Registration No. 333-256053

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

S-1/A

REGISTRATION

STATEMENT UNDER THE SECURITIES ACT OF 1933

Todos Medical Ltd.

(Exact name of registrant as

specified in its charter)

Israel

(State or other jurisdiction

of incorporation or organization)

2835

(Primary Standard Industrial

Classification Code Number)

N/A

(I.R.S. Employer Identification

Number)

121 Derech Menachem Begin, 30th Floor, Tel Aviv,

6701203 Israel, +972 (52) 642-0126

(Address, including zip code,

and telephone number,

including area code, of registrant’s

principal executive offices)

Puglisi & Associates

850 Library Avenue, Suite 204

Newark, Delaware 19711

302-738-6680

(Name,

address, including zip code, and telephone number,

including area code, of agent for service)

Copies of all Correspondence to:

|

Carl M. Sherer

Rimon PC

100 Park Ave, 16th floor

New York, NY 10017

Telephone No. (800) 930-7271

Facsimile No.: (617)997-0098

|

|

Jeffrey J. Fessler

Sheppard, Mullin, Richter &

Hampton LLP

30 Rockefeller Plaza

New York, NY 10112

Telephone No. (212) 634-3067

Facsimile No.: (917) 438-6133

|

As soon as practicable after the effective date

of this Registration Statement.

(Approximate date of commencement

of proposed sale to the public)

If any of the securities being registered on

this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities

Act of 1933 check the following box: ☒

If this Form is filed to register additional

securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities

Act registration statement number of the earlier effective registration statement for the same offering.

If this Form is a post-effective amendment

filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement

number of the earlier effective registration statement for the same offering.

If this Form is a post-effective amendment

filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement

number of the earlier effective registration statement for the same offering.

Indicate by check mark whether the registrant

is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company.

See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,”

and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer ☐

|

|

Accelerated filer ☐

|

|

Non-accelerated filer ☒

|

|

Smaller reporting company ☒

|

|

|

|

Emerging growth company ☐

|

If an emerging growth company,

indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised

financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

Calculation of Registration Fee

|

Title

of each class of securities to be registered

|

|

Amount

to

be Registered (1)

|

|

|

Proposed

Maximum Offering Price Per Share (2)

|

|

|

Proposed

Maximum Aggregate

Offering

Price

|

|

|

Amount

of

Registration

Fee

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Ordinary

shares, par value NIS 0.01, issuable upon exercise of Warrants

|

|

|

137,980,949

|

|

|

$

|

.064

|

|

|

$

|

8,830,781

|

|

|

$

|

818.61

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Ordinary

Shares, par value NIS 0.01, issuable upon conversion of Convertible Notes

|

|

|

123,086,088

|

|

|

$

|

.064

|

|

|

|

7,877,510

|

|

|

$

|

730.25

|

|

|

TOTAL

|

|

|

261,067,037

|

|

|

|

|

|

|

$

|

16,708,291

|

|

|

$

|

1,548.86

|

|

|

(1)

|

Pursuant to Rule 416 under the Securities Act of 1933, as amended (the “Securities Act”), the ordinary shares issuable upon the exercise of warrants, and ordinary shares issuable upon conversion of Convertible Notes being registered hereunder include such indeterminate number of ordinary shares as may be issuable as a result of share splits, share dividends or similar transactions.

|

|

|

|

|

(2)

|

Estimated solely for the purpose of calculating the registration fee

pursuant to Rule 457 (c) under the Securities Act of 1933, as amended. Calculated based upon the closing bid price for the Company’s

shares on the OTCQB Venture Market on January 13, 2022.

|

The Registrant hereby amends this Registration

Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment

which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of

the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Commission, acting pursuant

to said Section 8(a), may determine.

The

information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration

statement filed with the Securities and Exchange Commission becomes effective. This preliminary prospectus is not an offer to sell nor

does it seek an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

|

Preliminary

Prospectus

|

Subject

to Completion. Dated: January 18, 2022

|

TODOS

MEDICAL LTD.

261,067,037

Ordinary Shares

This

prospectus relates to the resale by the selling shareholders named herein, from time to time, of up to (i) 123,086,088 ordinary

shares, (the “Convertible Note Shares”), issuable upon the exercise of outstanding convertible notes (the “Convertible

Notes”), (ii) 78,332,201 ordinary shares, (the “Purchaser Warrant Shares”), issuable upon exercise of outstanding

warrants (the “2021 Warrants”), and (iii) 59,648,748 ordinary shares (the “Prior Warrant Shares”) issuable

upon the exercise of outstanding warrants (the “2020 Warrants”). The Convertible Notes and the 2021 Warrants were initially

issued by us in a private placement (the “Private Placement”), pursuant to nine securities purchase agreements, dated

as of July 6, 2021, July 7, 2021, August 9, 2021, September 15, 2021, October 18, 2021, November 2, 2021, November 24, 2021, December

14, 2021, and December 21, 2021 between us and certain selling shareholders. The 2020 Warrants were initially issued by us in a series

of private placements to fifteen purchasers between November 1, 2019, and July 8, 2020. The Purchaser Warrant Shares, the

Prior Warrant Shares and the Convertible Note Shares are referred to herein as the “Ordinary Shares” or the “Securities.”

We are not registering the resale of the Convertible Notes, the 2021 Warrants or the 2020 Warrants.

The

conversion price for the Convertible Notes is subject to adjustment downwards under certain circumstances. All share numbers in this

prospectus assume that such conversion price will not be adjusted. The maximum adjustment of the conversion price under the Convertible

Notes is 20%.

We

will not receive any proceeds from the sale of Securities by the selling shareholders. We will, however, receive the proceeds of any

Warrants exercised for cash in the future, which will total up to approximately $13,506,515, based on the Warrants’ respective

exercise prices. See “Use of Proceeds” in this prospectus.

The

selling shareholders may offer and sell the Securities from time to time at varying prices and in a number of different ways as each

selling shareholder may determine through public or private transactions or through other means described under “Plan of Distribution.”

Each selling shareholder may also sell shares under Rule 144 under the Securities Act of 1933, as amended, to the extent available pursuant

to the restrictions thereunder, rather than under this prospectus.

The

selling shareholders will bear all commissions, discounts and concessions, if any, attributable to the sale or disposition of the Securities.

Other than in connection with our indemnification obligations with respect to the selling shareholders, we will bear only the costs,

expenses and fees in connection with the registration of the Securities. We will not be paying any underwriting commissions or discounts

in offerings under this prospectus. For more information, see “Plan of Distribution.”

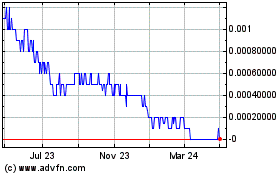

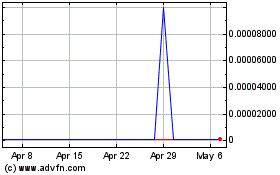

Our

ordinary shares are traded on the OTCQB under the symbol “TOMDF.” The last reported sales price of our ordinary shares on

the OTCQB on January 13, 2022 was $.064 per ordinary share.

