UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D/A

Under the Securities Exchange Act of 1934

(Amendment

No. 9)*

ARMATA

PHARMACEUTICALS, INC.

(Name of Issuer)

Common Stock, $0.01 par value

(Title of Class of Securities)

04216R 102

(CUSIP Number)

Innoviva, Inc.

1350 Old Bayshore Highway Suite 400

Burlingame, CA

877-202-1097

Attention: Pavel Raifeld

Chief Executive Officer

(Name, Address and Telephone Number

of Person Authorized to

Receive Notices and Communications)

July 10, 2023

(Date of Event which Requires Filing of this Statement)

If the

filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and

is filing this schedule because of §§240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box. ¨

Note:

Schedules filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See §240.13d-7

for other parties to whom copies are to be sent.

*

The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect

to the subject class of securities, and for any subsequent amendment containing information which would alter disclosures provided in

a prior cover page.

The information required on the remainder

of this cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act

of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions

of the Act (however, see the Notes).

Persons who respond to the collection of information

contained in this form are not required to respond unless the form displays a currently valid OMB control number.

SEC 1746 (3-06)

CUSIP No. 04216R 102

| 1. |

Names of Reporting Persons. |

| |

I.R.S. Identification Nos. of above persons (entities only). |

| |

|

| |

Innoviva, Inc. |

| 2. |

Check the Appropriate Box if a Member of a Group (See Instructions) |

| |

|

| |

(a) x |

| |

|

| |

(b) ¨ |

| |

|

| 3. |

SEC Use Only |

| |

|

| 4. |

Source of Funds (See Instructions) WC |

| |

|

| 5. |

Check if Disclosure of Legal Proceedings Is Required Pursuant to

Items 2(d) or 2(e) ¨ |

| |

|

| 6. |

Citizenship or Place of Organization Delaware |

Number of

Shares Bene-

ficially by

Owned by Each

Reporting

Person With |

7. |

Sole Voting Power 17,421,600 (1) |

| |

|

| 8. |

Shared Voting Power 46,756,659 (2) |

| |

|

| 9. |

Sole Dispositive Power 17,421,600 (1) |

| |

|

| 10. |

Shared Dispositive Power 46,756,659 (2) |

| 11. |

Aggregate Amount Beneficially Owned by Each Reporting Person 64,178,259

(3) |

| |

|

| 12. |

Check if the

Aggregate Amount in Row (11) Excludes Certain Shares (See Instructions) ¨ |

|

|

| 13. |

Percent of Class Represented by Amount in Row (11) 85.3% (4) |

|

|

| 14. |

Type of Reporting Person |

| |

CO |

| (1) | Includes 8,710,800 shares of Common Stock owned by the Reporting Persons and 8,710,800 shares of Common Stock issuable upon exercise

of the warrants to purchase Common Stock beneficially owned by the Reporting Persons. |

| (2) | Includes 16,365,969 shares of Common Stock owned by the Reporting Persons, 10,653,847 shares of Common Stock issuable upon exercise

of the warrants to purchase Common Stock beneficially owned by the Reporting Persons, and 19,736,843 shares of Common Stock issuable upon

the conversion of a certain convertible loan held by the Reporting Persons (excluding any accrued interest) beneficially owned by the

Reporting Persons. |

| (4) | Based on 36,144,706 shares of Common Stock outstanding as of May 5, 2023, as set forth on the Issuer’s Quarterly Report on Form

10-Q, plus 19,736,843 shares of Common Stock issuable upon the conversion of a certain convertible loan held by the Reporting Persons

(excluding any accrued interest) and shares of Common Stock issuable upon exercise of the warrants to purchase Common Stock beneficially

