|

PROSPECTUS

|

Filed

Pursuant to Rule 424(b)(3)

|

|

|

Registration

No. 333-228906

|

SIMPLICITY

ESPORTS AND GAMING COMPANY

6,449,000

Shares of Common Stock Underlying Warrants

6,203,969

Shares of Common Stock for Resale by Selling Securityholders

261,500

Warrants to Purchase Common Stock for Resale by Selling Securityholders

This

prospectus relates to the issuance by us of up to 6,449,000 shares of our common stock, par value $0.0001 per share (“Common

Stock”), which consist of (a) 5,200,000 shares of Common Stock that may be issued upon the exercise of 5,200,000 warrants

(the “Public Warrants”) originally sold as part of units in our initial public offering (the “IPO”) and

which entitle the holder to purchase Common Stock at an exercise price of $11.50 per share of Common Stock, (b) 261,500 shares

of Common Stock that may be issued upon the exercise of 261,500 warrants (the “Private Placement Warrants”) underlying

units originally issued in a private placement that closed simultaneously with the consummation of the IPO (the “Private

Placement Units”), which entitle the holder to purchase Common Stock at an exercise price of $11.50 per share of Common

Stock, and (c) 987,500 shares of our Common Stock, which represent shares of Common Stock that may be issued upon the exercise

of 987,500 warrants (the “2019 Warrants”, and together with the Public Warrants and Private Placement Warrants, the

“Warrants”) originally sold as part of units in a private placement that commenced on March 27, 2019 (the “2019

Private Placement”) and which entitle the holder to purchase Common Stock at an exercise price of $4.00 per share of Common

Stock.

In

addition, this prospectus relates to the resale from time to time of 6,203,969 shares of Common Stock and 261,500 Private

Placement Warrants by the selling securityholders named in this prospectus or their permitted transferees (the “Selling

Securityholders”).

We

will receive the proceeds from the exercise of the Warrants for cash, but not from the resale of the Private Placement Warrants

or the shares of Common Stock underlying the Warrants.

The

Selling Securityholders will sell their shares registered for resale in this prospectus at a fixed price of $3.00 per share

for the duration of this offering. See “Determination of Offering Price” and “Plan of Distribution.”

We will not receive any of the proceeds from the sale of the securities owned by the Selling Securityholders. See “Use

of Proceeds” beginning on page 33 of this prospectus. We will bear all costs, expenses and fees in connection with the

registration of these securities, including with regard to compliance with state securities or “blue sky” laws.

The Selling Securityholders will bear all commissions and discounts, if any, attributable to their sale of securities. See

“Plan of Distribution” beginning on page 105 of this prospectus.

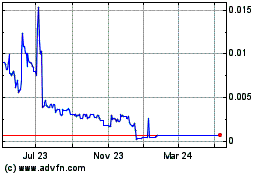

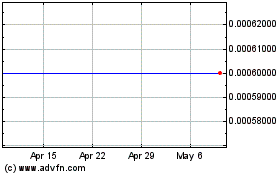

Our

Common Stock is currently quoted on the OTC Market Group, Inc.’s OTCQB tier under the symbol “WINR.” On October

2, 2020, the last reported sale price of our Common Stock was $1.60.

Our

principal executive offices are located at 7000 W. Palmetto Park Rd., Suite 505, Boca Raton, FL 33433.

Investing

in our common stock involves a high degree of risk. See “Risk Factors” beginning on page 9 of this prospectus.

Neither

the Securities and Exchange Commission (the “SEC”) nor any state securities commission has approved or disapproved

of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal

offense.

The

date of this prospectus is October 13, 2020.

TABLE

OF CONTENTS

No

dealer, salesperson or other individual has been authorized to give any information or to make any representation other than those

contained in this prospectus in connection with the offer made by this prospectus and, if given or made, such information or representations

must not be relied upon as having been authorized by us or the selling stockholder. This prospectus does not constitute an offer

to sell or a solicitation of an offer to buy any securities in any jurisdiction in which such an offer or solicitation is not

authorized or in which the person making such offer or solicitation is not qualified to do so, or to any person to whom it is

unlawful to make such offer or solicitation. Neither the delivery of this prospectus nor any sale made hereunder shall, under

any circumstances, create any implication that there has been no change in our affairs or that information contained herein is

correct as of any time subsequent to the date hereof.

For

investors outside the United States: We have not, and the selling stockholder has not, done anything that would permit this offering

or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in

the United States. Persons outside the United States who come into possession of this prospectus must inform themselves, and observe

any restrictions relating to, the offering of the shares of our common stock and the distribution of this prospectus outside the

United States.

Cautionary

Note Regarding Forward-Looking Statements

This

prospectus contains forward-looking statements. Specifically, forward-looking statements may include statements relating to:

|

|

●

|

our

future financial performance;

|

|

|

|

|

|

|

●

|

changes

in the market for our products and services;

|

|

|

|

|

|

|

●

|

our

expansion plans and opportunities; and

|

|

|

|

|

|

|

●

|

other

statements preceded by, followed by or that include the words “estimate,” “plan,” “project,”

“forecast,” “intend,” “expect,” “anticipate,” “believe,” “seek,”

“target” or similar expressions.

|

These

forward-looking statements are based on information available as of the date of this prospectus and current expectations, forecasts

and assumptions, and involve a number of judgments, risks and uncertainties. Accordingly, forward-looking statements should not

be relied upon as representing our views as of any subsequent date, and we do not undertake any obligation to update forward-looking

statements to reflect events or circumstances after the date they were made, whether as a result of new information, future events

or otherwise, except as may be required under applicable securities laws.

As

a result of a number of known and unknown risks and uncertainties, our actual results or performance may be materially different

from those expressed or implied by these forward-looking statements. Some factors that could cause actual results to differ include:

|

|

●

|

the

level of demand for our products and services;

|

|

|

|

|

|

|

●

|

competition

in our markets;

|

|

|

|

|

|

|

●

|

our

ability to grow and manage growth profitably;

|

|

|

|

|

|

|

●

|

our

ability to access additional capital;

|

|

|

|

|

|

|

●

|

changes

in applicable laws or regulations;

|

|

|

|

|

|

|

●

|

our

ability to attract and retain qualified personnel;

|

|

|

|

|

|

|

●

|

the

possibility that we may be adversely affected by other economic, business, and/or competitive factors; and

|

|

|

|

|

|

|

●

|

other

risks and uncertainties indicated in this prospectus, including those under “Risk Factors.”

|

INDUSTRY

AND MARKET DATA

We

are responsible for the disclosure in this prospectus. However, this prospectus includes industry data that we obtained from internal

surveys, market research, publicly available information and industry publications. The market research, publicly available information

and industry publications that we use generally state that the information contained therein has been obtained from sources believed

to be reliable. The information therein represents the most recently available data from the relevant sources and publications

and we believe remains reliable. We did not fund and are not otherwise affiliated with any of the sources cited in this prospectus.

Forward-looking information obtained from these sources is subject to the same qualifications and additional uncertainties regarding

the other forward-looking statements in this prospectus.