INVESTING

IN OUR SECURITIES INVOLVES A HIGH DEGREE OF RISK. SEE “RISK FACTORS” IN THIS PROSPECTUS.

None

of the Securities and Exchange Commission, the Israel Securities Authority or any state securities commission has approved or disapproved

of the securities being offered by this prospectus, or determined if this prospectus is truthful or complete. Any representation to the

contrary is a criminal offense.

The

date of this prospectus is January 18, 2022

TABLE

OF CONTENTS

ABOUT

THIS PROSPECTUS

This

prospectus relates to the resale from time to time by selling shareholders of up to (i) 123,086,088 ordinary shares, (the “Convertible

Note Shares”), issuable upon the exercise of outstanding convertible notes (the “Convertible Notes”), (ii) 78,332,201

ordinary shares, (the “Purchaser Warrant Shares”), issuable upon exercise of outstanding warrants (the “2021 Warrants”),

and (iii) 59,648,748 ordinary shares (the “Prior Warrant Shares”) issuable upon the exercise of outstanding warrants

(the “2020 Warrants”). Before buying any of the ordinary shares that the selling shareholders are offering, we urge you to

read this prospectus carefully. These documents contain important information that you should consider when making your investment decision.

We

have not authorized anyone to provide you with information that is different from that contained in this

prospectus, any amendment or supplement to this prospectus, or in any free writing prospectus we may authorize to be

delivered or made available to you. We do not take responsibility for, and can provide no assurance as to the reliability of,

any other information that others may give you. The selling shareholders are offering to sell our ordinary shares and seeking

offers to purchase our ordinary shares only in jurisdictions where offers and sales are permitted. The information contained in

this prospectus is accurate only as of the date on the front of this prospectus, regardless of the time of delivery of this

prospectus or any sale of our ordinary shares. Our business, financial condition, results of operations and prospects may have

changed since the date on the front cover of this prospectus.

For

investors outside the United States: We have not done anything that would permit offerings under this prospectus, or possession or distribution

of this prospectus, in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the

United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the

offering of the ordinary shares and the distribution of this prospectus outside of the United States.

Unless

the context clearly indicates otherwise, references in this prospectus to “we,” “our,” “ours,” “us,”

“the Company” and “Todos” refer to Todos Medical Ltd. and its subsidiaries.

CAUTIONARY

STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

In

addition to historical information, this prospectus contains forward-looking statements within the meaning of the U.S. Private Securities

Litigation Reform Act of 1995, Section 27A of the U.S. Securities Act of 1933 (the “Securities Act”), and Section 21E of

the U.S. Securities Exchange Act of 1934 (the “Exchange Act”). Such forward-looking statements may include projections regarding

the Company’s future performance and other statements that are not statements of historical fact and, in some cases, may be identified

by words like “anticipate,” “assume,” “believe,” “continue,” “could,” “estimate,”

“expect,” “intend,” “may,” “plan,” “potential,” “predict,” “project,”

“future,” “will,” “should,” “would,” “seek” and similar terms or phrases.

These

forward-looking statements are based on our management’s current expectations, which are subject to uncertainty, risks and changes

in circumstances that are difficult to predict, and many of which are outside of our control. Important factors that could cause our

actual resu0lts to differ materially from those indicated in the forward-looking statements include, among others, the factors discussed

under the heading “Risk Factors.”

You

should not rely upon forward-looking statements as predictions of future events. Although we believe that the expectations reflected

in the forward-looking statements are reasonable, we cannot guarantee that future results, levels of activity, performance and events

and circumstances reflected in the forward-looking statements will be achieved or will occur.

Any

forward-looking statements made in this prospectus speak only as of the date of the particular statement. Factors or events that could

cause the Company’s actual results to differ from the statements contained herein or therein may emerge from time to time, and

it is not possible for the Company to predict all of them. Except as required by law, the Company undertakes no obligation to publicly

update any forward-looking statements, whether as a result of new information, future developments or otherwise.

PROSPECTUS

SUMMARY

This

summary highlights information contained elsewhere in this prospectus. It may not contain all of the information that you should consider

before investing in our securities. You should read this entire prospectus carefully, including the “Risk Factors”, “Management’s

Discussion and Analysis of Financial Condition and Results of Operations” sections, and the financial statements and related notes

included herein. This prospectus includes forward-looking statements that involve risks and uncertainties. See “Forward-Looking

Statements.”

Overview

|

|

●

|

Todos

Medical Ltd. (“Todos Medical,” “Todos,” the “Company,” “we,” “our,”

“us”), is a comprehensive medical diagnostics and related solutions company focused on distributing comprehensive

solutions for COVID-19 screening and diagnosis, and immune resisting supplements, and on developing blood tests for the early

detection of cancer and Alzheimer’s disease.

|

|

|

|

|

|

|

●

|

Todos

has entered into distribution agreements with companies to distribute certain novel coronavirus (COVID-19) test kits. The agreements

cover multiple international suppliers of PCR testing kits and related materials and supplies, as well as antibody testing kits from

multiple manufacturers after completing validation of said testing kits and supplies in its partner CLIA/CAP certified laboratory

in the United States. Todos has combined the PCR testing kits with automated lab equipment to create lab workflows capable of performing

up to 40,000 PCR tests per day. Todos has entered into supply agreements with CLIA/CAP certified laboratories in the United States

to deploy these PCR workflows. Todos has formed strategic partnerships with Meridian Health and other strategic partners to deploy

COVID-19 antigen and antibody testing in the United States. Additionally, the Company is developing a lab-based COVID-19 3CL protease

test to determine whether a COVID-19 positive patient remains contagious after quarantine is complete and is further developing point-of-care-based

embodiments of the lab test for use in screening programs worldwide.

|

|

|

|

|

|

|

●

|

In

December 2020, Todos announced the commercial launch of its proprietary 3CL protease inhibitor dietary supplement Tollovid™ at

The Alchemist’s Kitchen in the SoHo district in Manhattan, New York. Tollovid, a mix of botanical extracts, is being targeted

to support healthy immune function against circulating coronaviruses. Tollovid’s mechanism of action is to inhibit the

activity of the 3CL protease, a key protease required for the intracellular replication of coronaviruses. Tollovid was granted a

Certificate of Free Sale by the US Food & Drug Administration in August 2020, allowing its commercial sale anywhere in the

United States. Tollovid has begun online sales through Amazon, Shopify and other online marketplaces.

|

|

|

|

|

|

|

●

|

Additionally,

the Company’s patented Todos Biochemical Infrared Analyses (TBIA) is a cancer-screening technology using peripheral blood analysis

that deploys deep examination into cancer’s influence on the immune system, looking for biochemical changes in blood mononuclear

cells and plasma. Todos’ two internally developed cancer-screening tests, TMB-1 and TMB-2 have received a CE mark in Europe.

