces the Company’s previous employment agreement with Mr. Stewart entered into prior to his appointment as Chief Financial

Officer of the Company. Under the terms of the Employment Agreement, Mr. Stewart will receive an annual base salary of $378,560 for his

service as Chief Financial Officer. Mr. Stewart’s performance will be reviewed annually for any changes in base salary and eligibility

for a performance bonus.

Pursuant to the Employment Agreement, the Company

may terminate Mr. Stewart’s employment at any time with or without cause. If his employment is terminated by the Company without

“just cause” (as defined in the Employment Agreement), Mr. Stewart will be entitled to receive his base salary for a period

of four months following such termination, provided that Mr. Stewart signs a separation agreement with the Company. The Employment Agreement

also provides Mr. Stewart the right to terminate his employment with the Company upon four months’ prior written notice to the Company.

However, the Company has the right to terminate Mr. Stewart’s employment immediately upon receipt of such notice. In the event of

such termination, Mr. Stewart is entitled to receive his base salary for the four-month period following the Company’s receipt of

his notice of termination. Mr. Stewart’s employment with the Company will be terminated upon his death and may be terminated by

the Company upon his disability. Upon termination due to disability, Mr. Stewart will continue to receive his compensation for a period

of three months after the date of disability, along with any residual bonus earned but not yet paid.

Under the Employment Agreement, Mr. Stewart is

subject to certain covenants with respect to non-solicitation of business that is competitive with the Company’s business or that

of certain affiliated companies under common ownership with the Company and non-solicitation of employees of the Company and the specified

affiliates for a period of 24 months following the termination of Mr. Stewart’s employment with the Company. If Mr. Stewart is terminated

by the Company without “just cause” (as defined in the Employment Agreement), the covenant not to compete will be for a period

of four months following his termination of employment but may be extended by the Company to up to one year. If the Company extends the

covenant not to compete to one year, the Company must extend Mr. Stewart’s base salary payments for the same one-year period. Mr.

Stewart has also agreed to maintain the confidentiality of the Company’s proprietary information.

The foregoing description of the terms and conditions

of the Employment Agreement does not purport to be complete and is qualified in its entirety by the full text of the Employment Agreement,

which is attached hereto as Exhibit 10.1 and is incorporated by reference herein.

Separation and Consulting Agreement with Allen

W. West

On July 10, 2023, the Company entered into a Separation

and Consulting Agreement (the “Separation and Consulting Agreement”), dated as of July 7, 2023, with the Company’s former

Chief Financial Officer, Allen W. West, who resigned from the Company effective June 8, 2023.

Under the terms of the Separation and Consulting

Agreement, Mr. West has agreed to make himself available to advise senior management and consult with the Company as reasonably requested

by the Company from time to time for a one-year period for a monthly consulting fee of $35,771.67. In recognition of his contributions

to the Company, and in consideration of the covenants contained in the agreement and the accompanying release, Mr. West will receive a

cash bonus in the aggregate amount of $1,250,000, payable in five equal semi-annual installments beginning six months after the agreement

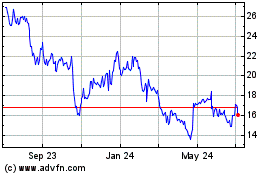

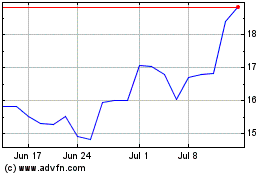

becomes effective. The Company has also agreed to repurchase the shares of Company common stock owned by Mr. West (excluding his unvested

restricted shares of common stock which were forfeited upon his resignation) at a price per share equal to the closing market price of

the Company’s common stock on the effective date of the Separation and Consulting Agreement.

The foregoing payments and benefits are subject

to Mr. West having not revoked a customary release of claims in favor of the Company and his compliance with terms and conditions of the

Separation and Consulting Agreement. The Separation and Consulting Agreement will be effective upon expiration of a customary seven-day

revocation period set forth in the accompanying release agreement.

Pursuant to the Separation and Consulting Agreement,

Mr. West will remain subject to certain covenants similar to those contained in his employment agreement with the Company, dated March

7, 2019, with respect to the confidentiality of the Company’s proprietary information and the non-solicitation of employees or business

that is competitive with the Company’s business or that of certain affiliated companies under common ownership with the Company

for a 12-month period following the effective date of his resignation from the Company. The Separation and Consulting Agreement also contains

customary cooperation and mutual non-disparagement provisions.

The foregoing description of the terms and conditions

of the Separation and Consulting Agreement does not purport to be complete and is qualified in its entirety by reference to the full text

of the Separation and Consulting Agreement, including the accompanying release agreement, a copy of which is attached hereto as Exhibit

10.2 and is incorporated by reference herein.

| Item 9.01 |

Financial Statements and Exhibits. |

(d) Exhibits.

SIGNATURES

Pursuant to

the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the

undersigned, hereunto duly authorized.

| |

|

P.A.M. TRANSPORTATION SERVICES, INC. |

| |

|

(Registrant) |

| |

|

|

| Date: July 13,

2023 |

By: |

/s/ Joseph A. Vitiritto |

| |

|

Joseph A. Vitiritto

President and Chief Executive Officer |

Exhibit 10.1

EMPLOYMENT AGREEMENT

This Agreement (“Agreement”)

is entered into as of July 7, 2023, by and between PAM Transportation Services, Inc. ("COMPANY") and Lance Stewart (“EMPLOYEE”),

and the parties therefore agree as follows:

Subject to the terms and conditions

contained in this Agreement and during the Term of this Agreement (as defined below), COMPANY hereby employs EMPLOYEE in the position

of Chief Financial Officer with such duties and responsibilities as are commensurate with such office and may from time-to-time be assigned

to EMPLOYEE by COMPANY.

EMPLOYEE hereby accepts such

employment as a full time employee, and while employed, shall devote his or her full business time, skills, energy and attention to the

business of COMPANY, shall perform his or her duties in a diligent, loyal, businesslike and efficient manner, all for the sole purpose

of enhancing the business of COMPANY, and in a manner consistent with all COMPANY policies, resolutions and directives from time to time

stated or made by the COMPANY. Moreover, EMPLOYEE shall perform such services and duties as are consistent with EMPLOYEE’s position,

are necessary or appropriate for the operation and management of COMPANY, and as are normally expected of persons appointed to executive

positions in the business in which COMPANY is engaged.

1. Compensation

for Services.

COMPANY shall pay to EMPLOYEE

an annual base salary of $378,560.00 (“Base Salary”) as COMPANY’s Chief Financial Officer.

Base Salary shall be payable

in equal installments pursuant to COMPANY’s payroll system in effect from time to time, less all applicable taxes required to be

withheld by COMPANY pursuant to federal, state or local law.

EMPLOYEE will be reviewed

annually for changes in Base Salary and eligibility for a performance bonus, if any.

2. Benefits.

EMPLOYEE shall be entitled

to fringe benefits provided by COMPANY for its employees in the normal course of business.

3. Business

Expenses.

COMPANY shall reimburse EMPLOYEE

for all reasonable and necessary business expenses incurred by EMPLOYEE in the performance of his or her duties hereunder with respect

to travel, entertainment and other business expenses, subject to COMPANY’s business expense policies in effect from time to time,

including its procedures with respect to the manner of incurring, reporting and documenting such expenses.