TRADEMARKS

AND COPYRIGHTS

We

own or have rights to trademarks or trade names that we use in connection with the operation of our business, including our corporate

names, logos and website names. In addition, we own or have the rights to copyrights, trade secrets and other proprietary rights

that protect the content of our products and the formulations for such products. This prospectus may also contain trademarks,

service marks and trade names of other companies, which are the property of their respective owners. Our use or display of third

parties’ trademarks, service marks, trade names or products in this prospectus is not intended to, and should not be read

to, imply a relationship with or endorsement or sponsorship of us. Solely for convenience, some of the copyrights, trade names

and trademarks referred to in this prospectus are listed without their ©, ® and ™ symbols, but we will assert,

to the fullest extent under applicable law, our rights to our copyrights, trade names and trademarks. All other trademarks are

the property of their respective owners.

PROSPECTUS

SUMMARY

This

summary highlights certain information about us, this offering, and selected information contained in this prospectus. This summary

is not complete and does not contain all of the information that you should consider before deciding whether to invest in our

common stock. For a more complete understanding of the Company and this offering, we encourage you to read and consider the more

detailed information in this prospectus, including “Risk Factors” and the financial statements and related notes.

Unless the context otherwise requires, “we,” “us,” “our,” or “the Company” refers

to “Simplicity Esports and Gaming Company,” a Delaware corporation, and its consolidated subsidiaries. “Simplicity

Esports LLC” means our wholly owned subsidiary, Simplicity Esports, LLC, a Florida limited liability company, and its consolidated

subsidiaries. “PLAYlive” means our wholly owned subsidiary PLAYlive Nation, Inc., a Delaware corporation and its consolidated

subsidiaries. “Simplicity One” means our 76% owned subsidiary Simplicity One Brasil Ltda, a Brazilian limited liability

company and its consolidated subsidiaries.

Industry

Overview

Esports

is the competitive playing of video games by amateur and professional teams for cash prizes. Esports typically takes the form

of organized, multiplayer video games that include real-time strategy, fighting, first-person shooter, and multiplayer online

battle arena games. As of October 5, 2020, the three largest selling esports games are Dota 2®, League of Legends®

(both multiplayer online battle arena games) and Counter Strike: Global Offensive® (a first-person shooter game). Other popular

games include SMITE®, StarCraft II®, Call of Duty®¸ Heroes of the Storm®, Hearthstone® and Fortnite®.

Most major professional esports events and a wide range of amateur esports events are broadcast live via streaming services including

twitch.tv, azubu.tv, ustream.tv and youtube.com. Esports also includes games which can be played, primarily by amateurs, in multiplayer

competitions on the Sony PlayStation®, Microsoft Xbox® and WII Nintendo® systems.

Although

official competitions have long been a part of video game culture, participation and spectatorship of such events have seen a

global surge in popularity over the last few years with the rapid growth of online streaming. The advent of online streaming technology

has turned esports into a global industry that includes professional players and teams competing in major events that are simultaneously

watched in person in stadiums, and by online viewers, which regularly exceed 1,000,000 viewers for major tournaments. According

to Business Insider, over 100 million viewers saw the 2019 League of Legends® World Championships in person and online. CNBC

reported in April 2019 that League of Legends® World Championships attract more viewers than the Super Bowl. Much like how

there is a worldwide gaming market for the sports industry, there has now developed a worldwide gaming market for the esports

industry. The impact has been so significant that many video game developers are now building features into their games designed

to facilitate competition.

According

to Newzoo, a global leader in esports, games and mobile intelligence, the total global esports audience was expected to reach

495 million in 2019, with an anticipated 27.5 million American gamers. In addition, according to Newzoo, esports produced $909

million in 2018 revenue and is projected to reach $1.1 billion in 2019. Esports enthusiasts, which are people who watch professional

esports content at least once a month, made up 201.2 million of the 2018 total, up from 143.2 million in 2017. With a compound

annual growth rate (“CAGR”) (2017-2022) of +15.7%, this number is expected to reach almost 297 million in 2022. The

global average revenue per esports enthusiast, which includes not only gaming revenue, but also sponsorships advertising and all

other esports related revenues, is projected to be $5.45 in 2019, up +8.9% from $5.00 in 2018. The number of occasional esports

viewers, (people who watch professional esports content less than once a month), is expected to reach 252.6 million in 2019, up

from 221.6 million in 2018, and is projected to grow with a CAGR of +12.6% to surpass 347 million in 2022. The number of people

who are aware of esports worldwide is expected to reach 1.8 billion in 2019, up from 1.6 billion in 2018. According to Newtech

Mag, China and the U.S. have the largest populations of esports fans, with Brazil ranking first in Latin America, and third globally,

with 20 million fans. The increasing prominence of esports as a mainstream entertainment industry is driving the growth in awareness

in most regions. Audience and awareness growth in the emerging regions of Latin America, Middle East and Africa, Southeast Asia,

and Rest of Asia is largely driven by improving IT infrastructure and urbanization. We believe the rise of new franchises, such

as Player Unknown’s Battlegrounds® or PubG®, is an important global growth factor as the influx of millennials should

continue to drive the growth of the esports industry’s audience and in turn, the esports gaming industry.

In

2018, there were 737 major esports events that generated an estimated $54.7 million in ticket revenues. The total prize money

of all esports events held in 2018 reached $150.8 million, after breaking the $100 million mark for the first time in 2017. The

League of Legends® World Championship was 2018’s biggest tournament by live viewership hours on Twitch, with 53.8 million

hours. It also produced $1.9 million in ticket revenues. The Overwatch® League was the most-watched league by live viewership

hours on Twitch, generating 79.5 million hours.

Business

Overview

We

are a global esports organization, with an established brand, that is capitalizing on the growth in esports through three business

units, Simplicity One Brasil Ltda (“Simplicity One”), Simplicity Esports, LLC (“Simplicity Esports LLC”)

and PLAYlive Nation, Inc. (“PLAYlive”).

Our

Esports Teams

We

own and manage numerous professional esports teams domestically and internationally. Revenue is generated from prize winnings,

corporate sponsorships, advertising, league subsidy payments and potential league revenue sharing payments from the publishers

of video games.

Domestic

Esports Teams – Simplicity Esports LLC

Through

our wholly owned subsidiary Simplicity Esports LLC, we own and manage numerous professional esports teams competing in games such

as Overwatch, Apex Legends, PUBG and more. We are committed to growing and enhancing the esports industry, fostering the development

of amateurs to compete professionally and signing established professional gamers to support their paths to greater success.

International

Esports Team - Simplicity One Brasil

Since

January 2020, through our 76% owned subsidiary Simplicity One Brasil, we manage Flamengo eSports, one of the leading Brazilian

League of Legends® teams. Flamengo eSports was established in 2017 as the Esports division of Clube de Regatas do Flamengo,

a successful Brazilian sports organization, with over 30 million followers across social media accounts, known for its world-famous

soccer team. Flamengo eSports’ League of Legends® team won the CBLoL Championship in September 2019, which qualified

the team to compete at the 2019 League of Legends® World Championship in Europe as one of 24 teams from 13 different regions

around the world. With cost cutting steps taken during April 2020, and anticipated additional sponsorship revenue, this business

unit is expected to be cash flow positive by January 2021. We recently entered into a binding letter of intent with our existing

sponsor, Redragon, pursuant to which Redragon would acquire a 7.5% equity stake in Simplicity One Brasil at a valuation exceeding

$6.9 million.