In April 2021, Todos completed the acquisition of U.S.-based medical diagnostics company Provista Diagnostics, Inc. to gain rights

to its Alpharetta, Georgia-based CLIA/CAP certified lab and Provista’s proprietary commercial-stage Videssa® breast cancer

blood test.

|

|

|

|

|

|

|

●

|

Todos

is also developing blood tests for the early detection of neurodegenerative disorders, such as Alzheimer’s disease.

|

|

|

|

|

|

|

●

|

In

July 2020, Todos completed the acquisition of Breakthrough Diagnostics, Inc., the owner of the LymPro Test intellectual property,

from Amarantus Bioscience Holdings, Inc.

|

|

|

|

|

|

|

●

|

In

July 2021, Todos completed the acquisition of Provista Diagnostics Inc. (“Provista”), a CLIA laboratory performing COVID

testing for the general population as well as other scientific functions.

|

|

|

|

|

|

|

●

|

At

our annual general meeting of shareholders held on July 26, 2021, our shareholders voted to approve a reverse share split of the

Company’s Ordinary Shares within a range of 2:1 to 500:1, to be effective at the ratio and on a date to be determined by the

Board of Directors of the Company (the “Reverse Split”). Although our shareholders approved the Reverse Split, all per

share amounts and calculations in this prospectus and the accompanying consolidated financial statements do not reflect the effects

of the Reverse Split, as the Board of Directors has not determined the final ratio or the effective date of the Reverse Split.

|

Recent

Developments

On

January 22, 2021, we entered into a Securities Purchase Agreement (the “SPA”) with Yozma Global Genomic Fund (the “Purchaser”)

pursuant to which on January 29, 2021, the Company issued a promissory convertible note (the “Note”) to the Purchaser in

the principal amount of $4,857,142.86 for proceeds of $3,400,000 (the “Transaction”). The Note has a maturity date of one

year from the date of issuance and pays interest at a rate of 4% per annum. The Note is convertible into Ordinary Shares of the Company

(the “Conversion Shares”) at a conversion price of $0.0599 (the “Conversion Price). In addition, the Purchaser received

a warrant (the “Warrant”) to purchase up to 16,956,929 Ordinary Shares (the “Warrant Shares”) of the Company

with an exercise price equal to $0.107415 per share. The Warrant is exercisable for 5 years from the date of issuance. In the event that

the Company effectuates a reverse split of its ordinary shares for a ratio in excess of 20:1, the resulting adjusted Warrant Shares and

Exercise Price are limited to a 20:1 ratio.

This

registration statement registers for resale the Warrant Shares. Subsequent to the effective date of such Registration

Statement, if the closing sale price of the Ordinary Shares averages less than the then Conversion Price over a period of ten (10) consecutive

trading days, the Conversion Price shall reset to such average price. If the 10 day volume weighted average price of the Ordinary Shares

continues to be less than the Conversion Price, then the Conversion Price should reset to such 10-day average price. The maximum discount

from the initial Conversion Price under the Note is 20%.

The

foregoing descriptions of the SPA, the Note and the Warrant do not purport to be complete and are qualified in their entirety by reference

to the full text of the SPA, Note and Warrant, forms of which are attached as Exhibit 10.1, 10.2 and 10.3, respectively, to the Company’s

Current Report on Form 8-K dated January 26, 2021.

The

Company and Leviston Resources LLC, a Delaware limited liability company (the “Purchaser”) are parties to that certain Securities

Purchase Agreement, dated as of July 9, 2020 (the “Purchase Agreement”), pursuant to which the Purchaser purchased an aggregate

principal amount of $850,000 of convertible notes (the “July 2020 Convertible Notes”) from the Company. On March 3, 2021,

the Company and the Purchaser entered into a Closing Agreement (the “Closing Agreement”) pursuant to which the Purchaser

exercised its right to invest an additional $847,570 into the Company of July 2020 Convertible Notes (the “Tranche 2 Securities”).

This

registration statement registers for resale the Ordinary Shares underlying the Tranche 2 Securities.

The

foregoing description of the Closing Agreement does not purport to be complete and is qualified in its entirety by reference to the full

text of the Closing Agreement, a form of which is attached as Exhibit 10.1 to the Company’s Current Report on Form 8-K dated March

10, 2021.

During

the first quarter of 2021, the Company’s contractual agreement to supply Covid-19 testing kits to NOAH Laboratories, Inc., a significant

customer expired. At the customer’s request, the Company continued to supply Covid-19 testing kits until such time as the customer

requested that the Company stop doing so. The customer has not yet paid for some of the Covid-19 testing kits so supplied and has not

yet renewed its agreement with the Company. On November 15, 2021, Todos USA sent a demand letter (the “Demand Letter”) to

the significant customer with which our contractual agreement to supply Covid-19 testing kits expired. The Demand Letter seeks (a) payment

for testing kits that Todos USA supplied for which it was not paid, in the amount of $3,465,000, (b) the return of Todos USA’s

equipment, title to which remains with Todos USA unless and until the significant customer meets a minimum purchase requirement, and

(c) payment of damages as a result of the significant customer’s unlawful retention of Todos USA’s equipment, in an amount

anticipated to be $2 million. The Company and Todos USA are negotiating a settlement with NOAH Laboratories, Inc., which the Company

believes will result in most of the Company’s demands being met.

On

April 8, 2021, the Company entered into a Securities Purchase Agreement (the “SPA”) with Kips Bay Select LP (the “Purchaser”)

pursuant to which the Company agreed to issue a promissory convertible note (the “Note”) to the Purchaser in the principal

amount of $4,285,714.29 for proceeds of $3,000,000 (the “Transaction”). The closing occurred on April 12, 2021 (the “Closing

Date”). The Note has a maturity date of one year from the date of issuance and pays interest at a rate of 4% per annum. The Note

is convertible into Ordinary Shares (the “Conversion Shares”) at a conversion price of $0.0599 (the “Conversion Price).

In addition, the Purchaser received a warrant (the “Warrant”) to purchase up to 16,000,000 Ordinary Shares (the “Warrant

Shares”) of the Company with an exercise price equal to $0.107415 per share. The Warrant is exercisable for 5 years from the date

of issuance. In the event that the Company effectuates a reverse split of its Ordinary shares for a ratio in excess of 20:1, the resulting

adjusted Warrant Shares and Exercise Price are limited to a 20:1 ratio. The Company used the net proceeds from this Note to initiate

the Phase 2 for Tollovir™ clinical trial in COVID-19 patients, complete the acquisition of Provista Diagnostics, Inc. and for general

corporate purposes.

This

registration statement registers for resale the Warrant Shares. Subsequent to the effective date of such registration

statement, if the closing sale price of our Ordinary Shares averages less than the then Conversion Price over a period of ten (10) consecutive

trading days, the Conversion Price shall reset to such average price. If the 10 day volume weighted average price of our Ordinary Shares

continues to be less than the Conversion Price then the Conversion Price should reset to such 10-day average price with a maximum of

a 20% discount from the initial Conversion Price.

