SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14C

Information Statement Pursuant to Section 14(c) of the

Securities Exchange Act of 1934

Check the appropriate box:

☐ Preliminary Information Statement

☐ Confidential, for Use of the Commission Only (as permitted by Rule 14c-5(d)(2))

☒ Definitive Information Statement

| PHOENIX RISING COMPANIES |

| (Name of Registrant as Specified In Its Charter) |

Copies to:

Thomas E. Puzzo, Esq.

Law Offices of Thomas E. Puzzo, PLLC

3823 44th Ave. NE

Seattle, Washington 98105

Telephone No.: (206) 522-2256

Payment of Filing Fee (Check the appropriate box)

☒ No fee required.

☐ Fee computed on table below per Exchange Act Rules 14c-5(g) and 0-11.

1) Title of each class of securities to which transaction applies:

2) Aggregate number of securities to which transaction applies:

3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act

Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined):

4) Proposed maximum aggregate value of transaction:

5) Total fee paid:

☐ Fee paid previously with preliminary materials.

☐ Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

1) Amount Previously Paid:

2) Form, Schedule or Registration Statement No.:

3) Filing Party:

4) Date Filed:

PHOENIX RISING COMPANIES

641 10th Street

Cedartown, Georgia 30125

WE ARE NOT ASKING YOU FOR A PROXY AND YOU ARE REQUESTED NOT TO SEND US A PROXY.

This Information Statement is first being furnished on or about March 21, 2022 to the holders of record as of the close of business on March 21, 2022 of the common stock of Phoenix Rising Companies, a Nevada corporation (the “Phoenix Rising”).

Effective February 4, 2022, the Board of Directors of Phoenix Rising and 1 stockholder holding an aggregate of 4,250,000 shares of common stock and 150,000,000 shares of Series A Preferred Stock issued and outstanding as of February 4, 2022, have approved and consented in writing to the following action:

| | · | The approval of an amendment to our Articles of Incorporation to increase the number of shares of common stock authorized for issuance from 1,000,000,000 to 8,000,000,000. |

Such approval and consent constitute the approval and consent of a majority of the total number of shares of outstanding common stock and are sufficient under the Nevada Revised Statutes (“NRS”) and Phoenix Rising’s Articles of Incorporation, as amended, and Bylaws to approve the actions. Accordingly, the actions will not be submitted to the other stockholders of Phoenix Rising for a vote, and this Information Statement is being furnished to stockholders to provide them with certain information concerning the action in accordance with the requirements of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and the regulations promulgated thereunder, including Regulation 14C.

ACTIONS BY BOARD OF DIRECTORS

AND

CONSENTING STOCKHOLDER

GENERAL

Phoenix Rising will pay all costs associated with the distribution of this Information Statement, including the costs of printing and mailing. Phoenix Rising will reimburse brokerage firms and other custodians, nominees and fiduciaries for reasonable expenses incurred by them in sending this Information Statement to the beneficial owners of Phoenix Rising’s common stock.

Phoenix Rising will only deliver one Information Statement to multiple security holders sharing an address unless Phoenix Rising has received contrary instructions from one or more of the security holders. Upon written or oral request, Phoenix Rising will promptly deliver a separate copy of this Information Statement and any future annual reports and information statements to any security holder at a shared address to which a single copy of this Information Statement was delivered, or deliver a single copy of this Information Statement and any future annual reports and information statements to any security holder or holders sharing an address to which multiple copies are now delivered. You should direct any such requests to the following address: Phoenix Rising Companies, 641 10th Street, Cedartown, Georgia 30125 Attn: Ding-Shin “DS” Chang, Chief Executive Officer. Mr. Chang may also be reached by telephone at (844) 487-4636.