Online

Tournaments

In

response to demand from customers for online esports tournaments which was in all likelihood triggered by the social distancing

protocols attendant to the COVID-19 pandemic, we recently introduced a new initiative of online esports tournaments. Since March

2020, through our wholly owned subsidiary Simplicity Esports LLC, we have been holding weekly online esports tournaments.in the

United States In addition, we have commenced promoting these weekly online tournaments via text messages to our database of over

400,000 paying esports gaming center customers, which we acquired in our acquisition of PLAYlive. If we can convert merely 1%

of these existing customers from the PLAYlive database to play in our paid online tournaments, we anticipate this business unit

may generate approximately $1 million in annual revenues. At a 5% conversion rate, this business segment may generate approximately

$5 million in annual revenue. Management also intends to sell sponsorship and marketing activations for these online tournaments

which would create additional revenue. We also announced our initiative to begin to offering play at home online tournaments in

Brazil in June 2020.

Our

Gaming Centers

We

own and operate corporate and franchise esports gaming centers, through our wholly owned subsidiaries Simplicity Esports LLC and

PLAYlive, throughout the U.S. giving casual gamers the opportunity to play in a social setting with other members of the gaming

community. In addition, aspiring and established professional gamers have an opportunity to compete in local and national esports

tournaments held in our gaming centers for prizes, notoriety, and potential contracts to play for one of our professional esports

teams. In this business unit, revenue is generated from franchise royalties, the sale of game time, memberships, tournament entry

fees, birthday party events, corporate party events, concessions and gaming-related merchandise.

Our

business plan encompasses a brick and click physical and digital approach to further recognize revenue from all verticals, which

we believe to be unique in the industry. The physical centers, together with our esports teams, lifestyle brand and marketing

campaigns offer opportunities for additional revenue via strategic partnerships with both endemic and non-endemic brands. Our

ultimate goal is to further engage a diverse fan base with a 360-degree approach driving traffic to both our digital platform,

tournaments (online and in-person) and physical real estate to maximize the monetization opportunities with these relationships.

In addition, we have proprietary intellectual capital, fan engagement strategies and brand development blueprints which complement

our publicly available information.

Optimally,

the esports gaming centers of Simplicity Esports LLC (“Simplicity Esports Gaming Centers”) will measure between 1,200

and 2,000 square feet, with dozens of gaming stations. The Simplicity Esports Gaming Centers will feature cutting edge technology,

futuristic aesthetic décor and dynamic high-speed gaming equipment. We believe our brick-and-click strategy will present

attractive opportunities for sponsors and advertisers to connect with our audience, creating an intriguing monetization opportunity

for sponsors and advertisers.

Creating

content that engages fans, sponsors and developers, while promoting our brand is one of our primary goals. Our talented team will

continue to produce unique in-depth content which showcases aspects of esports for fans. We seek to reach a broad demographic

encompassing the casual, amateur and professional gaming community. Our philosophy is to enhance our footprint for both endemic

and non-endemic partnerships. We believe we possess a deep perception of our markets and understand the new age of branding while

maintaining authenticity to the gaming community that comprises our fan base.

As a result of COVID-19

(discussed below), all of our corporate and franchised Simplicity Gaming Centers were closed effective April 1, 2020. We commenced

reopening Simplicity Gaming Centers on May 1, 2020 and have since reopened three corporate and 20 franchised Simplicity

Gaming Centers as of October 5, 2020. See “Risk Factors—Public health epidemics or outbreaks, such as COVID-19,

could materially and adversely impact our business.”

Corporate

Gaming Centers

Simplicity

Esports LLC has already opened and is operating four corporate-owned retail Simplicity Esports Gaming Centers. Our first Simplicity

Esports Gaming Center was opened on May 3, 2019. Furthermore, we have engaged a national tenant representation real estate broker

to assist in the strategic planning and negotiations for our future Simplicity Esports Gaming Center locations. We contemplate

that new Simplicity Esports Gaming Centers will be funded by us as well as a combination of tenant improvement allowances from

landlords and sponsorships. As announced in June 2020, we are in discussions with multiple commercial property owners regarding

their desire to have us open 8,000 to 12,000 square foot MEGA centers at their properties. There are multiple locations available

to us with a percentage of gross sales rent lease structure (as opposed to fixed rent payments), and construction funds offered

by the landlord to assist with the build out and equipping of our planned MEGA centers. These MEGA centers are planned as hubs

in our hub and spoke model that will see smaller corporate and franchisee owned gaming centers as spokes connected to MEGA centers

as hubs for larger events and tournaments.

Franchised

Gaming Centers

Due

to interest from potential franchisees, we have launched a franchising program to accelerate the expansion of our planned nationwide

footprint. We sell specific franchise territories, through our wholly owned subsidiary PLAYlive, and assist with the establishment

and buildout of esports gaming centers to potential business owners that desire to use our branding, infrastructure and process

to open and operate gaming centers. Franchise revenue is generated from the sale of franchise territories, supplying furniture,

equipment and merchandise to the franchisees for buildout of their centers, a gross sales royalty fee and a national marketing

fee. We license the use of our branding, assist in identifying and negotiating commercial locations, assist in overseeing the

buildout and development, provide access to proprietary software for point of sale, inventory management, employee training and

other HR functions. Franchisees also have an opportunity to participate in our national esports tournament events, and benefit

from the growing profile of our professional esports teams. Once an esports gaming center is opened, we provide operational guidance,

support and use of branding elements in exchange for a monthly royalty fee calculated as 6% of gross sales. On January 1, 2020,

we implemented a national marketing fee of 1% of gross sales. To date, we have sold five of these franchise territories.

The

combination of the esports gaming centers, owned or franchised by our wholly owned subsidiaries Simplicity Esports LLC or PLAYlive,

provides us with what we believe is the largest footprint of esports gaming centers in North America. Over the next 12 months,

existing PLAYlive esports gaming centers will be rebranded to Simplicity Esports gaming centers. All newly opened franchise esports

gaming centers will be branded as Simplicity Esports gaming centers and have numerous gaming PC’s. All gaming centers in

our footprint will be participating venues in our national esports tournaments.

Franchise

Roll Up Strategy

Due

to the impact of COVID-19 and the resulting disruptions in the commercial real estate market, we have signed non-binding letters

of intent with some of our existing franchisees to acquire their gaming centers. Closings are contingent upon our ability to secure

acceptable lease modifications from the landlords of the applicable properties. If the acquisitions close, the consideration paid

for each acquisition is contemplated to consist solely of restricted shares of common stock.

As

part of this strategy, we acquired our first franchisee owned gaming center, located in El Paso, Texas, on June 29, 2020. The

improved lease terms require monthly payments as a percentage of gross sales, resulting in the acquisition being EBITDA accretive

upon the commencement of operations.

Our

Stream Team

The

Simplicity Esports LLC and Flamengo Esports stream teams encompasses over 20 commentators (commonly known as “casters”),

influencers and personalities who connect to a dedicated fan base. Our electric group of live personalities represent our organization

to the fullest with their own unique style. We are proud to support and present a diverse group of gamers as we engage fans across

a multiple of esports genres. Our Twitch affiliation has enabled our stream team influences to reach a broad fan base. Additionally,

we have created several niches within the streaming community which has enabled us to engage fans within certain titles on a 24/7

basis. Our notoriety in the industry is evidenced by our audience that views millions of minutes of Simplicity Esports’

and Flamengo Esports’ content monthly, via various social media outlets including YouTube, Twitter and Twitch. Through Simplicity

Esports LLC, we have begun to implement a unique approach to ensure the ultimate fan friendly esports experience. Our intention

is to have gamers involved at the grassroots level and feel a sense of unity as we compete with top class talent. Our management

and players are known within the esports community and we plan to use their skills to create a seamless content creation plan

helping gamers feel closer to our brand than any other in the industry.