The

Purchaser has the option to purchase an additional Note in the principal amount of $5,285,714.20 for proceeds of $3,700,000 and an additional

Warrant to purchase 16,000,000 Ordinary Shares within 90 days of the effective date of the registration statement on Form S-1 described

in the previous paragraph.

The

foregoing descriptions of the SPA, the Note and the Warrant do not purport to be complete and are qualified in their entirety by

reference to the full text of the SPA, Note and Warrant, forms of which are attached as Exhibit 10.1, 10.2 and 10.3, respectively,

to the Company’s Current Report on Form 8-K dated April 14, 2021.

On

April 8, 2021, the Company received a notice of allowance (‘Letter of Intent to Grant a Patent’) from the European Patent

Office covering the use of the Company’s proprietary Total Biochemical Infrared Analysis (‘TBIA’) method that uses

blood (plasma and/or peripheral blood mononuclear cells ‘PBMCs’) to distinguish between patients with benign tumors vs. malignant

tumors vs. no tumors (healthy controls).

The

patent application specifically covers methods for capturing consistent data from infrared spectroscopy readers, as well as the application

of various artificial intelligence algorithm development methods to the data. The ability of TBIA to make a diagnosis of cancer has first

been applied to the detection of breast and colon cancers, where Todos has received CE Marks in Europe paving the way for commercialization

initially focused on TMB-2 (dense breast / inconclusive mammogram secondary screening) and TMB-1 (general breast cancer screening) cancer

detection tests.

On

April 19, 2021, the Company entered into an Agreement to Purchase Provista Diagnostics, Inc. (“Agreement to Purchase”) with

Strategic Investment Holdings, LLC (“SIH”), Ascenda BioSciences LLC (“Ascenda”) and Provista Diagnostics, Inc.

(“Provista”). Ascenda was the sole owner of the outstanding securities of Provista and SIH is the sole owner of all the outstanding

securities of Ascenda.

Pursuant

to the Agreement to Purchase, the Company acquired Provista from Ascenda and SIH for an aggregate purchase price of $7.5 million consisting

of an initial cash payment of $1.25 million, the issuance of $1.5 million in Ordinary Shares priced at $0.0512 per share, the issuance

to SIH of a $3.5 million convertible promissory note dated April 19, 2021 (the “Note”) and the payment on for before July

1, 2021 of $1.25 million in cash (the “July Payment”), which payment the Company had the right to, and did, extend to July

15, 2021. The Provista shares acquired by the Company remained in an escrow account until the July Payment was made.

The

Note has a maturity date of April 8, 2025, and is convertible beginning on October 20, 2021, into Ordinary Shares of the Company at a

conversion price equal to the lesser of $0.05 or the volume weighted average price of the last 20 trading days for the Ordinary Shares

prior to the date of conversion. In the event SIH delivers a Notice of Conversion to the Company at a per share price less than $0.05

($0.05), the Company has the right to immediately notify SIH of its intention to pay the conversion amount in cash within three (3) business

days of receipt of the Notice of Conversion (i.e., before SIH would take possession of shares converted under the Notice of Conversion).

If, at any time between October 20, 2021 and April 20, 2022, the average of the lowest bid and closing sale price at 4:00:00 p.m., New

York time (or such other time as such market publicly announces is the official close of trading) is below ($0.05), the Company has the

option to buy out all or any portion of the Note (the “Buyback Option”). In the event the Company exercises the Buyback Option

for an amount equal to or greater than one million, one hundred seventy thousand dollars ($1,170,000) (the “Buyback Amount”),

SIH may not submit any conversions below five cents ($0.05) for ninety (90) days from receipt of the Buyback Amount (“90 Day Period”).

In

the event that the Company uplists its Ordinary Shares to a national securities exchange, the Note shall automatically be exchanged into

Series B preferred stock with a conversion price equal to the lesser of (a) $0.05, (b) the opening price on the day of the uplisting

provides there is no transaction associated with the uplisting or (c) the deal price of an uplisting transaction.

As

of the date of this prospectus, SIH has not submitted a Conversion Notice.

The

foregoing descriptions of the Agreement to Purchase, the SPA, the Note and the Security Agreement do not purport to be complete and are

qualified in their entirety by reference to the full text of the Agreement to Purchase, SPA, Note and the Security Agreement, forms of

which are attached as Exhibit 10.1, 10.2 and 10.3, respectively, to the Company’s Current Report on Form 8-K dated April 23, 2021.

On

July 7, 2021, the Company entered into a Securities Purchase Agreement (the “SPA”) with Kips Bay Select LP (the “Purchaser”)

pursuant to which the Company agreed to issue a promissory convertible note (the “Note”) to the Purchaser in the principal

amount of $1,535,714 for proceeds of $1,075,000 (the “Transaction”). The closing occurred on July 7, 2021 (the “Closing

Date”). The Note has a maturity date of one year from the date of issuance and pays interest at a rate of 4% per annum. The Note

is convertible into Ordinary Shares of the Company (the “Conversion Shares”) at a conversion price of $0.0599 (the “Conversion

Price). In addition, the Purchaser received a warrant (the “Warrant”) to purchase up to 3,440,000 Ordinary Shares (the “Warrant

Shares”) of the Company with an exercise price equal to $0.107415 per share. The Warrant is exercisable for 5 years from the date

of issuance. From the Closing Date until 180 days thereafter, the Company shall be restricted from issuing or entering into any agreement

to issue any Ordinary Shares, except under certain circumstances, including an uplisting. This provision shall no longer be in effect

if the closing sale price of the Ordinary shares exceeds $0.10. The Company intends to use the net proceeds for general corporate purposes.

This

registration statement registers for resale the Warrant Shares. Subsequent to the effective date of such registration

statement, if the closing sale price of the Ordinary Shares averages less than the then Conversion Price over a period of ten (10) consecutive

trading days, the Conversion Price shall reset to such average price. If the 10-day volume weighted average price of the Ordinary Shares

continues to be less than the Conversion Price then the Conversion Price should reset to such 10-day average price with a maximum of

a 20% discount from the initial Conversion Price.

The

foregoing descriptions of the SPA, the Note and the Warrant do not purport to be complete and are qualified in their entirety by reference

to the full text of the SPA, Note and Warrant, forms of which are attached as Exhibit 10.1, 10.2 and 10.3, respectively, to the Company’s

Current Report on Form 8-K filed July 8, 2021.

On

September 23, 2021, the Company completed the conditions precedent required to enter into a Securities Purchase Agreement (the “SPA”)

with Mercer Street Global Opportunity Fund, LLC (the “Purchaser”) pursuant to which the Company issued a promissory convertible

note (the “Note”) to the Purchaser in the principal amount of $2,285,142.86 for proceeds of $2,000,000 (the “Transaction”).

