FCPT Announces Acquisition of a Cheesecake Factory Property and a Dual-tenant Starbucks and AT&T Property for $12.3 Million

December 02 2022 - 4:05PM

Business Wire

Four Corners Property Trust (NYSE:FCPT), a real estate

investment trust primarily engaged in the ownership and acquisition

of high-quality, net-leased restaurant and retail properties

(“FCPT” or the “Company”), is pleased to announce the acquisition

of a Cheesecake Factory property and a dual-tenant Starbucks and

AT&T property for $12.3 million. The properties are located in

a highly trafficked corridor in Kansas and are corporate-operated

under net leases with a weighted average of approximately seven

years of term remaining. The transaction was priced at a 6.6% cap

rate, exclusive of transaction costs.

About FCPT

FCPT, headquartered in Mill Valley, CA, is a real estate

investment trust primarily engaged in the ownership, acquisition

and leasing of restaurant and retail properties. The Company seeks

to grow its portfolio by acquiring additional real estate to lease,

on a net basis, for use in the restaurant and retail industries.

Additional information about FCPT can be found on the website at

www.fcpt.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20221202005419/en/

Four Corners Property Trust: Bill Lenehan, 415-965-8031 CEO

Gerry Morgan, 415-965-8032 CFO

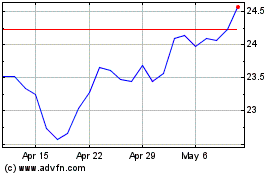

Four Corners Property (NYSE:FCPT)

Historical Stock Chart

From Aug 2024 to Sep 2024

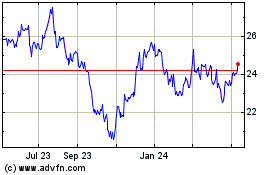

Four Corners Property (NYSE:FCPT)

Historical Stock Chart

From Sep 2023 to Sep 2024