COVID-19

In

December 2019, a novel strain of coronavirus (COVID-19) emerged in Wuhan, Hubei Province, China. While initially the outbreak

was largely concentrated in China and caused significant disruptions to its economy, it has now spread to several other countries

and infections have been reported globally.

Because

COVID-19 infections have been reported throughout the United States, certain federal, state and local governmental authorities

have issued stay-at-home orders, proclamations and/or directives aimed at minimizing the spread of COVID-19. Additional, more

restrictive proclamations and/or directives may be issued in the future. As a result, all of our corporate and franchised Simplicity

Gaming Centers were closed effective April 1, 2020. We commenced reopening Simplicity Gaming Centers on May 1, 2020 and have since

reopened three corporate and 20 franchised Simplicity Gaming Centers as of October 5, 2020. Although our

franchise agreements with franchisees of Simplicity Gaming Centers require a minimum monthly royalty payment to us from the franchisees

regardless of whether the franchised Simplicity Gaming Centers are operating, there is a potential risk that franchisees of Simplicity

Gaming Centers will default in their obligations to pay their minimum monthly royalty payment to us resulting in either an increase

in accounts receivables or a bad debt expense where account receivables are no longer collectible due to franchisee’s inability

to pay the minimum monthly royalty payments owed by the franchisee. We have not written off as bad debt any accounts receivables

attributable to franchisee minimum monthly royalty payments owed during the COVID-19 pandemic. However, we have recorded an allowance

for doubtful accounts of approximately $52,000, as our collection efforts are ongoing. We have experienced an increase in our

account receivables by approximately $32,000 and $14,000 during the quarters ended May 31, 2020 and August 31, 2020, respectively.

Notwithstanding it is unclear exactly how much of the increase in accounts receivables is attributable to the impact of COVID-19.

For the months of July and August 2020, we have waived the minimum monthly royalty payment obligations for the months of July

and August 2020 and are instead billing the franchisees a true-up of 6% of gross sales without a minimum.

The

ultimate impact of the COVID-19 pandemic on the Company’s operations is unknown and will depend on future developments,

which are highly uncertain and cannot be predicted with confidence, including the duration of the COVID-19 outbreak, new information

which may emerge concerning the severity of the COVID-19 pandemic, and any additional preventative and protective actions that

governments, or the Company, may direct, which may result in an extended period of continued business disruption, reduced customer

traffic and reduced operations. Any resulting financial impact cannot be reasonably estimated at this time but is anticipated

to have a material adverse impact on our business, financial condition and results of operations.

The

measures taken to date adversely impacted the Company’s business for the fiscal quarters ended May 31, 2020 and August 31,

2020 and will potentially continue to impact the Company’s business. Management expects that all of its business segments,

across all of its geographies, will be impacted to some degree, but the significance of the impact of the COVID-19 outbreak on

the Company’s business and the duration for which it may have an impact cannot be determined at this time.

RECENT

DEVELOPMENTS

For

a detailed description of recent developments of the Company, see “Description of Business—Recent Developments”

on page 41 of this prospectus.

Summary

Risk Factors

Our

business is subject to numerous risks and uncertainties, including those in the section entitled “Risk Factors” and

elsewhere in this prospectus. These risks include, but are not limited to, the following:

|

|

●

|

our

history of losses;

|

|

|

|

|

|

|

●

|

our

inability to attract sufficient demand for our services and products;

|

|

|

|

|

●

|

our

ability to successfully execute our growth and acquisition strategy and manage effectively our growth;

|

|

|

|

|

|

|

●

|

changes

in the competitive environment in our industry and the markets we serve, and our ability to compete effectively;

|

|

|

|

|

|

|

●

|

our

dependence on a strong brand image;

|

|

|

|

|

|

|

●

|

our

cash needs and the adequacy of our cash flows and earnings;

|

|

|

|

|

|

|

●

|

our

ability to access additional capital;

|

|

|

|

|

|

|

●

|

our

dependence upon our executive officers, founders and key employees;

|

|

|

●

|

our

ability to attract and retain qualified personnel;

|

|

|

|

|

|

|

●

|

our

reliance on our technology systems, the impact of technological changes and cybersecurity risks;

|

|

|

|

|

|

|

●

|

changes

in applicable laws or regulations;

|

|

|

|

|

|

|

●

|

our

ability to protect our trademarks or other intellectual property rights;

|

|

|

|

|

|

|

●

|

potential

litigation from competitors or customers;

|

|

|

|

|

|

|

●

|

public

health epidemics or outbreaks (such as the novel strain of coronavirus (COVID-19)) and our responses to such events could

materially and adversely impact our business; and

|

|

|

|

|

|

|

●

|

the

possibility that we may be adversely affected by other economic, business, and/or competitive factors.

|

In

addition, our management has concluded that our historical recurring losses from operations and negative cash flows from operations

as well as our dependence on securing private equity and other financings raise substantial doubt about our ability to continue

as a going concern and our auditor has included an explanatory paragraph relating to our ability to continue as a going concern

in its audit reports for the fiscal years ended May 31, 2020 and 2019.

Corporate

Information

Our

principal executive offices are located at 7000 W. Palmetto Park Road, Suite 505, Boca Raton, Florida 33433, and our telephone

number at that location is (855) 345-9467. The address of our website is www.ggsimplicity.com. The inclusion of our website address

in this prospectus does not include or incorporate by reference the information on our website into this prospectus.

The

name of the Company, the logos of the Company, and other trade names, trademarks or service marks of the Company appearing in

this prospectus are the property of the Company. Trade names, trademarks and service marks of other organizations appearing in

this prospectus are the property of their respective holders.

Unit

Offering, Nasdaq Listing, Reverse Stock Split and Increase in Authorized Shares of Common Stock

On

September 28, 2020, we filed with the SEC a pre-effective amendment to a registration statement on Form S-1 in connection with

our offering of units, each of which consists of one share of our common stock and one warrant to purchase one share of our common

stock, and shares of common stock issuable from time to time upon exercise of the warrants. In connection with the unit offering,

we have applied to list our common stock and warrants forming a part of the units on The Nasdaq Capital Market (“Nasdaq

Capital Market”). There is no assurance that our listing application will be approved by the Nasdaq Capital Market. The

approval of our listing on the Nasdaq Capital Market is a condition of closing the unit offering. If our application to the Nasdaq

Capital Market is not approved or we otherwise determine that we will not be able to secure the listing of the common stock and

warrants on the Nasdaq Capital Market, we will not complete the unit offering.