The Note has a maturity date of one year from the date of issuance and pays interest at a rate of 4% per annum. The Note is convertible

into Ordinary Shares of the Company (the “Conversion Shares”) at a conversion price of $0.0599 (the “Conversion Price).

In addition, the Purchaser received a warrant (the “Warrant”) to purchase up to 11,924,636 Ordinary Shares (the “Warrant

Shares”) of the Company with an exercise price equal to $0.107415 per share. The Warrant is exercisable for 5 years from the date

of issuance. The Company intends to use the net proceeds from this Note to initiate Phase 2/3 trials for Tollovir™ COVID-19 patients,

initiate digital marketing for its dietary supplement Tollovid®, increase sales & marketing for Provista Diagnostics, and for

general corporate purposes.

Univest

Securities, LLC acted as placement agent for the offering.

This

registration statement registers for resale the Conversion Shares and the Warrant Shares. Subsequent to the effective date of the registration

statement, if the closing sale price of the Ordinary shares averages less than the then Conversion Price over a period of ten (10) consecutive

trading days, the Conversion Price shall reset to such average price. If the 10 day volume weighted average price of the Ordinary

shares continues to be less than the Conversion Price then the Conversion Price should reset to such 10-day average price with a maximum

of a 20% discount from the initial Conversion Price.

The

foregoing descriptions of the SPA, the Note and the Warrant do not purport to be complete and are qualified in their entirety by reference

to the full text of the SPA, Note and Warrant, forms of which are attached as Exhibit 10.1, 10.2 and 10.3, respectively, to the Company’s

Current Report on Form 8-K filed September 24, 2021.

On

July 22, 2021, the US Food & Drug Administration (FDA) granted a new Certificate of Free Sale for Tollovid Daily™, the newest

member of the Company’s Tollovid™ dietary supplement product line.

The

Certificate of Free Sale is for a twice-daily dosing regimen and, critically, a 3CL protease inhibitor claim. Each 60-pill bottle of

Tollovid Daily can help support and maintain healthy immune function for 30 days. The Company intends to establish a monthly subscription

model as part of its marketing launch campaign for Tollovid Daily immune system support. Tollovid™ and Tollovid Daily are both

3CL protease inhibitor products developed under a joint venture with NLC Pharma.

On

November 15, 2021, Todos USA sent a demand letter (the “Demand Letter”) to a significant customer with which our contractual

agreement to supply Covid-19 testing kits expired. The Demand Letter seeks (a) payment for testing kits that Todos USA supplied for which

it was not paid, in the amount of $3,465,000, (b) the return of Todos USA’s equipment, title to which remains with Todos USA unless

and until the significant customer meets a minimum purchase requirement, and (c) payment of damages as a result of the significant customer’s

unlawful retention of Todos USA’s equipment, in an amount anticipated to be $2 million. Todos USA has yet to receive a response

to the Demand Letter.

On

November 18, 2021, Todos entered into a license agreement (the “License Agreement”) with T-Cell Protect Hellas S.A. (“T-Cell

Protect”) pursuant to which the Company will license the European manufacturing and distribution rights to a product based on the

Company’s Tollovid® and Tollovid Daily™ 3CL protease inhibitor and immune support dietary supplements to T-Cell Protect

(the “Product”). The License Agreement became effective on November 22, 2021 when the Company received a purchase order for

50,000 bottles of Tollovid Daily, per the terms of the License Agreement. The Product is expected to be marketed under the T-Cell Protect

brand in Europe. In addition, the Company will grant to T-Cell Protect an exclusive license to manufacture, sell and distribute the Product

in Greece. The License Agreement provides for royalty in the low double digits to the Company and a minimum of 500,000 bottles in sales

over the 18 months after the date of the License Agreement. In the event T-Cell Protect establishes its own manufacturing of the Product

in the European market, the 500,000 bottle minimum referred to in the previous sentence will become a minimum sales requirement. In the

License Agreement, T-Cell Protect acknowledged that the Company intends to assign the License Agreement to a subsidiary being formed

by the Company to focus on the development of 3CL protease biology called 3CL Sciences, Inc. (“3CL Sciences”).

On

November 22, 2021, the Company entered into a Securities Purchase Agreement (the “SPA”) with T-Cell pursuant to which the

Company issued a promissory convertible note (the “Note”) to T-Cell Protect in the principal amount of €1,000,000 (the

“Transaction”). The Note has a maturity date of one year from the date of issuance and pays interest at a rate of 10% per

annum. The Note is convertible into ordinary shares (the “Conversion Shares”) at a conversion price of $0.0599 (the “Conversion

Price). At any time prior to the Company uplisting its ordinary shares to a national securities exchange, T-Cell Protect may exchange

the Note into either (a) a direct equity investment in 3CL Sciences at the same terms as a financing round of at least $5,000,000 (the

“Sub”) or (b) into a note in the Sub, bearing 10% interest that converts into direct equity in the Sub at the same terms

as a financing round of at least $5,000,000. The proceeds from this Transaction are intended to be used for the clinical development

of Tollovir, the Company’s therapeutic candidate for hospitalized COVID-19 patients.

On

November 24, 2021, the Company entered into a binding letter of intent (the “LOI”) with NLC Pharma Ltd. (“NLC”)

pursuant to which 3CL Sciences will purchase all therapeutic, diagnostic, dietary supplement and pharmaceutical assets from NLC that

relate to 3CL protease biology in exchange for a 40% equity interest in 3CL Sciences that NLC will own, single digit royalties and Company

ordinary shares. Promptly following execution of the LOI, the Company will deliver $325,000 to pay outstanding invoices related to the

interim analysis of the ongoing clinical trial of Tollovir. The Company shall be responsible for providing or assisting in the raising

of a total of $10 million into 3CL Sciences over a period of 7 months from execution of the LOI. The Company and NLC agree to identify

a seasoned biopharmaceutical CEO to run 3CL Sciences going forward. The board of directors of 3CL Sciences will be made up of five (5)

individuals: two (2) appointed by the Company, two (2) appointed by NLC and one (1) to be mutually agreed upon by the Company and NLC.

In addition, NLC will be granted one (1) seat on the Company’s Board of Directors.

The

Company has agreed to file a registration statement with the Securities and Exchange Commission registering for resale the Conversion

Shares (the “Registration Statement).

The

foregoing descriptions of the License Agreement, SPA, the Note and LOI do not purport to be complete and are qualified in their entirety

by reference to the full text of the License Agreement, SPA, Note and LOI, forms of which are attached as Exhibit 10.1, 10.2, 10.3 and

10.4, respectively, to the Company’s Current Report on Form 8-K dated November 29, 2021.

