US Index Futures operated lower on Thursday morning due to

concerns arising from the minutes of the last monetary policy

meeting in the United States, which raised fears about the cycle of

monetary tightening.

By 6:42 AM, Dow Jones futures (DOWI:DJI) was down 140 points, or

0.41%. S&P 500 futures were down 0.41%, while Nasdaq-100

futures were down 0.45%. Yields on 10-year Treasuries are at

3.977%, the highest since March.

On Thursday’s US economic schedule, traders will be watching the

US Mortgage Market Index at 7:00 am. At 8:30 am, the US Trade

Balance, ADP Private Employment, and US Jobless Claims reports will

be released. At 10:00 am, the US Composite and Services PMI

and JOLT job postings will be released. EIA Oil Inventory

Change will be released at 11:00.

According to reports from financial institutions, the markets

are adopting a cautious stance in the face of the imminent release

of the formal US employment report, known as the Payroll, which

will take place tomorrow, along with the preliminary labor market

data that will be released today.

Elsewhere, the significant growth in orders to German industry

deserves to be highlighted, which registered an increase of 6.4%,

surpassing consensus expectations that pointed to a growth of

1.2%. Retail sales in the Euro Zone remained stable.

Elsewhere in commodities markets, West Texas Intermediate crude

for August was up 0.22% to trade at $71.95 a barrel. Brent

crude for September is close to $76.75 a barrel. Iron ore rose

1% on the Dalian stock exchange, in China, to US$114.52, still in

anticipation of stimuli from the Chinese government.

At the close of Wednesday, US risk assets closed lower after the

release of the Federal Open Market Committee (FOMC) minutes, as

investors pondered the signals about the future trajectory of

interest rates in the US inside the document. The Dow Jones

closed down 129.83 points or 0.38% to 34,288.64 points. The

S&P 500 closed down 8.77 points or 0.20% 4,446.82 points, while

the Nasdaq closed down 25.12 points or 0.18% at 13,791.65

points. Even so, the yields on Treasuries with shorter

maturities barely changed, despite the rise in long-term

Treasuries.

The Fed’s next monetary policy decision will take place in three

weeks’ time, when it will be confirmed whether the FFR increase

actually takes place. The CME Group survey on Wednesday

pointed to market pricing with a nearly 90% chance of a rate hike

at the next meeting. The variation was little in relation to

what was priced on Tuesday, which shows that the minutes did not

bring big news.

On the quarterly earnings front, Thursday will bring earnings

reports from Levi Strauss (NYSE:LEVI), sushi chain Kura Sushi

(NASDAQ:KRUS) and Simulations Plus (NASDAQ:SLP), a provider of

software for the pharmaceutical industry.

Wall Street Corporate Highlights for Today

Meta Platforms (NASDAQ:META) – Meta launched

Threads to compete with Twitter, attracting millions of users

within hours. With its integration with Instagram, Threads can

divert ads from Twitter, while its rival struggles. Analysts

see potential in the platform and expect it to be less

disruptive. In other news, Quebecor (USOTC:QBCAF) has

announced that it will be removing its ads from Facebook and

Instagram in response to Meta Platforms’ decision to block access

to news in Canada. Cogeco (USOTC:CGECF) will also withdraw its

advertising investments from Meta. In addition, Italy is

conducting a tax assessment of Meta, which could result in an

invoice of €870 million ($925 million). The investigation is

ongoing and the outcome will affect the prosecution of the case in

other EU countries.

Microsoft (NASDAQ:MSFT) – According to

analysts led by Daniel Ives, Microsoft is well positioned to take

market share from Amazon’s cloud services business. With

investor interest in AI growing, they believe Microsoft could join

Apple in the exclusive club of companies valued at $3 trillion by

early 2024. The company is investing in AI and its cloud service,

Azure , is also benefiting from the trend. Microsoft shares

are up 41% this year.

Bank of America (NYSE:BAC) – Bank of

America (BofA) announced that it intends to increase its quarterly

dividend on common stock from 22 to 24 cents per share beginning in

the third quarter of 2023. BofA postponed its decision last

week. The bank is in dialogue with the Fed to understand

discrepancies in stress test results.