In

order to obtain Nasdaq Capital Market listing approval, we have obtained approval of our board of directors and shareholders of

(i) a reverse stock split of the outstanding shares of our common stock in the range from one-for-two (1-for-2) to one-for-ten

(1-for-10), which ratio is to be selected by the board of directors and (ii) an increase in our authorized shares of common stock

from 20,000,000 to 36,000,000 shares of common stock. On August 17, 2020, we filed a Certificate of Amendment to increase the

authorized shares of common stock from 20,000,000 to 36,000,000. Accordingly, our authorized capital stock consists of (i) 36,000,000

shares of common stock, and (ii) 1,000,000 shares of preferred stock. On September 29, 2020, we filed a certificate of amendment

to our certificate of incorporation, as amended, setting the ratio of the reverse stock split at one-for-six (1-for-6). We anticipate

that the reverse stock split will become effective following approval by FINRA of the reverse stock split, on or about October

13, 2020. The reverse stock split is intended to allow us to meet the minimum share price requirement of the Nasdaq Capital Market.

Except

as otherwise indicated and except in our financial statements and the notes thereto, all references to our common stock, share

data, per share data and related information has been adjusted to depict the reverse stock split ratio of 1-for-6 (“Reverse

Stock Split”), as if it were effective and as if it had occurred at the beginning of the earliest period presented. The

Reverse Stock Split, when effective, will combine each six shares of our outstanding common stock into one share of common stock,

without any change in the par value per share, and the Reverse Stock Split correspondingly will adjust, among other things, the

exercise rate of our warrants and options into our common stock. No fractional shares will be issued in connection with the Reverse

Stock Split, and any fractional shares resulting from the Reverse Stock Split will be rounded up to the nearest whole share.

We

are registering (i) the issuance by us of up to 1,074,834 (6,449,000 pre-reverse split) shares of our Common Stock

which may be issued upon the exercise of the Warrants, and (ii) the resale from time to time by the Selling Securityholders

of 1,033,995 (6,203,969 pre-reverse split) shares of Common Stock and 43,584 (261,500 pre-reverse split) warrants

(“Private Placement Warrants”) forming part of the Private Placement Units. “Warrants” means

our redeemable warrants, which includes all of our warrants sold as part of the Public Units as well as the Private Placement

Warrants and 2019 Warrants to the extent they are no longer held by the initial purchasers of the Private Placement Warrants,

2019 Warrants or their permitted transferees.

Common

Stock and Warrants Held by Selling Securityholders

|

Securities

Outstanding Prior to This Registration

|

|

1,654,865 (9,929,190 pre-reverse split)

shares of our Common Stock are issued and outstanding as of October 5, 2020. In addition, as of October 5, 2020,

1,074,834 (6,449,000 pre-reverse split) shares of Common Stock underlying Warrants are issuable upon exercise of the

1,074,834 (6,449,000 pre-reverse split) outstanding Warrants.

|

|

|

|

|

|

Securities

Outstanding After

This

Registration

|

|

2,729,699

(16,378,190 pre-reverse split) shares of our Common Stock, which assumes the exercise

of all Warrants. The number of outstanding shares of Common Stock that will be outstanding

after this offering excludes 250,000 (1,500,000 pre-reverse split) shares of Common Stock

reserved and available for issuance under the Simplicity Esports and Gaming Company 2020

Omnibus Incentive Plan and the 2018 Equity Incentive Plan.

|

|

|

|

|

|

Common

Stock Held by the

Selling

Securityholders

|

|

We

are registering 1,033,995 (6,203,969 pre-reverse split) shares of Common Stock

held by the Selling Securityholders named herein.

|

|

|

|

|

|

Private

Placement Warrants

offered

by certain Selling Securityholders

|

|

We

are registering 43,584 (261,500 pre-reverse split) Private Placement Warrants

to be offered from time to time by certain Selling Securityholders. Each Private Placement

Warrant entitles the holder to purchase Common Stock at an exercise price of $69.00 ($11.50

pre-reverse split) per share of Common Stock, subject to adjustment as set forth in the

warrant agreement between Continental Stock Transfer & Trust Company, as warrant

agent, and us.

|

|

|

|

|

|

Warrants

Held by the Selling Securityholders

|

|

Each

Public Warrant and Private Placement Warrant entitles the holder to purchase one share of our Common Stock at an exercise

price of $69.00 ($11.50 pre-reverse split) per share. Each 2019 Warrant entitles the holder to purchase one share of our Common

Stock at an exercise price of $24.00 ($4.00 pre-reverse split) per share. Each Public Warrant and Private Placement Warrant

may be exercised at any time commencing on December 20, 2018 until November 19, 2023, or earlier upon redemption or liquidation.

The Private Placement Warrants may also be exercised on a cashless basis pursuant to the terms of such warrants.

|

|

|

|

|

|

Terms

of Offering

|

|

The

Selling Securityholders will determine when and how they will dispose of the Common Stock and Private Placement Warrants registered

under this prospectus for resale, as well as any shares of Common Stock issued by the Company in a registered issuance under

this prospectus upon exercise of any Warrants.

|

|

Use

of Proceeds

|

|

We

will not receive any of the proceeds from the sale of shares of Common Stock or Private Placement Warrants by the Selling

Securityholders. However, we will receive proceeds from the cash exercise of Warrants if they are exercised by the Selling

Securityholders, provided that the Private Placement Warrants may be exercised on a cashless basis. We intend to use any net

proceeds from the cash exercise of the Warrants for working capital, and general corporate purposes.

|

|

|

|

|

|

Trading

Market and Ticker Symbol

|

|

The

Company’s Common Stock and Public Warrants currently have been quoted on the OTCQB under the symbols “WINR”

and “WINRW,” respectively.

|

Issuance

of Warrant Shares Underlying the Warrants

|

Warrant

Shares to be Issued upon Exercise of Warrants

|

|

1,074,834

(6,449,000 pre-reverse split) shares of Common Stock underlying the Warrants.

|

|

|

|

|

|

Shares

Outstanding Prior to Exercise of Warrants

|

|

1,654,865

(9,929,190 pre-reverse split) shares of Common Stock as of October 5, 2020.

|

|

|

|

|

|

Shares

to be Outstanding Assuming Exercise of All Warrants

|

|

2,729,699

(16,378,190 pre-reverse split) shares of Common Stock.

|

|

|

|

|

|

Terms

of Warrants

|

|

Each

Public Warrant and Private Placement Warrant entitles the holder to purchase one share of our Common Stock at an exercise

price of $69.00 ($11.50 pre-reverse split) per share. Each 2019 Warrant entitles the holder to purchase one share of our Common

Stock at an exercise price of $24.00 ($4.00 pre-reverse split) per share. Each Public Warrant and Private Placement Warrant

may be exercised at any time commencing on December 20, 2018 until November 19, 2023, or earlier upon redemption or liquidation.

|

|

|

|

|

|

Use

of Proceeds

|

|

We

expect to receive approximately $66,757,250 in gross proceeds assuming the cash exercise of all of the (i) Public Warrants

and Private Placement Warrants at an exercise price of $69.00 ($11.50 pre-reverse split) per share of Common Stock and (ii)

2019 Warrants at an exercise price of $24.00 ($4.00 pre-reverse split) per share of Common Stock. However, the Private Placement

Warrants may be exercised on a cashless basis, in which case we would expect to receive $63,750,000 in gross proceeds from

the cash exercise of the Public Warrants and 2019 Warrants. We intend to use any net proceeds from the cash exercise of the

Warrants for working capital and general corporate purposes.

|

|

|

|

|

|

Trading

Market

|

|

Our

Public Warrants are currently quoted on the OTCQB tier of the OTC Market Group, Inc. under the symbols “WINRW.”

|

SELECTED

HISTORICAL CONSOLIDATED FINANCIAL DATA

The

following table presents our selected historical consolidated financial data for the periods indicated. The selected historical

consolidated financial data for the years ended May 31, 2020 and 2019 and the balance sheet data as of May 31, 2020 and 2019 are

derived from the audited financial statements.