Contractual

Obligations

The

following table summarizes our contractual obligations as of September 30, 2021:

|

|

|

Payments due by period

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(US$)

|

|

|

Less than 1

|

|

|

|

|

|

|

|

|

More than

|

|

|

|

|

Total

|

|

|

year

|

|

|

1-3 years

|

|

|

3-5 years

|

|

|

5 years

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Convertible bridge loans, net

|

|

|

15,560,000

|

|

|

|

15,560,000

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

Other loans, net

|

|

|

2,756,000

|

|

|

|

2,756,000

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Royalties to BGU (1)

|

|

|

501,000

|

|

|

|

296,000

|

|

|

|

95,000

|

|

|

|

39,000

|

|

|

|

71,000

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total (2)

|

|

|

18,817,000

|

|

|

|

18,612,000

|

|

|

|

95,000

|

|

|

|

39,000

|

|

|

|

71,000

|

|

(1)

This balance was measured based on the future cash payments discounted using an interest rate of 21%, which represents, according to

management’s estimate, the applicable rate of risk for us.

(2)

This does not include the repayment of approximately $272,000 of grants we received from the Israel Innovation Authority (“IIA”)

and interest thereon, which shall be repaid as royalties upon the commercialization of our products.

Summary

of Risk Factors

Our

business is subject to significant risks and uncertainties that make an investment in us speculative and risky. Below we summarize what

we believe are the principal risk factors, but these risks are not the only ones we face, and you should carefully review and consider

the full discussion of our risk factors in the section titled “Risk Factors”, together with the other information in this

prospectus. If any of the following risks actually occurs (or if any of those listed elsewhere in this prospectus occur), our business,

reputation, financial condition, results of operations, revenue, and future prospects could be seriously harmed. Additional risks and

uncertainties that we are unaware of, or that we currently believe are not material, may also become important factors that adversely

affect our business.

We

have a history of losses, may incur future losses and may not achieve profitability.

We

have a need for substantial additional financing and will have to significantly delay, curtail or cease operations if we are unable to

secure such financing.

The

report of our former independent registered public accounting firm expresses substantial doubt about our ability to continue as a going

concern.

There

can be no assurance of market acceptance for our COVID-19 antibody test.

We

rely on a third party to manufacture the COVID-19 antibody tests for us, and if such third party refuses or is unable to supply us with

the COVID-19 test kits, our business will be materially harmed.

We

may not succeed in completing the development of our cancer detection products, commercializing our products or generating significant

revenues.

We

are currently in the process of improving our technology and adapting to the high throughput methodology.

We

will require additional funding in order to commercialize our cancer detection kits and to develop and commercialize any future products.

We

may not successfully maintain our existing license agreement with BGU and Soroka, and we are currently not in compliance with the repayment

terms of the license agreement, which could adversely affect our ability to develop and commercialize our product candidates.

If

we are unable to protect our intellectual property rights, our competitive position could be harmed.

Because

the medical device industry is litigious, we are susceptible to intellectual property suits that could cause us to incur substantial

costs or pay substantial damages or prohibit us from selling our cancer detection kits.

If

we or our future distributors do not obtain and maintain the necessary regulatory clearances or approvals in a specific country or region,

we will not be able to market and sell our cancer detection kits or future products in that country or region.

If

we are unable to successfully complete clinical trials with respect to our cancer detection kits, we may be unable to receive regulatory

approvals or clearances for our cancer detection kits and/or our ability to achieve market acceptance of our cancer detection kits will

be harmed.

Conditions

in Israel could materially and adversely affect our business

Your

rights and responsibilities as a shareholder will be governed by Israeli law which differs in some material respects from the rights

and responsibilities of shareholders of U.S. companies.

It

may be difficult to enforce a judgment of a U.S. court against us, or against our officers and directors in Israel, or to assert U.S.

securities laws claims in Israel or to serve process on our officers and directors in Israel.

The

sale or issuance of our Ordinary Shares to Lincoln Park Capital may cause dilution and the sale of the Ordinary Shares acquired by Lincoln

Park, or the perception that such sales may occur, could cause the price of our Ordinary Shares to fall.

We

may not have access to the full amount available under the Purchase Agreement with Lincoln Park.

An

active trading market for our Ordinary Shares may not develop and our shareholders may not be able to resell their Ordinary Shares.

You

should not rely upon forward-looking statements as predictions of future events. Although we believe that the expectations reflected

in the forward-looking statements are reasonable, we cannot guarantee that future results, levels of activity, performance and events

and circumstances reflected in the forward-looking statements will be achieved or will occur.

Any

forward-looking statements made in this prospectus speak only as of the date of the particular statement. Factors or events that could

cause the Company’s actual results to differ from the statements contained herein or therein may emerge from time to time, and

it is not possible for the Company to predict all of them. Except as required by law, the Company undertakes no obligation to publicly

update any forward-looking statements, whether as a result of new information, future developments or otherwise.

Corporate

Information

We

were incorporated in the State of Israel in April 2010, and are subject to the Israel Companies Law, 5760-1999 (the “Companies

Law”). Since March 7, 2017, our Ordinary Shares have been quoted on the OTCQB under the symbol TOMDF.

In

January 2016, we incorporated our wholly owned subsidiary, Todos (Singapore) Pte. Ltd. In March 2016, Todos (Singapore) Pte. Ltd. changed

its name to Todos Medical Singapore Pte. Ltd., or Todos Singapore. Todos Singapore has not yet commenced its business operations.

In

January 2020, we incorporated Todos Medical USA, a Nevada corporation (“Todos US”), for the purpose of conducting

business as a medical importer and distributor focused on the distribution the Company’s testing products and services to

customers in North America and Latin America. In addition, in March 2020, Todos US formed a subsidiary, Corona Diagnostics, LLC, in

the State of Nevada, for the purpose of marketing COVID-19 related products in the United States. In July 2020, we completed the

acquisition of Breakthrough Diagnostics, Inc, which is now a wholly owned subsidiary of Todos. In July 2021, we completed the

acquisition of Provista Diagnostics, Inc., which is now a wholly owned subsidiary of Todos.

Effective

January 1, 2021, we began filing periodic reports with the SEC as a U.S. domestic issuer, after we determined that, as of June 30, 2020,

we no longer qualified as a foreign private issuer under SEC rules. As a U.S. domestic issuer, we must now, for the first time, make

our SEC filings under the rules applicable to U.S. domestic issuers, and must include certain disclosures that were not previously required.

The

current corporate organizational structure of the Company and how we have operated substantially for the past year appears below.

Our

principal executive office is located at 121 Derech Menachem Begin, 30th Floor, Tel Aviv, 6701203 Israel, and our telephone number in

Israel is +972-52-642-0126. Our web address is www.todosmedical.com. The information contained on our website or available through our

website is not incorporated by reference into and should not be considered a part of this prospectus, and the reference to our website

in this prospectus is an inactive textual reference only. Puglisi & Associates is our agent in the United States, and its address

is 850 Library Avenue, Suite 204 Newark, Delaware 19711.

All

per share amounts and calculations in this prospectus and the accompanying financial statements do not reflect the effects of

the Reverse Split discussed elsewhere in this prospectus.

