Robinhood Falls Below IPO Price After 3Q Results Miss

October 27 2021 - 12:03PM

Dow Jones News

By Michael Dabaie

Robinhood Markets Inc. shares fell in Wednesday trading after

quarterly revenue missed analyst views.

Shares were down 9% at $35.96 in late morning trading, putting

them below the company's initial public offering price of $38 from

this summer.

The financial services platform company reported after the bell

Tuesday reported third-quarter total net revenue of $365 million,

up on year but missing FactSet consensus for $437.1 million.

Transaction-based revenue of $267 million was below the $325.3

million FactSet consensus.

Options increased 29% to $164 million, above FactSet consensus

of $154.6 million. Cryptocurrencies increased 860% to $51 million,

but came in below FactSet consensus for $125.7 million. Crypto

activity declined from record highs in the prior quarter, leading

to considerably fewer new funded accounts, the company said.

Equities decreased 27% to $50 million and missed FactSet

consensus of $59.2 million.

Net loss was $2.06 per share. Adjusted earnings before interest,

taxes, depreciation and amortization was negative $84 million,

compared with positive $59 million in the third quarter of

2020.

"With top-line results significantly below expectations (ours as

well as consensus), lower [monthly active users], declining

[average revenue per user], very negative adjusted Ebitda...and

disappointing 4Q guidance including no uptick in new funded

accounts, we believe 3Q may be poorly received and we expect a

negative stock reaction," Mizuho Securities USA said in a note.

Although results were lackluster, there were a few positives,

including progress on crypto wallet, with a million wait list

sign-ups and a more normalized equities/crypto revenue mix, Mizuho

said.

"We have highlighted that we estimate Robinhood has a higher

market penetration leaving less room for growth, a hypothesis

supported by the 3Q results," J.P. Morgan said in an analyst

note.

"The core of Robinhood's earnings is trading revenues, which

fell more than expected," J.P. Morgan said, pointing to equity

trading as particularly weak.

"We believe Robinhood has been overearning and guidance will

weaken for '22," said J.P. Morgan, which rates the stock at

Underweight. JPM lowered its price target to $26 from $35.

KeyBanc Capital Markets, which rates shares at Overweight,

lowered its estimates and price target, but said it remained

constructive on several catalysts that could boost strategic

perception, including Cash Management scaling, yield enhancements,

the Crypto wallet launch and automatic account transfers-in.

Write to Michael Dabaie at michael.dabaie@wsj.com

(END) Dow Jones Newswires

October 27, 2021 11:48 ET (15:48 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

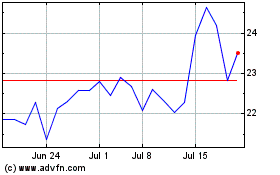

Robinhood Markets (NASDAQ:HOOD)

Historical Stock Chart

From Mar 2024 to Apr 2024

Robinhood Markets (NASDAQ:HOOD)

Historical Stock Chart

From Apr 2023 to Apr 2024