Historical

results are included for illustrative and informational purposes only and are not necessarily indicative of results we expect

in future periods, and results of interim periods are not necessarily indicative of results for the entire year. The data presented

below should be read in conjunction with, and are qualified in their entirety by reference to, “Management’s Discussion

and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and the notes thereto

included elsewhere in this prospectus.

|

|

|

Year Ended

|

|

|

|

|

May 31,

2020

|

|

|

May 31,

2019

|

|

|

|

|

|

|

|

|

|

|

Statement of Operations Data

|

|

|

|

|

|

|

|

|

|

Total revenues

|

|

$

|

861,410

|

|

|

$

|

37,995

|

|

|

Total operating expenses

|

|

|

3,170,992

|

|

|

|

4,353,189

|

|

|

Loss from operations

|

|

|

(2,732,121

|

)

|

|

|

(4,315,194

|

)

|

|

Total other income

|

|

|

66,342

|

|

|

|

749,922

|

|

|

Loss before provision for taxes

|

|

|

(2,665,779

|

)

|

|

|

(3,565,272

|

)

|

|

Income tax provisions

|

|

|

0

|

|

|

|

0

|

|

|

Net income (loss)

|

|

$

|

(2,620,238

|

)

|

|

$

|

(3,565,272

|

)

|

|

Basic and diluted net loss per share

|

|

$

|

(0.34

|

)

|

|

$

|

(1.00

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Balance Sheet Data (at period end)

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

$

|

160,208

|

|

|

$

|

1,540,158

|

|

|

Working capital (deficit) (1)

|

|

|

(2,662,032

|

)

|

|

|

(277,588

|

|

|

Total assets

|

|

|

8,591,774

|

|

|

|

7,754,543

|

|

|

Total liabilities

|

|

|

3,676,102

|

|

|

|

1,886,622

|

|

|

Stockholders’ equity (deficit)

|

|

|

4,915,672

|

|

|

|

5,867,921

|

|

|

(1)

|

Working

capital represents total current assets less total current liabilities.

|

RISK

FACTORS

An

investment in our securities carries a significant degree of risk. You should carefully consider the following risks, as well

as the other information contained in this prospectus, including our historical financial statements and related notes included

elsewhere in this prospectus, before you decide to purchase our securities. Any one of these risks and uncertainties has the potential

to cause material adverse effects on our business, prospects, financial condition and operating results which could cause actual

results to differ materially from any forward-looking statements expressed by us and a significant decrease in the value of our

common shares and warrants. Refer to “Cautionary Statement Regarding Forward-Looking Statements.”

We

may not be successful in preventing the material adverse effects that any of the following risks and uncertainties may cause.

These potential risks and uncertainties may not be a complete list of the risks and uncertainties facing us. There may be additional

risks and uncertainties that we are presently unaware of, or presently consider immaterial, that may become material in the future

and have a material adverse effect on us. You could lose all or a significant portion of your investment due to any of these risks

and uncertainties.

Risks

Related to Our Business

We

have a relatively limited operating history and limited revenues to date and thus are subject to risks of business development

and you have no basis on which to evaluate our ability to achieve our business objective.

Because

we have a relatively limited operating history and limited revenues to date, you should consider and evaluate our operating prospects

in light of the risks and uncertainties frequently encountered by early-stage operating companies in rapidly evolving markets.

These risks include that:

|

|

●

|

we

may not have sufficient capital to achieve our growth strategy;

|

|

|

●

|

we

may not develop our product and service offerings in a manner that enables us to be profitable and meet our customers’

requirements;

|

|

|

|

|

|

|

●

|

our

growth strategy may not be successful; and

|

|

|

|

|

|

|

●

|

fluctuations

in our operating results will be significant relative to our revenues.

|

Our

future growth will depend substantially on our ability to address these and the other risks described in this section. If we do

not successfully address these risks, our business could be significantly harmed.

We

have a history of operating losses and our management has concluded that factors raise substantial doubt about our ability to

continue as a going concern and our auditor has included an explanatory paragraph relating to our ability to continue as a going

concern in its audit report for the fiscal years ended May 31, 2020 and 2019.

To

date, we have not been profitable and have incurred significant losses and cash flow deficits. For the fiscal years ended May

31, 2020 and 2019, we reported net losses of $2,620,238 and $3,565,272, respectively, and negative cash flow from operating activities

of $1,522,486 and $1,395,255, respectively. As of May 31, 2020, we had an aggregate accumulated deficit of $6,195,044. We anticipate

that we will continue to report losses and negative cash flow for the foreseeable future. Our management has concluded that our

historical recurring losses from operations and negative cash flows from operations as well as our dependence on private equity

and other financings raise substantial doubt about our ability to continue as a going concern and our auditor has included an

explanatory paragraph relating to our ability to continue as a going concern in its audit report for the fiscal year ended May

31, 2020 and 2019.

Our

consolidated financial statements do not include any adjustments that might result from the outcome of this uncertainty. These

adjustments would likely include substantial impairment of the carrying amount of our assets and potential contingent liabilities

that may arise if we are unable to fulfill various operational commitments. In addition, the value of our securities would be

greatly impaired. Our ability to continue as a going concern is dependent upon generating sufficient cash flow from operations

and obtaining additional capital and financing. If our ability to generate cash flow from operations is delayed or reduced and

we are unable to raise additional funding from other sources, we may be unable to continue in business. For further discussion

about our ability to continue as a going concern and our plan for future liquidity, see “Management’s Discussion and

Analysis of Financial Condition and Results of Operations—Ability to Continue as a Going Concern.”

We

are a holding company and depend upon our subsidiaries for our cash flows.

We

are a holding company. All of our operations are conducted, and almost all of our assets are owned, by our subsidiaries. Consequently,

our cash flows and our ability to meet our obligations depend upon the cash flows of our subsidiaries and the payment of funds

by these subsidiaries to us in the form of dividends, distributions or otherwise. The ability of our subsidiaries to make any

payments to us depends on their earnings, the terms of their indebtedness, including the terms of any credit facilities and legal

restrictions. Any failure to receive dividends or distributions from our subsidiaries when needed could have a material adverse

effect on our business, results of operations or financial condition.

Future

acquisitions or strategic investments could disrupt our business and harm our business, results of operations or financial condition.

We

may in the future explore potential acquisitions of companies or strategic investments to strengthen our business. Even if we

identify an appropriate acquisition candidate, we may not be successful in negotiating the terms or financing of the acquisition,

and our due diligence may fail to identify all of the problems, liabilities or other shortcomings or challenges of an acquired

business.