Our

former independent registered public accounting firm indicated in its report on our financial statements for the year ended December

31, 2020, as included elsewhere in this prospectus, that conditions raise substantial doubts about our ability to continue as

a “going concern.” In addition, our financial status creates substantial doubt whether we will continue as a going concern.

Shares

offered for sale in this prospectus

The

shares offered in this prospectus relate to the resale by selling shareholders of an aggregate of (i) 123,086,088 ordinary shares

issuable upon the conversion of eight convertible notes (the “2021 Convertible Notes”) which were issued in private

placements to six institutional investors, (ii) 78,332,201 ordinary shares, (the “Purchaser Warrant Shares”),

issuable upon exercise of outstanding warrants (the “2021 Warrants”), and (iii) 59,648,748 ordinary shares (the “Prior

Warrant Shares”) issuable upon the exercise of outstanding warrants (the “2020 Warrants”). We sold the 2021 Convertible

Notes and the 2021 Warrants pursuant to nine securities purchase agreements between us and the respective investors party thereto,

dated July 6, 2021, July 7, 2021, August 9, 2021, September 15, 2021, October 18, 2021, November 2, 2021, November 24, 2021, December

14, 2021, and December 21, 2021, respectively (the “2021 Purchase Agreements”). The 2020 Warrants were initially issued

by us in a series of private placements to fifteen purchasers between November 1, 2019 and July 8, 2020.

The

2021 Convertible Notes include:

|

|

●

|

nine

convertible notes issued

to seven different investors in the original principal amounts ranging from $142,857

to $2,857,143 respectively, which may be

converted to purchase up to 123,086,088 ordinary shares at a conversion price of $0.0599

per share, which were issued to certain of the Selling Shareholders pursuant to the 2021

Purchase Agreements. The conversion price for the Convertible Notes is subject to adjustment

downwards under certain circumstances. All share numbers in this prospectus assume that such

conversion price will not be adjusted. The maximum adjustment of the conversion price under

the Convertible Notes is 20%. One convertible note did not include warrants.

|

The

2021 Warrants include:

|

|

●

|

fourteen

warrants issued to eight

different investors to purchase between 266,667 and 16,956,929 ordinary

shares respectively, at an exercise price of $0.10741, which were issued to certain

of the Selling Shareholders pursuant to the 2021 Purchase Agreements.

|

The

2020 Warrants include:

|

|

●

|

twenty-one

warrants issued to fifteen different investors to purchase up to an aggregate

of 59,648,748 ordinary shares (ranging from 446,428 to 8,000,000 ordinary shares)

at exercise prices ranging from $0.04 to $0.10 per ordinary share, which were issued

to certain of the Selling Shareholders in a series of private placements between November

2019 and July 2020.

|

All

of the 2021 Convertible Notes, 2021 Warrants and 2020 Warrants were issued pursuant to the exemption from the registration requirements

in Section 4(a)(2) of the Securities Act of 1933, as amended, and/or Regulation D thereunder. We are filing the registration statement

on Form S-1, of which this prospectus is a part, to enable the holders of the 2021 Convertible Notes to resell the underlying ordinary

shares upon converting the convertible notes to ordinary shares, and the holders of the 2021 Warrants and the 2020 Warrants to resell

the underlying ordinary shares after exercising the warrants for cash.

The

Offering

|

Securities

offered by the selling shareholders

|

|

123,086,088

ordinary shares issuable

upon the conversion of the 2021 Convertible Notes, 78,332,201 ordinary shares issuable

upon exercise of the outstanding 2021 Warrants, and 59,648,748 ordinary shares issuable

upon exercise of the outstanding 2020 Warrants.

|

|

|

|

|

|

Ordinary

shares outstanding before this offering

|

|

977,144,432

ordinary shares, based on the number of shares

outstanding as of January 13, 2022

|

|

|

|

|

|

Ordinary

shares to be outstanding after this offering

|

|

1,505,466,119

ordinary shares (assuming

(a) the conversion of all of the Convertible Notes, (b) the exercise of all

the outstanding 2021 Warrants, (c) the exercise of all of the outstanding 2020 Warrants,

and the resale of all underlying ordinary shares by the selling shareholders in offerings

under this prospectus, (d) the conversion by Yozma Global Genomic Fund 1 of $9,571,429

in principal amount of convertible notes into 166,181,732 ordinary shares, and (e) the conversion

by Kips Bay Select LP of an additional $5,821,428 in principal amount of convertible notes

into 101,072,918 ordinary shares). The conversion price for the Convertible Notes is subject

to adjustment downwards under certain circumstances. All share numbers in this prospectus

assume that such conversion price will not be adjusted. The maximum adjustment of the conversion

price under the Convertible Notes is 20%.

|

|

|

|

|

|

Use

of proceeds

|

|

We

will not receive any proceeds from the sale of ordinary shares issuable upon conversion of the 2021 Convertible Notes by the selling

shareholders. We will, however, receive the proceeds of any Warrants exercised for cash in the future. Such net proceeds will be

up to approximately $13,506,515, based on the 2020 Warrants’ and the 2021 Warrants’ respective exercise prices.

See “Use of Proceeds” in this prospectus.

|

|

|

|

|

|

Dividend

policy

|

|

We

have never declared or paid any cash dividends on our ordinary shares. We do not anticipate paying any cash dividends in the foreseeable

future.

|

|

|

|

|

|

Risk

factors

|

|

You

should carefully consider the risk factors described in the section of this prospectus entitled “Risk Factors,” together

with all of the other information included in this prospectus, before deciding to purchase our ordinary shares.

|

SUMMARY

CONSOLIDATED FINANCIAL INFORMATION

The

following tables present the Company’s Condensed Consolidated Financial Statements as of September 30, 2021.

The

summarized financial information presented below is derived from and should be read in conjunction with our audited consolidated financial

statements including the notes to those financial statements, which are included elsewhere in this prospectus along with the section

entitled “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” Our historical results

are not necessarily indicative of our future results.

TODOS

MEDICAL LTD.

CONDENSED

CONSOLIDATED BALANCE SHEETS

(U.S.

dollars in thousands except share and per share amounts)

The

accompanying notes are an integral part of these condensed consolidated financial statements.

TODOS

MEDICAL LTD.

CONDENSED

STATEMENTS OF OPERATIONS

(U.S.

dollars in thousands except share and per share amounts)

The

accompanying notes are an integral part of these condensed consolidated financial statements.

TODOS

MEDICAL LTD.