4. Proprietary

Information

a. EMPLOYEE

shall forever hold in the strictest confidence and not disclose to any person, firm, corporation or other entity any of COMPANY’s

Proprietary Information (as defined below) or any of COMPANY’s Records (as defined below) except as such disclosure may be required

in connection with EMPLOYEE’s work for COMPANY and as expressly authorized by COMPANY in writing.

b. For

the purposes of this Agreement, the term “Proprietary Information” shall mean intercompany publications, unpublished works,

plans, policies, computer and information systems, software and other information and knowledge relating or pertaining to the products,

services, sales or other business of COMPANY or its successor, affiliates and customers in any way which is of a confidential or proprietary

nature, the prices it obtains or has obtained from the sale of its services, its manner of operation, its plans, processes or other data,

contracts, information about contracts, contract forms, business applications, costs, profits, tax information, marketing information,

advertising methods, customers, potential customers, brokers, potential brokers, employees, matters of a technical nature (including inventions,

computer programs, concepts, developments, contributions, devices, discoveries, software and documentations, secret processes or machines,

including any improvements thereto and know-how related thereto, and research projects, etc.), and other information not generally available

to the public, without regard to whether all of the foregoing matters will be deemed confidential, material or important. Anything to

the contrary notwithstanding, the parties hereto stipulate that any and all knowledge, data and information gathered by EMPLOYEE through

this Agreement, his/her employment with COMPANY and the operation of the business of COMPANY is deemed important, material or confidential,

and gravely affects the effective and successful conduct of the business of COMPANY and COMPANY 's good will; could not without great

expense and difficulty be obtained or duplicated by others who have not been able to acquire such information by virtue of employment

with COMPANY; and that any breach of the terms of this Paragraph 4 shall be deemed a material breach of this Agreement.

c. EMPLOYEE

agrees that all creative work, including without limitation, designs, drawings, specifications, techniques, models, processes and software

prepared or originated by EMPLOYEE during or within the scope of employment whether or not subject to protection under the federal copyright

or other law constitutes work made for hire all rights to which are owned by COMPANY. Moreover, EMPLOYEE hereby assigns to COMPANY all

right, title and interest whether by way of copyright, trade secret, patent or otherwise, and all such work whether or not subject to

protection by copyright or other law.

d. Upon

termination of employment with COMPANY or at any other time requested by COMPANY, EMPLOYEE shall immediately return to COMPANY and not

retain any copies of, any records, data, lists, plans, policies, publications, computer and information systems, files, diagrams and documentation,

data, papers, drawings, memos, customer records, reports, correspondence, note books, service listing and any other business record of

any kind or nature (including without limitation records in machine-readable or computer-readable forms) relating to Proprietary Information

(“Records”).

e. EMPLOYEE

acknowledges that, to the extent COMPANY derives independent economic value from any of its Proprietary Information and takes reasonable

measures to maintain its secrecy, such Proprietary Information will be considered a trade secret under applicable law. EMPLOYEE further

acknowledges that under the Defend Trade Secrets Act of 2016, an individual may not be held criminally or civilly liable under any federal

or state trade secret law for the disclosure of a trade secret that: (1) is made (i) in confidence to a federal, state, or local government

official, either directly or indirectly, or to an attorney; and (ii) solely for the purpose of reporting or investigating a suspected

violation of law; or (2) is made in a complaint or other document that is filed under seal in a lawsuit or other proceeding. EMPLOYEE

further acknowledges that an individual who files a lawsuit for retaliation by an employer for reporting a suspected violation of law

may disclose the employer's trade secrets to the attorney and use the trade secret information in the court proceeding if the individual:

(1) files any document containing the trade secret under seal; and (2) does not disclose the trade secret, except pursuant to court order.

5. Covenant

Not To Solicit / Not To Compete:

a. As a material part of the consideration

for this Agreement, EMPLOYEE agrees for a twenty-four (24) month period following the termination of EMPLOYEE's employment with COMPANY

for any reason; EMPLOYEE agrees that he or she will not, either solely or jointly with, or as manager or agent for, any person, corporation,

trust, joint venture, partnership, or other business entity, directly or indirectly, approach or solicit for business, accept business

from, divert business from, or otherwise interfere with any COMPANY or Affiliated Companies relationship with, any person or entity (or

legal successor to such person or entity) that Employee had any direct contact with while employed by the COMPANY and that: (a) has been

a customer of COMPANY or any of the Affiliated Companies at any time within the six (6) month period prior to EMPLOYEE’s termination;

or (b) to whom COMPANY or one of the Affiliated Companies had made a proposal within the six (6) month period prior to EMPLOYEE’s

termination. In the event EMPLOYEE is terminated pursuant to Section 8 subsection (d) the Covenant Not to Compete will be for a period

of four (4) months unless COMPANY elects the option to extend the Covenant Not To Compete up to one (1) year provided the separation agreement

in Section 8 subsection (d) provides for compensation up to one (1) year. Anything contrary notwithstanding, this Paragraph 5 shall survive

after the termination or the earlier cancellation of this Agreement.

b. Both

parties agree that the restrictions in this section are fair and reasonable in all respects including the length of time that they shall

remain in effect and that COMPANY’s employment of EMPLOYEE upon the terms and conditions of this Agreement is fully sufficient consideration

for EMPLOYEE's obligations under this section.

c. If

any provisions of this section are ever held by a Court to be unreasonable, the parties agree that this section shall be enforced to the

extent it is deemed to be reasonable.

6. No

Interference With Employment Relationships

EMPLOYEE agrees that,

during his or her employment, and for a period of twenty-four (24) months after his/her employment has terminated, for any reason, EMPLOYEE

will not, directly or indirectly, solicit for employment, hire, or offer employment to, or otherwise aid or assist any person or entity

other than COMPANY, in soliciting for employment, hiring, or offering employment to: (a) any employee of COMPANY, Affiliated Companies,

or any independent contractor engaged by COMPANY or Affiliated Companies; or (b) any former employee or independent contractor of COMPANY

or Affiliated Companies who was employed, or engaged, by COMPANY or Affiliated Companies within six (6) months before or after the cessation

of EMPLOYEE’s employment. In the event EMPLOYEE hires an employee of COMPANY, COMPANY shall be compensated at a fee equal to 30%

of the EMPLOYEE's first year's gross compensation. This paragraph 6 also applies to employees of companies on Exhibit A.

7. Equitable

Relief And Remedies At Law

EMPLOYEE acknowledges that

COMPANY would suffer unique and irreparable injury in the event of a breach of the covenants contained in Sections 4, 5 and 6 of this

Agreement, which breach could not be adequately compensated by the payment of damages alone. Accordingly in the event of any such breach

by EMPLOYEE, EMPLOYEE agrees that this Agreement may be enforced by a decree of specific performance or an injunction without the necessity

of posting a bond in addition to any remedies available at law, including damages arising out of or relating to a breach of those covenants,

and that any remedy which COMPANY might have at law would be inadequate by itself.