Goldman Sachs (NYSE:GS) – European hedge

funds are reducing their exposure to US banks while maintaining

their placements in European banks, according to a report by

Goldman Sachs. European banks have outperformed their US peers

as they have not faced a deposit flight.

SVB Financial (NASDAQ:SIVB) – SVB

Financial Group, former owner of failed Silicon Valley Bank, has

obtained court permission to sell its investment banking arm for

$100 million after paying $280 million for the unit. The sale

is supported by Jeff Leerink and his management team, as well as

the Baupost Group. Despite initial concerns, US bankruptcy

judge Martin Glenn approved the sale after adding legal

restrictions. SVB Financial is facing a battle with Federal

Deposit Insurance Corp. for more than $2 billion in cash

deposited in the bank.

Blackrock (NYSE:BLK) – Larry Fink, CEO of

BlackRock, has expressed increased enthusiasm for Bitcoin

(COIN:BTCUSD) as his company seeks regulatory approval for a

Bitcoin spot ETF. Fink claimed that cryptography is digitizing

gold and can act as a hedge against inflation and currency

devaluation. He highlighted the importance of making

cryptocurrency more accessible and hopes that regulators will

support the democratization of cryptocurrency.

Alphabet (NASDAQ:GOOGL) – PwC Australia

allegedly provided confidential information to Google regarding the

start date of a new tax law, according to Reuters. This ties

in with the scandal involving the accounting firm that was revealed

in January. A former partner shared confidential drafts with

colleagues that were used to win deals with

multinationals. Google has stated that its tax structure

changes came after engaging directly with the Australian Tax

Office. PwC has not publicly identified any customers in the

scandal.

Tesla (NASDAQ:TSLA) – Tesla has cut prices

on its Model 3 and Y electric vehicles in Japan by single-digit

percentages. Prices for lower-priced Model 3 variants have

been reduced by around 3%, while prices for Model Y variants have

been reduced by around 4%. Model S and X pricing remained

unchanged.

Stellantis (NYSE:STLA) – Stellantis has

unveiled its new electric vehicle platform, the ‘STLA Medium’,

which will be the foundation for all future models from the

automaker. The platform was designed to allow for different

propulsion configurations and support state-of-the-art

batteries. Stellantis plans to produce up to two million

vehicles a year using this platform. The company has ambitious

electrification targets for its sales by 2030. In other news,

Stellantis-LG Energy Solution will resume construction on a battery

factory in Canada following increases in government

subsidies. Production is expected to start in 2024, creating

jobs and targeting an annual production capacity of more than 45

gigawatt hours. Furthermore, Stellantis does not plan to

transfer production of the electric Peugeot e-208 from Spain to

France, despite pressure from the French

government. Carlos Tavares, CEO of the company, stated that

the relocation would not be economically viable.

Nikola (NASDAQ:NKLA) – Nikola announced an

increase in wholesale and retail sales of its electric vehicles in

the second quarter, indicating a positive sign for the

startup. Retail sales doubled to 66 trucks, while wholesale

sales rose to 45. The company has faced financial challenges and

fierce competition.

Xpeng (NYSE:XPEV) – Chinese electric

vehicle manufacturer Xpeng expects strong delivery growth in the

second half, driven by its price-competitive new model and smart

driving technology. Xpeng has received a large volume of

orders for its pure electric G6 crossover, and expects to increase

monthly sales to 15,000 units in the third quarter and to more than

20,000 units in the final quarter of the year. The company

launched the G6 at a price that was 20% less than Tesla’s

best-selling model, and it also introduced advanced self-driving

features.

General Motors (NYSE:GM) – General Motors

has expressed concerns about proposed EPA emissions rules and other

US state and federal regulations, citing compliance challenges

related to electric vehicle (EV) requirements. The company

stated that a lack of clarity and coordination among regulatory

agencies could affect its ability to meet EV targets and remain

compliant with regulations. GM reaffirmed its commitment to

transition to 50% EVs by 2030 and 100% by 2035, but highlighted the

need for greater clarity on compliance requirements.