INFORMATION ON CONSENTING STOCKHOLDER

Pursuant to Phoenix Rising’s Bylaws and the Nevada Revised Statutes (“NRS”), a vote by the holders of at least a majority of Phoenix Rising’s outstanding capital stock is required to effect the action described herein. Phoenix Rising’s Articles of Incorporation, as amended, does not authorize cumulative voting. As of the record date, Phoenix Rising had 196,377,299 shares of common stock issued and outstanding. The voting power representing not less than 98,188,650 shares of common stock is required to pass any stockholder resolutions. The consenting stockholders are the record and beneficial owner of 4,250,000 shares of common stock and 1,500,000 shares of Series A Preferred Stock, which represents approximately 2.1% of the issued and outstanding shares of common stock and 100% of Series Preferred Stock of Phoenix Rising. Each share of Series A Preferred Stock has voting rights equal to 100 shares of common stock. Accordingly, the 1,500,000 shares of Series A Preferred Stock has voting power equal to 150,000,000 shares of common stock. Pursuant to Chapter 78.320 of the NRS, the consenting stockholders voted, with the Board of Directors, in favor of the actions described herein in a joint written consent, dated February 4, 2022. No consideration was paid for any consent. The consenting stockholders’ names, affiliation with Phoenix Rising, and their beneficial holdings are as follows:

| Name | Affiliation | Shares of Common Stock Beneficially Held | Shares of Series A Preferred Stock Held | Total Voting Power |

| Ding-Shin “DS” Chang (1) | President, Chief Executive Officer, Director, and greater than 10% holder of common stock | 4,250,000 (1) | 1,500,000 (2) | 154,250,000 shares (3) |

| | (1) | Such 4,250,000 shares equal to 2.1% of the 196,377,299 issued and outstanding shares of common stock on February 4, 2022. |

| | (2) | Such 1,500,000 equals 100% of the issued and outstanding shares of Series A Preferred Stock on February 4, 2022. Voting power equal to 150,000,000 shares of common stock. |

| | (3) | Comprised of 4,250,000 shares of common stock and 1,500,000 shares of Series A Preferred Stock, which has voting power equal to 150,000,000 shares of common stock. |

INTEREST OF CERTAIN PERSONS IN OR OPPOSITION TO MATTERS TO BE ACTED UPON

None.

PROPOSALS BY SECURITY HOLDERS

None.

DISSENTERS RIGHTS OF APPRAISAL

None.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth, as of February 4, 2022, certain information regarding the ownership of Phoenix Rising’s capital stock by each director and executive officer of Phoenix Rising, each person who is known to Phoenix Rising to be a beneficial owner of more than 5% of any class of Phoenix Rising’s voting stock, and by all officers and directors of Phoenix Rising as a group. Unless otherwise indicated below, to Phoenix Rising’s knowledge, all persons listed below have sole voting and investing power with respect to their shares of capital stock, except to the extent authority is shared by spouses under applicable community property laws.

Beneficial ownership is determined in accordance with the rules of the Securities and Exchange Commission (“SEC”) and generally includes voting or investment power with respect to securities. Shares of common stock subject to options, warrants or convertible securities exercisable or convertible within 60 days of February 4, 2022 are deemed outstanding for computing the percentage of the person or entity holding such options, warrants or convertible securities but are not deemed outstanding for computing the percentage of any other person, and is based on 196,377,299 shares of common stock issued and outstanding on a fully diluted basis, as of February 4, 2022.

| Name and Address of Beneficial Owner | | Amount and Nature of Beneficial Ownership | | | Percentage of Class (1) | |

| Ding-Shin “DS” Chang (2) | | | 4,250,000 | | | | 2.1 | % |

| Boon Jin “Patrick” Tan (3) | | | 414,638 | | | * | |

| Liang-Yu “Jacky” Chang (4) | | | 30,000 | | | * | |

| | | | | | | | | |

| Directors and Executive Officers as a Group (3 persons) | | | 4,694,638 | | | | 2.3 | % |

| | | | | | | | | |

| 5% or greater shareholders | | | | | | | | |

| Fakuan Liu (5) | | | 30,600,000 | | | | 15.5 | % |

| Likable (HK) Company Ltd. (6) | | | 9,800,000 | | | | 4.9 | % |

| SGCI Corporate Finance GMBH (7) | | | 10,056,619 | | | | 5.1 | % |

____________

*Less than 1%.