8. Termination

of Agreement

a. Without

limitation of any other remedy available to COMPANY, whether in law or in equity, EMPLOYEE’s employment relationship shall terminate

immediately without any further liability of COMPANY to EMPLOYEE, upon written notice from COMPANY to EMPLOYEE, for Just Cause. For purpose

of this Agreement, “Just Cause” means: conviction of a crime, moral turpitude, gross negligence in the performance of duties,

intentional failure to perform duties, failure to perform duties as designated in this agreement, insubordination or dishonesty. In the

event of EMPLOYEE’s termination pursuant to this Section 8(a), COMPANY shall have no obligation to pay Base Salary, bonuses, or

benefits after date the employment relationship is terminated.

b. EMPLOYEE’s

employment relationship shall terminate immediately upon death of EMPLOYEE.

c. EMPLOYEE

agrees to submit to a medical examination at any time at COMPANY's request and expense. The medical examination will be related to EMPLOYEE's

job and consistent with a business necessity of COMPANY. This Agreement may be terminated by COMPANY immediately upon written notice to

EMPLOYEE if the examination reveals that EMPLOYEE is unable to perform the essential functions of this Agreement even with a reasonable

accommodation. The Agreement may also be terminated if, for a period of three (3) consecutive months, EMPLOYEE is unable to perform the

essential functions of the Agreement even with a reasonable accommodation. Upon such termination due to medical disability, EMPLOYEE's

compensation shall be continued for three (3) months from the date of disability. In addition, EMPLOYEE will receive any residual bonus

earned but not paid. Residual bonus to be paid in normal course of business

d. Upon

the determination by COMPANY that the best interests of COMPANY would be served, COMPANY shall have the further right to terminate EMPLOYEE’s

employment relationship immediately or at any time, at its option upon written notice to EMPLOYEE, without Just Cause. If EMPLOYEE is

terminated pursuant to this Section 8(d), EMPLOYEE shall be entitled to receive only Base Salary for a period of four (4) months following

such termination, provided that EMPLOYEE signs the provided Separation Agreement (similar to the attached separation agreement). If COMPANY

elects to extend the Covenant Not To Compete up to one (1) year they agree to extend Base Salary up to one (1) year. These payments shall

not constitute employment for purpose of Section 5.

e. Any

compensation payable to EMPLOYEE pursuant to this Section 8 following termination pursuant to subsection (d) of this Section 8 shall be

reduced by the amount of any compensation earned by EMPLOYEE in any employment or consulting he/she may undertake during said period that

constitutes a violation of Section 7 respecting non-competition.

f. Upon

four (4) months’ prior written notice to COMPANY at any time, EMPLOYEE shall have the right to terminate his/her employment relationship

with COMPANY at his/her option. Upon receipt of such notice, COMPANY shall have the option to terminate EMPLOYEE’s employment relationship

immediately upon written notice to EMPLOYEE. In the event of termination pursuant to this Section 8(f), EMPLOYEE shall be entitled to

receive Base Salary only through the four (4) month period following EMPLOYEE’s notice of termination. The time period on the covenant

not to compete shall commence at the end of the four (4) month period, and EMPLOYEE shall also be bound by the covenant not to compete

during the four (4) month period he/she is receiving Base Salary. EMPLOYEE shall be liable for all costs and expenses incurred by COMPANY

for the failure to give four (4) months' notice.

g. Upon

termination of this Agreement by COMPANY, EMPLOYEE shall, without a claim for compensation, provide COMPANY with written resignations

from any and all offices held by his/her in or at the request of COMPANY, and in the event of his/her failure to do so, COMPANY is hereby

irrevocably authorized to be, or designated as EMPLOYEE’s attorney in fact, to act in his/her name and in his/her behalf to execute

such resignations.

9. No

Restriction on Performance of Services Contemplated by Agreement

EMPLOYEE represents and warrants

to COMPANY that: (i) EMPLOYEE is under no contractual or other restriction which would give a third party a legal right to assert

that EMPLOYEE would not be legally permitted to perform the services contemplated by this Agreement; and (ii) by entering into this

Agreement EMPLOYEE has not breached, and by performing the services contemplated by this Agreement, shall not breach, any Agreement or

duty relating to proprietary information of another person or entity. It shall be considered cause for termination under Section 8(a)

if the EMPLOYEE is under a contractual or other restriction which prevents the EMPLOYEE from performing services upon which they are hired

to perform.

10. Severability

In case any one or more of

the provisions hereof shall be held to be invalid, illegal or unenforceable, such invalidity, illegality or unenforceability shall not

affect any other provision of this Agreement, but this Agreement shall be construed as if such invalid, illegal or unenforceable provision

had never been contained herein. To the extent possible, there shall be deemed substituted such other provision as will most nearly accomplish

the intent of the parties, to the extent permitted by applicable law.

11. Entire

Agreement

This Agreement embodies all

the representations, warranties, covenants and agreements of the parties in relation to the subject matter hereof, and no representations,

warranties, covenants, understandings, or agreements, unless expressly set forth herein or in an instrument in writing signed by the party

to be bound thereby which makes reference to this Agreement, shall be considered effective.

12. No

Rights in Third Parties

Nothing herein expressed or

implied is intended to, or shall be construed to confer upon, or give to any person, firm or other entity other than the parties hereto

any rights or remedies under this Agreement, except as provided in Section 14.

13. Assignment

COMPANY may assign its rights

and delegate its responsibilities under this Agreement to any affiliated company or to any corporation which acquires all or substantially

all of the operating assets of COMPANY by merger, consolidation, dissolution, liquidation, combination, sale or transfer of assets or

stock or otherwise. EMPLOYEE shall not be entitled to assign his or her rights or delegate his or her responsibilities under this Agreement

to any person.

14. Payment

to Estate

No person, firm or entity

shall have any right to receive any payments owing to EMPLOYEE hereunder, except that EMPLOYEE’s estate shall be entitled to receive

a final payment of installment of Base Salary for services rendered to COMPANY through date of death, reimbursement for any business expenses

previously incurred by EMPLOYEE for which he or she would have been entitled to reimbursement hereunder, and any residual bonus earned

but not paid. Any residual bonus shall be paid in normal course of business.

15. Amendment

No modification or amendment

of this Agreement shall be binding unless executed in writing by each of the parties hereto.

16. Survival

of Covenants

Without limitation of any

other provisions of this Agreement, all representations and warranties set forth in this Agreement and the covenants set forth in Sections

4, 5 and 6 shall survive the termination of this Agreement for any reason for the maximum period permitted by law.

17. Governing

Law

This Agreement shall be governed

by and construed in accordance with the internal laws (and not the law of conflicts) of the State of Michigan. The parties agree that

should any litigation arise out of, in connection with, or relating to this Agreement, such litigation will be commenced in a the Circuit

Court for Macomb County Michigan or in the United States District Court for the Eastern District of Michigan provided such court has subject

matter jurisdiction and venue.

18. Notices.

Service of all notices under

this Agreement must be given personally to the party involved at the address set forth below or at such other address as such party shall

provide in writing from time to time.

| COMPANY: |

PAM

Transportation Services, Inc. |

|

| |

297 Henri de Tonti Blvd. |

|

| |

Tontitown, AR 72770 |

|

| |

|

|

| |

|

|

| EMPLOYEE: |

Lance Stewart |

Lance

Stewart |

| |

[ ] |

297 W. Henri de Tonti Blvd. |

| |

[ ] |

Tontitown, AR 72770 |

| |

(existing address) |

(principal executive

offices) |

19. Section

Headings

The titles to the Sections

of this Agreement are for convenience of the parties only and shall not affect in any way the meaning or construction of any Section of

this Agreement.

20. Non-Waiver.

No covenant or condition of

this Agreement may be waived except by the written consent of COMPANY. Forbearance or indulgence by COMPANY in any regard whatsoever shall

not constitute a waiver of the covenants or conditions to be performed by EMPLOYEE to which the same may apply, and, until complete performance

by EMPLOYEE of said covenant or condition, COMPANY shall be entitled to invoke any remedy available to COMPANY under this Agreement or

by law or in equity, despite said forbearance or indulgence.

