Exxon Planning Board, Other Changes Amid Activist Pressure--3rd Update

January 27 2021 - 12:04PM

Dow Jones News

By Cara Lombardo, Emily Glazer and Dana Cimilluca

Exxon Mobil Corp. is preparing to make changes to its board and

adopt further measures to reduce its carbon footprint as the

beleaguered energy giant faces pressure from a pair of activist

investors.

The company is discussing adding one or more new directors to

the board and stepping up sustainability investments, people

familiar with the matter said. Irving, Tex.-based Exxon, which has

been reducing its overall capital spending, could also curtail it

further.

Exxon is in talks with one of the activists, D.E. Shaw Group,

which may end up supporting the moves, some of the people said.

Meanwhile, the other, Engine No. 1 LLC, is moving forward with a

planned proxy fight for four board seats, it said Wednesday.

Exact details couldn't be learned and the talks with D.E. Shaw

could still fall apart. Like other activists, D.E. Shaw sometimes

employs nonbinding handshake agreements with the companies it

targets to avert a proxy fight.

The company said in a statement in response to the Engine No. 1

move that it has engaged with the firm since mid-December and that

its board-affairs committee will evaluate the nominees. "ExxonMobil

will continue to update shareholders in the coming weeks on the

company's strategy to build long-term, sustainable value for

shareholders," the company said. "It will also provide updates on

company performance and actions to address climate change,

including initiatives to commercialize technologies which are key

to reducing emissions and meeting societal goals consistent with

the Paris Agreement."

Exxon could announce the changes as soon as next week, possibly

with its fourth-quarter earnings Tuesday, the people said, though

there is no guarantee it will do so.

The company is expected to report its fourth straight quarterly

loss, the longest such losing streak in its modern history.

Prior to the pandemic, Exxon Chief Executive Darren Woods

embarked on an ambitious strategy to spend more to increase

production. The sharp drop in demand for fossil fuels since then

triggered billions of dollars of losses for the company. In

November, Exxon pulled back from Mr. Woods' plan to boost its

overall oil-and-gas production by one million barrels a day by

2025. The company said it would cut billions of dollars from its

capital expenditures over the next five years and invest only in

its best assets.

Adding to the pressure, the Securities and Exchange Commission

is investigating whether Exxon is overvaluing one of its most

important oil-and-gas properties, The Wall Street Journal recently

reported.

Investors have been pressuring Exxon to boost its lagging share

price, and the activists have pushed for moves that include

reducing capital expenditures and expanding in renewable energy.

Exxon's shares are down about 30% in the past year.

BlackRock Inc. Chief Executive Larry Fink this week asked

companies to disclose more information on how they are moving to

reduce greenhouse-gas emissions, adding another pressure point for

Exxon given that the investing giant is one of its biggest

shareholders.

Newly established Engine No. 1 said Wednesday it nominated four

previously announced board candidates. It said in December it

planned to make the nominations with the support of California

State Teachers' Retirement System, the big pension investor.

Together they control less than 0.3% of Exxon, which has a market

value of about $193 billion, so the outcome of their campaign will

depend on whether they get buy-in from more significant

investors.

Engine No. 1 and Exxon have held informal talks, but have so far

failed to agree. That potentially sets up a drawn-out and expensive

battle as the two sides campaign for shareholder support for their

board candidates, culminating in a vote at the company's annual

meeting this spring.

Engine No. 1 was launched by technology investor Chris James

late last year with $250 million under management. Its focus is on

so-called impact investing, which seeks to push companies to make

changes that will be beneficial in the long run to stakeholders

such as workers and shareholders alike.

Its nominees include Gregory Goff, the former CEO of refiner

Andeavor, which was sold to Marathon Petroleum Corp ., and three

other executives with energy ties.

D.E. Shaw, a hedge fund best known for its quantitative trading,

is an occasional activist, having picked fights at companies

including at Emerson Electric Co. and Lowe's Cos.

Christopher M. Matthews contributed to this article.

Write to Cara Lombardo at cara.lombardo@wsj.com, Emily Glazer at

emily.glazer@wsj.com and Dana Cimilluca at

dana.cimilluca@wsj.com

(END) Dow Jones Newswires

January 27, 2021 11:49 ET (16:49 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

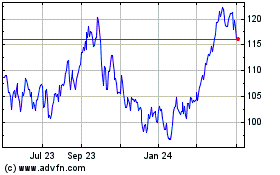

Exxon Mobil (NYSE:XOM)

Historical Stock Chart

From Mar 2024 to Apr 2024

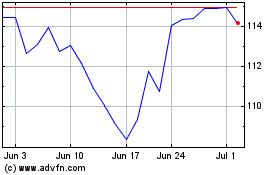

Exxon Mobil (NYSE:XOM)

Historical Stock Chart

From Apr 2023 to Apr 2024