| (1) | Percentages are calculated based on 196,377,299 shares of the Company’s common stock issued and outstanding on March 30, 2020. |

| (2) | Address at Neue Mainzer Strasse 6-10, 60311 Frankfurt am Main, Germany. |

| (3) | Address at D-15-05 Menara Mitraland, Jalan Pju 5/1, Kota Damansara, 47810 Selangor, Malaysia. |

| (4) | Address at 2F, No. 63, Sec 6, Xinhai Road, Taipei, Taiwan. |

| (5) | Address at 8 Zu Shang Gou Cun Mo Jie Xiang Yu Zhou Shi, Henan Prov, China 461683. |

| (6) | Address at Flat D 8/F Blk 18 Phase 2 Wham Poa Garden, Kowloon, Hong Kong. |

| (7) | Address at Neue Mainzer Strasse 6-10, 60311 Frankfurt am Main, Germany. |

The following table lists, as of February 4, 2022, the number of shares of Series A Preferred Stock of our Company that are beneficially owned by each person or entity known to our Company to be the beneficial owner of more than 5% of the outstanding Series A Preferred Stock.

| Name and Address of Beneficial Owner | | Amount and Nature of Beneficial Ownership of Series A Preferred Stock | | | Percentage of Class (1) | |

| Ding-Shin “DS” Chang (2) | | | 1,500,000 shares directly held(3) | | | | 100 | % |

| (1) | Percentages are calculated based on 1,500,000 shares of the Company’s Series A Preferred Stock issued and outstanding on February 4, 2022. Each share of Series A Preferred Stock has voting rights equal to 100 shares of common stock. Accordingly, the 1,500,000 shares of Series A Preferred Stock has voting power equal to 150,000,000 shares of common stock. |

| (2) | Address at Neue Mainzer Strasse 610, 60311 Frankfurt am Main, Germany. |

EXECUTIVE COMPENSATION

The following table sets forth information regarding each element of compensation that we paid or awarded to our named executive officers for fiscal years ended December 31, 2021 and 2020:

Summary Compensation Table

| Name and Principal Position | | Fiscal Year | | Salary ($) | | | Bonus ($) | | Stock Awards ($) | | | All Other Compensation ($) | | Total ($) | |

| Ding-Shin “DS” Chang, | | 2021 | | | 110,931 | | | -0- | | -0- | | | -0- | | | 110,931 | |

| Chief Executive Officer, President and Director (1) | | 2020 | | -0- | | | -0- | | | 2,056,022 | | | -0- | | | 2,056,022 | |

| | | | | | | | | | | | | | | | | | | |

| Boon Jin “Patrick” Chan, | | 2021 | | -0- | | | -0- | | -0- | | | -0- | | -0- | |

| Chief Financial Officer, Secretary and Director (2) | | 2020 | | -0- | | | -0- | | -0- | | | -0- | | -0- | |

| | | | | | | | | | | | | | | | | | | |

| Liang-Yu “Jacky” Chang, | | 2021 | | -0- | | | -0- | | -0- | | | -0- | | -0- | |

| Secretary (3) | | 2020 | | -0- | | | -0- | | -0- | | | -0- | | -0- | |

______________

| (1) | Appointed Chief Executive Officer, President and a Director on February 9, 2018. |

| (2) | Appointed Chief Financial Officer, Secretary and a Director on February 9, 2018. |

| (3) | Appointed Secretary on February 9, 2018. |

Employment Contracts, Termination of Employment, Change-in-Control Arrangements

The Company has no employment agreements with its officers or any significant employee and did not enter into any employment contracts, termination of employment, or change-in-control arrangements during the fiscal year ended December 31, 2021.

Option Exercises and Fiscal Year-End Option Value Table

There were no stock options exercised by the named executive officers as of the end of the fiscal year ended December 31, 2020.

Long-Term Incentive Plans and Awards

There were no awards made to a named executive officer, under any long-term incentive plan, as of the end of the fiscal year ended December 31, 2021.

We currently do not pay any compensation to our directors serving on our Board of Directors.

Other Compensation

There are no annuity, pension or retirement benefits proposed to be paid to officers, directors, or employees of our company in the event of retirement at normal retirement date as there was no existing plan as of December 31, 2021, provided for or contributed to by our company.

