Morgan Stanley Books Archegos Loss, But Profit Hits New High -- Update

April 16 2021 - 8:58AM

Dow Jones News

By Peter Rudegeair

Morgan Stanley said Friday that first-quarter profit more than

doubled from a year earlier, another Wall Street firm that reaped

big gains from the euphoric market conditions of early 2021.

The New York-based bank reported record quarterly profit of $4.1

billion, or $2.19 a share, on revenue of $15.7 billion. That beat

the consensus estimates of analysts polled by FactSet of per-share

earnings of $1.72 on revenue of $14.1 billion.

Record performance across many of its businesses was offset by

$911 million in losses Morgan Stanley booked related to the blowup

at Archegos Capital Management in March.

Still, Morgan Stanley rounded out an all-time great first

quarter from the nation's big banks. Asset prices rallied, millions

of investors traded stocks with abandon and scores of technology

and special-purpose acquisition companies listed their shares

publicly, creating an optimal environment for banks' Wall Street

divisions. On Wednesday, Morgan Stanley rival Goldman Sachs Group

Inc. reported record quarterly revenue and net income.

The same waves that lifted Goldman also lifted Morgan Stanley.

Stock- and bond-trading revenue rose 29% to $5.8 billion. Fees from

advising on deals and underwriting stock and bond offerings more

than doubled to $2.6 billion.

Morgan Stanley's E*Trade business also benefited from the burst

of trading activity among individual investors. The number of

retail-trading clients at Morgan Stanley increased 7% from the end

of 2020 to 7.2 million, and the average daily number of retail

trades the company handled for the quarter exceeded 1.6

million.

Revenue at Morgan Stanley's wealth-management division, which

includes E*Trade, increased 47% to roughly $6 billion. Its profit

margin reached 27% before taxes, up slightly from the first quarter

of 2020.

The firm's return on tangible equity, a measure of how

profitably it puts shareholders' money to use, was 21% for the

quarter.

Operating expenses increased 45% to $10.5 billion thanks in part

to a 59% increase in compensation and benefits. Morgan Stanley's

first-quarter compensation expense of $6.8 billion was 43% of

revenue, a similar ratio from a year earlier.

Unlike other banks that have reported weak demand for loans

among their consumer and commercial clients, Morgan Stanley boosted

lending by 15% to $303.4 billion outstanding.

Write to Peter Rudegeair at Peter.Rudegeair@wsj.com

(END) Dow Jones Newswires

April 16, 2021 08:43 ET (12:43 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

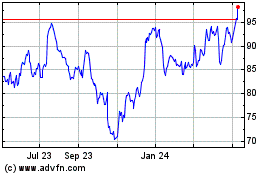

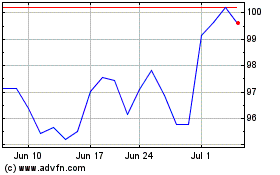

Morgan Stanley (NYSE:MS)

Historical Stock Chart

From Mar 2024 to Apr 2024

Morgan Stanley (NYSE:MS)

Historical Stock Chart

From Apr 2023 to Apr 2024