Acquisitions

involve numerous risks, any of which could harm our business, including:

|

|

●

|

straining

our financial resources to acquire a company;

|

|

|

●

|

anticipated

benefits may not materialize as rapidly as we expect, or at all;

|

|

|

|

|

|

|

●

|

diversion

of management time and focus from operating our business to address acquisition integration challenges;

|

|

|

|

|

|

|

●

|

retention

of employees from the acquired company;

|

|

|

|

|

|

|

●

|

cultural

challenges associated with integrating employees from the acquired company into our organization;

|

|

|

|

|

|

|

●

|

integration

of the acquired company’s accounting, management information, human resources and other administrative systems;

|

|

|

|

|

|

|

●

|

the

need to implement or improve controls, procedures and policies at a business that prior to the acquisition may have lacked

effective controls, procedures and policies; and

|

|

|

|

|

|

|

●

|

litigation

or other claims in connection with the acquired company, including claims from terminated employees, former stockholders or

other third parties.

|

Failure

to appropriately mitigate these risks or other issues related to such strategic investments and acquisitions could result in reducing

or completely eliminating any anticipated benefits of transactions, and harm our business generally. Future acquisitions could

also result in dilutive issuances of our equity securities, the incurrence of debt, contingent liabilities, amortization expenses

or the impairment of goodwill, any of which could have a material adverse effect on business, results of operations or financial

condition.

We

may require additional funding for our growth plans, and such funding may result in a dilution of your investment.

We

attempted to estimate our funding requirements in order to implement our growth plans. If the costs of implementing such plans

should exceed these estimates significantly or if we come across opportunities to grow through expansion plans which cannot be

predicted at this time, and our funds generated from our operations prove insufficient for such purposes, we may need to raise

additional funds to meet these funding requirements.

These

additional funds may be raised by issuing equity or debt securities or by borrowing from banks or other resources. We cannot assure

you that we will be able to obtain any additional financing on terms that are acceptable to us, or at all. If we fail to obtain

additional financing on terms that are acceptable to us, we will not be able to implement such plans fully if at all. Such financing

even if obtained, may be accompanied by conditions that limit our ability to pay dividends or require us to seek lenders’

consent for payment of dividends, or restrict our freedom to operate our business by requiring lender’s consent for certain

corporate actions.

Further,

if we raise additional funds by way of a rights offering or through the issuance of new shares, any shareholders who are unable

or unwilling to participate in such an additional round of fund raising may suffer dilution in their investment.

We

may not have sufficient capital to fund our ongoing operations, effectively pursue our strategy or sustain our growth initiatives.

After

the consummation of the acquisition of Simplicity Esports LLC and PLAYlive Nation, Inc., our remaining liquidity and capital resources

may not be sufficient to allow us to fund our ongoing operations, effectively pursue our strategy or sustain our growth initiatives.

If we require additional capital resources, we may seek such funds directly from third party sources; however, we may not be able

to obtain sufficient equity capital and/or debt financing from third parties to allow us to fund our expected ongoing operations

or we may not be able to obtain such equity capital or debt financing on acceptable terms or conditions. Factors affecting the

availability of equity capital or debt financing to us on acceptable terms and conditions include:

|

|

●

|

our

current and future financial results and position;

|

|

|

●

|

the

collateral availability of our otherwise unsecured assets;

|

|

|

|

|

|

|

●

|

the

market’s, investors and lenders’ view of our industry and products;

|

|

|

|

|

|

|

●

|

the

perception in the equity and debt markets of our ability to execute our business plan or achieve our operating results expectations;

and

|

|

|

|

|

|

|

●

|

the

price, volatility and trading volume and history of our Common Stock.

|

If

we are unable to obtain the equity capital or debt financing necessary to fund our ongoing operations, pursue our strategy and

sustain our growth initiatives, we may be forced to scale back our operations or our expansion initiatives, and our business and

operating results will be materially adversely affected.

Our

growth strategy depends on the availability of suitable locations for our Simplicity Esports Gaming Centers and our ability to

open new Simplicity Esports Gaming Centers and operate them profitably.

A

key element of our growth strategy is to extend our brand by opening corporate owned as well as franchising retail Simplicity

Esports Gaming Centers in locations in the United States that we believe will provide attractive returns on investment. We have

identified numerous sites for potential corporate Simplicity Esports Gaming Centers and many other sites for potential franchised

esports gaming centers, in the United States, however, desirable locations for additional Simplicity Esports Gaming Center openings

may not be available at an acceptable cost when we identify a particular opportunity for a new Simplicity Esports Gaming Center.

In

addition, our ability to open new Simplicity Esports Gaming Centers on a timely and cost-effective basis, or at all, is dependent

on a number of factors, many of which are beyond our control, including our ability or the ability of the selected franchisee

to:

|

|

●

|

reach

acceptable agreements regarding the lease of the locations;

|

|

|

|

|

|

|

●

|

comply

with applicable zoning, licensing, land use and environmental regulations;

|

|

|

|

|

|

|

●

|

raise

or have available an adequate amount of cash or currently available financing for construction and opening costs;

|

|

|

|

|

|

|

●

|

timely

hire, train and retain the skilled management and other employees necessary to meet staffing needs;

|

|

|

|

|

|

|

●

|

obtain,

for acceptable cost, required permits and approvals, including liquor licenses; and

|

|

|

|

|

|

|

●

|

efficiently

manage the amount of time and money used to build and open each new Simplicity Esports Gaming Center.

|

If

we succeed in opening new Simplicity Esports Gaming Centers on a timely and cost-effective basis, we may nonetheless be unable

to attract enough customers to the new Simplicity Esports Gaming Centers because potential customers may be unfamiliar with our

brands or concepts, or our entertainment and menu options might not appeal to them. Our new Simplicity Esports Gaming Centers

may not meet or exceed our performance targets, including target cash-on-cash returns. New Simplicity Esports Gaming Centers may

even operate at a loss, which could have a significant adverse effect on our overall operating results.

Our

operations of Simplicity Esports Gaming Centers are significantly dependent on changes in public and customer tastes and discretionary

spending patterns. Our inability to successfully anticipate customer preferences or to gain popularity for such Simplicity Esports

Gaming Centers games may negatively impact our profitability.

Our

success depends significantly on public and customer tastes and preferences, which can be unpredictable. If we are unable to successfully

anticipate customer preferences or increase the popularity of the games offered at the Simplicity Esports Gaming Centers, the

per capita revenue and overall customer expenditures at the Simplicity Esports Gaming Centers may decrease, and thereby negatively

impact our profitability. In response to such developments, we may need to increase our marketing and product development efforts

and expenditures, adjust our game or product sale pricing, modify the games themselves, or take other actions, which may further

erode our profit margins, or otherwise adversely affect our results of operations and financial condition. In particular, we may

need to expend considerable cost and effort in carrying out extensive research and development to assess the potential interest

in a game, testing and launching new games, and to remain abreast with continually evolving technology and trends, as well as

the success and popularity of Simplicity stream team’s casters, influencers and personalities among Simplicity Esports LLC’s

dedicated fan base.

While

we may incur significant expenditures of this nature, including in the future as we continue to expand our operations, there can

be no assurance that any such expenditures or investments by us will yield expected or commensurate returns or results, within

a reasonable or anticipated time, or at all.

The

nature of our business exposes us to negative publicity or customer complaints, including in relation to, among other things,

accidents, injuries or thefts at the Simplicity Esports Gaming Centers, or health and safety concerns arising from improper use

of our game equipment or at our food and beverage venues.