Mullen Automotive (NASDAQ:MULN) – Mullen

Automotive announced the hiring of a law firm to combat illegal

short selling activities. The company believes its actions may

have been subject to market manipulation and will take steps to

expose any wrongdoing. Despite the 85.2% drop in June, the

company posted revenue for the first time and is in a good

financial position.

Hertz (NASDAQ:HTZ) – On Wednesday, Hertz

received a “Buy” recommendation with a $24 price target from

Jefferies, which sees growth potential in the car rental company’s

pricing and margins, as well as opportunities in EVs. Analysts

highlighted the tight vehicle supply and improved margin profile,

as well as growth in the ridesharing business and EV

partnerships. The company was also praised by other analysts,

with a positive performance in the market.

JetBlue

Airways (NASDAQ:JBLU), American

Airlines (NASDAQ:AAL), Spirit

Airlines (NYSE:SAVE) – JetBlue Airways announced that

it will follow the court order to terminate its alliance with

American Airlines in order to protect its planned purchase of

Spirit Airlines. While it disagrees with the decision, JetBlue

will not appeal. American Airlines plans to appeal. The

end of the alliance is a setback for American’s strategy to

increase revenue. JetBlue intends to develop a retirement plan

that will protect consumers.

BP Plc (NYSE:BP) – BP is investing $10

million in California startup WasteFuel, which uses uneaten food

and other waste to produce low-emission fuel. The company

converts municipal and agricultural waste into sustainable energy,

including biomethanol for shipping. BP aims to produce around

100,000 barrels a day of biofuels by 2030 to help decarbonise the

transport sector. WasteFuel has selected Dubai as the location

for its first project and has plans for future expansion in

partnership with BP. Other investors include Maersk and TIME

Ventures.

Exxon Mobil (NYSE:XOM) – Exxon Mobil

announced that it expects a decrease in second-quarter earnings due

to lower natural gas prices in its exploration and production

business. The fall in gas prices should impact results by up

to US$ 2.2 billion. Scheduled maintenance and lower seasonal

demand also contribute to this situation. Full second-quarter

results will be released in late July or early August.

Duke Energy (NYSE:DUK) – Duke Energy

announced that it will sell its commercial distributed generation

business to ArcLight Capital Partners for $364 million. This

sale includes REC Solar’s operating assets, as well as projects

managed by Bloom Energy. Duke expects to use proceeds from

this sale to drive the incorporation of renewable energy into its

system and meet its climate goals. The deal is expected to

close by the end of 2023.

Vimeo (NASDAQ:VMEO) – Vimeo Inc CEO Anjali

Sud will leave the company in August to pursue new

opportunities. Adam Gross will take over as interim CEO while

the video platform seeks a permanent replacement. The company

maintains its financial outlook and intends to accelerate its

strategy of making video central to business

communication. Vimeo’s stock soared after the

announcement.

Lumentum Holdings (NASDAQ:LITE) – Lumentum

Holdings was downgraded to “Underweight” from “Equal Weight” by

Barclays on Wednesday. While the analyst raised the price

target and earnings per share estimate, he considers the stock

valuation to be high and unsustainable due to the limited

expectation of AI tailwinds.

Affirm (NASDAQ:AFRM) – Shares in Affirm

fell 4.7% to $14.70 in premarket trade Thursday after being

downgraded to an “Underweight” rating of “Neutral” by Piper

Sandler. The price target remained unchanged at $11.

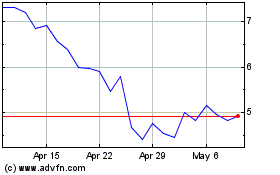

Hertz Global (NASDAQ:HTZ)

Historical Stock Chart

From Mar 2024 to Apr 2024

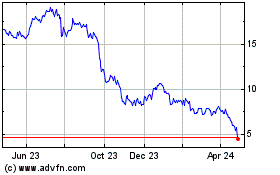

Hertz Global (NASDAQ:HTZ)

Historical Stock Chart

From Apr 2023 to Apr 2024