21. Construction

Although this Agreement was

drafted by COMPANY, the parties agree that it accurately reflects the intent and understanding of each party and should not be construed

against COMPANY if there is any dispute over the meaning or intent of any provisions.

IN WITNESS WHEREOF, the parties

hereto have caused this Agreement to be duly executed and delivered as of the day and year first above written.

| |

|

PAM TRANSPORTATION SERVICES,

INC. |

| |

|

|

| |

|

|

| |

|

|

| Tyler Majors |

By: |

/s/ Joseph A. Vitiritto |

| [Witness] |

|

Joseph Vitritto, President & CEO |

| |

|

|

| |

|

|

| /s/ Holly Wright |

|

/s/ Lance K. Stewart |

| [Witness] |

|

Lance Stewart – Chief Financial Officer

|

| |

|

[ ] |

| |

|

[ ] |

| |

|

|

| |

|

|

| |

|

|

EXHIBIT A

| | 1. | Central Transport, LLC. |

| | 2. | Universal Logistics Holdings Inc. |

| 3. | Conlan Tire Co LLC |

| 4. | P.A.M. Transport, Inc. |

| 5. | This will include all entities under common ownership to the above companies and/or their successors. |

Exhibit 10.2

SEPARATION AND CONSULTING AGREEMENT

THIS SEPARATION AND CONSULTING

AGREEMENT (this “Agreement”) is entered into as of July 7, 2023, by and between P.A.M. Transportation Services, Inc.

and its subsidiaries (collectively, the “Company”), and Allen W. West (“Executive”) (collectively,

the “Parties”).

WHEREAS, Executive has been

employed by the Company for over twenty-five (25) years and most recently served as its Vice President of Finance, Chief Financial Officer,

Secretary and Treasurer;

WHEREAS, Executive previously

notified the Company of his intention to resign from the Company effective June 8, 2023, in accordance with the terms of that certain

Employment Agreement dated as of January 1, 2019 by and between P.A.M. Transport, Inc. and Executive (the “Employment Agreement”);

WHEREAS, to facilitate a smooth

and orderly transition in the management of the Company, Executive agrees to make himself available to provide services to the Company

on the terms and conditions set forth herein; and

WHEREAS, Executive desires

to sell to the Company his vested shares of common stock of P.A.M. Transportation Services, Inc. (“PTSI”), and the

Company desires to purchase such shares from Executive;

NOW, THEREFORE, in consideration

of the mutual covenants and promises contained herein, the parties hereto, each intending to be legally bound hereby, agree as follows:

1.

Resignation.

1.1

Resignation from Positions. Executive’s resignation from employment with the Company is effective as of 11:59 p.m.,

Central Standard Time, on June 8, 2023 (such date, the “Resignation Date”). Such resignation from employment with the

Company includes Executive’s voluntary resignation from the positions of Vice President of Finance, Chief Financial Officer, Secretary

and Treasurer of the Company and all other officer, employee, director and manager positions held by Executive with the Company.

1.2 Release Agreement. The effectiveness of this Agreement is subject to Executive’s signing and not revoking the Release

Agreement substantially in the form attached hereto as Exhibit A (the “Release Agreement”). No payments or benefits

under this Agreement shall be paid or provided to Executive unless the Release Agreement is effective and has not been revoked during

the Revocation Period (as defined therein) in accordance with the preceding sentence, and this Agreement shall become effective upon the

expiration of such Revocation Period (the “Effective Date”).

2.

Transition.

2.1

Consulting Period and Services. Commencing on the Effective Date and ending on the first anniversary thereof (the “Consulting

Period”), Executive shall make himself available to advise senior management and otherwise consult with the Company as reasonably

requested by the Company from time to time (the “Consulting Services”); provided that the Consulting Services shall

not exceed twenty percent (20%) of the average level of services that Executive performed during the 36-month period prior to the Resignation

Date. The Company shall not control the manner or means by which Executive performs the Consulting Services, and Executive’s provision

of the Consulting Services to the Company shall be non-exclusive. Executive may determine at his discretion the specific times during

which he is available, provided that Executive shall be available within a reasonable timeframe and shall reasonably cooperate with the

Company with respect to any litigation or other dispute relating to any matter in which Executive was involved or had knowledge during

his employment with the Company. Any expenses associated with travel to locations outside Benton or Washington County shall be reimbursed

by the Company.

2.2

Consulting Fees. In exchange for the Consulting Services, subject to Section 1.2 above, commencing on the Effective Date,

the Company agrees to pay Executive a monthly fee of $35,771.67 (the “Monthly Fee”) during the Consulting Period for

a total fee of $429,260.04. Except as to the Monthly Fee, no other payment or benefits shall be due or payable to Executive for the Consulting

Services, other than any travel expense reimbursements. The Company may terminate Executive’s service as a consultant prior to the

expiration of the Consulting Period by payment of a lump sum for any remaining Monthly Fees due under this Agreement or upon Executive’s

breach of any provision of this Agreement as contemplated in Section 9.11 hereof. In the event Executive’s service as a consultant

is terminated by reason of Executive’s death, the Monthly Fee shall be paid through the month of termination.

2.3

Status as an Independent Contractor. In all matters relating to the Consulting Services, nothing under this Agreement shall

be construed as creating any partnership, joint venture or agency between the Company and Executive or to constitute Executive as an agent,

employee or representative of the Company. Executive shall act solely as an independent contractor and, as such, is not authorized to

bind the Company (including its subsidiaries) to third parties. Consequently, Executive shall not be entitled to participate during the

Consulting Period in any of the employee benefit plans, programs or arrangements of the Company in his capacity as a consultant. The Company

will not be responsible for withholding or paying any income, payroll, Social Security or other federal, state or local taxes, making

any insurance contributions, including unemployment or disability, or obtaining workers’ compensation insurance on Executive’s

behalf. The Company has not, is not and shall not be obligated to make, and it is the sole responsibility of Executive to make, all periodic

filings and payments required to be made in connection with any withholding taxes, FICA taxes, federal or state unemployment taxes, and

any other federal, state or local taxes, payments or filings required to be paid, made or maintained in connection with any payments made

by the Company to Executive in connection with the provision of the Consulting Services. Executive agrees to indemnify and hold the Company

harmless from and against any costs, fees, expenses, liabilities or penalties (and any interest that may accrue thereon) associated with

any withholding taxes, FICA taxes, federal unemployment taxes, and any other federal, state or local taxes, payments or filings required

to be paid, made or maintained in connection with any payments made by the Company to Executive for the Consulting Services. Executive

shall not make any public statements concerning the Consulting Services that purport to be on behalf of the Company without prior written

consent from the Company.

3.

Separation Payments. In recognition of Executive’s contribution to the Company, and in consideration of the covenants

contained herein and the waiver and release contained in the Release Agreement (including the non-revocation thereof), the Company shall

pay Executive a cash bonus in the total amount of $1,250,000 payable in five equal installments as set forth below (the “Separation

Payments”). Executive’s entitlement to receive the Separation Payments is subject to Executive’s (a) execution and

non-revocation of the Release Agreement and (b) compliance with the obligations and covenants under this Agreement. The Separation

Payments shall be paid to Executive in five equal semi-annual installments of $250,000 each, commencing on the date that is six months

after the Effective Date.

4.