CONDENSED

CONSOLIDATED STATEMENTS OF CHANGES IN SHAREHOLDERS’ DEFICIT

(U.S.

dollars in thousands except share and per share amounts)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Ordinary shares

|

|

|

Additional paid-in

|

|

|

Accumulated

|

|

|

Total Shareholders’

|

|

|

|

|

Shares

|

|

|

Amount

|

|

|

capital

|

|

|

deficit

|

|

|

deficit

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance as of December 31, 2019

|

|

|

103,573,795

|

|

|

$

|

280

|

|

|

$

|

10,979

|

|

|

$

|

(17,508

|

)

|

|

$

|

(6,249

|

)

|

|

Changes during the three months period ended March 31, 2020:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Issuance of ordinary shares for call option to acquire potential acquiree

|

|

|

17,091,096

|

|

|

|

49

|

|

|

|

951

|

|

|

|

-

|

|

|

|

1,000

|

|

|

Issuance of ordinary shares as settlement of previous commitments

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Issuance of ordinary shares as settlement of previous commitments, shares

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Partial conversion of convertible bridge loans into ordinary shares

|

|

|

27,336,061

|

|

|

|

78

|

|

|

|

1,508

|

|

|

|

-

|

|

|

|

1,586

|

|

|

Issuance of ordinary shares upon modification of terms relating to convertible

straight loan transaction

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Issuance of ordinary shares upon modification of terms relating to convertible

straight loan transaction, shares

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Classification of derivative warrants liability into equity as result of partial

conversion of convertible bridge loans into ordinary shares

|

|

|

-

|

|

|

|

-

|

|

|

|

333

|

|

|

|

-

|

|

|

|

333

|

|

|

Issuance of ordinary shares as partial settlement of financial liability

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Issuance of ordinary shares as partial settlement of financial liability, shares

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Issuance of ordinary shares and stock warrants upon modification of terms relating

to convertible bridge loans transactions

|

|

|

350,000

|

|

|

|

1

|

|

|

|

376

|

|

|

|

-

|

|

|

|

377

|

|

|

Commitment to issue units consisting of ordinary shares and stock warrants

|

|

|

-

|

|

|

|

-

|

|

|

|

30

|

|

|

|

-

|

|

|

|

30

|

|

|

Issuance of stock warrants as part of convertible bridge loan received

|

|

|

-

|

|

|

|

-

|

|

|

|

466

|

|

|

|

-

|

|

|

|

466

|

|

|

Issuance of ordinary shares in exchange for equity line received

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Issuance of ordinary shares in exchange for equity line received, shares

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Issuance of ordinary shares as collateral for loan repayment

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Issuance of ordinary shares as collateral for loan repayment, shares

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Issuance of ordinary shares or commitment for issuance of fixed number of ordinary

shares to service providers

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Issuance of ordinary shares as commitment shares in exchange for equity

line granted

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Issuance of ordinary shares as commitment shares in exchange for equity

line granted, shares

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Issuance of ordinary shares through equity line

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Issuance of ordinary shares through equity line, shares

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Issuance of ordinary shares as consideration to obtain control over affiliated

company

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Issuance of ordinary shares as consideration to obtain control over affiliated

company, shares

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Issuance of ordinary shares as commitment shares in exchange for receivables

financing facility

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Issuance of ordinary shares as commitment shares in exchange for receivables

financing facility, shares

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Issuance of units consisting of ordinary shares (or fixed number of shares to

be issued) and warrants

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Issuance of units consisting of ordinary shares (or fixed number of shares to

be issued) and warrants, shares

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Amount related to fixed number of ordinary shares to be issued as contingent

consideration

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Share based compensation for employees & directors

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Commitment to issue shares in acquisition of subsidiary

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Stock-based compensation to service providers

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Issuance of shares in acquisition of subsidiary

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Issuance of shares in acquisition of subsidiary, shares

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Issuance of ordinary shares to service providers

|

|

|

5,718,588

|

|

|

|

17

|

|

|

|

815

|

|

|

|

-

|

|

|

|

832

|

|

|

Net loss for the period

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

(4,638

|

)

|

|

|

(4,638

|

)

|

|

Balance as of March 31, 2020 (unaudited)

|

|

|

154,069,540

|

|

|

|

425

|

|

|

|

15,458

|

|

|

|

(22,146

|

)

|

|

|

(6,263

|

)

|

|

Changes during the three months period ended June 30, 2020:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Issuance of ordinary shares for call option to acquire potential acquiree

|

|

|

13,008,976

|

|

|

|

37

|

|

|

|

963

|

|

|

|

-

|

|

|

|

1,000

|

|

|

Partial conversion of convertible bridge loans into ordinary shares

|

|

|

13,015,711

|

|

|

|

36

|

|

|

|

866

|

|

|

|

-

|

|

|

|

902

|

|

|

Classification of derivative warrants liability into equity as result of partial

conversion of convertible bridge loans into ordinary shares

|

|

|

-

|

|

|

|

-

|

|

|

|

193

|

|

|

|

-

|

|

|

|

193

|

|

|

Issuance of stock warrants as part of convertible bridge loan received

|

|

|

-

|

|

|

|

-

|

|

|

|

126

|

|

|

|

-

|

|

|

|

126

|

|

|

Issuance of ordinary shares as partial settlement of financial liability

|

|

|

13,750,000

|

|

|

|

39

|

|

|

|

910

|

|

|

|

-

|

|

|

|

949

|

|

|

Issuance of ordinary shares and stock warrants upon modification of terms relating

to convertible bridge loans transactions

|

|

|

720,000

|

|

|

|

2

|

|

|

|

39

|

|

|

|

-

|

|

|

|

41

|

|

|

Issuance of ordinary shares to service providers

|

|

|

7,309,915

|

|

|

|

21

|

|

|

|

966

|

|

|

|

-

|

|

|

|

987

|

|

|

Net loss for the period

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

(2,585

|

)

|

|

|

(2,585

|

)

|

|

Balance as of June 30, 2020 (unaudited)

|

|

|

201,874,142

|

|

|

$

|

560

|

|

|

$

|

19,521

|

|

|

$

|

(24,731

|

)

|

|

$

|

(4,650

|

)

|

|

Changes during the three months period ended September 30, 2020:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Partial conversion of convertible bridge loans into ordinary shares

|

|

|

14,017,973

|

|

|

|

41

|

|

|

|

1,413

|

|

|

|

-

|

|

|

|

1,454

|

|

|

Issuance of stock warrants as part of convertible bridge loan received

|

|

|

-

|

|

|

|

-

|

|

|

|

582

|

|

|

|

-

|

|

|

|

582

|

|

|

Issuance of ordinary shares as commitment shares in exchange for equity line

granted

|

|

|

5,812,500

|

|

|

|

17

|

|

|

|

465

|

|

|

|

-

|

|

|

|

482

|

|

|

Issuance of ordinary shares through equity line

|

|

|

14,437,500

|

|

|

|

43

|

|

|

|

1,253

|

|

|

|

-

|

|

|

|

1,296

|

|

|

Issuance of ordinary shares as consideration to obtain control over affiliated

company

|

|

|

67,599,796

|

|

|

|

193

|

|

|

|

5,891

|

|

|

|

-

|

|

|

|

6,084

|

|

|

Issuance of ordinary shares for call option to acquire potential acquire

|

|

|

18,608,113

|

|