Director Compensation

| The following table sets forth director compensation for fiscal year ended December 31, 2021: |

| Name | | Fees Earned or Paid in Cash ($) | | | Stock Awards ($) | | | Option Awards ($) | | | Non-Equity Incentive Plan Compensation($) | | | Nonqualified Deferred Compensation Earnings ($) | | | All Other Compensation($) | | | Total ($) | |

| | | | | | | | | | | | | | | | | | | | | | |

| Ding-Shin “DS” Chang (1) | | | -0- | | | | -0- | | | | -0- | | | | -0- | | | | -0- | | | | -0- | | | | -0- | |

| Boon Jin “Patrick” Chan (2) | | | -0- | | | | -0- | | | | -0- | | | | -0- | | | | -0- | | | | -0- | | | | -0- | |

_______________

| (1) | Appointed Chief Executive Officer, President and a Director on February 9, 2018. |

| (2) | Appointed Chief Financial Officer, Secretary and a Director on February 9, 2018. |

Narrative to Director Compensation Table

The following is a narrative discussion of the material information that we believe is necessary to understand the information disclosed in the previous table.

Ding-Shin “DS” Chang and Boon Jin “Patrick” Tan receive no compensation solely in their capacities as directors of the Company. All travel and lodging expenses associated with corporate matters are reimbursed by us, if and when incurred.

Outstanding Equity Awards at Fiscal Year-End

he following table sets forth stock option grants and compensation for the fiscal year ended December 31, 2021:

| | | Option Awards | | Stock Awards | |

| Name | | Number of Securities Underlying Unexercised Options (#) Exercisable | | | Number of Securities Underlying Unexercised Options (#) Unexercisable | | | Equity Incentive Plan Awards: Number of Securities Underlying Unexercised Unearned Options (#) | | | Option Exercise Price ($) | | | Option Expiration Date | | Number of Shares or Units of Stock That Have Not Vested (#) | | | Market Value of Shares or Units of Stock That Have Not Vested ($) | | | Equity Incentive Plan Awards: Number of Unearned Shares, Units or Other Rights That Have Not Vested (#) | | | Equity Incentive Plan Awards: Market or Payout Value of Unearned Shares, Units or Other Rights That Have Not Vested ($) | |

| Ding-Shin “DS” Chang (1) | | | -0- | | | | -0- | | | | -0- | | | $ | -0- | | | N/A | | | -0- | | | | -0- | | | | -0- | | | | -0- | |

| Boon Jin “Patrick” Chan (2) | | | -0- | | | | -0- | | | | -0- | | | $ | -0- | | | N/A | | | -0- | | | | -0- | | | | -0- | | | | -0- | |

________________

| (1) | Appointed Chief Executive Officer, President and a Director on February 9, 2018. |

| (2) | Appointed Chief Financial Officer, Secretary and a Director on February 9, 2018. |

Option Exercises and Fiscal Year-End Option Value Table.

There were no stock options exercised by the named executive officers as of the end of the fiscal period ended December 31, 2021.

Long-Term Incentive Plans and Awards

There were no awards made to a named executive officer, under any long-term incentive plan, as of the end of the fiscal year ended December 31, 2021.

We currently do not pay any compensation to our directors serving on our Board of Directors.

Equity Compensation Plan Information

The following table summarizes information, as of December 31, 2021, with respect to shares that may be issued under Phoenix Rising’s existing equity compensation plans.

| Plan Category | | Number of Securities to be Issued Upon Exercise of Outstanding Options, Warrants and Rights (a) | | | Weighted-Average Exercise Price of Outstanding Options, Warrants and Rights (b) | | | Number of Securities Remaining Available for Future Issuance Under Equity Compensation Plans (Excluding Securities Reflected in Column (a)) (c) | |

| Equity compensation plans approved by security holders | | | 0 | (1) | | $ | N/A | | | | 5,000 | |

| Equity compensation plans not approved by security holders | | | 0 | | | | N/A | | | | 0 | |

| Total | | | 0 | | | $ | N/A | | | | 5,000 | |

| (1) | Consists of options and restricted stock granted under the plan. |

Other Compensation

There are no annuity, pension or retirement benefits proposed to be paid to officers, directors, or employees of our company in the event of retirement at normal retirement date as there was no existing plan as of the end of the fiscal year ended December 31, 20121.