Retirement Plans; Health Insurance. Executive shall be entitled to receive his vested accrued benefits, if any, under the Aon

Pooled Employer Plan in accordance with the terms and conditions of such plans. In addition, if the Executive timely and properly elects

Consolidated Omnibus Budget Reconciliation Act (“COBRA”) continuation coverage under the P.A.M. Transport and Met Express

Group Medical Plan, the Company shall pay the Executive’s premiums for continuing coverage under COBRA during the Consulting Period;

providing further, the obligation of the Company to pay COBRA premiums under this Section 4 shall terminate upon Executive becoming eligible

for executive benefits from a subsequent employer.

5.

No Other Compensation or Benefits. Except as otherwise specifically provided herein or as required by COBRA or other applicable

law, Executive shall not be entitled to any compensation or benefits or to participate in any past, present or future employee benefit

plans, programs or arrangements of the Company on or after the Resignation Date. Executive acknowledges and agrees that all of Executive’s

restricted shares of common stock of the Company that were unvested as of the Resignation Date and all unpaid deferred bonus amounts as

of the Resignation Date have been forfeited by Executive upon the Resignation Date in accordance with the terms of such awards.

6.

Stock Repurchase.

6.1

Repurchase of Executive’s Shares. Executive hereby agrees to sell to the Company and the Company hereby agrees to

purchase from Executive all of Executive’s directly and indirectly owned shares of common stock of PTSI (excluding any unvested

restricted shares of common stock, which have been forfeited in accordance with Section 5 hereof) (the “Shares”) at

a price per share equal to the closing market price as reported on the Nasdaq Stock Market at the close of trading on the Effective Date

(or the most recent trading day prior to the Effective Date if such date falls on a weekend or business holiday) (the “Purchase

Price”).

6.2

Closing. The closing of the Company’s purchase of the Shares shall take place on the next business day following the

Effective Date. On the closing date, Executive will notify the Company in writing of the amount of his then directly and indirectly owned

Shares and will coordinate with the Company to instruct the Company’s transfer agent and Executive’s broker or nominee, as

applicable, to electronically transfer the Shares to the Company’s account. Upon receipt of the Shares, the Company shall deliver

to Executive the aggregate Purchase Price for the Shares in cash, in the form of a Company check made payable to the order of Executive.

6.3

Executive Representations and Warranties. Executive hereby represents and warrants that: (a) Executive is the sole owner

of the Shares and has good title to the Shares; (b) Executive has the full authority to transfer, sell and deliver the Shares to the Company;

(c) the Shares are being delivered to the Company free of all liens, security interests, claims, restrictions or other encumbrances thereon;

(d) Executive has enough financial and other information concerning the Company to enable him to make an informed decision regarding the

value of the Shares; and (e) Executive is aware of or has consulted with his personal tax advisor concerning the tax effect of the sale

of the Shares on his personal tax situation. Such representations and warranties shall continue to be true and correct as of the closing

of the Company’s purchase of the Shares.

6.4

Company Authority. The Company hereby represents and warrants that the Company, through its representatives, has the full

authority to purchase the Shares from Executive.

6.5

Additional Documents. The Parties agree to execute and deliver all other appropriate supplemental agreements and other instruments

and take any other action necessary to undertake and complete the Company’s purchase of the Shares under the terms of this Agreement.

7.

Covenants and Agreements.

7.1

Covenant Not to Solicit / Not to Compete.

(a) Customers.

For a twelve (12) month period beginning on the Resignation Date, Executive agrees that he will not, either solely or jointly with, or

as manager or agent for, any person, corporation, trust, joint venture, partnership, or other business entity, directly or indirectly,

approach or solicit for business, accept business from, divert business from, or otherwise interfere with any Company or Affiliated Companies

(as listed on Exhibit B hereto) (the “Affiliated Companies”) relationship with, any person or entity (or legal successor

to such person or entity) that Executive had any direct contact with while employed by the Company and that: (a) has been a customer of

the Company or any of the Affiliated Companies at any time within the six (6) month period prior to the Resignation Date; or (b) to whom

the Company or one of the Affiliated Companies had made a proposal within the six (6) month period prior to the Resignation Date.

(b) Both

parties agree that the restrictions in this section are fair and reasonable in all respects including the length of time that they shall

remain in effect and that Company’s engagement of Executive upon the terms and conditions of this Agreement is fully sufficient

consideration for Executive’s obligations under this section.

(c) If

any provisions of this section are ever held by a Court to be unreasonable, the parties agree that this section shall be enforced to the

extent it is deemed to be reasonable.

7.2

No Interference With Employment Relationships.

Executive agrees

that for a twelve (12) month period beginning on the Resignation Date, Executive will not, directly or indirectly, solicit for employment,

hire, or offer employment to, or otherwise aid or assist any person or entity other than the Company, in soliciting for employment, hiring,

or offering employment to: (a) any employee of the Company, the Affiliated Companies, or any independent contractor engaged by the Company

or the Affiliated Companies; or (b) any former employee or independent contractor of the Company or the Affiliated Companies who was employed,

or engaged, by the Company or the Affiliated Companies within six (6) months before or after the Resignation Date. In the event Executive

hires an employee of the Company, the Company shall be compensated at a fee equal to 30% of the employee’s first year’s gross

compensation. This paragraph 7.2 also applies to employees of the companies listed on Exhibit B.

7.3

Proprietary Information.

(a) Executive

shall forever hold in the strictest confidence and not disclose to any person, firm, corporation or other entity any of the Company’s

Proprietary Information (as defined below) or any of the Company’s Records (as defined below) except as such disclosure may be required

in connection with Executive’s work for the Company as a consultant and as expressly authorized by Company in writing.

(b) For

the purposes of this Agreement, the term “Proprietary Information” shall mean intercompany publications, unpublished works,

plans, policies, computer and information systems, software and other information and knowledge relating or pertaining to the products,

services, sales or other business of the Company or its successor, affiliates and customers in any way which is of a confidential or proprietary

nature, the prices it obtains or has obtained from the sale of its services, its manner of operation, its plans, processes or other data,

contracts, information about contracts, contract forms, business applications, costs, profits, tax information, marketing information,

advertising methods, customers, potential customers, brokers, potential brokers, employees, matters of a technical nature (including inventions,

computer programs, concepts, developments, contributions, devices, discoveries, software and documentations, secret processes or machines,

including any improvements thereto and know-how related thereto, and research projects, etc.), and other information not generally available

to the public, without regard to whether all of the foregoing matters will be deemed confidential, material or important. Anything to

the contrary notwithstanding, the parties hereto stipulate that any and all knowledge, data and information gathered by Executive through

this Agreement, his engagement with the Company as a consultant and the operation of the business of the Company is deemed important,

material or confidential, and gravely affects the effective and successful conduct of the business of the Company and the Company’s

goodwill; could not without great expense and difficulty be obtained or duplicated by others who have not been able to acquire such information

by virtue of a consultancy with the Company; and that any breach of the terms of this Paragraph 7.3 shall be deemed a material breach

of this Agreement.

(c) Executive

agrees that all creative work, including without limitation, designs, drawings, specifications, techniques, models, processes and software

prepared or originated by Executive during the Consulting Period or within the scope of his engagement as a consultant for the Company

whether or not subject to protection under the federal copyright or other law constitutes work made for hire all rights to which are owned

by the Company. Moreover, Executive hereby assigns to the Company all right, title and interest whether by way of copyright, trade secret,

patent or otherwise, and all such work whether or not subject to protection by copyright or other law.