owned by the Reporting Persons. |

CUSIP No. 04216R 102

| 1. |

Names of Reporting Persons. |

| |

I.R.S. Identification Nos. of above persons (entities only). |

| |

|

| |

Innoviva Strategic Opportunities LLC |

| 2. |

Check the Appropriate Box if a Member of a Group (See Instructions) |

| |

|

| |

(a) x |

| |

|

| |

(b) ¨ |

| |

|

| 3. |

SEC Use Only |

| |

|

| 4. |

Source of Funds (See Instructions) WC |

| |

|

| 5. |

Check if Disclosure of Legal Proceedings Is Required Pursuant to

Items 2(d) or 2(e) ¨ |

| |

|

| 6. |

Citizenship or Place of Organization Delaware |

Number of

Shares Bene-

ficially by

Owned by Each

Reporting

Person With |

7. |

Sole Voting Power 0 |

| |

|

| 8. |

Shared Voting Power 46,756,659 (1) |

| |

|

| 9. |

Sole Dispositive Power 0 |

| |

|

| 10. |

Shared Dispositive Power 46,756,659 (1) |

| 11. |

Aggregate

Amount Beneficially Owned by Each Reporting Person 46,756,659 (2) |

| |

|

| 12. |

Check if the

Aggregate Amount in Row (11) Excludes Certain Shares (See Instructions) ¨ |

|

|

| 13. |

Percent of Class Represented by Amount in Row (11) 62.1%(3) |

|

|

| 14. |

Type of Reporting Person |

| |

OO |

| (1) | Includes 16,365,969 shares of Common Stock owned by the Reporting Persons, 10,653,847 shares of Common Stock issuable upon exercise

of the warrants to purchase Common Stock beneficially owned by the Reporting Persons, and 19,736,843 shares of Common Stock issuable upon

the conversion of a certain convertible loan held by the Reporting Persons (excluding any accrued interest) beneficially owned by the

Reporting Persons. |

| (3) | Based on 36,144,706 shares of Common Stock outstanding as of May 5, 2023, as set forth on the Issuer’s Quarterly Report on Form

10-Q, plus 19,736,843 shares of Common Stock issuable upon the conversion of a certain convertible loan held by the Reporting Persons

(excluding any accrued interest) and shares of Common Stock issuable upon exercise of the warrants to purchase Common Stock beneficially

owned by the Reporting Persons. |

Explanatory Note

This Amendment No. 9 to Schedule 13D (“Amendment No.

9”) amends and supplements the initial Statement of Beneficial Ownership on Schedule 13D, as filed with the U.S. Securities and

Exchange Commission (the “SEC”) by Innoviva, Inc. (“Innoviva”) on February 14, 2020, as amended and supplemented

by Amendment No. 1 filed with the SEC on March 31, 2020 by Innoviva, as further amended and supplemented by Amendment No. 2 filed with

the SEC on January 26, 2021 by Innoviva and Innoviva Strategic Opportunities LLC, a wholly-owned subsidiary of Innoviva (“Innoviva

Sub”), as further amended and supplemented by Amendment No. 3 filed with the SEC on March 17, 2021 by Innoviva and Innoviva Sub,

as further amended and supplemented by Amendment No. 4 filed with the SEC on April 1, 2021 by Innoviva and Innoviva Sub, as further amended

and supplemented by Amendment No. 5 filed with the SEC on November 1, 2021 by Innoviva and Innoviva Sub, as further amended and supplemented

by Amendment No. 6 filed with the SEC on February 11, 2022 by Innoviva and Innoviva Sub, as further amended and supplemented by Amendment

No. 7 filed with the SEC on April 1, 2022, as further amended and supplemented by Amendment No. 8 filed with the SEC on January 10, 2023

(the “Schedule 13D”), with respect to shares of common stock, $0.01 par value per share (“Common Stock”) of Armata

Pharmaceuticals, Inc., a Washington corporation (the “Issuer”), warrants to acquire additional shares of Common Stock of the

Issuer (“Warrants”), and secured convertible debt convertible into Common Stock of the Issuer. Innoviva and Innoviva Sub (collectively,

the “Reporting Persons”) are filing this amendment to reflect the amendment of the Credit Agreement (as defined below).

Except as specifically amended and supplemented by this Amendment

No. 9, the Schedule 13D (as amended) remains in full force and effect.