Our

business inherently exposes us to negative publicity or customer complaints as a result of accidents, injuries, or in extreme

cases, deaths, arising from instances of air-borne, water-borne or food-borne contagion or illness, food contamination, spoilage,

tampering, equipment failure, improper use of our equipment, fire, explosion, terrorist attacks or civil riots, and other safety

or security issues, such as kidnapping, or associated risks arising from other actual or perceived non-compliance with safety,

quality or service standards or norms in relation to the various game, entertainment and food and beverage attractions at the

Simplicity Esports Gaming Centers. Even isolated or sporadic incidents or accidents may have a negative impact on our brand image

and reputation, and the Simplicity Esports Gaming Centers’, or games’ or our own popularity with customers. The considerable

expansion of social media in recent years has compounded the effect of any potential negative publicity.

We

cannot guarantee that our or our franchisee’s employee training, internal controls and other precautions will be sufficient

to prevent any such occurrence at the Simplicity Esports Gaming Centers, in relation to our Simplicity global virtual reality

gaming and fully integrated esports platform, or to control or mitigate any negative consequences. In addition, we or our franchisees

rely on third-party security and housekeeping staff for certain non-core functions, as well as certain technology vendors and

partners. Although we monitor vendors and partners and, in certain cases, may have a contractual indemnity or recourse in case

of any default on their part, our ability to assure a safe and satisfactory experience to our customers is necessarily limited

to the extent of our or our franchisees’, dependence on third parties, from time to time. Moreover, we may not be able to

distance or insulate ourselves from any adverse publicity or reputational damage arising from any act, omission or negligence

on the part of a vendor or other third party, which may negatively affect a customer’s experience at any of the Simplicity

Esports Gaming Centers.

We

or our franchisees may not be able to operate in the United States, or obtain and maintain licenses and permits necessary for

such operation, in compliance with laws, regulations and other requirements, which could adversely affect our business, results

of operations or financial condition.

Each

Simplicity Esports Gaming Center will be subject to licensing and regulation by alcoholic beverage control, amusement, health,

sanitation, safety, building code and fire agencies in the country, state, county and/or municipality in which the Simplicity

Esports Gaming Center is located. In the United States, each Simplicity Esports Gaming Center with a restaurant or bar will be

required to obtain a license to sell alcoholic beverages on the premises from a state authority and, in certain locations, county

and municipal authorities. Typically, licenses must be renewed annually and may be revoked or suspended for cause at any time.

In some states, the loss of a license for cause with respect to one Simplicity Esports Gaming Center may lead to the loss of licenses

at all Simplicity Esports Gaming Centers in that state and could make it more difficult to obtain additional licenses in that

state. Alcoholic beverage control regulations relate to numerous aspects of the daily operations of each Simplicity Esports Gaming

Center, including minimum age of patrons and employees, hours of operation, advertising, wholesale purchasing, inventory control

and handling and storage and dispensing of alcoholic beverages. Our failure or a failure by a franchisee in obtaining and maintaining

the required licenses, permits and approvals at any one Simplicity Esports Gaming Center could impact the continuing operations

of existing Simplicity Esports Gaming Centers, or delay or prevent the opening of new Simplicity Esports Gaming Centers. Although

we do not anticipate any material difficulties occurring in the future, the failure to receive or retain a liquor license, or

any other required permit or license, in a particular location, or to continue to qualify for, or renew licenses, could have a

material adverse effect on operations and our ability to obtain such a license or permit in other locations.

As

a result of operating certain entertainment games and attractions, including skill-based games that offer redemption prizes, the

Simplicity Esports Gaming Centers in the United States are subject to amusement licensing and regulation by the countries, states,

provinces, counties and municipalities in which our Simplicity Esports Gaming Centers are located. These laws and regulations

can vary significantly by country, state, province, county, and municipality and, in some jurisdictions, may require us to modify

our business operations or alter the mix of redemption games and simulators we offer. Moreover, as more states in the United States

and local communities implement legalized gambling, the laws and corresponding enabling regulations may also be applicable to

our redemption games and regulators may create new licensing requirements, taxes or fees, or restrictions on the various types

of redemption games we offer. Furthermore, other states, provinces, counties and municipalities may make changes to existing laws

to further regulate legalized gaming and illegal gambling. Adoption of these laws, or adverse interpretation of existing laws,

after we have established a Simplicity Esports Gaming Center in the jurisdiction could require the existing center in these jurisdictions

to alter the mix of games, modify certain games, change the mix of prizes that we may offer or terminate the use of specific games,

any of which could adversely affect our operations.

We

are also subject to laws and regulations governing our relationship with our employees, including those related to minimum wage

requirements, exempt status, overtime, health insurance mandates, working and safety conditions, immigration status requirements,

child labor, and non-discrimination. Additionally, changes in federal labor laws, including card verification regulations, could

result in portions of our workforce being subjected to greater organized labor influence, which could result in an increase to

our labor costs. A significant portion of Simplicity Esports Gaming Center personnel will be paid at minimum wage rates established

by federal, state and municipal law. Increases in the minimum wage result in higher labor costs, which may be only partially offset

by price increases and operational efficiencies.

We

are also subject to the rules and regulations of the Federal Trade Commission and various state laws regulating the offer and

sale of franchises. The Federal Trade Commission and various state laws require that we furnish a franchise disclosure document

containing certain information to prospective franchisees, and a number of states require registration of the franchise disclosure

document with state authorities. State laws that regulate the franchisor-franchisee relationship presently exist in a substantial

number of states, and bills have been introduced in Congress from time to time that would provide for federal regulation of the

franchisor-franchisee relationship. The state laws often limit, among other things, the duration and scope of non-competition

provisions, the ability of a franchisor to terminate or refuse to renew a franchise and the ability of a franchisor to designate

sources of supply. We shall endeavor to make sure that any franchise disclosure document we provide, together with any applicable

state versions or supplements, and franchising procedures, comply in all material respects with both the Federal Trade Commission

guidelines and all applicable state laws regulating franchising in those states in which we have offered franchises.

If

we and our franchisees fail to comply with such laws and regulations, we may be subject to various sanctions and/or penalties

and fines or may be required to cease operations until we achieve compliance, which could have an adverse effect on our business

and our financial results.

Our

growth through franchising may not occur as rapidly as we currently anticipate and may be subject to additional risks.

As

part of our growth strategy, we will continue to seek franchisees to operate Simplicity Esports Gaming Centers in certain strategic

domestic locations or venues. We believe that our ability to recruit, retain and contract with qualified franchisees will be increasingly

important to our operations as we expand. Our franchisees are dependent upon the availability of adequate sources of financing

in order to meet their development obligations. Such financing may not be available to our franchisees, or only available upon

disadvantageous terms. Our franchise strategy may not enhance our results of operations.

Expanding

through franchising exposes our business and brand to risks because the quality of the franchised operations will be beyond our

immediate control, including risks associated with our confidential information, intellectual properties (including trademarks)

and brand reputation. Even if we have contractual remedies to cause franchisees to maintain operational standards, enforcing those

remedies may require litigation and therefore our image and reputation may suffer, unless and until such litigation is successfully

concluded.

We

could face liability from or as a result of our franchisees.

Various

state and federal laws will govern the relationship between us and our franchisees and the potential sale of a franchise. If we

fail to comply with these laws, we could be liable for damages to franchisees and fines or other penalties. A franchisee or government