(d) Upon

termination of Executive’s consultancy with the Company or at any other time requested by the Company, Executive shall immediately

return to the Company and not retain any copies of, any records, data, lists, plans, policies, publications, computer and information

systems, files, diagrams and documentation, data, papers, drawings, memos, customer records, reports, correspondence, note books, service

listing and any other business record of any kind or nature (including without limitation records in machine-readable or computer-readable

forms) relating to Proprietary Information (“Records”) to the extent any such Records were not returned prior to such

time in accordance with the Employment Agreement or are obtained by Executive during the Consulting Period.

(e) Executive

acknowledges that, to the extent the Company derives independent economic value from any of its Proprietary Information and takes reasonable

measures to maintain its secrecy, such Proprietary Information will be considered a trade secret under applicable law. Executive further

acknowledges that under the Defend Trade Secrets Act of 2016, an individual may not be held criminally or civilly liable under any federal

or state trade secret law for the disclosure of a trade secret that: (1) is made (i) in confidence to a federal, state, or local government

official, either directly or indirectly, or to an attorney; and (ii) solely for the purpose of reporting or investigating a suspected

violation of law; or (2) is made in a complaint or other document that is filed under seal in a lawsuit or other proceeding. Executive

further acknowledges that an individual who files a lawsuit for retaliation by an employer for reporting a suspected violation of law

may disclose the employer’s trade secrets to the attorney and use the trade secret information in the court proceeding if the individual:

(1) files any document containing the trade secret under seal; and (2) does not disclose the trade secret, except pursuant to court order.

This Paragraph does not in

any way restrict or impede Executive from exercising protected rights, including rights under the National Labor Relations Act (“NLRA”)

or the federal securities laws, including the Dodd-Frank Act, to the extent that such rights cannot be waived by agreement or

from complying with any applicable law or regulation or a valid order of a court of competent jurisdiction or an authorized government

agency, provided that such compliance does not exceed that required by the law, regulation, or order.

7.4

Reasonable Restrictions. Executive agrees and acknowledges that the restrictions contained in this Agreement are reasonable

and necessary in order to protect the valuable proprietary assets, goodwill and business of the Company and that the restrictions will

not prevent or unreasonably restrict his ability to earn a livelihood. Executive also agrees and acknowledges that if his provision of

Consulting Services ends for any reason, Executive will be able to earn a livelihood without violating the restrictions contained in this

Agreement and that Executive’s ability to earn a livelihood without violating said restrictions is an important reason in Executive

choosing to sign this Agreement.

7.5

Non-Disparagement. Each party to this Agreement agrees and covenants that they shall not make, publish, or communicate to

any person or entity or in any public forum any maliciously false, defamatory, or disparaging remarks, comments, or statements concerning

any other party to this Agreement, the Affiliated Companies or their businesses, or any of their employees, officers, directors or managers

and their existing and prospective customers, suppliers, investors, and other associated third parties, now or at any time in the future.

This Section does not in any

way restrict or impede Executive from exercising protected rights, including rights under the NLRA or the federal securities laws, including

the Dodd-Frank Act, to the extent that such rights cannot be waived by agreement or from complying with any applicable law or

regulation or a valid order of a court of competent jurisdiction or an authorized government agency, provided that such compliance does

not exceed that required by the law, regulation, or order.

8.

Section 409A. This Agreement is intended to meet, or be exempt from, the requirements of Section 409A of the Internal Revenue

Code of 1986, as amended, and the regulations and interpretive guidance promulgated thereunder (collectively, “Section 409A”),

with respect to amounts subject thereto, and shall be interpreted and construed consistent with that intent. No expenses eligible for

reimbursement, or in-kind benefits to be provided, during any calendar year shall affect the amounts eligible for reimbursement in any

other calendar year, to the extent subject to the requirements of Section 409A, and no such right to reimbursement or right to in-kind

benefits shall be subject to liquidation or exchange for any other benefit. For purposes of Section 409A, each payment in a series of

installment payments provided under this Agreement shall be treated as a separate payment. Notwithstanding the foregoing, the Company

makes no representations that the payments and benefits provided under this Agreement comply with Section 409A and in no event shall the

Company be liable for all or any portion of any taxes, penalties, interest or other expenses that may be incurred by the Executive on

account of non-compliance with Section 409A. If amounts payable under this Agreement do not qualify for exemption from Section 409A as

of the Resignation Date and therefore are deemed deferred compensation subject to the requirements of Section 409A on the Resignation

Date, then if Executive is a “specified employee” under Section 409A on the Resignation Date, payment of the amounts hereunder

shall be delayed for a period of six (6) months from the Resignation Date if required by Section 409A. The accumulated postponed amount

shall be paid in a lump sum within sixty (60) days after the end of the six-month period. If Executive dies during the postponement period

prior to payment of the postponed amount, the amounts withheld on account of Section 409A shall be paid to Executive’s estate within

sixty (60) days after the date of Executive’s death.

9.

Miscellaneous.

9.1

Severability. As the provisions of this Agreement are independent of and severable from each other, the Company and Executive

agree that if, in any action before any court or agency legally empowered to enforce this Agreement, any term, restriction, covenant,

or promise hereof is found to be unreasonable or otherwise unenforceable, then such decision shall not affect the validity of the other

provisions of this Agreement, and such invalid term, restriction, covenant, or promise shall also be deemed modified to the extent necessary

to make it enforceable.

9.2

Notice. For purposes of this Agreement, notices, demands and all other communications provided for in this Agreement shall

be in writing and shall be deemed to have been duly given when received if delivered in person, the next business day if delivered by

overnight commercial courier (e.g., Federal Express), or the third business day if mailed by United States certified mail, return receipt

requested, postage prepaid, to the following addresses:

If to the Company, to:

P.A.M. Transportation Services, Inc.

P.O. Box 188

Tontitown, Arkansas 72770

Attn: Mr. Joseph A. Vitiritto, Chief

Executive Officer

If to Executive, to:

Allen West

[ ]

[ ]

Either party may change its

address for notices in accordance with this Section 9.2 by providing written notice of such change to the other party.

9.3

Governing Law. This Agreement shall be governed by and construed in accordance with the laws of the State of Arkansas.

9.4

Arbitration. The Parties agree that any dispute, controversy, or claim arising out of or related to this Agreement, or any

alleged breach of this Agreement, shall be governed by the Federal Arbitration Act (FAA) and submitted to and decided by binding arbitration

before a panel of three (3) arbitrators. The arbitration shall be held in Washington County, Arkansas, and shall be administered before

JAMS pursuant to its Employment Arbitration Rules & Procedures and subject to JAMS Policy on Employment Arbitration Minimum Standards

of Procedural Fairness and any requirements imposed by Arkansas law. The parties shall equally split the costs of the arbitration, including

but not limited to the JAMS arbitration fees and arbitrator compensation and expenses; provided, however, that each party shall be responsible

for its own attorneys’ fees associated with or incurred during any such arbitration. Any arbitral award determination shall be final

and binding on the Parties and may be entered as a judgment in a court of competent jurisdiction.

9.5

Benefits; Binding Effect; Assignment. This Agreement shall be binding upon and inure to the benefit of the parties and their

respective heirs, personal representatives, legal representatives, successors and permitted assigns. Executive shall not assign his interest

in or delegate his duties under this Agreement. However, the Company is expressly authorized to assign this Agreement to one of its affiliates

or subsidiaries upon written notice to Executive. The rights and obligations of the Company hereunder may also be assigned by operation

of law in connection with a merger in which the Company is not the surviving corporation or in connection with the sale of substantially

all of the assets of the Company; and in the latter event, such assignment shall not relieve the Company of its obligations hereunder.

