By Mauro Orru

European companies across sectors and markets are citing the

effects of supply chain issues in their latest earnings reports,

with some expecting pandemic-related disruptions, supply

bottlenecks and a shortage of semiconductors to stretch into the

new year. Below is a roundup of comments made by European companies

on supply-chain issues:

German chemicals company BASF SE posted higher sales in the

third quarter, citing significantly higher prices due to strong

demand alongside low product availability and higher prices for raw

materials.

However, it conceded that production and supply-chain

disruptions due to hurricanes in the U.S. and raw material

shortages harmed product market availability.

"BASF assumes that supply bottlenecks will continue to

negatively impact [the] global economic recovery in the fourth

quarter of 2021," it said Wednesday.

French energy-management company Schneider Electric SE said

Wednesday that pressure in global supply chains, such as from

component shortages, increased in the third quarter and are

unlikely to abate for at least another two or three quarters.

The company expects it will continue to face higher input costs

for raw materials, freight and the sourcing of electronic

components, despite the stabilization of some commodity prices in

the third quarter.

"We continue to operate in an increasingly constrained supply

chain environment, globally, resulting in shortages, and increased

input and freight costs, which we continue to manage with our

customers and suppliers. Against this backdrop, we confirm our full

year targets," said Chief Executive Jean-Pascal Tricoire.

German sporting-goods company Puma SE said Wednesday that gross

profit margin in the third quarter climbed but it confirmed that

higher freight rates had a negative effect.

"As a result of the longer-than-expected lockdown in South

Vietnam as well as port congestion and container shortages, the

industry faces delays, which are having a negative impact on Puma's

product supply in the short-term. Puma will continue to maneuver

through these challenges by building on its brand momentum and

operational flexibility," the company said.

Italian aperitif maker Davide Campari-Milano NV said Tuesday

that sales in Asia Pacific rose 30% organically in the first nine

months, with Australian sales up 5.7%. However, it attributed a

normalizing trend in the third quarter to an unfavourable

comparison base, snap lockdowns in the country and some supply

constraints.

"Regarding the outlook for the rest of the year, we expect the

positive brand momentum and favorable sales mix to continue in the

last quarter, helping to partially offset the intensifying input

cost pressure, particularly logistics costs, accelerated brand

building investments, as well as structure costs phasing. Looking

beyond the current year, whilst uncertainty remains in connection

with the evolution of the pandemic and its induced effects such as

logistic constraints and intensified input cost pressure, albeit

mitigated by the improving outlook for agave, we remain confident

of our solid business momentum," Chief Executive Bob

Kunze-Concewitz said.

Swedish home-appliance manufacturer Electrolux AB said Wednesday

that supply-chain constraints hit production output by an estimated

10% during the third quarter and will become even more challenging

in the fourth quarter.

"The tight conditions for electronics and ocean freight also led

to significant temporary cost increases, such as express logistics

and spot buys, of about SEK300 million that could not be fully

offset in the short term. In particular, our North American

business area was affected since the congestion at important U.S.

ports amplified the supply constraints. In addition to a negative

impact on volumes and mix, the business area also faced higher

costs, driven by the use of more express logistics and high

production inefficiency caused by limited planning visibility,"

said Chief Executive Jonas Samuelson.

"We continue to have a tight collaboration with suppliers to

mitigate global supply shortages, but we estimate that the fourth

quarter will be even more challenging than the third quarter.

Although we anticipate sequential improvements in 2022, we expect

challenging conditions to remain in meeting continued strong

demand," he added.

Sweden's lock maker Assa Abloy AB said Wednesday that material

shortages, supply-chain challenges and higher costs will continue

to harm its markets for the rest of the year.

"Thanks to several price adjustments and operational

improvements we achieved an operating leverage of 22%, despite the

significantly higher material costs, higher logistical costs, and

operational challenges linked to component shortages," Chief

Executive Nico Delvaux said.

"We also assume material shortages, logistic challenges and cost

inflation to continue to impact our markets during the rest of the

year," Mr. Delvaux added.

London-based book publisher Bloomsbury Publishing PLC said

Wednesday that pretax profit for the first half of fiscal 2022 rose

nearly four-fold, with revenue up 29%.

The company said it mitigated print supply chain challenges in

the first half, as it printed well in advance of its usual peaks in

the run-up to Christmas and the beginning of the academic year in

the fall.

"Retailers and online booksellers have significantly increased

stock levels over previous years to ensure they have sufficient

stock for Christmas given the supply chain problems. Our first-half

revenues have therefore been boosted by customers ordering earlier

than in previous years," the company said.

It said it is confident of achieving market expectations for the

year ending Feb. 28 despite supply chain impediments.

Write to Mauro Orru at mauro.orru@wsj.com; @MauroOrru94

(END) Dow Jones Newswires

October 27, 2021 07:38 ET (11:38 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

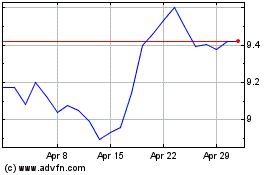

Davide Campari (BIT:CPR)

Historical Stock Chart

From Mar 2024 to Apr 2024

Davide Campari (BIT:CPR)

Historical Stock Chart

From Apr 2023 to Apr 2024