CHANGE IN CONTROL

To the knowledge of management, there are no present arrangements or pledges of securities of Phoenix Rising which may result in a change in control of Phoenix Rising.

NOTICE TO STOCKHOLDERS OF ACTION APPROVED BY CONSENTING STOCKHOLDER

The following action was taken based upon the unanimous recommendation of the Board of Directors and the written consent of the consenting stockholders:

I. AMENDMENT TO THE ARTICLES OF INCORPORATION TO INCREASE THE NUMBER OF SHARES OF AUTHORIZED COMMON STOCK

On February 4, 2022, the Board of Directors the consenting stockholders adopted and approved a resolution to effect an amendment to our Articles of Incorporation to increase the number of shares of authorized common stock from 1,000,000,000 to 8,000,000,000. Such amendment is referred to herein as the “Authorized Shares Amendment.”

Currently, Phoenix Rising has 1,000,000,000 shares of common stock authorized, of which 196,377,299 shares were issued and outstanding on February 4, 2022. As a result of the Authorized Shares Amendment, Phoenix Rising will have 8,000,000,000 shares of shares of common stock authorized for issuance, of which 7,803,622,701 will be available for issuance.

A table illustrating the Authorized Shares Amendment (discussed below) is as follows:

| | | Number of shares of common stock issued and outstanding | | | Number of shares of common stock authorized in Articles of Incorporation (1) | | | Number of shares of common stock authorized and reserved for issuance | | Number of shares of common stock authorized but unreserved for issuance | |

| Before Authorized Shares Amendment | | | 196,377,299 | | | | 1,000,000,000 | | | -0- | | | 803,622,701 | |

| After Authorized Shares Amendment | | | 196,377,299 | | | | 8,000,000,000 | | | -0- | | | 7,803,622,701 | |

| (1) | Does not include 15,000,000 shares of Preferred Stock, 1,500,000 shares of which has been designated as Series A Preferred Stock and all of which are issued and outstanding. |

Giving effect to the Authorized Shares Amendment, Phoenix Rising will still have 7,803,622,701 shares of common stock, all of which will be unreserved, but authorized for issuance. Any additional issuance of common stock could, under certain circumstances, have the effect of delaying or preventing a change in control of Phoenix Rising by increasing the number of outstanding shares entitled to vote and by increasing the number of votes required to approve a change in control of Phoenix Rising. Shares of common stock could be issued, or rights to purchase such shares could be issued, to render more difficult or discourage an attempt to obtain control of Phoenix Rising by means of a tender offer, proxy contest, merger or otherwise. The ability of the Board of the Directors to issue such additional shares of common stock could discourage an attempt by a party to acquire control of Phoenix Rising by tender offer or other means. Such issuances could therefore deprive stockholders of benefits that could result from such an attempt, such as the realization of a premium over the market price that such an attempt could cause. Moreover, the issuance of such additional shares of common stock to certain persons’ interests aligned with that of the Board of Directors could make it more difficult to remove incumbent managers and directors from office even if such change were to be favorable to stockholders generally.

While the increase in the number of shares of common stock authorized may have anti-takeover ramifications, the Board of Directors believes that the financial flexibility offered by the amendment outweighs any disadvantages. To the extent that the increase in the number of shares of common stock authorized may have anti-takeover effects, the amendment may encourage persons seeking to acquire Phoenix Rising to negotiate directly with the Board of Directors, enabling the Board of Directors to consider a proposed transaction in a manner that best serves the stockholders’ interests.

The Board of Directors believes that it is advisable and in the best interests of Phoenix Rising to have available additional authorized but unissued shares of common stock in an amount adequate to provide for Phoenix Rising’s future needs. The unissued shares of common stock will be available for issuance from time to time as may be deemed advisable or required for various purposes, including the issuance of shares in connection with financing or acquisition transactions. Phoenix Rising has no present plans or commitments for the issuance or use of the proposed additional shares of common stock in connection with any financing.