9.6

Entire Agreement. This Agreement, including its incorporated Exhibits A and B, constitutes the entire agreement between

the parties, and all prior understandings, agreements or undertakings between the parties concerning Executive’s resignation from

employment or the other subject matters of this Agreement are superseded in their entirety by this Agreement; provided, however, that

nothing in this Agreement modifies, supersedes, voids, or otherwise alters Executive’s post-employment contractual obligations contained

in the Employment Agreement, including but not limited to Executive’s confidentiality, proprietary information, noncompetition,

and nonsolicitation obligations. Executive’s contractual obligations contained in the Employment Agreement, including but not limited

to Executive’s confidentiality, proprietary information, noncompetition, and nonsolicitation obligations, shall remain in full force

and effect.

9.7 Waivers and Amendments. This Agreement may be amended, superseded, canceled, renewed or extended, and the terms hereof may

be waived, only by a written instrument signed by the parties or, in the case of a waiver, by the party waiving compliance. No delay on

the part of any party in exercising any right, power or privilege hereunder shall operate as a waiver thereof, nor shall any waiver on

the part of any party of any such right, power or privilege nor any single or partial exercise of any such right, power or privilege,

preclude any other or further exercise thereof or the exercise of any other such right, power or privilege.

9.8

Counterparts. This Agreement may be executed in counterparts, each of which shall be deemed an original, but which together

shall be one and the same instrument.

9.9

Interpretation. As both parties have had the opportunity to consult with legal counsel, no provision of this Agreement shall

be construed against or interpreted to the disadvantage of any party by reason of such party having, or being deemed to have, drafted,

devised, or imposed such provision.

9.10 Duration. Notwithstanding the termination of Executive’s service as a consultant under this Agreement, this Agreement

shall continue to bind the parties for so long as any obligations remain under this Agreement, and, in particular, Executive shall continue

to be bound by the covenants and time limits as set forth in Section 7 of this Agreement.

9.11

Remedies. In the event of a breach or threatened breach by Executive of any of the provisions of this Agreement or the Release

Agreement, Executive hereby consents and agrees that the Company shall be entitled to, in addition to other available remedies, a temporary

or permanent injunction or other equitable relief against such breach or threatened breach from any court of competent jurisdiction, without

the necessity of showing any actual damages or that money damages would not afford an adequate remedy, and without the necessity of posting

any bond or other security. The aforementioned equitable relief shall be in addition to, not in lieu of, legal remedies, monetary damages,

or other available forms of relief. If Executive fails to comply with any of the terms of this Agreement or the Release Agreement, the

Company may, in addition to any other available remedies, terminate any benefits or payments that are later due under this Agreement,

and Executive shall immediately return to the Company any amounts paid to Executive under the provisions of this Agreement, with the exception

of any amounts received by Executive for the sale of the Executive’s stock to the Company or any Consulting Service Monthly Fees

previously paid by the Company. Such remedies shall not be a waiver by the Company of the releases provided in the Release Agreement.

9.12 Tolling. If Executive violates any of the terms of the restrictive covenant obligations in this Agreement, including but

not limited to the non-solicitation, non-disclosure, non-competition and non-disparagement covenants, the obligation at issue will begin

to run from the first date on which the Executive ceases to be in violation of the obligation for all such restrictions and shall automatically

be extended by the period the Executive was in violation of them.

9.13 Incorporation of Recitals. The recitals set forth in the beginning of this Agreement are hereby incorporated into the body

of this Agreement as if fully set forth herein.

[Signature Page Follows]

IN WITNESS WHEREOF, the parties

hereto have signed their names on July 7, 2023, and the Agreement shall be effective as of the day and year first above written.

P.A.M. TransportATION

SERVICES, Inc.,

By: /s Joseph A. Vitiritto

Name: Joseph A. Vitiritto

Title: Chief Executive Officer

EXECUTIVE

HEREBY ACKNOWLEDGES THAT EXECUTIVE HAS READ THIS AGREEMENT, THAT EXECUTIVE FULLY KNOWS, UNDERSTANDS AND APPRECIATES ITS CONTENTS, AND

THAT EXECUTIVE HEREBY ENTERS INTO THIS AGREEMENT VOLUNTARILY AND OF EXECUTIVE’S OWN FREE WILL.

/s/ Allen West

Allen W. West

EXHIBIT A

RELEASE AGREEMENT

THIS RELEASE AGREEMENT (this

“Agreement”), dated as of July 7, 2023, by and between P.A.M. Transportation Services, Inc. (collectively, with

its consolidated subsidiaries, the “Company”), on behalf of itself, its subsidiaries, and other corporate affiliates,

and each of their respective present and former employees, officers, directors, owners, shareholders, and agents, individually and in

their official capacities (collectively referred to as the “Company Group”), and Allen W. West (“Executive”).

Capitalized terms used herein but not defined shall have the meanings set forth in the Separation and Consulting Agreement, dated as of

July 7, 2023 (the “Separation Agreement”), by and between the Company and Executive.

WHEREAS, the Separation Agreement

sets forth the terms and conditions of Executive’s separation from employment with the Company effective as of June 8, 2023; and

WHEREAS, the Separation Agreement

provides that, in consideration for certain payments and benefits payable to Executive in connection with his resignation, Executive shall

fully and finally release the Company from all claims arising from or relating to Executive’s employment relationship with the Company

and the termination of such relationship, other than any claims associated with the Separation Agreement; and

WHEREAS, in addition to those

certain payments and benefits outlined in the Separation Agreement, the Company and the Company Group acknowledge that they are not aware

of any claims against Executive arising from or relating to Executive’s employment relationship with the Company or the termination

of such relationship.

NOW, THEREFORE, in consideration

of the mutual covenants and promises contained herein, the parties hereto, each intending to be legally bound hereby, agree as follows:

1.

Executive Representations. The Executive specifically represents, warrants, and confirms that the Executive:

a) has not instituted, assisted or otherwise participated in connection with, any action, complaint, claim, charge, grievance, arbitration,

lawsuit or administrative agency proceeding, or action at law or otherwise against any member of the Company Group or any of their respective

officers, employees, directors, shareholders or agents;

b) has not made any claims or allegations to the Company related to sexual harassment, sex discrimination, or sexual abuse, and that

none of the payments set forth in the Separation Agreement are related to sexual harassment, sex discrimination, or sexual abuse;

c)

has been properly paid for all hours worked for the Company;

d) has received all salary, wages, commissions, bonuses, and other compensation due to the Executive, with the exception of any benefits

or payments due under the Separation Agreement; and

e) has not knowingly and willfully engaged in any unlawful conduct relating to the business of the Company that would have had a material

impact on its financial statements or any theft or fraud relating to the Company or its affiliates.

If any of these statements

is not true, the Executive cannot sign this Agreement and must notify the Company immediately in writing of the statements that are not

true.

2.

Release.