Item 4. Purpose of Transaction

Item 4 in Schedule 13D is hereby supplemented as follows:

On July 10, 2023, the Issuer and Innoviva Sub entered

into an amendment to the secured convertible credit and security agreement, dated January 10, 2023, by and among the Issuer,

Innoviva Sub and the other parties thereto (the “Credit Agreement” and such amendment, the “Credit Agreement

Amendment”) which Credit Agreement Amendment extended the maturity date of the Credit Agreement to January 10, 2025 and

revised the definitions of “Permitted Indebtedness” and “Permitted Liens” (each as defined therein) to

permit certain indebtedness and liens securing certain obligations under the New Credit Facility (defined below). On the date of

this Amendment No. 9, the Reporting Persons collectively own 25,076,769 shares of Common Stock of the Issuer, warrants to acquire an

additional 19,364,647 shares of Common Stock of the Issuer, and the right to acquire an additional 19,736,843 shares of Common Stock

of the Issuer upon conversion of the convertible loan (excluding any accrued interest).

Item 5. Interest in Securities of the Issuer

Item 5 in Schedule 13D is hereby supplemented as follows:

As of the date of this filing of Amendment No. 9, the Reporting

Persons collectively may be deemed to have beneficial ownership of 64,178,259 shares of Common Stock, representing approximately 85.3%

of the outstanding shares of Common Stock of the Issuer as of the date of this Amendment No. 9 to Schedule 13D, based on 36,144,706

shares of Common Stock outstanding as of May 5, 2023, as set forth on the Issuer’s Quarterly Report on Form 10-Q, plus 19,736,843

shares of Common Stock issuable upon the conversion of a certain convertible loan held by the Reporting Persons (excluding any accrued

interest) and shares of Common Stock issuable upon exercise of the warrants to purchase Common Stock beneficially owned by the Reporting

Persons.

Except as set forth in this Schedule 13D (as amended), the

Reporting Persons did not acquire or sell any shares of Common Stock or other securities of the Issuer during the last 60 days.

Item 6. Contracts, Arrangements, Understandings

or Relationships With Respect to Securities of the Issuer

Item 6 in Schedule 13D is hereby supplemented as follows:

On July 10, 2023, the Issuer and Innoviva Sub entered into

the Credit Agreement Amendment to extend the maturity date of the Credit Agreement to January 10, 2025 and revise the definitions of “Permitted

Indebtedness” and “Permitted Liens” (each as defined therein) to permit certain indebtedness and liens securing certain

obligations under the New Credit Facility (as defined below). In connection with the Credit Agreement Amendment, on July 10, 2023, the

Issuer also entered into, as borrower, a secured credit and security agreement with Innoviva Sub, which provides for a secured term loan

facility in an aggregate amount of $25,000,000 at an interest rate of 14 percent per annum, and a maturity date of January 10, 2025

(the “New Credit Facility”). The New Credit Facility is not convertible into securities of the Issuer or into any other securities.

The New Credit Facility is further described in the Issuer’s Form 8-K filed with the SEC on July 11, 2023.

The foregoing descriptions of the terms of the New

Credit Facility and of the Credit Agreement Amendment do not purport to be complete and are qualified in their entirety by the

full text of the New Credit Facility and the full text of the Credit Agreement Amendment, copies of which are filed as Exhibits 10.1

and 10.2 to the Form 8-K of the Issuer filed with the SEC on July 11, 2023.

Signature

After reasonable

inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete

and correct.

Dated: July 11, 2023

| INNOVIVA, INC. |

|

| |

|

|

| By: |

/s/ Pavel Raifeld |

|

| |

Name: Pavel Raifeld |

|

| |

Title: Chief Executive Officer |

|

INNOVIVA STRATEGIC OPPORTUNITIES LLC

BY INNOVIVA, INC. (ITS MANAGING MEMBER) |

|

| |

|

|

| By: |

/s/ Pavel Raifeld |

|

| |

Name: Pavel Raifeld |

|

| |

Title: Chief Executive Officer |

|

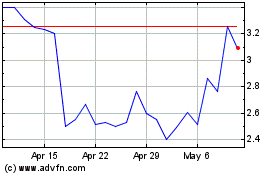

Armata Pharmaceuticals (AMEX:ARMP)

Historical Stock Chart

From Mar 2024 to Apr 2024

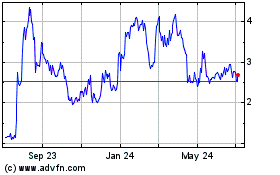

Armata Pharmaceuticals (AMEX:ARMP)

Historical Stock Chart

From Apr 2023 to Apr 2024