The Authorized Shares Amendment is not intended to have any anti-takeover effect and is not part of any series of anti-takeover measures contained in any debt instruments or the Articles of Incorporation or the Bylaws of Phoenix Rising in effect on the date of this Information Statement. However, Phoenix Rising stockholders should note that the availability of additional authorized and unissued shares of common stock could make any attempt to gain control of Phoenix Rising or the Board of Directors more difficult or time consuming and that the availability of additional authorized and unissued shares might make it more difficult to remove management. Phoenix Rising is not aware of any proposed attempt to take over Phoenix Rising or of any attempt to acquire a large block of Phoenix Rising’s stock. Phoenix Rising has no present intention to use the increased number of authorized common stock for anti-takeover purposes.

Effective Date

Under Rule 14c-2, promulgated pursuant to the Securities Exchange Act of 1934, as amended (the “Exchange Act”), the Authorized Shares Amendment shall be effective twenty (20) days after this Information Statement is mailed to stockholders of Phoenix Rising. We anticipate the effective date to be on or about March 30, 2022.

ADDITIONAL INFORMATION

We are subject to the informational requirements of the Exchange Act, and in accordance therewith file reports, proxy statements and other information including annual and quarterly reports on Form 10-K and 10-Q with the SEC. Copies of these documents can be obtained upon written request addressed to the SEC, Public Reference Section, 100 F Street, N.E., Washington, D.C., 20549, at prescribed rates. The SEC also maintains a web site on the Internet (http://www.sec.gov) where reports, proxy and information statements and other information regarding issuers that file electronically with the SEC through the Electronic Data Gathering, Analysis and Retrieval System may be obtained free of charge.

STATEMENT OF ADDITIONAL INFORMATION

Phoenix Rising’s Current Report on Form 8-K, filed with the SEC on December 6, 2021; Quarterly Report on Form 10-Q for the quarter ended September 30, 2021, and filed with the SEC on November 23, 2021; Current Report on Form 8-K, filed with the SEC on October 1, 2021; Quarterly Report on Form 10-Q for the quarter ended June 30, 2021, and filed with the SEC on August 17, 2021; Quarterly Report on Form 10-Q for the quarter ended March 31, 2021, and filed with the SEC on June 9, 2021; Annual Report on Form 10-K for the year ended December 31, 2020, and filed with the SEC on June 1, 2021; and Registration Statement on Form 8-A, filed with the SEC on November 12, 2014, have been incorporated herein by this reference.

Phoenix Rising will provide without charge to each person, including any beneficial owner of such person, to whom a copy of this Information Statement has been delivered, on written or oral request, a copy of any and all of the documents referred to above that have been or may be incorporated by reference herein other than exhibits to such documents (unless such exhibits are specifically incorporated by reference herein).

All documents filed by Phoenix Rising pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act subsequent to the date of this Information Statement shall be deemed to be incorporated by reference herein and to be a part hereof from the date of filing of such documents. Any statement contained in a document incorporated or deemed to be incorporated by reference herein shall be deemed to be modified or superseded for purposes of this Information Statement to the extent that a statement contained herein or in any other subsequently filed document which also is or is deemed to be incorporated by reference herein modifies or supersedes such statement. Any such statement so modified or superseded shall not be deemed, except as so modified or superseded, to constitute a part of this Information Statement.

COMPANY CONTACT INFORMATION

All inquiries regarding Phoenix Rising should be addressed to Ding-Shin “DS” Chang, Chief Executive Officer, at Phoenix Rising’s principal executive offices, at: Phoenix Rising Companies, 641 10th Street, Cedartown, Georgia 30125,. Mr. Chang may also be reached by telephone at (844) 487-4636.

APPENDICES

The following documents are appended to this information statement:

| Appendix A | Certificate of Amendment to Articles of Incorporation |

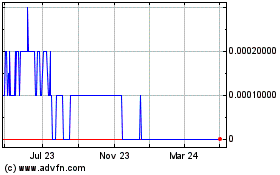

Phoenix Rising Companies (CE) (USOTC:PRCX)

Historical Stock Chart

From Mar 2024 to Apr 2024

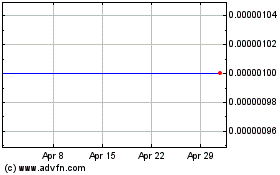

Phoenix Rising Companies (CE) (USOTC:PRCX)

Historical Stock Chart

From Apr 2023 to Apr 2024