2.1

General Release. In consideration of the Company’s obligations under the Separation Agreement and for other valuable

consideration, Executive and the Executive’s heirs, executors, representatives, administrators, agents, and assigns (collectively,

the “Releasors”) irrevocably and unconditionally fully and forever waive, release, and discharge the Company Group,

including each member of the Company Group’s parents, subsidiaries, affiliates, predecessors, successors, assigns, and employee

benefit plans, and each of its and their respective officers, directors, employees, shareholders, trustees, partners, in their corporate

and individual capacities (collectively, the “Released Parties”), from any and all claims, demands, actions, causes

of actions, judgments, rights, fees, damages, debts, obligations, liabilities, and expenses (inclusive of attorneys’ fees) of any

kind whatsoever, whether known or unknown (collectively, “Claims”), that Releasors may have or have ever had against

the Released Parties, or any of them. The Claims the Releasors are releasing include (without limiting the generality of the foregoing)

all claims arising out of, or in any way related to all relationships, interactions, transactions or contracts, express or implied, between

Executive and the Released Parties, including, without limitation, Executive’s hire, benefits, employment, termination, or separation

from employment with the Company Group, by reason of any actual or alleged act, omission, practice, conduct, occurrence, or other matter

from the beginning of time up to and including the date Executive executes this Agreement, including, but not limited to:

a) any and all claims under Title VII of the Civil Rights Act of 1964 (Title VII), the Americans with Disabilities Act (ADA), the

Family and Medical Leave Act (FMLA) (regarding existing but not prospective claims), the Fair Labor Standards Act (FLSA), the Equal Pay

Act, the Employee Retirement Income Security Act (ERISA) (regarding unvested benefits), the Civil Rights Act of 1991, Section 1981 of

U.S.C. Title 42, the Fair Credit Reporting Act (FCRA), the Worker Adjustment and Retraining Notification (WARN) Act, the National Labor

Relations Act (NLRA), the Uniform Services Employment and Reemployment Rights Act (USERRA), the Genetic Information Nondiscrimination

Act (GINA), the Immigration Reform and Control Act (IRCA), the Arkansas Civil Rights Act, and all state and local laws that may be legally

waived, all including any amendments and their respective implementing regulations, and any other federal, state, local, or foreign law

(statutory, regulatory, or otherwise) that may be legally waived and released; however, the identification of specific statutes is for

purposes of example only, and the omission of any specific statute or law shall not limit the scope of this general release in any manner;

b) any and all claims for compensation of any type whatsoever, including but not limited to claims for salary, wages, bonuses, commissions,

incentive compensation, vacation, and severance, other than those payments and benefits associated with the Separation Agreement, that

may be legally waived and released;

c) any and all claims arising under tort, contract, and quasi-contract law, including but not limited to claims of breach of an express

or implied contract, tortious interference with contract or prospective business advantage, breach of the covenant of good faith and fair

dealing, promissory estoppel, detrimental reliance, invasion of privacy, nonphysical injury, personal injury or sickness or any other

harm, wrongful or retaliatory discharge, fraud, defamation, slander, libel, false imprisonment, and negligent or intentional infliction

of emotional distress; and

d) any and all claims for monetary or equitable relief, including but not limited to attorneys' fees, back pay, front pay, reinstatement,

experts’ fees, medical fees or expenses, costs and disbursements, punitive damages, liquidated damages, and penalties.

Releasors further covenant and

agree not to institute or cause to be instituted any action, cause of action or other judicial or administrative proceeding based on any

claim released hereunder. If any such action or proceeding is brought by Releasors, the prevailing party shall be entitled to recover

any costs incurred by them (including, but not limited to, attorneys’ fees) in connection with any such action or proceeding.

However, this general release

and waiver of claims excludes, and Executive does not waive, release, or discharge: (A) any right to file an administrative charge or

complaint with, or testify, assist, or participate in an investigation, hearing, or proceeding conducted by, the Equal Employment Opportunity

Commission or other similar federal or state administrative agencies, although Executive waives any right to monetary relief related to

any filed charge or administrative complaint; (B) claims that cannot be waived by law; (C) indemnification rights Executive has against

the Company; (D) any right to file an unfair labor practice charge under the National Labor Relations Act; (E) protections against retaliation

under the Taxpayer First Act (26 U.S.C. § 2623(d)); (F) any rights to vested benefits, such as pension or retirement benefits, the

rights to which are governed by the terms of the applicable plan documents and award agreements; and (G) any claim for breach of this

Agreement or the Separation Agreement.

2.2

Specific Release of ADEA Claims. As further consideration for the payments and benefits provided to Executive under the

Separation Agreement, and for other valuable consideration, the Releasors hereby irrevocably and unconditionally fully and forever waive,

release, and discharge the Released Parties from any and all Claims, whether known or unknown, from the beginning of time through the

date Executive executes this Agreement (subject to Section 2.2(g) below), arising under the Age Discrimination in Employment Act (ADEA),

as amended, and its implementing regulations. By signing this Agreement, the Executive hereby acknowledges and confirms that:

a) the Executive has read this Agreement in its entirety and understands all of its terms;

b) by this Agreement, the Executive has been advised in writing to consult with an attorney of the Executive’s choosing before

signing this Agreement;

c) the Executive knowingly, freely, and voluntarily agrees to all of the terms and conditions set out in this Agreement including,

without limitation, the waiver, release, and covenants contained in it;

d) the Executive is signing this Agreement, including the waiver and release, in exchange for good and valuable consideration in addition

to anything of value to which the Executive is otherwise entitled;

e) the Executive was given at least twenty-one (21) days to consider the terms of this Agreement and consult with an attorney of the

Executive’s choice, although the Executive may sign it sooner if desired and changes to this Agreement, whether material or immaterial,

do not restart the running of the 21-day period;

f) the Executive understands that the Executive has seven (7) calendar days after signing this Agreement (the “Revocation

Period”) to revoke the release in this Section by delivering notice of revocation to Mr. Joseph A. Vitiritto at the Company,

297 W. Henri de Tonti Blvd., Tontitown, Arkansas 72770 by email or overnight delivery before the end of this seven-day period; in the

event of any such revocation by Executive, all obligations of the Company under the Separation Agreement shall terminate and be of no

further force and effect as of the date of such revocation. No such revocation by Executive shall be effective unless it is in writing

and signed by Executive and received by the Company prior to the expiration of the Revocation Period; and

g) the Executive understands that the release contained in this Section 2 does not apply to rights and claims that may arise after

the Executive signs this Agreement.

3.

Cessation of Payments. In the event that Executive (a) files any charge, claim, demand, action or arbitration against the Company

or any member of the Company Group with regard to Executive’s employment, compensation or termination of employment or any other

matter under any federal, state or local law, or an arbitration under any industry regulatory entity, except in either case for a claim

for breach of the Separation Agreement or failure to honor the obligations set forth therein; (b) breaches any of the covenants or obligations

contained in or incorporated into the Separation Agreement; or (c) is otherwise in breach of this Agreement or the Separation Agreement,

the Company shall be entitled to cease making any payments due pursuant to Sections 3, 4 and 5 of the Separation Agreement, and Executive

shall immediately return to the Company any amounts paid to Executive under the Separation Agreement, with the exception of any amounts

received by Executive for the sale of the Executive’s stock to the Company or any Consulting Service Monthly Fees previously paid

by the Company. Such remedies shall not be a waiver by the Company of the releases provided in this Agreement.

4.

Revocation. This Agreement may be revoked by Executive within the seven-day period commencing on the date Executive signs this

Agreement (the “Revocation Period”). In the event of any such revocation by Executive, all obligations of the Company

under the Separation Agreement shall terminate and be of no further force and effect as of the date of such revocation. No such revocation